By Paul Page

Sign up:With one click, get this newsletter delivered to your

inbox.

Do e-commerce companies have the tools to save beleaguered

traditional retailers? Alibaba Group Holding Ltd. is forming a

strategic partnership with brick-and-mortar retailer Bailian Group,

the WSJ's Liza Lin reports, the latest step by the Chinese online

sales giant into the physical retail business. Alibaba is trying to

find new ways to reach more customers and embed operations like its

online payment system in the consumer world. The agreement also

gives Alibaba new channel for managing goods, including

coordinating inventory and distribution between online stocks and

the goods needed for stores. Alibaba says it will "leverage the

power of big data" to manage Bailian's supply chain most

efficiently. That balance between online and store inventory has

been a challenge for retailers, and competitors will watch to see

whether Alibaba can solve that difficult equation.

After digging into a deep financial hole in recent years, some

of the world's biggest mining companies are climbing out with

copper. The industrial metal has surged more than 30% in the past

year, the WSJ's Scott Patterson reports, with demand outpacing

production while giving mining giants including Rio Tinto PLC,

Anglo American PLC, BHP Billiton Ltd. and Glencore PLC relief after

the recent commodities downturn sent them to the edge of financial

disaster. The metal's resurgence partly has been driven by a

government stimulus program in China, where over 40% of the world's

copper is consumed. But the turnaround is also driven partly by

restrained production, which explains why businesses like bulk

shipping companies aren't reaping the benefits. Demand for copper

is expected to outpace production in 2017 for the first time in six

years, and it could remain in deficit for the next three or four

years.

Kraft Heinz Co. and Unilever PLC will return to seeking savings

in their supply chains now that Kraft Heinz's $143 billion bid to

buy the rival packaged-food giant has fallen apart. The deal could

have generated upward of $5 billion in savings, reports the WSJ's

Annie Gasparro, and Kraft Heinz's decision to withdraw will revive

cost-savings plans that so far haven't matched the changes in the

food market that are pressuring both businesses. Kraft Heinz has

scaled back spending under private-equity investment firm 3G

Capital, including closing factories and consolidating sourcing for

better prices. Unilever is also paring back, looking for $1 billion

in savings over the next year, in part by acting more nimbly with

packaging and other supply decisions in local markets. Getting

bigger would help cut costs still further, but it won't respond to

the fundamental changes in the consumer packaged-goods market that

are hitting the industry's faltering giants.

SUPPLY CHAIN STRATEGIES

While some packaged-food giants are responding to nimbler

competitors by getting bigger, others are trying to bring the

upstarts into the fold. Some food giants are starting

venture-capital funds to invest in startups focused on healthier

and less-processed foods, the WSJ's Annie Gasparro reports, betting

the younger companies can teach them to be more entrepreneurial and

innovative. CircleUp, which connects private-equity firms and food

startups, says large consumer-goods companies lost $18 billion in

market share to smaller competitors between 2011 and 2015. The

investments in general have kept operations mostly separate,

rejecting the conventional approach of seeking savings by

consolidating manufacturing and supply chains. Startups say the

deals have brought help in particular areas such as packaging, but

for now Big Food seems more interested in learning from the

newcomers than in using them to build scale.

QUOTABLE

IN OTHER NEWS

The Trump administration is considering changing how it

calculates trade deficits, a shift that would make the country's

trade gap appear larger. (WSJ)

U.K. manufacturing orders rose to a two-year high.

(MarketWatch)

The IHS Markit measure of eurozone manufacturing and service

purchasing rose to its highest level since April 2011. (WSJ)

Deere & Co. says demand for its farm machinery is improving

amid signs that depressed commodity prices are recovering.

(WSJ)

German chip maker Infineon Technologies AG dropped its $850

million bid to buy a unit of Cree Inc. after failing to resolve

national security concerns. (WSJ)

Air Canada lost $136 million in the fourth quarter as rising

fuel and employee costs offset growing revenue. (WSJ)

Executives at big energy producers are considering scaling back

oil-extraction plans amid forecasts that demand will slow in the

coming decades. (WSJ)

General Mills Inc. cut its already-downbeat sales and earnings

forecast on weakening sales in the U.S. (WSJ)

Campbell Soup Co. reported weak sales in its most recent

quarter, with its fresh-food business reporting the steepest drop.

(WSJ)

Amazon.com Inc. quietly lowered its threshold for free shipping

to $35 in purchases. (USA Today)

Amazon says it will add 15,000 jobs in Europe this year, a third

of them in the U.K. (euronews)

European Union member states cleared an 18-month extension of

import tariffs on solar panels from China. (South China Morning

Post)

Some international textiles buyers are switching from China back

to Western suppliers because of China's rising costs. (Reuters)

Australia is having one of its busiest grain exporting seasons

ever, with 3.5 million metric tons of shipping capacity booked this

month. (Farm Weekly)

Toyota Motor Co. may raise wholesale steel prices it charges its

component makers to make up for rising raw materials costs. (Nikkei

Asian Review)

FedEx Corp. Chairman Fred Smith is pressing Congress to allow

twin 33-foot truck trailers on highways over opposition from

truckload carriers. (Supply Chain 247)

The Cass Freight Index of U.S. domestic shipments rose 3.2%

year-over-year in January, as freight expenditures rose for the

first time in 22 months. (Logistics Management)

Maersk Line brought one of its largest container ships to

Vietnam's Cai Mep Thi-Vai seaport to test the port's ability to

handle bigger vessels. (Viet Nam Net)

Fresh Del Monte Produce Inc. will expand import capacity by

adding container ships at Florida's Port Manatee. (Bradenton

Herald)

Gartner Inc. says more than 3 million drones will be produced

this year, 39% more than in 2016. (Material Handling &

Logistics)

Footwear manufacturer Timberland is launching a line of shoes

made of trash discarded in Haiti. (Greenbiz)

ABOUT US

Paul Page is deputy editor of WSJ Logistics Report. Follow him

at @PaulPage, and follow the entire WSJ Logistics Report team:

@brianjbaskin, @jensmithWSJ and @EEPhillips_WSJ and follow the WSJ

Logistics Report on Twitter at @WSJLogistics.

Subscribe to this email newsletter by clicking here:

http://on.wsj.com/Logisticsnewsletter .

Write to Paul Page at paul.page@wsj.com

(END) Dow Jones Newswires

February 21, 2017 06:45 ET (11:45 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

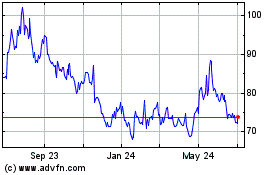

Alibaba (NYSE:BABA)

Historical Stock Chart

From Aug 2024 to Sep 2024

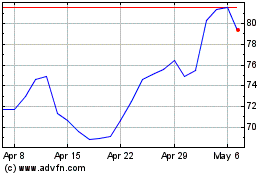

Alibaba (NYSE:BABA)

Historical Stock Chart

From Sep 2023 to Sep 2024