UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

|

| |

Date of Report (Date of earliest event reported): | January 19, 2016 |

Fulton Financial Corporation

(Exact name of Registrant as specified in its Charter)

|

| | |

Pennsylvania | 0-10587 | 23-2195389 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification Number) |

One Penn Square Lancaster, Pennsylvania | | 17604 |

(Address of principal executive offices) | | (Zip Code) |

Registrant's telephone number, including area code: 717-291-2411

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

£ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

£ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

£ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

£ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02 - Results of Operations and Financial Condition

On January 19, 2016, Fulton Financial Corporation (“Fulton”) issued a press release (the “Press Release”) announcing its results of operations for the fourth quarter and year ended December 31, 2015. A copy of the Press Release and supplementary financial information which accompanied the Press Release, are attached as Exhibits 99.1 and 99.2, respectively, to this Current Report and are incorporated herein by reference. Fulton also posted on its Investor Relations website, www.fult.com, presentation materials Fulton intends to use during a conference call and webcast to discuss those results on Wednesday, January 20, 2016 at 9:00 a.m. Eastern Time. A copy of the presentation materials is attached as Exhibit 99.3 to this Current Report and is incorporated herein by reference.

Forward-Looking Statements

This Current Report on Form 8-K, including the Exhibits hereto, may contain forward-looking statements with respect to Fulton’s financial condition, results of operations and business. Do not unduly rely on forward-looking statements. Forward-looking statements can be identified by the use of words such as “may,” “should,” “will,” “could,” “estimates,” “predicts,” “potential,” “continue,” “anticipates,” “believes,” “plans,” “expects,” “future,” “intends” and similar expressions which are intended to identify forward-looking statements. Statements relating to the “outlook” or “2016 Outlook” contained in Exhibit 99.3 to this Current Report are forward-looking statements. These forward-looking statements are not guarantees of future performance and are subject to risks and uncertainties, some of which are beyond Fulton’s control and ability to predict, that could cause actual results to differ materially from those expressed in the forward-looking statements.

A discussion of certain risks and uncertainties affecting Fulton, and some of the factors that could cause Fulton’s actual results to differ materially from those described in the forward-looking statements, can be found in the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Fulton’s Annual Report on Form 10-K for the year ended December 31, 2014 and Quarterly Reports on Form 10-Q for the quarters ended March 31, 2015, June 30, 2015 and September 30, 2015, which have been filed with the Securities and Exchange Commission and are available in the Investors Relations section of Fulton’s website (www.fult.com) and on the Securities and Exchange Commission’s website (www.sec.gov). Fulton undertakes no obligation, other than as required by law, to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Item 9.01 Financial Statements And Exhibits

(d) Exhibits.

|

| |

Exhibit No. | Description |

99.1 | Press Release dated January 19, 2016. |

99.2 | Supplemental financial information for the quarter and year ended December 31, 2015. |

99.3 | Presentation materials to be discussed during the conference call and webcast on January 20, 2016. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| |

Date: January 19, 2016 | FULTON FINANCIAL CORPORATION

|

| By: /s/ Patrick S. Barrett |

| Patrick S. Barrett

|

| Senior Executive Vice President and

|

| Chief Financial Officer |

Exhibit 99.1

FULTON FINANCIAL

CORPORATION

FOR IMMEDIATE RELEASE

Media Contact: Laura J. Wakeley (717) 291-2616

Investor Contact: Jason Weber (717) 327-2394

Fulton Financial reports 2015 earnings

| |

• | Diluted earnings per share for the fourth quarter of 2015 was 22 cents, compared to 20 cents in the third quarter of 2015 and 21 cents in the fourth quarter of 2014. For the year ended December 31, 2015, diluted earnings per share was 85 cents, a 1.2 percent increase from 84 cents in 2014. |

| |

• | Net interest income for the fourth quarter of 2015 increased $2.1 million, or 1.7 percent, |

compared to the third quarter of 2015, while the net interest margin increased one basis point to 3.19 percent. For the year ended December 31, 2015, net interest income decreased $14.9 million, or 2.9 percent, compared to 2014, while the net interest margin decreased 18 basis points to 3.21 percent.

| |

• | Loans at December 31, 2015 increased $302.2 million, or 2.2 percent, compared to September 30, 2015 and $726.9 million, or 5.5 percent, compared to December 31, 2014. Average loans for the fourth quarter of 2015 increased 2.2 percent and 4.6 percent, compared to the third quarter of 2015 and the fourth quarter of 2014, respectively. For the year ended December 31, 2015, average loans increased $445.8 million, or 3.5 percent, compared to 2014. |

| |

• | Deposits at December 31, 2015 increased $47.9 million, or 0.3 percent, compared to |

September 30, 2015 and $764.8 million, or 5.7 percent, compared to the December 31, 2014. Average deposits for the fourth quarter of 2015 increased 2.3 percent and 6.6 percent, compared to the third quarter of 2015 and the fourth quarter of 2014, respectively. For the year ended December 31, 2015, average deposits increased $879.5 million, or 6.8 percent, compared to 2014.

| |

• | The provision for credit losses in the fourth quarter of 2015 was $2.8 million, compared to a $1.0 million provision in the third quarter of 2015 and a $3.0 million provision in the fourth quarter of 2014. For the year ended December 31, 2015, the provision for credit losses was $2.3 million, a decrease of $10.3 million from 2014. |

| |

• | Non-interest income, excluding investment securities gains, increased $2.0 million, or 4.7 percent, in comparison to the third quarter of 2015, and increased $3.8 million, or 9.2 percent, |

in comparison to the fourth quarter of 2014. For the year ended December 31, 2015, non-interest income, excluding investment securities gains, increased $7.4 million, or 4.5 percent.

| |

• | Non-interest expense, excluding the loss on redemption of trust preferred securities, decreased $824,000, or 0.7 percent, compared to the third quarter of 2015 and increased $719,000, or 0.6 percent, compared to the fourth quarter of 2014. For the year ended December 31, 2015, non-interest expense, excluding the loss on redemption of trust preferred securities, increased $15.3 million, or 3.3%, compared to 2014. |

(January 19, 2016) - Lancaster, PA - Fulton Financial Corporation NASDAQ:FULT)reported net income of $38.5 million, or 22 cents per diluted share, for the fourth quarter of 2015, and net income of $149.5 million, or 85 cents per diluted share, for 2015.

“We are pleased with the increasing momentum that developed in the latter half of 2015, which enabled us to finish the year with strong commercial loan, core deposit and fee income growth,” said E. Philip Wenger, Chairman, President and CEO. “We believe the investments we are making in our talent and infrastructure, coupled with expectations for a generally improving business environment and changes in the competitive landscape in a number of our markets, position us to drive meaningful growth and generate positive operating leverage in 2016.”

Net Interest Income and Margin

Net interest income for the fourth quarter of 2015 increased $2.1 million, or 1.7 percent, from the third quarter of 2015. Net interest margin increased one basis point, or 0.3 percent, to 3.19 percent in the fourth quarter of 2015, from 3.18 percent in the third quarter of 2015. The average yield on interest-earning assets decreased one basis point, while the average cost of interest-bearing liabilities decreased three basis points during the fourth quarter of 2015 in comparison to the third quarter of 2015.

For the year ended December 31, 2015, net interest income decreased $14.9 million, or 2.9 percent, from 2014. Net interest margin decreased 18 basis points, or 5.3 percent, to 3.21 percent. The average yield on interest-earnings assets decreased 18 basis points, while the average cost of interest-bearing liabilities increased two basis points from 2014.

Average Balance Sheet

Total average assets for the fourth quarter of 2015 were $17.8 billion, an increase of $254.4 million from the third quarter of 2015. Average loans, net of unearned income, increased $289.4 million, or 2.2 percent, in comparison to the third quarter of 2015. Average loans and yields, by type, for the fourth quarter of 2015 in comparison to the third quarter of 2015, are summarized in the following table:

|

| | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Increase (decrease) |

| December 31, 2015 | | September 30, 2015 | | in Balance |

| Balance | | Yield (1) | | Balance | | Yield (1) | | $ | | % |

| (dollars in thousands) |

Average Loans, net of unearned income, by type: | | | | | | | | | | | |

Real estate - commercial mortgage | $ | 5,365,640 |

| | 4.05 | % | | $ | 5,242,021 |

| | 4.09 | % | | $ | 123,619 |

| | 2.4 | % |

Commercial - industrial, financial, and agricultural | 4,035,287 |

| | 3.74 | % | | 3,887,161 |

| | 3.78 | % | | $ | 148,126 |

| | 3.8 | % |

Real estate - home equity | 1,694,455 |

| | 4.07 | % | | 1,692,860 |

| | 4.08 | % | | $ | 1,595 |

| | 0.1 | % |

Real estate - residential mortgage | 1,377,116 |

| | 3.79 | % | | 1,381,141 |

| | 3.78 | % | | $ | (4,025 | ) | | (0.3 | )% |

Real estate - construction | 765,555 |

| | 3.75 | % | | 753,584 |

| | 3.88 | % | | $ | 11,971 |

| | 1.6 | % |

Consumer | 267,726 |

| | 5.72 | % | | 270,391 |

| | 5.81 | % | | $ | (2,665 | ) | | (1.0 | )% |

Leasing and other | 153,487 |

| | 5.31 | % | | 142,716 |

| | 6.79 | % | | $ | 10,771 |

| | 7.5 | % |

Total Average Loans, net of unearned income | $ | 13,659,266 |

| | 3.96 | % | | $ | 13,369,874 |

| | 4.02 | % | | $ | 289,392 |

| | 2.2 | % |

| | | | | | | | | | | |

(1) Presented on a tax-equivalent basis using a 35% Federal tax rate and statutory interest expense disallowances. |

For the year ended December 31, 2015, average loans increased $445.8 million, or 3.5 percent, in comparison to 2014.

Total average liabilities increased $240.5 million, or 1.6 percent, from the third quarter of 2015, including a $319.7 million, or 2.3 percent, increase in average deposits. Average deposits and interest rates, by type, for the fourth quarter of 2015 in comparison to the third quarter of 2015, are summarized in the following table:

|

| | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Increase (decrease) |

| December 31, 2015 | | September 30, 2015 | | in Balance |

| Balance | | Rate | | Balance | | Rate | | $ | | % |

| (dollars in thousands) |

Average Deposits, by type: | | | | | | | | | | | |

Noninterest-bearing demand | $ | 3,999,118 |

| | — | % | | $ | 3,904,176 |

| | — | % | | $ | 94,942 |

| | 2.4 | % |

Interest-bearing demand | 3,411,904 |

| | 0.13 | % | | 3,316,532 |

| | 0.13 | % | | 95,372 |

| | 2.9 | % |

Savings deposits | 3,903,741 |

| | 0.17 | % | | 3,714,282 |

| | 0.15 | % | | 189,459 |

| | 5.1 | % |

Total average demand and savings | 11,314,763 |

| | 0.10 | % | | 10,934,990 |

| | 0.09 | % | | 379,773 |

| | 3.5 | % |

Time deposits | 2,903,715 |

| | 1.03 | % | | 2,963,774 |

| | 1.03 | % | | (60,059 | ) | | (2.0 | )% |

Total Average Deposits | $ | 14,218,478 |

| | 0.29 | % | | $ | 13,898,764 |

| | 0.29 | % | | $ | 319,714 |

| | 2.3 | % |

For the year ended December 31, 2015, average deposits increased $879.5 million, or 6.8 percent, in comparison to 2014.

Asset Quality

Non-performing assets were $155.9 million, or 0.87 percent of total assets, at December 31, 2015, compared to $155.6 million, or 0.87 percent of total assets, at September 30, 2015 and $150.5 million, or 0.88 percent of total assets, at December 31, 2014.

Annualized net charge-offs for the quarter ended December 31, 2015 were 0.02 percent of total average loans, compared to 0.03 percent for the quarter ended September 30, 2015 and 0.25 percent for the quarter ended December 31, 2014. The allowance for credit losses as a percentage of non-performing loans was 118.4 percent at December 31, 2015, as compared to 116.8 percent at September 30, 2015 and 134.3 percent at December 31, 2014.

During the fourth quarter of 2015, the Corporation recorded a $2.8 million provision for credit losses, compared to a $1.0 million provision for credit losses in the third quarter of 2015.

Non-interest Income

Non-interest income, excluding investment securities gains, increased $2.0 million, or 4.7 percent, in comparison to the third quarter of 2015. Other service charges increased $1.7 million, or 15.6 percent, due to increases in commercial loan interest rate swap fees and debit card income. Mortgage banking income increased $453,000, or 11.7 percent, due to higher servicing income.

For the year ended December 31, 2015, non-interest income, excluding investment securities gains, increased $7.4 million, or 4.5 percent, in comparison to 2014. This increase was primarily driven by increases in commercial loan interest rate swap fees, merchant fees, and mortgage banking income.

Gains on sales of investment securities decreased $954,000 in comparison to the third quarter of 2015. For the year ended December 31, 2015, gains on sales of investment securities increased $7.0 million compared to 2014.

Non-interest Expense

Non-interest expense decreased $6.5 million, or 5.2 percent, in the fourth quarter of 2015, compared to the third quarter of 2015. In the third quarter of 2015, the Corporation incurred a $5.6 million loss on the redemption of trust preferred securities. Excluding this loss, non-interest expense decreased $824,000, or 0.7 percent, in the fourth quarter, compared to the third quarter 2015.

For the year ended December 31, 2015, non-interest expense increased $20.9 million, or 4.6 percent, compared to 2014. This increase was primarily due to higher salaries and benefits, data processing and software expenses. Also contributing to the increase was the $5.6 million loss on the redemption of trust preferred securities.

About Fulton Financial

Fulton Financial Corporation is a Lancaster, Pennsylvania-based financial holding company that has banking offices in Pennsylvania, Maryland, Delaware, New Jersey and Virginia through the following affiliates, headquartered as indicated: Fulton Bank, N.A., Lancaster, PA; Swineford National Bank, Middleburg, PA; Lafayette Ambassador Bank, Bethlehem, PA; FNB Bank, N.A., Danville, PA; Fulton Bank of New Jersey, Mt. Laurel, NJ; and The Columbia Bank, Columbia, MD.

The Corporation’s investment management and trust services are offered at all banks through Fulton Financial Advisors, a division of Fulton Bank, N.A. Residential mortgage lending is offered by all banks under the Fulton Mortgage Company brand.

Additional information on Fulton Financial Corporation is available on the Internet at

www.fult.com.

Safe Harbor Statement

This news release may contain forward-looking statements with respect to the

Corporation’s financial condition, results of operations and business. Do not unduly rely on forward-looking statements. Forward-looking statements can be identified by the use of words such as "may," "should," "will," "could," "estimates," "predicts," "potential," "continue," "anticipates," "believes," "plans," "expects," "future," "intends" and similar expressions which are intended to identify forward-looking statements. These forward-looking statements are not guarantees of future performance and are subject to risks and uncertainties, some of which are beyond the Corporation's control and ability to predict, that could cause actual results to differ materially from those expressed in the forward-looking statements.

A discussion of certain risks and uncertainties affecting the Corporation, and some of the factors that could cause the Corporation's actual results to differ materially from those described in the forward-looking statements, can be found in the sections entitled "Risk Factors" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" in the Corporation’s Annual Report on Form 10-K for the year ended December 31, 2014 and Quarterly Reports on Form 10-Q for the quarters ended March 31, 2015, June 30, 2015 and September 30, 2015, which have been filed with the Securities and Exchange Commission and are available in the Investor Relations section of the Corporation's website (www.fult.com) and on the Securities and Exchange Commission's website (www.sec.gov). The Corporation undertakes no obligation, other than as required by law, to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Non-GAAP Financial Measures

The Corporation uses certain non-GAAP financial measures in this earnings release. These non-GAAP financial measures are reconciled to the most comparable GAAP measures in tables at the end of this release.

|

| | | | | | | | | | | | | | | | | | |

Exhibit 99.2 | | |

| | | | | | | | | | |

FULTON FINANCIAL CORPORATION | | |

CONDENSED CONSOLIDATED ENDING BALANCE SHEETS (UNAUDITED) | | |

dollars in thousands | | |

| | | | | | | | % Change from |

| | December 31 | | December 31 | | September 30 | | December 31 | | September |

| | 2015 | | 2014 | | 2015 | | 2014 | | 2015 |

ASSETS | | | | | | | | |

| Cash and due from banks | $ | 101,120 |

| | $ | 105,702 |

| | $ | 93,803 |

| | (4.3 | )% | | 7.8 | % |

| Other interest-earning assets | 292,516 |

| | 423,083 |

| | 579,920 |

| | (30.9 | )% | | (49.6 | )% |

| Loans held for sale | 16,886 |

| | 17,522 |

| | 26,937 |

| | (3.6 | )% | | (37.3 | )% |

| Investment securities | 2,484,773 |

| | 2,323,371 |

| | 2,436,337 |

| | 6.9 | % | | 2.0 | % |

| Loans, net of unearned income | 13,838,602 |

| | 13,111,716 |

| | 13,536,361 |

| | 5.5 | % | | 2.2 | % |

| Allowance for loan losses | (169,054 | ) | | (184,144 | ) | | (167,136 | ) | | (8.2 | )% | | 1.1 | % |

| Net loans | 13,669,548 |

| | 12,927,572 |

| | 13,369,225 |

| | 5.7 | % | | 2.2 | % |

| Premises and equipment | 225,535 |

| | 226,027 |

| | 225,705 |

| | (0.2 | )% | | (0.1 | )% |

| Accrued interest receivable | 42,767 |

| | 41,818 |

| | 42,846 |

| | 2.3 | % | | (0.2 | )% |

| Goodwill and intangible assets | 531,556 |

| | 531,803 |

| | 531,562 |

| | — | % | | — | % |

| Other assets | 550,017 |

| | 527,869 |

| | 531,724 |

| | 4.2 | % | | 3.4 | % |

| Total Assets | $ | 17,914,718 |

| | $ | 17,124,767 |

| | $ | 17,838,059 |

| | 4.6 | % | | 0.4 | % |

LIABILITIES AND SHAREHOLDERS' EQUITY | | | | | | | | |

| Deposits | $ | 14,132,317 |

| | $ | 13,367,506 |

| | $ | 14,084,394 |

| | 5.7 | % | | 0.3 | % |

| Short-term borrowings | 497,663 |

| | 329,719 |

| | 431,631 |

| | 50.9 | % | | 15.3 | % |

| Other liabilities | 293,302 |

| | 291,464 |

| | 316,697 |

| | 0.6 | % | | (7.4 | )% |

| FHLB advances and long-term debt | 949,542 |

| | 1,139,413 |

| | 979,433 |

| | (16.7 | )% | | (3.1 | )% |

| Total Liabilities | 15,872,824 |

| | 15,128,102 |

| | 15,812,155 |

| | 4.9 | % | | 0.4 | % |

| Shareholders' equity | 2,041,894 |

| | 1,996,665 |

| | 2,025,904 |

| | 2.3 | % | | 0.8 | % |

| Total Liabilities and Shareholders' Equity | $ | 17,914,718 |

| | $ | 17,124,767 |

| | $ | 17,838,059 |

| | 4.6 | % | | 0.4 | % |

| | | | | | | | | | |

LOANS, DEPOSITS AND SHORT-TERM BORROWINGS DETAIL: | | | | | | | | |

Loans, by type: | | | | | | | | |

| Real estate - commercial mortgage | $ | 5,462,330 |

| | $ | 5,197,155 |

| | $ | 5,339,928 |

| | 5.1 | % | | 2.3 | % |

| Commercial - industrial, financial and agricultural | 4,088,962 |

| | 3,725,567 |

| | 3,929,908 |

| | 9.8 | % | | 4.0 | % |

| Real estate - home equity | 1,684,439 |

| | 1,736,688 |

| | 1,693,649 |

| | (3.0 | )% | | (0.5 | )% |

| Real estate - residential mortgage | 1,376,160 |

| | 1,377,068 |

| | 1,382,085 |

| | (0.1 | )% | | (0.4 | )% |

| Real estate - construction | 799,988 |

| | 690,601 |

| | 769,565 |

| | 15.8 | % | | 4.0 | % |

| Consumer | 268,588 |

| | 265,431 |

| | 271,696 |

| | 1.2 | % | | (1.1 | )% |

| Leasing and other | 158,135 |

| | 119,206 |

| | 149,530 |

| | 32.7 | % | | 5.8 | % |

| Total Loans, net of unearned income | $ | 13,838,602 |

| | $ | 13,111,716 |

| | $ | 13,536,361 |

| | 5.5 | % | | 2.2 | % |

Deposits, by type: | | | | | | | | |

| Noninterest-bearing demand | $ | 3,948,114 |

| | $ | 3,640,623 |

| | $ | 3,906,228 |

| | 8.4 | % | | 1.1 | % |

| Interest-bearing demand | 3,451,207 |

| | 3,150,612 |

| | 3,362,336 |

| | 9.5 | % | | 2.6 | % |

| Savings deposits | 3,868,046 |

| | 3,504,820 |

| | 3,880,103 |

| | 10.4 | % | | (0.3 | )% |

| Time deposits | 2,864,950 |

| | 3,071,451 |

| | 2,935,727 |

| | (6.7 | )% | | (2.4 | )% |

| Total Deposits | $ | 14,132,317 |

| | $ | 13,367,506 |

| | $ | 14,084,394 |

| | 5.7 | % | | 0.3 | % |

Short-term borrowings, by type: | | | | | | | | |

| Customer repurchase agreements | $ | 111,496 |

| | $ | 158,394 |

| | $ | 145,225 |

| | (29.6 | )% | | (23.2 | )% |

| Customer short-term promissory notes | 78,932 |

| | 95,106 |

| | 80,879 |

| | (17.0 | )% | | (2.4 | )% |

| Short-term FHLB advances | 110,000 |

| | 70,000 |

| | 200,000 |

| | 57.1 | % | | (45.0 | )% |

| Federal funds purchased | 197,235 |

| | 6,219 |

| | 5,527 |

| | N/M |

| | N/M |

|

| Total Short-term Borrowings | $ | 497,663 |

| | $ | 329,719 |

| | $ | 431,631 |

| | 50.9 | % | | 15.3 | % |

| | | | | | | | | | |

| | | | | | | | | | |

N/M - Not meaningful | | | | | | | | | |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

FULTON FINANCIAL CORPORATION | | | | | | | |

CONDENSED CONSOLIDATED STATEMENTS OF INCOME (UNAUDITED) | | | | | | | |

in thousands, except per-share data and percentages | | | | | | | |

| | | | Three Months Ended | | % Change from | | Year ended | | | |

| | | | December 31 | | December 31 | | September 30 | | Dec 31 | | Sep 30 | | December 31 | | | |

| | | | 2015 | | 2014 | | 2015 | | 2014 | | 2015 | | 2015 | | 2014 | | % Change | |

Interest Income: | | | | | | | | | | | | | | | | | | |

| Interest income | | | $ | 147,560 |

| | $ | 149,594 |

| | $ | 146,228 |

| | (1.4 | )% | | 0.9 | % | | $ | 583,789 |

| | $ | 596,078 |

| | (2.1 | )% | |

| Interest expense | | | 19,761 |

| | 21,556 |

| | 20,534 |

| | (8.3 | )% | | (3.8 | )% | | 83,795 |

| | 81,211 |

| | 3.2 | % | |

| Net Interest Income | | | 127,799 |

| | 128,038 |

| | 125,694 |

| | (0.2 | )% | | 1.7 | % | | 499,994 |

| | 514,867 |

| | (2.9 | )% | |

| Provision for credit losses | | | 2,750 |

| | 3,000 |

| | 1,000 |

| | (8.3 | )% | | 175.0 | % | | 2,250 |

| | 12,500 |

| | N/M |

| |

| Net Interest Income after Provision | | | 125,049 |

| | 125,038 |

| | 124,694 |

| | — | % | | 0.3 | % | | 497,744 |

| | 502,367 |

| | (0.9 | )% | |

Non-Interest Income: | | | | | | | | | | | | | | | | | | |

| Service charges on deposit accounts | | | 12,909 |

| | 12,229 |

| | 12,982 |

| | 5.6 | % | | (0.6 | )% | | 50,097 |

| | 49,293 |

| | 1.6 | % | |

| Other service charges and fees | | | 12,676 |

| | 10,489 |

| | 10,965 |

| | 20.9 | % | | 15.6 | % | | 43,992 |

| | 39,896 |

| | 10.3 | % | |

| Investment management and trust services | | | 10,919 |

| | 11,188 |

| | 11,237 |

| | (2.4 | )% | | (2.8 | )% | | 44,056 |

| | 44,605 |

| | (1.2 | )% | |

| Mortgage banking income | | | 4,317 |

| | 3,723 |

| | 3,864 |

| | 16.0 | % | | 11.7 | % | | 18,208 |

| | 17,107 |

| | 6.4 | % | |

| Investment securities gains | | | 776 |

| | 848 |

| | 1,730 |

| | (8.5 | )% | | (55.1 | )% | | 9,066 |

| | 2,041 |

| | N/M |

| |

| Other | | | 4,242 |

| | 3,624 |

| | 3,996 |

| | 17.1 | % | | 6.2 | % | | 16,420 |

| | 14,437 |

| | 13.7 | % | |

| Total Non-Interest Income | | | 45,839 |

| | 42,101 |

| | 44,774 |

| | 8.9 | % | | 2.4 | % | | 181,839 |

| | 167,379 |

| | 8.6 | % | |

Non-Interest Expense: | | | | | | | | | | | | | | | | | | |

| Salaries and employee benefits | | | 65,467 |

| | 65,398 |

| | 65,308 |

| | 0.1 | % | | 0.2 | % | | 260,832 |

| | 251,021 |

| | 3.9 | % | |

| Net occupancy expense | | | 11,566 |

| | 11,481 |

| | 10,710 |

| | 0.7 | % | | 8.0 | % | | 47,777 |

| | 48,130 |

| | (0.7 | )% | |

| Other outside services | | | 6,537 |

| | 8,720 |

| | 7,373 |

| | (25.0 | )% | | (11.3 | )% | | 27,785 |

| | 28,404 |

| | (2.2 | )% | |

| Data processing | | | 5,127 |

| | 4,346 |

| | 5,105 |

| | 18.0 | % | | 0.4 | % | | 19,894 |

| | 17,162 |

| | 15.9 | % | |

| Software | | | 4,068 |

| | 3,271 |

| | 3,984 |

| | 24.4 | % | | 2.1 | % | | 14,746 |

| | 12,758 |

| | 15.6 | % | |

| Equipment expense | | | 3,626 |

| | 3,298 |

| | 3,595 |

| | 9.9 | % | | 0.9 | % | | 14,514 |

| | 13,567 |

| | 7.0 | % | |

| FDIC insurance expense | | | 2,896 |

| | 2,772 |

| | 2,867 |

| | 4.5 | % | | 1.0 | % | | 11,470 |

| | 10,958 |

| | 4.7 | % | |

| Professional fees | | | 2,814 |

| | 2,382 |

| | 2,828 |

| | 18.1 | % | | (0.5 | )% | | 11,244 |

| | 12,097 |

| | (7.1 | )% | |

| Marketing | | | 1,754 |

| | 2,414 |

| | 2,102 |

| | (27.3 | )% | | (16.6 | )% | | 7,324 |

| | 8,133 |

| | (9.9 | )% | |

| OREO and repossession expense | | | 1,123 |

| | 236 |

| | 1,016 |

| | N/M |

| | 10.5 | % | | 3,630 |

| | 3,270 |

| | 11.0 | % | |

| Operating risk loss | | | 987 |

| | 485 |

| | 1,136 |

| | N/M |

| | (13.1 | )% | | 3,624 |

| | 4,271 |

| | (15.1 | )% | |

| Intangible amortization | | | 6 |

| | 315 |

| | 5 |

| | (98.1 | )% | | 20.0 | % | | 247 |

| | 1,259 |

| | (80.4 | )% | |

| Loss on redemption of trust preferred securities | | | — |

| | — |

| | 5,626 |

| | N/M |

| | N/M |

| | 5,626 |

| | — |

| | N/M |

| |

| Other | | | 12,468 |

| | 12,602 |

| | 13,234 |

| | (1.1 | )% | | (5.8 | )% | | 51,447 |

| | 48,216 |

| | 6.7 | % | |

| Total Non-Interest Expense | | | 118,439 |

| | 117,720 |

| | 124,889 |

| | 0.6 | % | | (5.2 | )% | | 480,160 |

| | 459,246 |

| | 4.6 | % | |

| Income Before Income Taxes | | | 52,449 |

| | 49,419 |

| | 44,579 |

| | 6.1 | % | | 17.7 | % | | 199,423 |

| | 210,500 |

| | (5.3 | )% | |

| Income tax expense | | | 13,914 |

| | 11,470 |

| | 10,328 |

| | 21.3 | % | | 34.7 | % | | 49,921 |

| | 52,606 |

| | (5.1 | )% | |

| Net Income | | | $ | 38,535 |

| | $ | 37,949 |

| | $ | 34,251 |

| | 1.5 | % | | 12.5 | % | | $ | 149,502 |

| | $ | 157,894 |

| | (5.3 | )% | |

| | | | | | | | | | | | | | | | | | | |

PER SHARE: | | | | | | | | | | | | | | | | | | |

| Net income: | | | | | | | | | | | | | | | | | | |

| Basic | | | $ | 0.22 |

| | $ | 0.21 |

| | $ | 0.20 |

| | 4.8 | % | | 10.0 | % | | $ | 0.85 |

| | $ | 0.85 |

| | — | % | |

| Diluted | | | 0.22 |

| | 0.21 |

| | 0.20 |

| | 4.8 | % | | 10.0 | % | | 0.85 |

| | 0.84 |

| | 1.2 | % | |

| | | | | | | | | |

| |

| | | | | | | |

| Cash dividends | | | $ | 0.09 |

| | $ | 0.10 |

| | $ | 0.09 |

| | (10.0 | )% | | — | % | | $ | 0.36 |

| | $ | 0.34 |

| | 5.9 | % | |

| Shareholders' equity | | | 11.72 |

| | 11.16 |

| | 11.66 |

| | 5.0 | % | | 0.5 | % | | 11.72 |

| | 11.16 |

| | 5.0 | % | |

| Shareholders' equity (tangible) | | | 8.67 |

| | 8.19 |

| | 8.60 |

| | 5.9 | % | | 0.8 | % | | 8.67 |

| | 8.19 |

| | 5.9 | % | |

| | | | | | | | | |

| |

| | | | | | | |

| Weighted average shares (basic) | | | 173,709 |

| | 181,251 |

| | 174,338 |

| | (4.2 | )% | | (0.4 | )% | | 175,721 |

| | 186,219 |

| | (5.6 | )% | |

| Weighted average shares (diluted) | | | 174,833 |

| | 182,189 |

| | 175,342 |

| | (4.0 | )% | | (0.3 | )% | | 176,774 |

| | 187,181 |

| | (5.6 | )% | |

| Shares outstanding, end of period | | | 174,176 |

| | 178,924 |

| | 173,771 |

| | (2.7 | )% | | 0.2 | % | | 174,176 |

| | 178,924 |

| | (2.7 | )% | |

| | | | | | | | | | | | | | | | | | | |

SELECTED FINANCIAL RATIOS: | | | | | | | | | | | | | | | | | | |

| Return on average assets | | | 0.86 | % | | 0.88 | % | | 0.78 | % | | | | | | 0.86 | % | | 0.93 | % | | | |

| Return on average shareholders' equity | | | 7.51 | % | | 7.34 | % | | 6.72 | % | | | | | | 7.38 | % | | 7.62 | % | | | |

| Return on average shareholders' equity (tangible) | | | 10.16 | % | | 9.96 | % | | 9.11 | % | | | | | | 10.01 | % | | 10.31 | % | | | |

| Net interest margin | | | 3.19 | % | | 3.31 | % | | 3.18 | % | | | | | | 3.21 | % | | 3.39 | % | | | |

| Efficiency ratio | | | 66.63 | % | | 67.53 | % | | 68.82 | % | | | | | | 68.61 | % | | 65.65 | % | | | |

N/M - Not meaningful | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

FULTON FINANCIAL CORPORATION | | | | | | |

CONDENSED CONSOLIDATED AVERAGE BALANCE SHEET ANALYSIS (UNAUDITED) | | | | | |

dollars in thousands | | | | | | |

| | Three Months Ended |

| | December 31, 2015 | | December 31, 2014 | | September 30, 2015 |

| | Average | | | | Yield/ | | Average | | | | Yield/ | | Average | | | | Yield/ |

| | Balance | | Interest (1) | | Rate | | Balance | | Interest (1) | | Rate | | Balance | | Interest (1) | | Rate |

ASSETS | | | | | | | | | | | | | | | | | |

Interest-earning assets: | | | | | | | | | | | | | | | | |

| Loans, net of unearned income | $ | 13,659,266 |

| | $ | 136,317 |

| | 3.96% | | $ | 13,056,153 |

| | $ | 136,636 |

| | 4.16% | | $ | 13,369,874 |

| | $ | 135,268 |

| | 4.02% |

| Taxable investment securities | 2,170,397 |

| | 11,801 |

| | 2.17% | | 2,109,884 |

| | 12,689 |

| | 2.40% | | 2,148,403 |

| | 11,252 |

| | 2.09% |

| Tax-exempt investment securities | 246,727 |

| | 3,085 |

| | 5.00% | | 241,711 |

| | 3,249 |

| | 5.38% | | 230,178 |

| | 2,929 |

| | 5.09% |

| Equity securities | 15,524 |

| | 208 |

| | 5.33% | | 33,981 |

| | 442 |

| | 5.16% | | 18,280 |

| | 257 |

| | 5.58% |

| Total Investment Securities | 2,432,648 |

| | 15,094 |

| | 2.48% | | 2,385,576 |

| | 16,380 |

| | 2.74% | | 2,396,861 |

| | 14,438 |

| | 2.41% |

| Loans held for sale | 15,713 |

| | 169 |

| | 4.31% | | 15,340 |

| | 201 |

| | 5.24% | | 20,704 |

| | 194 |

| | 3.74% |

| Other interest-earning assets | 399,309 |

| | 864 |

| | 0.86% | | 464,342 |

| | 953 |

| | 0.82% | | 477,145 |

| | 884 |

| | 0.74% |

| Total Interest-earning Assets | 16,506,936 |

| | 152,444 |

| | 3.67% | | 15,921,411 |

| | 154,170 |

| | 3.85% | | 16,264,584 |

| | 150,784 |

| | 3.68% |

Noninterest-earning assets: | | | | | | | | | | | | | | | | |

| Cash and due from banks | 106,810 |

| | | | | | 110,292 |

| | | | | | 104,622 |

| | | | |

| Premises and equipment | 226,335 |

| | | | | | 224,516 |

| | | | | | 226,446 |

| | | | |

| Other assets | 1,108,094 |

| | | | | | 1,073,302 |

| | | | | | 1,097,600 |

| | | | |

| Less: allowance for loan losses | (169,251 | ) | | | | | | (189,029 | ) | | | | | | (168,770 | ) | | | | |

| Total Assets | $ | 17,778,924 |

| | | | | | $ | 17,140,492 |

| | | | | | $ | 17,524,482 |

| | | | |

LIABILITIES AND SHAREHOLDERS' EQUITY | | | | | | | | | | | | | | | | |

Interest-bearing liabilities: | | | | | | | | | | | | | | | | |

| Demand deposits | $ | 3,411,904 |

| | $ | 1,207 |

| | 0.13% | | $ | 3,145,658 |

| | $ | 1,027 |

| | 0.13% | | $ | 3,316,532 |

| | $ | 1,122 |

| | 0.13% |

| Savings deposits | 3,903,741 |

| | 1,633 |

| | 0.17% | | 3,548,504 |

| | 1,171 |

| | 0.13% | | 3,714,282 |

| | 1,436 |

| | 0.15% |

| Time deposits | 2,903,715 |

| | 7,549 |

| | 1.03% | | 3,016,834 |

| | 7,333 |

| | 0.96% | | 2,963,774 |

| | 7,659 |

| | 1.03% |

| Total Interest-bearing Deposits | 10,219,360 |

| | 10,389 |

| | 0.40% | | 9,710,996 |

| | 9,531 |

| | 0.39% | | 9,994,588 |

| | 10,217 |

| | 0.41% |

| Short-term borrowings | 281,497 |

| | 100 |

| | 0.14% | | 417,838 |

| | 138 |

| | 0.13% | | 324,685 |

| | 92 |

| | 0.11% |

| FHLB advances and long-term debt | 950,792 |

| | 9,272 |

| | 3.88% | | 1,086,321 |

| | 11,887 |

| | 4.36% | | 996,247 |

| | 10,225 |

| | 4.09% |

| Total Interest-bearing Liabilities | 11,451,649 |

| | 19,761 |

| | 0.69% | | 11,215,155 |

| | 21,556 |

| | 0.76% | | 11,315,520 |

| | 20,534 |

| | 0.72% |

Noninterest-bearing liabilities: | | | | | | | | | | | | | | | | |

| Demand deposits | 3,999,118 |

| | | | | | 3,630,780 |

| | | | | | 3,904,176 |

| | | | |

| Other | 291,388 |

| | | | | | 242,346 |

| | | | | | 281,957 |

| | | | |

| Total Liabilities | 15,742,155 |

| | | | | | 15,088,281 |

| | | | | | 15,501,653 |

| | | | |

| Shareholders' equity | 2,036,769 |

| | | | | | 2,052,211 |

| | | | | | 2,022,829 |

| | | | |

| Total Liabilities and Shareholders' Equity | $ | 17,778,924 |

| | | | | | $ | 17,140,492 |

| | | | | | $ | 17,524,482 |

| | | | |

| Net interest income/net interest margin (fully taxable equivalent) | | | 132,683 |

| | 3.19% | | | | 132,614 |

| | 3.31% | | | | 130,250 |

| | 3.18% |

| Tax equivalent adjustment | | | (4,884 | ) | | | | | | (4,576 | ) | | | | | | (4,556 | ) | | |

| Net interest income | | | $ | 127,799 |

| | | | | | $ | 128,038 |

| | | | | | $ | 125,694 |

| | |

| | | | | | | | | | | | | | | | | | |

| (1) Presented on a tax-equivalent basis using a 35% Federal tax rate and statutory interest expense disallowances. | | | | | | |

| | | | | | | | | | | | | | | | | | |

AVERAGE LOANS, DEPOSITS AND SHORT-TERM BORROWINGS DETAIL: | | | | | | | | | | | | |

| | Three Months Ended | | % Change from | | | | | | | | |

| | December 31 | | December 31 | | September 30 | | December 31 | | September 30 | | | | | | | | |

| | 2015 | | 2014 | | 2015 | | 2014 | | 2015 | | | | | | | | |

Loans, by type: | | | | | | | | | | | | | | | | |

| Real estate - commercial mortgage | $ | 5,365,640 |

| | $ | 5,131,375 |

| | $ | 5,242,021 |

| | 4.6 | % | | 2.4 | % | | | | | | | | |

| Commercial - industrial, financial and agricultural | 4,035,287 |

| | 3,723,211 |

| | 3,887,161 |

| | 8.4 | % | | 3.8 | % | | | | | | | | |

| Real estate - home equity | 1,694,455 |

| | 1,735,769 |

| | 1,692,860 |

| | (2.4 | )% | | 0.1 | % | | | | | | | | |

| Real estate - residential mortgage | 1,377,116 |

| | 1,378,452 |

| | 1,381,141 |

| | (0.1 | )% | | (0.3 | )% | | | | | | | | |

| Real estate - construction | 765,555 |

| | 697,741 |

| | 753,584 |

| | 9.7 | % | | 1.6 | % | | | | | | | | |

| Consumer | 267,726 |

| | 275,349 |

| | 270,391 |

| | (2.8 | )% | | (1.0 | )% | | | | | | | | |

| Leasing and other | 153,487 |

| | 114,256 |

| | 142,716 |

| | 34.3 | % | | 7.5 | % | | | | | | | | |

| Total Loans, net of unearned income | $ | 13,659,266 |

| | $ | 13,056,153 |

| | $ | 13,369,874 |

| | 4.6 | % | | 2.2 | % | | | | | | | | |

Deposits, by type: | | | | | | | | | | | | | | | | |

| Noninterest-bearing demand | $ | 3,999,118 |

| | $ | 3,630,780 |

| | $ | 3,904,176 |

| | 10.1 | % | | 2.4 | % | | | | | | | | |

| Interest-bearing demand | 3,411,904 |

| | 3,145,658 |

| | 3,316,532 |

| | 8.5 | % | | 2.9 | % | | | | | | | | |

| Savings deposits | 3,903,741 |

| | 3,548,504 |

| | 3,714,282 |

| | 10.0 | % | | 5.1 | % | | | | | | | | |

| Time deposits | 2,903,715 |

| | 3,016,834 |

| | 2,963,774 |

| | (3.7 | )% | | (2.0 | )% | | | | | | | | |

| Total Deposits | $ | 14,218,478 |

| | $ | 13,341,776 |

| | $ | 13,898,764 |

| | 6.6 | % | | 2.3 | % | | | | | | | | |

Short-term borrowings, by type: | | | | | | | | | | | | | | | | |

| Customer repurchase agreements | $ | 142,004 |

| | $ | 183,331 |

| | $ | 149,415 |

| | (22.5 | )% | | (5.0 | )% | | | | | | | | |

| Customer short-term promissory notes | 80,568 |

| | 87,338 |

| | 79,308 |

| | (7.8 | )% | | 1.6 | % | | | | | | | | |

| Federal funds purchased | 44,468 |

| | 59,669 |

| | 85,092 |

| | (25.5 | )% | | (47.7 | )% | | | | | | | | |

| Short-term FHLB advances and other borrowings | 14,457 |

| | 87,500 |

| | 10,870 |

| | (83.5 | )% | | 33.0 | % | | | | | | | | |

| Total Short-term Borrowings | $ | 281,497 |

| | $ | 417,838 |

| | $ | 324,685 |

| | (32.6 | )% | | (13.3 | )% | | | | | | | | |

| | | | | | | | | | | | | | | | | |

|

| | | | | | | | | | | | | | | | | | | | | | | |

FULTON FINANCIAL CORPORATION | | | | | | |

CONDENSED CONSOLIDATED AVERAGE BALANCE SHEET ANALYSIS (UNAUDITED) | | | | | | |

dollars in thousands | | | | | | |

| | | Year Ended December 31 |

| | | 2015 | | 2014 |

| | | Average | | | | | | Average | | | | |

| | | Balance | | Interest (1) | | Yield/Rate | | Balance | | Interest (1) | | Yield/Rate |

ASSETS | | | | | | |

| | | | | | | | | | | | | |

Interest-earning assets: | | | | | | |

| Loans, net of unearned income | | $ | 13,330,973 |

| | $ | 537,979 |

| | 4.04 | % | | $ | 12,885,180 |

| | $ | 542,540 |

| | 4.21 | % |

| Taxable investment securities | | 2,093,829 |

| | 45,279 |

| | 2.16 | % | | 2,189,510 |

| | 50,651 |

| | 2.31 | % |

| Tax-exempt investment securities | | 230,633 |

| | 12,120 |

| | 5.26 | % | | 261,825 |

| | 13,810 |

| | 5.27 | % |

| Equity securities | | 23,348 |

| | 1,294 |

| | 5.54 | % | | 33,957 |

| | 1,728 |

| | 5.09 | % |

| Total Investment Securities | | 2,347,810 |

| | 58,693 |

| | 2.50 | % | | 2,485,292 |

| | 66,189 |

| | 2.66 | % |

| Loans held for sale | | 19,937 |

| | 801 |

| | 4.02 | % | | 17,524 |

| | 786 |

| | 4.49 | % |

| Other interest-earning assets | | 447,354 |

| | 4,786 |

| | 1.07 | % | | 314,345 |

| | 4,018 |

| | 1.28 | % |

| Total Interest-earning Assets | | 16,146,074 |

| | 602,259 |

| | 3.73 | % | | 15,702,341 |

| | 613,533 |

| | 3.91 | % |

| | | | | | | | | | | | | |

Noninterest-earning assets: | | | | | | |

| Cash and due from banks | | 105,359 |

| | | | | | 177,664 |

| | | | |

| Premises and equipment | | 226,436 |

| | | | | | 224,903 |

| | | | |

| Other assets | | 1,103,427 |

| | | | | | 1,049,765 |

| | | | |

| Less: allowance for loan losses | | (174,453 | ) | | | | | | (195,166 | ) | | | | |

| Total Assets | | $ | 17,406,843 |

| | | | | | $ | 16,959,507 |

| | | | |

| | | | | | | | | | | | | |

LIABILITIES AND SHAREHOLDERS' EQUITY | | | | | | |

| | | | | | | | | | | | | |

Interest-bearing liabilities: | | | | | | |

| Demand deposits | | $ | 3,255,192 |

| | $ | 4,299 |

| | 0.13 | % | | $ | 3,013,879 |

| | $ | 3,793 |

| | 0.13 | % |

| Savings deposits | | 3,677,079 |

| | 5,435 |

| | 0.15 | % | | 3,431,957 |

| | 4,298 |

| | 0.13 | % |

| Time deposits | | 2,988,648 |

| | 30,748 |

| | 1.03 | % | | 2,992,920 |

| | 27,019 |

| | 0.90 | % |

| Total Interest-bearing Deposits | | 9,920,919 |

| | 40,482 |

| | 0.41 | % | | 9,438,756 |

| | 35,110 |

| | 0.37 | % |

| | | | | | | | | | | | | |

| Short-term borrowings | | 323,772 |

| | 372 |

| | 0.11 | % | | 832,839 |

| | 1,608 |

| | 0.19 | % |

| FHLB advances and long-term debt | | 1,023,972 |

| | 42,941 |

| | 4.19 | % | | 965,601 |

| | 44,493 |

| | 4.61 | % |

| Total Interest-bearing Liabilities | | 11,268,663 |

| | 83,795 |

| | 0.74 | % | | 11,237,196 |

| | 81,211 |

| | 0.72 | % |

| | | | | | | | | | | | | |

Noninterest-bearing liabilities: | | | | | | |

| Demand deposits | | 3,826,194 |

| | | | | | 3,428,907 |

| | | | |

| Other | | 285,103 |

| | | | | | 221,764 |

| | | | |

| Total Liabilities | | 15,379,960 |

| | | | | | 14,887,867 |

| | | | |

| Shareholders' equity | | 2,026,883 |

| | | | | | 2,071,640 |

| | | | |

| | | | | | | | | | | | | |

| Total Liabilities and Shareholders' Equity | | $ | 17,406,843 |

| | | | | | $ | 16,959,507 |

| | | | |

| | | | | | | | | | | | | |

| Net interest income/net interest margin (fully taxable equivalent) | | | | 518,464 |

| | 3.21 | % | | | | 532,322 |

| | 3.39 | % |

| Tax equivalent adjustment | | | | (18,470 | ) | | | | | | (17,455 | ) | | |

| | | | | | | | | | | | | |

| Net interest income | | | | $ | 499,994 |

| | | | | | $ | 514,867 |

| | |

| | | | | | | | | | | | | |

(1) Presented on a tax-equivalent basis using a 35% Federal tax rate and statutory interest expense disallowances. | | | | | | |

| | | | | | | | | | | | | |

AVERAGE LOANS, DEPOSITS AND SHORT-TERM BORROWINGS DETAIL: | | | | | | |

| | | | | | | | | | | | | |

| | | Year Ended | | | | | | | | |

| | | December 31 | | | | | | | | |

| | | 2015 | | 2014 | | % Change | | | | | | |

Loans, by type: | | | | | | |

| Real estate - commercial mortgage | | $ | 5,246,054 |

| | $ | 5,117,433 |

| | 2.5 | % | | | | | | |

| Commercial - industrial, financial and agricultural | | 3,882,998 |

| | 3,659,059 |

| | 6.1 | % | | | | | | |

| Real estate - home equity | | 1,700,851 |

| | 1,738,449 |

| | (2.2 | )% | | | | | | |

| Real estate - residential mortgage | | 1,371,321 |

| | 1,355,876 |

| | 1.1 | % | | | | | | |

| Real estate - construction | | 726,914 |

| | 631,968 |

| | 15.0 | % | | | | | | |

| Consumer | | 265,688 |

| | 277,853 |

| | (4.4 | )% | | | | | | |

| Leasing and other | | 137,147 |

| | 104,542 |

| | 31.2 | % | | | | | | |

| Total Loans, net of unearned income | | $ | 13,330,973 |

| | $ | 12,885,180 |

| | 3.5 | % | | | | | | |

| | | | | | | | | | | | | |

Deposits, by type: | | | | | | |

| Noninterest-bearing demand | | $ | 3,826,194 |

| | $ | 3,428,907 |

| | 11.6 | % | | | | | | |

| Interest-bearing demand | | 3,255,192 |

| | 3,013,879 |

| | 8.0 | % | | | | | | |

| Savings deposits | | 3,677,079 |

| | 3,431,957 |

| | 7.1 | % | | | | | | |

| Time deposits | | 2,988,648 |

| | 2,992,920 |

| | (0.1 | )% | | | | | | |

| | | | | | | | | | | | | |

| Total Deposits | | $ | 13,747,113 |

| | $ | 12,867,663 |

| | 6.8 | % | | | | | | |

| | | | | | | | | | | | | |

Short-term borrowings, by type: | | | | | | |

| Customer repurchase agreements | | $ | 161,093 |

| | $ | 197,432 |

| | (18.4 | )% | | | | | | |

| Customer short-term promissory notes | | 81,530 |

| | 88,670 |

| | (8.1 | )% | | | | | | |

| Federal funds purchased | | 65,779 |

| | 285,169 |

| | (76.9 | )% | | | | | | |

| Short-term FHLB advances and other borrowings | | 15,370 |

| | 261,568 |

| | (94.1 | )% | | | | | | |

| Total Short-term Borrowings | | $ | 323,772 |

| | $ | 832,839 |

| | (61.1 | )% | | | | | | |

| | | | | | | | | | | | | |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

FULTON FINANCIAL CORPORATION | | | | | | | | | | | |

ASSET QUALITY INFORMATION (UNAUDITED) | | | | | | | | | | | |

dollars in thousands | | | | | | | | | | | |

| | Three Months Ended | | Year Ended | | | | | | | | |

| | Dec 31 | | Dec 31 | | Sep 30 | | Dec 31 | | | | | | | | |

| | 2015 | | 2014 | | 2015 | | 2015 | | 2014 | | | | | | | | |

ALLOWANCE FOR CREDIT LOSSES: | | | | | | | | | | | | | | | | |

Balance at beginning of period | $ | 169,395 |

| | $ | 191,108 |

| | $ | 169,453 |

| | $ | 185,931 |

| | $ | 204,917 |

| | | | | | | | |

| Loans charged off: | | | | | | | | | | | | | | | | | |

| Consumer and home equity | (1,466 | ) | | (1,696 | ) | | (1,590 | ) | | (5,831 | ) | | (7,811 | ) | | | | | | | | |

| Real estate - commercial mortgage | (1,207 | ) | | (920 | ) | | (660 | ) | | (4,218 | ) | | (6,004 | ) | | | | | | | | |

| Commercial - industrial, financial and agricultural | (970 | ) | | (8,712 | ) | | (1,640 | ) | | (15,639 | ) | | (24,516 | ) | | | | | | | | |

| Real estate - residential mortgage | (513 | ) | | (752 | ) | | (1,035 | ) | | (3,612 | ) | | (2,918 | ) | | | | | | | | |

| Real estate - construction | — |

| | (464 | ) | | (114 | ) | | (201 | ) | | (1,209 | ) | | | | | | | | |

| Leasing and other | (1,304 | ) | | (701 | ) | | (522 | ) | | (2,656 | ) | | (2,135 | ) | | | | | | | | |

| Total loans charged off | (5,460 | ) | | (13,245 | ) | | (5,561 | ) | | (32,157 | ) | | (44,593 | ) | | | | | | | | |

Recoveries of loans previously charged off: | | | | | | | | | | | | | | | | | |

| Consumer and home equity | 825 |

| | 419 |

| | 618 |

| | 2,492 |

| | 2,347 |

| | | | | | | | |

| Real estate - commercial mortgage | 1,072 |

| | 319 |

| | 842 |

| | 2,801 |

| | 1,960 |

| | | | | | | | |

| Commercial - industrial, financial and agricultural | 1,409 |

| | 1,724 |

| | 1,598 |

| | 5,264 |

| | 4,256 |

| | | | | | | | |

| Real estate - residential mortgage | 775 |

| | 132 |

| | 201 |

| | 1,322 |

| | 451 |

| | | | | | | | |

| Real estate - construction | 548 |

| | 2,325 |

| | 898 |

| | 2,824 |

| | 3,177 |

| | | | | | | | |

| Leasing and other | 98 |

| | 149 |

| | 346 |

| | 685 |

| | 916 |

| | | | | | | | |

| Recoveries of loans previously charged off | 4,727 |

| | 5,068 |

| | 4,503 |

| | 15,388 |

| | 13,107 |

| | | | | | | | |

Net loans charged off | (733 | ) | | (8,177 | ) | | (1,058 | ) | | (16,769 | ) | | (31,486 | ) | | | | | | | | |

Provision for credit losses | 2,750 |

| | 3,000 |

| | 1,000 |

| | 2,250 |

| | 12,500 |

| | | | | | | | |

Balance at end of period | $ | 171,412 |

| | $ | 185,931 |

| | $ | 169,395 |

| | $ | 171,412 |

| | $ | 185,931 |

| | | | | | | | |

Net charge-offs to average loans (annualized) | 0.02 | % | | 0.25 | % | | 0.03 | % | | 0.13 | % | | 0.24 | % | | | | | | | | |

NON-PERFORMING ASSETS: | | | | | | | | | | | | | | | | |

| Non-accrual loans | $ | 129,523 |

| | $ | 121,080 |

| | $ | 132,154 |

| | | | | | | | | | | | |

| Loans 90 days past due and accruing | 15,291 |

| | 17,402 |

| | 12,867 |

| | | | | | | | | | | | |

| Total non-performing loans | 144,814 |

| | 138,482 |

| | 145,021 |

| | | | | | | | | | | | |

| Other real estate owned | 11,099 |

| | 12,022 |

| | 10,561 |

| | | | | | | | | | | | |

| Total non-performing assets | $ | 155,913 |

| | $ | 150,504 |

| | $ | 155,582 |

| | | | | | | | | | | | |

NON-PERFORMING LOANS, BY TYPE: | | | | | | | | | | | | | | | | |

| Commercial - industrial, financial and agricultural | $ | 44,071 |

| | $ | 30,388 |

| | $ | 38,032 |

| | | | | | | | | | | | |

| Real estate - commercial mortgage | 41,170 |

| | 45,237 |

| | 49,021 |

| | | | | | | | | | | | |

| Real estate - residential mortgage | 28,484 |

| | 28,995 |

| | 27,707 |

| | | | | | | | | | | | |

| Consumer and home equity | 17,123 |

| | 17,330 |

| | 15,186 |

| | | | | | | | | | | | |

| Real estate - construction | 12,460 |

| | 16,399 |

| | 14,989 |

| | | | | | | | | | | | |

| Leasing | 1,506 |

| | 133 |

| | 86 |

| | | | | | | | | | | | |

| Total non-performing loans | $ | 144,814 |

| | $ | 138,482 |

| | $ | 145,021 |

| | | | | | | | | | | | |

TROUBLED DEBT RESTRUCTURINGS (TDRs), BY TYPE: | | | | | | | | | | | | | | | | |

| Real-estate - residential mortgage | $ | 28,511 |

| | $ | 31,308 |

| | $ | 29,330 |

| | | | | | | | | | | | |

| Real-estate - commercial mortgage | 17,563 |

| | 18,822 |

| | 17,282 |

| | | | | | | | | | | | |

| Commercial - industrial, financial and agricultural | 5,953 |

| | 5,237 |

| | 7,399 |

| | | | | | | | | | | | |

| Real estate - construction | 3,942 |

| | 9,241 |

| | 4,363 |

| | | | | | | | | | | | |

| Consumer and home equity | 4,589 |

| | 3,013 |

| | 3,983 |

| | | | | | | | | | | | |

| Total accruing TDRs | $ | 60,558 |

| | $ | 67,621 |

| | $ | 62,357 |

| | | | | | | | | | | | |

| Non-accrual TDRs (1) | 31,035 |

| | 24,616 |

| | 27,618 |

| | | | | | | | | | | | |

| Total TDRs | $ | 91,593 |

| | $ | 92,237 |

| | $ | 89,975 |

| | | | | | | | | | | | |

(1) Included within non-accrual loans above. | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

DELINQUENCY RATES, BY TYPE: | | | | | | | | | | | | | | | | |

| | December 31, 2015 | | December 31, 2014 | | September 30, 2015 |

| | 31-89 Days | | ≥90 Days (2) | | Total | | 31-89 Days | | ≥90 Days (2) | | Total | | 31-89 Days | | ≥90 Days (2) | | Total |

| | | | | | | | | | | | | | | | | | |

| Real estate - commercial mortgage | 0.14 | % | | 0.77 | % | | 0.91 | % | | 0.35 | % | | 0.87 | % | | 1.22 | % | | 0.16 | % | | 0.92 | % | | 1.08 | % |

| Commercial - industrial, financial and agricultural | 0.21 | % | | 1.06 | % | | 1.27 | % | | 0.17 | % | | 0.81 | % | | 0.98 | % | | 0.35 | % | | 0.97 | % | | 1.32 | % |

| Real estate - construction | 0.28 | % | | 1.59 | % | | 1.87 | % | | 0.02 | % | | 2.38 | % | | 2.40 | % | | 0.30 | % | | 1.95 | % | | 2.25 | % |

| Real estate - residential mortgage | 1.33 | % | | 2.07 | % | | 3.40 | % | | 1.96 | % | | 2.10 | % | | 4.06 | % | | 1.27 | % | | 2.00 | % | | 3.27 | % |

| Consumer, home equity, leasing and other | 0.70 | % | | 0.88 | % | | 1.58 | % | | 0.80 | % | | 0.82 | % | | 1.62 | % | | 0.69 | % | | 0.72 | % | | 1.41 | % |

| Total | 0.37 | % | | 1.04 | % | | 1.41 | % | | 0.52 | % | | 1.06 | % | | 1.58 | % | | 0.42 | % | | 1.07 | % | | 1.49 | % |

(2) Includes non-accrual loans | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

ASSET QUALITY RATIOS: | | | | | | | | | | | | | | | | |

| | Dec 31 | | Dec 31 | | Sep 30 | | | | | | | | | | | | |

| | 2015 | | 2014 | | 2015 | | | | | | | | | | | | |

| Non-accrual loans to total loans | 0.94 | % | | 0.92 | % | | 0.98 | % | | | | | | | | | | | | |

| Non-performing loans to total loans | 1.05 | % | | 1.06 | % | | 1.07 | % | | | | | | | | | | | | |

| Non-performing assets to total loans and OREO | 1.13 | % | | 1.15 | % | | 1.15 | % | | | | | | | | | | | | |

| Non-performing assets to total assets | 0.87 | % | | 0.88 | % | | 0.87 | % | | | | | | | | | | | | |

| Allowance for credit losses to loans outstanding | 1.24 | % | | 1.42 | % | | 1.25 | % | | | | | | | | | | | | |

| Allowance for credit losses to non-performing loans | 118.37 | % | | 134.26 | % | | 116.81 | % | | | | | | | | | | | | |

| Non-performing assets to tangible common shareholders' equity and allowance for credit losses | 9.27 | % | | 9.12 | % | | 9.35 | % | | | | | | | | | | | | |

|

| | | | | | | | | | | | | | | | | | | | | | | | | |

FULTON FINANCIAL CORPORATION | | | | | | |

RECONCILIATION OF GAAP TO NON-GAAP MEASURES (UNAUDITED) | | | | | | |

in thousands, except per share data and percentages | | | | | | |

| | | | | | | | | | | | | | | |

Explanatory note: | This press release contains certain financial information, as detailed below, which has been derived by methods other than Generally Accepted Accounting Principles ("GAAP"). The Corporation has presented these non-GAAP financial measures because it believes that these measures provide useful and comparative information to assess trends in the Corporation's quarterly results of operations. Presentation of these non-GAAP financial measures is consistent with how the Corporation evaluates its performance internally and these non-GAAP financial measures are frequently used by securities analysts, investors and other interested parties in the evaluation of companies in the Corporation's industry. Management believes that these non-GAAP financial measures, in addition to GAAP measures, are also useful to investors to evaluate the Corporation's results. Investors should recognize that the Corporation's presentation of these non-GAAP financial measures might not be comparable to similarly-titled measures of other companies. These non-GAAP financial measures should not be considered a substitute for GAAP basis measures and the Corporation strongly encourages a review of its condensed consolidated financial statements in their entirety. Reconciliations of these non-GAAP financial measures to the most directly comparable GAAP measure follow: |

| | | | | | | | | | | | | | | |

| | | | | | | Three Months Ended | | Year Ended |

| | | | | | | Dec 31 | | Dec 31 | | Sep 30 | | Dec 31 | | Dec 31 |

| | | | | | | 2015 | | 2014 | | 2015 | | 2015 | | 2014 |

Shareholders' equity (tangible), per share | | | | | | | | | | | |

Shareholders' equity | | | $ | 2,041,894 |

| | $ | 1,996,665 |

| | $ | 2,025,904 |

| | | | |

Less: Goodwill and intangible assets | | | (531,556 | ) | | (531,803 | ) | | (531,562 | ) | | | | |

Tangible shareholders' equity (numerator) | | | $ | 1,510,338 |

| | $ | 1,464,862 |

| | $ | 1,494,342 |

| | | | |

Shares outstanding, end of period (denominator) | | | 174,176 |

| | 178,924 |

| | 173,771 |

| | | | |

Shareholders' equity (tangible), per share | | | $ | 8.67 |

| | $ | 8.19 |

| | $ | 8.60 |

| | | | |

| | | | | | | | | | | | | | | |

Return on average common shareholders' equity (tangible) | | | | | | | | | | |

Net income | | | $ | 38,535 |

| | $ | 37,949 |

| | $ | 34,251 |

| | $ | 149,502 |

| | $ | 157,894 |

|

Plus: Intangible amortization, net of tax | | | 4 |

| | 205 |

| | 3 |

| | 161 |

| | 818 |

|

Numerator | | $ | 38,539 |

| | $ | 38,154 |

| | $ | 34,254 |

| | $ | 149,663 |

| | $ | 158,712 |

|

| | | | | | | | | | | |

Average shareholders' equity | | | $ | 2,036,769 |

| | $ | 2,052,211 |

| | $ | 2,022,829 |

| | $ | 2,026,883 |

| | $ | 2,071,640 |

|

Less: Average goodwill and intangible assets | | | (531,559 | ) | | (531,955 | ) | | (531,564 | ) | | (531,618 | ) | | (532,425 | ) |

Average tangible shareholders' equity (denominator) | | $ | 1,505,210 |

| | $ | 1,520,256 |

| | $ | 1,491,265 |

| | $ | 1,495,265 |

| | $ | 1,539,215 |

|

Return on average common shareholders' equity (tangible), annualized | | 10.16 | % | | 9.96 | % | | 9.11 | % | | 10.01 | % | | 10.31 | % |

| | | | | | | | | | | | | | | |

Efficiency ratio | | | | | | | | | | | | | |

Non-interest expense | | | $ | 118,439 |

| | $ | 117,720 |

| | $ | 124,889 |

| | $ | 480,160 |

| | $ | 459,246 |

|

Less: Intangible amortization | | | (6 | ) | | (315 | ) | | (5 | ) | | (247 | ) | | (1,259 | ) |

Less: Loss on redemption of trust preferred securities | | | — |

| | — |

| | (5,626 | ) | | (5,626 | ) | | — |

|

Numerator | | | $ | 118,433 |

| | $ | 117,405 |

| | $ | 119,258 |

| | $ | 474,287 |

| | $ | 457,987 |

|

| | | | | | | | | | | |

Net interest income (fully taxable equivalent) | | | $ | 132,683 |

| | $ | 132,614 |

| | $ | 130,250 |

| | $ | 518,464 |

| | $ | 532,322 |

|

Plus: Total Non-interest income | | | 45,839 |

| | 42,101 |

| | 44,774 |

| | 181,839 |

| | 167,379 |

|

Less: Investment securities gains | | | (776 | ) | | (848 | ) | | (1,730 | ) | | (9,066 | ) | | (2,041 | ) |

Denominator | | | $ | 177,746 |

| | $ | 173,867 |

| | $ | 173,294 |

| | $ | 691,237 |

| | $ | 697,660 |

|

Efficiency ratio | | | 66.63 | % | | 67.53 | % | | 68.82 | % | | 68.61 | % | | 65.65 | % |

| | | | | | | | | | | | | | | |

Non-performing assets to tangible common shareholders' equity and allowance for credit losses | | | | | | |

Non-performing assets (numerator) | | | $ | 155,913 |

| | $ | 150,504 |

| | $ | 155,582 |

| | | | |

| | | | | | | | | | | |

Tangible shareholders' equity | | | $ | 1,510,338 |

| | $ | 1,464,862 |

| | $ | 1,494,342 |

| | | | |

Plus: Allowance for credit losses | | | 171,412 |

| | 185,931 |

| | 169,395 |

| | | | |

Tangible shareholders' equity and allowance for credit losses (denominator) | $ | 1,681,750 |

| | $ | 1,650,793 |

| | $ | 1,663,737 |

| | | | |

Non-performing assets to tangible common shareholders' equity and allowance for credit losses | 9.27 | % | | 9.12 | % | | 9.35 | % | | | | |

| | | | | | | | | | | | | | | |

D A T A A S O F D E C E M B E R 3 1 , 2 0 1 5 U N L E S S O T H E R W I S E N O T E D 2015 AND FOURTH QUARTER RESULTS

FORWARD-LOOKING STATEMENTS This presentation may contain forward-looking statements with respect to Fulton Financial Corporation’s financial condition, results of operations and business. Do not unduly rely on forward-looking statements. Forward-looking statements can be identified by the use of words such as “may,” “should,” “will,” “could,” “estimates,” “predicts,” “potential,” “continue,” “anticipates,” “believes,” “plans,” “expects,” “future,” “intends” and similar expressions which are intended to identify forward-looking statements. Management’s “2016 Outlook” contained herein is comprised of forward-looking statements. Forward-looking statements are not guarantees of future performance and are subject to risks and uncertainties, some of which are beyond the Corporation’s control and ability to predict, that could cause actual results to differ materially from those expressed in the forward-looking statements. The Corporation undertakes no obligation, other than as required by law, to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. A discussion of certain risks and uncertainties affecting the Corporation, and some of the factors that could cause the Corporation’s actual results to differ materially from those described in the forward-looking statements, can be found in the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in the Corporation’s Annual Report on Form 10-K for the year ended December 31, 2014 and Quarterly Reports on Form 10-Q for the quarters ended March 31, 2015, June 30, 2015 and September 30, 2015, which have been filed with the Securities and Exchange Commission and are available in the Investor Relations section of the Corporation’s website (www.fult.com) and on the Securities and Exchange Commission’s website (www.sec.gov). The Corporation uses certain non-GAAP financial measures in this presentation. These non-GAAP financial measures are reconciled to the most comparable GAAP measures at the end of this presentation. 2

2015 HIGHLIGHTS Diluted Earnings Per Share • $0.22 diluted earnings per share in 4Q15, $0.85 YTD Loan and Core Deposit Growth • 3.5% increase in average loans and 8.9% increase in average core deposits • Ending loans increased 5.5% in 2015, with more than 75% of this growth occurring in the last six months of the year Net Interest Income & Margin • Net interest income and net interest margin both decreased modestly during the year • Q4 2015 saw an increase in each compared to Q3 2015 Asset Quality Improvements • Lower provision, lower net charge-offs and lower delinquency Non-Interest Income (Excluding Securities Gain) • Increase of 4.5% in total, with increases across most categories Non-Interest Expenses (Excluding Loss on Redemption of TruPS) • Increase of 3.3% reflecting continued build-out of Compliance, Risk Management & Technology 3

INCOME STATEMENT SUMMARY – ANNUAL COMPARISON Note: ROA is return an average assets determined by dividing net income for the period indicated by average assets (1) Non-GAAP based financial measure. Please refer to the calculation and management’s reasons for using this measure on the slide titled “Non-GAAP Reconciliation” at the end of this presentation. Net Income of $149.5 million, down 5.3% due primarily to lower net interest income and higher non-interest expense, partially offset by lower loan loss provision and higher non-interest income Net Interest Income Net interest income down 2.9% due to margin compression Loan Loss Provision $2.3 million provision in 2015 reflects significant improvements in asset quality Non-Interest Income Increase of 4.5% driven primarily by commercial loan interest rate swap fees, merchant fees, and mortgage banking income Non-Interest Expense Increase of 3.3% largely driven by higher salaries and benefits, data processing and software. 2015 2014 Change Net Interest Income 499,994$ 514,867$ (14,873)$ Loan Loss Provision 2,250 12,500 (10,250) Non-Interest Income 172,773 165,338 7,435 Securities Gains 9,066 2,041 7,025 Non-Interest Expense 474,534 459,246 15,288 Loss on redemption of TruPS 5,626 - 5,626 Income before Income Taxes 199,423 210,500 (11,077) Income Taxes 49,921 52,606 (2,685) Net Income 149,502$ 157,894$ (8,392)$ Per Share (Diluted) 0.85$ 0.84$ 0.01$ ROA 0.86% 0.93% (0.07%) ROE (tangible) (1) 10.01% 10.31% (0.30%) Efficiency rati (1) 68.61% 65.65% 2.96% (dollars in thousands, except per-share data) 4

INCOME STATEMENT SUMMARY – QUARTERLY COMPARISON Net Income of $38.5 million; a 12.5% increase from 3Q15 and a 1.5% increase from 4Q14 Net Interest Income From 3Q15: Increase of 1.7% due to a 1.5% increase in average earning assets and a 1 bp improvement in net interest margin (NIM) From 4Q14: Remained unchanged due to 12 bps decline in NIM, being partially offset by 3.7% increase in average earning assets Loan Loss Provision $2.8 million provision in 4Q15 due primarily to growth in the loan portfolio Non-Interest Income From 3Q15: Increase of 4.7% driven by increases in commercial loan interest rate swap fees and debit card income From 4Q14: Increase of 9.2% due to increase in commercial loan interest rate swap fees, service charges on deposits and mortgage banking income Non-Interest Expenses $5.6 million loss on redemption of trust preferred securities (TruPS) in Q315; excluding this loss: From 3Q15: Decrease of 0.7% due to lower other outside service fees From 4Q14: Increase of 0.6% Note: ROA is return an average assets determined by dividing net income for the period indicated by average assets (1) Non-GAAP based financial measure. Please refer to the calculation and management’s reasons for using this measure on the slide titled “Non-GAAP Reconciliation” at the end of this presentation. Q4 2015 Q3 2015 Change Net Interest Income 127,799$ 125,694$ 2,105$ Provision for Credit Losses 2,750 1,000 1,750 Non-Interest Income 45,063 43,044 2,019 Securities Gains 776 1,730 (954) Non-Interest Expense 118,439 119,263 (824) Loss on redemption of TruPS - 5,626 (5,626) Income before Income Taxes 52,449 44,579 7,870 Income Taxes 13,914 10,328 3,586 Net Income 38,535$ 34,251$ 4,284$ Per Share (Diluted) 0.22$ 0.20$ 0.02$ ROA 0.86% 0.78% 0.08% ROE (tangible) (1) 10.16% 9.11% 1.05% Efficiency ratio ( ) 66.63% 68.82% (2.19%) (dollars in thousands, except per-share data) 5

NET INTEREST INCOME AND MARGIN – QUARTER COMPARISON Net Interest Income & Net Interest Margin ~ $730 million ~ $610 million $128.0 $123.6 $122.9 $125.7 $127.8 3.31% 3.27% 3.20% 3.18% 3.19% 0.0% 0.5% 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% $- $20.0 $40.0 $60.0 $80.0 $100.0 $120.0 $140.0 Q4 2014 Q1 2015 Q2 2015 Q3 2015 Q4 2015 Net Interest Income Net Interest Margin (Fully-taxable equivalent basis, or FTE) Average Interest-Earning Assets & Yields Average Liabilities & Rates $2.9 $2.8 $2.8 $2.9 $2.8 $13.1 $13.1 $13.2 $13.4 $13.7 3.85% 3.83% 3.74% 3.68% 3.67% 0.0% 2.0% 4.0% $- $3.0 $6.0 $9.0 $12.0 $15.0 $18.0 Q4 2014 Q1 2015 Q2 2015 Q3 2015 Q4 2015 Securities & Other Loans Earning Asset Yield (FTE) $13.3 $13.4 $13.5 $13.9 $14.2 $1.5 $1.4 $1.4 $1.3 $1.2 0.76% 0.80% 0.77% 0.72% 0.69% 0.5% 0.7% 0.9% $- $3.0 $6.0 $9.0 $12.0 $15. Q4 2014 Q1 2015 Q2 2015 Q3 2015 Q4 2015 Deposits Borrowings Cost of Interest-bearing Liabilit ies ($ IN MILLIONS) ($ IN BILLIONS) ($ IN BILLIONS) 6

ASSET QUALITY – ANNUAL COMPARISON ($ IN MILLIONS) Provision for Credit Losses Non-Performing Loans (NPLs) & NPLs to Loans Net Charge-offs (NCOs) and NCOs to Average Loans Allowance for Credit Losses (Allowance) to NPLs & Loans 7

NON-INTEREST INCOME – QUARTER COMPARISON ($ IN MILLIONS) Non-interest Income, Excluding Securities Gains ~ $730 million ~ $610 million $41.3 $40.6 $44.1 $43.0 $45.1 $- $5.0 $10.0 $15.0 $20.0 $25.0 $30.0 $35.0 $40.0 $45.0 $50.0 Q4 2014 Q1 2015 Q2 2015 Q3 2015 Q4 2015 Mortgage Banking Income & Spreads Other Non-interest Income 1.03% 1.11% 1.62% 1.17% 1.60% 0.0% 0.5% 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% 4.0% $- $1.0 $2.0 $3.0 $4.0 $5.0 $6.0 Q4 2014 Q1 2015 Q2 2015 Q3 2015 Q4 2015 Gains on Sales Servicing Income Spread on Sales (1) $3.7 $4.7 $5.3 $3.9 $4.3 $- $5.0 $10.0 $15.0 $20.0 $25.0 $30.0 $35.0 $40.0 $45.0 Q4 2014 Q1 2015 Q2 2015 Q3 2015 Q4 2015 Invt Mgmt & Trust Srvs Deposit Srv Chgs Oth Srv Chgs Other $37.5 $35.9 $38.7 $39.2 $40.7 (1) Represents Gains on Sales divided by total commitments to originate residential mortgage loans for customers. 8

NON-INTEREST EXPENSES – QUARTER COMPARISON ($ IN MILLIONS) Non-interest Expense & Efficiency Ratio (1) ~ $730 million ~ $610 million $117.7 $118.5 $118.4 $119.3 $118.4 67.5% 70.2% 68.9% 68.8% 66.6% 0.0% 10.0% 20.0% 30.0% 40.0% 50.0% 60.0% 70.0% 80.0% $- $20.0 $40.0 $60.0 $80.0 $100.0 $120.0 $140.0 Q4 2014 Q1 2015 Q2 2015 Q3 2015 Q4 2015 Salaries and Employee Benefits & Staffing Other Non-interest Expenses 3,520 3,460 - 2,000 4,000 6,000 $- $10.0 $20.0 $30.0 $40.0 $50.0 $60.0 $70.0 Q4 2014 Q1 2015 Q2 2015 Q3 2015 Q4 2015 Total Salaries Employee Benefits Average Full-time Equivalent Employees $65.4 $65.0 $65.1 $65.3 $65.5 $- $10.0 $20.0 $30.0 40.0 $50.0 $60.0 Q4 2014 Q1 2015 Q2 2015 Q3 2015 Q4 2015 Occp & Equip Data Processing & Software Outside Srvs Other $52.3 $53.5 $53.3 $54.0 $52.9 (1) Non-GAAP based financial measure. Please refer to the calculation and management’s reasons for using this measure on the slide titled “Non- GAAP Reconciliation” at the end of this presentation. 9

COMPLIANCE & RISK MANAGEMENT $1.8 $2.1 $3.2 $4.3 $4.6 $1.4 $8.2 $4.8 $0.4 $1.5 13 26 30 45 47 0 5 10 15 20 25 30 35 40 45 50 $- $3.0 $6.0 $9.0 $12.0 2011 2012 2013 2014 2015 (Projected) Salaries & Benefits Expense Outside Consulting Services# Temporary Employee Expense Staffing $0.8 YTD Sep 15: $3.1 YTD Sep 15: $3.9 $0.1 YTD Sep 15: $1.1 # Represents third-party consulting and legal services directly related to BSA/AML compliance program. 2015 and 2014 exclude $0.7 million and $0.6 million, respectively, of capitalized software costs. To tal A n n u al E xp e n ses , in m ill io n s • Strengthening Risk Management and Compliance infrastructures • Address deficiencies within BSA/AML compliance • BSA/AML enforcement actions at the Corporation and banking subsidiaries • Significant investments in personnel, outside services and systems BSA/AML Compliance Program Expenses and Staffing To tal N u m b e r o f Em p lo ye e s at Pe rio d En d $1.8 $2.1 $3.2 $4.3 $4.6 $1.4 $8.2 $4.5 $0.4 $1.4 13 26 30 45 47 0 5 10 15 20 25 30 35 40 45 50 $- $3.0 $6.0 $9.0 $12.0 2011 2012 2013 2014 2015 Salaries & Benefits Expense Outside Consulting Services# Temporary Employee Expense Staffing $0.8$0.1 10

PROFITABILITY & CAPITAL – ANNUAL COMPARISON ROA ROE (tangible) (1) Tangible Common Equity Ratio (1) Diluted Earnings Per Common Share Note: ROA is return an average assets determined by dividing net income for the period indicated by average assets (1) Non-GAAP based financial measure. Please refer to the calculation and management’s reasons for using this measure on the slide titled “Non-GAAP Reconciliation” at the end of this presentation. 9.7% 9.3% 8.8% 8.7% 0.0% 4.0% 8.0% 12.0% 2012 2013 2014 2015 11

2016 OUTLOOK • Loans & Deposits: Annual average growth rate in the mid- to high-single digits • Net Interest Margin: Stable on an annual basis, with modest volatility (+/- 0 to 3 basis points) on a quarterly basis • Asset Quality: Provision driven primarily by loan growth • Non-Interest Income (Excluding Securities Gain): Mid- to high-single digit growth rate • Non-Interest Expense (Excluding Loss on Redemption of TruPS): Low- to mid- single digit growth rate • Capital: Focus on utilizing capital to support growth and provide appropriate returns to our shareholders 12

NON-GAAP RECONCILIATION D ec 31, Sep 30, Jun 30, M ar 31, D ec 31, 2015 2015 2015 2015 2014 2015 2014 Eff iciency rat io Non-interest expense 118,439$ 124,889$ 118,354$ 118,478$ 117,720$ 480,160$ 459,246$ Less: Intangible amortization (6) (5) (106) (130) (315) (247) (1,259) Less: Loss on redemption of trust preferred securities - (5,626) - - - (5,626) Numerator 118,433$ 119,258$ 118,248$ 118,348$ 117,405$ 474,287$ 457,987$ Net interest income (fully taxable equivalent) 132,684$ 130,250$ 127,444$ 128,085$ 132,614$ 518,464$ 532,322$ P lus: Total Non-interest income 45,839 44,774 46,489 44,737 42,101 181,839 167,379 Less: Investment securities (gains) losses (776) (1,731) (2,415) (4,145) (848) (9,066) (2,041) Denominator 177,747$ 173,293$ 171,518$ 168,677$ 173,867$ 691,237$ 697,660$ Efficiency ratio 66.63% 68.82% 68.94% 70.16% 67.53% 68.61% 65.65% D ec 31, Sep 30, 2015 2015 2015 2014 2013 2012 (dollars in thousands) R eturn o n A verage Shareho lders' Equity (R OE) (T angible) Net income 38,535$ 34,251$ 149,502$ 157,894$ 161,840$ 159,845$ P lus: Intangible amortization, net of tax 4 3 161 818 1,585 1,970 Numerator 38,539$ 34,254$ 149,663$ 158,712$ 163,425$ 161,815$ Average shareholders' equity 2,036,769$ 2,022,829$ 2,026,883$ 2,071,640$ 2,053,821$ 2,050,994$ Less: Average goodwill and intangible assets (531,559) (531,564) (531,618) (532,425) (534,431) (542,600) Average tangible shareholders' equity (denominator) 1,505,210$ 1,491,265$ 1,495,265$ 1,539,215$ 1,519,390$ 1,508,394$ Return on average common shareholders' equity (tangible), annualized 10.16% 9.11% 10.01% 10.31% 10.76% 10.73% Year Ended D ec 31, (dollars in thousands) T hree M o nths Ended T hree M o nths Ended Year Ended D ec 31, Note: The Corporation has presented the following non-GAAP (Generally Accepted Accounting Principles) financial measures because it believes that these measures provide useful and comparative information to assess trends in the Corporation's results of operations and financial condition. Presentation of these non-GAAP financial measures is consistent with how the Corporation evaluates its performance internally and these non- GAAP financial measures are frequently used by securities analysts, investors and other interested parties in the evaluation of companies in the Corporation's industry. Investors should recognize that the Corporation's presentation of these non-GAAP financial measures might not be comparable to similarly-titled measures of other companies. These non-GAAP financial measures should not be considered a substitute for GAAP basis measures and the Corporation strongly encourages a review of its condensed consolidated financial statements in their entirety. 13

NON-GAAP RECONCILIATION (CON’T) D ec 31, D ec 31, D ec 31, D ec 31, 2015 2014 2013 2012 T angible C o mmo n Equity to T angible A ssets (T C E R atio ) Shareholders' equity 2,037,214$ 1,996,665$ 2,063,187$ 2,081,656$ Less: Intangible assets (531,556) (531,803) (533,076) (535,563) Tangible shareholders' equity (numerator) 1,505,658$ 1,464,862$ 1,530,111$ 1,546,093$ Total assets 17,917,139$ 17,124,767$ 16,934,634$ 16,533,097$ Less: Intangible assets (531,556) (531,803) (533,076) (535,563) Total tangible assets (denominator) 17,385,583$ 16,592,964$ 16,401,558$ 15,997,534$ Tangible Common Equity to Tangible Assets 8.66% 8.83% 9.33% 9.66% (dollars in thousands) 14

www.fult.com

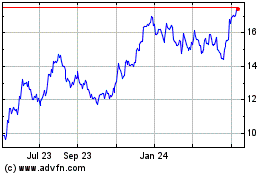

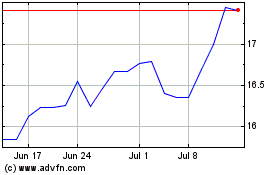

Fulton Financial (NASDAQ:FULT)

Historical Stock Chart

From Aug 2024 to Sep 2024

Fulton Financial (NASDAQ:FULT)

Historical Stock Chart

From Sep 2023 to Sep 2024