By Erin Ailworth

Some of America's biggest shale producers are beginning to

ratchet back oil and gas production for the first time in years,

bending to the reality that a global glut will keep prices

depressed.

The production cuts, announced as shale companies reported

dismal earnings in recent days, stand in stark contrast to the past

year, when many U.S. drillers kept the taps turned on even as oil

prices plunged from nearly $100 a barrel to about $30. American oil

satisfies 10% of the world's daily needs, putting U.S. production

on par with output from Russia and Saudi Arabia.

The Organization of the Petroleum Exporting Countries continues

to at pump full tilt, further pressuring higher-cost operators such

as U.S. shale producers. Last week, Saudi Arabia oil minister Ali

al-Naimi bluntly told a roomful of energy executives in Houston

that the supply problem will only be resolved when low prices force

companies to stop producing the oil that is most expensive to

extract and sell.

So after years of boosting oil and gas flows across Oklahoma,

Texas and North Dakota, Continental Resources Inc., Devon Energy

Corp. and Marathon Oil Corp. say they plan to pull roughly 10% less

from the ground in 2016 than they did last year. EOG Resources Inc.

joined the chorus Friday, telling investors it has curbed

production and expects to pump 5% less oil this year.

One hurdle to throttling back production in the U.S. is that

shale drillers have become more efficient, tapping wells faster,

for less money, and coaxing more fuel out of each one. But other

companies have been forced to keep pumping just to bring in cash so

they could make interest payments on their heavy debt loads, or to

satisfy lease obligations.

EOG, which lost money last year for the first time, is

considered by many analysts to be the most efficient shale operator

in the U.S. Chief Executive Bill Thomas said the company would only

pump wells that give it a high rate of return--at least 30%--when

U.S. crude sells for $40 a barrel.

One way companies are trying to put a lid on production this

year is by waiting to pump wells they have already drilled. That

trend is creating a large inventory of oil and gas wells that will

be ready to turn on when crude prices finally do rebound.

Both Continental and rival Whiting Petroleum Corp. say they

won't pump much crude from new wells in North Dakota's Bakken Shale

this year. Continental still plans to drill a few new prospects,

but won't start pumping oil from many of them this year. It expects

to have a backlog of 195 drilled-but-uncompleted wells in North

Dakota this year. Similarly, Whiting said it would have 73 such

wells by year-end.

"We just don't want to bring anything else on in this

environment until we see a recovery happen," Continental Chief

Executive Harold Hamm told analysts and investors on a call last

week.

Once the biggest oil producer in North Dakota, Whiting lost $2.2

billion in 2015, mostly because it had to partially write down the

value of a field in Texas. The company, which brought in $2 billion

in revenue last year, is cutting its 2016 budget by 80%.

More than three dozen energy companies have collectively gutted

their budgets by nearly 50% on average in recent weeks, dialing

back spending for the year by roughly $36 billion when compared

with 2015.

"They're being forced to cut," said David Tameron, an energy

analyst at Wells Fargo Securities. "When you cut spending,

naturally production goes down."

IHS, the consulting firm that held the energy gathering in

Houston last week, is forecasting that U.S. oil output could fall

from more than 9 million barrels a day to as little as 8.3 million

barrels a day by this summer.

If that drop does materialize, it could boost crude prices back

to the $40-a-barrel range, according to IHS.

One risk, though, is that as prices move higher, some producers

may be tempted to turn on the spigot once again, a move that could

in turn drive prices back down.

That happened last spring when prices popped back to $60 a

barrel, spurring producers to race back into oil fields and tap new

wells.

If that happens, prices could collapse even below current

levels, said Jamie Webster, senior director of oil markets for

IHS.

"It wouldn't surprise me if it were single digits," Mr. Webster

said of the potential for oil prices to fall below $10 a barrel if

U.S. producers decide to drill more.

Some companies, particularly those that have hedged against

falling prices, are bucking the trend. Pioneer Natural Resources

Co., which drills in West Texas, still plans to boost production at

least 10% this year thanks in part to hedging contracts that give

it above-market prices for much of the crude it pumps.

"We have good hedges, we have a great balance sheet, and still

good returns," said Scott Sheffield, Pioneer's chief executive.

Jim Teague, who runs Enterprise Products Partners LP, one of the

biggest pipeline companies in the U.S., said he can't predict how

long the pain in the oil patch will last.

"I don't have a clue how low crude oil is going to go, how long

it's going to stay there, or what normal's going to look like" when

things finally stabilize, he said. "People keep calling it a cycle.

I call it pure hell."

--Alison Sider and Dan Molinski contributed to this article.

Write to Erin Ailworth at Erin.Ailworth@wsj.com

(END) Dow Jones Newswires

February 29, 2016 20:33 ET (01:33 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

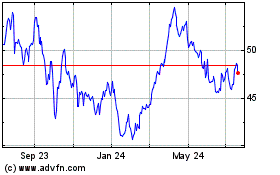

Devon Energy (NYSE:DVN)

Historical Stock Chart

From Mar 2024 to Apr 2024

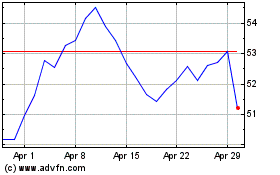

Devon Energy (NYSE:DVN)

Historical Stock Chart

From Apr 2023 to Apr 2024