ISS Opposes Coca-Cola CEO's Pay Package

April 06 2017 - 8:47PM

Dow Jones News

By Jennifer Maloney and Joann S. Lublin

The biggest proxy adviser is challenging the $17.6 million pay

package given last year to Coca-Cola Co.'s outgoing chief

executive.

Institutional Shareholder Services Inc. said it opposes Chief

Executive Muhtar Kent's 2016 package because his total compensation

increased from $14.6 million in 2015 despite weaker financial

performance and unmet financial goals. Mr. Kent is set to hand the

reins on May 1 to Chief Operating Officer James Quincey; Mr. Kent

will remain chairman of the board.

The proxy adviser took issue with the board's use of

discretionary pay tied to qualitative assessments of Mr. Kent's

performance. It urged Coke shareholders to vote "no" on its

nonbinding resolution about executive-pay practices. The

shareholder meeting is scheduled for April 26.

"Discretionary assessments have led to overall pay increases

amid a period of flagging share price and underwhelming financial

performance," ISS said. The firm noted that most performance

measures declined for Coke in 2016, including shareholder return,

revenue and net income.

"The fundamental principle of our compensation programs is that

they should pay for performance and compensate leaders for

delivering results, " a Coke spokesman said. Under Mr. Kent's

leadership, the company "delivered its profit target for the full

year," expanded its global market share and diversified its

beverage portfolio, the spokesman said.

"We continue to see support for our executive compensation

programs through our ongoing direct engagement with shareowners,"

he added.

Recommendations by ISS are taken into account by some large

shareholders. Glass Lewis & Co., the second-biggest proxy

advisory firm, recommended earlier this week that shareholders vote

"yes" on Coke's pay practices.

In 2014, Coke overhauled its executive-compensation plan,

scaling back stock options and shifting to more cash-based

performance awards, following criticism from billionaire investor

Warren Buffett and other shareholders who called the equity plan

excessive.

Mr. Kent in 2016 received $1.41 million for "individual

performance" -- close to the maximum potential payout for this

component. Coke said he received this pay for accomplishments such

as diversifying the company's beverage portfolio, overseeing an

orderly CEO transition and leading an effort to divest its bottling

operations.

In a proxy statement filed March 9, Coke's board compensation

committee wrote that while the majority of incentive pay should be

based on financial metrics, "progress toward non-financial goals

that are critical to our business, including our sustainability

focus areas, also adds value for our shareowners."

Write to Jennifer Maloney at jennifer.maloney@wsj.com and Joann

S. Lublin at joann.lublin@wsj.com

(END) Dow Jones Newswires

April 06, 2017 20:32 ET (00:32 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

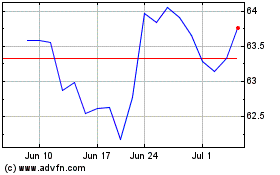

Coca Cola (NYSE:KO)

Historical Stock Chart

From Aug 2024 to Sep 2024

Coca Cola (NYSE:KO)

Historical Stock Chart

From Sep 2023 to Sep 2024