Retro 'Space Jam' Hit Fails to Solve Nike's Sales Woes

March 22 2017 - 2:38PM

Dow Jones News

By Sara Germano

Nike Inc. said a sneaker homage to the cult classic film "Space

Jam" was a smash hit, but the retro shoes were a rare highlight in

otherwise troubling results for the world's largest athletic

company.

In a conference call late Tuesday, Nike Brand President Trevor

Edwards said a recent rerelease of a sneaker worn by Michael Jordan

in the 1996 film was "the largest and most successful shoe launch

in the history of Nike." Nonetheless, the company's sales missed

expectations and profit margins were squeezed.

Shares of Nike fell 6.4% to $54.32 in afternoon trading

Wednesday.

For decades, Nike has built market share on the strength of its

coveted sneakers, especially those worn by Mr. Jordan. But the

business model by which those shoes are sold is changing, as the

company is moving away from its traditional role as a wholesaler

and tightens its grip on product releases.

The Space Jam 11 shoes went on sale for $220 in December at Nike

stores as well as at two major retail partners, Foot Locker Inc.

and Finish Line Inc., according to SneakerNews. Nike declined to

clarify how it quantified the Space Jam 11's success, but said the

shoe was also available on its direct-sales app, SNKRS. The company

typically releases a handful of limited-edition sneakers each

month.

Other information reported by Nike on Tuesday revealed its

business is slowing. Shipments of its products to wholesalers in

the next six months are down 4% world-wide, the first time that

metric has been negative in more than seven years, according to

Citi Research.

To combat recent inventory gluts and promotions, Nike said it

plans to more tightly control supply of its shirts and shoes in its

home market. External data show domestic consumers are pulling back

spending on sneakers; U.S. retail athletic-shoe sales fell 14% to

$1.3 billion in February, according to NPD Group.

Nike's basketball business has been challenged by Under Armour

Inc., which two years ago launched a line of sneakers endorsed by

NBA star Steph Curry, as well as a resurgent Adidas AG, which has

regained market share with its own classic sneakers.

As part of a basketball-themed "triple-double" strategy, Nike

executives on Tuesday reiterated their goal of doubling the

company's direct sales via its website and stores, a plan that

could affect how many highly-coveted retro shoes are released to

big sneaker retailers.

Some analysts pointed to what Nike didn't say on the call,

specifically the company's lack of revenue guidance for its next

fiscal year. "Management gave more limited preliminary annual

guidance than past Q3 periods, noting that that the guidance will

be appropriately cautious given the broader retail environment,"

wrote Citi analyst Kate McShane.

Write to Sara Germano at sara.germano@wsj.com

(END) Dow Jones Newswires

March 22, 2017 14:23 ET (18:23 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

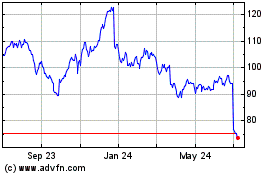

Nike (NYSE:NKE)

Historical Stock Chart

From Mar 2024 to Apr 2024

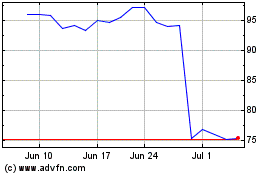

Nike (NYSE:NKE)

Historical Stock Chart

From Apr 2023 to Apr 2024