Today's Top Supply Chain and Logistics News From WSJ

September 26 2017 - 7:09AM

Dow Jones News

By Paul Page

Sign up: With one click, get this newsletter delivered to your

inbox.

Labor tensions in expedited transport are heating up as the fall

shipping season gets underway. Atlas Air Worldwide Holdings Inc. is

accusing unionized pilots of causing "widespread and significant"

flight delays with a work slowdown, the WSJ's Imani Moise reports.

The freighter operator, which this year struck a jet-leasing and

investment deal with Amazon.com Inc., is asking a court to order

the Teamsters union to end what Atlas says is an illegal job action

that includes last-minute sick calls and refusal to work overtime.

The dispute is similar to one last year between pilots and Air

Transport Services Group Inc., another cargo flier that works

closely with Amazon. The airlines and their customers -- including

United Parcel Service Inc. Deutsche Post AG's DHL and FedEx Corp.

-- are trying to meet increasingly tough delivery demands that come

with the growth in e-commerce. The online sales are pushing out

more packages, but the labor unease suggests they're also adding

strains to expedited networks.

Alibaba Group Holding Ltd. is putting new financial weight

behind its logistics business. The Chinese e-commerce giant is

spending $800.8 million to take majority control in Cainiao Smart

Logistics Ltd., the WSJ's Alyssa Abkowitz reports, and plans to

invest another $15.1 billion over the next five years to expand its

delivery capabilities and the automation in its fulfillment

operations. The plan carries potentially important implications for

Alibaba's international growth plans that go beyond the

distribution networks, however. Taking full control could allay

concerns over financial transparency that drew the attention of

U.S. securities regulators last year. Alibaba is highly profitable,

but it doesn't count Cainiao's losses or include its assets on its

balance sheet. It will also give Alibaba more control over

logistics and customer data as the company looks to expand its

reach outside China with investments in Southeast Asia and

India.

Unilever PLC, like other consumer-products suppliers, is trying

to put the best face on its business prospects. The Anglo-Dutch

group is buying Carver Korea, a Seoul-based provider of skin-care

products, the WSJ's Saabira Chaudhuri reports, in its ongoing push

to pivot into higher-growth sectors and get more of the big but

potentially problematic Chinese market. The $2.7 billion

acquisition is Unilever's biggest in seven years, one measure of

the urgency among consumer-goods suppliers in a changing retail

environment. E-commerce has cut into sales at the traditional

storefronts that sell consumer staples, and many retailers are

trying to prop up their profit margins by moving toward their own

brands. China is a beckoning market to Unilever, which lags in

sales there, but there also are geopolitical clouds over the

business: tensions between South Korea and Beijing have been

growing, making Unilever's move into China through Seoul a risky

path.

RELIEF LOGISTICS

Workers at Puerto Rico's main airport are trying to restore

operations to the island's main lifeline to the outside world. A

trickle of flights is moving through the airport following the

devastating damage inflicted by Hurricane Maria, the WSJ's Jose De

Cordoba and Arian Campo-Flores report, most of them military and

aid flights bringing in critical supplies from power generators to

drinking water. The struggle at the airport, which is operating

with only limited radar and communications equipment, is part of

the broader battle in Puerto Rico after Maria wiped out important

infrastructure. A new estimate said damage from Maria could end up

exceeding that inflicted by hurricanes Harvey and Irma, and it's

crippled relief efforts. Sen. Marco Rubio said the logistics of

getting supplies, equipment and personnel to the airport and ports

remains challenging. Getting relief beyond the sites is just as

difficult: technicians trying to reach a damaged long-range radar

site were using chainsaws to get through two miles of crushed and

impassable rain forest.

This isn't what electronics companies usually mean by a reverse

logistics. Consumer disappointment with Apple Inc.'s new iPhone

offerings is weighing on the shares of key component makers in

Asia, the WSJ's Kevin Kingsbury reports, signaling that concerns

over supplier earnings are rising as hopes for a boost from Apple's

flagship device are fading. Confidence in companies linked to

Apple's supply chain had been riding high. But that excitement has

given way to some disappointment and criticism of the new devices,

and production glitches that have led to shipment delays have added

to the problems. The troubles mark a rare stumble in an Apple

supply chain known for its precision in linking suppliers of

high-value parts and contract manufacturers. Apple has a long reach

in the electronics world, of course, but the impact of the new

iPhones wasn't what suppliers were expecting.

QUOTABLE

IN OTHER NEWS

Oil prices are poised to return to bull-market territory after a

slow climb from their slide three months ago. (WSJ)

Target Corp. is raising its minimum wage as the retailer

competes to fill low-wage jobs in a tighter labor market. (WSJ)

German business leaders warn that the rise of a nationalist

anti-immigration party could hurt the nation's export-driven

economy. (WSJ)

General Electric Co. is selling its industrial-solutions

business to Switzerland's ABB Ltd. (WSJ)

The number of U.S. mergers and acquisitions has grown this year

but deal values have slipped 15%. (WSJ)

Canadian retailers are concerned a U.S. proposal raise the

duty-free threshold on cross-border imports would hurt sales.

(Calgary Herald)

Amazon took a 5% stake in Indian retailer Shoppers Stop Ltd.

(Bloomberg)

The Uber Technologies Inc. UberEats business has been a

surprising success in a competitive food-delivery market. ( New

York Times)

Japan's government raised about $11.6 billion in an offering of

its shares in Japan Post Holdings Co. (Nikkei Asian Review)

The Trump administration named Raymond Martinez, chief

administrator of the New Jersey Motor Vehicle Commission, to lead

the Federal Motor Carrier Safety Administration. (Fleet Owner)

Dockworkers and employers at U.S. East Coast and Gulf Coast

ports are moving closer toward contract negotiations. (Journal of

Commerce)

Iran's shipping line IRISL formed a joint venture freight

business with Kazakhstan's national railway. (Splash 24/7)

Kenya's Mombasa Port will expand its second container terminal

with a $339 million loan from Japan's government. (Standard

Media)

Hawaii will start construction in December of a container

terminal at Honolulu Harbor. (Port Technology)

U.S. and Mexican authorities will start cooperating on joint

cargo inspections at the Otay Mesa crossing south of San Diego.

(American Shipper)

Singapore state investment fund Temasek Holdings took a

significant minority stake in U.K. supply-chain software firm

BluJay Solutions. (Reuters)

Grocer Hy-Vee Inc. will build its first distribution center

outside of Iowa in Austin, Minn. (Des Moines Register)

Liquidators of insolvent Chinese carrier Jade Cargo

International are auctioning three 747-400 freighters on Alibaba's

Taobao marketplace. (The Standard)

ABOUT US

Paul Page is deputy editor of WSJ Logistics Report. Follow him

at @PaulPage, and follow the entire WSJ Logistics Report team:

@brianjbaskin , @jensmithWSJ and @EEPhillips_WSJ. Follow the WSJ

Logistics Report on Twitter at @WSJLogistics.

Write to Paul Page at paul.page@wsj.com

(END) Dow Jones Newswires

September 26, 2017 06:54 ET (10:54 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

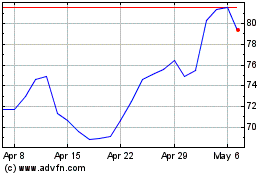

Alibaba (NYSE:BABA)

Historical Stock Chart

From Aug 2024 to Sep 2024

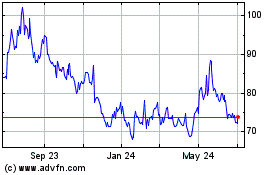

Alibaba (NYSE:BABA)

Historical Stock Chart

From Sep 2023 to Sep 2024