| As filed with the Securities and Exchange Commission on June 23, 2017 |

Registration No. 333-____________ |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

_________________

FORM S-8

REGISTRATION STATEMENT UNDER THE SECURITIES

ACT OF 1933

_________________

Luvu Brands, Inc.

(Exact name of registrant as specified

in its charter)

_________________

| Florida |

59-3581576 |

|

(State or other jurisdiction of

incorporation or organization) |

(I.R.S. Employer

Identification Number) |

| |

|

| 2745 Bankers Industrial Drive, Atlanta, GA |

30360 |

| (Address of Principal Executive Offices) |

(Zip Code) |

_________________________________

2015 Executive Incentive Plan

(Full title of the plan)

_________________

Mr. Ronald P. Scott

Chief Financial Officer

2745 Bankers Industrial Drive

Atlanta, GA 30360

(Name and address of agent for service)

(770) 246-6400

(Telephone number, including area code, of agent

for service)

With copies to:

Brian A. Pearlman, Esq.

Pearlman Law Group LLP

200 South Andrews Avenue, Suite 901

Fort Lauderdale, FL 33301

(954) 880-9484

Indicate by check mark whether the registrant is a large accelerated

filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated

filer,” “accelerated filer,” “smaller reporting company” and "emerging growth company"

in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer |

o |

Accelerated filer |

o |

| Non-accelerated filer |

o |

Smaller reporting company |

þ |

| |

|

Emerging growth company |

o |

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided

pursuant to Section 7(a)(2)(B) of the Securities Act. o

CALCULATION OF REGISTRATION FEE

| Title of securities to be registered |

Amount to be

registered (1) |

Proposed maximum offering price per share (2) |

Proposed maximum aggregate offering price (2) |

Amount of

registration fee |

| Common stock, par value $0.01 per share |

5,000,000 |

$0.05 |

$250,000.00 |

$28.98 |

| |

(1) |

Pursuant to Rule 416(a) of the Securities Act of 1933, as amended (the “Securities Act”), this registration statement also covers any additional shares of common stock that may become issuable in the event of a stock split, stock dividend, recapitalization or other similar transactions. |

| |

(2) |

Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(c) under the Securities Act, and Rule 457(h) under the Securities Act based on the average of the high and low sale prices of the common stock as reported on the OTCQB Tier of the OTC Markets on June 22, 2017. |

EXPLANATORY NOTE

This registration statement on Form S-8 is being

filed for the purpose of registering 5,000,000 shares of our common stock which may be issued upon exercise of grants made or to

be made under our 2015 Equity Incentive Plan (the "2015 Plan"). This registration statement also includes a reoffer prospectus

prepared in accordance with General Instruction C of Form S-8 and in accordance with the requirements of Part I of Form S-3. This

reoffer prospectus may be used by executive officers and directors of our company to offer and sell or otherwise dispose of shares

of our common stock issuable upon the exercise of grants made up or to be made to them under the 2015 Plan.

When used herein, the terms "LUVU,"

"we," "us," or "our" refers to Luvu Brands, Inc., a Florida corporation, and our subsidiaries. The

information which appears on our web sites at www.luvubrands.com, www.liberator.com,

www.liberatorshop.com, www.theliberator.co.uk, www.jaxxliving.com, and/or www.avanacomfort.com are not

part of this registration statement.

PART I

INFORMATION REQUIRED IN THE SECTION 10(a) PROSPECTUS

The information specified in Item 1 and Item

2 of Part I of Form S-8 is omitted from this registration statement in accordance with Rule 428 under the Securities Act of 1933,

as amended (the “Securities Act”), and the introductory note to Part I of Form S-8. The documents containing the information

specified in Part I will be sent or given to participants in the 2015 Plan as required by Rule 428(b)(1) under the Securities Act.

Such documents are not required to be filed with the Securities and Exchange Commission (the “SEC”), either as part

of this registration statement or as a prospectus or prospectus supplement pursuant to Rule 424 under the Securities Act. Such

documents, together with the documents incorporated by reference herein pursuant to Item 3 of Part II of this registration statement

on Form S-8, constitute a prospectus that meets the requirements of Section 10(a) of the Securities Act.

REOFFER PROSPECTUS

LUVU BRANDS, INC.

5,000,000 SHARES OF COMMON STOCK

This reoffer prospectus forms a part of a registration

statement, which registers an aggregate of 5,000,000 shares of common stock issued or issuable from time-to-time under the Luvu

Brands, Inc. 2015 Equity Incentive Plan, or "2015 Plan."

This reoffer prospectus also covers the resale

of shares granted under the 2015 Plan by persons who are our "affiliates" within the meaning of federal securities laws.

Affiliated selling security holders may sell all or a portion of the shares from time to time in the over-the-counter market, in

negotiated transactions, directly or through brokers or otherwise, and at market prices prevailing at the time of such sales or

at negotiated prices, but which may not exceed 1% of our outstanding common stock.

We will not receive any proceeds from sales

of shares by selling security holders.

For a description of the plan of distribution

of these shares, please see page 12 of this prospectus.

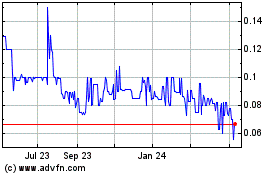

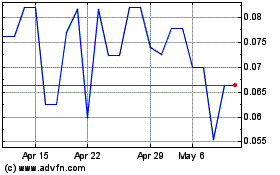

Our common stock is quoted on the OTC Markets

OTCQB tier under the symbol LUVU. On June 22, 2017 the last sale price of our common stock was $0.05 per share.

Investing in the securities offered under

this reoffer prospectus involves a high degree of risk. You should read the “Risk Factors” section beginning on page

4 and in the documents incorporated by reference herein, before making an investment decision.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION

NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ADEQUACY OR ACCURACY OF

THIS REOFFER PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

You should rely only on the information contained

in this reoffer prospectus. No person has been authorized to give any information or to make any representations, other than as

contained herein, in connection with the offer contained in this reoffer prospectus, and, if given or made, such information or

representations must not be relied upon. This reoffer prospectus does not constitute an offer to sell or solicitation of an offer

to buy any of the securities offered hereby in any state to any person to whom it is unlawful to make such offer or solicitation.

The date of this reoffer prospectus is June

23, 2017.

1

TABLE OF CONTENTS

| |

Page |

| PROSPECTUS SUMMARY |

3 |

| CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS |

3 |

| RISK FACTORS |

4 |

| USE OF PROCEEDS |

9 |

| 2015 EQUITY INCENTIVE PLAN |

9 |

| SELLING SECURITY HOLDERS |

11 |

| PLAN OF DISTRIBUTION |

12 |

| LEGAL MATTERS |

13 |

| EXPERTS |

13 |

| WHERE YOU CAN FIND MORE INFORMATION |

14 |

| INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE |

14 |

| DISCLOSURE OF COMMISSION POSITION ON INDEMNIFICATION FOR SECURITIES ACT LIABILITIES |

14 |

2

PROSPECTUS SUMMARY

Our business

We are a vertically integrated US-based manufacturer

that has built several brands in the wellness, lifestyle and fashion seating categories. Our products are offered in innovative

vacuum eco-compressed packaging for retail stores, mass merchants, drug and internet retailers worldwide. All of our brands are

headquartered in Atlanta, Georgia in a 140,000 square foot manufacturing facility that employs over 150 people. Making products

that people love, bringing manufacturing back to the USA, sustainable manufacturing practices, and decreasing the overall impact

on the environment are core to our operating principles.

We also manage, market, and distribute our products

directly to consumers through several websites that include www.liberator.com, www.liberatorshop.com, www.theliberator.co.uk, www.jaxxliving.com,

and www.avanacomfort.com. We reach additional consumers through a retail concept store located within our Atlanta factory.

Our executive offices are located at 2745 Bankers

Industrial Dr., Atlanta, GA 30360; our telephone number is +1-770-246-6400. Our fiscal year end is June 30.

Corporate history

We were incorporated in the State of Florida

in February 1999, under the name of WES Consulting, Inc. to provide consulting and commercial property management services. In

October 2009, we entered into a merger and recapitalization agreement with Liberator, Inc., a Nevada corporation, pursuant to which

Liberator, Inc. was merged with and into our company and we were the surviving entity. In February 2011, we changed our name to

Liberator, Inc. and in November 2015, we changed our name to Luvu Brands, Inc. to reflect our broader offering of wellness and

lifestyle products designed for mass market channels.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING

STATEMENTS

This reoffer prospectus includes forward-looking

statements that relate to future events or our future financial performance and involve known and unknown risks, uncertainties

and other factors that may cause our actual results, levels of activity, performance or achievements to differ materially from

any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. Words

such as, but not limited to, “believe,” “expect,” “anticipate,” “estimate,” “intend,”

“plan,” “targets,” “likely,” “aim,” “will,” “would,” “could,”

and similar expressions or phrases identify forward-looking statements. We have based these forward-looking statements largely

on our current expectations and future events and financial trends that we believe may affect our financial condition, results

of operation, business strategy and financial needs. Forward-looking statements include, but are not limited to, statements about:

| |

Ÿ |

our ability to continue as a going concern; |

| |

Ÿ |

the impact on our company if we were to default under our secured credit facility; |

| |

Ÿ |

our need to raise additional capital; |

| |

Ÿ |

our plans to make continued investments in advertising and marketing; |

| |

Ÿ |

our dependence on a limited number of suppliers; |

| |

Ÿ |

risks associated with fluctuations in our quarterly operating results; |

| |

Ÿ |

seasonality of our revenues; |

| |

Ÿ |

our ability to develop awareness of our brand; |

| |

Ÿ |

our dependence on our Chief Executive Officer and key personnel; |

3

| |

Ÿ |

risks associated with the control of our company by our Chief Executive Officer; |

| |

Ÿ |

our dependence on our domain names and other intellectual property and risks associated with inadvertent infringement of third party intellectual property rights; |

| |

Ÿ |

potential declines in the prices at which we can sell our products in the future; |

| |

Ÿ |

risks associated with restrictions on credit card processing; |

| |

|

|

| |

Ÿ |

risks associated with the industry in which we operate; |

| |

Ÿ |

restrictions to access on the internet affecting traffic to our websites; |

| |

Ÿ |

the limited public market for our common stock; |

| |

Ÿ |

risks associated with the penny stock rules on the trading in our common stock; and |

| |

Ÿ |

risks associated with the application of FINRA sales practices to the market for our common stock. |

You should read thoroughly this reoffer prospectus

and the documents that we refer to herein with the understanding that our actual future results may be materially different from

and/or worse than what we expect. We qualify all of our forward-looking statements by these cautionary statements including those

made in Risk Factors appearing elsewhere in this reoffer prospectus. Other sections of this reoffer prospectus include additional

factors which could adversely impact our business and financial performance. New risk factors emerge from time to time and it is

not possible for our management to predict all risk factors, nor can we assess the impact of all factors on our business or the

extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any

forward-looking statements. Except for our ongoing obligations to disclose material information under the Federal securities laws,

we undertake no obligation to release publicly any revisions to any forward-looking statements, to report events or to report the

occurrence of unanticipated events. These forward-looking statements speak only as of the date of this reoffer prospectus, and

you should not rely on these statements without also considering the risks and uncertainties associated with these statements and

our business.

RISK FACTORS

An investment in our common stock involves

a significant degree of risk. You should not invest in our common stock unless you can afford to lose your entire investment. You

should consider carefully the following risk factors and other information in this prospectus before deciding to invest in our

common stock.

Our independent auditors have expressed substantial doubt

about our ability to continue as a going concern.

Our consolidated financial statements have been

prepared assuming we will continue as a going concern. As of March 31, 2017, we had an accumulated deficit

of approximately $8,875,000 and a working capital deficit of approximately $2,077,000. We reported a net loss of approximately

$334,000 for the nine months then ended (unaudited). We reported net income of approximately $312,000 for the year ended June 30,

2016 and at June 30, 2016 we had a working capital deficiency of approximately $2.4 million, and an accumulated deficit

of approximately $9.2 million. In their report on our financial statements for the year ended June 30,

2016, our independent auditors included an explanatory paragraph regarding the substantial doubt about our ability to continue

as a going concern. Our financial statements contain additional note disclosures describing the circumstances that led to this

disclosure by our independent auditors. Our consolidated financial statements do not include any adjustments that might

result from the outcome of this uncertainty. There are no assurances that we will be able to increase our revenues and cash flow

to a level, which supports profitable operations and provides sufficient funds to pay our obligations. If we are unable to meet

those obligations, we could be forced to cease operations in which event investors would lose their entire investment in our company.

4

Our assets serve as collateral under our credit facility with

Advance Financial Corporation. If we were to default on this agreement, the lender could foreclose on our assets.

Our wholly-owned subsidiary, OneUp and OneUp’s

wholly-owned subsidiary, Foam Labs are parties to a credit facility with Advance Financial which is secured by our accounts receivable

and other rights to payment, general intangibles, inventory and equipment. Mr. Friedman, our Chief Executive Officer, has personally

guaranteed the repayment of the facility. At March 31, 2017 the balance owed under this line of credit was $660,868. If we should

default under the terms of this agreement, the lender could seek to foreclose on our assets. If the lender was successful, we would

be unable to conduct our business as it is presently conducted and our ability to generate revenues and fund our ongoing operations

would be materially adversely affected.

If we are unable to obtain financing in the amounts and on

terms and dates acceptable to us, we may not be able to execute our business plan, and so may be forced to modify, scale back or

cease operations, and you could lose your entire investment.

We estimate that the operational and strategic

growth plans we have identified will require approximately $200,000 of funding over the next twelve months, of which we anticipate

will be provided by debt financing and, to a lesser extent, cash flow from operations as well as cash on hand. There can be no

assurance that financing will continue to be available to us if necessary or, if the financing is available, that it will be on

terms acceptable to us. The issuance of additional equity securities by us will result in a significant dilution in the equity

interests of our shareholders. Obtaining commercial loans, assuming those loans would be available, will increase our liabilities

and future cash commitments. If we are unable to obtain financing in the amounts and on terms deemed acceptable to us, we may not

be able to continue to execute our business plan, and so may be forced to modify, scale back or cease our operations. In such an

event, you could lose your entire investment in our company.

We must dedicate significant resources to market our products

to consumers.

Subject to the availability of sufficient capital,

we plan to continue to dedicate significant resources to market our products to consumers and create awareness of the benefits

of our products. Although our prior advertising campaigns have generally been successful, there is no assurance that our future

marketing programs will achieve the desired results. Failure to achieve the desired success in our marketing programs may have

a material adverse effect on our business, financial condition and results of operations. Our success in promoting and enhancing

the Liberator brand will also depend on our success in providing our customers high-quality products and a high level of customer

service. If our customers do not perceive our products to be of high quality, the value of the Liberator brand would be diminished,

we will lose customers and our revenues will decline.

Because there are a limited number of suppliers of a key component

of our products, we may suffer cost and supply difficulties if we are forced to change suppliers.

A limited number of domestic suppliers currently

manufacture the microfiber fabric included in the outer shell of our main product line. This concentration in supply by two domestic

manufacturers for this item subjects us to certain economic and production risks that are beyond our control. To date, we

have been able to purchase the required levels of microfiber fabric on an as-needed basis and we believe that these suppliers can

meet our expected future demand requirements. However, should one or both of these suppliers experience any disruptions in

their businesses; we may be forced to seek out other sources of supply. While foreign suppliers of the microfiber fabric

are available, cost of goods sold and other costs may increase and order lead times may increase, in the event a change in supplier

is necessitated.

Our quarterly operating results may fluctuate significantly

and you should not rely on them as an indication of our future results.

Our future revenues and results of operations

may fluctuate significantly due to a combination of factors, many of which are outside of our control. The most important of these

factors include:

| |

Ÿ |

seasonality; |

| |

Ÿ |

the timing and effectiveness of our marketing programs; |

| |

Ÿ |

the timing and effectiveness of capital expenditures; |

| |

Ÿ |

our ability to enter into or renew marketing agreements with other sexual wellness companies; and |

| |

Ÿ |

competition. |

5

Our operating results for any particular quarter

may not be indicative of future operating results. You should not rely on quarter-to-quarter comparisons of our results of operations

as an indication of our future performance. It is possible that, in future periods, our results of operations may be below the

expectations of investors. Consumer spending on sexual wellness products and other products we sell may vary with general economic

conditions. If general economic conditions deteriorate and our customers have less disposable income, consumers will likely spend

less on our products and our quarterly operating results will suffer.

Our operating results will suffer if sales during our peak

seasons do not meet our expectations.

Sales of our products are seasonal, concentrated

in the fourth calendar quarter, due to the Christmas holiday, and the first calendar quarter, due to Valentine's Day. In anticipation

of increased sales activity during these periods, we hire a number of temporary employees to supplement our permanent staff and

we increase our inventory levels. If sales during these periods do not meet our expectations, we may not generate sufficient revenue

to offset these increased costs and our operating results will suffer.

If we fail to develop and increase awareness of our brand,

we will not increase or maintain our customer base or our revenues.

We must develop and increase awareness of the

Liberator brand in order to expand our customer base and our revenues. In addition, we may introduce or acquire other brands in

the future. We believe that the importance of brand recognition will increase as we expand our product offerings. Many of our customers

may not be aware of the variety of products we offer. We intend to substantially increase our expenditures for creating and maintaining

brand loyalty and raising awareness of our current and additional product offerings. However, if we fail to advertise and market

our products effectively, we may not succeed in maintaining our brands, we will lose customers and our revenues will decline.

We are dependent on key personnel, whose loss may be difficult

to replace.

We are highly dependent on the technical and

managerial skills of our key employees, including sales, marketing, information systems, financial and executive personnel. Therefore,

the success of our business is highly dependent upon our ability to retain existing employees and to identify, hire and retain

additional personnel as the need arises. Currently, we particularly depend upon the efforts and skills of Louis S. Friedman.

Mr. Friedman, one of the founders and our current President and Chief Executive Officer, is the driving force behind our overall

direction and our growth. While we are a party to an employment agreement with him, the loss of services of Mr. Friedman

could materially adversely affect our business, financial condition or results of operations. If Mr. Friedman left our employ,

we might not be able to employ an equally qualified person or persons on suitable terms. Competition for key personnel is intense

and there can be no assurance that we will be able to retain existing personnel or to identify or hire additional qualified personnel

as needed. The need for such personnel is particularly important in light of the anticipated demands of future growth.

Our inability to attract, hire or retain necessary personnel could have a material adverse effect on our business, prospects, operating

results and financial condition.

We are controlled by our Chief Executive Officer, whose interests

may differ from other shareholders.

Our voting

securities include our common stock and our Series A Convertible Preferred Stock which vote together as one class on all matters

submitted to a vote of our shareholders. As a result of the voting rights of our Series A Convertible Preferred Stock, all of which

is owned by Mr. Friedman, at June 23, 2017 he controls approximately 71% of the combined voting power of the common stock and Series

A Convertible Preferred Stock, and acting alone, will be able to control all matters requiring shareholder approval, including

the election of directors and approval of mergers and other significant corporate transactions. This concentration of ownership

may have the effect of delaying, preventing or deterring a change in control of our company. It would also deprive our shareholders

of an opportunity to receive a premium for their shares as part of a sale of our company and it may affect the market price of

our common stock.

If we are unable to obtain or maintain key website addresses,

our ability to operate and grow our business may be impaired.

Our website

addresses, or domain names, are critical to our business. However, as with phone numbers, we do not have and cannot acquire

any property rights in an Internet address. The regulation of domain names in the United States and

other countries is subject to change, and regulatory bodies could establish additional top-level domains, appoint additional

domain name registrars or modify the requirements for holding domain names. It may be difficult for

us to prevent third parties from acquiring domain names that are similar to ours or that otherwise decrease the value of our brands.

If we are unable to obtain or maintain key domain names for the various areas of our business, our ability to operate and grow

our business may be impaired.

6

The prices we charge for our products may decline over time,

which would reduce our revenues and adversely affect our profitability.

As our products continue to gain consumer acceptance

and attract the attention of competitors, we may experience pressure to decrease the prices for our products, which could adversely

affect our revenues and gross margin. If we are unable to sell our products at acceptable prices, or if we fail to develop

and offer new products with sufficient profit margins, our revenue growth will slow and our business and financial results will

suffer.

Continued imposition of tighter processing restrictions by

credit card processing companies and acquiring banks would make it more difficult to generate revenue from our websites.

We rely on third parties to provide credit card

processing services allowing us to accept credit card payments from the majority of our customers. Our business could be

disrupted if these companies become unwilling or unable to provide these services to us. We are also subject to the operating

rules, certification requirements and rules governing electronic funds transfers imposed by the payment card industry seeking to

protect credit cards issuers, which could change or be reinterpreted to make it difficult or impossible for us to comply with such

rules or requirements. If we fail to comply, we may be subject to fines and higher transaction fees and lose our ability

to accept credit card payments from our customers, and our business and operating results would be adversely affected. Our

ability to accept credit cards as a form of payment for our online products sales could also be restricted or denied for a number

of other reasons, including but not limited to:

| Ÿ |

if we experience excessive charge backs and/or credits; |

| Ÿ |

if we experience excessive fraud ratios; |

| Ÿ |

if there is an adverse change in policy of the acquiring banks and/or card associations with respect to the processing of credit card charges for sexual wellness products; |

| Ÿ |

an increase in the number of European and U.S. banks that will not accept accounts selling sexual wellness products; |

| Ÿ |

if there is a breach of our security resulting in the theft of credit card data; |

| Ÿ |

continued tightening of credit card association chargeback regulations in international commerce; and |

| Ÿ |

association requirements for new technologies that consumers are less likely to use. |

Our business, financial condition and results of operations

could be adversely affected if we fail to provide adequate security to protect our customers’ data and our systems.

Consumer concerns over the security of transactions

conducted on the internet or the privacy of users may inhibit the growth of the internet and online commerce. Online security

breaches could adversely affect our business, financial condition and results of operations. Any well-publicized compromise

of security could deter use of the internet in general or use of the internet to conduct transactions that involve transmitting

confidential information or downloading sensitive materials. In offering online payment services, we may increasingly rely on technology

licensed from third parties to provide the security and authentication necessary to effect secure transmission of confidential

information, such as customer credit card numbers. Advances in computer capabilities, new discoveries in the field of cryptography

or other developments could compromise or breach the algorithms that we use to protect our customers’ transaction data.

If third parties are able to penetrate our network security or otherwise misappropriate confidential information, we could be subject

to liability, which could result in litigation. In addition, experienced programmers or “hackers” may attempt

to misappropriate proprietary information or cause interruptions in our services that could require us to expend significant capital

and resources to protect against or remediate these problems.

7

We may not be able to protect and enforce our intellectual

property rights and claims by third parties that we have infringed on their intellectual property could result in significant costs

and liabilities to us.

We believe that our marks, particularly the

“Liberator”, “Wedge”, “Ramp”, “Stage”, “Esse”, “Zeppelin”,

“Jaxx”, “Explore More”, “Bedroom Adventure Gear”, and the Liberator logo, and other proprietary

rights are critical to our success, potential growth and competitive position. Our inability or failure to protect or enforce

these trademarks and other proprietary rights could materially adversely affect our business. Our actions to establish, protect

and enforce our marks and other proprietary rights may not prevent imitation of our products or brands or control piracy by others

or prevent others from claiming violations of their trademarks and other proprietary rights by us.

Although not currently, we have in the past

been subject to claims of infringement or other violations of intellectual property rights. Intellectual property claims

are generally time-consuming and expensive to litigate or settle. To the extent that any future claims against us are successful,

we may have to pay monetary damages or discontinue sales of any of our products that are found to be in violation of another party’s

rights. Our inability to adequately protect our intellectual property rights from infringement by third parties could result

in a decline in our revenues and increased operating expenses associated with legal fees. Successful claims against us could also

result in us having to seek a license to continue sales of such products, which may significantly increase our operating burden

and expenses, potentially resulting in a negative effect on our business, financial condition and results of operations.

Because of the adult nature of our products, companies providing

products and services on which we rely may refuse to do business with us.

Many companies that provide products and services

we need are concerned that associating with a company in our industry will somehow hurt their reputation. As a result

of these concerns, these companies may be reluctant to enter into or continue business relationships with us. For example, some

credit card companies have declined to be affiliated with us. This has caused us, in some cases, to seek out and establish

business relationships with other providers of the services we need to operate our business. There can be no assurance

however, that we will be able to maintain our existing business relationships with the companies that currently provides us with

services and products. Our inability to maintain such business relationships, or to find replacement service providers,

would materially adversely affect our business, financial condition and results of operations. We could be forced to

enter into business arrangements on terms less favorable to us than we might otherwise obtain, which could lead to our doing business

with less competitive terms, higher transaction costs and more inefficient operations than if we were able to maintain such business

relationships or find replacement service providers.

Workplace and other restrictions on access to the internet

may limit user traffic on our websites.

Many offices, businesses, libraries and educational

institutions restrict employee and student access to the internet or to certain types of websites, including websites containing

sexual wellness content. Since much of our revenue is dependent on customer traffic to our Liberator websites, an increase

in these types of restrictions, or other similar policies, could harm our business, financial condition and operating results. In

addition, access to our Liberator websites outside the U.S. may be restricted by governmental authorities or internet service providers. If

these restrictions become more prevalent, our growth could be hindered.

There may never be an active market for our common stock,

which trades in the over-the-counter market in low volumes and at volatile prices.

There currently is a limited market for our

common stock. Although our common stock is quoted on the OTCQB Tier of the OTC Markets, an over-the-counter quotation system, trading

of our common stock is limited and sporadic and generally at very low volumes. Further, the price at which our common stock may

trade is volatile and we expect that it will continue to fluctuate significantly in response to various factors, many of which

are beyond our control. The stock market in general, and securities of small-cap companies in our industry in particular, has experienced

extreme price and volume fluctuations in recent years. Continued market fluctuations could result in further volatility in the

price at which our stock may trade, which could cause its value to decline. A more active market for our common stock may never

develop. As a result, investors must bear the economic risk of holding their shares of our common stock for an indefinite period

of time.

8

Our common stock is a "penny stock," which makes

it more difficult for our investors to sell their shares.

Our common stock is considered a "penny

stock" and is subject to the "penny stock" rules adopted under Section 15(g) of the Securities Exchange Act of 1934.

These rules require, among other things, that brokers who trade penny stock to persons other than "established customers"

complete certain documentation, make suitability inquiries of investors and provide investors with certain information concerning

trading in the security, including a risk disclosure document and quote information under certain circumstances. Many brokers have

decided not to trade penny stocks because of the requirements of the penny stock rules and, as a result, the number of broker-dealers

willing to act as market makers in such securities is limited. If we remain subject to the penny stock rules for any significant

period, it could have an adverse effect on the market, if any, for our common stock. If our common stock is subject to the penny

stock rules, investors will find it more difficult to dispose of our securities.

FINRA sales practice requirements may limit a shareholder's

ability to buy and sell our stock.

In addition to the "penny stock" rules

described above, FINRA has adopted rules that require that, in recommending an investment to a customer, a broker-dealer must have

reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low priced

securities to their non-institutional customers, broker-dealers must take reasonable efforts to obtain information about the customer's

financial status, tax status, investment objectives and other information. Under interpretations of these rules, FINRA has indicated

its belief that there is a high probability that speculative low priced securities will not be suitable for at least some customers.

These FINRA requirements make it more difficult for broker-dealers to recommend that at least some of their customers buy our common

stock, which may limit the ability of our shareholders to buy and sell our common stock and could have an adverse effect on the

market for our shares.

USE OF PROCEEDS

We will not receive any proceeds from the sale

of the common stock by the selling security holder.

2015 EQUITY INCENTIVE PLAN

On April 31, 2015, our board of directors approved

the 2015 Plan, and recommended the adoption of the 2015 Plan by our shareholders. On April 31, 2015 the 2015 Plan was approved

by our shareholders. The 2015 Plan reserves 5,000,000 shares of our common stock for issuance pursuant to the terms of the plan

upon the grant of awards under the 2015 Plan. As of June 21, 2017, we have outstanding options under the 2015 Plan to purchase

4,225,000 shares of our common stock at exercise prices ranging from $0.0125 to $0.035 per share.

The purpose of the 2015 Plan is to advance the

interests of our company by providing an incentive to attract, retain and motivate highly qualified and competent persons who are

important to us and upon whose efforts and judgment the success of our company is largely dependent. Grants to be made under the

2015 Plan may be made to our employees, our executive officers and members of our board of directors. The 2015 Plan provides for

the grant of restricted stock awards, deferred stock grants, stock appreciation rights, incentive stock options, or “ISOs,”

and non-statutory stock options, or “NSOs”. The terms and provisions of the 2015 Plan are summarized below, which summary

is qualified in its entirety by reference to the 2015 Plan, a copy of which is filed as an exhibit to our definitive information

statement on Schedule 14C filed with the SEC on October 9, 2015. See "Where You Can Find More Information"

appearing later in this reoffer prospectus.

The 2015 Plan is administered by our board of

directors. The board of directors determines, from time to time, those of our employees, executive officers and/or directors to

whom stock awards or plan options will be granted, the terms and provisions of each such grant, the dates such grants will become

exercisable, the number of shares subject to each grant, the purchase price of such shares and the form of payment of such purchase

price. All other questions relating to the administration of the 2015 Plan and the interpretation of the provisions thereof are

to be resolved at the sole discretion of the board of directors.

The board of directors may amend, suspend or

terminate the 2015 Plan at any time, except that no amendment shall be made which:

| Ÿ |

increases the total number of shares subject to the plan in excess of the evergreen formula or changes the minimum purchase price therefore (except in either case in the event of adjustments due to changes in our capitalization); |

| |

|

| Ÿ |

affects outstanding options or any exercise right thereunder; |

| |

|

| Ÿ |

extends the term of any option beyond 10 years; or |

| |

|

| Ÿ |

extends the termination date of the plan. |

9

Unless the plan is suspended or terminated by

the board of directors, the 2015 Plan will terminate 10 years from the date of the plan’s adoption. Any termination of the

2015 Plan will not affect the validity of any options previously granted thereunder.

Plan options under the 2015 Plan may either

be options qualifying as ISOs under Section 422 of the Internal Revenue Code, or options that do not so qualify which are known

as NSOs. Any option granted under the 2015 Plan must provide for an exercise price of not less than 100% of the fair market value

of the underlying shares on the date of such grant, but the exercise price of any ISO granted to an eligible employee owning more

than 10% of our common stock must be at least 110% of such fair market value as determined on the date of the grant. Subject to

the limitation on the aggregate number of shares issuable under the plan, there is no maximum or minimum number of shares as to

which a stock grant or plan option may be granted to any person. Shares used for stock grants and plan options may be authorized

and unissued shares or shares reacquired by us, including shares purchased in the open market.

The 2015 Plan provides

that, in the event of any dividend (other than a cash dividend) payable on shares of our common stock, stock split, reverse stock

split, combination or exchange of shares, or other similar event occurring after the grant of an award which results in a change

in the shares of our common stock as a whole, (i) the number of shares issuable in connection with any such award and the purchase

price thereof, if any, will be proportionately adjusted to reflect the occurrence of any such event and (ii) the board of

directors will determine whether such change requires an adjustment in the aggregate number of shares reserved for issuance under

the 2015 Plan or to retain the number of shares reserved and available under the plan in their sole discretion.

Any adjustment, however, does not change the total purchase price payable for the shares subject to outstanding options. In the

event of our proposed dissolution or liquidation, a proposed sale of all or substantially all of our assets, a merger or tender

offer for our shares of common stock, the board of directors may declare that each option granted under the plan shall terminate

as of a date to be fixed by the committee; provided that not less than 30 days written notice of the date so fixed shall be given

to each participant holding an option, and each such participant shall have the right, during the period of 30 days preceding such

termination, to exercise the participant’s option, in whole or in part, including as to options not otherwise exercisable.

All plan options are nonassignable and nontransferable,

except by will or by the laws of descent and distribution, and during the lifetime of the optionee, may be exercised only by such

optionee, except as provided by the board of directors. If an optionee should die while our employee or within three months after

termination of employment by us because of disability, retirement or otherwise, such options may be exercised, to the extent that

the optionee shall have been entitled to do so on the date of death or termination of employment, by the person or persons to whom

the optionee’s right under the option pass by will or applicable law, or if no such person has such right, by his executors

or administrators. Options are also subject to termination by the board of directors under certain conditions.

In the event of termination of employment because

of death while an employee, or because of disability, the optionee’s options may be exercised not later than the expiration

date specified in the option or one year after the optionee’s death, whichever date is earlier, or in the event of termination

of employment because of retirement or otherwise, not later than the expiration date specified in the option or one year after

the optionee’s death, whichever date is earlier. If an optionee’s employment by us terminates because of disability

and such optionee does not die within the following three months after termination, the options may be exercised, to the extent

that the optionee shall have been entitled to do so at the date of the termination of employment, at any time, or from time to

time, but not later than the expiration date specified in the option or one year after termination of employment, whichever date

is earlier. If an optionee’s employment terminates for any reason other than death or disability, the optionee may exercise

the options to the same extent that the options were exercisable on the date of termination, for up to three months following such

termination, or on or before the expiration date of the options, whichever occurs first. In the event that the optionee was not

entitled to exercise the options at the date of termination or if the optionee does not exercise such options (which were then

exercisable) within the time specified herein, the options shall terminate. If an optionee’s employment terminates for any

reason other than death, disability or retirement, all rights to exercise the option will terminate not later than 90 days following

the date of such termination of employment, except as otherwise provided under the plan. Non-qualified options are not subject

to the foregoing restrictions unless specified by the compensation committee.

The following is only a brief summary of the

effect of federal income taxation on an optionee under the 2015 Plan. We have adopted FASB ASC Topic 718. This Statement requires

that compensation costs related to share-based payment transactions, such as stock options or restricted stock award, be recognized

in the financial statements. Under ASC Topic 718, an optionee, recipient of a restricted stock award and our company will be subject

to certain tax consequences and accounting charges, regardless of the type of option or restricted stock award. Options granted

under the 2015 Plan may be either ISOs which satisfy the requirements of Section 422 of the Internal Revenue Code or NSOs which

do not meet such requirements. The federal income tax treatment for the two types of options differs, as summarized below.

10

• ISOs. No taxable income is

recognized by an optionee at the time of the grant of an ISO, and no taxable income is generally recognized at the time an ISO

is exercised. However, the excess of the fair market value of the common stock received upon the exercise of an ISO over the exercise

price is includable in the employee’s alternative minimum taxable income and may be subject to the alternative minimum tax,

or “AMT”. For AMT purposes only, the basis of the common stock received upon exercise of an ISO is increased by the

amount of such excess.

An optionee will recognize taxable income in

the year in which the purchased shares acquired upon exercise of an ISO are sold or otherwise disposed. For federal tax purposes,

dispositions are divided into two categories: (i) qualifying and (ii) disqualifying. An optionee will make a qualifying disposition

of the purchased shares if the sale or disposition is made more than two years after the grant date of the option and more than

one year after the exercise date. If an optionee fails to satisfy either of these two holding periods prior to sale or disposition,

then a disqualifying disposition of the purchased shares will result.

Upon a qualifying disposition, an optionee will

recognize long-term capital gain or loss in an amount equal to the difference between the amount realized upon the sale or other

disposition of the purchased shares and the exercise price paid for the shares except that, for AMT purposes, the gain or loss

would be the difference between the amount realized upon the sale or other disposition of the purchased shares and the employee’s

basis increased as described above. If there is a disqualifying disposition of the shares, then the optionee will generally recognize

ordinary income to the extent of the lesser of the difference between the exercise price and (i) the fair market value of the common

stock on the date of exercise, or (ii) the amount realized on such disqualifying disposition. Any additional gain recognized upon

the disposition will be capital gain. If the amount realized is less than the exercise price, the optionee will, in general, recognize

a capital loss. If the optionee makes a disqualifying disposition of the purchased shares, then we will be entitled to an income

tax deduction, for the taxable year in which such disposition occurs, to the extent the optionee recognizes ordinary income. In

no other instance will we be allowed a deduction with respect to the optionee’s disposition of the purchased shares.

• NSOs. No taxable income is

recognized by an optionee upon the grant of an NSO. The optionee will in general recognize ordinary income, in the year in which

an NSO is exercised, equal to the excess of the fair market value of purchased shares on the date of exercise over the exercise

price paid for such shares, and the optionee will be required to satisfy the tax withholding requirements applicable to such income.

Upon a subsequent sale of the purchased shares, the optionee will generally recognize either a capital gain or a capital loss depending

on whether the amount realized is more or less than the exercise price. We will be entitled to a business expense deduction equal

to the amount of ordinary income recognized by the optionee with respect to an exercised NSO. The deduction will in general be

allowed for our taxable year in which ordinary income is recognized by the optionee in connection with the acquisition of the option

shares.

• Restricted Stock. Unless the

recipient of a restricted stock grant elects to treat such grant as ordinary income at the time the grant is made, the recipient

does not recognize taxable income upon the grant of restricted stock. Instead, the recipient will recognize ordinary income at

the time of vesting (i.e. when the restrictions on the grant lapse) equal to the fair market value of the restricted shares

on the vesting date minus any amount paid for the restricted shares. At the time that the recipient recognizes ordinary income

in respect of the restricted stock grant, we would be entitled to a tax deduction for compensation expense equal to the amount

of ordinary income recognized by the recipient.

The foregoing is only a summary of the effect

of federal income taxation upon us and the participants under the 2015 Plan. It does not purport to be complete, and does not discuss

all of the tax consequences of a participant’s death or the provisions of the income tax laws of any state, municipality,

or foreign country in which the participants may reside.

SELLING SECURITY HOLDERS

At June 22, 2017 we had 73,452,596 shares

of our common stock issued and outstanding. The information under this heading relates to resales of shares covered by this

reoffer prospectus by persons who are our "affiliates" as that term is defined under federal securities laws. These

persons will be members of our board of directors, executive officers and/or employees of our company. Shares of our common

stock issued pursuant to this reoffer prospectus to our affiliates are "control" shares under federal securities

laws.

The following table sets forth:

| |

• |

the name of each affiliated selling security holder, |

| |

|

|

| |

• |

the amount of common stock owned beneficially, directly or indirectly, by each affiliated selling security holder, |

| |

|

|

| |

• |

the maximum amount of shares to be offered by the affiliated selling security holders pursuant to this prospectus, and |

| |

|

|

| |

• |

the amount of common stock to be owned by each affiliated selling security holder following sale of the shares. |

11

Beneficial ownership is determined in accordance

with the rules of the SEC and generally includes voting or investment power with respect to securities and includes any securities

which the person has the right to acquire within 60 days through the conversion or exercise of any security or other right. The

information as to the number of shares of our common stock owned by each affiliated selling security holder is based upon our books

and records and the information provided by our transfer agent.

We may amend or supplement this reoffer prospectus

from time to time to update the disclosure set forth in the table. Because the selling security holders identified in the table

may sell some or all of the shares owned by them which are included in this reoffer prospectus, and because there are currently

no agreements, arrangements or understandings with respect to the sale of any of the shares, no estimate can be given as to the

number of shares available for resale hereby that will be held by the affiliated selling security holders upon termination of the

offering made hereby. We have therefore assumed, for the purposes of the following table, that the affiliated selling security

holders will sell all of the shares owned by them, which are being offered hereby, but will not sell any other shares of our common

stock that they presently own.

| Name of selling security holder |

No. of shares beneficially owned |

No. of shares being registered |

No. of shares owned after the offering |

% owned after the offering |

| Louis S. Friedman (1) |

35,569,376 |

800,000 |

35,444,376 |

40.9% |

| Ronald P. Scott (2) |

885,516 |

500,000 |

810,516 |

1.1% |

| Leslie S. Vogelman (3) |

475,000 |

500,000 |

400,000 |

0.5% |

| (1) |

Mr. Friedman is an executive officer and member of our board of directors. The number of shares beneficially owned by him includes: |

| |

|

| |

Ÿ |

4,300,000 shares of common stock issuable upon conversion of 4,300,000 shares of Series A Convertible Preferred Stock at the discretion of the holder; and |

| |

Ÿ |

125,000 shares of our common stock underlying options granted under the 2015 Plan at exercise prices ranging from $0.0138 to $0.033 per share. |

| |

|

| |

The number of shares beneficially owned by Mr. Friedman excludes 675,000 shares of common stock underlying options with exercise prices ranging from $0.0138 to $0.033 per share which have not yet vested. The number of shares offered represents shares issuable upon the exercise of the options granted under the 2015 Plan. |

| |

|

| (2) |

Mr. Scott is an executive officer and member of our board of directors. The number of shares beneficially owned by him includes 675,000 shares of our common stock underlying options granted under our 2009 Incentive Stock Option Plan and the 2015 Plan at exercise prices ranging from $0.0125 to $0.06 per share, but excludes an additional 425,000 shares issuable upon the exercise of options granted under those plans at exercise prices ranging from $0.0125 to $0.51 per share which have not yet vested. The number of shares offered represents shares issuable upon the exercise of options granted under the 2015 Plan. |

| |

|

| (3) |

Ms. Vogelman is an officer of our company. The number of shares beneficially owned by her includes 475,000 shares of our common stock underlying options granted under our 2009 Incentive Stock Option Plan and the 2015 Plan at exercise prices ranging from $0.0125 to $0.06 per share, but excludes an additional 425,000 shares issuable upon the exercise of options granted under those plans at exercise prices ranging from $0.0125 to $0.51 per share which have not yet vested. The number of shares offered represents shares issuable upon the exercise of options granted under the 2015 Plan. |

PLAN OF DISTRIBUTION

The information under this heading includes

resales of shares covered by this reoffer prospectus by persons who are our "affiliates" as that term in defined under

federal securities laws.

The shares covered by this reoffer prospectus

may be resold and distributed from time to time by the selling security holders in one or more transactions, including ordinary

broker's transactions, privately-negotiated transactions or through sales to one or more broker-dealers for resale of these shares

as principals, at market prices existing at the time of sale, at prices related to existing market prices, through Rule 144 transactions

or at negotiated prices. The selling security holders in connection with sales of securities may pay usual and customary, or specifically

negotiated, brokerage fees or commissions.

12

The selling security holders may sell shares

in one or more of the following methods, which may include crosses or block transactions:

| Ÿ |

on the over-the-counter market on which our shares may be quoted from time-to-time, in transactions which may include special offerings, exchange distributions and/or secondary distributions, pursuant to and in accordance with the rules of such exchanges, or through brokers, acting as principal or agent; |

| |

|

| Ÿ |

in transactions other than on the over-the-counter market, or a combination of such transactions, including sales through brokers, acting as principal or agent, sales in privately negotiated transactions, or dispositions for value, subject to rules relating to sales by affiliates; or |

| |

|

| Ÿ |

through the writing of options on our shares, whether or not such options are listed on an exchange, or other transactions requiring delivery of our shares, or the delivery of our shares to close out a short position. |

Any such transactions may be effected at market

prices prevailing at the time of sale, at prices related to such prevailing market prices, at negotiated prices or at fixed prices.

In making sales, brokers or dealers used by

the selling security holders may arrange for other brokers or dealers to participate. The selling security holders who are affiliates

of our company and others through whom such securities are sold may be "underwriters" within the meaning of the Securities

Act for the securities offered, and any profits realized or commission received may be considered underwriting compensation. Information

as to whether an underwriter(s) who may be selected by the selling security holders, or any other broker-dealer, is acting as principal

or agent for the selling security holders, the compensation to be received by underwriters who may be selected by the selling security

holders, or any broker-dealer, acting as principal or agent for the selling security holders and the compensation to be received

by other broker-dealers, in the event the compensation of other broker-dealers is in excess of usual and customary commissions,

will, to the extent required, be set forth in a supplement to this prospectus. Any dealer or broker participating in any distribution

of the shares may be required to deliver a copy of this prospectus, including the supplement, if any, to any person who purchases

any of the shares from or through a dealer or broker.

We have advised the selling security holders

that, at the time a resale of the shares is made by or on behalf of a selling security holder, a copy of this reoffer prospectus

is to be delivered.

We have also advised the selling security holders

that during the time as they may be engaged in a distribution of the shares included herein they are required to comply with Regulation

M of the Securities Exchange Act of 1934, or the "Exchange Act." With certain exceptions, Regulation M precludes any

selling security holders, any affiliated purchasers and any broker-dealer or other person who participates in the distribution

from bidding for or purchasing, or attempting to induce any person to bid for or purchase any security which is the subject of

the distribution until the entire distribution is complete. Regulation M also prohibits any bids or purchase made in order to stabilize

the price of a security in connection with the distribution of that security.

Sales of securities by the selling security

holders or even the potential of these sales may have an adverse effect on the market price for shares of our common stock.

LEGAL MATTERS

The validity of the shares of common stock offered

by this reoffer prospectus will be passed upon by Pearlman Law Group LLP, Fort Lauderdale, Florida.

EXPERTS

Our consolidated financial statements as of

June 30, 2016 and 2015 and for the years then ended incorporated by reference into this reoffer prospectus have been so incorporated

in reliance on the reports of Liggett & Webb, P.A., independent registered public accounting firm, upon the authority of said

firm as experts in auditing and accounting.

13

WHERE YOU CAN FIND MORE INFORMATION

We are subject to the information and periodic

reporting requirements of the Exchange Act and, in accordance with that act, file periodic reports and other information with the

SEC. The periodic reports and other information filed by us are available for inspection and copying at prescribed rates at the

SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further

information about the operation of the SEC’s Public Reference Room. The SEC also maintains an Internet site that contains

all reports and other information that we file electronically with the SEC. The address of that website is www.sec.gov.

This reoffer prospectus is a part of a registration

statement on Form S-8 that we filed with the SEC. This reoffer prospectus does not contain all of the information set forth in

the registration statement and its exhibits and schedules, certain parts of which are omitted in accordance with the SEC’s

rules and regulations. For further information, we refer you to the registration statement and to such exhibits and schedules.

You may review a copy of the registration statement at the SEC’s public reference room in Washington, D.C. as well as through

the SEC’s website. Please be aware that statements in this Reoffer Prospectus referring to a contract or other document are

summaries and you should refer to the exhibits that are part of the registration statement for a copy of the contract or other

document.

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE

We hereby incorporate by reference the following

documents previously filed with the SEC:

| |

· |

our Annual Report on Form 10-K for the year ended June 30, 2016 filed with the SEC on September 27, 2016; and |

| |

· |

our Quarterly Report on Form 10-Q for the period ended March 31, 2017 filed with the SEC on May 15, 2017. |

All documents subsequently filed by the registrant

pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act, prior to the filing of a post-effective amendment which indicates

that all securities offered have been sold or which deregisters all securities then remaining unsold, shall be deemed to be incorporated

by reference in the registration statement and to be part thereof from the date of filing of such documents. Under no circumstances

shall any information furnished prior to or subsequent to the date hereof under Item 2.02 or 7.01 of Form 8-K be deemed incorporated

herein by reference unless such Form 8-K expressly provides to the contrary.

Any statement incorporated by reference herein

shall be deemed to be modified or superseded for purposes of this reoffer prospectus to the extent that a statement contained herein

or in any other subsequently filed document, which also is or is deemed to be incorporated by reference herein, modifies or supersedes

such statement. Any statement modified or superseded shall not be deemed, except as so modified or superseded, to constitute part

of this prospectus.

We hereby undertake to provide without charge

to each person, including any beneficial owner, to whom a copy of the reoffer prospectus has been delivered, on the written request

of any such person, a copy of any or all of the documents referred to above which have been or may be incorporated by reference

in this reoffer prospectus, other than exhibits to such documents. Written requests for such copies should be directed to our Corporate

Secretary at 2745 Bankers Industrial Drive, Atlanta, GA 30360, telephone number (770) 246-6400.

DISCLOSURE OF COMMISSION POSITION ON INDEMNIFICATION

FOR SECURITIES ACT LIABILITIES

Insofar as indemnification for liabilities arising

under the Securities Act may be permitted to directors, officers or persons controlling the registrant pursuant to the foregoing

provisions, we have been informed that in the opinion of the Securities and Exchange Commission such indemnification is against

public policy as expressed in the Act and is therefore unenforceable.

14

PART II

INFORMATION REQUIRED IN THE REGISTRATION

STATEMENT

| |

ITEM 3. |

Incorporation of Documents by Reference |

We hereby incorporate by reference the following

documents previously filed with the SEC:

| |

· |

our Annual Report on Form 10-K for the year ended June 30, 2016 filed with the SEC on September 27, 2016; and |

| |

· |

our Quarterly Report on Form 10-Q for the period ended March 31, 2017 filed with the SEC on May 15, 2017. |

All documents filed by the registrant pursuant

to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act subsequent to the date of this registration statement and prior to the

filing of a post-effective amendment to this registration statement which indicates that all securities offered hereby have been

sold or which deregisters all such securities then remaining unsold, shall be deemed to be incorporated by reference herein and

to be a part hereof from the date of filing of such documents. Any statement contained in this registration statement, in an amendment

hereto or in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded

for purposes of this registration statement to the extent that a statement contained herein or in any subsequently filed amendment

to this registration statement or in any document that is or is deemed to be incorporated by reference herein modifies or supersedes

such statement.

Under no circumstances shall any information

furnished prior to or subsequent to the date hereof under Item 2.02 or 7.01 of Form 8-K be deemed incorporated herein by reference

unless such Form 8-K expressly provides to the contrary.

| |

ITEM 4. |

Description of Securities |

Not applicable.

| |

ITEM 5. |

Interests of Named Experts and Counsel |

Not applicable.

| |

ITEM 6. |

Indemnification of Directors and Officers |

The Florida Business Corporation Act permits

the indemnification of directors, employees, officers and agents of a Florida corporation. Our articles of incorporation and bylaws

provide that we shall indemnify to the fullest extent permitted by the Florida Business Corporation Act any person whom we may

indemnify under the act. The provisions of Florida law that authorize indemnification do not eliminate the duty of care of a director,

and in appropriate circumstances equitable remedies including injunctive or other forms of non-monetary relief will remain available.

In addition, each director will continue to be subject to liability for:

| |

• |

violations of criminal laws, unless the director has reasonable cause to believe that his or her conduct was lawful or had no reasonable cause to believe his conduct was unlawful; |

| |

• |

deriving an improper personal benefit from a transaction; |

| |

• |

voting for or assenting to an unlawful distribution; and |

| |

• |

willful misconduct or conscious disregard for our best interests in a proceeding by or in our right to procure a judgment in its favor or in a proceeding by or in the right of a shareholder. |

The statute does not affect a director's responsibilities

under any other law, including federal securities laws. The effect of Florida law, our articles of incorporation and our bylaws

is to require us to indemnify our officers and directors for any claim arising against those persons in their official capacities

if the person acted in good faith and in a manner that he or she reasonably believed to be in or not opposed to the best interests

of the corporation, and, with respect to any criminal action or proceeding, had no reasonable cause to believe his or her conduct

was unlawful.

15

| |

ITEM 7. |

Exemption from Registration Claimed |

Persons eligible to receive grants under the

2015 Plan will have an existing relationship with us and will have access to comprehensive information about us to enable them

to make an informed investment decision. The recipient must express an investment intent and, in the absence of registration under

the Securities Act, consent to the imprinting of a legend on the securities restricting their transferability except in compliance

with applicable securities laws.

See the Exhibit Index following the signature

page for a list of exhibits filed as part of this registration statement, which Exhibit Index is incorporated herein by reference.

(a) The undersigned registrant hereby undertakes:

(1) To file, during any period in which offers

or sales are being made, a post-effective amendment to this registration statement:

(i) To include any prospectus required by

Section 10(a)(3) of the Securities Act;

(ii) To reflect in the prospectus

any facts or events arising after the effective date of this registration statement (or the most recent post-effective amendment

thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in this registration

statement;

(iii) To include any material information

with respect to the plan of distribution not previously disclosed in this registration statement or any material change to such

information in this registration statement; provided, however, that paragraphs (a)(1)(i) and (a)(1)(ii) do not apply if the information

required to be included in a post-effective amendment by those paragraphs is contained in periodic reports filed with or furnished

to the Commission by registrant pursuant to Section 13 or Section 15(d) of the Exchange Act that are incorporated by reference

in this registration statement.

(2) That, for the purpose of determining any

liability under the Securities Act, each such post-effective amendment shall be deemed to be a new registration statement relating

to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide

offering thereof.

(3) To remove from registration by means of

a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(b) The undersigned registrant hereby undertakes

that, for purposes of determining any liability under the Securities Act, each filing of registrant’s annual report pursuant

to Section 13(a) or Section 15(d) of the Exchange Act (and, where applicable, each filing of an employee benefit plan’s annual

report pursuant to Section 15(d) of the Exchange Act) that is incorporated by reference in this registration statement shall be

deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that

time shall be deemed to be the initial bona fide offering thereof.

(c) Insofar as indemnification for liabilities

arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons of the registrant pursuant

to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the Securities and Exchange Commission

such indemnification is against public policy as expressed in the Act and is, therefore, unenforceable. In the event that a claim

for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director,

officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such

director, officer or controlling person in connection with the securities being registered, the registrant will, unless in the

opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the

question whether such indemnification by it is against public policy as expressed in the Act and will be governed by the final

adjudication of such issue.

16

SIGNATURES

Pursuant to the requirements of the Securities

Act of 1933, Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on

Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized,

in Atlanta, GA, on June 23, 2017.

| |

LUVU BRANDS, INC. |

| |

|

|

| |

By: |

/s/ Louis S. Friedman |

| |

|

Louis S. Friedman |

| |

|

Chief Executive Officer and President |

Pursuant to the requirements of the Securities

Act of 1933, as amended, this registration statement has been signed by the following persons in the capacities indicated.

| Signature |

|

Title |

|

Date |

| |

|

|

|

|

| /s/ Louis S. Friedman |

|

Chairman of the Board of Directors, Chief Executive Officer and President (principal executive officer) |

|

June 23, 2017 |

| Louis S. Friedman |

|

|

|

| |

|

|

|

|

| /s/ Ronald P. Scott |

|

Chief Financial Officer, Secretary and director (principal financial officer) |

|

June 23, 2017 |

| Ronald P. Scott |

|

|

|

17

EXHIBIT INDEX

| Exhibit No. |

|

Description |

| |

|

|

| 3.1 |

|

Amended and Restated Articles of Incorporation (incorporated by reference to the registration statement on Form SB-2, SEC File No. 333-141022, as amended, as declared effective on July 5, 2007). |

| |

|

|

| 3.2 |

|

Bylaws (incorporated by reference to the registration statement on Form SB-2, SEC File No. 333-141022, as amended, as declared effective on July 5, 2007). |

| |

|

|

| 3.3 |

|

Articles of Amendment to the Amended and Restated Articles of Incorporation (incorporated by reference to the Current Report on Form 8-K filed February 23, 2011). |

| |

|

|

| 3.4 |

|

Designations of Rights and Preferences of Series A Convertible Preferred Stock (incorporated by reference to the Current Report on Form 8-K filed February 23, 2011). |

| |

|

|

| 3.5 |

|

Articles of Amendment to the Amended and Restated Articles of Incorporation (incorporated by reference to the Current Report on Form 8-K filed November 5, 2015) |

| |

|

|

| 4.1 |

|

2015 Equity Incentive Plan (incorporated by reference to the definitive Information Statement on Schedule 14C filed October 9, 2015). |