Jones Soda Co. (the Company) (OTCQB:JSDA), a leader in the

premium soda category and known for its unique branding and

innovative marketing, today announced results for the second

quarter ended June 30, 2014.

The Company reported a net loss of $429,000 or $(0.01) per

share, for the second quarter of 2014 compared to a net loss of

$95,000 or $(0.00) per share, for the second quarter 2013. Results

for the second quarter of 2014 were impacted by key distributor

transitions in certain regions and increased costs of production

due to commodity glass prices and special packaging for a major

retail chain.

Jennifer Cue, CEO of Jones Soda Co., stated, “As we complete the

restructuring process of our business, we are now shifting the

management team’s focus from stability towards growth and

profitability. I am extremely pleased with the significant

improvements we have achieved in our operating structure over the

long term. We have made some key investments in the second quarter

of 2014 that impacted our net loss; however, these were

mission-critical expenditures to build new distribution in certain

regions and to foster a growing relationship with a major

international retailer. With the diverse Jones product portfolio

and upcoming innovations in products, programs and partnerships, we

are excited for our future.”

Second Quarter Review - Comparison of Quarters Ended June 30,

2014 and 2013

- Revenue decreased 9.5% to $3.9 million,

compared to $4.3 million last year.

- Gross margin decreased to 22.5% of

revenue, compared to 28.8% of revenue last year due to higher costs

of commodity glass and special packaging for a major retail

chain.

- Operating expenses decreased slightly

by $41,000, or 3.1%, to $1.27 million, compared to $1.32 million

last year.

- Net loss increased to $429,000, or

$(0.01) per share, compared to a net loss of $95,000 or $(0.00) per

share, last year.

Conference Call

The Company will discuss its results for the quarter ended June

30, 2014, on its scheduled conference call today, August 7, 2014,

at 4:30 p.m. Eastern time (1:30 p.m. Pacific time). This call will

be webcast and can be accessed by visiting our website at

www.jonessoda.com or www.jonessoda.com/company/jones-press/webcasts.

Investors may also listen to the call via telephone by dialing

719-325-2177 (confirmation code: 2936909). In addition, a telephone

replay will be available by dialing 858-384-5517 (confirmation

code: 2936909) through August 14, 2014, at 11:59 p.m. Eastern

Time.

About Jones Soda Co.

Headquartered in Seattle, Washington, Jones Soda Co® markets and

distributes its premium beverages under the Jones® Soda, Jones

Zilch® and Jones Stripped™ brands. A leader in the premium soda

category, Jones Soda is known for its variety of flavors,

high-quality ingredients including pure cane sugar and organic

agave syrup, and innovative labeling technique that incorporates

always-changing photos sent in from its consumers. Jones Soda is

sold through traditional beverage retailers in markets primarily

across North America. For more information, visit www.jonessoda.com or www.myjones.com.

Forward-Looking Statements Disclosure

Certain statements in this press release are “forward-looking

statements” within the meaning of the Private Securities Litigation

Reform Act of 1995. Forward-looking statements include all passages

containing words such as “will,” “aims,” “anticipates,” “becoming,”

“believes,” “continue,” “estimates,” “expects,” “future,”

“intends,” “plans,” “predicts,” “projects,” “targets,” or

“upcoming.” Forward-looking statements also include any other

passages that are primarily relevant to expected future events or

that can only be evaluated by events that will occur in the future.

Forward-looking statements are based on the opinions and estimates

of management at the time the statements are made and are subject

to certain risks and uncertainties that could cause actual results

to differ materially from those anticipated or implied in the

forward-looking statements. Factors that could affect the Company's

actual results include, among others: its ability to successfully

execute on its operating plans for 2014; its ability to maintain

and expand distribution arrangements with distributors, independent

accounts, retailers or national retail accounts; its ability to

manage operating expenses and generate sufficient cash flow from

operations; its ability to increase revenues and achieve case sales

goals on reduced operating expenses; its ability to develop and

introduce new products to satisfy customer preferences; its ability

to market and distribute brands on a national basis; changes in

consumer demand or market acceptance for its products; its ability

to increase demand and points of distribution for its products or

to successfully innovate new products and product extensions; its

ability to maintain relationships with co-packers; its ability to

maintain a consistent and cost-effective supply of raw materials;

its ability to maintain brand image and product quality; its

ability to attract, retain and motivate key personnel; its ability

to protect its intellectual property; the impact of future

litigation; the impact of intense competition from other beverage

suppliers; and its ability to access the capital markets for any

future equity financing. More information about factors that

potentially could affect the Company’s operations or financial

results is included in its most recent annual report on Form 10-K

for the year ended December 31, 2013, filed with the

Securities and Exchange Commission on March 31, 2014, and in

its quarterly reports on Form 10-Q and current reports on Form 8-K

filed in 2014. Readers are cautioned not to place undue reliance

upon these forward-looking statements that speak only as to the

date of this release. Except as required by law, the Company

undertakes no obligation to update any forward-looking or other

statements in this press release, whether as a result of new

information, future events or otherwise.

JONES SODA CO.

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS

(Unaudited)

Three months ended June 30, Six months ended June

30, 2014 2013 2014 2013

(In thousands, except share data) (Unaudited) Revenue

$ 3,879 $ 4,287 $ 6,769 $ 7,383 Cost of goods sold 3,007

3,053 5,204 5,389

Gross profit 872 1,234 1,565 1,994 Gross profit % 22.5 % 28.8 %

23.1 % 27.0 % Operating expenses: Selling and marketing 591

625 1,089 1,098 General and administrative 683

690 1,388 1,365 1,274

1,315 2,477 2,463

Loss from operations (402 ) (81 ) (912 ) (469 ) Other (expense)

income, net 3 (9 ) (8 ) 4

Loss before income taxes (399 ) (90 ) (920 ) (465 ) Income tax

expense, net (30 ) (5 ) (48 ) (29 ) Net

loss $ (429 ) $ (95 ) $ (968 ) $ (494 ) Net loss per share -

basic and diluted $ (0.01 ) $ 0.00 $ (0.02 ) $ (0.01 ) Weighted

average basic and diluted common shares outstanding 39,078,592

38,530,416 38,894,504 38,530,416

Three

months ended June 30, Six months ended June 30, Case

sale data (288-ounce equivalent) 2014 2013

2014 2013 Finished product cases 278,000 306,000

491,000 531,000

JONES SODA CO.

CONDENSED CONSOLIDATED BALANCE

SHEETS

June 30, 2014 December 31, 2013

(Unaudited) (In thousands, except share data)

ASSETS Current assets: Cash and cash equivalents $ 519 $

1,464 Accounts receivable, net of allowance of $48 and $42 2,648

1,034 Inventory 3,420 2,315 Prepaid expenses and other current

assets 185 410 Total current assets

6,772 5,223 Fixed assets, net of accumulated depreciation of $1,245

and $1,194 126 232 Other assets 36 59

Total assets $ 6,934 $ 5,514

LIABILITIES AND

SHAREHOLDERS’ EQUITY Current liabilities: Accounts payable $

3,036 $ 871 Accrued expenses 776 892 Taxes payable 17 37 Other

current liabilities 50 48 Total current

liabilities 3,879 1,848 Long-term liabilities — other 381 406

Shareholders’ equity: Common stock, no par value: Authorized —

100,000,000; issued and outstanding shares — 39,134,582 and

38,710,416 shares, respectively 53,117 52,981 Additional paid-in

capital 8,128 7,941 Accumulated other comprehensive income 413 355

Accumulated deficit (58,984 ) (58,017 ) Total

shareholders’ equity 2,674 3,260 Total

liabilities and shareholders’ equity $ 6,934 $ 5,514

Jones Soda Co.Mark Miyata, 206-624-3357mmiyata@jonessoda.comVice

President of Finance

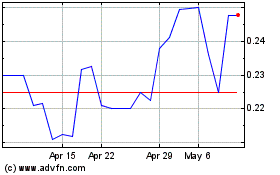

Jones Soda (QB) (USOTC:JSDA)

Historical Stock Chart

From Mar 2024 to Apr 2024

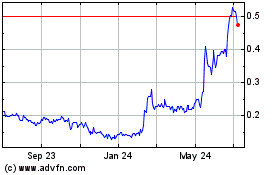

Jones Soda (QB) (USOTC:JSDA)

Historical Stock Chart

From Apr 2023 to Apr 2024