Lonza to Buy Capsugel from KKR in Multibillion-Dollar Deal-- 2nd Update

December 15 2016 - 9:48AM

Dow Jones News

By Dana Mattioli and Denise Roland

Lonza Group AG on Thursday said it had agreed to buy Capsugel, a

New Jersey-based maker of drug capsules, from private-equity

company KKR & Co., in a deal valued at $3.5 billion excluding

debt refinancing.

The Basel, Switzerland-based pharmaceutical company said it

expected the deal to accelerate growth and boost earnings in the

first full year after closing. The transaction, which also includes

the refinancing of about $2 billion of Capsugel's existing debt,

has already been approved by the boards of both companies.

News of the deal came just days after Lonza confirmed it was in

talks to acquire Capsugel, after The Wall Street Journal reported

that KKR was nearing an agreement to sell the business.

Capsugel, based in Morristown, N.J., makes capsules used for the

delivery of drugs and food supplements. Its designs are used in

vitamins, over-the-counter drugs, dietary supplements and

prescription medicines. KKR bought Capsugel from pharmaceutical

giant Pfizer Inc. for $2.4 billion in 2011.

Lonza produces a wide range of chemical, health care and

personal-care products and has been scouring for a possible deal.

The acquisition of Capsugel will broaden the range of manufacturing

and development services it can provide to drugmakers.

The company said it expected to achieve operating synergies of

30 million Swiss francs ($31.6 million) and tax synergies of 15

million francs a year by 2019 from the deal and 100 million francs

a year in top line synergies in the mid-to-long term.

Lonza said the deal would be positive for core earnings per

share in the first full year post-close.

The transaction is expected to close in the second quarter of

2017. Jefferies acted as the lead financial adviser to Lonza,

alongside UBS and Bank of America Merrill Lynch. Goldman Sachs

advised Capsugel.

While health care deal-making has dropped from 2015's brisk

pace, several companies that provide ancillary products and

services to the pharmaceutical sector have announced combinations

lately.

Blackstone Group LP in October agreed to lead an acquisition of

healthcare-staffing provider Team Health Holdings Inc. for more

than $3 billion. Software-and-data company IMS Health Holdings Inc.

in October merged with outsourcer Quintiles Transnational Holdings

Inc. in a deal worth nearly $9 billion.

Private-equity companies Carlyle Group LP and Hellman &

Friedman LLC are seeking buyers for drug-research company

Pharmaceutical Product Development LLC, which could fetch around $5

billion, The Wall Street Journal reported last week.

Write to Dana Mattioli at dana.mattioli@wsj.com and Denise

Roland at Denise.Roland@wsj.com

(END) Dow Jones Newswires

December 15, 2016 09:33 ET (14:33 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

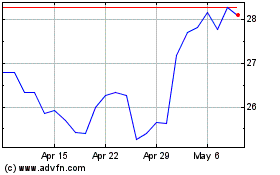

Pfizer (NYSE:PFE)

Historical Stock Chart

From Aug 2024 to Sep 2024

Pfizer (NYSE:PFE)

Historical Stock Chart

From Sep 2023 to Sep 2024