- Fourth quarter net income attributable

to Rayonier of $48.3 million ($0.39 per share) on revenues of

$220.5 million

- Fourth quarter pro forma net income of

$5.7 million ($0.05 per share) on pro forma revenues of $142.8

million

- Fourth quarter operating income of

$61.5 million, pro forma operating income of $18.9 million and

Adjusted EBITDA of $52.0 million

- Full-year net income attributable to

Rayonier of $212.0 million ($1.73 per share) on revenues of $788.3

million

- Full-year pro forma net income of $69.1

million ($0.56 per share) on pro forma revenues of $581.0

million

- Full-year operating income of $255.8

million, pro forma operating income of $112.9 million and Adjusted

EBITDA of $239.7 million

- Full-year cash provided by operations

of $203.8 million and cash available for distribution (CAD) of

$144.3 million

Rayonier Inc. (NYSE:RYN) today reported fourth quarter net

income attributable to Rayonier of $48.3 million, or $0.39 per

share, on revenues of $220.5 million. This compares to net income

attributable to Rayonier of $10.3 million, or $0.08 per share, on

revenues of $137.1 million in the prior year quarter. The fourth

quarter results included $42.6 million of income from a Large

Disposition.1 The prior year fourth quarter results included $1.0

million of costs related to shareholder litigation.2 Excluding

these items, pro forma net income3 was $5.7 million, or $0.05 per

share, on pro forma revenues of $142.8 million versus $11.3

million, or $0.09 per share, on pro forma revenues of $137.1

million in the prior year period.

The following table summarizes the current quarter and

comparable prior year period results on an actual and pro forma

basis:

Three Months Ended December 31, December

31, (millions of dollars, except earnings per share (EPS))

2016 2015 $ EPS $

EPS Revenues $220.5 $137.1 Large Dispositions1 (77.7

) — Pro forma revenues3 $142.8 $137.1

Net income attributable to Rayonier $48.3 $0.39 $10.3 $0.08 Costs

related to shareholder litigation2 — — 1.0 0.01 Large Dispositions1

(42.6 ) (0.34 ) — — Pro forma net income3 $5.7 $0.05

$11.3 $0.09

Full-year 2016 net income attributable to Rayonier was $212.0

million, or $1.73 per share, on revenues of $788.3 million. This

compares to net income attributable to Rayonier of $46.2 million,

or $0.37 per share, on revenues of $544.9 million in the prior

year. The full-year results included $2.2 million of costs related

to shareholder litigation,2 $1.2 million of gain on foreign

currency derivatives4 and $143.9 million from Large Dispositions.1

The prior full-year results included $4.1 million of costs related

to shareholder litigation2 and $0.4 million of expense related to

the write-off of capitalized financing costs. Excluding these

items, pro forma net income3 was $69.1 million, or $0.56 per share,

on pro forma revenues of $581.0 million versus $50.7 million, or

$0.40 per share, on pro forma revenues of $544.9 million in the

prior year.

The following table summarizes the current full-year and

comparable prior year results on an actual and pro forma basis:

Year Ended December 31, December 31,

(millions of dollars, except earnings per share (EPS))

2016

2015 $ EPS $ EPS

Revenues $788.3 $544.9 Large Dispositions1 (207.3 ) —

Pro forma revenues3 $581.0 $544.9 Net income

attributable to Rayonier $212.0 $1.73 $46.2 $0.37 Costs related to

shareholder litigation2 2.2 0.02 4.1 0.03 Gain on foreign currency

derivatives4 (1.2 ) (0.01 ) — — Large Dispositions1 (143.9 ) (1.18

) — — Expense related to the write-off of capitalized financing

costs — — 0.4 — Pro forma net income3 $69.1

$0.56 $50.7 $0.40

Fourth quarter operating income was $61.5 million versus $15.7

million in the prior year period. The fourth quarter operating

income included $42.6 million from a Large Disposition.1 The prior

year fourth quarter operating income included $1.0 million of costs

related to shareholder litigation.2 Excluding these items, pro

forma operating income3 was $18.9 million versus $16.7 million in

the prior year period. Fourth quarter Adjusted EBITDA3 was $52.0

million versus $47.6 million in the prior year period.

The following table summarizes operating income (loss), pro

forma operating income (loss)3 and Adjusted EBITDA3 for the current

quarter and comparable prior year period:

Three Months Ended December 31,

Pro forma Operating Income Operating

Income (Loss)

(Loss)3

Adjusted EBITDA3

(millions of dollars)

2016 2015 2016

2015 2016 2015 Southern Timber

$8.1 $12.0 $8.1 $12.0 $20.8 $24.9 Pacific Northwest Timber

(3.1 ) (0.4 ) (3.1 ) (0.4 ) 7.2 3.5 New Zealand Timber 11.7 (1.1 )

11.7 (1.1 ) 17.9 6.9 Real Estate 49.4 10.3 6.8 10.3 10.6 16.2

Trading 0.5 0.6 0.5 0.6 0.5 0.6 Corporate and other (5.1 ) (5.7 )

(5.1 ) (4.7 ) (5.0 ) (4.5 ) Total $61.5 $15.7 $18.9

$16.7 $52.0 $47.6

Full-year operating income was $255.8 million versus $77.8

million in the prior year. The full-year operating income included

$2.2 million of costs related to shareholder litigation,2 $1.2

million of gain on foreign currency derivatives4 and $143.9 million

from Large Dispositions.1 The prior year operating income included

$4.1 million of costs related to shareholder litigation.2 Excluding

these items, pro forma operating income3 was $112.9 million versus

$81.9 million in the prior year. Full-year Adjusted EBITDA3 was

$239.7 million versus $208.0 million in the prior year.

The following table summarizes operating income (loss), pro

forma operating income (loss)3 and Adjusted EBITDA3 for the current

full year and comparable prior year:

Year Ended December 31, Pro

forma Operating Income Operating Income

(Loss)

(Loss)3

Adjusted EBITDA3

(millions of dollars)

2016 2015 2016

2015 2016 2015 Southern Timber

$43.1 $46.7 $43.1 $46.7 $92.9 $101.0 Pacific Northwest

Timber (4.0 ) 6.9 (4.0 ) 6.9 21.2 21.7 New Zealand Timber 33.1 2.8

33.1 2.8 58.3 33.0 Real Estate 202.4 44.3 58.5 44.3 84.7 70.8

Trading 2.0 1.2 2.0 1.2 2.0 1.2 Corporate and other (20.8 ) (24.1 )

(19.8 ) (20.0 ) (19.4 ) (19.7 ) Total $255.8 $77.8

$112.9 $81.9 $239.7 $208.0

Full-year cash provided by operating activities was $203.8

million versus $177.2 million in the prior year. Full-year cash

available for distribution (CAD)3 was $144.3 million versus $117.4

million in the prior year. Full-year CAD increased $26.9 million

versus the prior year primarily due to higher Adjusted

EBITDA3($31.7 million), partially offset by higher cash interest

paid ($3.2 million), higher cash taxes paid ($0.2 million) and

increased capital expenditures ($1.4 million).

“We are pleased with our fourth quarter results as favorable

Pacific Northwest and New Zealand Timber results more than offset

the impact of lower harvest volumes in Southern Timber and reduced

land sales in Real Estate,” said David Nunes, President and CEO.

“Southern Timber volumes decreased 9% relative to the prior year

quarter as we exercised our discretion to defer harvest volume in

response to weaker market conditions. Average stumpage prices in

Southern Timber decreased 6% versus the prior year quarter,

primarily due to geographic mix and continued supply impacts from

extended dry weather conditions. In Pacific Northwest Timber,

harvest volumes increased 13% and average prices increased 9%

relative to the prior year quarter, largely driven by strong

results from our newly-acquired Menasha properties. New Zealand

Timber results were well above the prior year quarter, as continued

strong export and domestic demand drove significantly higher

pricing. Real Estate results, excluding the gain on the

previously-announced Large Disposition,1 were below the prior year

quarter due to the sale of fewer Non-strategic / Timberland acres,

partially offset by a timberland sale in Washington for roughly

$6,500 per acre.”

Southern Timber

Fourth quarter sales of $30.6 million decreased $5.5 million, or

15%, versus the prior year period. Harvest volumes decreased 9% to

1.29 million tons versus 1.41 million tons in the prior year

period, as harvest levels were deliberately reduced in response to

softer market conditions. Average sawtimber stumpage prices were

relatively flat at $26.75 per ton versus $26.76 per ton in the

prior year period, while average pulpwood stumpage prices decreased

13% to $15.83 per ton versus $18.24 per ton in the prior year

period. The decrease in average pulpwood prices was largely due to

geographic mix as well as increased supply caused by extended dry

weather along the east coast. Overall, weighted-average stumpage

prices (including hardwood) decreased 6% to $19.06 per ton versus

$20.36 per ton in the prior year period. Operating income of $8.1

million decreased $3.9 million versus the prior year period due to

lower volumes ($1.2 million), lower weighted-average stumpage

prices ($1.7 million), higher depletion rates ($1.0 million) and

lower non-timber income ($0.4 million), which were partially offset

by lower software and road maintenance costs ($0.4 million).

Fourth quarter Adjusted EBITDA3 of $20.8 million was $4.1

million below the prior year period.

Pacific Northwest Timber

Fourth quarter sales of $22.9 million increased $4.2 million, or

22%, versus the prior year period. Harvest volumes increased 13% to

356,000 tons versus 315,000 tons in the prior year period due to

additional volume from our recent Menasha acquisition, partially

offset by planned harvest deferrals in the fourth quarter from our

legacy Washington properties. Average delivered sawtimber prices

increased 13% to $74.97 per ton versus $66.27 per ton in the prior

year period, while average delivered pulpwood prices decreased 12%

to $39.62 per ton versus $44.93 per ton in the prior year period.

The increase in average sawtimber prices was due to an overall

strengthening of export and domestic sawtimber markets, combined

with additional volume from our newly-acquired Menasha properties,

which generally command a higher sawtimber price than our legacy

Washington properties. The decrease in pulpwood prices was

primarily due to the increased availability of wood chips in

certain market areas. Operating loss of $3.1 million versus $0.4

million in the prior year period was primarily due to higher

depletion rates resulting from the Menasha acquisition ($5.9

million) and lower non-timber income ($0.5 million), which were

partially offset by higher prices ($2.3 million), higher volumes

($0.3 million) and lower overhead and severance taxes ($1.1

million).

Fourth quarter Adjusted EBITDA3 of $7.2 million was $3.7 million

above the prior year period.

New Zealand Timber

Fourth quarter sales of $46.6 million increased $6.5 million, or

16%, versus the prior year period. Harvest volumes decreased 1% to

562,000 tons versus 568,000 tons in the prior year period. Average

delivered prices for export sawtimber increased 19% to $104.26 per

ton versus $87.35 per ton in the prior year period, while average

delivered prices for domestic sawtimber increased 30% to $77.41 per

ton versus $59.71 per ton in the prior year period. The increase in

export sawtimber prices was primarily due to stronger demand from

China. The increase in domestic sawtimber prices (in U.S. dollar

terms) was driven primarily by strong domestic demand for

construction materials and the rise in the NZ$/US$ exchange rate

(US$0.72 per NZ$1.00 versus US$0.66 per NZ$1.00). Excluding the

impact of foreign exchange rates, domestic sawtimber prices

increased 18% from the prior year period. Operating income of $11.7

million increased $12.8 million versus the prior year period due to

higher prices ($7.5 million), lower overhead and forest management

expenses ($0.3 million), favorable changes in foreign exchange

impacts ($1.4 million) and higher non-timber and other income ($3.7

million), which were partially offset by changes in volume/mix

($0.1 million).

Fourth quarter Adjusted EBITDA3 of $17.9 million was $11.0

million above the prior year period.

Real Estate

Fourth quarter sales of $88.1 million increased $67.6 million

versus the prior year period, while operating income of $49.4

million increased $39.1 million versus the prior year period. The

fourth quarter sales and operating income included $77.7 million

and $42.6 million, respectively, from Large Dispositions.1

Excluding Large Dispositions,1 pro forma sales and operating income

decreased in the fourth quarter due to reduced land sales (1,489

acres sold versus 9,193 acres sold in the prior year period), which

were partially offset by a significant increase in weighted-average

prices ($6,929 per acre versus $2,233 per acre in the prior year

period) and the receipt of a $4.7 million deferred payment with

respect to a prior land sale.

Unimproved Development sales of $3.3 million were comprised of

an 84-acre tract in St. John’s County, Florida for $39,385 per

acre.

Rural sales of $1.5 million were comprised of 504 acres at an

average price of $2,749 per acre.

Non-strategic / Timberland sales of $5.6 million were comprised

of 901 acres at an average price of $6,228 per acre, including a

sale of 816 acres in Washington for $6,495 per acre.

Large Dispositions1 of $77.7 million were comprised of the

previously announced disposition of 37,000 acres in Alabama and

Mississippi at an average price of $2,094 per acre.

Fourth quarter Adjusted EBITDA3 of $10.6 million was $5.6

million below the prior year period.

Trading

Fourth quarter sales of $32.3 million increased $10.6 million

versus the prior year period due to higher volumes and prices.

Sales volumes increased 30% to 321,000 tons versus 247,000 tons in

the prior year period. Average prices increased 14% to $100.41 per

ton versus $87.97 per ton in the prior year period. The increases

in both volumes and prices were primarily due to stronger demand

from China. Operating income of $0.5 million decreased $0.1 million

versus the prior year period.

Other Items

Fourth quarter corporate and other operating expenses of $5.1

million decreased $0.6 million versus the prior year period due to

lower costs related to shareholder litigation2 ($1.0 million),

which were partially offset by increased selling, general and

administrative expenses ($0.2 million) and other minor variances

($0.2 million).

Fourth quarter interest expense of $8.6 million increased $1.5

million versus the prior year period due to higher outstanding

debt, partially offset by lower average rates.

Fourth quarter income tax expense of $2.8 million was

principally related to the New Zealand JV.

Outlook

“In 2017, we expect to achieve net income attributable to

Rayonier of $66 to $72 million, pro forma net income of $39 to $45

million and Adjusted EBITDA of $220 to $240 million,” added Nunes.

“In our Southern Timber segment, we expect harvest volumes to be

slightly down compared to 2016 as we continue to flex regional

harvest volumes based on end market conditions. We continue to see

near-term headwinds in product pricing in certain markets due to

ample mill log inventories, relatively modest near-term growth in

new housing construction, and high levels of Canadian lumber

imports. However, we’re optimistic that pricing will improve over

the longer-term as we see incremental growth in housing starts and

a potential return to some form of managed lumber trade. In our

Pacific Northwest Timber segment, we expect a modest increase in

harvest volumes with a full-year contribution from the Menasha

acquisition as well as a modest improvement in sawtimber prices due

to increased regional manufacturing capacity. In our New Zealand

Timber segment, we expect a modest increase in volume and continued

strong pricing dynamics driven by solid demand in both domestic and

export markets. In our Real Estate segment, we remain highly

focused on unlocking the long-term value of our HBU development and

rural property portfolio. We continue to be encouraged by the

market interest in our Wildlight development project north of

Jacksonville, Florida, and we expect to realize our first sales

from this project in 2017.”

Conference Call

A conference call and live webcast will be held on Thursday,

February 9, 2017 at 10:00 AM EST to discuss these results.

Access to the live webcast will be available at

www.rayonier.com. A replay of the webcast will be archived on the

Company’s website and available shortly after the call.

Investors may listen to the conference call by dialing

800-369-1184 (domestic) or 415-228-3898 (international), passcode:

Rayonier. A replay of the conference call will be available one

hour following the call until Thursday, February 16, 2017 by

dialing 800-568-3705 (domestic) or 203-369-3811 (international),

passcode: 02092017. Complimentary copies of Rayonier press releases

and other financial documents are also available by calling

1-800-RYN-7611.

1“Large Dispositions” are defined as transactions involving the

sale of timberland that exceed $20 million in size and do not have

any identified HBU premium relative to timberland value.

2“Costs related to shareholder litigation” include expenses

incurred as a result of the securities litigation, the shareholder

derivative demands and the Securities and Exchange Commission

investigation. See Note 10—Contingencies of Item 8 — Financial

Statements and Supplementary Data in the Company’s most recent

Annual Report on Form 10-K.

3Pro forma net income, Pro forma revenues (sales), Pro forma

operating income, Adjusted EBITDA and CAD are non-GAAP measures

defined and reconciled to GAAP in the attached exhibits.

4The Company used foreign exchange derivatives to mitigate the

risk of fluctuations in foreign exchange rates while awaiting the

planned capital contribution to the New Zealand JV.

About Rayonier

Rayonier is a leading timberland real estate investment trust

with assets located in some of the most productive softwood timber

growing regions in the United States and New Zealand. As of

December 31, 2016, Rayonier owned, leased or managed

approximately 2.7 million acres of timberlands located in the U.S.

South (1.85 million acres), U.S. Pacific Northwest (378,000 acres)

and New Zealand (433,000 acres). More information is available at

www.rayonier.com.

___________________________________________________________________________

Forward-Looking Statements

Forward-Looking Statements - Certain statements in this

presentation regarding anticipated financial outcomes including

Rayonier’s earnings guidance, if any, business and market

conditions, outlook, expected dividend rate, Rayonier’s business

strategies, including expected harvest schedules, timberland

acquisitions, sales of non-strategic timberlands, the anticipated

benefits of Rayonier’s business strategies, and other similar

statements relating to Rayonier’s future events, developments or

financial or operational performance or results, are

“forward-looking statements” made pursuant to the safe harbor

provisions of the Private Securities Litigation Reform Act of 1995

and other federal securities laws. These forward-looking statements

are identified by the use of words such as “may,” “will,” “should,”

“expect,” “estimate,” “believe,” “intend,” “project,” “anticipate”

and other similar language. However, the absence of these or

similar words or expressions does not mean that a statement is not

forward-looking. While management believes that these

forward-looking statements are reasonable when made,

forward-looking statements are not guarantees of future performance

or events and undue reliance should not be placed on these

statements.

The following important factors, among others, could cause

actual results or events to differ materially from those expressed

in forward-looking statements that may have been made in this

document: the cyclical and competitive nature of the industries in

which we operate; fluctuations in demand for, or supply of, our

forest products and real estate offerings; entry of new competitors

into our markets; changes in global economic conditions and world

events; fluctuations in demand for our products in Asia, and

especially China; various lawsuits relating to matters arising out

of our previously announced internal review and restatement of our

consolidated financial statements; the uncertainties of potential

impacts of climate-related initiatives; the cost and availability

of third party logging and trucking services; the geographic

concentration of a significant portion of our timberland; our

ability to identify, finance and complete timberland acquisitions;

changes in environmental laws and regulations regarding timber

harvesting, delineation of wetlands, and endangered species, that

may restrict or adversely impact our ability to conduct our

business, or increase the cost of doing so; adverse weather

conditions, natural disasters and other catastrophic events such as

hurricanes, wind storms and wildfires, which can adversely affect

our timberlands and the production, distribution and availability

of our products; interest rate and currency movements; our capacity

to incur additional debt; changes in tariffs, taxes or treaties

relating to the import and export of our products or those of our

competitors; changes in key management and personnel; our ability

to meet all necessary legal requirements to continue to qualify as

a real estate investment trust (“REIT”) and changes in tax laws

that could adversely affect beneficial tax treatment; the cyclical

nature of the real estate business generally; a delayed or weak

recovery in the housing market; the lengthy, uncertain and costly

process associated with the ownership, entitlement and development

of real estate, especially in Florida, which also may be affected

by changes in law, policy and political factors beyond our control;

unexpected delays in the entry into or closing of real estate

transactions; changes in environmental laws and regulations that

may restrict or adversely impact our ability to sell or develop

properties; the timing of construction and availability of public

infrastructure; and the availability of financing for real estate

development and mortgage loans.

For additional factors that could impact future results, please

see Item 1A - Risk Factors in the Company’s most recent Annual

Report on Form 10-K and similar discussion included in other

reports that we subsequently file with the Securities and Exchange

Commission (the “SEC”). Forward-looking statements are only as of

the date they are made, and the Company undertakes no duty to

update its forward-looking statements except as required by law.

You are advised, however, to review any further disclosures we make

on related subjects in our subsequent reports filed with the

SEC.

Non-GAAP Financial Measures - To supplement Rayonier’s

financial statements presented in accordance with generally

accepted accounting principles in the United States (“GAAP”),

Rayonier uses certain non-GAAP measures, including “cash available

for distribution,” “pro forma sales,” “pro forma operating income,”

“pro forma net income,” and “Adjusted EBITDA,” which are defined

and further explained in this communication. Reconciliation of such

measures to the nearest GAAP measures can also be found in this

communication. Rayonier’s definitions of these non-GAAP measures

may differ from similarly titled measures used by others. These

non-GAAP measures should be considered supplemental to, and not a

substitute for, financial information prepared in accordance with

GAAP.

RAYONIER INC. AND SUBSIDIARIES CONDENSED STATEMENTS OF

CONSOLIDATED INCOME December 31, 2016 (unaudited)

(millions of dollars, except per share information)

Three Months Ended Year Ended December 31, September

30, December 31, December 31, December 31, 2016 2016

2015 2016 2015

SALES $220.5 $171.4 $137.1 $788.3 $544.9

Costs and expenses Cost of sales 161.9 116.6 114.1 524.7 441.1

Selling and general expenses 11.1 10.6 11.4 42.8 45.8 Other

operating income, net (14.0) (5.5) (4.1) (35.0) (19.8)

OPERATING

INCOME 61.5 49.7 15.7 255.8 77.8 Interest expense (8.6) (8.5)

(7.1) (32.2) (31.7) Interest income and miscellaneous income

(expense), net 0.4 0.2 1.3 (0.8) (3.0)

INCOME BEFORE INCOME

TAXES 53.3 41.4 9.9 222.8 43.1 Income tax (expense) benefit

(2.8) (0.8) (0.5) (5.0) 0.8

NET INCOME 50.5 40.6 9.4 217.8

43.9 Less: Net income (loss) attributable to noncontrolling

interest 2.2 1.2 (0.9) 5.8 (2.3)

NET INCOME ATTRIBUTABLE TO

RAYONIER INC. $48.3 $39.4 $10.3 $212.0 $46.2

EARNINGS PER

COMMON SHARE Basic earnings per share attributable to Rayonier

Inc. $0.39 $0.32 $0.08 $1.73 $0.37 Diluted earnings per share

attributable to Rayonier Inc. $0.39 $0.32 $0.08 $1.73 $0.37

Pro forma net income (a) $0.05 $0.33 $0.09 $0.56 $0.40

Weighted Average Common Shares used for determining

Basic EPS 122,618,278 122,597,927 123,186,975

122,585,200 125,385,085 Diluted EPS 122,900,350

122,882,633 123,300,068 122,812,323

125,900,189

(a) Pro forma net income is a non-GAAP

measure. See Schedule F for definition and a reconciliation to the

nearest GAAP measure.

A

RAYONIER INC. AND SUBSIDIARIES CONDENSED CONSOLIDATED

BALANCE SHEETS December 31, 2016 (unaudited)

(millions of dollars) December 31, December

31, 2016 2015

Assets Cash and cash equivalents $85.9 $51.8

Assets held for sale 23.2 — Other current assets 55.8 53.9 Timber

and timberlands, net of depletion and amortization 2,291.0 2,066.8

Higher and better use timberlands and real estate development

investments 70.4 65.4 Property, plant and equipment 23.1 15.8 Less

- accumulated depreciation (9.1) (9.1) Net property, plant and

equipment 14.0 6.7 Restricted deposits 71.7 23.5 Other assets 73.8

47.8 Total Assets $2,685.8 $2,315.9

Liabilities and

Shareholders’ Equity Current maturities of long-term debt $31.7

— Other current liabilities 60.3

59.5

Long-term debt 1,030.2 830.6 Other non-current liabilities 66.7

64.1 Total Rayonier Inc. shareholders’ equity 1,411.7 1,288.1

Noncontrolling interest 85.2 73.6 Total shareholders’ equity

1,496.9 1,361.7 $2,685.8 $2,315.9

B

RAYONIER INC. AND SUBSIDIARIES CONDENSED CONSOLIDATED

STATEMENTS OF SHAREHOLDERS’ EQUITY December 31, 2016

(unaudited) (millions of dollars, except share

information)

Common Shares

Accumulated

Other

Non-

Retained

Comprehensive

controlling

Shareholders'

Shares

Amount

Earnings

Income/(Loss)

Interest

Equity

Balance, December 31, 2014 126,773,097 $702.6 $790.7 ($4.8 )

$86.7 $1,575.2 Net income (loss) — — 46.2 — (2.3 ) 43.9 Dividends

($1.00 per share) — — (124.9 ) — — (124.9 ) Issuance of shares

under incentive stock

plans

205,219 2.1 — — — 2.1 Stock-based compensation — 4.5 — — — 4.5

Repurchase of common shares made under

repurchaseprogram

(4,202,697 ) — (100.0 ) — — (100.0 ) Other (a) (5,402 ) (0.4 ) 0.8

(28.7 ) (10.8 ) (39.1 )

Balance, December 31, 2015

122,770,217 $708.8 $612.8 ($33.5 ) $73.6 $1,361.7 Net income — —

212.0 — 5.8 217.8 Dividends ($1.00 per share) — — (123.2 ) — —

(123.2 ) Issuance of shares under incentive stock

plans

179,743 1.6 — — — 1.6 Stock-based compensation — 5.1 — — — 5.1

Repurchase of common shares made under repurchase program (35,200 )

— (0.7 ) — — (0.7 ) Other (a) (10,392 ) (5.6 ) — 34.4

5.8 34.6

Balance, December 31, 2016

122,904,368 $709.9 $700.9 $0.9 $85.2

$1,496.9

(a) Primarily includes shares purchased

from employees in non-open market transactions to pay withholding

taxes associated with the vesting of restricted stock, actuarial

changes and amortization of pension and postretirement plan

liabilities, foreign currency translation adjustments, and

mark-to-market adjustments of qualifying cash flow hedges. The

twelve months ended December 31, 2016 also includes changes as a

result of the recapitalization of the New Zealand JV.

C

RAYONIER INC. AND SUBSIDIARIES CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS December 31, 2016 (unaudited)

(millions of dollars) Year Ended December 31,

2016 2015

Cash provided by operating activities: Net income

$217.8 $43.9 Depreciation, depletion and amortization 115.1 113.7

Non-cash cost of land and improved development 11.7 12.5 Gain on

sale of large dispositions (143.9 ) — Other items to reconcile net

income to cash provided by operating activities 12.7 7.6 Changes in

working capital and other assets and liabilities (9.6 ) (0.5 )

203.8 177.2

Cash used for investing

activities: Capital expenditures (58.7 ) (57.3 ) Real estate

development investments (8.7 ) (2.7 ) Purchase of timberlands

(366.5 ) (98.4 ) Assets purchased in business acquisition (0.9 ) —

Net proceeds from large dispositions 203.9 — Change in restricted

deposits (48.2 ) (16.8 ) Proceeds from settlement of net investment

hedge — 2.8 Rayonier office building under construction (6.3 ) 0.9

Other 2.2 5.2 (283.2 ) (166.3 )

Cash used for

financing activities: Increase in debt, net of issuance costs

236.6 106.4 Dividends paid (122.8 ) (124.9 ) Proceeds from the

issuance of common shares 1.6 2.1 Repurchase of common shares (0.7

) (100.0 ) Other (0.3 ) (0.1 ) 114.4 (116.5 )

Effect of

exchange rate changes on cash (0.9 ) (4.2 )

Cash and cash

equivalents: Change in cash and cash equivalents 34.1 (109.8 )

Balance, beginning of year 51.8 161.6 Balance, end of

year $85.9 $51.8

D

RAYONIER INC. AND SUBSIDIARIES BUSINESS SEGMENT SALES AND

OPERATING INCOME (LOSS) December 31, 2016 (unaudited)

(millions of dollars) Three Months Ended Year

Ended December 31, September 30, December 31,

December 31, December 31, 2016 2016 2015 2016 2015

Sales Southern Timber $30.6 $27.8 $36.1 $132.9 $139.1

Pacific Northwest Timber 22.9 16.1 18.7 75.2 76.5 New Zealand

Timber 46.6 42.2 40.1 172.5 161.6 Real Estate 88.1 60.6 20.5 299.4

86.5 Trading 32.3 24.7 21.7 108.3 81.2

Total sales $220.5

$171.4 $137.1 $788.3 $544.9

Pro forma sales (a)

Southern Timber $30.6 $27.8 $36.1 $132.9 $139.1 Pacific Northwest

Timber 22.9 16.1 18.7 75.2 76.5 New Zealand Timber 46.6 42.2 40.1

172.5 161.6 Real Estate 10.4 60.6 20.5 92.1 86.5 Trading 32.3 24.7

21.7 108.3 81.2

Pro forma sales $142.8 $171.4 $137.1 $581.0

$544.9

Operating income (loss) Southern Timber $8.1

$8.2 $12.0 $43.1 $46.7 Pacific Northwest Timber (3.1) (3.3) (0.4)

(4.0) 6.9 New Zealand Timber 11.7 6.6 (1.1) 33.1 2.8 Real Estate

49.4 43.1 10.3 202.4 44.3 Trading 0.5 0.5 0.6 2.0 1.2 Corporate and

other (5.1) (5.4) (5.7) (20.8) (24.1)

Operating income $61.5

$49.7 $15.7 $255.8 $77.8

Pro forma operating

income/(loss) (a) Southern Timber $8.1 $8.2 $12.0 $43.1 $46.7

Pacific Northwest Timber (3.1) (3.3) (0.4) (4.0) 6.9 New Zealand

Timber 11.7 6.6 (1.1) 33.1 2.8 Real Estate 6.8 43.1 10.3 58.5 44.3

Trading 0.5 0.5 0.6 2.0 1.2 Corporate and other (5.1) (4.2) (4.7)

(19.8) (20.0)

Pro forma operating income $18.9 $50.9 $16.7

$112.9 $81.9

Adjusted EBITDA (a) Southern Timber

$20.8 $18.2 $24.9 $92.9 $101.0 Pacific Northwest Timber 7.2 3.4 3.5

21.2 21.7 New Zealand Timber 17.9 12.6 6.9 58.3 33.0 Real Estate

10.6 56.6 16.2 84.7 70.8 Trading 0.5 0.5 0.6 2.0 1.2 Corporate and

other (5.0) (4.1) (4.5) (19.4) (19.7)

Adjusted EBITDA $52.0

$87.2 $47.6 $239.7 $208.0

(a) Pro forma sales, Pro forma operating

income (loss) and Adjusted EBITDA are non-GAAP measures. See

Schedule F for definitions and reconciliations.

E

RAYONIER INC. AND SUBSIDIARIES RECONCILIATION OF NON-GAAP

MEASURES December 31, 2016 (unaudited) (millions of

dollars, except per share information)

LIQUIDITY MEASURES: Year Ended December 31, December 31,

2016 2015

Cash Provided by Operating Activities $203.8

$177.2 Working capital and other balance sheet changes (0.8 ) (2.5

) Capital expenditures (a) (58.7 ) (57.3 )

Cash Available for

Distribution (b) $144.3 $117.4

Net income $217.8

$43.9 Interest, net and miscellaneous expense (income) 33.0 34.7

Income tax expense (benefit) 5.0 (0.9 ) Depreciation, depletion and

amortization 115.1 113.7 Non-cash cost of land and improved

development 11.7 12.5 Costs related to shareholder litigation (c)

2.2 4.1 Gain on foreign currency derivatives (d) (1.2 ) — Large

Dispositions (e) (143.9 ) —

Adjusted EBITDA $239.7

$208.0 Cash interest paid (f) (36.2 ) (33.0 ) Cash taxes paid (0.5

) (0.3 ) Capital expenditures (a) (58.7 ) (57.3 )

Cash Available

for Distribution $144.3 $117.4

Cash Available for

Distribution $144.3 $117.4 Real estate development investments

(8.7 ) (2.7 )

Cash Available for Distribution after real estate

development investments $135.6 $114.7 (a)

Capital expenditures exclude timberland acquisitions of $366.5

million and $98.4 million and spending on the Rayonier office

building of $6.3 million and $0.9 million for the years ended

December 31, 2016 and December 31, 2015, respectively. (b) Cash

Available for Distribution (CAD) is a non-GAAP measure that

management uses to measure cash generated during a period that is

available for dividend distribution, repurchase of the Company’s

common shares, debt reduction and strategic acquisitions. CAD is

defined as cash provided by operating activities adjusted for

capital spending (excluding timberland acquisitions and spending on

the Rayonier office building) and working capital and other balance

sheet changes. CAD is not necessarily indicative of the CAD that

may be generated in future periods. (c) “Costs related to

shareholder litigation” include expenses incurred as a result of

the securities litigation, the shareholder derivative demands and

the Securities and Exchange Commission investigation. See Note

10—Contingencies of Item 8 — Financial Statements and Supplementary

Data in the Company’s most recent Annual Report on Form 10-K. (d)

The Company used foreign exchange derivatives to mitigate the risk

of fluctuations in foreign exchange rates while awaiting the

capital contribution to the New Zealand JV. (e) “Large

Dispositions” are defined as transactions involving the sale of

timberland that exceed $20 million in size and do not have any

identified HBU premium relative to timberland value. Large

Dispositions in 2016 included $143.9 million of gain, $36.1 million

of depletion and $22.2 million non-cash cost of land sold. (f) Cash

interest paid is presented net of patronage refunds received of

$0.4 million and $1.3 million for the years ended December 31, 2016

and December 31, 2015, respectively.

F

PRO FORMA SALES (a)

Pacific New Southern Northwest

Zealand Real Three Months Ended Timber

Timber Timber Estate Trading

Total December 31, 2016 Sales $30.6 $22.9

$46.6 $88.1 $32.3 $220.5 Large Dispositions (b) — — —

(77.7 ) — (77.7 )

Pro forma sales $30.6

$22.9 $46.6 $10.4 $32.3 $142.8

Pacific New Southern Northwest

Zealand Real Year Ended Timber

Timber Timber Estate Trading

Total December 31, 2016 Sales $132.9 $75.2

$172.5 $299.4 $108.3 $788.3 Large Dispositions (b) — —

— (207.3 ) — (207.3 )

Pro forma sales

$132.9 $75.2 $172.5 $92.1 $108.3

$581.0

PRO FORMA NET INCOME (c):

Three Months Ended Twelve Months Ended

December 31, September 30, December 31, December 31,

December 31, 2016 2016 2015 2016 2015 $

PerDilutedShare

$

PerDilutedShare

$

PerDilutedShare

$

PerDilutedShare

$

PerDilutedShare

Net income attributable to Rayonier Inc. $48.3 $0.39 $39.4

$0.32 $10.3 $0.08 $212.0 $1.73 $46.2 $0.37 Costs related to

shareholder litigation (d) — — 1.2 0.01 1.0 0.01 2.2 0.02 4.1 0.03

Gain on foreign currency derivatives (e) — — — — — — (1.2 ) (0.01 )

— — Large Dispositions (b) (42.6 ) (0.34 ) — — — — (143.9 ) (1.18 )

— — Expense related to the write-off of capitalized financing costs

— — — — — — — —

0.4 —

Pro forma net income $5.7 $0.05

$40.6 $0.33 $11.3 $0.09 $69.1

$0.56 $50.7 $0.40

PRO FORMA OPERATING INCOME (LOSS) AND ADJUSTED

EBITDA (f)(g):

Pacific New Corporate

Southern Northwest Zealand Real

and Three Months Ended Timber Timber

Timber Estate Trading other

Total December 31, 2016 Operating income (loss) $8.1

($3.1 ) $11.7 $49.4 $0.5 ($5.1 ) $61.5 Large Dispositions (b) —

— — (42.6 ) — — (42.6 ) Pro

forma operating income (loss) $8.1 ($3.1 ) $11.7 $6.8 $0.5 ($5.1 )

$18.9 Depreciation, depletion and amortization 12.7 10.3 6.2 2.2 —

0.1 31.5 Non-cash cost of land and improved development — —

— 1.6 — — 1.6 Adjusted

EBITDA $20.8 $7.2 $17.9 $10.6 $0.5

($5.0 ) $52.0

September 30, 2016

Operating income (loss) $8.2 ($3.3 ) $6.6 $43.1 $0.5 ($5.4 ) $49.7

Costs related to shareholder litigation (d) — — —

— — 1.2 1.2 Pro forma operating

income (loss) $8.2 ($3.3 ) $6.6 $43.1 $0.5 ($4.2 ) $50.9

Depreciation, depletion and amortization 10.0 6.7 6.0 9.2 — 0.1

32.0 Non-cash cost of land and improved development — —

— 4.3 — — 4.3 Adjusted

EBITDA $18.2 $3.4 $12.6 $56.6 $0.5

($4.1 ) $87.2

December 31, 2015

Operating income (loss) $12.0 ($0.4 ) ($1.1 ) $10.3 $0.6 ($5.7 )

$15.7 Costs related to shareholder litigation (d) — —

— — — 1.0 1.0 Pro forma

operating income (loss) $12.0 ($0.4 ) ($1.1 ) $10.3 $0.6 ($4.7 )

$16.7 Depreciation, depletion and amortization 12.9 3.9 7.5 3.4 —

0.2 27.9 Non-cash cost of land and improved development — —

0.5 2.5 — — 3.0 Adjusted

EBITDA $24.9 $3.5 $6.9 $16.2 $0.6

($4.5 ) $47.6

F

Pacific New

Corporate Southern Northwest

Zealand Real and Year Ended

Timber Timber Timber Estate

Trading other Total December 31, 2016

Operating income (loss) $43.1 ($4.0 ) $33.1 $202.4 $2.0 ($20.8 )

$255.8 Large Dispositions (b) — — — (143.9 ) — — (143.9 ) Costs

related to shareholder litigation (d) — — — — — 2.2 2.2 Gain on

foreign currency derivatives — — — — —

(1.2 ) (1.2 ) Pro forma operating income (loss) $43.1 ($4.0

) $33.1 $58.5 $2.0 ($19.8 ) $112.9 Depreciation, depletion and

amortization 49.8 25.2 23.4 16.3 — 0.4 115.1 Non-cash cost of land

and improved development — — 1.8 9.9 —

— 11.7 Adjusted EBITDA $92.9 $21.2

$58.3 $84.7 $2.0 ($19.4 ) $239.7

December 31, 2015 Operating income (loss) $46.7 $6.9

$2.8 $44.3 $1.2 ($24.1 ) $77.8 Costs related to shareholder

litigation (d) — — — — — 4.1

4.1 Pro forma operating income (loss) $46.7 $6.9 $2.8

$44.3 $1.2 ($20.0 ) $81.9 Non-operating expense — — — — — (0.1 )

(0.1 ) Depreciation, depletion and amortization 54.3 14.8 29.7 14.5

— 0.4 113.7 Non-cash cost of land and improved development —

— 0.5 12.0 — — 12.5

Adjusted EBITDA $101.0 $21.7 $33.0 $70.8

$1.2 ($19.7 ) $208.0

2017

Guidance Net Income to Adjusted EBITDA Reconciliation

Net income

$72.5

-

$78.5

Less: Net income attributable to noncontrolling interest (6.5 ) -

(7.0 ) Net Income attributable to Rayonier Inc.

$66.0

-

$71.5

Less: Large Dispositions (b) (27.0 ) - (27.0 )

Pro forma net

income

$39.0

-

$44.5

Interest, net 33.0 - 33.2 Income tax expense 10.5 - 11.3

Depreciation, depletion and amortization

116.0

-

124.0

Non-cash cost of land and improved development 15.0 - 20.0 Net

income attributable to noncontrolling interest 6.5 - 7.0

Adjusted EBITDA $220.0 - $240.0 (a) Pro

forma sales is defined as revenue adjusted for Large Dispositions.

Rayonier believes that this non-GAAP financial measure provides

investors with useful information to evaluate our core business

operations because it excludes specific items that are not

indicative of ongoing operating results. (b) “Large Dispositions”

are defined as transactions involving the sale of timberland that

exceed $20 million in size and do not have any identified HBU

premium relative to timberland value. On April 28, 2016, the

Company completed a disposition of approximately 55,000 acres

located in Washington for a sales price and gain of approximately

$129.5 million and $101.3 million, respectively. On October 21,

2016, the Company completed a second disposition of approximately

37,000 acres located in Mississippi and Alabama for a sales price

and gain of approximately $77.7 million and $42.6 million,

respectively. (c) Pro forma net income is defined as net income

attributable to Rayonier Inc. adjusted for costs related to

shareholder litigation, the gain on foreign currency derivatives,

Large Dispositions and expense related to the write-off of

capitalized financing costs. Rayonier believes that this non-GAAP

financial measure provides investors with useful information to

evaluate our core business operations because it excludes specific

items that are not indicative of ongoing operating results. (d)

“Costs related to shareholder litigation” includes expenses

incurred as a result of the securities litigation, the shareholder

derivative demands and the Securities and Exchange Commission

investigation. See Note 10—Contingencies of Item 8 — Financial

Statements and Supplementary Data in the Company’s most recent

Annual Report on Form 10-K. (e) The company used foreign exchange

derivatives to mitigate the risk of fluctuations in foreign

exchange rates while awaiting the capital contribution to the New

Zealand JV. (f) Pro forma operating income is defined as operating

income adjusted for costs related to shareholder litigation, the

gain on foreign currency derivatives and Large Dispositions.

Rayonier believes that this non-GAAP financial measure provides

investors with useful information to evaluate our core business

operations because it excludes specific items that are not

indicative of ongoing operating results. (g) Adjusted EBITDA is

defined as earnings before interest, taxes, depreciation,

depletion, amortization, the non-cash cost of land and improved

development, costs related to shareholder litigation, the gain on

foreign currency derivatives and Large Dispositions. Adjusted

EBITDA is a non-GAAP measure that management uses to make strategic

decisions about the business and that investors can use to evaluate

the operational performance of the assets under management. It

removes the impact of specific items that management believes do

not directly reflect the core business operations on an ongoing

basis.

F

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170208006209/en/

Rayonier Inc.InvestorsMark McHugh, 904-357-3757orMediaRoseann

Wentworth, 904-357-9185roseann.wentworth@rayonier.com

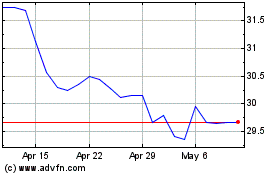

Rayonier (NYSE:RYN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Rayonier (NYSE:RYN)

Historical Stock Chart

From Apr 2023 to Apr 2024