Cummins Profit Falls on Weak Demand and Commodities Prices -- Update

February 04 2016 - 4:04PM

Dow Jones News

By Bob Tita

Cummins Inc. said its fourth-quarter profit plunged 64%,

becoming the latest U.S. equipment manufacturer pulled down by a

sliding demand for trucks in North America, anemic commodity prices

and slower growth in developing overseas markets.

Cummins, which supplies diesel engines for commercial trucks,

construction and mining machinery and power generators, widened its

forecasted decline for 2016 revenue to down 5% to 9% from 2015

after projecting a 5% decrease in October. Caterpillar Inc., Eaton

Corp., Meritor Inc. and other companies facing the commercial truck

and off-road machinery markets expect lower 2016 sales as well.

"Due to weak or slowing demand in many our major markets, 2016

will be another challenging year," Chairman and Chief Executive Tom

Linebarger said during a conference call Thursday. "The market

circumstances are everything we expected."

Cummins' latest outlook implies 2016 revenue of $17.3 billion to

$18 billion with earnings per share of about $7.90, according to

analysts. Cummins' revenue for 2015 was about flat with 2014 at

$19.1 billion. Profit for the year declined 15% to $1.4 billion, or

$7.84 a share.

Cummins stock was recently trading up 7.3% at $97.29 a share as

part of a broad advance by industrial stocks Thursday.

Fourth-quarter profit was lower than expected, reflecting

deteriorating demand for Cummins' commercial trucks in North

America. Truck buyers dialed back purchases late in the year as

U.S. industrial activity weakened. Cummins, the leading supplier of

engines for heavy-duty commercial trucks, said fourth-quarter sales

of heavy-duty truck engines fell 11% from a year earlier to $700

million.

A flurry of truck orders early in 2015 pushed North American

truck sales to their highest level since 2006. With most trucking

fleets already well-stocked with new equipment, Columbus,

Ind.-based Cummins, expects industrywide production of heavy-duty

trucks to fall 25% this year. The decline is in line with forecasts

offered this week by truck transmission maker Eaton Corp. and truck

axle manufacturer Meritor Inc.

Cummins expects revenue from heavy-duty truck engines to fall

20% this year from 2015 because of declining truck volumes in North

America. Cummins recorded a fourth-quarter impairment charge of

$211 million to account for the diminished value of its light-duty

truck engine business. Cummins, which supplies diesel engines for

Ram and Nissan pickup trucks, expanded production capacity for V-8

engines in the U.S. in anticipation of additional customers.

"In light of the current economic situations [that is] is less

likely in the short-term," said Rich Freeland, chief operating

officer. "The line remains intact. We're not actually getting rid

of any assets. We'll continue to look for more customers. We'll add

some non-pickup truck customers in 2016."

Cummins is facing tough business conditions in once-highflying

engine markets in China and Brazil. The company said revenue from

Brazil plunged 48% last year under the weight an economic recession

and low prices for mined commodities that are crimping demand for

high-horsepower Cummins engines used in trucks, mining equipment

and power generators.

"At some point we will see a return to growth in Brazil, but

that appears unlikely in 2016," Mr. Linebarger said.

Meanwhile in China, Cummins said its 2015 revenue of $3.3

billion was flat with 2014. Mr. Linebarger said the company

increased its engine share in China's truck market, but sales of

trucks and other machinery continue to fall as the country shifts

the focus of its economy to consumer spending and away from

infrastructure construction project and factory expansions.

"Almost all of our markets are declining, even as the economy

grows. That's a reflection of that shift," said Mr. Linebarger,

noting that more efficient use of trucks and machinery is

contributing to lower demand. Cummins expects industrywide sales in

most of its end-markets in China to contract by about 10% this year

with a slightly a lower decline expected for commercial trucks.

Overall for the fourth quarter, Cummins reported a profit of

$161 million, or 92 cents a share, down from $444 million, or $2.44

a share, a year earlier. Excluding one-time items, per-share

earnings fell to $2.02 from $2.56 a year ago. Revenue declined 6%

to $4.77 billion. Analysts expected $2.11 in per-share earnings and

$4.68 billion in revenue.

Write to Bob Tita at robert.tita@wsj.com

(END) Dow Jones Newswires

February 04, 2016 15:49 ET (20:49 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

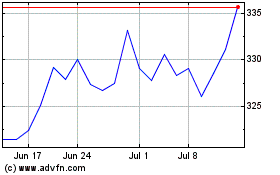

Caterpillar (NYSE:CAT)

Historical Stock Chart

From Mar 2024 to Apr 2024

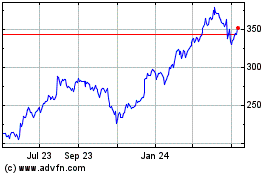

Caterpillar (NYSE:CAT)

Historical Stock Chart

From Apr 2023 to Apr 2024