Coke's Sales Volumes Grow -- WSJ

October 27 2016 - 3:03AM

Dow Jones News

Modest improvement reflects growth for noncarbonated drinks;

profit declines 28%

By Mike Esterl

Coca-Cola Co. sold more drinks in the third quarter after

volumes stalled earlier this year, lifted by noncarbonated

offerings and solid growth in the U.S., Japan and parts of Europe,

despite weakness in less-developed markets.

The beverage giant also said Wednesday it would continue efforts

to cut sugar from its products and diversify beyond soda as more

countries weigh special taxes on high-calorie drinks to combat

rising obesity and diabetes.

The maker of Coke, Minute Maid juices and Powerade sports drinks

reported volumes rose 1% in the third quarter, an improvement from

the second quarter, when volumes were flat for the first time since

1999. Revenue rose 3% in the most recent quarter after stripping

out bottling divestments and foreign-exchange losses.

Highlighting shifting consumer habits, soda volumes were flat,

including a 2% decline in Latin America. Noncarbonated volumes grew

3%, fueled mainly by bottled water and sports drinks.

North American revenue rose 3% as the company continues to roll

out smaller package sizes, charging consumers more on a per-ounce

basis. Noncarbonated volumes rose 2%, helped by a high-single-digit

percentage increase in Vitaminwater. Soda volumes were even, with

growth in Fanta and Sprite being offset by declines in Diet Coke as

Americans avoid artificial zero-calorie sweeteners.

Developed markets in Japan and Western Europe also grew but

emerging markets remain "a mixed bag" as economic and political

uncertainty weigh on results, Chief Executive Muhtar Kent told

analysts on an earnings call.

Management singled out the Latin American countries of Brazil,

Argentina and Venezuela as particularly challenging, despite

healthy growth in Mexico. Volumes also declined in India and

conditions in Russia remain difficult, offsetting healthy growth in

Nigeria and other parts of Africa.

Volumes rose 2% in China after declining the first six months of

the year, helped partly by better weather. Still, James Quincey,

Coke's chief operating officer, warned of "continued near-term

volatility" in the world's biggest marketplace amid a spending

slowdown. Coke has responded by launching smaller, cheaper package

sizes and scaling back the use of returnable bottles as more people

consume drinks in their homes instead of visiting restaurants.

Mr. Quincey said Coke also has more than 200 reformulation

initiatives under way across the world to reduce added sugars in

its beverages, including the use of stevia, a zero-calorie

sweetener. The company recently rolled out a variation of Sprite

with 30% fewer calories in the U.K., which plans to introduce a

sugary drink tax in 2018.

"We're making progress but we have a lot more to do," Mr.

Quincey told reporters on a conference call.

That also includes cutting Coke's reliance on soda, which

represents about 70% of company volumes, down from more than 90%

about 15 years ago. The portfolio mix has been shifting toward

noncarbonated drinks at a rate of roughly 1% a year and would take

another two decades to reach 50/50 at the current pace.

"I would certainly like to get there quicker than 20 years,"

said Mr. Quincey, who singled out dairy and plant-based beverages

as two areas that could see more bolt-on acquisitions.

Coke reported that revenue fell 6.9% to $10.63 billion in the

third quarter from $11.43 billion a year earlier. Structural items,

including bottling and distribution divestments, had a negative

impact of 8 percentage points. Weaker foreign currencies had a

negative impact of 2 percentage points.

Net income fell 28% to $1.05 billion, or 24 cents a share, from

$1.45 billion, or 33 cents a share, also weighed down by

restructuring costs and foreign currencies.

Still, Coke's results were slightly better than Wall Street

expectations and the company reiterated it expects pretax profit to

rise by 6% to 8% in 2016 after adjusting for structural items and

foreign-exchange losses.

Coke's share price was 0.1% lower at $42.49 in afternoon trade

on the New York Stock Exchange.

Write to Mike Esterl at mike.esterl@wsj.com

(END) Dow Jones Newswires

October 27, 2016 02:48 ET (06:48 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

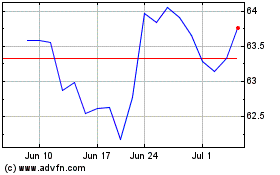

Coca Cola (NYSE:KO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Coca Cola (NYSE:KO)

Historical Stock Chart

From Apr 2023 to Apr 2024