UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

______________

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

DATE OF REPORT (Date of earliest event reported): July 30, 2015

______________

InterDigital, Inc.

(Exact name of registrant as specified in charter)

|

| | |

Pennsylvania | 1-33579 | 23-1882087 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

|

| |

200 Bellevue Parkway, Suite 300, Wilmington, DE | 19809 |

(Address of Principal Executive Offices) | (Zip Code) |

Registrant's telephone number, including area code: 302-281-3600

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

q Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

q Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

q Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17

CFR 240.14d-2(b))

q Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17

CFR 240.13e-4(c))

| |

Item 2.02. | Results of Operations and Financial Condition. |

On July 30, 2015, InterDigital, Inc. issued a press release announcing its results of operations and financial condition for the fiscal quarter ended June 30, 2015. A copy of the press release is attached hereto as Exhibit 99.1.

InterDigital, Inc. does not intend for this Item 2.02 or Exhibit 99.1 to be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 or to be incorporated by reference into filings under the Securities Act of 1933, as amended.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

|

| | |

99.1 |

| InterDigital, Inc. press release dated July 30, 2015. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

INTERDIGITAL, INC. |

|

|

By: /s/ Jannie K. Lau |

Jannie K. Lau |

Executive Vice President, |

General Counsel and Secretary |

Dated: July 30, 2015

EXHIBIT INDEX

Exhibit No. Description

99.1 InterDigital, Inc. press release dated July 30, 2015.

INTERDIGITAL SECOND QUARTER 2015 FINANCIAL RESULTS DRIVEN BY

23% INCREASE IN RECURRING REVENUE

WILMINGTON, DE.—July 30, 2015—InterDigital, Inc. (NASDAQ: IDCC), a mobile technology research and development company, today announced results for the second quarter ended June 30, 2015.

Second Quarter 2015 Financial Highlights

| |

• | Second quarter 2015 recurring revenue was $91.2 million, consisting of current patent royalties and current technology solutions revenue, representing an increase of 23% compared to recurring revenue of $74.3 million in second quarter 2014. This increase in recurring revenue is primarily attributable to an increase in per-unit royalties related to an increase in shipments by Pegatron and our other Taiwan-based licensees. |

| |

• | Total revenue was $118.6 million, compared to $194.2 million in second quarter 2014. Second quarter 2014 benefited from past patent royalties of $119.9 million, primarily related to new patent license agreements signed during that quarter, including with Samsung Electronics Co., Ltd. (“Samsung”). Second quarter 2015 included $27.3 million of past patent royalties as a result of the previously announced settlement with Arima Communications Corporation (“Arima”). |

| |

• | Second quarter 2015 operating expenses were $60.0 million, compared to $65.9 million in second quarter 2014. The decrease was driven primarily by a $10.8 million decrease in performance-based incentive compensation. |

| |

• | Net income1 was $32.6 million, or $0.89 per diluted share, compared to net income of $78.9 million, or $1.93 per diluted share, in second quarter 2014. |

| |

• | In second quarter 2015, the company generated $17.0 million of free cash flow3 compared to $23.7 million generated in second quarter 2014. Ending cash and short-term investments totaled $907.6 million. |

| |

• | During second quarter 2015, the company repurchased 0.4 million shares of common stock for $19.8 million. In addition, from July 1, 2015 through July 29, 2015, the company repurchased an additional 12,000 shares at a cost of $0.7 million. In June 2015, the company's Board of Directors authorized a $100 million increase to the current stock repurchase program, bringing it to $400 million. Since initiating this stock repurchase program in June 2014, the company has repurchased a total of 4.9 million shares for $223.9 million, representing approximately 14% of the company's shares outstanding at the time the program was authorized. |

“Building on a number of years of success, the second quarter saw us again drive strong revenue, profit and positive cash flow, underscoring the value of our focus on developing fundamental technologies used broadly across the mobile wireless industry,” said William J. Merritt, President and CEO of InterDigital. “Our recent announcements regarding key research projects worldwide highlight InterDigital’s continuing efforts to pioneer future mobile technologies and contribute those technologies to worldwide standards, while growing our customer base and market share.”

Additional Financial Highlights for Second Quarter 2015

| |

• | The $5.9 million decrease in operating expenses was primarily due to the $10.8 million decrease in performance-based incentive compensation. The higher performance-based incentive compensation in second quarter 2014 was primarily related to increased accrual rates as a result of new license agreements signed during that quarter. The decrease in operating expenses was partially offset by a $2.5 million increase in commercial initiatives expense, which was primarily attributable to research and development activities to commercialize our IoT and next generation networks technologies. |

| |

• | Companies that accounted for ten percent or more of second quarter 2015 total revenue were Pegatron Corporation (30%), Arima Communications Corporation (23%) and Samsung Electronics Co., Ltd. (15%). |

| |

• | The company's second quarter effective tax rate was approximately 37.1% as compared to 37.4% during second quarter 2014, based on the statutory federal tax rate net of discrete federal and state taxes. |

Conference Call Information

InterDigital will host a conference call on Thursday, July 30, 2015 at 10:00 a.m. Eastern Time to discuss its second quarter 2015 financial performance and other company matters. For a live Internet webcast of the conference call, visit www.interdigital.com,click on the link to the Investors section, and follow the link under Events and Presentations. The company encourages participants to take advantage of the Internet option.

For telephone access to the conference, call (888) 802-2225 within the United States or (913) 312-1254 from outside the United States. Please call by 9:50 a.m. ET on July 30 and give the operator Conference ID number 5730502.

An Internet replay of the conference call will be available on InterDigital's website in the Investors section. In addition, a telephone replay will be available from 1:00 p.m. ET July 30 through 1:00 p.m. ET August 4. To access the recorded replay, call (888) 203-1112 or (719) 457-0820 and use the replay code 5730502.

About InterDigital®

InterDigital develops wireless technologies that are at the core of mobile devices, networks, and services worldwide. We solve many of the industry's most critical and complex technical challenges, inventing solutions for more efficient broadband networks and a richer multimedia experience years ahead of market deployment. InterDigital has licenses and strategic relationships with many of the world's leading wireless companies. Founded in 1972, InterDigital is listed on NASDAQ and is included in the S&P MidCap 400® index.

InterDigital is a registered trademark of InterDigital, Inc.

For more information, visit the InterDigital website: www.interdigital.com.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended. Such statements include information regarding our current beliefs, plans and expectations, including, without limitation, our plans to continue our efforts to pioneer future mobile technologies and contribute those technologies to worldwide standards, while growing our customer base and market share. Words such as "believe," “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “forecast,” and variations of any such words or similar expressions are intended to identify such forward-looking statements.

Forward-looking statements are subject to risks and uncertainties. Actual outcomes could differ materially from those expressed in or anticipated by such forward-looking statements due to a variety of factors, including, without limitation, those identified in this press release, as well as the following: (i) unanticipated delays, difficulties or acceleration in the execution of patent license agreements; (ii) our ability to leverage our strategic relationships and secure new patent license agreements on acceptable terms; (iii) our ability to enter into sales and/or licensing partnering arrangements for certain of our patent assets; (iv) our ability to enter into partnerships with leading inventors and research organizations and identify and acquire technology and patent portfolios that align with InterDigital’s roadmap; (v) our ability to commercialize the company’s technologies and enter into customer agreements; (vi) the failure of the markets for the company’s current or new technologies to materialize to the extent or at the rate that we expect; (vii) unexpected delays or difficulties related to the development of the company’s technologies; (viii) changes in the market share and sales performance of our primary licensees, delays in product shipments of our licensees, delays in the timely receipt and final reviews of quarterly royalty reports from our licensees, delays in payments from our licensees and related matters; (ix) the resolution of current legal proceedings, including any awards or judgments relating to such proceedings, additional legal proceedings, changes

in the schedules or costs associated with legal proceedings or adverse rulings in such legal proceedings; (x) changes or inaccuracies in market projections; and (xi) changes in the company’s business strategy.

We undertake no duty to update publicly any forward-looking statement, whether as a result of new information, future events or otherwise, except as may be required by applicable law, regulation or other competent legal authority.

Footnotes

1 Throughout this press release, net income (loss) and diluted earnings per share ("EPS") are attributable to InterDigital, Inc. (e.g., after adjustments for noncontrolling interests), unless otherwise stated.

2 Free cash flow is a supplemental non-GAAP financial measure that InterDigital believes is helpful in evaluating the company's ability to invest in its business, make strategic acquisitions and fund share repurchases, among other things. A limitation of the utility of free cash flow as a measure of financial performance is that it does not represent the total increase or decrease in the company's cash balance for the period. InterDigital defines “free cash flow” as net cash provided by operating activities less purchases of property and equipment, technology licenses and investments in patents. InterDigital's computation of free cash flow might not be comparable to free cash flow reported by other companies. The presentation of this financial information, which is not prepared under any comprehensive set of accounting rules or principles, is not intended to be considered in isolation or as a substitute for the financial information prepared and presented in accordance with GAAP. A detailed reconciliation of free cash flow to net cash provided by operating activities, the most directly comparable GAAP financial measure, is provided at the end of this press release.

SUMMARY CONSOLIDATED STATEMENTS OF OPERATIONS

(dollars in thousands except per share data)

(unaudited)

|

| | | | | | | | | | | | | | | |

| For the Three Months Ended June 30, | | For the Six Months Ended June 30, |

| 2015 | | 2014 | | 2015 | | 2014 |

REVENUES: | | | | | | | |

Per-unit royalty revenue | $ | 55,989 |

| | $ | 33,916 |

| | $ | 131,572 |

| | $ | 70,404 |

|

Fixed fee amortized royalty revenue | 33,373 |

| | 38,250 |

| | 66,746 |

| | 55,186 |

|

Current patent royalties | 89,362 |

| | 72,166 |

| | 198,318 |

| | 125,590 |

|

Past patent royalties | 27,260 |

| | 119,922 |

| | 27,277 |

| | 120,772 |

|

Total patent licensing royalties | 116,622 |

| | 192,088 |

| | 225,595 |

| | 246,362 |

|

Current technology solutions revenue | 1,845 |

| | 2,146 |

| | 3,250 |

| | 4,916 |

|

Past technology solutions revenue | 84 |

| | — |

| | 84 |

| | 800 |

|

| $ | 118,551 |

| | $ | 194,234 |

| | $ | 228,929 |

| | $ | 252,078 |

|

| | | | | | | |

OPERATING EXPENSES: | | | |

| | | | |

Patent administration and licensing | 31,212 |

| | 31,272 |

| | 62,837 |

| | 64,966 |

|

Development | 18,326 |

| | 22,901 |

| | 36,317 |

| | 38,788 |

|

Selling, general and administrative | 10,435 |

| | 11,689 |

| | 19,953 |

| | 19,993 |

|

| 59,973 |

| | 65,862 |

| | 119,107 |

| | 123,747 |

|

| | | | | | | |

Income from operations | 58,578 |

| | 128,372 |

| | 109,822 |

| | 128,331 |

|

| | | | | | | |

OTHER EXPENSE (NET) | (7,746 | ) | | (3,602 | ) | | (12,982 | ) | | (7,566 | ) |

Income before income taxes | 50,832 |

| | 124,770 |

| | 96,840 |

| | 120,765 |

|

INCOME TAX PROVISION | (18,877 | ) | | (46,658 | ) | | (36,553 | ) | | (45,208 | ) |

NET INCOME | $ | 31,955 |

| | $ | 78,112 |

| | $ | 60,287 |

| | $ | 75,557 |

|

Net loss attributable to noncontrolling interest | (647 | ) | | (789 | ) | | (1,380 | ) | | (1,483 | ) |

NET INCOME ATTRIBUTABLE TO INTERDIGITAL, INC. | $ | 32,602 |

| | $ | 78,901 |

| | $ | 61,667 |

| | $ | 77,040 |

|

NET INCOME PER COMMON SHARE — BASIC | $ | 0.91 |

| | $ | 1.95 |

| | $ | 1.69 |

| | $ | 1.90 |

|

WEIGHTED AVERAGE NUMBER OF COMMON SHARES OUTSTANDING — BASIC | 36,022 |

| | 40,443 |

| | 36,486 |

| | 40,444 |

|

NET INCOME PER COMMON SHARE — DILUTED | $ | 0.89 |

| | $ | 1.93 |

| | $ | 1.67 |

| | $ | 1.90 |

|

WEIGHTED AVERAGE NUMBER OF COMMON SHARES OUTSTANDING — DILUTED | 36,442 |

| | 40,822 |

| | 36,883 |

| | 40,643 |

|

CASH DIVIDENDS DECLARED PER COMMON SHARE | $ | 0.20 |

| | $ | 0.20 |

| | $ | 0.40 |

| | $ | 0.30 |

|

Note: Certain reclassifications have been made to prior period amounts to conform to the current period presentation.

SUMMARY CONSOLIDATED CASH FLOWS

(dollars in thousands)

(unaudited)

|

| | | | | | | | | | | | | | | |

| For the Three Months Ended June 30, | | For the Six Months Ended June 30, |

| 2015 | | 2014 | | 2015 | | 2014 |

Income before income taxes | $ | 50,832 |

| | $ | 124,770 |

| | $ | 96,840 |

| | $ | 120,765 |

|

Taxes paid | (24,050 | ) | | (12,424 | ) | | (36,764 | ) | | (22,823 | ) |

Non-cash expenses | 20,763 |

| | 19,213 |

| | 39,022 |

| | 33,178 |

|

Increase in deferred revenue | 18,273 |

| | 242,361 |

| | 90,776 |

| | 256,859 |

|

Deferred revenue recognized | (41,865 | ) | | (47,701 | ) | | (86,022 | ) | | (74,336 | ) |

Increase (decrease) in operating working capital, deferred charges and other | 1,342 |

| | (293,079 | ) | | (76,786 | ) | | (283,362 | ) |

Capital spending and capitalized patent costs | (8,255 | ) | | (9,475 | ) | | (17,520 | ) | | (18,578 | ) |

FREE CASH FLOW | 17,040 |

| | 23,665 |

| | 9,546 |

| | 11,703 |

|

| | | | | | | |

Tax benefit from share-based compensation | 624 |

| | 66 |

| | 2,163 |

| | 1,196 |

|

Acquisition of patents | — |

| | (25,275 | ) | | (20,000 | ) | | (25,275 | ) |

Proceeds from noncontrolling interests | 1,276 |

| | 1,275 |

| | 2,551 |

| | 2,550 |

|

Dividends paid | (7,232 | ) | | (4,045 | ) | | (14,665 | ) | | (8,088 | ) |

Share repurchases | (19,841 | ) | | (8,454 | ) | | (70,572 | ) | | (8,454 | ) |

Proceeds from other financing activities | 4,500 |

| | — |

| | 4,500 |

| | — |

|

Proceeds from issuance of convertible senior notes | — |

| | — |

| | 316,000 |

| | — |

|

Purchase of convertible bond hedge | — |

| | — |

| | (59,376 | ) | | — |

|

Proceeds from issuance of warrants | — |

| | — |

| | 42,881 |

| | — |

|

Payment of debt issuance costs | — |

| | — |

| | (9,403 | ) | | — |

|

Net proceeds from exercise of stock options | 26 |

| | 10 |

| | 26 |

| | 353 |

|

Unrealized loss on short-term investments | 21 |

| | 1,067 |

| | 16 |

| | 466 |

|

NET (DECREASE) INCREASE IN CASH AND SHORT-TERM INVESTMENTS | $ | (3,586 | ) | | $ | (11,691 | ) | | $ | 203,667 |

| | $ | (25,549 | ) |

CONDENSED CONSOLIDATED BALANCE SHEETS

(dollars in thousands)

(unaudited)

|

| | | | | | | |

| JUNE 30, 2015 | | DECEMBER 31, 2014 |

ASSETS | |

| | |

|

Cash & short-term investments | $ | 907,595 |

| | $ | 703,928 |

|

Accounts receivable (net) | 108,717 |

| | 51,702 |

|

Current deferred tax assets | 68,409 |

| | 54,019 |

|

Other current assets | 32,473 |

| | 32,227 |

|

Property & equipment and patents (net) | 271,183 |

| | 278,086 |

|

Other long-term assets (net) | 72,745 |

| | 73,000 |

|

TOTAL ASSETS | $ | 1,461,122 |

| | $ | 1,192,962 |

|

| | | |

LIABILITIES AND SHAREHOLDERS’ EQUITY | | | |

Current portion of long-term debt | $ | 221,607 |

| | $ | — |

|

Accounts payable, accrued liabilities, taxes payable & dividends payable | 66,548 |

| | 80,474 |

|

Current deferred revenue | 110,198 |

| | 124,695 |

|

Long-term deferred revenue | 312,592 |

| | 293,342 |

|

Long-term debt & other long-term liabilities | 257,346 |

| | 218,774 |

|

TOTAL LIABILITIES | 968,291 |

| | 717,285 |

|

TOTAL INTERDIGITAL, INC. SHAREHOLDERS' EQUITY | 484,311 |

| | 468,328 |

|

Noncontrolling interest | 8,520 |

| | 7,349 |

|

TOTAL EQUITY | 492,831 |

| | 475,677 |

|

TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | $ | 1,461,122 |

| | $ | 1,192,962 |

|

RECONCILIATION OF FREE CASH FLOW TO NET CASH

PROVIDED BY OPERATING ACTIVITIES

In the summary consolidated cash flows and throughout this release, the company refers to free cash flow. The table below presents a reconciliation of this non-GAAP financial measure to net cash provided by operating activities, the most directly comparable GAAP financial measure.

|

| | | | | | | | | | | | | | | | |

| | For the Three Months Ended June 30, | | For the Six Months Ended June 30, |

| | 2015 | | 2014 | | 2015 | | 2014 |

Net cash provided by operating activities | | $ | 25,295 |

| | $ | 33,140 |

| | $ | 27,066 |

| | $ | 30,281 |

|

Purchases of property, equipment, & technology licenses | | (491 | ) | | (246 | ) | | (1,329 | ) | | (1,466 | ) |

Capitalized patent costs | | (7,764 | ) | | (9,229 | ) | | (16,191 | ) | | (17,112 | ) |

Free cash flow | | $ | 17,040 |

| | $ | 23,665 |

| | $ | 9,546 |

| | $ | 11,703 |

|

|

| |

CONTACT: | InterDigital, Inc.: |

| Patrick Van de Wille |

| patrick.vandewille@interdigital.com |

| +1 (858) 210-4814 |

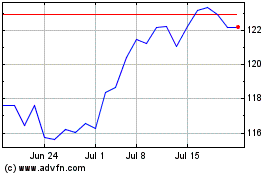

InterDigital (NASDAQ:IDCC)

Historical Stock Chart

From Mar 2024 to Apr 2024

InterDigital (NASDAQ:IDCC)

Historical Stock Chart

From Apr 2023 to Apr 2024