CEOs See U.S. Economy Stuck in Slow-Growth Mode

September 12 2016 - 8:50PM

Dow Jones News

Chief executives see the U.S. economy stuck in slow-growth mode

and appear to have little optimism that November's election will

spark stronger gains.

The Business Roundtable's quarterly survey of CEOs, released

Monday, shows the economic outlook among leaders of America's

largest businesses is little changed from a year ago. The election

is one reason businesses are reluctant to increase capital

investment or hire at a stronger pace, said Doug Oberhelman, CEO of

Caterpillar Inc. and the group's chairman.

"At this time of every election cycle, especially after a

two-term president, there is a degree of uncertainty," he said.

Regardless of whether Democratic nominee Hillary Clinton or her

Republican rival Donald Trump wins, Mr. Oberhelman said, the

business advocacy group's agenda for 2017 won't change: expanding

free-trade agreements, lowering business taxes and reducing

regulation.

But neither candidate support the Trans-Pacific Partnership

trade deal, a top priority for the group. Roundtable president John

Engler said the group is pushing for Congress to vote on it before

President Barack Obama leaves office.

"Public support for TPP has come up," Mr. Engler said. That's

"remarkable given the unprecedented opposition from the two major

presidential candidates."

CEOs see the economy gathering little momentum in the second

half, according to the group's third-quarter survey.

The business leaders expect a slight deceleration in hiring,

with 27% saying their firms plan to add to U.S. payrolls in the

next six months, compared with 29% in the second-quarter survey.

The share planning to reduce employment increased by a percentage

point, to 36%.

CEOs' outlook on business investment was virtually unchanged

from the second quarter, with 38% expecting to increase business

spending in the next six months. The sales outlook was slightly

weaker, but still a majority expect increased sales in the next two

quarters.

"This reflects the unfortunate new normal," Mr. Oberhelman said.

"The U.S. economy is pretty much stuck in neutral."

The executives expect the economy to grow 2.2% for all of 2016,

up from a 2.1% annual gain forecast in the prior survey. Given that

the economy has grown at near a 1% annual rate through the first

half of the year, that would amount to a modest acceleration in the

second half. But 2.2% growth is just in line with the average gain

during the seven-year-old expansion.

The third-quarter survey was conducted between Aug. 3 and Aug.

24. Responses were received from 144 CEOs.

Write to Eric Morath at eric.morath@wsj.com

(END) Dow Jones Newswires

September 12, 2016 20:35 ET (00:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

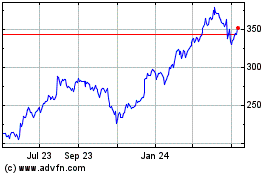

Caterpillar (NYSE:CAT)

Historical Stock Chart

From Mar 2024 to Apr 2024

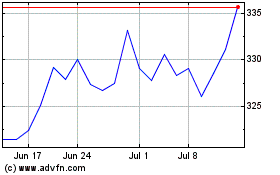

Caterpillar (NYSE:CAT)

Historical Stock Chart

From Apr 2023 to Apr 2024