Devon Energy Corp. (NYSE: DVN) today reported operational and

financial results for the second quarter of 2016 and provided

guidance for the third quarter and full-year 2016.

Highlights

- Exceeded production expectations in

U.S. resource plays

- Raised 2016 production guidance for

retained assets by 3 percent

- Reduced lease operating expenses 26

percent year over year

- Improved operating and G&A expense

outlook

- Completed asset divestiture program

with proceeds totaling $3.2 billion

- Increased E&P capital investment by

$200 million in 2016

“Devon Energy’s strategy of operating in North America’s best

resource plays, coupled with a focus on delivering best-in-class

execution, led to another quarter of excellent operational

results,” said Dave Hager, president and CEO. “Production from our

U.S. resource plays once again exceeded guidance expectations and

we were able to deliver this outperformance with dramatically lower

costs. With the cost savings achieved year to date, we are now on

pace to reduce operating and G&A expenses by nearly $1 billion

in 2016.

“In addition to our strong operating performance, we were able

to significantly improve our financial strength over the past

several months with the timely completion of our non-core asset

divestiture program,” Hager said. “Total divestitures reached $3.2

billion and surpassed the top end of our $2 billion to $3 billion

guidance range. The majority of the sales proceeds will be utilized

to reduce debt and position us to further accelerate investment in

our best-in-class U.S. resource plays, led by the STACK and

Delaware Basin.”

Production Exceeds Expectations in U.S. Resource

Plays

Devon’s reported net production averaged 644,000 oil-equivalent

barrels (Boe) per day during the second quarter of 2016. Of this

amount, 545,000 Boe per day was attributable to the Company’s core

assets, where investment will be directed going forward. Production

from core assets exceeded the mid-point of guidance by 6,000 Boe

per day, driven entirely by Devon’s U.S. resource plays.

Within the Company’s U.S. resource plays, production averaged

419,000 Boe per day. This performance was highlighted by strong

results from the STACK and Delaware Basin where aggregate

production increased 27 percent year over year. Light-oil

production from U.S. resource plays, which is Devon’s highest

margin product, averaged 110,000 barrels per day. This result

exceeded the top end of guidance by 2,000 barrels per day.

In Canada, net oil production from Devon’s heavy-oil projects

averaged 121,000 barrels per day in the second quarter. Driven by

the industry-leading performance of the Jackfish 3 facility,

Canadian oil production increased 24 percent compared to the second

quarter of 2015. Scheduled maintenance at the Company’s Jackfish 2

facility curtailed production by 11,000 barrels per day in the

quarter.

Retained Midland Assets Enhance 2016 Production

Outlook

With the earlier than expected completion of Devon’s asset

divestiture program, the Company is updating its third quarter and

full-year 2016 production expectations for its retained, go-forward

asset base. The most significant change to previous guidance is

Devon’s decision to retain select assets in the Midland Basin that

were previously categorized as non-core. These legacy Midland Basin

assets have extremely low declines and are expected to produce

approximately 15,000 Boe per day in the second half of 2016.

Due to the retention of Midland assets and other minor operating

interests, Devon is raising the mid-point of its 2016 production

guidance from its retained, go-forward asset base by 18,000 Boe per

day, or 3 percent. The largest portion of this production raise is

attributable to oil, where 2016 mid-point guidance increased by 4

percent or 10,000 barrels per day.

Lease Operating Expenses Decline 26 Percent; Additional

Savings Expected

The Company has several cost-reduction initiatives underway that

positively impacted second-quarter results. The most significant

operating cost savings came from lease operating expenses (LOE),

which is Devon’s largest field-level cost. LOE declined 26 percent

compared to the second quarter of 2015 to $416 million, and was 5

percent below the low end of guidance. The decrease in LOE was

primarily driven by improved power and water-handling

infrastructure, declining labor expense and lower supply chain

costs.

Due to the operating cost performance achieved year to date and

the impact of recently announced asset divestitures, the Company is

lowering its full-year 2016 LOE outlook by $150 million to a range

of $1.6 billion to $1.7 billion. With this improved outlook, Devon

is now on track to reduce LOE and production taxes by nearly $600

million compared to 2015.

G&A Cost Savings Initiatives Ahead of Schedule

Devon also realized substantial general and administrative

(G&A) cost savings in the second quarter. G&A expenses

totaled $147 million, a 30 percent improvement compared to the

second quarter of 2015. The significantly lower overhead costs were

driven by reduced personnel expenses.

The Company now anticipates G&A expenses to decline to a

range of $600 million to $650 million for the full-year 2016.

Combined with reductions in capitalized G&A, Devon projects its

total overhead costs to decline by approximately $400 million

compared to 2015.

Accelerating Upstream Investment Activity

Devon continued to effectively control capital costs during the

second quarter. Devon’s accrued upstream capital spending, which

accounts for activity that was incurred during the reporting

period, amounted to $221 million in the quarter. This result was

$29 million below the low end of the Company’s guidance range.

As previously announced in June, Devon expects its full-year

2016 upstream capital program to range between $1.1 billion and

$1.3 billion, an increase of $200 million from previous guidance.

The incremental capital will be deployed in the STACK and Delaware

Basin, with the potential to add as many as 7 operated rigs between

these prolific plays in the second half of 2016. The additional

capital investment is expected to deliver incremental production in

early 2017.

Second-Quarter 2016 Operations Report

For additional details on Devon’s E&P operations, please

refer to the Company’s second-quarter 2016 operations report at

www.devonenergy.com. Highlights from the report include:

- Record-setting Meramec oil well brought

online

- Successful spacing tests in STACK

- Bone Spring development wells

outperform type curve

- Another high-rate well in the Leonard

Shale

- Significant free cash flow generation

in Eagle Ford

- Jackfish complex production exceeds

nameplate capacity by 9 percent

Divestiture Program Complete and Exceeds Expectations

In the second quarter of 2016, Devon announced multiple

agreements to monetize $2 billion of non-core upstream assets in

the U.S. Several of these transactions have closed and the Company

expects the remaining transactions to close in the third quarter.

The Company expects to incur minimal cash taxes associated with

these divestitures.

Subsequent to quarter end, the Company announced an agreement to

sell its 50 percent interest in the Access Pipeline for CAD $1.4

billion, or USD $1.1 billion. This transaction is expected to close

in the third quarter of 2016. With the announced sale of Access

Pipeline, Devon’s divestiture program is now complete reaching $3.2

billion, exceeding the top end of the Company’s $2 billion to $3

billion guidance range. At least two-thirds of the sales proceeds

are expected to be utilized for debt reduction, while the remaining

amount will be reinvested in the Company’s U.S. resource plays.

Significant Liquidity and Financial Strength

Devon exited the second quarter with $1.7 billion of cash on

hand. Pro-forma for the recent asset sales, cash balances will

increase to $4.6 billion and the Company had no borrowings on its

$3 billion senior credit facility.

The Company’s consolidated debt was $12.7 billion at the end of

the second quarter. Adjusted for asset sales, Devon’s net debt,

which excludes non-recourse EnLink obligations, declines to $4.7

billion. The Company’s ownership in EnLink is valued at greater

than $3 billion and is expected to generate cash distributions of

$270 million in 2016.

Cash Inflow Exceeds $800 Million

In the second quarter of 2016 Devon had a reported net loss of

$1.6 billion, or $3.04 per share. Adjusting for items that

securities analysts typically exclude from their published

estimates, Devon’s core earnings totaled $33 million, or $0.06 per

share.

Adjusted earnings before interest, taxes, depreciation and

amortization (EBITDA) reached $649 million in the second quarter of

2016. The closing of the Company’s non-core Mississippian assets

added approximately $200 million of additional cash flow in the

second quarter of 2016, bringing cash inflows to more than $800

million.

Non-GAAP Reconciliations

Pursuant to regulatory disclosure requirements, Devon is

required to reconcile non-GAAP (generally accepted accounting

principles) financial measures to the related GAAP information. Net

debt, adjusted net debt, core earnings, core earnings per share and

adjusted EBITDA referenced within the commentary of this release

are non-GAAP financial measures. Reconciliations of these non-GAAP

measures are provided within the tables of this release.

Conference Call Webcast and Supplemental Earnings

Materials

Please note that as soon as practicable today, Devon will post

an operations report to its website at www.devonenergy.com. The

Company’s second-quarter conference call will be held at 10 a.m.

Central (11 a.m. Eastern) on Wednesday, Aug. 3, 2016, and will

serve primarily as a forum for analyst and investor questions and

answers.

Forward-Looking Statements

This press release includes "forward-looking statements" as

defined by the Securities and Exchange Commission (SEC). Such

statements include those concerning strategic plans, expectations

and objectives for future operations, and are often identified by

use of the words “expects,” “believes,” “will,” “would,” “could,”

“forecasts,” “projections,” “estimates,” “plans,” “expectations,”

“targets,” “opportunities,” “potential,” “anticipates,” “outlook”

and other similar terminology. All statements, other than

statements of historical facts, included in this press release that

address activities, events or developments that the Company

expects, believes or anticipates will or may occur in the future

are forward-looking statements. Such statements are subject to a

number of assumptions, risks and uncertainties, many of which are

beyond the control of the Company. Statements regarding our

business and operations are subject to all of the risks and

uncertainties normally incident to the exploration for and

development and production of oil and gas. These risks include, but

are not limited to: the volatility of oil, gas and NGL prices,

including the currently depressed commodity price environment;

uncertainties inherent in estimating oil, gas and NGL reserves; the

extent to which we are successful in acquiring and discovering

additional reserves; the uncertainties, costs and risks involved in

exploration and development activities; risks related to our

hedging activities; counterparty credit risks; regulatory

restrictions, compliance costs and other risks relating to

governmental regulation, including with respect to environmental

matters; risks relating to our indebtedness; our ability to

successfully complete mergers, acquisitions and divestitures; the

extent to which insurance covers any losses we may experience; our

limited control over third parties who operate our oil and gas

properties; midstream capacity constraints and potential

interruptions in production; competition for leases, materials,

people and capital; cyberattacks targeting our systems and

infrastructure; and any of the other risks and uncertainties

identified in our Form 10-K and our other filings with the SEC.

Investors are cautioned that any such statements are not guarantees

of future performance and that actual results or developments may

differ materially from those projected in the forward-looking

statements. The forward-looking statements in this press release

are made as of the date of this press release, even if subsequently

made available by Devon on its website or otherwise. Devon does not

undertake any obligation to update the forward-looking statements

as a result of new information, future events or otherwise.

The SEC permits oil and gas companies, in their filings with the

SEC, to disclose only proved, probable and possible reserves that

meet the SEC's definitions for such terms, and price and cost

sensitivities for such reserves, and prohibits disclosure of

resources that do not constitute such reserves. This release

may contain certain terms, such as resource potential

and exploration target size. These estimates are by their

nature more speculative than estimates of proved, probable and

possible reserves and accordingly are subject to substantially

greater risk of being actually realized. The SEC guidelines

strictly prohibit us from including these estimates in filings with

the SEC. Investors are urged to consider closely the disclosure in

our Form 10-K, available at www.devonenergy.com. You can also

obtain this form from the SEC by calling 1-800-SEC-0330 or from the

SEC’s website at www.sec.gov.

About Devon Energy

Devon Energy is a leading independent energy company engaged in

finding and producing oil and natural gas. Based in Oklahoma City

and included in the S&P 500, Devon operates in several of the

most prolific oil and natural gas plays in the U.S. and Canada with

an emphasis on a balanced portfolio. The Company is the

second-largest oil producer among North American onshore

independents. For more information, please visit

www.devonenergy.com.

DEVON ENERGY CORPORATION

FINANCIAL AND OPERATIONAL INFORMATION

Quarter Ended Six Months Ended PRODUCTION NET OF

ROYALTIES June 30, June 30, 2016

2015 2016

2015 Oil and bitumen (MBbls/d) U. S. - Core

110 131 119 129 Heavy Oil 121 98 124 101 Core assets 231 229 243

230 Other 28 41 29 41 Total 259 270 272 271

Natural gas liquids

(MBbls/d) U. S. - Core 103 100 105 102 Other 28 34 29 34 Total

131 134 134 136

Gas (MMcf/d) U. S. - Core 1,239 1,288 1,267

1,296 Heavy Oil 28 20 22 24 Core assets 1,267 1,308 1,289 1,320

Other 260 319 265 316 Total 1,527 1,627 1,554 1,636

Oil

equivalent (MBoe/d) U. S. - Core 419 446 436 448 Heavy Oil 126

101 127 105 Core assets 545 547 563 553 Other 99 127 102 126 Total

644 674 665 679

KEY OPERATING STATISTICS BY REGION

Quarter Ended June 30, 2016 Avg. Production Gross

Wells Operated Rigs at (MBoe/d) Drilled

June 30, 2016 STACK 91 24 2 Delaware Basin 65 14 — Eagle

Ford 75 6 — Rockies Oil 21 — — Heavy Oil 126 — — Barnett Shale 167

— —

Core assets 545 44 2

PRODUCTION TREND 2015 2016

Quarter 2 Quarter 3

Quarter 4 Quarter 1

Quarter 2 Oil and bitumen (MBbls/d)

STACK 6 6 7 14 17 Delaware Basin 41 41 42 38 36 Eagle Ford 67 62 60

59 41 Rockies Oil 16 16 16 17 15 Heavy Oil 98 121 121 126 121

Barnett Shale 1 1 1 1 1 Core assets 229 247 247 255 231 Other 41 35

31 30 28 Total 270 282 278 285 259

Natural gas liquids

(MBbls/d) STACK 16 22 23 29 29 Delaware Basin 10 8 11 12 13

Eagle Ford 24 26 27 24 17 Rockies Oil 1 2 1 1 1 Barnett Shale 49 44

46 42 43 Core assets 100 102 108 108 103 Other 34 32 31 29 28 Total

134 134 139 137 131

Gas (MMcf/d) STACK 221 216 235 286 267

Delaware Basin 75 70 82 84 99 Eagle Ford 146 154 151 144 103

Rockies Oil 41 41 38 32 31 Heavy Oil 20 16 24 15 28 Barnett Shale

805 788 768 749 739 Core assets 1,308 1,285 1,298 1,310 1,267 Other

319 301 285 271 260 Total 1,627 1,586 1,583 1,581 1,527

Oil

equivalent (MBoe/d) STACK 59 64 70 91 91 Delaware Basin 64 61

66 63 65 Eagle Ford 114 113 111 107 75 Rockies Oil 24 25 23 23 21

Heavy Oil 101 124 126 129 126 Barnett Shale 185 176 175 168 167

Core assets 547 563 571 581 545 Other 127 117 110 104 99 Total 674

680 681 685 644

BENCHMARK PRICES

(average prices)

Quarter 2 June YTD 2016

2015 2016 2015 Oil ($/Bbl) - West Texas

Intermediate (Cushing) $ 45.54 $ 57.78 $ 39.60 $ 53.33 Natural Gas

($/Mcf) - Henry Hub $ 1.95 $ 2.65 $ 2.02 $ 2.82

REALIZED

PRICES Quarter Ended June 30, 2016 Oil /Bitumen

NGL Gas Total (Per Bbl) (Per

Bbl) (Per Mcf) (Per Boe) United States $ 41.56 $

10.14 $ 1.40 $ 17.68 Canada $ 22.53 N/M

N/M $ 21.85 Realized price without hedges $ 32.64 $ 10.14 $

1.40 $ 18.50 Cash settlements $ (2.57 ) $ (0.25 ) $ 0.24 $ (0.53 )

Realized price, including cash settlements $ 30.07 $ 9.89

$ 1.64 $ 17.97

Quarter Ended June 30,

2015 Oil /Bitumen NGL Gas Total

(Per Bbl) (Per Bbl) (Per Mcf) (Per Boe)

United States $ 52.52 $ 10.31 $ 2.13 $ 24.18 Canada $ 36.49

N/M N/M $ 35.33 Realized price without

hedges $ 46.69 $ 10.31 $ 2.13 $ 25.86 Cash settlements $ 16.08

$ — $ 0.58 $ 7.83 Realized price, including

cash settlements $ 62.77 $ 10.31 $ 2.71 $ 33.69

Six Months Ended June 30, 2016 Oil

/Bitumen NGL Gas Total (Per Bbl)

(Per Bbl) (Per Mcf) (Per Boe) United States $

34.70 $ 8.46 $ 1.47 $ 15.89 Canada $ 15.71 N/M

N/M $ 15.33 Realized price without hedges $ 26.05 $

8.46 $ 1.47 $ 15.78 Cash settlements $ (1.23 ) $ (0.13 ) $ 0.18 $

(0.10 ) Realized price, including cash settlements $ 24.82 $

8.33 $ 1.65 $ 15.68

Six Months Ended June

30, 2015 Oil /Bitumen NGL Gas Total

(Per Bbl) (Per Bbl) (Per Mcf) (Per Boe)

United States $ 47.74 $ 9.85 $ 2.29 $ 22.93 Canada $ 29.51

N/M N/M $ 28.56 Realized price without

hedges $ 40.94 $ 9.85 $ 2.29 $ 23.80 Cash settlements $ 18.59

$ — $ 0.55 $ 8.72 Realized price, including

cash settlements $ 59.53 $ 9.85 $ 2.84 $ 32.52

CONSOLIDATED STATEMENTS OF

EARNINGS (in millions, except per share amounts)

Quarter

Ended Six Months Ended June 30, June 30,

2016 2015 2016 2015 Oil, gas and NGL

sales $ 1,085 $ 1,587 $ 1,910 $ 2,926 Oil, gas and NGL derivatives

(142 ) (282 ) (109 ) 12 Marketing and midstream revenues

1,545 2,088 2,813 3,720

Total operating revenues 2,488 3,393

4,614 6,658 Lease operating

expenses 416 562 860 1,115 Marketing and midstream operating

expenses 1,338 1,863 2,404 3,302 General and administrative

expenses 147 212 341 463 Production and property taxes 75 116 153

224 Depreciation, depletion and amortization 484 814 1,026 1,744

Asset impairments 1,497 4,168 4,532 9,628 Restructuring and

transaction costs 24 — 271 — Other operating items 4

21 24 40 Total operating

expenses 3,985 7,756 9,611

16,516 Operating loss (1,497 ) (4,363 ) (4,997

) (9,858 ) Net financing costs 163 125 327 242 Other nonoperating

items 85 (9 ) 106 3

Loss before income taxes (1,745 ) (4,479 ) (5,430 ) (10,103

) Income tax benefit (182 ) (1,686 ) (399 )

(3,721 ) Net loss (1,563 ) (2,793 ) (5,031 ) (6,382 ) Net

earnings (loss) attributable to noncontrolling interests 7

23 (405 ) 33 Net loss

attributable to Devon $ (1,570 ) $ (2,816 ) $ (4,626 ) $ (6,415 )

Net loss per share attributable to Devon: Basic $ (3.04 ) $ (6.94 )

$ (9.33 ) $ (15.81 ) Diluted $ (3.04 ) $ (6.94 ) $ (9.33 ) $ (15.81

) Weighted average common shares outstanding: Basic 524 411

502 411 Diluted 524 411 502 411

CONSOLIDATED STATEMENTS OF CASH FLOWS (in millions)

Quarter Ended Six Months Ended June 30,

June 30, 2016 2015 2016 2015

Cash flows from operating activities: Net loss $ (1,563 ) $ (2,793

) $ (5,031 ) $ (6,382 ) Adjustments to reconcile net loss to net

cash from operating activities: Depreciation, depletion and

amortization 484 814 1,026 1,744 Asset impairments 1,497 4,168

4,532 9,628 Deferred income tax benefit (179 ) (1,593 ) (386 )

(3,640 ) Derivatives and other financial instruments 223 305 417

(125 ) Cash settlements on derivatives and financial instruments

(44 ) 464 (148 ) 1,183 Other noncash charges 88 41 21 266 Net

change in working capital (153 ) (189 ) 45 26 Change in long-term

other assets (40 ) 18 13 159 Change in long-term other liabilities

22 (134 ) (5 ) (110 ) Net cash

from operating activities 335 1,101

484 2,749 Cash flows from investing

activities: Capital expenditures (489 ) (1,432 ) (1,238 ) (3,149 )

Acquisitions of property, equipment and businesses (11 ) (13 )

(1,638 ) (417 ) Divestitures of property and equipment 191 6 209 8

Other (26 ) (8 ) (27 ) (5 ) Net cash

from investing activities (335 ) (1,447 )

(2,694 ) (3,563 ) Cash flows from financing activities:

Borrowings of long-term debt, net of issuance costs 450 2,094 846

3,051 Repayments of long-term debt (290 ) (1,034 ) (549 ) (1,521 )

Net short-term repayments — (778 ) (626 ) (763 ) Issuance of common

stock — — 1,469 — Sale of subsidiary units — 85 — 654 Issuance of

subsidiary units 49 2 776 4 Dividends paid on common stock (33 )

(98 ) (158 ) (197 ) Distributions to noncontrolling interests (74 )

(65 ) (147 ) (118 ) Other (2 ) 4 (2 )

(8 ) Net cash from financing activities 100

210 1,609 1,102 Effect of

exchange rate changes on cash (12 ) 3 14 (43 ) Net change in cash

and cash equivalents 88 (133 ) (587 ) 245 Cash and cash equivalents

at beginning of period 1,635 1,858

2,310 1,480 Cash and cash equivalents

at end of period $ 1,723 $ 1,725 $ 1,723 $

1,725

CONSOLIDATED BALANCE SHEETS (in millions)

June 30,

December 31, 2016 2015 Current assets: Cash

and cash equivalents $ 1,723 $ 2,310 Accounts receivable 1,167

1,105 Assets held for sale 728 — Other current assets 364

606 Total current assets 3,982

4,021 Property and equipment, at cost: Oil and gas,

based on full cost accounting: Subject to amortization 80,066

78,190 Not subject to amortization 3,798 2,584

Total oil and gas 83,864 80,774 Midstream and other

10,243 10,380 Total property and equipment, at

cost 94,107 91,154 Less accumulated depreciation, depletion and

amortization (77,292 ) (72,086 ) Property and

equipment, net 16,815 19,068 Goodwill

4,159 5,032 Other long-term assets 2,288 1,330

Total assets $ 27,244 $ 29,451 Current

liabilities: Accounts payable $ 545 $ 906 Revenues and royalties

payable 819 763 Short-term debt 350 976 Liabilities held for sale

205 — Other current liabilities 1,010 650

Total current liabilities 2,929 3,295

Long-term debt 12,357 12,056 Asset retirement obligations

1,473 1,370 Other long-term liabilities 1,011 853 Deferred income

taxes 555 888 Stockholders’ equity: Common stock 52 42 Additional

paid-in capital 7,500 4,996 Retained earnings (accumulated deficit)

(2,970

)

1,781 Accumulated other comprehensive earnings 265

230 Total stockholders’ equity attributable to Devon

4,847 7,049 Noncontrolling interests 4,072

3,940 Total stockholders’ equity 8,919

10,989 Total liabilities and stockholders’ equity $ 27,244

$ 29,451 Common shares outstanding 524 418

CONSOLIDATING STATEMENTS OF OPERATIONS

(in millions)

Quarter Ended June 30, 2016

Devon U.S.& Canada

EnLink Eliminations Total Oil, gas and NGL

sales $ 1,085 $ — $ — $ 1,085 Oil, gas and NGL derivatives (142 ) —

— (142 ) Marketing and midstream revenues 688

1,033 (176 ) 1,545 Total operating

revenues 1,631 1,033 (176 )

2,488 Lease operating expenses 416 — — 416 Marketing

and midstream operating expenses 692 822 (176 ) 1,338 General and

administrative expenses 118 29 — 147 Production and property taxes

64 11 — 75 Depreciation, depletion and amortization 359 125 — 484

Asset impairments 1,497 — — 1,497 Restructuring and transaction

costs 23 1 — 24 Other operating items 4 —

— 4 Total operating expenses

3,173 988 (176 ) 3,985

Operating earnings (loss) (1,542 ) 45 — (1,497 ) Net

financing costs 117 46 — 163 Other nonoperating items 85

— — 85 Loss before

income taxes (1,744 ) (1 ) — (1,745 ) Income tax benefit

(180 ) (2 ) — (182 ) Net earnings

(loss) (1,564 ) 1 — (1,563 ) Net earnings attributable to

noncontrolling interests 1 6 —

7 Net loss attributable to Devon $ (1,565 ) $

(5 ) $ — $ (1,570 )

OTHER KEY

STATISTICS (in millions)

Quarter Ended June 30, 2016

Devon U.S.& Canada

EnLink

Eliminations Total Cash flow

statement related items: Operating cash flow $ 225 $ 110 $ — $

335 Capital expenditures $ (336 ) $ (153 ) $ —

$

(489

)

Acquisitions of property, equipment and businesses $ (17 ) $ 6 $ —

$

(11

)

EnLink distributions received (paid) $ 66 $ (140 ) $ —

$

(74

)

Issuance of subsidiary units $ — $ 49 $ — $ 49

Balance

sheet statement items:

Net debt (1)

$ 7,630 $ 3,354 $ — $ 10,984

(1) Net debt is a non-GAAP measure. For a

reconciliation of the comparable GAAP measure, see "Non-GAAP

Financial Measures" later in this release.

CAPITAL

EXPENDITURES (in millions)

Quarter Ended June 30, 2016

Six Months Ended June 30, 2016 Exploration and development

capital $ 221 $ 584 Capitalized G&A and interest 73 160

Acquisitions 12 1,530 Other 7 13 Devon capital

expenditures (1) $ 313 $ 2,287

(1) Excludes $139 million and $684 million

attributable to EnLink for the second quarter and first six months

of 2016, respectively.

NON-GAAP FINANCIAL MEASURES

This press release includes non-GAAP financial measures. These

non-GAAP measures are not alternatives to GAAP measures, and you

should not consider these non-GAAP measures in isolation or as a

substitute for analysis of our results as reported under GAAP.

Below is additional disclosure regarding each of the non-GAAP

measures used in this press release, including reconciliations to

their most directly comparable GAAP measure.

CORE EARNINGS

Devon’s reported net earnings include items of income and

expense that are typically excluded by securities analysts in their

published estimates of the Company’s financial results.

Accordingly, the Company also uses the measures of core earnings

and core earnings per share attributable to Devon. Devon believes

these non-GAAP measures facilitate comparisons of its performance

to earnings estimates published by securities analysts. Devon also

believes these non-GAAP measures can facilitate comparisons of its

performance between periods and to the performance of its peers.

The following table summarizes the effects of these items on

second-quarter 2016 earnings.

(in millions, except per share amounts)

Quarter Ended June 30, 2016

Before-tax

After-tax

AfterNoncontrollingInterests

Per Share Loss attributable to Devon (GAAP) $ (1,745 ) $

(1,563 ) $ (1,570 ) $ (3.04 ) Adjustments: Fair value changes in

financial instruments and foreign currency 205 134 130 0.25

Restructuring and transaction costs 24 16 16 0.03 Deferred tax

asset valuation allowance — 467 467 0.91 Asset impairments

1,497 990 990 1.91

Core earnings (loss) attributable to Devon (Non-GAAP) $ (19 ) $ 44

$ 33 $ 0.06

ADJUSTED EBITDA

We define Adjusted EBITDA, a non-GAAP financial measure, as

EBITDA adjusted for certain items presented in the accompanying

reconciliation. We believe that EBITDA is widely used by investors

to measure a company’s performance without regard to items such as

interest expense, taxes, depreciation and amortization, which can

vary substantially from company to company depending upon

accounting methods and book value of assets, capital structure and

the method by which assets were acquired. In addition, Adjusted

EBITDA generally excludes certain other items that management

believes affect the comparability of operating results or are not

related to Devon’s ongoing operations. Management uses Adjusted

EBITDA to evaluate the company’s operational trends and performance

relative to other oil and gas companies.

(in millions)

Quarter Ended June 30,

2016 Net loss (GAAP) $ (1,563 ) Net financing costs 163 Income

taxes (182 ) Depreciation, depletion and amortization and

impairments 1,981 Asset retirement obligation accretion 21

EBITDA 420 Restructuring and transaction costs 24 Fair value

changes in financial instruments and foreign currency 205

Adjusted EBITDA (Non-GAAP) $ 649

NET DEBT AND ADJUSTED NET DEBT

Devon defines net debt as debt less cash and cash equivalents

and net debt attributable to the consolidation of EnLink Midstream

as presented in the following table. Adjusted net debt is net debt

further adjusted for the estimated proceeds Devon expects to

receive from the asset divestitures that have closed or will close

in the third quarter of 2016. Devon believes that netting these

sources of cash, including the estimated asset sale proceeds,

against debt and adjusting for EnLink net debt provides a clearer

picture of the future demands on cash from Devon to repay debt.

(in millions)

June 30, 2016 Devon

U.S. & Canada EnLink

Devon Consolidated Total debt (GAAP) $ 9,343 $

3,364 $ 12,707 Less cash and cash equivalents (1,713 )

(10 ) (1,723 ) Net debt (non-GAAP) 7,630 3,354 10,984

Proceeds from assets sales (2,932 ) —

(2,932 ) Adjusted net debt (Non-GAAP) $ 4,698 $ 3,354

$ 8,052

DEVON ENERGY CORPORATION FORWARD LOOKING GUIDANCE

PRODUCTION GUIDANCE Quarter 3 Full

Year Low High Low

High Oil and bitumen

(MBbls/d) U. S. 106 111 117 122 Heavy Oil 131 136 126 131

Retained assets 237 247 243 253 Divested assets 3 7 8 10 Total 240

254 251 263

Natural gas liquids (MBbls/d) U. S. 101 105 105

109 Divested assets 5 10 12 14 Total 106 115 117 123

Gas

(MMcf/d) U. S. 1,200 1,230 1,245 1,275 Heavy Oil 14 18 15 20

Retained assets 1,214 1,248 1,260 1,295 Divested assets 70 80 120

125 Total 1,284 1,328 1,380 1,420

Oil equivalent (MBoe/d) U.

S. 407 421 430 444 Heavy Oil 133 139 128 134 Retained assets 540

560 558 578 Divested assets 20 30 40 45 Total 560 590 598 623

PRICE

REALIZATIONS GUIDANCE Quarter 3 Full Year

Low High Low

High Oil and bitumen - % of WTI U. S.

86 % 96 % 83 % 93 % Canada 47 % 57 % 38 % 48 % NGL - realized price

$ 8 $ 12 $ 8 $ 12 Natural gas - % of Henry Hub 78 % 88 % 73 % 83 %

OTHER GUIDANCE

ITEMS Quarter 3 Full Year ($ millions, except %)

Low High Low

High Marketing & midstream

operating profit $ 200 $ 220 $ 825 $ 875 Lease operating expenses $

380 $ 420 $ 1,600 $ 1,700 General & administrative expenses $

135 $ 155 $ 600 $ 650 Production and property taxes $ 70 $ 80 $ 285

$ 315 Depreciation, depletion and amortization $ 425 $ 475 $ 1,900

$ 2,100 Other operating items $ 15 $ 20 $ 50 $ 75 Net financing

costs (1) $ 160 $ 170 $ 650 $ 700 Current income tax rate 0.0 % 0.0

% 0.0 % 0.0 % Deferred income tax rate 35.0 % 45.0 %

35.0 % 45.0 % Total income tax rate 35.0 %

45.0 % 35.0 % 45.0 % Net earnings

attributable to noncontrolling interests $ — $ — $ — $ — (1) Full

year 2016 includes $50 million of non-cash accretion on EnLink’s

installment purchase obligations.

CAPITAL EXPENDITURES GUIDANCE

Quarter 3 Full Year (in millions)

Low

High Low

High Exploration and development $ 275 $ 325 $ 1,100

$ 1,300 Capitalized G&A 50 60 200 250 Capitalized interest 10

20 40 50 Other 5 15 30 45 Devon capital

expenditures (2) $ 340 $ 420 $ 1,370 $ 1,645 (2) Excludes capital

expenditures related to EnLink.

COMMODITY

HEDGES

Oil Commodity Hedges Price

Swaps Price Collars Call Options Sold Period

Volume(Bbls/d)

WeightedAveragePrice($/Bbl)

Volume(Bbls/d)

WeightedAverageFloor Price($/Bbl)

WeightedAverageCeiling Price($/Bbl)

Volume(Bbls/d)

WeightedAverage Price($/Bbl)

Q3-2016 33,000 $ 48.37 65,000 $ 40.37 $ 46.91 18,500 $ 55.00

Q4-2016 30,000 $ 48.58 20,000 $ 40.85 $ 50.85 18,500 $ 55.00 Q1-Q4

2017 6,470 $ 51.24 10,115 $ 46.44 $ 56.44 - -

Oil Basis Swaps

Period Index Volume (Bbls/d)

Weighted Average Differential toWTI

($/Bbl)

Q3-2016 Western Canadian Select 50,000 (13.45 ) Q4-2016 Western

Canadian Select 33,000 (13.40 )

Natural Gas

Commodity Hedges Price Swaps

Price Collars Call Options Sold

Period

Volume(MMBtu/d)

WeightedAverage Price($/MMBtu)

Volume(MMBtu/d)

WeightedAverage FloorPrice($/MMBtu)

WeightedAverageCeiling Price($/MMBtu)

Volume(MMBtu/d)

WeightedAverage Price($/MMBtu)

Q3-2016 140,000 $ 2.78 105,000 $ 2.57 $ 2.85 400,000 $ 2.80 Q4-2016

155,000 $ 2.83 305,000 $ 2.71 $ 2.92 400,000 $ 2.80 Q1-Q4 2017

99,329 $ 3.03 62,315 $ 3.01 $ 3.31 - -

Devon’s oil derivatives settle against the average of the prompt

month NYMEX West Texas Intermediate futures price. Devon’s natural

gas derivatives settle against the Inside FERC first of the month

Henry Hub index. Commodity hedge positions are shown as of July 27,

2016.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160802006880/en/

Devon Energy CorporationInvestor ContactsHoward Thill,

405-552-3693Scott Coody, 405-552-4735Chris Carr,

405-228-2496Media ContactJohn Porretto, 405-228-7506

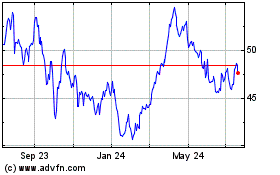

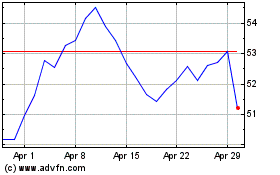

Devon Energy (NYSE:DVN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Devon Energy (NYSE:DVN)

Historical Stock Chart

From Apr 2023 to Apr 2024