IRS Says to Expect Delays for Tax Refunds

January 05 2017 - 3:40PM

Dow Jones News

By Richard Rubin

Millions of low-income and middle-income taxpayers shouldn't

count on getting their tax refunds until Feb. 27, more than a month

after the tax filing season opens, the IRS said Thursday.

That is the result of a new law passed by Congress that's

designed to cut down on tax fraud.

The IRS must delay paying out refunds on returns that claim the

earned-income tax credit or a child tax credit.

About 15 million households -- or 10% of all individual

income-tax returns -- will be affected by the delay, according to

H&R Block Inc., the tax-preparation company.

Those returns are the most likely to contain identity-theft

fraud, because criminals can claim refunds of $3,000 and up using

those tax breaks and get the money before the real taxpayer even

knows what happened. But they are also the returns of the

low-income taxpayers who file their tax returns early in the year

and rely heavily on those refunds to pay down debt, make big

purchases or replenish savings.

"For many people, this is the biggest check they see all year,"

said IRS Commissioner John Koskinen.

The delay will allow the Internal Revenue Service to match

information on the tax returns with income data on W-2s filed by

employers. Mr. Koskinen didn't have an estimate of how much

additional fraud the IRS might catch. The nonpartisan congressional

Joint Committee on Taxation projected the law would increase

federal revenue by $779 million over a decade.

Over the past few years, the IRS has processed tax refunds

faster and now says 90% of taxpayers get their money within 21

days. That speed and direct deposit of refunds helped shrink the

short-term lending market that bridged the gap for low-income

households waiting for checks in the mail, but it also created

opportunities for fraud.

Mr. Koskinen said taxpayers should file their returns as they

normally would and that the IRS would process them as it receives

them. Then, he said, the agency will release all approved refunds

on Feb. 15, the first date the new law allows.

But Presidents Day on Feb. 20 and processing times for the

federal government and banks mean that refunds may not land in

taxpayers' bank accounts until Feb. 27.

Estimated arrival dates for those refunds won't show up in the

agency's online "Where's My Refund?" tool until after Feb. 15.

The IRS will begin accepting 2016 tax returns on Jan. 23. This

year's deadline -- without allowed extensions -- is April 18, not

April 15, because of a weekend and the Emancipation Day holiday in

Washington, D.C.

Write to Richard Rubin at richard.rubin@wsj.com

(END) Dow Jones Newswires

January 05, 2017 15:25 ET (20:25 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

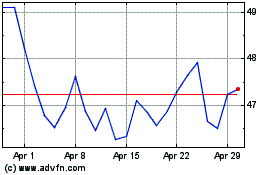

H and R Block (NYSE:HRB)

Historical Stock Chart

From Mar 2024 to Apr 2024

H and R Block (NYSE:HRB)

Historical Stock Chart

From Apr 2023 to Apr 2024