UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the

Registrant

x

Filed by a Party other than the Registrant

¨

Check the appropriate box:

|

¨

|

Preliminary Proxy Statement

|

|

¨

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

x

|

Definitive Proxy Statement

|

|

¨

|

Definitive Additional Materials

|

|

¨

|

Soliciting Material Pursuant to §240.14a-12

|

|

|

|

|

|

|

|

|

|

|

|

CYTODYN INC.

|

|

|

|

|

|

(Name of Registrant as Specified In Its Charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

|

|

Payment of Filing Fee (Check the appropriate box):

|

¨

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and

state how it was determined):

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

¨

|

Fee paid previously with preliminary materials.

|

|

¨

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously.

Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

CYTODYN INC.

1111 Main Street, Suite 660

Vancouver, Washington 98660

(360) 980-8524

July 18, 2014

Dear Shareholder:

You are cordially invited to

attend the annual meeting of shareholders of CytoDyn Inc. to be held at 1:00 p.m., Pacific Time, on Wednesday, August 20, 2014, at the Hilton Hotel, 301 West Sixth Street, Vancouver, Washington 98660.

Matters to be presented for action at the meeting include the election of directors, approval of a proposal to authorize our board of

directors to effect a reverse stock split at its discretion, as further described in the enclosed proxy statement, ratification of the selection of our auditors, and an advisory vote on our executive compensation. We will also act on such other

business as may properly come before the meeting or any adjournment or postponement thereof.

We are excited about the future of our

company, and we look forward to conversing with those of you who are able to attend the meeting in person. Whether or not you can attend, it is important that you sign, date, and return your proxy as soon as possible. If you are a shareholder of

record and attend the meeting in person, you may revoke your proxy and vote at the meeting if you wish.

Sincerely,

Nader Z. Pourhassan, Ph.D.

President and Chief Executive Officer

CYTODYN INC.

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

August 20, 2014

You

are invited to attend the annual meeting of shareholders (the “Annual Meeting”) of CytoDyn Inc., a Colorado corporation (the “Company”), to be held at the Hilton Hotel, 301 West Sixth Street, Vancouver, Washington 98660, on

Wednesday, August 20, 2014, at 1:00 p.m., Pacific Time.

Only shareholders of record at the close of business on July 10,

2014, will be entitled to notice of and to vote at the Annual Meeting or any postponements or adjournments thereof.

The Annual Meeting is

being held to consider and vote on the following matters:

|

|

1.

|

Election of seven directors;

|

|

|

2.

|

Approval of a reverse stock split at a ratio of any whole number between one-for-three and one-for-eight, as determined by our board of directors, and an amendment to the Company’s Articles of Incorporation to

implement the reverse stock split at any time before August 20, 2015, if and as determined by our board of directors;

|

|

|

3.

|

Ratification of the selection of Warren Averett, LLC as the Company’s independent registered public accounting firm for the fiscal year ending May 31, 2015;

|

|

|

4.

|

A non-binding advisory vote to approve our executive compensation; and

|

|

|

5.

|

The transaction of any other business as may properly come before the Annual Meeting or any postponements or adjournments thereof.

|

Please sign and date the accompanying form of proxy and return it promptly in the enclosed

postage-paid

envelope to avoid the expense of further solicitation. If you are a shareholder of record and attend the Annual Meeting, you may revoke your proxy and vote your shares in person.

By Order of the Board of Directors

Michael D. Mulholland

Chief Financial Officer, Treasurer, and Corporate Secretary

Vancouver, Washington

July 18, 2014

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS

FOR THE SHAREHOLDER MEETING TO BE HELD ON August 20, 2014:

The proxy statement for the 2014 annual meeting of shareholders and 2014 annual report to shareholders are available at www.cytodyn.com.

CYTODYN INC.

PROXY

STATEMENT

2014 ANNUAL MEETING OF SHAREHOLDERS

This proxy

statement is furnished in connection with the solicitation of proxies by the Board of Directors (the “Board”) of CytoDyn Inc., a Colorado corporation (“CytoDyn” or the “Company”), to be voted at the annual meeting of

shareholders to be held on August 20, 2014 (the “Annual Meeting”), and any postponements or adjournments thereof. The proxy statement and accompanying form of proxy were first mailed to shareholders on approximately July 18,

2014.

VOTING, REVOCATION, AND SOLICITATION OF PROXIES

Solicitation of Proxies

. The enclosed proxy is solicited by and on behalf of the Board, with the cost of solicitation borne by the

Company. Solicitation may also be made by directors and officers of the Company without additional compensation for such services. In addition to mailing proxy materials, the directors, officers and employees may solicit proxies in person, by

telephone or otherwise.

Voting.

When a proxy in the accompanying form is returned properly signed and dated,

the shares represented by the proxy will be voted at the Annual Meeting in accordance with the instructions specified in the spaces provided in the proxy.

If no instructions are specified, the proxies will be voted FOR the election of all

nominees for director, as well as FOR Proposals 2, 3 and 4.

If a shareholder of record attends the Annual Meeting, he or she may vote in person. If you hold shares through a broker or nominee (that is, in “street name”),

please follow their directions on how to vote your shares.

A broker “non-vote” occurs when a nominee holding shares for

a beneficial owner does not have discretionary voting power with respect to the matter being considered and has not received instructions from the beneficial owner. Banks and brokers acting as nominees are not permitted to vote proxies for the

election of directors or the other proposals to be acted on at the Annual Meeting, except ratification of the auditors, without express voting instructions from the beneficial owner of the shares. As such, it is particularly important that you

provide voting instructions to your bank, broker or other nominee.

Revocation of Proxies

. Proxies may be revoked by written notice

delivered in person or mailed to the Secretary of the Company or by filing a later-dated proxy prior to a vote being taken on the election of directors at the Annual Meeting. Attendance at the Annual Meeting will not automatically revoke a proxy.

OUTSTANDING VOTING SECURITIES AND QUORUM

Shareholders of record as of the close of business on July 10, 2014, are entitled to one vote at the Annual Meeting for each share of

Common Stock of the Company (“Common Stock”) then held by each shareholder. As of that date, the Company had 55,752,503 shares of Common Stock issued and outstanding. The presence, in person or by proxy, of at least a majority of the total

number of outstanding shares of Common Stock entitled to vote constitutes a quorum at the Annual Meeting. Abstentions and broker non-votes, if any, will be considered present for purposes of determining the presence of a quorum.

1

PROPOSAL 1 – ELECTION OF DIRECTORS

The directors will be elected at the Annual Meeting to serve until the next annual meeting of shareholders and until their successors are

elected and qualify. Our Articles of Incorporation and Bylaws authorize the Board to set the number of positions on the Board within a range of one to nine. By resolution adopted on February 7, 2014, the Board set the number of positions on the

Board at seven. During periods between annual shareholder meetings, vacancies on the Board, including vacancies resulting from an increase in the number of positions, may be filled by the Board for a term ending with the next annual meeting of

shareholders and when a successor is duly elected and qualifies.

The seven nominees for election as directors at the Annual Meeting who

receive the highest number of affirmative votes will be elected, provided that a quorum is present at the Annual Meeting. Shareholders are not permitted to cumulate their votes for the election of directors. Votes may be cast for or withheld from

the directors as a group, or from any individual nominee. Votes that are withheld and broker non-votes will have no effect on the outcome of the election.

The Board recommends that shareholders vote FOR each of the nominees named below to serve as a director.

If for some unforeseen reason

a nominee should become unavailable for election, the proxy may be voted for the election of such substitute nominee as may be designated by the Board.

The following table sets forth information with respect to each person nominated for election as a director, including their current principal

occupation or employment and age as of July 18, 2014.

|

|

|

|

|

|

|

|

|

Name

|

|

Age

|

|

|

Principal Occupation

|

|

Nader Z. Pourhassan, Ph.D.

|

|

|

51

|

|

|

President and Chief Executive Officer of the Company

|

|

Denis R. Burger, Ph.D.

|

|

|

71

|

|

|

Retired Chief Executive Officer of AVI Biopharma Inc.

|

|

Anthony D. Caracciolo

|

|

|

59

|

|

|

Retired Senior Vice President of Gilead Sciences, Inc.

|

|

Gregory A. Gould

|

|

|

48

|

|

|

Chief Financial Officer, Treasurer, and Corporate Secretary of Ampio Pharmaceuticals, Inc.

|

|

A. Bruce Montgomery, M.D.

|

|

|

61

|

|

|

Chief Executive Officer of Cardeas Pharma Corporation

|

|

Jordan G. Naydenov

|

|

|

53

|

|

|

Vice President and Treasurer of Milara, Inc., a provider of stencil and screen printing systems

|

|

S. Michael Nobel, Ph.D.

|

|

|

74

|

|

|

Fellow at Tokyo Institute of Technology

|

The experience, qualifications, attributes and skills of each nominee, including his business experience

during the past five years, are described below.

Nader Z. Pourhassan, Ph.D.

Dr. Pourhassan was appointed President and Chief Executive

Officer of CytoDyn in December 2012, following his service as interim President and Chief Executive Officer for the preceding three months. On September 24, 2012, the Board appointed Dr. Pourhassan as a director. Dr. Pourhassan was

employed by the Company as its Chief Operating Officer from May 2008 until June 30, 2011, at which time Dr. Pourhassan accepted a position as the Company’s Managing Director of Business Development. Before joining the Company,

Dr. Pourhassan was an instructor of college-level engineering at The Center for Advanced Learning, a charter school in Gresham, Oregon, from June 2005 through December 2007. Dr. Pourhassan immigrated to the United States in 1977 and

became a U.S. citizen in 1991. He received his B.S. degree from Utah State University in 1985, his M.S. degree from Brigham Young University in 1990 and his Ph.D. from the University of Utah in 1998, in each case in Mechanical Engineering.

Dr. Pourhassan brings to the Board his deep knowledge of the Company’s operations and industry. He also contributes his business, leadership and management experience.

Below is information regarding certain prior legal proceedings involving Dr. Pourhassan:

(i) On May 3, 2006, in Superior Court of Washington for Clark County Case No. 204227D, Dr. Pourhassan was convicted of a

domestic violence court order violation. Dr. Pourhassan pled guilty to violation of the

2

provisions of a protection order by contacting his former spouse via email with communications intended for his son. Dr. Pourhassan performed community service, paid a fine of $100, served

24 months of probation and was ordered to comply with the protection order.

(ii) On June 9, 1986, in the First District Court in

Logan, Utah, Dr. Pourhassan was convicted of a third-degree felony of theft by deception for overdrawing his bank account by approximately $100. Dr. Pourhassan was placed on one year of probation.

(iii) Dr. Pourhassan filed for Chapter 7 bankruptcy in 1991 in Salt Lake City, Utah, case number 91-24348, and in 2001 in Portland,

Oregon, case number 01-36712-elp7.

Denis R. Burger, Ph.D.

Dr. Burger has been a director since February 2014. Consideration of his nomination

was recommended to the Nominating and Governance Committee by the Company’s Chief Executive Officer. He is also currently a director of Lorus Therapeutics, Inc., a cancer therapeutics company listed on the TSX, and serves on its audit

committee. Dr. Burger co-founded Trinity Biotech PLC, a NASDAQ listed diagnostic company, in June 1992, served as its Chairman from June 1992 to May 1995, and is currently lead independent director. Until March 2007, he was Chairman and Chief

Executive Officer of AVI Biopharma Inc. (now Sarepta Therapeutics, Inc.), a NASDAQ listed RNA therapeutics company. He was also a co-founder of Epitope Inc. (now Orasure Technologies Inc., NASDAQ listed), serving as its Chairman from 1981 to 1990.

Dr. Burger previously held a professorship in the Department of Microbiology and Immunology and Surgery (Surgical Oncology) at the Oregon Health and Sciences University in Portland. Dr. Burger received his undergraduate degree in

Bacteriology and Immunology from the University of California, Berkeley and his Master of Science and Ph.D. degrees in Microbiology and Immunology from the University of Arizona. Dr. Burger brings significant biotechnology company experience

and operational expertise to our Board, as well as a local presence for in person consultations with management.

Anthony D. Caracciolo.

Mr. Caracciolo has served as Chairman of the Board of the Company since June 2013 and is also chair of the Compensation Committee. In December 2011, the Board appointed Mr. Caracciolo as a director. Mr. Caracciolo has over

30 years of experience in the pharmaceutical sciences industry. He was formerly employed at Gilead Sciences, Inc. (“Gilead”), a publicly held, research-based biopharmaceutical company that discovers, develops and commercializes

innovative medicines in areas of unmet medical need, from 1997 until retiring in October 2010. During his tenure, Mr. Caracciolo served as Senior Vice President, Manufacturing and Operations and was a senior member of Gilead’s executive

committee, which was responsible for the strategic and operational direction of Gilead. During Mr. Caracciolo’s tenure at Gilead, Gilead grew from 300 employees to approximately 4,000 worldwide, with commercial activities in

38 countries. In addition, Gilead’s sales rose from $200 million to over $7 billion. While at Gilead, Mr. Caracciolo was responsible for directing operational and strategic initiatives for two manufacturing sites,

development of a portfolio of contract manufacturing organizations, production of over 50 percent of Gilead’s commercial products, information technology, compliance assurance associated with aseptic processing, product development,

optimization, technology transfers, and supervision of over 600 employees at six global locations. Prior to Gilead, Mr. Caracciolo was Vice President of Operations for Bausch and Lomb’s pharmaceutical division. Before joining Bausch

and Lomb, he held various management positions at Sterling Drug for over 13 years. Mr. Caracciolo received a B.S. degree in Pharmaceutical Science from St. John’s University in 1978. Mr. Caracciolo brings to the Board an

understanding of the Company’s operational issues and extensive experience in management and the biotech industry.

Gregory A. Gould.

Mr. Gould currently serves as Chair of the Audit Committee and previously served as CytoDyn’s Chairman of the Board from July 2012 until June 2013. He has been a director since March 2006. Mr. Gould has served as Chief Financial

Officer, Treasurer, and Corporate Secretary of Ampio Pharmaceuticals, Inc. (NYSE MKT: AMPE), a clinical stage pharmaceutical company, since June 2014. Prior to joining Ampio, he provided financial and operational consulting services to the biotech

industry through his consulting company, Gould LLC, from April 2012 until June 2014. Mr. Gould was Chief Financial Officer, Treasurer and Secretary of SeraCare Life Sciences, Inc., a provider of biopharmaceutical products and services to the

global life sciences industry, from November 2006 until the company was sold to Linden Capital Partners in April 2012. During the period from July 2011 until April 2012, Mr. Gould also served as the Interim President and Chief Executive

Officer of SeraCare. Mr. Gould has held several

3

other executive positions at publicly traded life sciences companies, including as Chief Financial Officer of Atrix Laboratories, Inc., an emerging specialty pharmaceutical company focused on

advanced drug delivery, and Colorado MedTech, Inc., a medical device design and manufacturing company. Mr. Gould was instrumental in the negotiation and sale of Atrix to QLT, Inc., for over $855 million and the prior sale of Colorado

MedTech to KRG. While with Atrix, he also played a critical role in the management of several licensing agreements, including a global licensing agreement with Sanofi-Synthelabo. Mr. Gould began his career as an auditor with Arthur Andersen,

LLP. Mr. Gould graduated from the University of Colorado with a BS in Business Administration and is a Certified Public Accountant. He brings biotech and public company M&A experience, as well as financial expertise, to the Board through

his professional experience.

A. Bruce Montgomery, M.D.

Dr. Montgomery was appointed as a director of the Company in September 2013.

Dr. Montgomery is a prominent biotech entrepreneur with an extensive background in product development and clinical studies. He is currently the Chief Executive Officer of Cardeas Pharma Corporation, a biotechnology firm focused on treatment of

multidrug resistant bacteria causing pneumonia in patients on ventilation. Before joining Cardeas Pharma Corporation in 2010, Dr. Montgomery founded and was the Chief Executive Officer of Corus Pharma, Inc., a development stage pharmaceutical

company, from 2001 until 2006. In 2006, Gilead acquired Corus Pharma, Inc., and Dr. Montgomery continued at Gilead, serving as Senior Vice President, Respiratory Therapeutics, from 2006 until 2010. He previously held positions in clinical

development with PathoGenesis Corporation and Genentech. Dr. Montgomery is a director of Alder BioPharmaceuticals, Inc., a NASDAQ listed company, and a Trustee for the Washington State Life Sciences Discovery Fund. He has previously served on

the boards of ZymoGenetics, Inc., a NASDAQ listed company until its acquisition in 2010, Pacific Science Center, and the Washington Biotechnology & Biomedical Association. Dr. Montgomery received a B.S. degree in chemistry and his M.D.

from the University of Washington, and completed his residency in Internal Medicine at the University of Washington and fellowships at the University of Washington and the University of California, San Francisco. Dr. Montgomery brings extensive

pharmaceutical research, development, and patent experience to the Board, as well as his skills in fundraising and as a serial entrepreneur.

Jordan G.

Naydenov.

Mr. Naydenov has been a director of the Company since June 2009. Mr. Naydenov immigrated to the U.S. in 1982 from Bulgaria where he was a competitive gymnast. Mr. Naydenov purchased a gymnasium, Naydenov Gymnastics,

which he built into a successful business and sold in 2005. Since 2001, he has served as Vice President and a director of Milara, Inc., and since 2006 he has served as Treasurer of Milara, Inc., and a director of Milara International. Milara Inc.

and Milara International are leading providers of stencil and screen printing systems for the surface mount and semiconductor industries. Mr. Naydenov brings leadership skills and significant management experience to the Board.

S. Michael Nobel, Ph.D.

Dr. Nobel was elected as a director at the annual shareholder meeting in December 2012 and serves as chair of the

Nominating and Governance Committee. He has extensive experience in assisting and launching new companies in the fields of medical diagnostics and treatment and medical technology transfer from inventions to commercial products, as well as

supervision of such companies. Dr. Nobel has served as a director of BSD Medical Corporation (“BSD”) since January 1998 and is a member of BSD’s audit, corporate governance, nominating, and compensation committees. Dr. Nobel

participated in the introduction of magnetic resonance imaging as European Vice President of Fonar Corp. He is founder and trustee of the Nobel Sustainable Trust Foundation and chairman of Nobel Charitable Trust Foundation (Asia). From 1991 to 2007,

Dr. Nobel served as the Executive Chairman of the MRAB Group, which he co-founded, a company providing diagnostic imaging services in Sweden. From August 2005 until June 2008, Dr. Nobel served as a director of WorldSpace Corp. He has also

been a consultant to Unesco in Paris and the United Nations Social Affairs Division in Geneva. Dr. Nobel is chairman or a board member of several international companies in medical diagnostics, treatment and information systems. In the academic

field, Dr. Nobel was guest professor at the Solutions Science Research Centre in the Tokyo Institute of Technology from 2007 to 2012. Dr. Nobel holds a Ph.D. in psychopedagogy from the University of Lausanne. Today he is a fellow at the

same institute. Dr. Nobel’s qualifications to serve on the Board include, among others, his expertise in medical diagnosis and treatment, his extensive business and financial experience, and his service on several public company boards.

4

MEETINGS AND COMMITTEES OF THE BOARD OF DIRECTORS

The Board held 11 meetings in fiscal 2014. During fiscal 2014, each current director attended at least 75 percent of the total

number of the meetings of the Board and the meetings held by each committee of the Board on which he served during his tenure on such committee or the Board.

Board Leadership Structure

The Board

believes that the Board leadership structure, which reflects the separation of the Chairman and Chief Executive Officer positions, serves the best interests of the Company and its shareholders by giving an independent director a direct and

significant role in establishing priorities and the strategic direction and oversight of the Company. The Board believes that the manner in which it oversees risk management at the Company has not affected its leadership structure.

The Board’s Role in Risk Oversight

The Company’s management is responsible for identifying, assessing and managing the material risks facing the Company. The Board generally

oversees risk management practices and processes and, either as a whole or through the Audit Committee and other board committees, periodically discusses with management strategic and financial risks associated with the Company’s operations,

their potential impact on the Company, and the steps taken to manage these risks.

While the Board is ultimately responsible for risk

oversight, the Board’s committees assist the Board in fulfilling its oversight responsibilities in certain areas of risk. In particular, the Audit Committee focuses on financial and enterprise risk and discusses with management and the

Company’s independent registered public accounting firm the Company’s policies and practices with respect to risk and particular areas of risk exposure. The Nominating and Governance Committee oversees recruitment of potential director

nominees and succession planning for the Company’s executive positions. The Compensation Committee monitors the Company’s incentive compensation programs to assure that management is not encouraged to take actions involving excessive risk.

Code of Ethics

We have adopted a

Code of Ethics for our executive officers (the Chief Executive Officer and Chief Financial Officer), as well as a Code of Business Conduct and an Insider Trading Policy for the Company. Copies of these governing documents, as well as the committee

charters described below, are available on our website at www.cytodyn.com.

Director Independence

In determining director independence, the Company uses the definition of independence in Rule 5605(a)(2) of the listing standards of The

Nasdaq Stock Market (the “NASDAQ Rules”). The Board has determined that Messrs. Carraciolo, Gould, and Naydenov and Drs. Montgomery and Nobel are independent under the NASDAQ Rules in that each is not, and has not been, an

executive officer or employee of the Company and does not otherwise have a relationship which, in the opinion of the Board, would interfere with his exercise of independent judgment in carrying out the responsibilities of a director.

In considering Mr. Naydenov’s independence, the Board considered his investments in one of the Company’s three-year convertible

promissory notes in the principal amount of $1,000,000 bearing interest at an annual rate of 5% and a one-year promissory note in the principal amount of $500,000 bearing interest at an annual rate of 15%. The $500,000 note was repaid in full at

maturity in April 2014. With respect to Dr. Nobel, the Board reviewed a brief consulting arrangement between the Company and Dr. Nobel pursuant to which he was paid a total of $20,000 for his assistance in arranging contacts with the

investment community in Europe, which arrangement ended in mid-2013.

5

Prior to Dr. Burger’s election as a director on February 7, 2014, the Board

initially determined that he was independent under the NASDAQ Rules, and he was appointed to the Compensation Committee and the Nominating and Governance Committee. However, the Board later requested that Dr. Burger resign from all Board

committees in connection with its approval of a consulting arrangement in late February 2014. Under his consulting agreement with the Company, Dr. Burger provides advice to the Company’s executive management team regarding strategic and

operational issues, including during regular in-person meetings, and receives $5,000 per month in cash for his services.

The Company is

not a “listed issuer” as that term is used in Regulation S-K Item 407 adopted by the Securities and Exchange Commission (the “SEC”).

Audit Committee

Our Audit Committee

Charter was adopted by the Board of Directors and became effective on November 2, 2011. The primary role of the Audit Committee is to oversee the financial reporting and disclosure process. The Audit Committee is responsible for overseeing the

work done by the Company’s independent auditors and reviewing and discussing with management and the independent auditors the adequacy and effectiveness of the Company’s financial reporting process, the annual audited financial statements,

and the results of the annual audit. The Audit Committee held five meetings during fiscal 2014 to review the Company’s financial statements with the auditors following the end of each fiscal quarter prior to their inclusion in reports filed

with the SEC.

The Audit Committee is presently composed of Mr. Gould (chair), Mr. Caracciolo, and Dr. Montgomery.

Mr. Gould is a “financial expert” as defined in Regulation S-K Item 407(d)(5)(ii) adopted by the SEC. During fiscal 2014, Mr. Caracciolo, Mr. Gould, and Dr. Montgomery also met the additional independence and

experience requirements of the SEC and the NASDAQ Rules applicable specifically to members of the Audit Committee.

Compensation Committee

Our Compensation Committee Charter was adopted by the Board in October 2012 and was updated on May 29, 2014. The Compensation Committee

reviews and approves the Company’s overall compensation philosophy and determines base salaries and other forms of compensation to be paid to executive officers, including decisions as to cash incentive compensation, grants of options and other

stock-based awards. The Compensation Committee is also responsible for making recommendations to the Board with respect to new compensation plans, including incentive compensation plans and equity-based plans. The Compensation Committee held four

meetings during fiscal 2014. The current members of the Compensation Committee are Messrs. Caracciolo (chair) and Gould, and Dr. Nobel.

Nominating and Governance Committee

Our

Nominating and Governance Committee Charter was adopted by the Board on October 26, 2012. The Nominating and Governance Committee identifies individuals qualified to become members of the Board, makes recommendations to the Board with regard to

the size and composition of the Board and Board committees, and evaluates the Board and its members. The Nominating and Governance Committee also assists the Board in developing succession and continuity plans for principal officer positions. The

current members of the Nominating and Governance Committee are Drs. Nobel (chair) and Montgomery, and Messrs. Caracciolo, Gould, and Naydenov. The Nominating and Governance Committee met twice during fiscal 2014.

The Nominating and Governance Committee does not have any specific, minimum qualifications for director candidates. In evaluating potential

director nominees, the committee will consider:

|

|

•

|

|

Demonstration of ethical behavior;

|

|

|

•

|

|

Positions of leadership that demonstrate the ability to exercise sound judgment in a wide variety of matters;

|

6

|

|

•

|

|

The candidate’s ability to commit sufficient time to the position;

|

|

|

•

|

|

The candidate’s understanding of the Company’s business and operations; and

|

|

|

•

|

|

The need to satisfy independence requirements relating to Board composition.

|

The Nominating

and Governance Committee relies on its annual evaluations of the Board in determining whether to recommend nomination of current directors for re-election. The Nominating and Governance Committee has not hired a third-party search firm to date, but

has the authority to do so if it deems such action to be appropriate. It does not have a policy in place for considering diversity in identifying nominees for director.

The Nominating and Governance Committee will consider director candidates recommended by shareholders for nomination in the same manner as

other director candidates presented to the committee. Shareholders wishing to submit a candidate for consideration should do so by sending the candidate’s name, biographical information, business and educational experience, and qualifications,

as well as the candidate’s signed written consent to be considered as a nominee and agreement to serve as a director if nominated and elected, to: Nominating and Governance Committee Chair, CytoDyn Inc., 1111 Main Street, Suite 660,

Vancouver, Washington 98660.

7

COMPENSATION OF DIRECTORS

During fiscal 2014, each director who was not an employee of the Company was entitled to receive: (i) $25,000 in annual compensation;

(ii) additional annual cash retainers for committee chairs and committee members ranging from $2,500 to $15,000; (iii) an additional cash retainer of $15,000 for the Chairman of the Board; and (iv) an annual grant on June 1,

2013, of a non-qualified stock option covering 50,000 shares of Common Stock vesting in four equal quarterly installments. At the instructions of the Board, the Company deferred payment of cash director fees for the second half of fiscal 2013 until

the Company had sufficient cash resources to make such payments. The deferred payments were paid in full during the second quarter of fiscal 2014.

The following table sets forth certain information regarding the compensation earned by or awarded to each non-employee director for services

during fiscal 2014.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name

|

|

Cash

Fees

|

|

|

Stock

Options(1),(2)

|

|

|

All Other

Compensation(3)

|

|

|

Total

|

|

|

Denis R. Burger

|

|

$

|

7,974

|

|

|

$

|

8,724

|

|

|

$

|

15,000

|

|

|

$

|

31,698

|

|

|

Anthony D. Caracciolo

|

|

|

56,848

|

|

|

|

53,498

|

|

|

|

—

|

|

|

|

110,346

|

|

|

Gregory A. Gould

|

|

|

50,652

|

|

|

|

23,292

|

|

|

|

—

|

|

|

|

73,944

|

|

|

A. Bruce Montgomery

|

|

|

21,966

|

|

|

|

19,276

|

|

|

|

—

|

|

|

|

41,242

|

|

|

Jordan G. Naydenov

|

|

|

27,500

|

|

|

|

23,292

|

|

|

|

—

|

|

|

|

50,792

|

|

|

S. Michael Nobel

|

|

|

37,500

|

|

|

|

23,292

|

|

|

|

—

|

|

|

|

60,792

|

|

|

(1)

|

Represents aggregate grant date fair value of options granted during fiscal 2014 pursuant to Black-Scholes valuation model.

|

|

(2)

|

Total number of shares covered by stock options held by each non-employee director at May 31, 2014, were as follows:

|

|

|

|

|

|

|

|

|

|

No. of Shares

|

|

|

Denis R. Burger

|

|

|

15,616

|

|

|

Anthony D. Caracciolo

|

|

|

186,543

|

|

|

Gregory A. Gould

|

|

|

225,000

|

|

|

A. Bruce Montgomery

|

|

|

33,836

|

|

|

Jordan G. Naydenov

|

|

|

125,000

|

|

|

S. Michael Nobel

|

|

|

61,645

|

|

|

(3)

|

Represents consulting fees in a monthly amount of $5,000 beginning March 1, 2014.

|

8

STOCK OWNERSHIP BY PRINCIPAL SHAREHOLDERS

AND MANAGEMENT

Beneficial Ownership

Table

The following table sets forth the beneficial ownership of our Common Stock as of July 1, 2014, by (i) each person or

entity who is known by us to own beneficially more than 5 percent of the outstanding shares of Common Stock, (ii) each of our directors, (iii) each of our executive officers, and (iv) all of our current directors and executive

officers as a group.

|

|

|

|

|

|

|

|

|

|

|

Name and Address of Beneficial Owner(1)

|

|

Amount and Nature of

Beneficial Ownership (2)

|

|

|

Percent of Total (2) (3)

|

|

|

Owners of more than 5 percent:

|

|

|

|

|

|

|

|

|

|

Jordan G. Naydenov

|

|

|

4,222,242

|

(4)

|

|

|

7.2

|

%

|

|

C. David Callaham

|

|

|

3,773,845

|

(5)

|

|

|

6.4

|

%

|

|

Behrouz Rajaee

|

|

|

3,484,352

|

(6)

|

|

|

5.9

|

%

|

|

Nickitas Panayotou

|

|

|

3,172,958

|

(7)

|

|

|

5.5

|

%

|

|

Alpha Ventures Capital Partners, LP

|

|

|

3,143,550

|

(8)

|

|

|

5.5

|

%

|

|

Kenneth J. Van Ness

|

|

|

3,053,528

|

(9)

|

|

|

5.4

|

%

|

|

Craig Bordon

|

|

|

3,014,010

|

(10)

|

|

|

5.3

|

%

|

|

|

|

|

|

Directors and Executive Officers:

|

|

|

|

|

|

|

|

|

|

Jordan G. Naydenov

|

|

|

4,222,242

|

(4)

|

|

|

7.2

|

%

|

|

Nader Z. Pourhassan

|

|

|

1,159,101

|

(11)

|

|

|

2.1

|

%

|

|

Anthony D. Caracciolo

|

|

|

248,679

|

(12)

|

|

|

*

|

|

|

Gregory A. Gould

|

|

|

244,176

|

(13)

|

|

|

*

|

|

|

Michael D. Mulholland

|

|

|

156,876

|

(14)

|

|

|

*

|

|

|

S. Michael Nobel

|

|

|

67,270

|

(15)

|

|

|

*

|

|

|

A. Bruce Montgomery

|

|

|

33,836

|

(16)

|

|

|

*

|

|

|

Denis R. Burger

|

|

|

15,616

|

(17)

|

|

|

*

|

|

|

All Current Directors and Executive Officers as a Group (8 persons)

|

|

|

6,147,796

|

|

|

|

10.3

|

%

|

|

*

|

Less than 1% of the outstanding shares of Common Stock.

|

|

(1)

|

Unless otherwise indicated, the business address of each current director and executive officer is c/o CytoDyn Inc., 1111 Main Street, Suite 660, Vancouver, Washington 98660.

|

|

(2)

|

Shares of common stock subject to options, warrants or other convertible securities that are exercisable or convertible currently or within 60 days of July 1, 2014, are deemed outstanding for purposes of

computing the number of shares beneficially owned and percentage ownership of the person or group holding such options, warrants or convertible securities, but are not deemed outstanding for computing the percentage of any other person.

|

|

(3)

|

Percentages are based on 55,752,503 shares of common stock outstanding.

|

|

(4)

|

Includes: (i) 1,430,576 shares of common stock directly held by Mr. Naydenov; (ii) warrants exercisable for 1,333,333 shares of common stock; (iii) a note convertible into 1,333,333 shares of common

stock; and (iv) 125,000 shares of common stock subject to options.

|

|

(5)

|

Includes: (i) 104,786 shares of common stock directly held by Mr. Callaham and his wife; (ii) 50,000 shares of common stock subject to options held by Mr. Callaham; (iii) 60,000 shares of

Series B Preferred Stock held by Mr. Callaham that are convertible into 600,000 shares of common stock; (iv) notes held by Mr. Callaham that are convertible into 1,266,666 shares of common stock; (v) warrants held by

Mr. Callaham that are exercisable for 1,319,059 shares of common stock; (vi) notes held by Callaham & Callaham, a partnership of which Mr. Callaham is a general partner, that are convertible into 216,667 shares of common

stock; and (vii) warrants held by Callaham & Callaham that are exercisable for 216,667 shares of common stock. The address of C. David Callaham and Callaham & Callaham is 10804 NE Highway 99, Vancouver, Washington

98686-5655.

|

9

|

(6)

|

Includes 545,122 shares of outstanding common stock, notes convertible into 1,333,334 shares of common stock, and warrants exercisable for 1,605,896 shares of common stock, in each case held by family trusts of which

Mr. Rajaee is trustee. The address of the Rajaee Family trusts is 3281 E. Guasti Road, Ontario, California 91761.

|

|

(7)

|

Includes: (i) 431,114 shares of common stock directly held by Mr. Panayotou; (ii) warrants held by Mr. Panayotou that are exercisable for 426,667 shares of common stock; (iii) 1,215,177 shares

of common stock directly held by 3NT; and (iv) warrants held by 3NT that are exercisable for 1,100,000 shares of common stock. The address of Mr. Panayotou and 3NT is 2200 Redington Road, Hillsborough, California 94010. See also

note 10 to the table.

|

|

(8)

|

Includes 2,095,700 shares of outstanding common stock and warrants exercisable for 1,047,850 shares of common stock. The address of Alpha Venture Capital Partners, L.P. is 2026 Crystal Wood Drive, Lakeland, Florida

33801.

|

|

(9)

|

Includes 1,778,528 shares of common stock held in the name of Greenwood Hudson Portfolio, LLC, of which Mr. Van Ness is the managing member, based on information reported on Form 4 filed on April 30, 2012, by

Mr. Van Ness. Also includes 1,275,000 shares of common stock subject to options held by Mr. Van Ness. The address of Mr. Van Ness is 110 Crenshaw Lake Road, Lutz, Florida 33548.

|

|

(10)

|

Includes: (i) 343,666 shares of common stock directly held by Mr. Bordon; (ii) warrants held by Mr. Bordon that are exercisable for 355,167 shares of common stock; (iii) 1,215,177 shares of

common stock directly held by 3NT Management LLC (“3NT”); and (iv) warrants held by 3NT that are exercisable for 1,100,000 shares of common stock. The address of Mr. Bordon is 516 Loma Drive, Hermosa Beach, California 90254.

The address of 3NT is 2200 Redington Road, Hillsborough, California 94010. See also note 7 to the table.

|

|

(11)

|

Includes: (i) 60,056 shares of common stock directly held by Dr. Pourhassan; (ii) 375,750 shares beneficially owned by Dr. Pourhassan’s wife; and (iii) 723,295 shares of common stock

subject to options held by Dr. Pourhassan.

|

|

(12)

|

Includes 62,136 shares of common stock directly held by Mr. Caracciolo and 186,543 shares of common stock subject to options.

|

|

(13)

|

Includes 19,176 shares of common stock directly held by Mr. Gould and 225,000 shares of common stock subject to options.

|

|

(14)

|

Includes 23,543 shares of common stock directly held by Mr. Mulholland and 133,333 shares of common stock subject to options.

|

|

(15)

|

Includes 5,625 shares of common stock directly held by Dr. Nobel and 61,645 shares of common stock subject to options.

|

|

(16)

|

Represents shares of common stock subject to options.

|

|

(17)

|

Represents shares of common stock subject to options.

|

Section 16(a) Beneficial Ownership Reporting

Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires our directors, officers and beneficial

owners of more than 10 percent of our Common Stock to file reports of ownership and reports of changes in ownership with the SEC. Such persons are required by SEC regulations to furnish us with copies of all Section 16(a) reports they

file. Based on a review of those reports, all Section 16 reporting persons complied with all applicable Section 16(a) filing requirements during the fiscal year ended May 31, 2014, other than Mr. Naydenov who filed one late

Form 4 reporting changes in beneficial ownership on January 16, 2014.

MATTERS RELATING TO OUR

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Warren Averett, LLC (“Warren Averett”) was the Company’s independent registered public accounting firm with respect to its

audited financial statements for the fiscal year ended May 31, 2014. On January 8, 2013, the Company was advised that, effective January 1, 2013, Pender Newkirk & Company LLP (“Pender Newkirk”), the Company’s

former independent registered public accounting firm, had discontinued its audit practice and that the partners and employees of Pender Newkirk had joined the firm of Warren Averett. On January 11, 2013, the Company’s Audit

10

Committee approved the retention of Warren Averett as the Company’s new independent registered public accounting firm. Representatives of Warren Averett are not expected to be present at the

Annual Meeting.

Change in Independent Auditor

Pender Newkirk’s report on the financial statements of the Company for its fiscal year ended May 31, 2012, did not contain an adverse

opinion or a disclaimer of opinion, nor was the report qualified or modified as to uncertainty, audit scope, or accounting principles, other than an explanatory paragraph regarding a significant doubt about the Company’s ability to continue as

a going concern due to net loss, accumulated deficit, and working capital deficit.

During fiscal 2012 and the subsequent interim period

in which Pender Newkirk served as the Company’s independent auditor, there were no disagreements with Pender Newkirk on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which

disagreements, if not resolved to the satisfaction of Pender Newkirk, would have caused Pender Newkirk to make reference to the subject matter of such disagreements in connection with its audit report.

The Company provided Pender Newkirk with a copy of the above disclosures prior to reporting the change in auditors. Pender Newkirk advised the

Company that it agreed with the Company’s disclosures; its letter was annexed to the Company’s Current Report on Form 8-K filed on January 14, 2013.

Prior to engaging Warren Averett as the Company’s independent registered public accounting firm, the Company did not consult Warren

Averett regarding either (i) the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on the Company’s financial statements; or (ii) any

matter that was either the subject of a disagreement or a reportable event, as those terms are defined in applicable SEC rules.

The

Company previously provided Warren Averett with a copy of the above disclosures. Warren Averett advised the Company that it had no basis on which to submit a letter to the SEC commenting on the disclosures.

Board of Directors Pre-Approval Process, Policies and Procedures

The Audit Committee pre-approves all engagements for audit and non-audit services provided by the Company’s independent registered public

accounting firm. Warren Averett performed its audit procedures in accordance with our Audit Committee’s policies and procedures. Warren Averett informed our Audit Committee of the scope and nature of each service provided. No services were

provided by Warren Averett or Pender Newkirk during fiscal 2013 or fiscal 2014 other than audit, review, or attest services.

Fees Paid to Principal

Independent Registered Public Accounting Firm

The aggregate fees billed during the fiscal years ended May 31, 2014 and

2013 for professional services rendered by Warren Averett and Pender Newkirk for: (1)

Audit Fees

(the audit of the financial statements included in our annual reports on Form 10-K and for the review of the interim condensed

financial statements included in our quarterly reports on Form 10-Q) were approximately $114,000 and $109,000, respectively; and (2) A

udit-Related Fees

(review of the Company’s Registration Statement on Form S-1 filed in fiscal

2014 and related accountants’ consent) were $2,500. No other fees were paid to our principal accounting firm for services in fiscal 2013 or fiscal 2014.

AUDIT COMMITTEE REPORT

The Audit Committee met with management and the Company’s independent auditors, Warren Averett, to review the Company’s accounting

functions and the audit process and to review and discuss the audited financial statements for the fiscal year ended May 31, 2014. The Audit Committee discussed and reviewed with Warren

11

Averett the matters required to be discussed by Statement on Auditing Standards No. 16, as amended, “Communications with Audit Committees.” Warren Averett has also provided to the

Audit Committee the written disclosures and the letter required by applicable requirements of the Public Company Accounting Oversight Board regarding communications with the Audit Committee concerning independence.

Based on its review and discussions with management and the Company’s independent auditors, the Audit Committee recommended to the Board

that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended May 31, 2014, for filing with the Securities and Exchange Commission.

Submitted by the Audit Committee of the Board of Directors:

Gregory A. Gould (Chair), Anthony D. Caracciolo, and A. Bruce Montgomery

PROPOSAL 2 – APPROVAL OF A REVERSE STOCK SPLIT AND AN

AMENDMENT TO THE COMPANY’S ARTICLES OF INCORPORATION TO

IMPLEMENT THE REVERSE STOCK SPLIT

General

The Board believes it is in the

best interests of the Company and its shareholders to authorize a reverse stock split of the Company’s outstanding Common Stock. The Board is asking shareholders to approve: a reverse split of the Company’s Common Stock and grant to the

Board the authority to set the ratio for the reverse split at either one-for-three, one-for-four, one-for-five, one-for-six, one-for-seven or one-for-eight (the “Reverse Stock Split”), or not to complete the Reverse Stock Split, as

determined in the discretion of the Board at any time before August 20, 2015; and an amendment to the Company’s Articles of Incorporation (the “Articles”) to implement the Reverse Stock Split. If the proposal is approved by

shareholders, our Board will have authority to effect the Reserve Stock Split if and at such time as it determines to be appropriate. The principal effect of the Reverse Stock Split would be to decrease the outstanding number of shares of Common

Stock, while maintaining the authorized number of shares at its current level.

The Board is asking that shareholders approve a range of

exchange ratios for the Reverse Stock Split because it is not possible at this time to predict market conditions at the time the split would be implemented. If shareholders approve the proposal for the Reverse Stock Split at the Annual Meeting, the

Board will be authorized to implement a reverse stock split at a ratio of any whole number between one-for-three and one-for-eight, or to abandon the split, as determined at the discretion of the Board. The Board will set the ratio for the Reverse

Stock Split or abandon the Reverse Stock Split as it determines is advisable considering relevant market conditions at the time the reverse split is to be implemented or abandoned.

To implement the Reverse Stock Split, the Company would file the proposed amendment to the Articles in the form attached hereto as

Appendix A (the “Reverse Split Amendment”). If this proposal is approved and the Reverse Stock Split effected, the number of issued and outstanding shares of Common Stock would be reduced by a ratio of one share for every three, four,

five, six, seven or eight shares outstanding, depending on the ratio chosen by the Board. The relative voting and other rights that accompany shares of Common Stock will not be affected by the Reverse Stock Split, which would become effective upon

filing the Reverse Split Amendment with the Colorado Secretary of State.

Shareholders do not have the statutory right to dissent and

obtain an appraisal of their shares under Colorado law or under the Company’s Articles or Bylaws in connection with the proposal to approve the Reverse Stock Split.

12

Purpose

The Board is proposing the Reverse Stock Split in an effort to decrease the number of shares of Common Stock outstanding and increase the

market price of its shares. The Board is also seeking to reduce certain administrative burdens and costs relating to the large number of shares that are currently issued and outstanding.

Among the factors considered by the Board in reaching its decision to recommend the Reverse Stock Split, the Board considered the potential

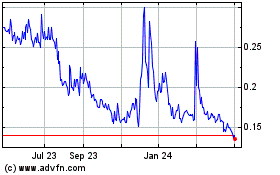

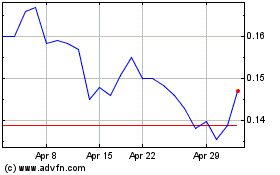

effects of having stock that trades at a low price; our closing stock price on July 10, 2014, was $0.87 per share. For example, certain brokerage firms have internal practices and policies that discourage individual brokers from dealing in

stocks trading below a particular dollar level. Further, since the brokerage commissions on stock with a low trading price generally represent a higher percentage of the stock price than commissions on higher priced stock, investors in stocks with a

low trading price pay transaction costs (commissions, markups, or markdowns) at a higher percentage of their total share value, which may limit the willingness of individual investors and institutions to purchase our Common Stock. The Board also

believes that certain institutional investors, such as mutual funds or pension plans, have policies or procedures that discourage or prohibit acquisitions of shares priced at less than $5.00 per share, making our shares less attractive. Each of

these factors could weaken the market for the Company’s Common Stock.

The SEC has also adopted rules governing “penny

stock” that impose additional burdens on broker-dealers trading in stock priced at or below $5.00 per share, unless listed on certain securities exchanges. The Board believes that the Reverse Stock Split will enhance the Company’s ability

to obtain an initial listing on a national securities exchange and thereby avoid classification of the Common Stock as penny stock under the SEC’s rules. The NASDAQ Capital Market requires, among other items, an initial bid price of least

$4.00 per share and, following initial listing, maintenance of a continued price of at least $1.00 per share. Reducing the number of outstanding shares of the Common Stock should, absent other factors, increase the per share market price

of the Common Stock, although the Company cannot provide any assurance that the minimum bid price would continue to be achieved following any Reverse Stock Split.

Reducing the number of outstanding shares of Common Stock through the Reverse Stock Split is intended, absent other factors, to increase the

per share market price of Common Stock. However, other factors, such as financial results and market conditions, may adversely affect the market price of our Common Stock. As a result, there can be no assurance that the Reverse Stock Split, if

completed, will result in the intended benefits described above, that the market price of Common Stock will increase proportionately following the Reverse Stock Split, or that the market price of Common Stock will not decrease in the future.

Accordingly, the total market capitalization of Common Stock after the Reverse Stock Split may be lower than the total market capitalization before the Reverse Stock Split. Additionally, if implemented, the Reverse Stock Split may result in some

shareholders owning “odd-lots” of less than 100 shares of Common Stock, particularly as the ratio for the Reverse Stock Split increases. Brokerage commissions and other costs of transactions in odd-lots may be higher, particularly on a

per-share basis, than the cost of transactions in even multiples of 100 shares.

The Board will not decrease the authorized Common

Stock in connection with the Reverse Stock Split, which will result in a significant increase in the availability of authorized shares of Common Stock. Any additional Common Stock so authorized will be available for issuance by the Board for stock

splits or stock dividends, acquisitions, raising additional capital, conversion of our debt into equity, stock options or other corporate purposes, and any such issuances may be dilutive to current shareholders.

As of July 10, 2014, the Company had approximately 5.5 million shares of Common Stock remaining authorized for issuance in excess of

outstanding shares and shares reserved for issuance upon the exercise or conversion of stock options, warrants and convertible securities. This number may increase to up to a total of about 13 million shares (absent the exercise of certain

outstanding warrants or other stock issuances) in October 2014. The Company currently anticipates that it will need to raise additional capital in the fall of 2014 to fund ongoing research and development activities. Such financing may include the

issuance or reservation for issuance of additional shares of Common Stock that may become available as a result of the Reverse Stock Split. The

13

Company has not, however, entered into any contracts, arrangements or understandings with respect to any such capital-raising efforts, including the engagement of any investment bankers, or made

any specific determinations as to the amount or terms of any such financing. Other than as disclosed in this proxy statement, the Company has no other specific plans, arrangements or understandings regarding the issuance of shares of Common Stock

that may become available for issuance as a result of implementation of the Reverse Stock Split if Proposal 2 is approved by the Company’s shareholders at the Annual Meeting.

Effects of the Reverse Stock Split

To

implement the Reverse Stock Split, the Company would file the Reverse Split Amendment with the Colorado Secretary of State on any date selected by the Company’s Board. Upon filing and without further action on the part of the Company or its

shareholders, the shares of Common Stock held by shareholders of record as of the effective time set forth in the Reverse Split Amendment would be converted into the number of shares of Common Stock issued in accordance with the Restated Articles

(the “New Common Stock”) calculated based on the reverse split ratio. We will issue cash in lieu of any fractional shares left after the Reverse Stock Split has been effected.

For example, if a shareholder presently holds 100 shares of Common Stock, he or she would hold 33 shares following a one-for-three

split, 25 shares following a one-for-four split, 20 shares following a one-for-five split, 16 shares following a one-for-six split, 14 shares following a one-for-seven split, or 12 shares following a one-for-eight split. No

fractional shares or scrip would be issued. Each shareholder who would otherwise be entitled to a fraction of a share would receive a cash payment for such share based on the average closing price of a share of Common Stock on the OTCQB of the OTC

Markets marketplace or other securities trading market on which it is traded for the five trading days immediately preceding the effective date of the Reverse Stock Split.

All outstanding stock options, warrants and convertible securities will be adjusted to reduce the number of shares to be issued upon exercise

or conversion of such options, warrants or convertible securities, and increase the exercise or conversion price thereof, proportionately. Accordingly, following the Reverse Stock Split, the outstanding Series B Preferred Stock will be convertible

into a proportionately fewer number of shares of Common Stock. Also, the Company has a total of 3,000,000 shares authorized for issuance under its 2012 Equity Incentive Plan (the “Plan”), of which 1,238,903 shares remain available for

grant. When the reverse split becomes effective, the number of shares reserved for issuance under the Plan will be proportionately decreased as well.

As of the record date for the Annual Meeting, there were approximately 330 holders of record of the Company’s Common Stock (although

there are significantly more beneficial holders). The Company does not expect the Reverse Stock Split to result in a significant reduction in the number of record holders.

Board Discretion to Implement the Reverse Stock Split

If this proposal is approved by the shareholders, the Reverse Stock Split will be effected, if at all, only upon a determination by the Board

that a reverse stock split (at a ratio determined by the Board as described above) is in the best interests of the Company and its shareholders. The Board’s determination as to whether the Reverse Stock Split will be effected and, if so, at

what ratio, will be based upon certain factors, including existing and expected marketability and liquidity of our Common Stock, prevailing market conditions, and the likely effect on the market price of our Common Stock. If the Board determines to

effect the Reverse Stock Split, the Board will consider various factors in selecting the ratio, including the overall market conditions at the time, the effect of a particular ratio on the market for our Common Stock, and the recent trading history

of the Common Stock.

Exchange of Stock Certificates; Fractional Shares

As soon as practicable after the effective time of the Reverse Stock Split, the Company, or its transfer agent, will send a letter to each

shareholder of record for use in transmitting certificates representing shares of Common Stock (“Old Certificates”) to the Company’s transfer agent, Computershare (the “Exchange Agent”). The letter of

14

transmittal will contain instructions for the surrender of Old Certificates to the Exchange Agent in exchange for certificates representing the appropriate number of whole shares of New Common

Stock and a cash payment in lieu of any fractional share. No new certificates will be issued to a shareholder until such Old Certificates are surrendered, together with a properly completed and executed letter of transmittal, to the Exchange Agent.

Shareholders will then receive a new certificate or certificates representing the number of whole shares of New Common Stock into which

their shares of Common Stock have been converted as a result of the Reverse Stock Split. Until surrendered, outstanding stock certificates held by shareholders will be deemed for all purposes to represent the number of whole shares of New Common

Stock to which such shareholders are entitled as a result of the Reverse Stock Split. Shareholders should not send their Old Certificates to the Exchange Agent until they have received the letter of transmittal. All expenses of the exchange of

certificates will be borne by the Company.

We intend to treat shares held by shareholders in “street name,” through a bank,

broker or other nominee, in the same manner as shareholders whose shares are registered in their names. Banks, brokers or other nominees will be instructed to effect the Reverse Stock Split for their beneficial or “street name” holders.

However, these banks, brokers or other nominees may have different procedures for processing the Reverse Stock Split and making payment for fractional shares. Shareholders holding shares of Common Stock with a bank, broker or other nominee should

contact their bank, broker or other nominee with any questions in this regard.

Federal Income Tax Consequences

The Company believes that the Reverse Stock Split will qualify as a recapitalization under Section 368(a)(1)(E) of the Internal Revenue

Code, in which case a shareholder of the Company who exchanges Common Stock solely for New Common Stock should recognize no gain or loss for federal income tax purposes. A shareholder’s aggregate tax basis in his or her shares of New Common

Stock received from the Company should remain the same, as should the holding period for the shares, provided all such Common Stock is held as a capital asset. Shareholders who receive cash in lieu of a fractional share will realize capital gain (or

loss) in an amount equal to the difference between the amount of cash received and the adjusted basis of the fractional share surrendered, unless the transaction is deemed to be equivalent to a dividend.

This summary is based on federal income tax laws as currently in effect and as presently interpreted and is provided for general information

only. This summary is not intended as tax advice to any particular person and does not address any consequences of the Reverse Stock Split under state, local and foreign tax laws. We encourage you to consult your own tax advisor regarding the

specific tax consequences of the Reverse Stock Split to you.

Approval Required

Provided that a quorum is present, this proposal will be approved if the number of shares voted in favor of the proposal exceeds the number of

shares voted against. Shares that are not represented at the Annual Meeting, shares that abstain from voting on this proposal, and broker non-votes will have no effect on the outcome of the voting on this proposal.

The Board recommends that shareholders vote FOR the proposal to approve a reverse stock split at a ratio of any whole number between

one-for-three and one-for-eight, as determined by our board of directors, and an amendment to the Company’s Articles of Incorporation to implement the reverse stock split at any time before August 20, 2015, if and as determined by our

board of directors.

15

PROPOSAL 3 – RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee has selected Warren Averett, LLC as the Company’s independent registered public accounting firm to examine

the financial statements of the Company for the fiscal year ending May 31, 2015. Although the selection of independent auditors is not required to be submitted to a shareholder vote by the Company’s governance documents or applicable law,

the Board has decided to ask the shareholders to ratify the selection. If the shareholders do not approve the selection of Warren Averett, the Audit Committee will reconsider its selection.

Provided that a quorum is present, the selection of Warren Averett as the Company’s independent auditors will be ratified if the votes

cast in favor of the proposal exceed the votes cast opposing it. Abstentions and broker non-votes will have no effect on the outcome of the voting on this proposal.

The Board recommends that shareholders vote FOR ratification of the selection of Warren Averett, LLC as the Company’s

independent registered public accounting firm for fiscal 2015

.

PROPOSAL 4 – ADVISORY VOTE ON EXECUTIVE

COMPENSATION

The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (the

“Dodd-Frank

Act”) included a provision that requires public companies to hold an advisory shareholder vote to approve or disapprove the compensation of their named executive officers. The Dodd-Frank

Act also included a provision providing shareholders of a public company the opportunity to vote, on an advisory basis, on how frequently they would like the company to hold an advisory vote on the compensation of executive officers. At the 2013

annual meeting, the Company’s shareholders approved the Board’s recommendation that an advisory vote on executive compensation be conducted annually. Accordingly, we are conducting an advisory vote to approve the compensation of the

Company’s executive officers again this year.

A detailed description of the compensation paid to our executive officers is included

in this proxy statement under the heading “Executive Compensation” below in accordance with the SEC’s rules.

The

Company’s philosophy is that executive compensation should align with shareholders’ interests, without encouraging excessive and unnecessary risk. During fiscal 2014, the main components of executive compensation, as shown in the Summary

Compensation Table below, included (i) base salary, (ii) bonus based on the Compensation Committee’s assessment of each executive officer’s performance in achieving corporate and individual goals, and (iii) employee stock

options. This vote is intended to consider the overall compensation of our executive officers and the policies and practices described in this proxy statement.

This vote is advisory and therefore not binding on the Company, the Compensation Committee, or the Board. The Board and the Compensation

Committee value the opinions of shareholders and will take into account the outcome of the vote when considering future executive compensation arrangements.

The Board of Directors unanimously recommends that you vote, on an advisory basis,

FOR

the following resolution:

“RESOLVED, that the compensation paid to our named executive officers, as disclosed in this proxy statement pursuant to Item 402

of Regulation S-K adopted by the SEC, including the executive compensation tables and accompanying footnotes and narrative discussion, is hereby approved.”

The above-referenced disclosures appear under the heading “Executive Compensation” on pages 18 and 19 of this proxy statement.

The above resolution will be deemed to be approved if the votes cast in favor of Proposal 4 exceed the votes cast against it at the

Annual Meeting. Abstentions and broker non-votes will have no effect on the outcome of the vote.

16

EXECUTIVE OFFICERS OF THE COMPANY

In addition to Dr. Pourhassan, whose background appears under “Proposal 1—Election of Directors,” Michael D.

Mulholland, age 62, is an executive officer of the Company. The Board appointed Mr. Mulholland as the Company’s Chief Financial Officer, Treasurer, and Corporate Secretary on December 13, 2012. Mr. Mulholland provides

CytoDyn with more than 25 years of senior level financial leadership for public companies in the business services, retail and manufacturing industries. His broad experience includes strategic planning, corporate finance, including raising debt

and equity capital, acquisitions, corporate restructurings, SEC reporting, risk management, investor relations and corporate governance matters. Mr. Mulholland has also collaborated with a leading European scientific inventor and IP counsel in

connection with the evaluation of the patentability of certain biological compounds for potential applications to improve human health and the preparation of the related patent filings. Most recently, from 2011-2012, he served as Chief Financial

Officer of Nautilus, Inc., a NYSE-listed developer and marketer of fitness equipment. He previously was Co-Chief Financial Officer of Corporate Management Advisors, Inc., a private holding company of various businesses and investments, including a

majority interest in a publicly held manufacturing company, from 2010 to 2011; Vice President of Finance of Gevity HR, Inc., a former Nasdaq-listed professional employer organization, from 2008 to 2009; Chief Financial Officer and Secretary of

Barrett Business Services, Inc., a Nasdaq-listed business services firm, from 1994 to 2008; and Executive Vice President, Chief Financial Officer and Secretary of Sprouse-Reitz Stores Inc., a former publicly held retail company, from 1988 to 1994.

He began his career with Deloitte & Touche LLP. Mr. Mulholland received a B.S. degree in accounting and a M.B.A. in finance from the University of Oregon. He is a certified public accountant.

17

EXECUTIVE COMPENSATION

Summary Compensation Table

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name and Principal Position

|

|

Fiscal

Year

|

|

|

Salary

($)

|

|

|

Bonus

($)(3)

|

|

|

Option

Awards

($)(4)

|

|

|

All Other

Compensation

($)(5)

|

|

|

Total

($)

|

|

|

Nader Z. Pourhassan,

President and Chief

Executive Officer (1)

|

|

|

2014

2013

|

|

|

|

265,000

212,969

|

|

|

|

100,000

177,500

|

|

|

|

72,659

409,372

|

|

|

|

9,863

7,852

|

|

|

|

447,522

807,693

|

|

|

|

|

|

|

|

|

|

|

Michael D. Mulholland,

Chief Financial Officer (2)

|

|

|

2014

2013

|

|

|

|

225,000

82,228

|

|

|

|

92,500

87,500

|

|

|

|

54,494

241,306

|

|

|

|

8,063

1,313

|

|

|

|

380,057

412,347

|

|

|

(1)

|

Dr. Pourhassan served as the Company’s Chief Operating Officer until June 30, 2011, when he ceased to be an executive officer and accepted a position as the Company’s Managing Director of Business

Development. Dr. Pourhassan was appointed interim President and Chief Executive Officer on September 10, 2012, and President and Chief Executive Officer in December 2012.

|

|

(2)

|

Mr. Mulholland was appointed as the Company’s Chief Financial Officer effective December 13, 2012.

|

|

(3)

|

Bonuses for fiscal 2013 were paid in cash in the amount of $113,750 to Dr. Pourhassan and $43,750 to Mr. Mulholland, with the balance paid in shares of Common Stock, net of tax withholding. One-half of bonuses

for fiscal 2014 were paid in cash shortly following fiscal year-end; the balance will be paid no later than December 31, 2014.

|

|

(4)

|

Option awards represent the grant date fair value of the awards pursuant to FASB ASC Topic 718, as described in Note 5 “Stock Options and Warrants” in the Notes to Consolidated Financial Statements

in the Company’s Annual Report on Form 10-K for the year ended May 31, 2014, to which reference is hereby made.

|

|

(5)

|

“All Other Compensation” represents the Company’s contributions to the CytoDyn Inc. 401(k) Profit Sharing Plan.

|

Outstanding Equity Awards at Fiscal Year-End