FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the month of May, 2017

Commission File Number: 001-15002

ICICI Bank

Limited

(Translation of registrant’s name into English)

ICICI Bank

Towers,

Bandra-Kurla Complex

Mumbai, India 400 051

(Address of principal executive office)

Indicate

by check mark whether the registrant files or will file

annual reports under cover Form 20-F or Form 40-F.

Indicate

by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate

by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7):

Indicate

by check mark whether by furnishing the information

contained in this Form, the Registrant is also thereby furnishing the

information to the Commission pursuant to Rule 12g3-2(b)

under the Securities Exchange Act of 1934:

If “Yes” is marked,

indicate below the file number assigned to the registrant in

connection with Rule 12g 3-2(b):

Not Applicable

Table

of Contents

|

Item

|

|

|

|

|

|

1.

2.

3.

4.

|

Other News

Legend attached to the Notice sent to ADS

holders

Postal Ballot Notice sent to equity shareholders

Postal Ballot Form sent to equity shareholders

|

|

|

|

Item

1

OTHER

NEWS

Subject:

Approvals through Postal Ballot and intimation of revised book closure dates

IBN

ICICI

Bank Limited (the ‘Company’) Report on Form 6-K

This

is further to our letters dated May 3, 2017 and May 4, 2017 vide which the Bank had informed about issuance of bonus shares, seeking

approval of the shareholders for the same through postal ballot and the book closure dates for determining the eligibility of

shareholders to receive dividend.

Further

to the above, we have given the below disclosures today to the stock exchanges under the Indian Listing Regulations.

Approval

of shareholders is being sought for the following resolutions through postal ballot:

|

|

1.

|

Ordinary

Resolution for increase in the Authorised Share Capital of the Company and consequent

amendment to the Capital Clause of the Memorandum of Association.

|

|

|

2.

|

Special

Resolution for alteration of Capital Clause of Articles of Association.

|

|

|

3.

|

Ordinary

Resolution for issue of Bonus Shares in proportion of 1:10 i.e. 1 (one) equity share

of Rs. 2/- each for every 10 (ten) fully paid-up equity shares of Rs. 2/- each (including

creation of bonus equity shares underlying American Depository Shares (ADS) and adjustments

with respect to the stock options granted under the Employee Stock Option Scheme, 2000)

|

|

|

4.

|

Special

Resolution for Amendment to Employees Stock Option Scheme.

|

We

enclose

the postal ballot notice and form being sent to equity shareholders of the Bank i

n

terms of the provisions of Section 110 of the Companies Act, 2013

read with Companies (Management

& Administration) Rules, 2014.

The Postal Ballot Form and Postal Ballot Notice is uploaded

on the website of the Bank

www.icicibank.com

.

:

2 :

The

Bank has also revised the book closure dates for closure of Register of Members and Share Transfer Books as intimated vide our

letter dated May 3, 2017. The Register of Members and Share Transfer Books will be closed from June 22, 2017 to June 24, 2017

(both days inclusive) for the following purposes:

|

|

1.

|

For

the purpose of the Annual General Meeting of the Bank to be held on June 30, 2017.

|

|

|

2.

|

Determining

the eligibility of shareholders to receive dividend. Member

s

holding shares in electronic form at the close of business hours on June 21, 2017 and

Members holding shares in physical form, whose names appear in the Register of Members

of the Company, at the close of business hours on June 24, 2017 after giving effect to

all valid transfers in physical form lodged on or before June 21, 2017 are eligible to

receive dividend as approved by the Members at the ensuing AGM

|

|

|

3.

|

Determining

the eligibility of shareholders to receive bonus shares subject to the approval of the

shareholders by postal ballot the results of which will be announced on or before June

14, 2017. Member

s

holding shares in electronic form at the close of business hours on June 21, 2017 and

Members holding shares in physical form, whose names appear in the Register of Members

of the Company, at the close of business hours on June 24, 2017 after giving effect to

all valid transfers in physical form lodged on or before June 21, 2017 are entitled to

be issued bonus shares subject to approval of the same by the Members through postal

ballot. The bonus shares will not be entitled to any dividend in respect of financial

year ending March 31, 2017.

|

We

request you to please take the above disclosure on record.

|

ICICI

Bank Limited

ICICI

Bank Towers

Bandra-Kurla

Complex

Mumbai

400 051, India.

|

Tel.:

(91-22) 2653 1414

Fax:

(91-22) 2653 1122

Website

www.icicibank.com

CIN.:

L65190GJ1994PLC021012

|

Regd.

Office: ICICI Bank Tower,

Near

Chakli Circle,

Old

Padra Road

Vadodara

390007. India

|

Item

2

ICICI Bank Limited

CIN: L65190GJ1994PLC021012

Registered

Office:

ICICI

Bank Tower

,

Near

Chakli Circle, Old Padra Road

, Vadodara

390 007, Phone: 0265-6722286

Corporate Office: ICICI Bank Towers,

Bandra-Kurla Complex, Mumbai 400 051, Phone: 022-26538900, Fax: 022-26531230

Website:

www.icicibank.com

,

E-mail: i

nvestor@icicibank.com

|

Notice

to American Depositary Shares (“ADS”) Holders

Notice

to ADS Holders

The

attached is being provided by ICICI Bank Limited (the “Bank”) FOR INFORMATIONAL PURPOSES ONLY and is not to

be construed, and does not purport to be, an offer to sell or solicitation of an offer to buy any securities.

Deutsche

Bank Trust Company Americas, the Depositary (the “Depositary”), has not reviewed the enclosed, and expressly

disclaims any responsibility for, and does not make any recommendation with respect to, the Bank or the matters and/or

transactions described or referred to in the enclosed documentation. Furthermore, neither the Depositary nor any of its

officers, employees, directors, agents or affiliates controls, is responsible for, endorses, adopts, or guarantees the

accuracy or completeness of any information provided at the Bank’s request or otherwise made available by the Bank

and none of them are liable or responsible for any information contained therein.

Registered

Holders have no voting rights with respect to the Shares or other Deposited Securities represented by their American Depositary

Shares. The instructions of Registered Holders shall not be obtained with respect to the voting rights attached to the

Shares or other Deposited Securities represented by their respective ADSs. In accordance with the Governmental Approval,

the Depositary is required, at the direction of the Board of Directors of the Bank (the “Board”), to vote

as directed by the Board.

The

matters referred to in the attached are being made with respect to the securities of an Indian company. The proposed action

is subject to the disclosure requirements of India, which are different from those of the United States.

It

may be difficult for you to enforce your rights and any claim you may have arising under the U.S. federal securities laws,

since the issuer is located in India, and some or all of its officers and directors may be residents of India. You may

not be able to sue an Indian company or its officers or directors in an Indian court for violations of the U.S. securities

laws. It may be difficult to compel an Indian company and its affiliates to subject themselves to a U.S. court’s

judgment.

Capitalized

terms used in this notice but not defined herein shall have the meanings ascribed to them in the Deposit Agreement, dated

as of March 31, 2000 (as amended) between the Bank, the Depositary and all Registered Holders and Beneficial Owners from

time to time of Receipts issued thereunder.

|

Item

3

CIN: L65190GJ1994PLC021012

Registered

Office:

ICICI Bank Tower, Near Chakli Circle, Old Padra Road, Vadodara 390 007, Gujarat, Phone: 0265-6722286

Corporate

Office:

ICICI Bank Towers, Bandra-Kurla Complex, Mumbai 400 051, Phone: 022-26538900, Fax: 022-26531230

Website:

www.icicibank.com

,

E-mail:

investor@icicibank.com

POSTAL

BALLOT NOTICE

Dear

Members,

Notice

is hereby given pursuant to the provisions of Section 110 and other applicable provisions, if any, of the Companies Act, 2013 (‘the

Act’), read with Rule 22 of the Companies (Management and Administration) Rules, 2014 including any statutory modification

or re-enactment thereof for the time being in force and subject to other applicable laws and regulations, that the resolutions

appended below for increase in Authorised share capital and consequential amendments to the Memorandum and Articles of Association

of the Bank, issue of bonus shares and amendment to the Employee Stock Option Scheme 2000, are proposed to be passed by the Members

through Postal Ballot/electronic voting (e-voting).

The

explanatory statement pursuant to Sections 102 and 110 of the Act pertaining to the aforesaid resolutions setting out the material

facts concerning each item and the reasons thereof are annexed hereto with a Postal Ballot Form for your consideration.

The

Board of Directors of the Bank, at its Meeting held on May 3, 2017, has appointed Mr. Alwyn D’souza of Alwyn D’souza

& Co., Practicing Company Secretaries, as the Scrutinizer for conducting the Postal Ballot and e-voting process in a fair and

transparent manner. Members have the option to vote either by Postal Ballot or through e-voting. Members desiring to exercise their

vote by Postal Ballot are requested to carefully read the instructions printed in the Postal Ballot Form and return the same duly

completed in the enclosed self-addressed Business Reply Envelope. Postal Ballot Form(s), if sent by courier or by registered post/speed

post at the expense of the Member(s) will also be accepted. The Postal Ballot Form(s) may also be deposited personally at the address

given thereon. The duly completed Postal Ballot Form(s) should reach the Scrutinizer not later than 5:00 p.m. on June 12, 2017

to be eligible for being considered, failing which it will be strictly considered that no reply has been received from the Member.

Members

desiring to opt for e-voting are requested to read the instructions in the Notes under the section “Voting through electronic

means”.

The

Scrutinizer will submit his report to the Chairman or any other Director of the Bank after completion of scrutiny of the Postal

Ballots (including e-voting). The results of Postal Ballot shall be declared on or before June 14

,

2017 at any time

before 5:00 p.m. and be displayed at the Registered as well as Corporate Office of the Bank, communicated to the Stock Exchanges

and would also be uploaded on the Bank’s website www.icicibank.com

Item

No. 1

Increase

in Authorised Share Capital and consequential alteration to the Capital Clause of Memorandum of Association

To

consider and, if thought fit, to pass, the following resolution as an Ordinary Resolution:

RESOLVED

that pursuant to the provisions of Section 61 and other applicable provisions of the Companies Act, 2013 approval of the Members

be and is hereby accorded to increase the authorised share capital of the Bank from

Rs.

1775,00,00,000 (Rupees One thousand seven hundred seventy five crores only) divided into 637,50,00,000 equity shares of

Rs.

2 each, 150,00,000 shares of

Rs.

100 each and 350 shares of

Rs.

100,00,000 each to

Rs.

2500,00,00,000 (Rupees Two thousand five hundred

crores only) divided into 1000,00,00,000 equity shares of

Rs.

2 each,

150,00,000 shares of

Rs.

100 each and 350 shares of

Rs.

100,00,000 each by creation of additional 362,50,00,000 equity shares of

Rs.

2 each.

RESOLVED

FURTHER

that subject to the provisions of Section 13, 61 and other applicable provisions of the Companies Act, 2013 and subject

to such other approval(s) from the concerned Statutory Authority(ies), including the Reserve Bank of India, Clause V of the Memorandum

of Association of the Bank relating to Capital be substituted by the following Clause:

Clause

V would be substituted as follows:

The

authorised capital of the Company shall be

Rs.

2500,00,00,000 divided

into 1000,00,00,000 equity shares of

Rs.

2 each, 150,00,000 shares

of

Rs.

100 each and 350 shares of

Rs.

100,00,000 each with rights, privileges and conditions attached thereto as are provided by the Articles of Association of the Company

for the time being with power to increase or reclassify or alter the capital of the Company and to divide/consolidate the shares

in the capital for the time being into several classes and face values and to attach thereto respectively such preferential, cumulative,

convertible, guarantee, qualified or other special rights, privileges, conditions or restrictions, as may be determined by or in

accordance with the Articles of Association of the Company for the time being and to vary, modify or abrogate any such right, privilege

or condition or restriction in such manner as may for the time being be permitted by the Articles of Association of the Company

and the legislative provisions for the time being in force.

RESOLVED

FURTHER

that the Board of Directors of the Bank (which expression shall also include a Committee thereof) be authorised to

take such steps as may be necessary including the delegation of all or any of its powers herein conferred to any Director(s), the

Company Secretary, the Joint Company Secretary or any other officer(s) of the Bank for obtaining approvals, statutory, contractual

or otherwise, in relation to the above and to do all acts, deeds, matters and things that may be necessary, proper, expedient or

incidental for the purpose of giving effect to this resolution.

Item

No. 2

Alteration

of Articles of Association

To

consider and, if thought fit, to pass, the following resolution, as a Special Resolution:

RESOLVED

that subject to the provisions of Section 14 and other applicable provisions of the Companies Act, 2013 and subject to such

other approval(s) from the concerned Statutory Authority(ies), including the Reserve Bank of India, Article 5(a) of the Articles

of Association of the Bank relating to Capital be substituted by the following Clause:

Article

5(a) would be substituted as follows:

The

Authorised Capital of the Company is

Rs.

2500,00,00,000 divided into:

|

|

i.

|

1000,00,00,000 equity shares of

Rs.

2 each.

|

|

|

ii.

|

150,00,000 shares of

Rs.

100 each which shall be of such class and with rights, privileges, conditions or restrictions as may be determined by the

Company in accordance with these presents and subject to the legislative provisions for the time being in that behalf, and

|

|

|

iii.

|

350 preference shares of

Rs.

100,00,000 each.

|

RESOLVED

FURTHER

that the Board of Directors of the Bank (which expression shall also include a Committee thereof) be authorised to

take such steps as may be necessary including the delegation of all or any of its powers herein conferred to any Director(s), the

Company Secretary, the Joint Company Secretary or any other officer(s) of the Bank for obtaining approvals, statutory, contractual

or otherwise, in relation to the above and to do all acts, deeds, matters and things that may be necessary, proper, expedient or

incidental for the purpose of giving effect to this resolution.

Item

No. 3

Issue

of Bonus Shares

To

consider and, if thought fit, to pass, the following resolution as an Ordinary Resolution:

RESOLVED

that pursuant to the provisions of Section 63 and other applicable provisions of the Companies Act, 2013 and the rules made

there under, the Securities and Exchange Board of India (SEBI) (Issue of Capital and Disclosure Requirements) Regulations, 2009

and other applicable regulations and guidelines issued by SEBI and Reserve Bank of India (RBI) from time to time, the relevant

provisions of the Articles of Association of the Company, and the recommendation of the Board of Directors of the Bank, and subject

to such approvals as may be required in this regard, approval of the Members be and is hereby accorded to the Board of Directors

of the Bank (hereinafter referred to as the Board and which expression shall be deemed to include a Committee of the Board) for

capitalisation of such sums standing to the credit of the Securities Premium Account, as may be considered appropriate by the Board,

for the purpose of the issue of bonus equity shares of

Rs.

2/- each,

credited as fully paid-up equity shares to the holders of the existing equity shares of the Bank in consideration of their said

holding in the proportion of 1 (one) equity share of

Rs.

2/- each for

every 10 (ten) equity shares of

Rs.

2/- each held by the Members.

RESOLVED

FURTHER

that for the purpose of determining the eligibility of Members who will be entitled to be issued the aforesaid bonus

equity shares, the Register of Members and Share Transfer Books as determined under the Authority granted by the Board, will be

closed from Thursday, June 22, 2017 to Saturday June 24, 2017 (both days inclusive) and the bonus equity shares will be allotted

to those Members holding shares in electronic form as per the beneficiary position downloaded from the Depositories i.e. National

Securities Depository Limited (NSDL) and Central Depository Services Limited (CDSL) on June 21, 2017 and to those Members holding

shares in physical form on June 24, 2017 after giving effect to all valid transfers received upto June 21, 2017 (“Record

Date”).

RESOLVED

FURTHER

that no fractions arising out of the issue and allotment of bonus equity shares shall be allotted by the Bank and the

Bank shall not issue any certificate or coupon in respect thereof but all such fractional entitlements shall be consolidated and

the bonus equity shares, in lieu thereof, shall be allotted by the Board to the Nominees appointed by the Board, who shall hold

the same as Trustees for the Members entitled thereto, and sell the said equity shares so arising at the then prevailing market

rate and pay to the Bank net sale proceeds thereof, after adjusting therefrom the cost and expenses in respect of such sale, for

distribution to Members in proportion to their fractional entitlement.

RESOLVED

FURTHER

that pursuant to the Securities and Exchange Board of India (Share Based Employee Benefits) Regulations, 2014 and any

amendments thereto from time to time, with respect to the employee stock options outstanding (whether vested or unvested including

lapsed and forfeited options available for re-issuance) as on the record date/book closure dates as mentioned above under the Employee

Stock Option Scheme of the Bank, the Board or the Board Governance Remuneration & Nomination Committee be authorised to make

appropriate adjustments with respect to the exercise price and the number of stock options and decide on the allotment of such

number of additional stock options as bonus options to the employees who have been granted stock options in the same proportion

as the bonus equity shares being issued.

RESOLVED

FURTHER

that for the purpose of giving effect to the bonus issue of equity shares of the Bank underlying each American Depository

Share (ADS) and consequent proportionate increase in issuance of ADS in the same proportion of bonus equity shares being issued

viz. one additional ADS including underlying equity shares for every ten ADS held, and subject to any approvals or filings which

may be necessary to be obtained/done with Securities and Exchange Commission (SEC), New York Stock Exchange (NYSE), or any other

regulatory authorities in India or overseas, approval of the Members be and is hereby accorded to the Board for the purpose of

issue of bonus equity shares to the holders of the existing ADS of the Bank by making proportionate and appropriate adjustments

to the number of American Depository Shares (ADSs) held by such holders on such date as may be considered equivalent to a record

date under Indian laws and regulations. The Board in consultation with Deutsche Bank Trust Company Americas, the Depository for

the ADS holders is authorised to decide on the manner of providing the benefit of fractional entitlements, if any which may arise

or become due to the ADS holders considering the bonus ratio of one equity share for every ten equity shares and the resultant

proportion of one ADS for every ten ADS held.

RESOLVED

FURTHER

that no allotment letters shall be issued to the allottees of the bonus equity shares and that the certificate(s) in

respect of bonus equity shares shall be completed and thereafter be dispatched to the allottees, except in respect of those allottees

who hold shares in dematerialised form, within the period prescribed or that may be prescribed in this behalf, from time to time.

RESOLVED

FURTHER

that the bonus equity shares so allotted shall rank pari passu in all respects with the fully-paid up equity shares

of the Bank as existing on the record date/book closure date save and except that they shall not be entitled to any dividend in

respect of financial year ending March 31, 2017.

RESOLVED

FURTHER

that the issue and allotment of the said bonus equity shares to the extent they relate to Non-Resident Indians (NRIs),

Persons of Indian Origin (PIO), Foreign Portfolio Investors (FPIs), Overseas Corporate Bodies (OCBs) and other foreign investors

of the Bank will be subject to the approval of the RBI, as may be necessary.

RESOLVED

FURTHER

that for the purposes of giving effect to the bonus issue of equity shares, underlying bonus equity shares relating

to ADS and grant of bonus stock options under the ESOS scheme of the Bank as resolved herein before, the issuance of equity shares

and/or ADS or instruments or securities representing the same and bonus stock options relating to the ESOS scheme of the Bank,

the Board and other designated officers of the Bank as may be authorised by the Board and are hereby authorised on behalf of the

Bank to do all such acts, deeds, matters and things as it may at its discretion deem necessary or desirable for such purpose, including

without limitation, filing a registration statement, if any, and other documents with the SEC, NYSE and/or the SEBI, listing the

additional equity shares and/or ADS on BSE Limited, National Stock Exchange of India, New York Stock Exchange (NYSE) as the case

may be, amending, if necessary, the relevant sections of the agreement entered into between the Bank, Deutsche Bank Trust Company

Americas, New York (the depositary to the Bank’s ADS) and the ADS Holders (‘the Depositary Agreement’) in connection

with the Bank’s ADS offering, listing on NYSE, and entering into of any depositary arrangements in regard to any such bonus

as it may in its absolute discretion deem fit.

RESOLVED

FURTHER

that the Board be and is hereby authorised to take such steps as may be necessary including the delegation of all or

any of its powers herein conferrred to any Director(s), the Company Secretary, the Joint Company Secretary or any other officer(s)

of the Bank for obtaining approvals, statutory, contractual or otherwise, in relation to the above and to settle all matters arising

out of and incidental thereto, and to execute all deeds, applications, documents and writings that may be required, on behalf of

the Bank and generally to do all acts, deeds, matters and things that may be necessary, proper, expedient or incidental for the

purpose of giving effect to this resolution.

Item

No. 4

Amendment

of the Employee Stock Option Scheme

To

consider and, if thought fit, to pass, the following resolution, as a Special Resolution:

RESOLVED

that in accordance with the provisions of the Securities and Exchange Board of India (Share Based Employee Benefits) Regulations,

2014 and ICICI Bank Employees Stock Option Scheme 2000 (Scheme) as amended from time to time and subject to such other approvals

as may be required, approval of the Members be and is hereby accorded to amend the definition of Exercise Period in the Scheme

as “Exercise Period means the period commencing from the date of vesting and will expire on completion of such period not

exceeding ten years from the date of vesting of Options as may be determined by the Board Governance Remuneration & Nomination

Committee for each grant”.

RESOLVED

FURTHER

that for the purpose of giving effect to the above resolution the Board or Board Governance, Remuneration & Nomination

Committee of the Board be and is hereby authorised on behalf of the Bank to do all such acts, deeds, matters and things as it may,

in its absolute discretion, deem necessary or desirable for such purpose and with power on behalf of the Bank to settle all questions,

difficulties or doubts that may arise in regard to implementation of the resolution including but not limited to determination

of eligibility or otherwise of employees of the Bank or subsidiaries or any other grantees who continue to be covered by the Scheme

to the benefits extended under the Scheme.

|

|

1.

|

The relevant Explanatory Statement pursuant to the provisions

of Section 102(1) of the Companies Act, 2013 in respect of the aforesaid items set out in the Notice is annexed hereto.

|

|

|

2.

|

The Postal Ballot Notice is being sent to the Members

whose names appear on the Register of Members/List of Beneficial Owners as received from NSDL and Central Depository Services

(India) Limited (CDSL) as on May 5, 2017. The Postal Ballot Notice is being sent to Members in electronic form to the e-mail IDs

registered with their Depository Participant (in case of electronic shareholding)/the Bank’s Registrar and Transfer Agents

(RTA) (in case of physical shareholding). In case of Members whose e-mail ID is not registered, physical copy of Postal Ballot

Notice and Form is being sent by permitted mode along with a postage pre-paid self-addressed Business Reply Envelope (BRE).

|

|

|

3.

|

The Members whose name appears on the Register of Members/List

of Beneficial Owners as on May 5, 2017 will be considered for the purpose of voting.

|

|

|

4.

|

Resolutions passed by the Members through Postal Ballot

are deemed to have been passed as if the same have been passed at a general meeting of the Members.

|

|

|

5.

|

The Members can opt for only one mode of voting, i.e.,

either by physical ballot form or e-voting. In case Members cast their votes through both the modes, voting done by e-voting shall

prevail and votes cast through physical postal ballot form will be treated as invalid.

|

|

|

6.

|

In case a Member is desirous of obtaining a duplicate copy of a Postal Ballot Form, he/she may

send an e-mail to investor@icicibank.com. The RTA/Bank shall forward the same along with postage pre-paid self-addressed BRE to

the Member.

|

|

|

7.

|

Voting through electronic means:

|

In

compliance with Regulation 44 of SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 and Section 108, 110

and other applicable provisions of the Companies Act, 2013 read with the related rules, the Bank is pleased to provide e-voting

facility to all its Members, to enable them to cast their votes electronically instead of dispatching the physical Postal Ballot

Form by post. The Bank has engaged the services of NSDL for the purpose of providing e-voting facility to all its Members.

|

|

a.

|

The instructions for e-voting are as under:

|

|

|

i.

|

Members whose e-mail IDs are registered with the RTA/Depository

Participant(s) will receive an e-mail from NSDL informing the User-ID and Password/PIN.

|

|

|

1.

|

Open e-mail and open the attached PDF file with your

Client ID or Folio No. as password. The said PDF file contains your user ID and password for e-voting. Please note that the password

is an initial password.

|

|

|

|

Note: Shareholders already registered with NSDL for e-voting

will not receive the PDF file “Remote e-voting.pdf”.

|

|

|

2.

|

Launch internet browser by typing the following URL:

https://www.evoting.nsdl.com.

|

|

|

3.

|

Click on Shareholder – Login.

|

|

|

4.

|

Enter the user ID and password/PIN as initial password

noted in step (1) above. Click Login.

|

|

|

5.

|

Password change menu appears. Change the password/PIN

with new password of your choice with minimum 8 digits/characters or combination thereof. Note new password. It is strongly recommended

not to share your password with any other person and take utmost care to keep your password confidential.

|

|

|

6.

|

Home page of e-voting opens. Click on e-voting: Active

Voting Cycles.

|

|

|

7.

|

Select “EVEN” (E-Voting Event Number) of

ICICI Bank Limited.

|

|

|

8.

|

Now you are ready for e-voting as Cast Vote page opens.

|

|

|

9.

|

Cast your vote by selecting appropriate option and click

on “Submit” and also “Confirm” when prompted.

|

|

|

10.

|

Upon confirmation, the message “Vote cast successfully”

will be displayed.

|

|

|

11.

|

Once you have voted on the resolution, you will not be

allowed to modify your vote.

|

|

|

12.

|

Institutional Members (i.e. other than individuals, HUF,

NRI etc.) are required to send scanned copy (PDF/JPG Format) of the relevant Board Resolution/Authority letter etc. together with

attested specimen signature of the duly authorised signatory(ies) who are authorised to vote, to the Scrutinizer through e-mail

to scrutinizericicibank@gmail.com or evoting@icicibank.com with a copy marked to evoting@nsdl.co.in.

|

|

|

ii.

|

For Members whose e-mail IDs are not registered with

the RTA/Depository Participant(s) and who receive the physical Postal Ballot Forms, the following instructions may be noted:

|

|

|

a

|

Initial password is provided as below/at the bottom of

the Postal Ballot Form:

|

EVEN

(E-Voting Event Number)

USER ID

PASSWORD/PIN

|

|

b

|

Please follow all steps from Sr. No. 1 to Sr. No. 12

of (i) above, to cast vote.

|

|

|

b.

|

In case of any queries/grievances, you may refer the

Frequently Asked Questions (FAQs) for Members and e-voting user manual for Members available at the downloads section of www.evoting.nsdl.com

or may contact on the NSDL toll free no. 1800 222 990.

|

|

|

c.

|

Login to the e-voting website will be disabled upon five unsuccessful attempts to key in the correct

password. In such an event, you will need to go through the ‘Forgot Password’ option available on the site to reset

the password.

|

|

|

d.

|

If you are already registered with NSDL for e-voting

then you can use your existing user ID and password/PIN for casting your vote.

|

|

|

e.

|

You can also update your mobile number and e-mail id

in the user profile details of the folio which may be used for sending future communication(s).

|

|

|

f.

|

The e-voting period commences on Saturday, May 13, 2017

(9:00 a.m. IST) and ends on Monday, June 12, 2017 (5:00 p.m. IST). During this period Members of the Bank, holding shares either

in physical form or in dematerialised form, as on the relevant date of May 5, 2017 may cast their vote electronically. The e-voting

module shall be disabled by NSDL for voting thereafter. Once the vote on a resolution is cast by the Member, the Member shall

not be allowed to change it subsequently.

|

|

|

g.

|

The voting rights of Members shall be in proportion to

their share of the paid-up equity share capital of the Bank as on the relevant date of May 5, 2017 subject to the provisions of

the Banking Regulation Act, 1949.

|

|

|

8.

|

All the material documents referred to in the Notice will be made available for inspection by the

Members at the registered office of the Bank during working hours on any working day upto June 12, 2017.

|

For

and behalf of the Board of Directors

P.

Sanker

Senior

General Manager (Legal) & Company Secretary

Mumbai,

May 5, 2017

EXPLANATORY

STATEMENT UNDER SECTION 102(1) OF THE COMPANIES ACT, 2013

Item

Nos. 1, 2 and 3

The

equity shares of your Bank are listed and actively traded on the National Stock Exchange of India Limited and BSE Limited, and

American Depository Shares (ADS) are listed and actively traded on New York Stock Exchange. The Board of Directors of the Bank

at its Meeting held on May 3, 2017 considered and approved a bonus issue of 1 (one) equity share for every 10 (ten) existing equity

share held and consequent to creation of bonus equity shares underlying ADS, a bonus issue of one ADS for every ten existing ADS

held, respectively, as on the Record Date (as indicated in the resolution) subject to approval of the Members and any other statutory

and regulatory approvals as applicable. The ratio of equity shares underlying the ADS held by an ADS holder would remain unchanged.

The

bonus issue of equity shares would, inter alia, require appropriate adjustments with respect to all the stock options of the Bank

under The Employee Stock Option Scheme 2000, pursuant to the SEBI (Share Based Employee Benefits) Regulations, 2014 and any amendments

thereto from time to time, such that all stock options which are available for grant and those already granted but not exercised

as on Record Date shall be proportionately adjusted. The bonus issue would also require appropriate adjustments to the ADSs considering

the terms of the ADSs which entitles an ADS holders to two equity shares for one Depository Receipt (DR) held by them.

Presently,

the Authorised Share Capital of your Bank is

Rs.

1775,00,00,000/- (Rupees

One Thousand Seven Hundred and Seventy Five Crores) divided into:

i.

637,50,00,000 (Six Hundred Thirty Seven Crores and Fifty Lakhs) equity shares of

Rs.

2 (Rupees Two) each,

ii. 150,00,000 (One Crore Fifty Lakhs) shares of

Rs.

100 (Rupees One Hundred) each which shall be of such class and with rights, privileges, conditions or restrictions as may be determined

by the company in accordance with these presents and subject to the legislative provisions for the time being in that behalf, and

iii.

350 (Three Hundred and Fifty) preference shares of

Rs.

100,00,000 (Rupees

One Crore) each.

It

is necessary to increase the quantum of authorised share capital to facilitate issuance of bonus shares and for future requirements

if any. Hence it is proposed to increase the Authorised Share Capital to

Rs.

2500,00,00,000 (Rupees Two thousand five hundred crores only) divided into 1000,00,00,000 equity shares of

Rs.

2 each, 150,00,000 shares of

Rs.

100 each and 350 preference shares

of

Rs.

100,00,000 each by creation of additional 362,50,00,000 equity

shares of

Rs.

2 each.

The

increase in Authorised Share Capital as aforesaid would require consequential amendments to the existing capital clauses in the

Memorandum and Articles of Association of the Bank.

The

increase in Authorised Share Capital and amendments to relevant clauses of the Memorandum and Articles of Association of the Bank

and issue of bonus equity shares are subject to Members’ approval in terms of Sections 13,14, 61 and 63 of the Companies

Act, 2013 and any other applicable statutory and regulatory approvals.

Accordingly,

the resolutions 1, 2 and 3 of the Postal Ballot Notice seek Members’ approval for increase in Authorised share capital and

consequential amendments to Memorandum of Association and Articles of Association of the Bank and capitalisation of the amount

standing to the credit of Securities Premium Account for the purpose of issue of bonus equity shares on the terms and conditions

set out in the resolution.

The

Board recommends the resolutions 1, 2 and 3 for approval of the Members.

Members

may kindly note that the Bonus shares/ consequent ADS proposed to be issued, subject to approval of Members will not be eligible

for dividend in respect of financial year ending March 31, 2017 which is being proposed at the forthcoming Annual General Meeting

of the Bank.

None

of the Directors or Key Managerial Personnel of the Bank or their relatives are in any way concerned or interested, financially

or otherwise in the resolutions 1, 2 and 3 of the Notice except to the extent of their shareholding and outstanding employee stock

options in the Bank.

Item

No. 4

SEBI

(Share Based Employee Benefits) Regulations, 2014 defines Exercise Period as the time period after vesting within which an employee

should exercise his/her right to apply for shares against the vested options. Members

vide

Postal Ballot resolution passed

on April 22, 2016 approved the amendment to the ‘Employees Stock Option Scheme – 2000 ’ (ESOS scheme) of the

Bank relating to the definition of Exercise Period as under :

“Exercise

Period means the period commencing from the date of vesting of Options and ending on the tenth anniversary of the date of vesting

of Options.”

It

is now proposed to amend this definition of Exercise Period as under:

“Exercise

Period means the period commencing from the date of vesting and will expire on completion of such period not exceeding ten years

from the date of vesting of Options as may be determined by the Board Governance, Remuneration & Nomination Committee (“BGNRC”)

for each grant”.

The

amendment is intended to cover only future grants to be made and would come into effect only after approval by Members and will

not cover grants already made. There is no incremental Exercise Period being granted or proposed. The present definition provides

for a fixed term Exercise Period of ten years and does not allow flexibility to align the Exercise Period of future grants to reflect

the time horizon of short term and long term strategies of the Bank. The amendment would enable grants to be made with appropriate

Exercise Period(s) for each grant after vesting to better align (i) employee efforts to the articulated strategy; and (ii) the

compensation payout schedules for senior management to the time horizon of risks.

As

per the SEBI Regulations, any variation to the terms of the Scheme requires the approval of Members by way of a special resolution.

There are no other changes to the existing terms of the Scheme. None of the Directors or Key Managerial Personnel of the Bank including

their relatives are, in any way, concerned or interested, financially or otherwise, in the proposed resolution except to the extent

of grant of stock options to them, if any, under the said Scheme.

A copy

of the draft amended Scheme would be available for inspection at the Registered Office of the Bank on all working days from 11:00

a.m. IST to 1:00 p.m. IST upto June 12, 2017.

For

and on behalf of the Board of Directors

P.

Sanker

Senior

General Manager (Legal) & Company Secretary

Mumbai,

May 5, 2017

Item

4

ICICI Bank Limited

Registered

Office:

ICICI Bank Tower

,

Near Chakli Circle, Old Padra Road

,

Vadodara 390 007, Phone: 0265-6722286

Corporate Office: ICICI Bank

Towers, Bandra-Kurla Complex, Mumbai 400 051

Phone: 022-26538900, Fax:

022-26531230

CIN: L65190GJ1994PLC021012,

Website:

www.icicibank.com

, Email:

investor@icicibank.com

Sr. No.

POSTAL

BALLOT FORM

|

|

1.

|

Name(s)

of the Member(s) :

[including

joint-holder(s), if any]

|

|

|

2.

|

Registered

Address of the :

sole/first named Member

|

|

|

3.

|

Folio

No./DP ID/Client ID* :

(*applicable

only to Members holding Shares

in dematerialised form)

|

|

|

4.

|

Number

of Equity Share(s) held :

|

|

|

5.

|

I/We

hereby exercise my/our vote(s) in respect of the following Resolution(s) to be passed

through Postal Ballot for the special business stated in the Postal Ballot Notice dated

May 5, 2017 of ICICI Bank Limited (“the Bank”), by conveying my/our assent

or dissent to the said Resolution(s) by placing the tick (

ü

) mark at the appropriate

box below:

|

|

Sr.No.

|

Details

of Resolution

|

No.

of Equity Shares

|

I/We

assent to the Resolution (FOR)

|

I/We

dissent to the Resolution (AGAINST)

|

|

1.

|

Ordinary Resolution for increase in the Authorized Share Capital of the Company and consequent amendment to the Capital Clause of the Memorandum of Association.

|

|

|

|

|

2.

|

Special Resolution for alteration of Capital Clause of Article of Association.

|

|

|

|

|

3.

|

Ordinary Resolution for

issue of Bonus Shares in proportion of 1:10 i.e. 1 (one) equity share of Rs. 2/- each for every 10 (ten) fully paid-up equity

shares of Rs. 2/- each.

|

|

|

|

|

4.

|

Special Resolution for Amendment to the Employee Stock Option Scheme

|

|

|

|

|

Place:

Date:

|

|

|

|

# E-mail address:

Tel. No.:______________

# To be provided by the Members

holding Equity Shares in physical form. Members holding shares in electronic form who have not registered their email ID with

the depository participant (DP) may please update their email IDs/contact number with their DP.

|

|

Signature of the Member

|

ELECTRONIC

VOTING PARTICULARS

|

EVEN

(E-Voting

Event Number)

|

USER

ID

|

PASSWORD/PIN

|

|

|

|

|

Note : Please read the instructions

given overleaf carefully before exercising your vote.

Instructions

for filling Postal Ballot Form:

|

|

i.

|

A Member

desirous of exercising his/her vote by Postal Ballot should complete and sign this Postal Ballot Form and send it to the Scrutinizer,

Mr. Alwyn D’Souza of Alwyn D’Souza & Co., Company Secretaries at 3i Infotech Limited, Tower No. 5, 3

rd

floor, International Infotech Park, Vashi Railway Station Complex, Vashi, Navi Mumbai 400 703, India in the attached postage pre-paid

self-addressed Business Reply Envelope (BRE). Postage charges will be borne and paid by the Bank. Postal Ballot Form(s), if deposited

in person or sent by courier or registered/speed post at the expense of the Member will also be accepted.

|

|

|

ii.

|

The consent

must be accorded by recording the assent in the column ‘FOR’ or dissent

in the column ‘AGAINST’ by placing a tick mark (

√

)

in the appropriate box in the Postal Ballot Form. The assent or dissent received in any other physical form shall be considered

invalid.

|

|

|

iii.

|

This Form

should be completed and signed by the Member (as per the specimen signature registered with the Bank/Registrar and Transfer Agent

(RTA)/Depository Participant). In case of joint-holding, this Form should be completed and signed by the first named Member and

in his/her absence, by the next named Member.

|

|

|

iv.

|

In case

of Equity Shares held by companies, trusts, societies etc., the duly completed Postal Ballot Form should be accompanied by a certified

copy of the relevant board resolution/appropriate authorisation with the specimen signature(s) of the authorised signatory(ies)

duly certified/attested.

|

|

|

v.

|

Duly completed

Postal Ballot Form should reach the Scrutinizer not later than Monday, June 12, 2017, 5.00 p.m. (IST). All Postal Ballot Forms

received after this date will be considered invalid. The Scrutinizer will submit the report to the Chairman of the Bank after completion

of the scrutiny and the results of the Postal Ballot will be announced on Wednesday, June 14, 2017.

|

|

|

vi.

|

Incomplete,

unsigned, incorrect, defaced or mutilated Postal Ballot Forms will be rejected. The Scrutinizer’s decision on the validity

of a Postal Ballot Form will be final and binding.

|

|

|

vii.

|

Members

are requested not to send any other paper along with the Postal Ballot Form in the enclosed postage pre-paid self-addressed BRE,

as all such envelopes will be sent to the Scrutinizer and any extraneous paper found in such envelope would not be considered and

would be destroyed by the Scrutinizer.

|

|

|

viii.

|

The Bank

is also offering e-voting facility as an alternate, for all its Members to enable them to cast their votes electronically instead

of using the Postal Ballot Form. The detailed procedure for e-voting has been enumerated in the Notes to the Postal Ballot Notice

dated May 5, 2017.

|

|

|

ix.

|

For every

Folio No./DP ID/Client ID, there will be only one Postal Ballot Form/e-voting irrespective of the number of joint-holder(s). Voting

rights in the Postal Ballot/e-voting cannot be exercised by a proxy.

|

|

|

x.

|

The voting rights of the

Members shall be in proportion to their Equity Shares in the total paid-up Equity Share capital of the Bank as on May 5, 2017 subject

to the provisions of the Banking Regulation Act, 1949.

|

|

|

xi.

|

Members

can opt for only one mode of voting i.e. either by Postal Ballot or through e-voting.

In case you are opting for voting by Postal Ballot, then please do not cast your vote

by e-voting and vice versa. In case Members cast their votes both by Postal Ballot and

e-voting, the votes cast through e-voting shall prevail and the votes cast through Postal

Ballot Form shall be considered invalid.

|

|

|

xii.

|

In case of non-receipt

of the Postal Ballot Form or for any query relating thereto, the Members may contact the Bank’s RTA,

3i

Infotech Limited, Tower No. 5, 3

rd

floor, International Infotech Park, Vashi Railway Station Complex, Vashi, Navi Mumbai

400 703, India or send an e-mail at

investor@icicibank.com

|

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorised.

|

|

|

For ICICI

Bank Limited

|

|

|

|

|

|

|

|

|

|

Date:

|

May 9, 2017

|

|

By:

|

/s/ Shanthi Venkatesan

|

|

|

|

|

|

Name :

|

Ms. Shanthi Venkatesan

|

|

|

|

|

|

Title :

|

Deputy General Manager

|

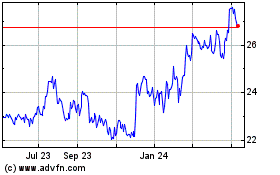

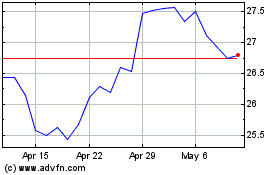

Icici Bank (NYSE:IBN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Icici Bank (NYSE:IBN)

Historical Stock Chart

From Apr 2023 to Apr 2024