|

Filed Pursuant to Rule 424(b)(5)

|

|

|

PROSPECTUS SUPPLEMENT

|

|

|

(to Prospectus dated August 27, 2015)

|

Registration Statement No.: 333-206357

|

20,454,546 Common Shares

________________________

We are offering 20,454,546

common shares, no par value, to selected institutional investors. The

purchase price for one common share is $0.22. The proceeds to us before expenses

from the sale of the common shares will be $4,500,000.

In a concurrent private

placement, we are offering to such investors warrants to purchase up to

20,454,546 common shares. Each warrant has an initial exercise price of $0.30

per common share. The warrants are being offered pursuant to the exemption

provided in Section 4(a)(2) under the Securities Act of 1933, as amended, or the

Securities Act, and Rule 506(b) of Regulation D promulgated thereunder, and they

are not being offered pursuant to this prospectus supplement and the

accompanying prospectus.

We have retained Roth Capital

Partners, LLC to act as our placement agent in connection with the offering and

the concurrent private placement, and agreed to pay a cash fee equal to 7.5% of

the aggregate proceeds of the offering and the additional compensation as

described in the section entitled “Plan of Distribution” beginning on page 10 of

this prospectus supplement. We estimate the total expenses of the offering and

the concurrent private placement, excluding such fees payable to the placement

agent, will be approximately $250,000. The placement agent has no obligation to

buy any of the shares from us or to arrange for the purchase or sale of any

specific number or dollar amount of securities. See “Plan of Distribution”

beginning on Page S-16 of this prospectus supplement for more information

regarding these arrangements.

Our common shares are traded on

The NASDAQ Capital Market under the symbol “ANY”. On March 20, 2017, the last

reported sale price for our common shares on NASDAQ was $0.30 per share. Common

shares sold pursuant to this prospectus supplement will be listed on NASDAQ.

Delivery of the securities offered hereby is expected to be made on or about

March 29, 2017 unless otherwise agreed by the company and the investors.

The aggregate market value of our

outstanding common shares held by non-affiliates as of the date of this

prospectus supplement was approximately $18,700,125, based on 82,117,997 common

shares outstanding of which 50,540,878 were held by non-affiliates, and a per

share price of $0.37 based on the closing sale price of our common shares on

January 30, 2017. We have sold no securities pursuant to General Instructions

I.B.5 of Form F-3 during the prior 12 calendar month period that ends on, and

includes, the date of this prospectus supplement.

________________________

Our business and an investment

in our securities involve significant risks. You should consider the risks

included in the section entitled “Risk Factors” beginning on page S-6 of this

prospectus supplement, page 6 of the accompanying prospectus and the risk

factors incorporated by reference into this prospectus supplement before

investing in our securities.

Neither the Securities and

Exchange Commission nor any other regulatory body has approved or disapproved of

these securities or passed upon the adequacy or accuracy of this prospectus

supplement or the accompanying prospectus. Any representation to the contrary is

a criminal offense.

|

|

|

|

Per Share

|

|

|

Total

|

|

|

|

|

|

|

|

|

|

|

|

Public Offering Price

|

|

$

|

0.220

|

|

$

|

4,500,000

|

|

|

Placement Agent Fees (1)

|

|

$

|

0.017

|

|

$

|

337,500

|

|

|

Proceeds, before expenses, to us

|

|

$

|

0.203

|

|

$

|

4,162,500

|

|

|

|

(1)

|

We have also agreed to reimburse the placement agent for

certain of its expenses. See "Plan of Distribution" on page S-16 of this

prospectus supplement for more information about these

arrangements.

|

We expect to deliver the shares through the facilities of the

Depository Trust Company on or about March 29, 2017.

|

___________________

|

|

|

|

Roth Capital Partners

|

|

|

|

The date of this prospectus is March 24, 2017

|

TABLE OF CONTENTS

Prospectus Supplement

Prospectus

|

ABOUT THIS PROSPECTUS

|

Page 1

|

|

WHERE YOU CAN FIND ADDITIONAL INFORMATION

|

1

|

|

INCORPORATION OF CERTAIN DOCUMENTS BY

REFERENCE

|

2

|

|

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

|

3

|

|

PROSPECTUS SUMMARY

|

4

|

|

RISK FACTORS

|

6

|

|

USE OF PROCEEDS

|

8

|

|

PLAN OF DISTRIBUTION

|

8

|

|

CAPITALIZATION AND INDEBTEDNESS

|

11

|

|

PRICE RANGE OF OUR SHARES

|

12

|

|

ENFORCEABILITY OF CIVIL LIABILITIES AGAINST

FOREIGN PERSONS

|

13

|

|

OFFERING EXPENSES

|

13

|

|

SHARE CAPITAL

|

13

|

|

DESCRIPTION OF WARRANTS

|

14

|

|

INDEMNIFICATION OF DIRECTORS AND OFFICERS

|

16

|

|

LEGAL MATTERS

|

16

|

|

EXPERTS

|

17

|

-i-

ABOUT THIS PROSPECTUS SUPPLEMENT

This document is in two parts.

The first part is this prospectus supplement, which describes the specific terms

of this offering of common shares and also adds to and updates information

contained in the accompanying prospectus and the documents incorporated by

reference. The second part is the accompanying prospectus, which gives more

general information, some of which may not apply to this offering. To the extent

there is a conflict between the information contained in this prospectus

supplement, on the one hand, and the information contained in the accompanying

prospectus or any document incorporated by reference, on the other hand, you

should rely on the information in this prospectus supplement.

You should read this prospectus

supplement, the accompanying prospectus and the documents incorporated by

reference, and the additional information described below under the heading

“Where You Can Find Additional Information” carefully because these documents

contain important information you should consider when making your investment

decision. Whenever we make reference in this prospectus supplement to any of our

contracts, agreements or other documents, the references are not necessarily

complete and you should refer to the exhibits attached to the registration

statement or the documents incorporated by reference for copies of the actual

contract, agreements or other document. See “Where You Can Find More

Information” and “Information Incorporated by Reference.”

You should rely only on the

information provided in this prospectus supplement, the accompanying prospectus

and the information and documents incorporated by reference into this prospectus

supplement. We have not authorized anyone to provide you with different

information. This prospectus supplement is not an offer to sell these securities

and it is not soliciting offers to buy these securities, in any jurisdiction

where the offer or sale of these securities is not permitted. The information

contained in this prospectus supplement and the accompanying prospectus is

accurate only as of the date of this prospectus supplement, regardless of the

time of delivery of this prospectus supplement or the accompanying prospectus or

of any sale of any securities. You should not assume that the information

contained in this prospectus supplement or the accompanying prospectus is

accurate as of any date other than the date on the front cover of this

prospectus supplement, or that the information contained in any document

incorporated by reference is accurate as of any date other than the date of the

document incorporated by reference, regardless of the time of delivery of this

prospectus supplement or the accompanying prospectus or any sale of a security.

In this prospectus supplement,

unless otherwise indicated or the context otherwise requires, references to

“Sphere,” “we,” “company,” “us,” or “our” refer to Sphere 3D Corp. and its

consolidated subsidiaries.

-S-1-

SUMMARY

The following is only a summary

and therefore does not contain all of the information you should consider before

investing in our securities. We urge you to read this entire prospectus

supplement and the accompanying prospectus, including the matters discussed

under “Risk Factors” and the risk factors incorporated by reference into this

prospectus supplement and the accompanying prospectus from our other filings

with the SEC, and the more detailed consolidated financial statements, notes to

the consolidated financial statements and other information incorporated by

reference into this prospectus supplement and the accompanying prospectus from

our other filings with the SEC.

Our Company

We are a virtualization

technology and data management solutions provider with a portfolio of products

that address the complete data continuum. We enable the integration of virtual

applications, virtual desktops, and storage into workflow, and allow

organizations to deploy a combination of public, private or hybrid cloud

strategies. We achieve this through the sale of solutions that are derived from

our primary product groups: disk systems, virtualization, and data management

and storage.

We have a global presence and

maintain offices in multiple locations. Executive offices and our primary

operations are conducted from our San Jose and San Diego, California locations.

Our main office is located at 9112 Spectrum Center Blvd., San Diego, CA 92123.

Our virtualization product development is primarily done from our research and

development center near Toronto, Canada. Our European headquarters are located

in Germany. We maintain additional offices in Singapore, Japan, and the United

Kingdom.

We were incorporated on May 2,

2007 under the Business Corporations Act (Ontario) as “T.B. Mining Ventures

Inc.”. Our registered office is located at 240 Matheson Blvd. East Mississauga,

Ontario L4Z 1X1 and our main telephone number is (858) 571-5555. Our Internet

address is

http://www.sphere3d.com

. Except for the documents referred to

under “Where You Can Find Additional Information” which are specifically

incorporated by reference into this prospectus supplement, information contained

on our website or that can be accessed through our website does not constitute a

part of this prospectus supplement. We have included our website address only as

an interactive textual reference and do not intend it to be an active link to

our website.

Recent Developments

Preliminary Financial Results (unaudited)

Our financial results for the

year ended December 31, 2016 are not yet complete and will not be available

until after the completion of this offering. The preliminary estimated unaudited

financial results for the three months and year ended December 31, 2016 below

are forward-looking statements based solely on information available to us as of

the date of this prospectus and may differ materially from actual results.

Actual results remain subject to the completion of management’s and our audit

committee’s reviews and our other financial closing procedures, as well as the

completion of the audit of our annual consolidated financial statements.

Accordingly, you should not place undue reliance on this preliminary data.

During the course of the preparation of the respective financial statements and

related notes, additional items that would require material adjustments to be

made to the preliminary financial information presented above may be identified.

The preliminary estimates are subject to risks and uncertainties, many of which

are not within our control. These financial results are an estimate only, have

not been audited and are subject to change upon completion of the audit of our

financial statements as of and for the year ended December 31, 2016. Additional

information and disclosures would be required for a more complete understanding

of our financial position and results of operations as of December 31, 2016. The

preliminary financial data included in this prospectus supplement has been

prepared by, and is the responsibility of management. Moss Adams LLP, our

independent registered public accounting firm has not audited, reviewed,

compiled or performed any procedures with respect to the preliminary financial

data. Accordingly, it does not express an opinion or any other form of assurance

with respect thereto. Our actual results for the period ended December 31, 2016

may not be available until after this offering is completed. There can be no

assurance that these estimates will be realized, and estimates are subject to

risks and uncertainties, many of which are not within our control. See “Risk

Factors” and “Cautionary Note Regarding Forward-Looking Statements.” We plan to

file our Annual Report on Form 20-F including our financial statements as of and

for the year ended December 31, 2016 on or around March 30, 2017, subject to

completion of the audit.

Net revenue for the fourth

quarter of 2016 is currently anticipated to be approximately $18.7 million,

which is slightly higher than net revenue for the third quarter of 2016.

Operating expenses decreased from $13.6 million in the first quarter of 2015,

which was the first full quarter after the merger of Overland and Sphere 3D, to

an estimated $10.8 million in the fourth quarter of 2016. Operating expenses

include non-cash share-based compensation of $0.7 million in the first quarter

of 2015 and $1.6 million in the fourth quarter of 2016. This reflects a reduction of more than 28% when

excluding the share based compensation. Operating expenses were also down when

compared to the third quarter of 2016, which were $47.8 million including

non-cash share-based compensation of $2.6 million and $34.4 million of goodwill

and acquired intangible asset impairment. Cash used in operations in the second

half of 2016 was below $4 million, and is expected to be less than $2 million in

Q4 2016, compared to $13.8 million in the first half of 2016. There has been a

global headcount reduction of approximately 120 people from December 2014

through December 2016. This represents a 26% reduction of non- factory headcount

since the merger with Overland in December 2014 and a 23% reduction in factory

headcount in that same period. Additional reductions took place in February 2017

to eliminate redundancies from the acquisition of HVE ConneXions (HVE) and

Unified ConneXions (UCX).

-S-2-

Private Placement

Between December 30, 2016 and

March 16, 2017, the Company issued a total of 18,139,998 “Units,” at a purchase

price of U.S. $0.30 per Unit. Each Unit consisted of one common share and one

warrant from each of two series of warrants. The first series of warrants is

exercisable to purchase 18,139,998 common shares in the aggregate and has an

exercise price of U.S. $0.40 per share, a one-year term, and is exercisable in

whole or in part at any time prior to expiration. The second series of warrants

is exercisable for 18,139,998 common shares in the aggregate and has an exercise

price of U.S. $0.55 per share, a five-year term, and is exercisable in whole or

in part at any time prior to expiration. The company received gross proceeds of

U.S. $5.44 million in connection with the sale of the Units.

Consent, Waiver, Reaffirmation and Amendment Number One to

Credit Agreement

On April 6, 2016, Overland

Storage, Inc., a California corporation (“Overland”) and wholly owned subsidiary

of the Company, Tandberg Data GmbH, a limited liability company organized under

the laws of Germany (“Tandberg” and, together with Overland, collectively the

“Borrowers”), and Opus Bank, a California commercial bank, as Lender (“Lender”),

entered into a Credit Agreement (the “Credit Agreement”) pursuant to which the

Lender provided the Borrowers a $10 Million revolving credit facility and

Overland $10 Million term loan facility. On December 30, 2016, the Borrowers and

Lender entered into a Consent, Waiver, Reaffirmation and Amendment Number One to

Credit Agreement (the “First Amendment”) pursuant to which (i) the maturity date

for the revolving and term loan credit facilities were amended to be the earlier

of the maturity date in the 8% Senior Secured Convertible Debenture, dated

December 1, 2014, issued to FBC Holdings S.a r.l. (the “Debenture”), or March

31, 2017, (ii) the Lender granted a waiver of specified defaults under the

Credit Agreement relating to a minimum asset coverage ratio, (iii) the Lender

provided its consent to the consummation of the Acquisition (as defined below),

and (iv) certain other terms of the Credit Agreement were amended, including but

not limited to terms related to collateral coverage, milestone deliverables, and

financial covenants.

Further, as a condition of the

entry into the First Amendment, the Company (i) cancelled the warrant issued to

Lender for the purchase of 1,541,768 common shares at an exercise price of $1.30

per common share and (ii) issued to the Lender a warrant for the purchase of up

to 862,068 common shares at an exercise price of $0.01 per common share. In

addition, the First Amendment warrant provide for “piggyback” registration

rights. These “piggyback” registration rights would be triggered by the filing

of a registration statement to register the resale of the warrants and common

shares issuable upon the exercise of the warrants. The exercise price and number

of common shares issuable upon exercise of the warrants may be adjusted in

certain circumstances including in the event of a share dividend, extraordinary

cash dividend or our recapitalization, reorganization, merger or consolidation.

Amendments Number Two and Three to Credit Agreement,

Amendment Number One to Amendment Number 1, Waiver and Reaffirmation

On March 12, 2017, the Borrowers

and Lender entered into an Amendment Number Two to Credit Agreement, Amendment

Number One to Amendment Number 1, Waiver and Reaffirmation (the “Second

Amendment”). On March 21, 2017, the Borrowers and Lender entered into an

Amendment Number Three to Credit Agreement (the “Third Amendment” and, together

with the First Amendment and the Second Amendment, the “Opus Amendments”)

further amending the Second Amendment. Under the terms of the Second Amendment,

as modified by the Third Amendment, (i) the maturity date for the revolving and

term loan credit facilities were amended to be the earlier of (a) the maturity

date in the Debenture or (b) (x) June 30, 2017 if the Maturity Extension Trigger

Date (as defined below) occurs on or before March 31, 2017 or (y) if the

Maturity Extension Trigger Date has not occurred by such date, March 31, 2017,

(ii) the Lender granted a waiver of specified defaults under the Credit

Agreement relating to obligations to deliver to the Lender an executed letter of

intent with respect to refinancing the credit facility, and (iii) certain other

terms of the Credit Agreement were amended, including but not limited to terms

related to collateral coverage, milestone deliverables, and financial covenants.

The Maturity Extension Trigger Date is the date upon which both of the following

conditions have been satisfied: (a) the Company shall have received gross cash

proceeds of at least $3,000,000 from the issuance of the common shares and

related warrants and (b) the Company shall have deposited at least $2,500,000 of

the funds raised in an equity offering into the primary operating account that our wholly-owned subsidiary, Overland Storage,

Inc., maintains at Opus Bank. In the event of certain specified events of

default, including failure to meet certain monthly revenue and EBITDA targets,

to enter into a term sheet with a new lender by April 28, 2017, or to enter into

a letter of intent with respect to a financing or retain a financial advisor

with respect to a sale of a significant portion of the Company’s assets, all

amounts under the Credit Agreement may be accelerated and become immediately

payable.

-S-3-

Further, as a condition of the

entry into the Second Amendment, the Company issued to the Lender (i) a warrant,

exercisable in the event that the Company has not repaid all outstanding amounts

due under the Credit Agreement on or prior to April 17, 2017, for the purchase

of the number of common shares determined by dividing (i) 75,000 by (ii) the

difference between the market price of our common shares on April 17, 2017 and

$0.01, at an exercise price of $0.01 per common share and (ii) a warrant,

exercisable in the event that the Company has not repaid all outstanding amounts

due under the Credit Agreement on or prior to May 31, 2017, for the purchase of

the number of common shares determined by dividing (i) 100,000 by (ii) the

difference between the market price of our common shares on May 31, 2017 and

$0.01, at an exercise price of $0.01 per common share. In addition, the warrants

provide for “piggyback” registration rights. These “piggyback” registration

rights would be triggered by the filing of a registration statement to register

the resale of the warrants and common shares issuable upon the exercise of the

warrants. The exercise price and number of common shares issuable upon exercise

of the warrants may be adjusted in certain circumstances including in the event

of a share dividend, extraordinary cash dividend or our recapitalization,

reorganization, merger or consolidation.

Acquisition

In January 2017, the Company

completed its acquisition of all of the outstanding equity interests of HVE

ConneXions, LLC and Unified ConneXions, Inc. (the “Acquisition”). The Company

initially purchased 19.9% of the outstanding equity interests in December 2016,

and in connection with such purchase, issued to the sellers 3,947,368 shares. In

January 2017, in connection with the Company’s purchase of the remaining equity

interests of HVE ConneXions, LLC and Unified ConneXions, Inc., the Company paid

to the sellers $1,100,000 and issued 2,205,883 shares.

Grant of Inducement RSUs

In January 2017, we granted

5,156,030 inducement RSUs in connection with the hiring of additional employees,

which will vest over the next one to three years.

The Offering

|

Securities we are offering:

|

20,454,546 common shares, no par value.

|

|

|

|

|

Common shares to be outstanding after the

offering:

|

102,572,543 shares.

|

|

|

|

|

Use of proceeds:

|

We intend to use a portion of the net proceeds

from the sale of our common shares for general corporate purposes. See

“Use of Proceeds” beginning on page S-12.

|

|

|

|

|

Participation Rights:

|

Until the date that is fifteen months from

closing, purchasers of at least $500,000 of common shares and warrants will, in the aggregate, have the right to

participate in future offerings of our common shares or securities

convertible into common shares, in an amount equaling up to 50% of such

subsequent financings. See “Plan of Distribution” beginning on page S-16.

|

|

|

|

|

Purchaser Leakout Agreements:

|

Until April 23, 2017, purchasers of our common

shares in this offering will not be able to sell or otherwise transfer

common shares purchased in this offering or issuable pursuant to the

warrants in an amount more than, in aggregate,

35% of the trading volume of common shares on NASDAQ on any day, subject

to certain exceptions. See “Plan of Distribution” beginning on page S-16.

|

|

|

|

|

Lock-up Agreements:

|

Each of our directors and executive officers

has agreed not to offer, pledge, sell or otherwise transfer any common

shares or any securities convertible into common shares, as well as enter

into other arrangements with respect to such securities for a period of 90

days from the effective date of this offering. See “Plan of

Distribution” beginning on page S-16.

|

|

|

|

|

Risk factors:

|

See “Risk Factors” beginning on page S-6 of

this prospectus supplement, and the other information included in this

prospectus supplement or incorporated by reference, for a discussion of factors you

should consider before making an investment decision.

|

-S-4-

|

The NASDAQ Capital Market symbol:

|

Our common shares are listed on The NASDAQ

Capital Market and trade under the symbol “ANY.” The common shares sold

pursuant to this prospectus supplement and the accompanying prospectus

will be listed on The NASDAQ Capital Market.

|

The number of common shares to be outstanding after this

offering is based on 82,117,997 common shares outstanding as of March 17, 2017,

and excludes as of such date:

|

|

•

|

3,257,621 common shares subject to outstanding

options having a weighted-average exercise price of $2.16 per share;

|

|

|

|

|

|

|

•

|

6,718,929 common shares subject to outstanding

restricted stock awards;

|

|

|

|

|

|

|

•

|

2,998,116 common shares reserved for issuance

in connection with future awards under our 2015 Equity Incentive Plan;

|

|

|

|

|

|

|

•

|

2,000,000 common shares reserved for future

sale under our Employee Stock Purchase Plan;

|

|

|

|

|

|

|

•

|

46,522,919 common shares subject to outstanding

warrants having a weighted-average exercise price of $0.74 per share; and

|

|

|

|

|

|

|

•

|

20,454,546 common shares issuable upon exercise

of warrants to be issued in the concurrent private placement.

|

Unless otherwise indicated, this prospectus supplement reflects

and assumes no exercise of our outstanding warrants or options to purchase

common shares described above.

-S-5-

CONCURRENT PRIVATE PLACEMENT

In a concurrent private placement, we

are selling to investors warrants to purchase up to 20,454,546 common shares.

Each warrant has an initial exercise price of $0.30 per common share. The warrants are exercisable for cash

immediately or on a cashless basis commencing on a date which is the earlier of

(i) six months from the date of the effective date of this offering or (ii) the

date on which we fail to fulfill our obligations to register the common shares

underlying the warrants under the registration rights agreements and expiring on

a date which is no more than five years from the date of the effective date of

this offering. The warrants are being offered pursuant to the exemption provided

in Section 4(a)(2) under the Securities Act of 1933, as amended, or the

Securities Act, and Rule 506(b) of Regulation D promulgated thereunder, and they

are not being offered pursuant to this prospectus supplement and the

accompanying prospectus. We expect to enter into a registration rights agreement

pursuant to which we will agree to register the resale of the common shares

issuable upon the exercise of the warrants, and we will bear all fees and

expenses attendant to registering the common shares issuable on exercise of the

warrants.

If at any time while the warrants

are outstanding, we sell or grant options to purchase, reprice or otherwise

issue any common shares or securities convertible into common shares at a price

less than $0.30, then the exercise price for the warrants will be reduced to

such price, provided that the exercise price will not be lower than $0.10, and

the number of common shares issuable under the warrants will be increased such

that, after taking into account the decrease in the exercise price, the

aggregate exercise price under the warrants will remain the same. In addition,

upon the occurrence of certain fundamental transactions, including certain

mergers, sales of substantially all of our assets or those of our significant

subsidiaries, and other significant corporate events, the warrant holders will

have certain rights, including for the exchange of the warrants for warrants to

purchase common shares of the successor entity and the right to have the company

purchase the warrants for their Black Scholes Value.

RISK FACTORS

An investment in our

securities involves a high degree of risk. In addition to the other information

included in this prospectus supplement and the accompanying prospectus, you

should carefully consider the risk factors set forth in our most recent Annual

Report on Form 40-F on file with the SEC and Form 6-K filed November 14, 2016,

each of which are incorporated by reference into this prospectus supplement and

the accompanying prospectus, as well as the following risk factors which

supplement or augment the risk factors set forth in our Annual Report on Form

40-F and Form 6-K filed November 14, 2016. Before making an investment decision,

you should carefully consider these risks as well as other information we

include or incorporate by reference in this prospectus supplement and the

accompanying prospectus. The risks and uncertainties not presently known to us

or that we currently deem immaterial may also materially harm our business,

operating results and financial condition and could result in a complete loss of

your investment.

Risks Related to Our Business

We have in the past failed to comply with financial

covenants and other provisions in certain of our loan documents, which have

resulted in defaults under certain of our loan documents. These and similar

defaults in the future could adversely affect our financial condition and our

ability to meet our payment obligations on our indebtedness.

We have in the past defaulted under

financial and other covenants under our Opus Bank credit agreement and under our

previous loan documents, which have been waived by our lenders. In the past,

these defaults generally have related to maintenance of required minimum asset

coverage ratios. Upon the occurrence of certain events of default under our

current credit facility, including failure to meet certain monthly revenue and

EBITDA targets, to enter into a term sheet with a new lender by April 28, 2017,

or to enter into a letter of intent with respect to a financing or retain a

financial advisor with respect to a sale of a significant portion of the

Company’s assets, our lender may elect to declare all amounts outstanding to be

immediately due and payable and terminate all commitments to extend further

credit. While our ongoing defaults have been waived, our lender may not in the

future waive such defaults. In addition, as a result of such defaults, we could

be deemed to be in default under other of our indebtedness and agreements.

In the event of the acceleration of

our indebtedness or if we are unable to otherwise maintain compliance with

covenants set forth in these arrangements, including our Opus Bank credit

agreement, Term Loan Agreement, and Debenture or if these arrangements are

otherwise terminated for any reason, management may be forced to make further

reductions in spending, extend payment terms with suppliers, liquidate assets

where possible and/or curtail, suspend or cease planned programs or operations

generally or possibly seek bankruptcy protection, which would have a material

adverse effect on our business, results of operations, financial position and

liquidity.

S-6

Our credit facility matures on the earlier of the

maturity date in the 8% Senior Secured Convertible Debenture, dated December 1,

2014, issued to FBC Holdings S.a r.l., or depending on whether certain terms in

the Second Amendment are satisfied, March 31, 2017 or June 30, 2017. If we are

unable to refinance or amend our credit facility before its maturity date, we

may be forced to liquidate assets and/or curtail or cease

operations.

We have obtained external funding for

our business through a credit agreement with Opus Bank. Pursuant to the terms of

the Second Amendment, the credit facility matures on the earlier of (a) the

maturity date in the Debenture, or (b) (x) June 30, 2017 if the Maturity

Extension Trigger Date occurs on or before March 31, 2017 or (y) if the Maturity

Extension Trigger Date has not occurred by such date, March 31, 2017. The

Maturity Extension Trigger Date occurs when we have received gross cash proceeds

of at least $3,000,000 from the issuance of the common shares and warrants and,

in addition, have contributed to Overland at least $2,500,000 in immediately

available funds from the sale of common shares and warrants by depositing such

funds into the primary operating account that our wholly-owned subsidiary,

Overland Storage, Inc., maintains at Opus Bank.

Even if we are able to meet the

requirements of the Maturity Extension Trigger Date, we will need to raise

additional funds and/or amend or refinance our credit facility in order to

satisfy our obligations under our credit agreement with Opus Bank. In addition,

upon the occurrence of certain events of default under our current credit

facility, including failure to meet certain monthly revenue and EBITDA targets,

to enter into a term sheet with a new lender by April 28, 2017, or to enter into

a letter of intent with respect to a financing or retain a financial advisor

with respect to a sale of a significant portion of the company's assets, our

lender may elect to declare all amounts outstanding to be immediately due and

payable and terminate all commitments to extend further credit. In addition, a

default under the agreement could result in default and cross-acceleration under

other indebtedness. There can be no guarantee that we will be able to raise

additional funds or amend or refinance our credit facility on favorable terms or

at all. If we are unable to, we may be forced to make further reductions in

spending, extend payment terms with suppliers, liquidate assets where possible

and/or curtail, suspend or cease planned programs or operations generally or

possibly seek bankruptcy protection, which would have a material adverse effect

on our business, results of operations, financial position and liquidity.

Our cash and other sources of liquidity may not be

sufficient to fund our operations for the next 3 months if we are unable to

amend or refinance our credit facility with Opus Bank. If we are unable to raise

additional funding for operations, we may be forced to liquidate assets and/or

curtail or cease operations.

Our available cash and cash

equivalents was approximately $3.5 million and our outstanding indebtedness was

approximately $44.8 million as of March 17, 2017. We have projected that cash on

hand (excluding proceeds from this offering) will not be sufficient to allow the

Company to continue operations beyond the next 3 months if we are unable to

amend or refinance our credit facility with Opus Bank. As a result, we expect to

need to refinance the short term portions of our existing debt and/or continue

to raise additional debt, equity or equity-linked financing in the near future,

but such financing may not be available on favorable terms on a timely basis or

at all. If we are unable to generate sufficient cash from operations or

financing sources, we may be forced to make further reductions in spending,

extend payment terms with suppliers, liquidate assets where possible and/or

curtail, suspend or cease planned programs or operations generally or possibly

seek bankruptcy protection, which would have a material adverse effect on our

business, results of operations, financial position and liquidity.

If we raise additional funding through sales of equity or

equity-based securities, your shares will be diluted.

If we raise additional funds by

selling additional shares of our capital stock, or securities convertible into

shares of our capital stock, the ownership interest of our existing shareholders

will be diluted. The amount of dilution could be increased by the issuance of

warrants or securities with other dilutive characteristics, such as

anti-dilution clauses or price resets. In addition, we have in the past and may

in the future amend outstanding warrants pursuant to their terms or otherwise,

which could result in the dilution of your ownership interest.

Our cash forecasts and capital requirements are subject

to change as a result of a variety of risks and uncertainties.

Cash from operations can change as a

result of a variety of factors including changes in sales levels, unexpected

increases in product costs, increases in operating costs, and changes to the

historical timing of collecting accounts receivable. Significant changes from

the Company’s current forecasts, including but not limited to: (i) failure to

comply with the financial covenants in our credit facility, (ii) shortfalls from

projected sales levels; (iii) unexpected increases in product costs; (iv)

increases in operating costs; (v) changes in the historical timing of collecting

accounts receivable; and (vi) inability to regain compliance with the minimum

bid price requirement of the NASDAQ Capital Market and/or inability to maintain

listing with the NASDAQ Capital market, could have a material adverse impact on

our ability to access the level of funding necessary to continue our operations

at current levels. If any of these events occurs or if we are not able to secure

additional funding, we may be forced to make reductions in spending, extend payment terms with suppliers, liquidate assets where possible,

and/or suspend or curtail planned programs. Any of these actions could

materially harm our business, results of operations and future prospects.

S-7

We face a selling cycle of variable length to secure new

purchase agreements for our products and services, and design wins may not

result in purchase orders or new customer relationships.

We face a selling cycle of

variable lengths to secure new purchase agreements. Even if we succeed in

developing a relationship with a potential new customer and/or obtaining design

wins, we may not be successful in securing new sales for our products or

services, or new customers. In addition, we cannot accurately predict the timing

of entering into purchase agreements with new customers due to the complex

purchase decision processes of some large institutional customers, such as

healthcare providers or school districts, which often involve high-level

management or board approvals. Consequently, we have only a limited ability to

predict the timing of specific new customer relationships.

If our common shares are delisted from the NASDAQ Capital

Market, our business, financial condition, results of operations and share price

could be adversely affected, and the liquidity of our common shares and our

ability to obtain financing could be impaired.

On August 1, 2016, we received a

letter from the NASDAQ Stock Market LLC (“NASDAQ”) notifying us that we were not

in compliance with the requirement of NASDAQ Listing Rule 5450(a)(1) (“Listing

Rule”) for continued listing on the NASDAQ Global Market as a result of the

closing bid price for our common shares being below $1.00 for 30 consecutive

business days. This notification has had no effect on the listing of our common

shares at this time. In accordance with the Listing Rule, we had 180 calendar

days, or until January 30, 2017, to regain compliance with such rule. On

February 1, 2017, we were granted an additional 180 calendar day period to

regain compliance with the Listing Rule in connection with the transfer of the

listing of our common shares to The NASDAQ Capital Market. To regain compliance,

we must have a closing bid price of our common shares above $1.00 for a minimum

of 10 consecutive business days. No assurance can be given that we will regain

compliance during that period.

Any delisting of our common shares

from the NASDAQ Capital Market could adversely affect our ability to attract new

investors, decrease the liquidity of our outstanding common shares, reduce our

flexibility to raise additional capital, reduce the price at which our common

shares trade, and increase the transaction costs inherent in trading such shares

with overall negative effects for our shareholders. In addition, delisting of

our common shares could deter broker-dealers from making a market in or

otherwise seeking or generating interest in our common shares, and might deter

certain institutions and persons from investing in our securities at all. If our

Board of Directors exercises its discretion to approve a reverse share split to

seek to regain compliance with the NASDAQ listing requirements and increase the

per share trading price of our common shares, the announcement of the reverse

share split could adversely affect the trading price per share even if we

ultimately regain compliance. For these reasons and others, delisting could

adversely affect our business, financial condition, and results of operations.

Risks Related to Our Common Shares and this Offering

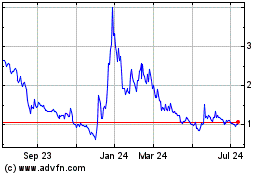

Our stock price has been volatile and your investment in

our common shares could decrease in value.

The market price for securities

of technology companies, including ours, historically has been highly volatile,

and the market from time to time has experienced significant price and volume

fluctuations that are unrelated to the operating performance of such companies.

For example, during the 12-month period ended February 28, 2017, our closing

stock price has ranged from a low of $0.20 to a high of $1.97. Fluctuations in

the market price or liquidity of our common shares may harm the value of your

investment in our common shares. You may not be able to resell your common

shares, at or above the price you pay for those shares due to fluctuations in

the market price caused by changes in our operating performance or prospects and

other factors, including, among others:

|

|

•

|

actual or anticipated fluctuations in our operating

results or future prospects;

|

|

|

|

|

|

|

•

|

our announcements or our competitors’ announcements of

new products;

|

|

|

|

|

|

|

•

|

public reaction to our press releases, our other public

announcements and our filings with the SEC;

|

|

|

|

|

|

|

•

|

strategic actions by us or our competitors;

|

|

|

|

|

|

|

•

|

changes in financial markets or general economic

conditions;

|

|

|

|

|

|

|

•

|

our ability to raise additional capital as needed;

|

S-8

|

|

•

|

developments regarding our patents or

proprietary rights or those of our competitors; and

|

|

|

|

|

|

|

•

|

changes in stock market analyst recommendations

or earnings estimates regarding our common shares, other comparable

companies or our industry generally.

|

Future sales of our common shares could adversely affect

the market price and our future capital-raising activities could involve the

issuance of equity securities, which would dilute your investment and could

result in a decline in the trading price of our common shares.

We will likely sell securities in

the public or private equity markets if and when conditions are favorable, even

if we do not have an immediate need for additional capital at that time. Sales

of substantial amounts of common shares, or the perception that such sales could

occur, could adversely affect the prevailing market price of our common shares

and our ability to raise capital. We may issue additional common shares in

future financing transactions or as incentive compensation for our executive

management and other key personnel, consultants and advisors. Issuing any equity

securities would be dilutive to the equity interests represented by our

then-outstanding common shares. The market price for our common shares could

decrease as the market takes into account the dilutive effect of any of these

issuances.

Sales of shares issuable upon exercise of outstanding

warrants, the conversion of outstanding convertible debt, or the effectiveness

of our registration statement may cause the market price of our shares to

decline.

Excluding the warrants issued

pursuant to the securities purchase agreements, as of March 17, 2017, we have

warrants outstanding for the purchase of up to 46,522,919 common shares having a

weighted-average exercise price of $0.74 per share. Our 8% Senior Secured

Convertible Debenture is convertible to common shares at a conversion price of

$3.00 per common share as of March 17, 2017. Additionally, we expect to register

with the SEC the warrants and common shares issuable upon exercise of warrants

for resale, and upon the effectiveness of the registration statement for these

shares, they may be freely sold in the open market. The sale of our common

shares upon exercise of our outstanding warrants, the conversion of the

debenture into common shares, or the sale of a significant amount of the common

shares issued or issuable upon exercise of the warrants in the open market, or

the perception that these sales may occur, could cause the market price of our

common shares to decline or become highly volatile.

Future sales of our securities under certain

circumstances may trigger price-protection provisions in outstanding warrants,

which would dilute your investment and could result in a decline in the trading

price of our common shares.

In connection with our registered

direct offering in December 2015, we issued a warrant exercisable to purchase up

to 1,500,000 common shares that contains certain price protection provisions. If

we, at any time while these warrants are outstanding, effect certain variable

rate transactions and the issue price, conversion price or exercise price per

share applicable thereto is less than the exercise price then in effect for the

warrants, then the exercise price of the warrants will be reduced to equal such

price. The triggering of this price protection provision, together with this

warrant’s exercise for the purchase of 1,500,000 common shares, could cause

additional dilution to our shareholders.

We may have to pay liquidated damages to our investors,

which will increase our negative cash flows.

Under the terms of our

registration rights agreements entered into with certain investors in connection

with private placements of our securities in May, June, and August 2015 and in

connection with the warrant exchange agreement we entered into in March 2016, if

we fail to comply with certain provisions set forth in these agreements,

including covenants requiring that we maintain the effectiveness of the

registration statements registering these securities, then we will be required

to pay liquidated damages to our investors. There can be no assurance that the

registration statements will remain effective for the time periods necessary to

avoid payment of liquidated damages. If we are required to pay our investors

liquidated damages, this could materially harm our business and future

prospects.

We do not expect to pay cash dividends on our common

shares for the foreseeable future.

We have never paid cash dividends

on our common shares and do not anticipate that any cash dividends will be paid

on the common shares for the foreseeable future. The payment of any cash

dividend by us will be at the discretion of our board of directors and will

depend on, among other things, our earnings, capital, regulatory requirements

and financial condition.

S-9

We will have broad discretion in how we use a portion of

the net proceeds from this offering, and we may use the net proceeds in ways in

which you disagree.

We have not allocated specific

amounts of the net proceeds from this offering for any specific purpose. We may

use a portion of the net proceeds from this offering to fund possible

investments in, or acquisitions of, complementary businesses, technologies or

products. See “Use of Proceeds.” Our management will have significant

flexibility in applying some of the net proceeds of this offering. You will be

relying on the judgment of our management with regard to the use of these net

proceeds, and you will not have the opportunity, as part of your investment

decision, to assess whether the proceeds are being used appropriately. It is

possible that the net proceeds will be invested in a way that does not yield a

favorable, or any, return for our company. The failure of our management to use

such funds effectively could have a material adverse effect on our business,

financial condition, operating results and cash flow.

S-10

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements in this

prospectus supplement and the accompanying prospectus and the documents we

incorporate by reference in this prospectus supplement and the accompanying

prospectus constitute forward-looking information that involves risks and

uncertainties. This forward-looking information includes, but is not limited to,

statements with respect to management’s expectations regarding our future growth

and business plans, business planning process, results of operations, uses of

cash, performance, and business prospects, including statements regarding

preliminary results under “Preliminary Financial Results.” This forward-looking

information may also include other statements that are predictive in nature, or

that depend upon or refer to future events or conditions. Statements with the

words “could”, “expects”, “may”, “will”, “anticipates”, “assumes”, “intends”,

“plans”, “believes”, “estimates”, “guidance” and similar expressions are

intended to identify statements containing forward-looking information, although

not all forward-looking statements include such words. In addition, any

statements that refer to expectations, projections or other characterizations of

future events or circumstances contain forward-looking information. Statements

containing forward-looking information are not historical facts but instead

represent management’s expectations, estimates and projections regarding future

events.

Although management believes the

expectations reflected in such forward-looking statements are reasonable,

forward-looking statements are based on the opinions, assumptions and estimates

of management at the date the statements are made, and are subject to a variety

of risks and uncertainties and other factors that could cause actual events or

results to differ materially from those projected in the forward-looking

statements. These factors include, but are not limited to:

|

|

•

|

our ability to maintain the listing of our

common shares on the NASDAQ Capital Market;

|

|

|

•

|

our limited operating history;

|

|

|

•

|

our ability to generate cash to fund

operations;

|

|

|

•

|

our ability to refinance our credit facilities

prior to maturity or otherwise raise additional debt or equity financing;

|

|

|

•

|

our ability to integrate the businesses of HVE

ConneXions, LLC and Unified ConneXions, Inc.;

|

|

|

•

|

the impact of competition;

|

|

|

•

|

any defects in components or design of our

products;

|

|

|

•

|

the retention or maintenance of key personnel;

|

|

|

•

|

the possibility of significant fluctuations in

operating results;

|

|

|

•

|

currency fluctuations;

|

|

|

•

|

our ability to maintain business relationships;

|

|

|

•

|

financial, political or economic conditions;

|

|

|

•

|

financing risks;

|

|

|

•

|

future acquisitions;

|

|

|

•

|

our ability to protect our intellectual

property;

|

|

|

•

|

third party intellectual property rights;

|

|

|

•

|

volatility in the market price for our common

shares;

|

|

|

•

|

our compliance with financial reporting and

other requirements as a public company;

|

|

|

•

|

conflicts of interests;

|

|

|

•

|

future sales of our common shares by our

directors, officers and other shareholders;

|

|

|

•

|

dilution and future sales of common shares;

|

|

|

•

|

acquisition-related risks; and

|

|

|

•

|

other factors described under the heading

“Risk Factors” and other risk factors described in the documents

incorporated by reference in this prospectus supplement and the

accompanying prospectus.

|

In addition, if any of the

assumptions or estimates made by management prove to be incorrect, actual

results and developments are likely to differ, and may differ materially, from

those expressed or implied by the forward-looking information. Accordingly,

investors are cautioned not to place undue reliance on such statements.

All of this forward-looking

information is qualified by these cautionary statements. Statements containing

forward-looking information are made only as of the date of such document. We

expressly disclaim any obligation to update or alter statements containing any

forward-looking information, or the factors or assumptions underlying them,

whether as a result of new information, future events or otherwise, except as

required by law.

S-11

USE OF PROCEEDS

We intend to use the net proceeds

from the sale of our common shares for general corporate purposes. These

purposes may include repayment of debt, working capital needs, capital

expenditures, acquisitions and any other general corporate purpose.

CAPITALIZATION

The following table sets forth our cash

and cash-equivalents and our capitalization as of December 31, 2016 as

follows:

|

|

•

|

On an actual basis

(1)

; and

|

|

|

|

|

|

|

•

|

On an as-adjusted basis to give effect to our issuance

and sale of 20,454,546 common shares (excluding 20,454,546 common shares

issuable upon exercise of the warrants being offered in the concurrent

private placement) in this offering at the public offering price of $0.22

per common share and a warrant to purchase one common share, after

deducting the estimated offering expenses payable by us, excluding the

proceeds, if any, from the exercise of the warrants issued in the

concurrent private placement.

|

You should read the information

in the following table in conjunction with our consolidated financial statements

and the related notes and the section entitled “Management’s Discussion and

Analysis of Financial Condition and Results of Operations” contained in our

Annual Report on Form 40-F for the year ended December 31, 2015 filed with the

SEC on March 30, 2016 and Form 6-K filed on November 14, 2016, each incorporated

by reference in this prospectus supplement and the accompanying prospectus.

|

|

|

|

As of December 31, 2016

|

|

|

(In thousands, except share and per share information)

|

|

|

Actual

|

|

|

As adjusted for this offering

|

|

|

Cash and cash equivalents

|

|

$

|

5,056

|

|

$

|

8,923

|

|

|

Current portion of long-term debt

|

|

|

19,594

|

|

|

19,594

|

|

|

Long-term debt, net of

current portion

|

|

|

24,401

|

|

|

24,401

|

|

|

Warrant liability

|

|

|

200

|

|

|

4,700

|

|

|

Shareholders’ equity

|

|

|

|

|

|

|

|

Common

stock, no par value per share;

unlimited

shares

authorized, 66,565,174 shares issued and outstanding, actual

|

|

|

157,254

|

|

|

157,254

|

|

|

Accumulated deficit

|

|

|

(135,243

|

)

|

|

(135,876

|

)

|

|

Accumulated other comprehensive loss

|

|

|

(1,565

|

)

|

|

(1,565

|

)

|

|

Total

shareholders’ equity

|

|

$

|

20,446

|

|

$

|

19,813

|

|

|

Total

liabilities and shareholders’ equity

|

|

$

|

92,556

|

|

$

|

96,423

|

|

(1)

Subsequent to December 31, 2016, an aggregate of

22,486,156 common shares were issued pursuant to (i) restricted share issuance

releases, (ii) the subscription agreements we entered into with investors on

various dates between December 29, 2016 and March 16, 2017, and (iii) the

acquisition of HVE ConneXions, LLC and Unified ConneXions, Inc.

S-12

DILUTION

Our net tangible deficit as of

December 31, 2016 was approximately $(38.4) million, or $(0.58) per common

share. Net tangible book value (deficit) per share is calculated by subtracting

our total liabilities from our total tangible assets, which is total assets less

intangible assets, and dividing this amount by the number of common shares

outstanding. After giving effect to the sale of common shares in this offering

and warrants in the concurrent private placement to purchase up to 20,454,546

common shares (excluding the 20,454,546 common shares issuable upon exercise of the

warrants) at the public

offering price of $0.22 per common share and a warrant to purchase one common

share and after deducting estimated offering expenses payable by us, we would

have had a net tangible deficit as of December 31, 2016 of approximately $(37.6)

million, or $(0.40) per common share. This represents an immediate increase in

net tangible deficit of $0.18 per share to our existing shareholders and an

immediate dilution in net tangible deficit of $(0.21) per share to investors in

this offering. The following table illustrates this dilution:

|

Public offering price common

share and a warrant to purchase one common share

|

|

|

|

$

|

0.19

|

|

|

Net

tangible deficit per share as of December 31, 2016

|

$

|

(0.58

|

)

|

|

|

|

|

Increase per share attributable to this offering

|

$

|

0.18

|

|

|

|

|

|

As adjusted net tangible book per share after

this offering

|

|

|

|

$

|

(0.40

|

)

|

|

Net dilution per share to

investors in this offering

|

|

|

|

$

|

(0.21

|

)

|

The public offering price above

is prior to reduction for the value of the liability associated with the

warrants. After giving effect to such reduction, the public offering price would

be $0.00. The number of common shares shown above to be outstanding after this

offering is based on 66,565,174 shares outstanding as of December 31, 2016 and

excludes as of such date:

|

|

•

|

3,255,174 common shares subject to outstanding

options having a weighted-average exercise price of $2.17 per share;

|

|

|

|

|

|

|

•

|

3,763,798 common shares subject to outstanding

restricted stock awards;

|

|

|

|

|

|

|

•

|

2,974,376 common shares reserved for issuance

in connection with future awards under our 2015 Equity Incentive Plan;

|

|

|

|

|

|

|

•

|

2,000,000 common shares reserved for future

sale under our Employee Stock Purchase Plan;

|

|

|

|

|

|

|

•

|

10,242,923 common shares subject to outstanding

warrants having a weighted-average exercise price of $1.67 per share; and

|

|

|

|

|

|

|

•

|

20,454,546 common shares issuable upon exercise

of warrants to be issued in the concurrent private placement.

|

To the extent our outstanding

options, warrants and adjustment warrants are exercised, you may experience

further dilution. The above illustration of dilution per share to investors

participating in this offering assumes no exercise of outstanding options or

outstanding warrants or adjustment warrants to purchase shares of our common

shares. The exercise of outstanding options and warrants having an exercise

price less than the offering price of the common stock in this offering, or

issuance of common shares valued at less than the offering price of one common

share in this offering or a warrant to purchase one common share in the

concurrent private placement, would further increase dilution to investors in

this offering.

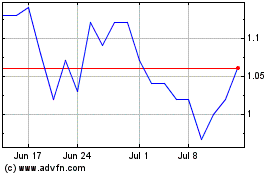

PRICE RANGE OF OUR COMMON SHARES

On December 28, 2012, our common

shares commenced trading on the TSX Venture Exchange under the symbol “ANY”. On

December 10, 2014, we voluntarily delisted our common shares from the TSXV. On

July 8, 2014, our common shares commenced trading on the NASDAQ Global Market

under the symbol “ANY”, and on February 1, 2017, our common shares commenced

trading on the NASDAQ Capital Market in connection with our application to

transfer the listing of our shares from the NASDAQ Global

Market.

The tables below set forth, for

the periods indicated, the per share high and low sales prices for our common

shares as reported on the NASDAQ and the TSXV. TSXV prices of our common shares

are presented in Canadian dollars, and the NASDAQ prices of our common shares

are presented in U.S. dollars.

S-13

|

|

|

TSXV

|

|

|

Annual Highs and Lows

|

|

High

|

|

|

Low

|

|

|

|

|

CAD$

|

|

|

CAD$

|

|

|

Fiscal 2012 (from December

28, 2012)

|

|

0.95

|

|

|

0.74

|

|

|

Fiscal 2013

|

|

6.80

|

|

|

0.41

|

|

|

Fiscal 2014 (through December

10, 2014)

|

|

11.20

|

|

|

5.35

|

|

|

|

|

TSXV

|

|

|

|

|

|

|

|

|

|

|

Quarterly Highs and Lows for Fiscal 2014 and

2015

|

|

High

|

|

|

Low

|

|

|

2014, quarter ended

|

|

CAD$

|

|

|

CAD$

|

|

|

December 31 (through December

10, 2014)

|

|

10.87

|

|

|

5.35

|

|

|

September 30

|

|

11.20

|

|

|

6.57

|

|

|

June 30

|

|

11.19

|

|

|

6.46

|

|

|

March 31

|

|

8.85

|

|

|

5.40

|

|

|

|

|

NASDAQ

|

|

|

Annual Highs and Lows

|

|

High

|

|

|

Low

|

|

|

|

|

USD$

|

|

|

USD$

|

|

|

Fiscal 2014 (from July 8,

2014)

|

|

11.00

|

|

|

4.87

|

|

|

Fiscal 2015

|

|

7.49

|

|

|

1.30

|

|

|

Fiscal 2016

|

|

2.00

|

|

|

0.18

|

|

|

|

|

NASDAQ

|

|

|

|

|

|

|

|

|

|

|

Quarterly Highs and Lows for Fiscal 2015 and

2016

|

|

High

|

|

|

Low

|

|

|

2015, quarter ended

|

|

USD$

|

|

|

USD$

|

|

|

|

|

|

|

|

|

|

|

December 31

|

|

3.80

|

|

|

1.30

|

|

|

September 30

|

|

5.73

|

|

|

1.66

|

|

|

June 30

|

|

5.46

|

|

|

2.98

|

|

|

March 31

|

|

7.49

|

|

|

3.35

|

|

|

2016, quarter ended

|

|

|

|

|

|

|

|

December 31

|

|

0.92

|

|

|

0.18

|

|

|

September 30

|

|

0.95

|

|

|

0.40

|

|

|

June 30

|

|

1.38

|

|

|

0.66

|

|

|

March 31

|

|

2.00

|

|

|

1.02

|

|

S-14

|

|

|

NASDAQ

|

|

|

Monthly Highs and Lows for the last six months

|

|

High

|

|

|

Low

|

|

|

|

|

USD$

|

|

|

USD$

|

|

|

September 2016

|

|

0.84

|

|

|

0.40

|

|

|

October 2016

|

|

0.68

|

|

|

0.45

|

|

|

November 2016

|

|

0.92

|

|

|

0.42

|

|

|

December 2016

|

|

0.85

|

|

|

0.18

|

|

|

January 2017

|

|

0.56

|

|

|

0.26

|

|

|

February 2017

|

|

0.36

|

|

|

0.26

|

|

|

March 2017 (through March 20,

2017)

|

|

0.34

|

|

|

0.28

|

|

S-15

PLAN OF DISTRIBUTION

We are offering 20,454,546

common shares, no par value, to selected institutional investors. The

purchase price for one common share is 0.22. The proceeds to us before expenses

from the sale of the common shares will be $4,500,000. The shares will be issued

pursuant to a securities purchase agreement between us and the investors. The

securities purchase agreement will be included as an exhibit to a Report of

Foreign Private Issuer on Form 6-K that we expect to file with the SEC in

connection with this offering and incorporate by reference into the registration

statement of which this prospectus supplement and the accompanying prospectus

form a part.

Pursuant to the terms of the

securities purchase agreement, purchasers

of at least $500,000 of common shares and warrants will, in the aggregate, have

the right to participate in future offerings of our common shares or securities

convertible into common shares, in an amount equaling up to 50% of such

subsequent financings, which right expires fifteen months from the closing of

this offering. Additionally, pursuant to the terms of our placement

agency agreement with Roth Capital Partners, LLC, each of our directors and

executive officers has entered into a lock-up agreement pursuant to which they

have agreed not to offer, pledge, sell or otherwise transfer any common shares

or any securities convertible into common shares, enter into any swap or other

arrangement that transfers such securities; make any demand for or exercise any

right with respect to the registration of any of such securities; or publicly

disclose the intention to make any offer, sale, pledge or disposition, or to

enter into any transaction, swap, hedge or other arrangement relating to such

securities for a period of 90 days from the effective date of this offering.

Pursuant to an engagement letter

dated as of January 18, 2017, we have engaged Roth Capital Partners, LLC as our

placement agent for this offering. Roth Capital Partners, LLC is not purchasing

or selling any shares, nor are they required to arrange for the purchase and

sale of any specific number or dollar amount of shares other than the use their

“best efforts” to arrange for the sale of our securities. Therefore, we may not

sell the entire amount of shares being offered. Roth Capital Partners, LLC may

engage one or more sub-agents or selected dealers to assist with the offering.

Pursuant to the engagement letter, we agreed to pay a cash fee equal to 7.5% of

the aggregate proceeds of the offering and the concurrent private placement and

the fees and expenses incurred by the placement agent in an amount not to exceed

$45,000. We estimate the total expenses of the offering and the concurrent

private placement, excluding such fees payable to the placement agent, will be

approximately $250,000.

In addition, we have agreed to

issue to Roth Capital Partners, LLC, as additional compensation, warrants to

purchase up to 1,227,272 common shares, which is 3.0% of the common shares and

warrant shares. The warrants are exercisable for cash immediately or on a

cashless basis commencing on a date which is the earlier of (i) six months from

the date of the effective date of this offering or (ii) the date on which we

failed to fulfill our obligations to register the common shares underlying the

warrants under the registration rights agreements and expiring on a date which

is no more than five years from the date of the effective date of this offering

in compliance with FINRA Rule 5110(f)(2)(G)(i). The warrants and the common

shares underlying the warrants have been deemed compensation by FINRA and are,

therefore, subject to a 180-day lockup pursuant to Rule 5110(g)(1) of FINRA. We

will bear all fees and expenses attendant to registering the common shares

issuable on exercise of the warrants. If at any time while the warrants are

outstanding, we sell or grant options to purchase, reprice or otherwise issue

any common shares or securities convertible into common shares at a price less

than $0.30, then the exercise price for the warrants will be reduced to such

price and the number of common shares issuable under the warrants will be

increased such that, after taking into account the decrease in the exercise

price, the aggregate exercise price under the warrants will remain the same. In

addition, upon the occurrence of certain fundamental transactions, including

certain mergers, sales of substantially all of our assets or those of our

significant subsidiaries, and other significant corporate events, the warrant

holders will have certain rights, including for the exchange of the warrants for

warrants to purchase common shares of the successor entity and the right to have

the company purchase the warrants for their Black Scholes Value.

Each investor in this offering

will enter into separate and substantially similar leak-out agreement with us.

From the date of the securities purchase agreement until the date that is 30

calendar days after (and including) the date of the securities purchase

agreement, each investor who is party to a leak-out agreement (together with

certain of its affiliate) may not sell, dispose or otherwise transfer, directly

or indirectly (including, without limitation, any sales, short sales, swaps or

any derivative transactions that would be equivalent to any sales or short

positions), on any trading day, shares purchased in this offering, including the

shares of Common Stock issuable upon exercise of the Warrants, in an amount more

than a specified percentage of the trading volume of the Common Stock on the

principal trading market, subject to certain exceptions. The aggregate trading

volume for all investors who execute leak-out agreements will be 35% of the