UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

September 11, 2014

Wabash National Corporation

(Exact name of registrant

as specified in its charter)

| Delaware |

|

1-10883 |

|

52-1375208 |

| |

|

|

|

|

| (State or other jurisdiction |

|

(Commission File No.) |

|

(IRS Employer |

| of incorporation) |

|

|

|

Identification No.) |

| 1000 Sagamore Parkway South, Lafayette, Indiana 47905 |

| ___________________________________________________ |

| (Address of principal executive offices) (Zip Code) |

Registrant’s telephone number, including

area code:

(765) 771-5310

__________________

Not applicable

(Former name or former

address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the

Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the

Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c)) |

INFORMATION TO BE INCLUDED IN THE REPORT

Item 7.01. Regulation FD Disclosure.

Wabash National

Corporation is making the presentation attached hereto as Exhibit 99.1 and incorporated herein by reference in connection with

the FTR Transportation Conference on September 11, 2014.

Item 9.01. Financial Statements and Exhibits.

| 99.1 | Wabash National Corporation presentation on September

11, 2014. |

SIGNATURES

Pursuant to

the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on

its behalf by the undersigned thereunto duly authorized.

| |

WABASH NATIONAL CORPORATION |

|

| |

|

|

|

| Date: September 11, 2014 |

By: |

/s/ Jeffery L. Taylor

_________________________

Jeffery L. Taylor

Senior Vice President and Chief Financial Officer |

|

EXHIBIT INDEX

| |

|

|

|

|

| Exhibit No. |

|

Description |

| ______________ |

|

____________________________________ |

| |

|

|

|

|

| 99.1 |

|

Wabash National Corporation presentation on September 11, 2014 |

A TRAILER OEM’S PERSPECTIVE ON THE CV MARKET FTR Transportation Conference September 11, 2014 Dick Giromini, President & CEO

2 This presentation contains certain forward - looking statements, as defined by the Private Securities Litigation Reform Act of 1995. All statements other than historical facts are forward - looking statements, including without limit, those regarding shipment outlook, Operating EBITDA, backlog, demand level expectations, profitability and earnings capacity, margin opportunities, and potential benefits of any recent acquisitions. Any forward - looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those implied by the forward - looking statements. Without limit, these risks and uncertainties include economic conditions, increased competition, dependence on new management, reliance on certain customers and corporate partnerships, shortages and costs of raw materials, manufacturing capacity and cost containment risks, dependence on industry trends, access to capital, acceptance of products, and government regulation. You should review and consider the various disclosures made by the Company in this presentation and in its reports to its stockholders and periodic reports on Forms 10 - K and 10 - Q. We cannot give assurance that the expectations reflected in our forward - looking statements will prove to be correct. Our actual results could differ materially from those anticipated in these forward - looking statements. All written and oral forward - looking statements attributable to us are expressly qualified in their entirety by the factors we disclose that could cause our actual results to differ materially from our expectations. S AFE H ARBOR S TATEMENT © 2014 Wabash National, L.P. All rights reserved. Wabash®, Wabash National®, DuraPlate ®, DuraPlate AeroSkirt ®, Walker, Brenner® and Beall® are marks owned by Wabash National, L.P. Transcraft ® and Benson® are marks owned by Transcraft Corporation.

3 S TRATEGIC S EGMENTS Wabash National Corporation Commercial Trailer Products 2013 Sales: $1.1B • Dry & Refrigerated Vans • Platform Trailers • Fleet Used Trailers Diversified Products 2013 Sales: $502M • Walker Group • Wabash Composites • Wabash Wood Products Retail 2013 Sales: $181M • 15 Retail Locations in U.S. • New & Used Trailer Sales • Parts & Service Segment Revenue is prior to the elimination of intersegment sales.

4 T RANSPORTATION S ECTOR O UTLOOK Strong demand above replacement levels ▪ Manufacturing Activity and Retail Sales driving freight volume ▪ Truck Tonnage at or near record levels ▪ Truck Loadings continue to rise Positive Freight Trends Freight Volume

5 T RAILER D EMAND D RIVERS Fleet Rates Increase with Tightening Capacity ▪ Active truck utilization has reached 99%, expected to stay elevated ▪ Truckload rates increasing ▪ Fleet net profit margins exceeding previous peak: 5% - 6% ▪ Driver shortage and pay increases Carrier Capacity & Rates

6 T RAILER D EMAND D RIVERS Strong demand above replacement levels Challenging Carrier O perating E nvironment Fleet Equipment – Trailers ▪ Average age of equipment remains near record high ▪ 3 + years of significant underbuy (2008 – 2010) ▪ Heavy - Duty Tractor - Trailer Greenhouse Gas (HD GHG) ▪ California Air Resources Board (CARB) ▪ Compliance , Safety, Accountability (CSA ) ▪ Hours of Service (HOS) ▪ Moving Ahead for Progress in the 21st Century Act (MAP - 21) Regulatory

7 T RAILER F ORECAST ▪ Strong demand above replacement levels forecast for next 5 years ▪ Fleet equipment, capacity and regulations key drivers of trailer demand FTR Production Forecast by Segment 2013 2014 F 2015 F 2016 F Vans 170,300 191,684 181,500 168,419 Tanks 10,925 12,079 11,100 10,353 Major Vocational 1 35,154 40,081 36,700 33,784 Other 2 18,576 20,218 18,700 17,444 Total 234,955 264,062 248,000 230,000 1 Major Vocational Trailers = Sum of Flatbed, Dump and Lowbed trailers 2 Includes specialty vocational trailers including grain, livestocking , logging, auto hauling, etc.

8 O UR R ESPONSIBILITIES ▪ Lower Operating Costs and Enhance Productivity ▪ Optimize Weight , Cube and Payload Capacity ▪ Extend the Life of the Equipment ▪ Continually Enhance Product Safety & Sustainability

9 T RADE C YCLES AND F LEET B UYING C RITERIA Trailer Type Trade Cycle Dry Freight Van 8 - 12 years Refrigerated Van 5 - 7 years Steel/Combo Platform 7 - 10 years Aluminum Platform 12 - 15 years Aluminum Tank 9 - 11 years Stainless Steel Tank 15 - 30+ years ▪ Lower operating costs ▪ Optimize weight, cube & payload ▪ Enhance productivity & utilization ▪ Regulatory compliance & safety ▪ Improve fuel economy ▪ Reduce environmental impact Fleet Buying Criteria

10 I NCREASING P AYLOAD – W EIGHT O PTIMIZATION ▪ Hundreds of lightweight options available ▪ Opportunities to improve fuel efficiency, increase payload and offset truck weights ▪ Cost/benefit considerations ▪ Continue to innovate and develop lighter - weight, higher - strength materials and components Lightweight Options Weight Reduction 1 - 1/8" Composite Floor 265 lbs. DuraPlate® Composite Nose 100 lbs. Aluminum Crossmembers in Bay 245 lbs. Wide Base Tires with aluminum rims 476 lbs. Lightweight Hub and Drum 168 lbs. Lightweight Landing Gear 30 lbs. 6 mm DuraPlate Composite Sidewalls 435 lbs. Aluminum Floor 660 lbs. Aluminum Rims with duals (22.5) 184 lbs. Items in red are exclusive to Wabash National

11 E NHANCING S AFETY , P RODUCTIVITY AND U TILIZATION MaxClearance Overhead Door System (U.S. Patent Nos. 8,016,527 and 8,506,221) MaxClearance® Overhead Door System ▪ Provides swing door access in overhead door configuration ▪ Safer operator environment ▪ Reduced door and freight damage ▪ More efficient loading and unloading ▪ Increases usable cube and load efficiency Typical Door Damage

12 E NHANCING S AFETY , P RODUCTIVITY AND U TILIZATION PROBLEM: Any vehicle between you and a semi blocks visibility of the trailer brake lamps. Current lights do not signal when a trailer is braking ID/Auxiliary Stop Light System

13 E NHANCING S AFETY , P RODUCTIVITY AND U TILIZATION ID/Auxiliary Stop Light System ( U.S. Patent Nos. 8,025,331; 8,016,527 and 8,506,221 ) SOLUTION: Header lights now work as auxiliary brake lights to increase visibility. REAR HEADER LIGHTS: NOT BRAKING REAR HEADER LIGHTS: BRAKES APPLIED ID/Auxiliary Stop Light System

14 E NHANCING S AFETY , P RODUCTIVITY AND U TILIZATION ▪ Lowers handles to more comfortable position ▪ Improves driver safety and ergonomics ▪ Improves freight security TRADITIONAL DESIGN TRUSTLOCK PLUS DESIGN TrustLock® Plus

15 E NHANCING S AFETY , P RODUCTIVITY AND U TILIZATION ▪ Reduces the total weight of a standard DOT 407 tank by 700 lbs. ▪ Offers improved mechanical properties ▪ Eliminates wide temperature fluctuations ▪ Corrosion resistance equivalent to type 316 stainless steel Lean Duplex Stainless Steel Lean Duplex Tank T railer

16 E NHANCING S AFETY , P RODUCTIVITY AND U TILIZATION ▪ Extending equipment lifecycles ▪ G alvanized components ▪ Composite brackets and housings ▪ Undercoating technology ▪ Oak flooring Corrosion Resistance DuraPlate Composite D oor Plycore Door C orrosion Composite Side M arker B racket Galvanized Landing Gear “K Brace”

17 I MPROVING F UEL E CONOMY AND S USTAINABILITY Source: Cascade Sierra Solutions, EPA SmartWay Technology Fuel Savings Trailer Side Skirts 4 - 7% Low Rolling Resistance Tires 3 - 5% Tire Inflation Systems ~1% Trailer - Mounted Gap Reducers 1 - 2% Trailer Boat Tail 1 - 6% Trailer Under Tray Systems 1 - 2% DuraPlate AeroSkirt ® (U.S. Patent No. 8,177,286 and 8,398,150) Trailer - Mounted Gap Reducer LRR Wide Base Tires w/Tire Inflation System Trailer Boat Tail

18 I MPROVING F UEL E CONOMY AND S USTAINABILITY ▪ Nitrogen - based cooling systems reduce greenhouse gas emissions ▪ New aerodynamic devices ▪ Bonding technology ▪ Use of recycled materials ▪ More to come… Key Products and Initiatives Nitrogen - Cooled Refrigerated V an Bonded DuraPlate® Sidewall

19

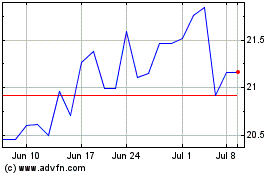

Wabash National (NYSE:WNC)

Historical Stock Chart

From Mar 2024 to Apr 2024

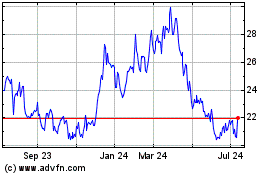

Wabash National (NYSE:WNC)

Historical Stock Chart

From Apr 2023 to Apr 2024