Sysco Posts Increased Volume, Revenue and Profit

August 15 2016 - 9:30AM

Dow Jones News

Sysco Corp. said profit, revenue and volumes all rose in its

latest quarter.

Results easily beat expectations, and shares rose 4.4% to $54.50

in premarket trading.

In its fourth quarter, Sysco's domestic case volume grew 10.2%

as sales volume rose 10.3% among smaller, local restaurants. It has

faced competition recently from smaller, specialty distributors and

wholesale stores.

Sysco is one of the largest food and supplies distributors and

serves restaurants, hospitals and schools in the U.S.

In all for the quarter, Sysco earned $215.7 million, or 38 cents

a share, up from $73 million, or 12 cents a share, a year

prior.

Excluding restructuring costs and other items, adjusted earnings

rose to 64 cents a share from 52 cents. The number of shares

outstanding fell 5.2% in the quarter, boosting per-share

earnings.

Revenue rose 10% to $13.7 billion.

Analysts had projected 61 cents in adjusted earnings per share

on $13.68 billion in revenue, according to Thomson Reuters.

Gross margin improved to 18.34% from 17.90%.

Food deflation was 1.2% with deflation in meat and dairy being

partially offset by inflation in other categories.

Write to Austen Hufford at austen.hufford@wsj.com

(END) Dow Jones Newswires

August 15, 2016 09:15 ET (13:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

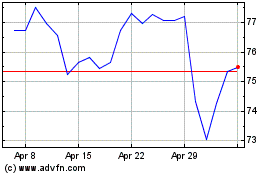

Sysco (NYSE:SYY)

Historical Stock Chart

From Mar 2024 to Apr 2024

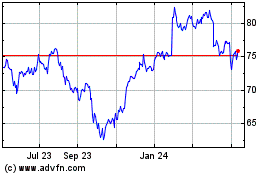

Sysco (NYSE:SYY)

Historical Stock Chart

From Apr 2023 to Apr 2024