Current Report Filing (8-k)

July 21 2017 - 4:49PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported)

July 18, 2017

Six Flags Entertainment Corporation

(Exact Name of Registrant as Specified in Its Charter)

Delaware

(State or Other Jurisdiction of Incorporation)

|

|

|

|

|

|

|

1-13703

|

|

13-3995059

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

|

|

|

|

|

|

|

924 Avenue J East

|

|

|

|

Grand Prairie, Texas

|

|

75050

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

(972) 595-5000

(Registrant’s Telephone Number, Including Area Code)

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (

see

General Instruction A.2. below):

o

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Exchange Act of 1934 of 1934 (§240.12b-2 of this chapter)

|

|

|

|

|

Emerging Growth Company

o

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

o

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On July 18, 2017, Six Flags Entertainment Corporation (the “Company”) issued a press release announcing that its Board of Directors has appointed James Reid-Anderson, 58, who has been serving as Executive Chairman of the Company since February 2016, as the Company’s Chairman, President and Chief Executive Officer effective July 18, 2017. Mr. Reid-Anderson is replacing John M. Duffey, who has retired as Chief Executive Officer of the Company and as a director. Mr. Reid-Anderson formerly served as Chairman, President and Chief Executive Officer of the Company from August 2010 through February 2016.

In connection with Mr. Reid-Anderson’s appointment as Chairman, President and Chief Executive Officer, the Company entered into a new employment agreement with Mr. Reid-Anderson (the “Reid-Anderson Employment Agreement”) that provides for, among other things, a base salary of at least $1,800,000 per year and an annual bonus with a target opportunity of 200% of his base salary

and a maximum bonus opportunity of two times the target bonus. The target bonus will be prorated for the 2017 fiscal year with 200% of his base salary as the target bonus percentage for the portion of the 2017 fiscal year the Reid-Anderson Employment Agreement is in effect and 100% of his base salary as the target bonus percentage for the portion of the 2017 fiscal year before effectiveness of the Reid-Anderson Employment Agreement. In addition, on July 18, 2017, Mr. Reid-Anderson was granted options to purchase 500,000 shares of the Company’s common stock in accordance with a nonqualified stock option agreement under the Company’s Long-Term Incentive Plan, which will generally vest in equal amounts upon each of the first four anniversaries of the grant date. Mr. Reid-Anderson will also be granted an additional award under the Company’s Project 600 Program with a target award of 185,000 shares for a total target award (including his existing award) under the Company’s Project 600 Program of 435,000 shares and an award under the Company’s Project 750 Program with a target award of 150,000 shares. Mr. Reid-Anderson is also entitled to participate in or receive benefits under the employee benefit programs of the Company, including the Company’s life, health and disability programs, as well as to receive reimbursement of certain expenses incurred during his employment. The Reid-Anderson Employment Agreement also contains provisions for separation payments and benefits upon certain types of termination of employment as well as contains customary non-competition, indemnification, confidentiality and proprietary information provisions.

In connection with Mr. Duffey’s retirement, the Company entered into a retirement agreement (the “Retirement Agreement”) with Mr. Duffey setting forth certain terms relating to Mr. Duffey’s retirement from the Company. The Retirement Agreement provides that Mr. Duffey will forfeit one-half of his target award under the Company’s Project 600 Program on July 18, 2017, and will continue to participate in the Company’s Project 600 Program with respect to a target award of 185,000 shares even though Mr. Duffey has retired. The Retirement Agreement also provides, among other things, that (i) Mr. Duffey will be entitled to receive a prorated bonus, payable in shares of common stock of the Company and at the same time as other executive officers are paid the bonus for 2017, if any, (ii) stock options that are scheduled to vest in the twelve month period following the effective date of Mr. Duffey’s retirement will vest and become exercisable and such stock options, as well as currently exercisable stock options, shall remain exercisable through the first anniversary of the effective date of Mr. Duffey's retirement, and (iii) the Company will assume the remaining seven months of lease obligations for Mr. Duffey’s apartment in Dallas, Texas. The Retirement Agreement also contains customary release provisions.

The foregoing descriptions of the Reid-Anderson Employment Agreement and the Duffey Retirement Agreement do not purport to be complete and are qualified in their entirety by the text of the agreements, copies of which are filed as Exhibit 10.1 and Exhibit 10.2, respectively, to this Current Report on Form 8-K and incorporated by reference herein.

A copy of the press release announcing these management changes is filed as Exhibit 99.1 to this Current Report on Form 8-K and incorporated by reference herein.

Item 9.01

Financial Statements and Exhibits.

(d) Exhibits

|

|

|

|

10.1

|

Employment Agreement, dated as of July 18, 2017, by and between James Reid-Anderson and Six Flags Entertainment Corporation

|

|

|

|

|

10.2

|

Retirement Agreement, dated as of July 18, 2017, by and between John M. Duffey and Six Flags Entertainment Corporation

|

99.1 Press Release of Six Flags Entertainment Corporation, dated July 18, 2017

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

SIX FLAGS ENTERTAINMENT CORPORATION

|

|

|

|

|

|

|

|

|

By:

|

/s/ Lance C. Balk

|

|

|

|

Name:

|

Lance C. Balk

|

|

|

|

Title:

|

Executive Vice President and General Counsel

|

|

|

|

|

|

|

Date: July 21, 2017

|

|

EXHIBIT INDEX

|

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

|

10.1

|

|

Employment Agreement, dated as of July 18, 2017, by and between James Reid-Anderson and Six Flags Entertainment Corporation

|

|

10.2

|

|

Retirement Agreement, dated as of July 18, 2017, by and between John M. Duffey and Six Flags Entertainment Corporation

|

|

99.1

|

|

Press Release of Six Flags Entertainment Corporation, dated July 18, 2017

|

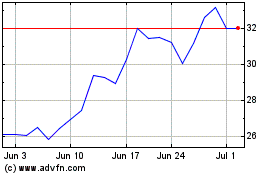

Six Flags Entertainment (NYSE:SIX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Six Flags Entertainment (NYSE:SIX)

Historical Stock Chart

From Apr 2023 to Apr 2024