Nexstar Reaches Deal for Media General Buyout

January 27 2016 - 10:40AM

Dow Jones News

Nexstar Broadcasting Group Inc. on Wednesday said had reached a

deal for its takeover of Media General Inc. for $2.13 billion,

ending a three-way merger standoff with rival deal-seeker Meredith

Corp.

Nexstar will pay $10.55 in cash and 0.1249 of a Nexstar share,

totaling $16.69, for each share of Media General, representing a

3.5% premium over Media General's closing price Tuesday. The deal

represents a 50% premium over the closing share price of Media

General on Sep. 25, the last trading day before Nexstar's public

announcement it was interested in acquiring Media General. The

agreement also includes a so-called contingent value right to

additional money received from the upcoming spectrum auction by the

Federal Communications Commission to buy back airwaves and

repurpose them.

The deal was struck following the termination of the proposed

merger transaction between broadcasters Meredith and Media General,

awarding Meredith a $60 million termination fee. In addition, the

companies said, Meredith will be able to negotiate for the purchase

of certain broadcast and digital assets currently owned by Media

General.

Earlier this month, Nexstar reiterated its commitment to buying

Media General, but didn't raise the stakes even as Meredith refused

to terminate its agreement with Media General. Any deal between

Nexstar and Media General was contingent on Meredith pulling out of

its negotiations with Media General.

Shares of Media General rose 3% premarket to $16.61, while share

of Nexstar and Meredith remained inactive.

Write to Anne Steele at Anne.Steele@wsj.com

(END) Dow Jones Newswires

January 27, 2016 10:25 ET (15:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

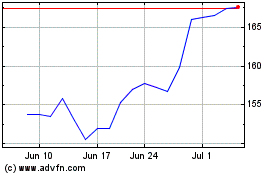

Nexstar Media (NASDAQ:NXST)

Historical Stock Chart

From Mar 2024 to Apr 2024

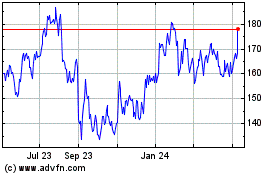

Nexstar Media (NASDAQ:NXST)

Historical Stock Chart

From Apr 2023 to Apr 2024