W.W. Grainger Lowers Guidance Amid Demand Pressure

October 18 2016 - 9:09AM

Dow Jones News

By Anne Steele

W.W. Grainger Inc. narrowed its guidance for the year--lowering

the midpoint of its outlook--though it posted an unexpected rise in

adjusted profit in the latest quarter as the company continued to

trim expenses amid a slide in sales.

Chief Executive D.G. Macpherson said the maintenance, repair and

operating supply distributor continued to effectively manage costs

in what he called a "low-growth environment." He said the company

expects fourth quarter demand to remain challenged.

For 2016, the company now expects per-share earnings of $11.40

to $11.70 and sales to grow 1.5% to 2.5%. It had previously guided

for earnings of $11.20 to $12.20 on 1% to 4% sales growth.

In the quarter ended Sept. 30, organic sales, which exclude

foreign-exchange fluctuations and acquisitions, were flat, as a 1

percentage point reduction in price weighed on a 1 percentage point

volume lift from seasonal products.

Sales in its U.S. segment, which account for more than

three-quarters of total sales, slipped 0.6% to $2.03 billion,

dragged by lower pricing and volume, despite strong sales to

government and retail customers.

Canadian sales tumbled 16% to $179.3 million, also hurt by

volume and price decreases. The company's 2015 acquisition of

England's Cromwell Group drove a 36% surge in sales in its other

business segment.

In all for the period, Grainger reported a profit of $185.9

million, or $3.05 a share, versus $192.2 million, or $2.92 a share,

a year earlier.

Excluding charges related to restructuring in the U.S. and

Canada, among other items, earnings grew to $3.06 a share from

$3.03 a share a year before. Analysts polled by Thomson Reuters

were looking for an adjusted $2.99 a share. Revenue improved 2.5%

to $2.6 billion, edging in above analyst expectations for $2.59

billion.

The company's gross margin declined to 40% from 41.9% a year

ago, mostly owing to unfavorable customer mix and price deflation

exceeding product cost deflation. Operating expenses were 1% lower

thanks to lower payroll and benefits costs.

Grainger shares, inactive premarket, have risen 5.9% so far this

year.

Write to Anne Steele at anne.steele@wsj.com

(END) Dow Jones Newswires

October 18, 2016 08:54 ET (12:54 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

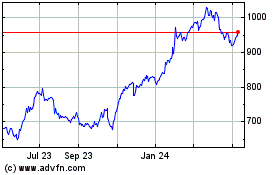

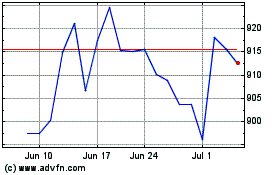

WW Grainger (NYSE:GWW)

Historical Stock Chart

From Aug 2024 to Sep 2024

WW Grainger (NYSE:GWW)

Historical Stock Chart

From Sep 2023 to Sep 2024