Delta Surpasses United for No. 2 Airline Spot by Traffic

January 12 2016 - 3:00PM

Dow Jones News

Delta Air Lines Inc. nosed ahead of United Continental Holdings

Inc. in 2015 to become the nation's No. 2 airline based on newly

released traffic figures for the year, adding a flourish to the

Atlanta-based carrier's strong performance in recent years.

Delta said it ended the year with 209.6 billion miles flown by

paying passengers, up 3.3% from the prior year. That put it behind

American Airlines Group Inc., which on Tuesday reported its traffic

rose 2.4% to 223 billion revenue-passenger miles in 2015. United

came in at 208.6 billion revenue-passenger miles, up 1.5% from

2014. The figures include regional-carrier partners flying under

the airlines' brands.

United has been one of the most cautious carriers about boosting

its capacity in recent years, and has been consumed with trying to

finish integrating its operations and workforce after its 2010

merger. United said it is "continuing to focus on running a

reliable operation and investing in the tools and services that

allow us to deliver the flier-friendly experience our customers

deserve and expect." Delta declined to comment on its higher

ranking.

Traffic—the number of passengers multiplied by the miles they

flew—is widely used to compare airlines. Rankings differ slightly

by other measures, such as the number of passengers carried:

American hauled 201.2 million fliers last year, Delta 179.4

million, Southwest 144.6 million and United 140.4 million. Based on

annual revenue, Delta had already been second after American before

last year, and by market capitalization, Delta ranks first, with a

value of about $37 billion, followed by Southwest Airlines Co. at

$27 billion.

Traffic volume doesn't necessarily translate into profit,

although all the U.S. carriers for now are posting record results

on sharply lower fuel expenses, conservative capacity additions and

a gush of revenue from charging for things such as checked luggage,

priority boarding, Wi-Fi service and food.

Delta had become first by traffic among U.S. airlines after its

2008 merger with Northwest Airlines. But it lost that crown in 2010

when United bolstered its size by merging with Continental

Airlines. American, after its combination with US Airways in late

2013, retook the top honors in 2014.

Southwest, the nation's largest discounter, has long cruised in

fourth place, despite its 2011 acquisition of AirTran Airways. It

has no regional partners. Last year, Southwest racked up 117.5

billion revenue-passenger miles, up 8.8%.

The four largest U.S. carriers control more than 80% of domestic

capacity because of the recent mergers. The three biggest also have

extensive international operations, with United leading the

pack.

The rest of the U.S. airlines are much smaller, with JetBlue

Airways Corp. and Alaska Airlines Group Inc., generally the largest

of that group by traffic. Smaller still are Hawaiian Holdings Inc.,

Virgin America Inc., Spirit Airlines Inc., Frontier Airlines and

Allegiant Travel Co.

Write to Susan Carey at susan.carey@wsj.com

(END) Dow Jones Newswires

January 12, 2016 14:45 ET (19:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

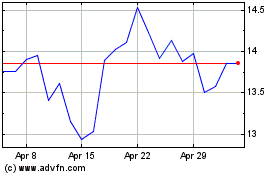

American Airlines (NASDAQ:AAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

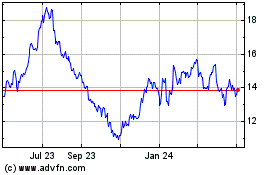

American Airlines (NASDAQ:AAL)

Historical Stock Chart

From Apr 2023 to Apr 2024