UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C.

20549

Form SD

SPECIALIZED

DISCLOSURE REPORT

Wabash National

Corporation

(Exact Name of Registrant

as Specified in Charter)

| Delaware | |

1-10883 | |

52-1375208 |

| (State or Other Jurisdiction | |

(Commission File No.) | |

(I.R.S. Employer |

| of Incorporation) | |

| |

Identification Number) |

| 1000 Sagamore Parkway South, Lafayette,

Indiana |

47905 |

| (Address of Principal Executive Offices) |

(Zip Code) |

765-771-5300

(Registrant’s

telephone number, including area code)

Check the appropriate box to indicate the rule pursuant

to which this form is being filed, and provide the period to which the information in this form applies:

| √ | Rule

13p-1 under the Securities Exchange Act (17 CFR 240.13p-1) for the reporting period from

January 1 to December 31, 2014. |

Section 1 - Conflict Minerals Disclosure

Items 1.01 Conflict Minerals Disclosure and Report,

Exhibits

A copy of Wabash National Corporation’s

Conflict Minerals Report is provided as Exhibit 1.01 hereto and is publicly available at www.wabashnational.com.

Item 1.02 Exhibit

As specified in this Form SD,

Wabash National Corporation is hereby filing its Conflict Minerals Report as Exhibit 1.01.

Section 2 - Exhibits

Exhibits 1.01 - Conflict Minerals Report as required by Item

1.01 of this Form.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto

duly authorized.

| |

|

WABASH NATIONAL CORPORATION |

|

| |

|

|

|

|

| Date: May 28, 2015 |

|

By: |

/s/

Jeffery L. Taylor

|

|

| |

|

|

Jeffery L. Taylor |

|

| |

|

|

|

Senior Vice President and Chief Financial

Officer |

|

Exhibit 1.01

Wabash National Corporation

Conflict Minerals Report

For The Year Ended December 31, 2014

This report for the year ending December

31, 2014 is presented to comply with Rule 13p-1 under the Securities Exchange Act of 1934 (the “Rule”). The Rule was

adopted by the Securities and Exchange Commission (the “SEC”) to implement reporting and disclosure requirements related

to conflict minerals as directed by the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (the “Dodd-Frank

Act”). The Rule imposes certain reporting obligations on SEC registrants whose manufactured products contain conflict minerals

that are necessary to the functionality or production of their products. “Conflict Minerals” are defined as cassiterite,

columbite-tantalite, gold, wolframite, and their derivatives, which are limited to tin, tantalum, tungsten, and gold (“3TG”).

These requirements apply to registrants whatever the geographic origin of the Conflict Minerals and whether or not they fund armed

conflict.

As described in detail below, following

reasonable due diligence conducted with our supply base into the source and chain of custody of Conflict Minerals in our products,

we are unable with absolute assurance to determine the origin of the Conflict Minerals in our products and therefore cannot exclude

the possibility that some may have originated in the Democratic Republic of the Congo or an adjoining country (the “Covered

Countries”), or from recycled and scrap sources. For that reason, we are required under the Rule to submit to the SEC this

Conflict Minerals Report (“CMR”) as an Exhibit to Form SD. In accordance with the Organization for Economic Cooperation

and Development (the “OECD”) Guidance and the Rule, this report is available on our website at www.wabashnational.com.

This CMR is not audited as the Rule provides that if a registrant’s products are “DRC conflict undeterminable”

in 2013 or 2014, the CMR is not subject to an independent private sector audit.

This report has been prepared by management

of Wabash National Corporation (herein referred to as “Wabash,” the “Company,” “we,” “us,”

or “our”). The information includes the activities of all majority-owned subsidiaries that are required to be consolidated.

Headquartered in Lafayette, Indiana, Wabash National Corporation (NYSE: WNC) is a diversified industrial manufacturer and North

America’s leading producer of semi trailers and liquid transportation systems. Established in 1985, the Company specializes

in the design and production of dry freight vans, refrigerated vans, platform trailers, liquid tank trailers, intermodal equipment,

engineered products, and composite products. Its innovative products are sold under the following brand names: Wabash National®,

Transcraft®, Benson®, DuraPlate®, ArcticLite®, Walker Transport, Walker Defense Group, Walker Barrier Systems,

Walker Engineered Products, Brenner® Tank, Beall®, Garsite, Progress Tank, TST®, Bulk Tank International and Extract

Technology®. To learn more, visit www.wabashnational.com.

Supply chain

Because of our size, the complexity of

our products, and the depth, breadth, and constant evolution of our supply chain, it is difficult to identify entities upstream

from our suppliers who provide us with products and/or raw materials necessary to the functionality or production of our products

(“Direct Suppliers”). As such, we rely heavily on our Direct Suppliers to provide information on the origin of the

Conflict Minerals contained in components and materials supplied to us – including sources of Conflict Minerals that are

supplied to them from lower tier suppliers. Current contracts with most of our key Direct Suppliers, which account for the majority

of our sourced materials, are in effect for multiple year terms, thus we cannot unilaterally impose new contract terms and flow-down

requirements at this time. As we execute new contracts and/or renew contracts, we are requiring affected Direct Suppliers to provide

us with geographic origin information concerning Conflict Minerals and smelters. Additionally, all new Direct Suppliers receive

Conflict Minerals reporting requirements as a part of our new supplier information packet. It will take several years to ensure

that all of our Direct Suppliers are contractually obligated to report this information to us as part of their normal business

interactions with us. In the meantime, as described below, we have established a process to contact affected Direct Suppliers to

collect necessary Conflict Minerals sourcing information. We have used and will continue to use the data collected through the

process described below, and through our contractually obligated disclosures from our Direct Suppliers, to evaluate our supply

chain to ensure compliance with the SEC’s Conflict Minerals rules.

Presently, our supply chain consists of

over 13,000 suppliers, including many suppliers providing us with services and/or products that are not necessary to the functionality

or production of our products and/or products that do not contain Conflict Minerals. As such, it was not practicable to conduct

a survey of our entire supply base. Instead, we targeted only those Direct Suppliers that we believed, based upon an evaluation

of the composition of the product and/or raw material they supplied, could possibly supply us with products containing Conflict

Minerals. Upon removal of intracompany-supplied products, retail purchases, and those Direct Suppliers who do not supply products

that could possibly contain Conflict Minerals (i.e. wood suppliers), the population of Direct Suppliers surveyed was set at approximately

1,100. The Company contacted these approximately 1,100 Direct Suppliers, requesting each to provide Conflict Minerals geographic

origin data in the Conflict-Free Sourcing Initiative’s (“CFSI”) Conflict Minerals Reporting Template (“CMRT”.)

Surveys conducted with other manufacturing companies confirmed that our risk-based approach to developing our list of our surveyed

Direct Suppliers, as described above, is consistent with how many peer companies are approaching the Rule.

At this time, having conducted this due

diligence process, our products that are subject to the reporting obligations of the Rule are “DRC conflict undeterminable,”

as we are unable to determine all of the following with regard to all Conflict Minerals present in our supply chain that are necessary

to the functionality or production of our products: (1) the origin of the Conflict Minerals and/or the 3TG they contain (or to

determine whether they come from recycled or scrap sources), or (2) the location of the facilities used to process them and/or

origin mines.

Conflict Minerals Policy

Wabash is committed to working with our

global supply chain to ensure compliance with the SEC’s Rule. We have established a Conflict Minerals compliance program,

as outlined above, that is designed to follow the framework established by the OECD. Our enterprise is fully engaged in implementing

that program.

For additional information about our commitment

to responsible sourcing and other human rights, see our Conflict Minerals Policy and

Code of Business Conduct and Ethics, which are both publicly available on our website at www.wabashnational.com.

| 2.1 | Design of Due Diligence |

Our due diligence measures have been designed

to conform, in all material respects, with the framework in The OECD Due Diligence Guidance for Responsible Supply Chains of Minerals

from Conflict-Affected and High-Risk Areas and the related Supplements for Conflict Minerals.

| 2.2 | Establish Strong Company Management Systems |

Internal Team

Our Senior Vice President –

General Counsel and our Vice President of Global Strategic Sourcing established a cross-functional team of subject matter experts

from relevant functions of finance, legal, and supply chain to create our Conflict Minerals compliance program and due diligence

efforts necessary to comply with the Rule. As part of this team, our Global Director of Strategic Sourcing, a Strategic Commodity

Manager and a Global Strategic Sourcing Assistant lead our ongoing due diligence efforts with our Direct Suppliers. Senior management

and members of our Audit Committee are briefed about the results of our due diligence efforts on a regular basis.

Control systems

As we do not typically have a direct relationship

with 3TG smelters and refiners, we are engaged and actively cooperate with other major manufacturers in the transportation industry

and other relevant sectors, as well as our own Direct Suppliers to encourage the disclosure of all the conflict mineral status

of the upstream entities held in common by our various supply chains. Our due diligence process includes utilization of industry-wide

initiatives to disclose upstream entities in the supply chain, such as the CMRT and the CFSI certified list.

Our controls include, but are not limited

to, our Code of Conduct which outlines expected behaviors for all Wabash National employees and suppliers. Going forward, as discussed

above, our controls will also include contractual disclosure requirements in our Direct Supplier contracts.

Supplier Engagement

With respect to the OECD requirement to

strengthen engagement with suppliers, we have invested in tools and developed internal processes and procedures to query and track

supplier activity. In addition, we have included Conflict Minerals request forms in our new supplier packets, and we will continue

to request from all of our Direct Suppliers annual Conflict Minerals reporting data. We will also utilize key opportunities such

as annual Executive Management Reviews with our suppliers to reinforce and review compliance.

Grievance Mechanism

We have multiple mechanisms and

processes for employees and suppliers to use to report violations of Wabash’s policies. These are described in our Code

of Business Conduct and Ethics policy, which is publicly available on our website at www.wabashnational.com.

Maintain records

We have adopted a policy to retain relevant documentation requested

from and disclosed by our suppliers.

| 2.3 | Identify and assess risk in the supply chain |

As outlined previously, since we do not

typically have a direct relationship with 3TG smelters and refiners, our due diligence efforts undertaken to comply with the Rule

rely heavily on our Direct Suppliers providing us with information about the source of Conflict Minerals contained in the products

and raw materials supplied to us. Our Direct Suppliers are similarly reliant upon information provided by their suppliers. Many

of our largest suppliers are also SEC registrants and subject to the Rule. However, our ability to comply with the Rule is dependent

upon receipt of complete and accurate information from our Direct Suppliers.

| 2.4 | Design and Implement a Strategy to Respond to Risks |

In response to this risk assessment,

Wabash has an approved risk management plan, through which the Conflict Minerals program is implemented, managed and monitored.

As part of the risk management efforts undertaken as part of the Conflict Minerals program, our Global Director of Strategic Sourcing,

a Strategic Commodity Manager and a Global Strategic Sourcing Assistant regularly review Conflict Minerals data provided by our

Direct Suppliers. Direct Suppliers who provide incomplete or inconsistent Conflict Minerals data are contacted to update and confirm

the data provided until Wabash can conclude with a reasonable degree of certainty that the provided data is likely accurate. Updates

regarding our due diligence process and this risk assessment are provided regularly to senior management and the Audit Committee.

As described above, we also

utilize and participate in several industry-wide initiatives to disclose the conflict mineral status of upstream entities in the

supply chain. We will continue to pursue training and participate in seminars to increase our awareness and further enhance our

compliance. As part of our risk management plan, and to ensure suppliers understand our ongoing expectations to provide accurate

and complete Conflict Minerals data, we will continue to engage suppliers in various ways such as training sessions, Executive

Management Reviews and our annual supplier conference.

| 2.5 | Carry out Independent Third Party Audit of Supply

Chain Due Diligence at Identified Points in the Supply Chain |

Since we do not have a direct

relationship with 3TG smelters and refiners, we do not perform or direct audits of these upstream entities within our supply chain.

We will support audits by our supply base, as necessary, and have augmented our own Direct Supplier audit process with questions

and procedures to address compliance by our Direct Suppliers with the Rule.

| 2.6 | Report on supply chain due diligence |

This report outlines the due

diligence efforts Wabash has taken.

Request Information

As described above, we conducted a survey

of certain Direct Suppliers using the CMRT, which was developed to facilitate disclosure and communication of information regarding

smelters that provide material to a company’s supply chain. It includes questions regarding a supplier’s conflict-free

policies, engagement with its direct suppliers, and a listing of the smelters the suppliers (and its suppliers) utilize in their

own supply chain.. In addition, the CMRT contains questions about the origin of Conflict Minerals included in suppliers’

products, as well as suppliers’ due diligence efforts. Written instructions and recorded training illustrating the use of

the tool is available on the CFSI’s website. The CMRT is being used by many of our peer companies in their due diligence

processes related to Conflict Minerals.

Survey Responses

To date, we’ve received responses

from 65% of the approximately 1,100 Direct Suppliers surveyed, which represents approximately 99% of Wabash’s direct material

spend surveyed in 2014. We reviewed the responses provided against criteria developed to determine whether further engagement with

our Direct Suppliers was necessary. These criteria included: (1) untimely or incomplete responses, (2) inconsistencies within the

data reported in the CMRT or in other provided documentation, or (3) uncertainty in the accuracy of the data reported in light

of the product supplied by the Direct Supplier. We have worked directly with these Direct Suppliers until we received data sufficient

to allow Wabash to conclude with a reasonable degree of certainty that the provided data is likely accurate.

Approximately 80% of our responding Direct

Suppliers reported using no 3TG in products sold to Wabash. The remaining responses included the names of approximately 4,900 refiners

or smelters that were utilized within our Direct Suppliers’ supply chains. Of these refiners or smelters, approximately 28%

were validated through either the Electronic Industry Citizenship Coalition – Global e-Sustainability Initiative (“EICC-GeSI”)

list or a CFSI certified list as being “Conflict-Free” refiners or smelters. However, the remaining 72% of identified

refiners or smelters could not be validated as Conflict-Free through either list. As we do not typically have a direct relationship

with 3TG smelters and refiners, and thus are unable to directly audit or request documentation from these facilities, Wabash supports

the refinement and expansion of the list of participating smelters through the CFSI program.

Additionally, a large majority of our responding

Direct Suppliers provided Conflict Minerals data to us at a company or divisional level – and did not specify whether the

particular products, parts or raw materials specifically supplied to Wabash: (1) contained Conflict Minerals, or (2) originated

from a supply chain that included mines, smelters, or refiners containing/using Conflict Minerals. These “blanket responses”

covering the totality of what these Direct Suppliers sell in aggregate to their customers, do not allow us to determine whether

any of the Conflict Minerals reported by these Direct Suppliers are actually contained in the particular products, parts or raw

materials the Direct Supplier sells specifically to Wabash. Therefore, we are also unable to validate whether any of the 4,900

smelters or refiners (described above) who were disclosed by our Direct Suppliers as being part of the Direct Supplier’s

overall supply chain, are actually part of Wabash’s supply chain.

Efforts to determine mine or location

of origin

Through our utilization of CFSI tools,

the OECD implementation guidelines, and requesting our Direct Suppliers to complete the CMRT, we have determined that seeking information

about 3TG smelters and refiners through our supply chain represents the most reasonable effort we can make to determine the mines

or locations of origin of the 3TG in our supply chain.

Smelters or Refiners

Based on Direct Supplier responses received

to date:

| · | 80% of respondents reported using no 3TG in their

products and, therefore, utilize no smelters or refiners of concern. |

| · | The remaining 20% of respondents reported either:

(1) no smelter information available or, (2) a list of smelters utilized in their respective supply chains. When smelter and refiner

lists were included in a response, Wabash was able to verify that approximately 28% of the identified smelters or refiners were

Conflict-Free, while the remaining 72% cannot be verified as Conflict-Free at this time due to lack of reporting through the EICC-GeSI

or CFSO initiatives. |

| · | The majority of our responding Direct Suppliers who

do utilize 3TG in some or all of the products they sell to their entire customer base: (1) Could not represent to us that any

smelter or refiner entities they listed as using Conflict Minerals had actually been included in the supply chain for the products,

parts and/or raw materials they supplied to Wabash; and/or, (2) Reported that it was “not known” or “undetermined”

if Conflict Minerals had been utilized by smelters or refiners included in the supply chain for the products, parts and/or raw

materials they supplied to Wabash. |

We have elected not to present the smelter

and refiner names reported to us by our Direct Suppliers in this report due to the size of the list.

The statements above are based on the Reasonable

Country of Origin Inquiry process and due diligence performed in good faith by Wabash. As noted previously, these statements are

based solely on the information received from our Direct Suppliers through this process.

| 4. | Steps to be taken to mitigate risk |

We intend to take the following steps to

improve the due diligence we conduct, in an effort to further mitigate risk that the Conflict Minerals necessary to the functionality

or production of our products could benefit armed groups in the Covered Countries:

| a) | Inclusion of Conflict Minerals flow-down requirements in Wabash’s new or renewed Direct Supplier

contracts. |

| b) | Revisit annually the scope of Direct Suppliers requested to supply information as part of our due

diligence process. |

| c) | Engage with Direct Suppliers, as deemed necessary, directing them to training resources in an attempt

to increase the due diligence response rate and improve the content of the Direct Supplier survey responses. |

| d) | Work with the OECD and relevant trade associations to define and improve

best practices and build leverage over the supply chain in accordance with the OECD Guidance. |

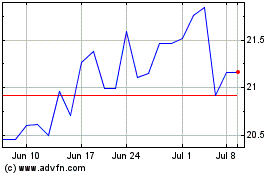

Wabash National (NYSE:WNC)

Historical Stock Chart

From Mar 2024 to Apr 2024

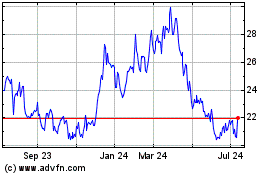

Wabash National (NYSE:WNC)

Historical Stock Chart

From Apr 2023 to Apr 2024