UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

July 23, 2014

DELTA AIR LINES, INC.

(Exact name

of registrant as specified in its charter)

| Delaware |

001-05424 |

58-0218548 |

|

|

(State or other jurisdiction

of incorporation) |

(Commission

File Number) |

(IRS Employer

Identification No.) |

P.O. Box 20706, Atlanta, Georgia 30320-6001

(Address of principal executive offices)

Registrant’s telephone number, including

area code: (404) 715-2600

Registrant’s Web site address: www.delta.com

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

[_] Written communications pursuant to Rule 425 under

the Securities Act (17 CFR 230.425)

[_] Soliciting material pursuant to Rule 14a-12 under

the Exchange Act (17 CFR 240.14a-12)

[_] Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[_] Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02 Results

of Operations and Financial Condition.

Delta Air Lines, Inc. today issued a press release reporting

financial results for the quarter ended June 30, 2014. The press release is furnished as Exhibit 99.1. The information furnished

in this Form 8-K shall not be deemed incorporated by reference into any other filing with the Securities and Exchange Commission.

Item 9.01 Financial

Statements and Exhibits.

(d) Exhibits.

Exhibit

99.1 Press Release dated July 23, 2014 titled “Delta Air Lines Announces June Quarter

Profit”

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

| |

DELTA AIR LINES, INC. |

| |

|

| |

|

| |

|

| |

By: /s/ Paul A. Jacobson |

| Date: July 23, 2014 |

Paul

A. Jacobson

Executive Vice President and Chief Financial Officer |

EXHIBIT INDEX

| Exhibit Number |

Description |

| |

|

| Exhibit

99.1 |

Press Release dated July 23, 2014 titled “Delta Air Lines Announces June Quarter

Profit” |

Exhibit 99.1

| CONTACT: |

Investor Relations |

| |

404-715-2170 |

| |

|

| |

Corporate Communications |

| |

404-715-2554, media@delta.com |

Delta Air Lines Announces June Quarter

Profit

ATLANTA, July 23, 2014 – Delta Air Lines (NYSE:DAL)

today reported financial results for the June 2014 quarter. Key points include:

| · | Delta’s pre-tax income for the June 2014 quarter was $1.4

billion, excluding special items1, an increase of $593 million over the June 2013 quarter on a similar basis. Delta’s

net income for the June 2014 quarter was $889 million, or $1.04 per diluted share, and its operating margin was 15.1 percent, excluding

special items. |

| · | On a GAAP basis which includes special items, Delta’s pre-tax

income was $1.3 billion, operating margin was 14.9 percent and net income was $801 million, or $0.94 per diluted share. |

| · | Results include $340 million in profit sharing expense in recognition

of Delta employees’ contributions toward achieving the company’s financial goals. |

| · | Delta generated over $2 billion of operating cash flow and $1.5

billion of free cash flow during the June 2014 quarter. As of mid-July, the company has used its strong cash generation in 2014

to reduce its adjusted net debt below $8 billion, contribute more than $900 million of funding to its defined benefit pension plans,

and return $550 million to shareholders through dividends and share repurchases. |

“Delta’s performance this quarter, with 9 percent

top line growth, more than 4 points of margin expansion and $1.5 billion of free cash flow, shows the financial strength and resilience

of our company. We expect our September quarter performance will be even stronger, as we expand our operating margins to 15-17%

and further improve our profitability,” said Delta chief executive officer Richard Anderson. “All credit goes to Delta

people worldwide who not only produced this record financial performance, but also continue to lead the industry in operational

reliability and customer satisfaction.”

Revenue Environment

Delta’s operating revenue improved 9 percent, or $914

million, in the June 2014 quarter compared to the June 2013 quarter, driven by continued strength in corporate and domestic revenues.

Traffic increased 5.0 percent on a 3.2 percent increase in capacity.

| · | Passenger revenue increased 9 percent, or $772 million, compared

to the prior year period. Passenger unit revenue (PRASM) increased 5.7 percent year-over-year with a 3.8 percent improvement in

yield. Seat-related products and other merchandising initiatives increased revenues by $45 million versus the prior year period. |

| · | Cargo revenue decreased 1 percent, or $2 million, as lower

freight yields were partially offset by higher volumes. |

| · | Other revenue increased 15 percent, or $144 million, driven

by higher joint venture and SkyMiles revenues. |

Comparisons of revenue-related statistics are as follows:

| | |

| | |

Increase (Decrease) | |

|

| | |

| | |

2Q14 versus 2Q13 | |

|

| | |

| | |

Passenger | | |

Unit | | |

| | |

| |

|

| Passenger Revenue | |

2Q14 ($M) | | |

Revenue | | |

Revenue | | |

Yield | | |

Capacity | |

|

| Domestic | |

| 4,493 | | |

| 15.7 | | % |

| 10.2 | | % |

| 7.4 | | % |

| 5.0 | |

% |

| Atlantic | |

| 1,666 | | |

| 5.5 | | % |

| 7.2 | | % |

| 5.6 | | % |

| (1.6 | ) |

% |

| Pacific | |

| 819 | | |

| (2.6 | ) | % |

| (3.2 | ) | % |

| (1.9 | ) | % |

| 0.7 | |

% |

| Latin America | |

| 604 | | |

| 22.6 | | % |

| (0.7 | ) | % |

| (0.4 | ) | % |

| 23.5 | |

% |

| Total mainline | |

| 7,582 | | |

| 11.6 | | % |

| 7.0 | | % |

| 5.4 | | % |

| 4.2 | |

% |

| Regional | |

| 1,684 | | |

| (0.8 | ) | % |

| 3.3 | | % |

| 0.2 | | % |

| (4.0 | ) |

% |

| Consolidated | |

| 9,266 | | |

| 9.1 | | % |

| 5.7 | | % |

| 3.8 | | % |

| 3.2 | |

% |

“A solid demand environment, coupled with higher revenues

from our corporate contract gains, merchandising efforts, and investments in New York and Seattle, helped offset weakness in Pacific

yields and resulted in a nearly 6 percent increase in Delta’s unit revenues for the June quarter,” said Ed Bastian,

Delta’s president. “For the September quarter, we expect unit revenues to increase 2 to 4 percent, driven by continued

corporate and domestic strength, along with benefits from our revenue initiatives.”

Cost Performance

Consolidated unit cost excluding fuel expense, profit sharing

and special items (CASM-Ex2), was flat in the June 2014 quarter on a year-over-year basis as the benefits of Delta’s

domestic refleeting and other cost initiatives offset the company’s investments in its employees, products and operations.

GAAP consolidated CASM decreased 0.4 percent.

Total operating expense in the quarter increased $249 million

year-over-year driven by higher revenue- and volume-related expenses and $222 million higher profit sharing expense. These cost

increases were partially offset by lower fuel expense and savings from Delta’s cost initiatives.

Fuel expense declined $168 million driven by hedge benefits,

refinery profits and prior year mark to market adjustments that offset higher market fuel prices and higher consumption. Delta’s

average fuel price was $2.93 per gallon for the June quarter, which includes $99 million in settled hedge gains. Operations at

the refinery produced a $13 million profit for the June quarter, a $64 million improvement year-over-year.

Excluding special items, non-operating expense declined by $58

million as a result of lower interest expense, lower foreign exchange impact, and a $7 million gain associated with Delta’s

49 percent ownership stake in Virgin Atlantic. Including a $111 million special item for loss on extinguishment of debt resulting

from Delta’s debt reduction initiatives, non-operating expense for the quarter increased by $53 million.

Tax expense increased $496 million compared to the prior year

quarter, as the company now recognizes tax expense for financial reporting purposes following the reversal of its tax valuation

allowance at the end of 2013.

“With our domestic refleeting continuing and our cost

initiatives taking hold, we have been able to keep our non-fuel unit cost growth below 2 percent for each of the last four quarters,”

said Paul Jacobson, Delta’s chief financial officer. “Not only are these initiatives driving our current performance,

but they are also building a foundation for sustaining this performance into the future.”

Cash Flow

Cash from operations during the June 2014 quarter was $2.1 billion,

driven by the company’s June quarter profit and the normal seasonal increase in advance ticket sales, which were partially

offset by $300 million in contributions to the defined benefit pension plan. The company generated $1.5 billion of free cash flow.

Capital expenditures during the June 2014 quarter were $520

million, including $343 million in fleet investments. During the quarter, Delta’s net debt maturities and capital leases

were $851 million.

With its strong cash generation year to date, the company has

returned $550 million to shareholders as of mid-July. Through its $0.06 per share quarterly dividend, the company paid $101 million

to shareholders. In addition, the company repurchased 12.4 million shares at an average price of $36.33 for a total of $450 million.

These repurchases represent $200 million under the May 2014 $2 billion authorization, in addition to completing the May 2013 $500

million authorization.

Delta ended the quarter with $6.0 billion of unrestricted liquidity

and adjusted net debt of $7.9 billion. The company has now achieved more than $9 billion in net debt reduction since 2009.

Jacobson continued, “By taking a balanced approach to

capital deployment, Delta has been able to invest more than $1 billion in our fleet and other products, while also reducing our

debt to its lowest level in twenty years, contributing over $900 million to our pension plans, and returning $550 million to shareholders

so far this year.”

September 2014 Quarter Guidance

Following are Delta’s projections for the September 2014

quarter:

| | |

3Q14 Forecast |

| | |

|

| Operating margin | |

15% – 17% |

| Fuel price, including taxes, settled hedges and refinery impact | |

$2.88 – $2.93 |

| Consolidated unit costs – excluding fuel expense and profit sharing (compared to 3Q13) | |

Up 0 – 2% |

| Profit sharing expense | |

$350 – $400 million |

| Non-operating expense | |

$100 – $150 million |

| System capacity (compared to 3Q13) | |

Up 2 – 3% |

Company Highlights

Delta has a strong commitment to its employees, customers and

the communities it serves. Key accomplishments in the June 2014 quarter include:

| · | Recognizing the achievements of Delta employees toward meeting the

company’s financial and operational goals with $476 million of incentives so far this year, including accruing $439 million

in employee profit sharing and paying $37 million in Shared Rewards; |

| · | Improving its global network with new service connecting Delta’s

hubs in New York and Seattle with the key business destinations of London-Heathrow, Zurich, Rome, Hong Kong and Seoul; |

| · | Announcing an order for 15 A321 aircraft, adding to the 30 aircraft

of this type already on order. These economically efficient, proven-technology aircraft will provide an improved customer experience

as they replace similar, less-efficient domestic aircraft that are being retired as part of the Delta’s domestic fleet restructuring; |

| · | Completing modifications on its international widebody fleet, making

Delta the only U.S. carrier to offer full flat-bed seats with direct aisle access in BusinessElite and personal, on-demand entertainment

at every seat on all long-haul international flights; and |

| · | Celebrating the grand opening of the new Delta Flight Museum, which

coincided with the 85th anniversary of Delta’s first passenger service. The museum is housed in the airline’s

two original maintenance hangars with exhibits that chronicle more than eight decades of Delta history and the growth and development

of commercial aviation. |

Special Items

Delta recorded a net $88 million special items charge in the

June 2014 quarter, including:

| · | a $69 million charge for debt extinguishment associated with Delta’s

debt reduction initiative; and |

| · | a $20 million charge associated with Delta’s domestic fleet

restructuring. |

Delta recorded a net $159 million special items charge in the

June 2013 quarter, including:

| · | a $125 million mark-to-market adjustment on fuel hedges settling in

future periods; and |

| · | a $34 million charge for facilities, fleet and other items, primarily

associated with Delta’s domestic fleet restructuring. |

Other Matters

Included with this press release are Delta’s unaudited

Consolidated Statements of Operations for the three and six months ended June 30, 2014 and 2013; a statistical summary for those

periods; selected balance sheet data as of June 30, 2014 and December 31, 2013; and a reconciliation of non-GAAP financial measures.

About Delta

Delta Air Lines serves nearly 165 million customers each year.

This year, Delta was named the 2014 Airline of the Year by Air Transport World magazine and

was named to FORTUNE magazine’s 50 Most Admired Companies, in addition to being named the most admired airline for

the third time in four years. With an industry-leading global network, Delta and the

Delta Connection carriers offer service to 333 destinations in 64 countries on six continents. Headquartered in Atlanta, Delta

employs nearly 80,000 employees worldwide and operates a mainline fleet of more than 700 aircraft. The airline is a founding member

of the SkyTeam global alliance and participates in the industry’s leading trans-Atlantic joint venture with Air France-KLM

and Alitalia as well as a newly formed joint venture with Virgin Atlantic. Including its worldwide alliance partners, Delta offers

customers more than 15,000 daily flights, with key hubs and markets including Amsterdam, Atlanta, Boston, Detroit, Los Angeles,

Minneapolis-St. Paul, New York-JFK, New York-LaGuardia, Paris-Charles de Gaulle, Salt Lake City, Seattle and Tokyo-Narita. Delta

has invested billions of dollars in airport facilities, global products, services and technology to enhance the customer experience

in the air and on the ground. Additional information is available on delta.com, Twitter @Delta, Google.com/+Delta, Facebook.com/delta

and Delta’s blog takingoff.delta.com.

End Notes

| (1) | Note A to the attached Consolidated Statements of Operations provides a reconciliation of non-GAAP

financial measures used in this release and provides the reasons management uses those measures. |

| (2) | CASM - Ex: In addition to fuel expense, profit sharing and special items, Delta

believes excluding ancillary business costs is helpful to investors because ancillary business costs are not related to the generation

of a seat mile. These businesses include aircraft maintenance and staffing services Delta provides to third parties and Delta's

vacation wholesale operations. The amounts excluded were $193 million and $165 million

for the June 2014 and June 2013 quarters, respectively,

and $377 million and $350 million for the six months ended June 30, 2014 and 2013, respectively. Management believes

this methodology provides a more consistent and comparable reflection of Delta's airline operations. |

Forward-looking Statements

Statements in this press release that are not

historical facts, including statements regarding our estimates, expectations, beliefs, intentions, projections or strategies for

the future, may be "forward-looking statements" as defined in the Private Securities Litigation Reform Act of 1995. All

forward-looking statements involve a number of risks and uncertainties that could cause actual results to differ materially from

the estimates, expectations, beliefs, intentions, projections and strategies reflected in or suggested by the forward-looking statements.

These risks and uncertainties include, but are not limited to, the cost of aircraft fuel; the availability of aircraft fuel;

the impact of posting collateral in connection with our fuel hedge contracts; the impact of significant funding obligations with

respect to defined benefit pension plans; the restrictions that financial covenants in our financing agreements will have

on our financial and business operations; labor issues; interruptions or disruptions in service at one of our hub airports; our

dependence on technology in our operations; disruptions or security breaches of our information technology infrastructure; the

ability of our credit card processors to take significant holdbacks in certain circumstances; the possible effects of accidents

involving our aircraft; the effects of weather, natural disasters and seasonality on our business; the effects of an extended disruption

in services provided by third party regional carriers; failure or inability of insurance to cover a significant liability at the

Trainer refinery; the impact of environmental regulation on the Trainer refinery, including costs related to renewable fuel standard

regulations; our ability to retain management and key employees; competitive conditions in the airline industry; the effects of

extensive government regulation on our business; the effects of terrorist attacks; the effects of the rapid spread of contagious

illnesses; and the costs associated with war risk insurance.

Additional information concerning risks and

uncertainties that could cause differences between actual results and forward-looking statements is contained in our Securities

and Exchange Commission filings, including our Annual Report on Form 10-K for the fiscal year ended December 31, 2013. Caution

should be taken not to place undue reliance on our forward-looking statements, which represent our views only as of July 23, 2014,

and which we have no current intention to update.

DELTA AIR LINES, INC.

Consolidated Statements of Operations

Unaudited

| |

Three Months Ended June 30, | |

Six Months Ended June 30, |

| (in millions, except per share data) |

2014 | |

2013 | |

$ Change | |

% Change | |

2014 | |

2013 | |

$ Change | |

| %

Change |

| Operating Revenue: |

| | |

| | |

| | |

| | |

| |

| | |

| | |

| | |

| | |

| |

| Passenger: |

| | |

| | |

| | |

| | |

| |

| | |

| | |

| | |

| | |

| |

| Mainline |

$ | 7,582 | |

$ | 6,796 | |

$ | 786 | |

| 12 | |

% | |

$ | 13,806 | |

$ | 12,656 | |

$ | 1,150 | |

| 9 | |

% | |

| Regional carriers |

| 1,684 | |

| 1,698 | |

| (14 | ) |

| (1 | ) |

% | |

| 3,137 | |

| 3,158 | |

| (21 | ) |

| (1 | ) |

% | |

| Total passenger revenue |

| 9,266 | |

| 8,494 | |

| 772 | |

| 9 | |

% | |

| 16,943 | |

| 15,814 | |

| 1,129 | |

| 7 | |

% | |

| Cargo |

| 230 | |

| 232 | |

| (2 | ) |

| (1 | ) |

% | |

| 447 | |

| 470 | |

| (23 | ) |

| (5 | ) |

% | |

| Other |

| 1,125 | |

| 981 | |

| 144 | |

| 15 | |

% | |

| 2,147 | |

| 1,923 | |

| 224 | |

| 12 | |

% | |

| Total operating revenue |

| 10,621 | |

| 9,707 | |

| 914 | |

| 9 | |

% | |

| 19,537 | |

| 18,207 | |

| 1,330 | |

| 7 | |

% | |

| |

| | |

| | |

| | |

| | |

| |

| | |

| | |

| | |

| | |

| |

| Operating Expense: |

| | |

| | |

| | |

| | |

| |

| | |

| | |

| | |

| | |

| |

| Aircraft fuel and related taxes |

| 2,434 | |

| 2,595 | |

| (161 | ) |

| (6 | ) |

% | |

| 4,660 | |

| 4,884 | |

| (224 | ) |

| (5 | ) |

% | |

| Salaries and related costs |

| 2,046 | |

| 1,922 | |

| 124 | |

| 6 | |

% | |

| 4,015 | |

| 3,833 | |

| 182 | |

| 5 | |

% | |

| Regional carrier expense |

| | |

| | |

| | |

| | |

| |

| | |

| | |

| | |

| | |

| |

| Fuel |

| 500 | |

| 507 | |

| (7 | ) |

| (1 | ) |

% | |

| 973 | |

| 1,026 | |

| (53 | ) |

| (5 | ) |

% | |

| Other |

| 861 | |

| 937 | |

| (76 | ) |

| (8 | ) |

% | |

| 1,707 | |

| 1,817 | |

| (110 | ) |

| (6 | ) |

% | |

| Aircraft maintenance materials and outside repairs |

| 466 | |

| 472 | |

| (6 | ) |

| (1 | ) |

% | |

| 914 | |

| 963 | |

| (49 | ) |

| (5 | ) |

% | |

| Depreciation and amortization |

| 451 | |

| 415 | |

| 36 | |

| 9 | |

% | |

| 893 | |

| 820 | |

| 73 | |

| 9 | |

% | |

| Contracted services |

| 440 | |

| 409 | |

| 31 | |

| 8 | |

% | |

| 867 | |

| 810 | |

| 57 | |

| 7 | |

% | |

| Passenger commissions and other selling expenses |

| 440 | |

| 408 | |

| 32 | |

| 8 | |

% | |

| 813 | |

| 765 | |

| 48 | |

| 6 | |

% | |

| Landing fees and other rents |

| 355 | |

| 359 | |

| (4 | ) |

| (1 | ) |

% | |

| 696 | |

| 682 | |

| 14 | |

| 2 | |

% | |

| Profit sharing |

| 340 | |

| 118 | |

| 222 | |

| NM | |

| 439 | |

| 138 | |

| 301 | |

| NM | |

| Passenger service |

| 215 | |

| 197 | |

| 18 | |

| 9 | |

% | |

| 388 | |

| 361 | |

| 27 | |

| 7 | |

% | |

| Aircraft rent |

| 56 | |

| 55 | |

| 1 | |

| 2 | |

% | |

| 107 | |

| 115 | |

| (8 | ) |

| (7 | ) |

% | |

| Restructuring and other items |

| 30 | |

| 34 | |

| (4 | ) |

| (12 | ) |

% | |

| 79 | |

| 136 | |

| (57 | ) |

| (42 | ) |

% | |

| Other |

| 408 | |

| 365 | |

| 43 | |

| 12 | |

% | |

| 787 | |

| 721 | |

| 66 | |

| 9 | |

% | |

| Total operating expense |

| 9,042 | |

| 8,793 | |

| 249 | |

| 3 | |

% | |

| 17,338 | |

| 17,071 | |

| 267 | |

| 2 | |

% | |

| |

| | |

| | |

| | |

| | |

| |

| | |

| | |

| | |

| | |

| |

| Operating Income |

| 1,579 | |

| 914 | |

| 665 | |

| 73 | |

% | |

| 2,199 | |

| 1,136 | |

| 1,063 | |

| 94 | |

% | |

| |

| | |

| | |

| | |

| | |

| |

| | |

| | |

| | |

| | |

| |

| Other (Expense) Income: |

| | |

| | |

| | |

| | |

| |

| | |

| | |

| | |

| | |

| |

| Interest expense, net |

| (155 | ) |

| (172 | ) |

| 17 | |

| (10 | ) |

% | |

| (320 | ) |

| (350 | ) |

| 30 | |

| (9 | ) |

% | |

| Amortization of debt discount, net |

| (18 | ) |

| (41 | ) |

| 23 | |

| (56 | ) |

% | |

| (39 | ) |

| (83 | ) |

| 44 | |

| (53 | ) |

% | |

| Loss on extinguishment of debt |

| (111 | ) |

| – | |

| (111 | ) |

| (100 | ) |

% | |

| (129 | ) |

| – | |

| (129 | ) |

| (100 | ) |

% | |

| Miscellaneous, net |

| 3 | |

| (15 | ) |

| 18 | |

| NM | |

| (78 | ) |

| (14 | ) |

| (64 | ) |

| NM | |

| Total other expense, net |

| (281 | ) |

| (228 | ) |

| (53 | ) |

| 23 | |

% | |

| (566 | ) |

| (447 | ) |

| (119 | ) |

| 27 | |

% | |

| |

| | |

| | |

| | |

| | |

| |

| | |

| | |

| | |

| | |

| |

| Income Before Income Taxes |

| 1,298 | |

| 686 | |

| 612 | |

| 89 | |

% | |

| 1,633 | |

| 689 | |

| 944 | |

| NM | |

| |

| | |

| | |

| | |

| | |

| |

| | |

| | |

| | |

| | |

| |

| Income Tax (Provision) Benefit |

| (497 | ) |

| (1 | ) |

| (496 | ) |

| NM | |

| (619 | ) |

| 3 | |

| (622 | ) |

| NM | |

| |

| | |

| | |

| | |

| | |

| |

| | |

| | |

| | |

| | |

| |

| Net Income |

$ | 801 | |

$ | 685 | |

$ | 116 | |

| 17 | |

% | |

| 1,014 | |

| 692 | |

| 322 | |

| 47 | |

% | |

| |

| | |

| | |

| | |

| | |

| |

| | |

| | |

| | |

| | |

| |

| Basic Earnings Per Share |

$ | 0.95 | |

$ | 0.81 | |

| | |

| | |

| |

$ | 1.20 | |

$ | 0.81 | |

| | |

| | |

| |

| Diluted Earnings Per Share |

$ | 0.94 | |

$ | 0.80 | |

| | |

| | |

| |

$ | 1.19 | |

$ | 0.81 | |

| | |

| | |

| |

| Cash Dividends Declared Per Share |

$ | 0.06 | |

| – | |

| | |

| | |

| |

$ | 0.12 | |

| – | |

| | |

| | |

| |

| |

| | |

| | |

| | |

| | |

| |

| | |

| | |

| | |

| | |

| |

| Basic Weighted Average Shares Outstanding |

| 841 | |

| 850 | |

| | |

| | |

| |

| 843 | |

| 849 | |

| | |

| | |

| |

| Diluted Weighted Average Shares Outstanding |

| 850 | |

| 859 | |

| | |

| | |

| |

| 852 | |

| 856 | |

| | |

| | |

| |

DELTA AIR LINES, INC.

Selected Balance Sheet Data

| (in millions) | |

June 30,

2014 | | |

December 31,

2013 | |

| | |

(Unaudited) | | |

| |

| Cash and cash equivalents | |

$ | 3,362 | | |

$ | 2,844 | |

| Short-term investments | |

| 719 | | |

| 959 | |

| Restricted cash, cash equivalents and short-term investments | |

| 121 | | |

| 122 | |

| Total assets | |

| 52,191 | | |

| 52,252 | |

| Total debt and capital leases, including current maturities | |

| 10,322 | | |

| 11,342 | |

| Total stockholders' equity | |

| 12,203 | | |

| 11,643 | |

DELTA AIR LINES, INC.

Statistical Summary

(Unaudited)

| | |

Three Months Ended June 30, | |

Six Months Ended June 30, |

| | |

2014 | | |

2013 | | |

Change | |

2014 | | |

2013 | | |

Change |

| Consolidated: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Revenue passenger miles (millions) | |

| 53,341 | | |

| 50,781 | | |

| 5 | % | |

| 97,942 | | |

| 93,859 | | |

| 4 | % |

| Available seat miles (millions) | |

| 61,817 | | |

| 59,880 | | |

| 3 | % | |

| 115,721 | | |

| 112,902 | | |

| 2 | % |

| Passenger mile yield (cents) | |

| 17.37 | | |

| 16.73 | | |

| 4 | % | |

| 17.30 | | |

| 16.85 | | |

| 3 | % |

| Passenger revenue per available seat mile (cents) | |

| 14.99 | | |

| 14.19 | | |

| 6 | % | |

| 14.64 | | |

| 14.01 | | |

| 4 | % |

| Operating cost per available seat mile (cents) | |

| 14.63 | | |

| 14.69 | | |

| – | % | |

| 14.98 | | |

| 15.12 | | |

| (1) | % |

| CASM-Ex - see Note A (cents) | |

| 8.98 | | |

| 8.98 | | |

| – | % | |

| 9.35 | | |

| 9.34 | | |

| – | % |

| Passenger load factor | |

| 86.3 | % | |

| 84.8 | % | |

| 1.5 | pts | |

| 84.6 | % | |

| 83.1 | % | |

| 1.5 | pts |

| Fuel gallons consumed (millions) | |

| 1,001 | | |

| 981 | | |

| 2 | % | |

| 1,882 | | |

| 1,856 | | |

| 1 | % |

| Average price per fuel gallon, adjusted - see Note A | |

$ | 2.93 | | |

$ | 3.03 | | |

| (3) | % | |

$ | 2.98 | | |

$ | 3.13 | | |

| (5) | % |

| Number of aircraft in fleet, end of period | |

| 922 | | |

| 908 | | |

| 14 | | |

| | | |

| | | |

| | |

| Full-time equivalent employees, end of period | |

| 80,723 | | |

| 79,629 | | |

| 2 | % | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Mainline: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Revenue passenger miles (millions) | |

| 47,596 | | |

| 44,976 | | |

| 6 | % | |

| 87,163 | | |

| 82,994 | | |

| 5 | % |

| Available seat miles (millions) | |

| 54,773 | | |

| 52,540 | | |

| 4 | % | |

| 102,134 | | |

| 98,742 | | |

| 3 | % |

| Operating cost per available seat mile (cents) | |

| 13.73 | | |

| 13.70 | | |

| – | % | |

| 14.01 | | |

| 14.09 | | |

| (1) | % |

| CASM-Ex – see Note A (cents) | |

| 8.36 | | |

| 8.26 | | |

| 1 | % | |

| 8.70 | | |

| 8.62 | | |

| 1 | % |

| Fuel gallons consumed (millions) | |

| 839 | | |

| 810 | | |

| 4 | % | |

| 1,568 | | |

| 1,526 | | |

| 3 | % |

| Average price per fuel gallon, adjusted - see Note A | |

$ | 2.90 | | |

$ | 3.04 | | |

| (5) | % | |

$ | 2.95 | | |

$ | 3.13 | | |

| (6) | % |

| Number of aircraft in fleet, end of period | |

| 760 | | |

| 727 | | |

| 33 | | |

| | | |

| | | |

| | |

Note: except for full-time equivalent employees and number of

aircraft in fleet, consolidated data presented includes operations under Delta’s contract carrier arrangements.

Note A: The following tables show reconciliations of non-GAAP

financial measures. The reasons Delta uses these measures are described below.

Delta sometimes uses information ("non-GAAP financial measures")

that is derived from the Consolidated Financial Statements, but that is not presented in accordance with accounting principles

generally accepted in the U.S. ("GAAP"). Under the U.S. Securities and Exchange Commission rules, non-GAAP financial

measures may be considered in addition to results prepared in accordance with GAAP, but should not be considered a substitute for

or superior to GAAP results. The tables below show reconciliations of non-GAAP financial measures used in this press release to

the most directly comparable GAAP financial measures.

Forward Looking Projections. Delta is unable to reconcile

certain forward-looking projections to GAAP as the nature or amount of special items cannot be estimated at this time.

Net Income and Pre-Tax Income, excluding special items.

Delta excludes special items from net income and pre-tax income because management believes the exclusion of these items is helpful

to investors to evaluate the company’s recurring core operational performance in the periods shown. Therefore, we adjust

for these amounts to arrive at more meaningful financial measures. Special items excluded in the tables below showing the reconciliation

of net income and pre-tax income are:

| (a) | Mark-to-market adjustments on fuel hedges recorded in periods other than the settlement period ("MTM adjustments").

MTM adjustments are based on market prices at the end of the reporting period for contracts settling in future periods. Such

market prices are not necessarily indicative of the actual future value of the underlying hedge in the contract settlement period.

Therefore, excluding these adjustments allows investors to better understand and analyze the company's core operational performance

in the periods shown. |

| (b) | Restructuring and other items. Because of the variability in restructuring and other items, the exclusion of this item

is helpful to investors to analyze the company’s recurring core operational performance in the period shown. |

| (c) | Loss on extinguishment of debt. Because of the variability in loss on extinguishment of debt, the exclusion of this

item is helpful to investors to analyze the company’s recurring core operational performance in the period shown. |

| (d) | Income tax. We project that our annual effective tax rate for 2014 will be approximately 38%. Accordingly, this adjustment

represents the income tax effect associated with our special items. We believe this adjustment allows investors to better understand

and analyze the company’s core operational performance in the periods shown. |

| | |

Three Months ended | | |

Net Income | |

| | |

June 30, 2014 | | |

Per Diluted Share | |

| | |

Pre-Tax | | |

Income | | |

Net | | |

Three Months ended | |

| (in millions) | |

| Income | | |

| Tax | | |

| Income | | |

| June 30, 2014 | |

| GAAP | |

$ | 1,298 | | |

$ | 497 | | |

$ | 801 | | |

$ | 0.94 | |

| Items excluded: | |

| | | |

| | | |

| | | |

| | |

| MTM adjustments | |

| (1 | ) | |

| – | | |

| (1 | ) | |

| | |

| Restructuring and other items | |

| 30 | | |

| 10 | | |

| 20 | | |

| | |

| Loss on extinguishment of debt and other | |

| 111 | | |

| 42 | | |

| 69 | | |

| | |

| Total items excluded | |

| 140 | | |

| 52 | | |

| 88 | | |

| 0.10 | |

| Non-GAAP | |

$ | 1,438 | | |

$ | 549 | | |

$ | 889 | | |

$ | 1.04 | |

| | |

Three Months ended | | |

Net Income | |

| | |

June 30, 2013 | | |

Per Diluted Share | |

| | |

Pre-Tax | | |

Income | | |

Net | | |

Three Months ended | |

| (in millions) | |

Income | | |

Tax | | |

Income | | |

June 30, 2013 | |

| GAAP | |

$ | 686 | | |

$ | (1 | ) | |

$ | 685 | | |

$ | 0.80 | |

| Items excluded: | |

| | | |

| | | |

| | | |

| | |

| MTM adjustments | |

| 125 | | |

| – | | |

| 125 | | |

| | |

| Restructuring and other items | |

| 34 | | |

| – | | |

| 34 | | |

| | |

| Total items excluded | |

| 159 | | |

| – | | |

| 159 | | |

| 0.18 | |

| Non-GAAP | |

$ | 845 | | |

$ | (1 | ) | |

$ | 844 | | |

$ | 0.98 | |

Free Cash Flow. Delta presents free cash flow because

management believes this metric is helpful to investors to evaluate the company's ability to generate cash that is available for

use for debt service or general corporate initiatives.

| | |

Three months ended | |

| (in millions) | |

June 30, 2014 | |

| Net cash provided by operating activities | |

$ | 2,056 | |

| Net cash used in investing activities | |

| (279 | ) |

| Adjustments: | |

| | |

| Proceeds from sale of short-term investments and other | |

| (240 | ) |

| Total free cash flow | |

$ | 1,537 | |

Adjusted Net Debt. Delta uses adjusted total debt, including

aircraft rent, in addition to long-term adjusted debt and capital leases, to present estimated long-term financial obligations.

Delta reduces adjusted total debt by cash, cash equivalents, and short-term investments, resulting in adjusted net debt to present

the amount of assets needed to satisfy the debt. Management believes this metric is helpful to investors in assessing the company’s

overall debt profile.

| | |

Three Months Ended | | |

Year Ended | |

| (in billions) | |

June 30, 2014 | | |

December 31, 2009 | |

| Debt and capital lease obligations | |

$ | 10.3 | | |

| | | |

$ | 17.2 | | |

| | |

| Plus: unamortized discount, net from purchase accounting and fresh start reporting | |

| 0.3 | | |

| | | |

| 1.1 | | |

| | |

| Adjusted debt and capital lease obligations | |

| | | |

$ | 10.6 | | |

| | | |

$ | 18.3 | |

| Plus: 7x last twelve months' aircraft rent | |

| | | |

| 1.4 | | |

| | | |

| 3.4 | |

| Adjusted total debt | |

| | | |

| 12.0 | | |

| | | |

| 21.7 | |

| Less: cash, cash equivalents and short-term investments | |

| | | |

| (4.1 | ) | |

| | | |

| (4.7 | ) |

| Adjusted net debt | |

| | | |

$ | 7.9 | | |

| | | |

$ | 17.0 | |

Operating Margin. Delta excludes MTM adjustments and

restructuring and other items from operating margin for the same reasons as described above under the heading Net Income and Pre-tax

Income.

| | |

Three Months ended | |

| | |

June 30, | |

| | |

2014 | | |

2013 | |

| Operating margin | |

| 14.9% | | |

| 9.4% | |

| Items excluded: | |

| | | |

| | |

| MTM adjustments | |

| – | | |

| 1.3% | |

| Restructuring and other items | |

| 0.2% | | |

| 0.3% | |

| Operating margin, adjusted | |

| 15.1% | | |

| 11.0% | |

Cost per Available Seat Mile or Non-Fuel Unit Cost ("CASM-Ex").

We exclude the following items from consolidated and mainline CASM to evaluate the company’s core cost performance:

| • | Aircraft fuel and related taxes. The volatility in fuel prices impacts the comparability of year-over-year non-fuel

financial performance. The exclusion of aircraft fuel and related taxes (including our regional carriers under capacity purchase

arrangements) allows investors to better understand and analyze our non-fuel costs and year-over-year financial performance. |

| • | Ancillary businesses. Our ancillary businesses include aircraft maintenance and staffing services we provide to third

parties and our vacation wholesale operations. Because these businesses are not related to the generation of a seat mile, we exclude

the costs related to these businesses to provide a more meaningful comparison of the costs of our airline operations to the rest

of the airline industry. |

| • | Profit sharing. We exclude profit sharing because this exclusion allows investors to better understand and analyze our

recurring cost performance and provides a more meaningful comparison of our core operating costs to the airline industry. |

| • | Restructuring and other items. We exclude restructuring and other items for the same reasons described above

under the heading Net Income and Pre-Tax Income, excluding special items. |

Consolidated CASM-Ex:

| | |

Three Months Ended | | |

Three Months Ended | |

| | |

June 30, 2014 | | |

June 30, 2013 | | |

March 31, 2014 | | |

March 31, 2013 | |

| CASM (cents) | |

| 14.63 | | |

| 14.69 | | |

| 15.39 | | |

| 15.61 | |

| Items excluded: | |

| | | |

| | | |

| | | |

| | |

| Aircraft fuel and related taxes | |

| (4.75 | ) | |

| (5.17 | ) | |

| (5.01 | ) | |

| (5.28 | ) |

| Ancillary businesses | |

| (0.30 | ) | |

| (0.28 | ) | |

| (0.34 | ) | |

| (0.35 | ) |

| Profit sharing | |

| (0.55 | ) | |

| (0.20 | ) | |

| (0.18 | ) | |

| (0.04 | ) |

| Restructuring and other items | |

| (0.05 | ) | |

| (0.06 | ) | |

| (0.09 | ) | |

| (0.19 | ) |

| CASM-Ex | |

| 8.98 | | |

| 8.98 | | |

| 9.77 | | |

| 9.75 | |

| Year-over-year change | |

| 0% | | |

| | | |

| 0.2% | | |

| | |

| | |

Three Months Ended | | |

Three Months Ended | |

| | |

December 31, 2013 | | |

December 31, 2012 | | |

September 30, 2013 | | |

September 30, 2012 | |

| CASM (cents) | |

| 14.97 | | |

| 15.18 | | |

| 13.97 | | |

| 13.83 | |

| Items excluded: | |

| | | |

| | | |

| | | |

| | |

| Aircraft fuel and related taxes | |

| (4.86 | ) | |

| (5.33 | ) | |

| (4.43 | ) | |

| (4.42 | ) |

| Ancillary businesses | |

| (0.32 | ) | |

| (0.33 | ) | |

| (0.34 | ) | |

| (0.34 | ) |

| Profit sharing | |

| (0.21 | ) | |

| (0.12 | ) | |

| (0.39 | ) | |

| (0.28 | ) |

| Restructuring and other items | |

| (0.29 | ) | |

| (0.23 | ) | |

| (0.17 | ) | |

| (0.24 | ) |

| CASM-Ex | |

| 9.29 | | |

| 9.17 | | |

| 8.64 | | |

| 8.55 | |

| Year-over-year change | |

| 1.3% | | |

| | | |

| 1.1% | | |

| | |

| | |

Six Months Ended | |

| | |

June 30, 2014 | | |

June 30, 2013 | |

| CASM (cents) | |

| 14.98 | | |

| 15.12 | |

| Items excluded: | |

| | | |

| | |

| Aircraft fuel and related taxes | |

| (4.87 | ) | |

| (5.23 | ) |

| Ancillary businesses | |

| (0.31 | ) | |

| (0.31 | ) |

| Profit sharing | |

| (0.38 | ) | |

| (0.12 | ) |

| Restructuring and other items | |

| (0.07 | ) | |

| (0.12 | ) |

| CASM-Ex | |

| 9.35 | | |

| 9.34 | |

Mainline CASM-Ex:

| | |

Three Months Ended | | |

Six Months Ended | |

| | |

June 30, 2014 | | |

June 30, 2013 | | |

June 30, 2014 | | |

June 30, 2013 | |

| CASM (cents) | |

| 13.73 | | |

| 13.70 | | |

| 14.01 | | |

| 14.09 | |

| Items excluded: | |

| | | |

| | | |

| | | |

| | |

| Aircraft fuel and related taxes | |

| (4.44 | ) | |

| (4.93 | ) | |

| (4.55 | ) | |

| (4.93 | ) |

| Ancillary businesses | |

| (0.30 | ) | |

| (0.26 | ) | |

| (0.32 | ) | |

| (0.31 | ) |

| Profit sharing | |

| (0.62 | ) | |

| (0.23 | ) | |

| (0.43 | ) | |

| (0.14 | ) |

| Restructuring and other items | |

| (0.01 | ) | |

| (0.02 | ) | |

| (0.01 | ) | |

| (0.09 | ) |

| Mainline CASM-Ex | |

| 8.36 | | |

| 8.26 | | |

| 8.70 | | |

| 8.62 | |

Fuel Expense, Adjusted and Average Fuel Price per Gallon

Adjusted. The tables below show the components of fuel expense, including the impact of the refinery and hedging on fuel expense

and average price per gallon. We then exclude MTM adjustments from total fuel expense and average price per gallon because, as

described above, excluding these adjustments allows investors to better understand and analyze Delta's costs for the periods reported.

Consolidated:

| | |

| | |

Average Price Per Gallon | |

| | |

Three Months Ended | | |

Three Months Ended | |

| | |

June 30, | | |

June 30, | |

| (in millions, except per gallon data) | |

2014 | | |

2013 | | |

2014 | | |

2013 | |

| Fuel purchase cost | |

$ | 3,046 | | |

$ | 2,935 | | |

$ | 3.04 | | |

$ | 2.99 | |

| Airline segment fuel hedge (gains) losses | |

| (99 | ) | |

| 116 | | |

| (0.10 | ) | |

| 0.12 | |

| Refinery segment impact | |

| (13 | ) | |

| 51 | | |

| (0.01 | ) | |

| 0.05 | |

| Total fuel expense | |

$ | 2,934 | | |

$ | 3,102 | | |

$ | 2.93 | | |

$ | 3.16 | |

| MTM adjustments | |

| 1 | | |

| (125 | ) | |

| – | | |

| (0.13 | ) |

| Total fuel expense, adjusted | |

$ | 2,935 | | |

$ | 2,977 | | |

$ | 2.93 | | |

$ | 3.03 | |

| | |

| | |

Average Price Per Gallon | |

| | |

Six Months Ended | | |

Six Months Ended | |

| | |

June 30, | | |

June 30, | |

| (in millions, except per gallon data) | |

2014 | | |

2013 | | |

2014 | | |

2013 | |

| Fuel purchase cost | |

$ | 5,777 | | |

$ | 5,779 | | |

$ | 3.07 | | |

$ | 3.11 | |

| Airline segment fuel hedge (gains) losses | |

| (172 | ) | |

| 58 | | |

| (0.09 | ) | |

| 0.03 | |

| Refinery segment impact | |

| 28 | | |

| 73 | | |

| 0.01 | | |

| 0.04 | |

| Total fuel expense | |

$ | 5,633 | | |

$ | 5,910 | | |

$ | 2.99 | | |

$ | 3.18 | |

| MTM adjustments | |

| (33 | ) | |

| (101 | ) | |

| (0.01 | ) | |

| (0.05 | ) |

| Total fuel expense, adjusted | |

$ | 5,600 | | |

$ | 5,809 | | |

$ | 2.98 | | |

$ | 3.13 | |

Mainline:

| | |

Three Months Ended June 30, | | |

Six Months Ended

June 30, | |

| | |

2014 | | |

2013 | | |

2014 | | |

2013 | |

| Mainline average price per gallon | |

$ | 2.90 | | |

$ | 3.19 | | |

$ | 2.97 | | |

$ | 3.20 | |

| MTM adjustments | |

| – | | |

| (0.15 | ) | |

| (0.02 | ) | |

| (0.07 | ) |

| Mainline average price per gallon, adjusted | |

$ | 2.90 | | |

$ | 3.04 | | |

$ | 2.95 | | |

$ | 3.13 | |

Non-operating expense. Because of variability in the

loss on extinguishment of debt, Delta excludes this item from non-operating expense to evaluate the company’s recurring non-operating

expense performance.

| | |

Three Months Ended | |

| | |

June 30, | |

| (in millions) | |

2014 | | |

2013 | |

| GAAP | |

$ | 281 | | |

$ | 228 | |

| Item excluded: | |

| | | |

| | |

| Loss on extinguishment of debt and other | |

| (111 | ) | |

| – | |

| Non-GAAP | |

$ | 170 | | |

$ | 228 | |

Net Debt Maturities. Delta presents net debt maturities

because management believes this metric is helpful to investors to evaluate the company's debt related activities and cash flows.

| | Three Months Ended |

| (in millions) | June 30, 2014 |

| Payments on long-term debt and capital leases | |

$ | 1,065 | |

| Proceeds from long-term obligations | |

| (214 | ) |

| Net debt maturities | |

$ | 851 | |

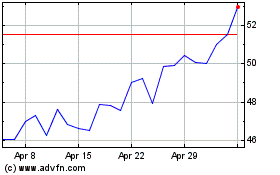

Delta Air Lines (NYSE:DAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

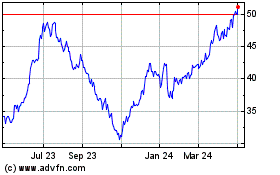

Delta Air Lines (NYSE:DAL)

Historical Stock Chart

From Apr 2023 to Apr 2024