While value stocks have performed better than growth stocks

sixty percent of the time over the past 20 years (1989-2008) 1,

they have stood out particularly after periods of recession. Value

companies often become leaner during economic downturns, generate

more operating leverage by cutting fixed costs and assets to

weather a slower revenue environment, and set the stage for a

greater acceleration in earnings as market conditions improve.

History shows that value investments have outperformed growth

investments for the one-, three-, and five-year time periods

following the past four recessions (1/1980-7/1980, 7/1981-11/1982,

7/1990-3/1991, and 3/2001-11/2001)1.

INDEX PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.

Index Performance does not represent the performance of The

Hartford Mutual Funds or any particular investment. Indices

measured are Russell 1000 Value and Russell 1000 Growth, which are

unmanaged; you cannot invest directly in these indices. Assumes

reinvestment of income and no transaction cost.

“Why is it that some investment trends always seem to be in

style, like value investing?” asks Dr. Bob Froehlich, senior

managing director at The Hartford. “It’s the basic premise of

investing – you buy low and sell high. What that really means is

buying value stocks.”

The current opportunity in value investing is the theme of The

Hartford Mutual Funds’ latest marketing campaign, which focuses on

The Hartford’s value suite of mutual funds:

- The Hartford Balanced Income

Fund2, 3: Invests in a mix of approximately 55 percent bonds and 45

percent stocks, with an investment objective to provide income with

growth of capital.

- The Hartford Equity Income

Fund2: Seeks established companies that are currently being

overlooked by the market and are trading at a significant discount,

and dividend paying companies.

- The Hartford Dividend and Growth

Fund2: Blends a value-oriented approach with a focus on companies

that pay or intend to pay dividends.

- The Hartford Value Fund2: Uses a

“flexible value” approach to invest across the large-cap value

spectrum in companies that have a negatively impacted

valuation.

- The Hartford Value Opportunities

Fund2, 4: Invests primarily in stocks believed to be undervalued

and with growth potential across the market-cap spectrum.

- The Hartford MidCap Value Fund2,

4: Focuses on midcap companies with below average price/earnings

ratio and bottom-up security selection.

The Hartford® SMART529®, Offered by the West Virginia College

Prepaid Tuition and Savings Board of Directors, also provides

investors with the opportunity for value investing as part of the

college savings plan’s individual fund options. In that plan,

families saving for college may choose among four value options*,

which invest in The Hartford mutual fund value investment

options5.

*The Hartford Equity Income 529 Fund, The Hartford Dividend and

Growth 529 Fund, The Hartford Value 529 Fund and The Hartford

MidCap Value 529 Fund.

A June 2009 Hartford survey of 530 investors over the age of 30

who work with financial advisors found that 81 percent of investors

who work with advisors would like to have a dividend-paying stock

in their portfolio, yet over half said their advisor has not talked

to them about adding this type of option to their portfolio.

Seventy-five percent of investors who don’t already hold

dividend-paying investments would be open to including them in the

future.

“We strongly believe in the power of value investing for growth

and income,” says Keith Sloane, senior vice president of Hartford

Mutual Funds. “We also think there is an opportunity for advisors

to talk to their clients about solutions that can provide current

income and capital growth.”

“Investments seem to be the only thing that retail investors do

not want to buy on sale,” says Froehlich. “They shop for cars and

clothes at discount prices but when it comes to stocks and

investments, ‘on sale’ suddenly makes investors feel uneasy because

they think the price is low. One way to heed Warren Buffet’s advice

to ‘be fearful when others are greedy and greedy when others are

fearful’ is to overweight the value style of investing.”

Wellington Management Company, LLP, is an independent and

unaffiliated investment sub-adviser to The Hartford’s

value-oriented mutual funds. The firm’s experience in

value-oriented investing dates back more than eight decades to

1928, when its founder launched America’s first balanced fund.

Client brochures and other FINRA-reviewed brochures, articles,

letters and emails are available to the public at

www.hartfordmutualfunds.com. Financial professionals registered at

Hartford Mutual Funds’ broker-only Web site (password protected)

can access portfolio manager podcasts and an interactive flashbook

which allows advisors to flip though the virtual pages of the

brochure while listening to audio commentary from Hartford personal

finance experts.

The Hartford Value Suite: Performance Summary

Class A-Share Average Annual Total

Returns Including Maximum 5.5% Sales Charge (as of 12/31/09)

Fund Name (Fund Inception Date) 1 Year

5 Years 10 Years Since Inception Gross

Operating Expenses6 The Hartford Dividend and Growth Fund (7/22/96)

16.89% 1.56% 3.20% 6.98% 1.09%

The Hartford Value Fund (4/30/01) 16.84% 1.59%

N/A 1.64% 1.32%

The Hartford Equity Income Fund

(8/28/03)

11.85% 1.44% N/A 4.48% 1.19% The

Hartford Balanced Income Fund (7/31/06) 15.69% N/A

N/A 1.60% 1.25% The Hartford MidCap Value Fund

(4/30/01) 35.74% 1.08% N/A 4.72%

1.39% The Hartford Value Opportunities Fund (1/2/96) 36.77%

-1.31% 2.81% 6.22% 1.42%

Performance data quoted represents past performance and is

not indicative of future results. The investment return and

principal value of an investment will fluctuate so that shares,

when redeemed, may be worth more or less than their original cost.

Current performance may be lower or higher than the performance

data quoted. For more current performance information to the most

recent month ended, please see

www.hartfordmutualfunds.com. Performance results are

historical and include reinvestment of all distributions at net

asset value. Performance information may reflect historical or

current expense waivers/reimbursements from an affiliate of the

investment advisor, without which performance would have been

lower. For more information on waivers/reimbursements, please see

prospectus.

Performance data quoted does not represent performance of

SMART529.

About The Hartford Mutual Funds

The Hartford Mutual Funds, established in 1996, offers a wide

array of both broad-mandate and style-focused equity and

fixed-income investment options. The Hartford Mutual Funds draw on

the investment strength, experience and expertise of Wellington

Management and Hartford Investment Management Co. These two

organizations bring their decades of market experience, in-house

investment capabilities, rigorous research and time-tested

investment process to bear in managing the funds to help The

Hartford Mutual Fund investors meet their long-term financial

goals. Total retail mutual fund assets under management were $40.1

billion as of September 30, 2009. For more information on The

Hartford Mutual Funds, including current holdings, visit

www.hartfordmutualfunds.com.

About The Hartford

Celebrating nearly 200 years, The Hartford (NYSE: HIG) is an

insurance-based financial services company that serves households,

businesses and employees by helping to protect their assets and

income from risks, and by managing wealth and retirement needs. A

Fortune 500 company, The Hartford is recognized widely for its

service expertise and as one of the world’s most ethical companies.

More information on the company and its financial performance is

available at www.thehartford.com.

HIG-L

Some of the statements in this release may be considered

forward-looking statements as defined in the Private Securities

Litigation Reform Act of 1995. We caution investors that these

forward-looking statements are not guarantees of future

performance, and actual results may differ materially. Investors

should consider the important risks and uncertainties that may

cause actual results to differ. These important risks and

uncertainties include those discussed in our Quarterly Reports on

Form 10-Q, our 2008 Annual Report on Form 10-K and the other

filings we make with the Securities and Exchange Commission. We

assume no obligation to update this release, which speaks as of the

date issued.

You should carefully consider investment objectives, risks,

and charges and expenses of The Hartford Mutual Funds before

investing. This and other information can be found in the Fund's

prospectus, which can be obtained from your investment

representative or by calling 888-843-7824. Please read it carefully

before you invest or send money.

1 INDEX PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.

Index Performance does not represent the performance of The

Hartford Mutual Funds or any particular investment. The Russell

1000 Value and Growth Indices are unmanaged; you cannot invest

directly in these indices. Assumes reinvestment of income and no

transaction cost.

Recession dates were 1/1980-7/1980, 7/1981-11/1982,

7/1990-3/1991, and 3/2001-11/2001.

Indices measured are Russell 1000 Value and Russell 1000

Growth.

Russell 1000 Value Index measures the performance of those

Russell 1000 Index companies with lower price-to-book ratios and

lower forecasted growth values.

Russell 1000 Growth Index measures the performance of those

Russell 1000 Index companies with higher price-to-book ratios and

higher forecasted growth values.

Data Source: Morningstar Direct, 10/2009

2 The Fund may invest in foreign securities, which can be

riskier than investments in U.S. securities (risks may include

currency risk, illiquidity risks, and risks from substantially

lower trading volume on foreign markets).

The sub-adviser's investment strategy will influence performance

significantly and the Fund could underperform its peers or lose

money if that strategy does not perform as expected.

3 The Fund is subject to credit risk (the risk that the issuing

company may not be able to pay interest and principal when due),

interest rate risk (the risk that your investment may go down in

value when interest rates rise), and risk of loss (the risk that

you could lose money on your investment).

A portion of this Fund’s assets may be below investment grade

securities ("high-yield securities" or "junk bonds"), which are

rated lower because there is a greater possibility that the issuer

may be unable to make interest and principal payments on those

securities.

The Fund may invest in securities of companies that conduct

their principal business activities (or that trade principally on

exchanges) in emerging markets (including Asia, Latin America,

Eastern Europe, and Africa), which is riskier than investing in

securities of more developed countries (including risks of

illiquidity and increased price volatility).

4 The Fund invests in securities of small-cap and/or mid-cap

companies, which is riskier than stocks of larger companies,

because smaller companies generally are young, have limited

business history, and frequently rely on narrow product lines and

niche markets.

5 These are not mutual funds. Fees, charges and expenses are

different. Refer to the Offering Statement for additional

information.

6 Gross operating expenses shown are before management

fee waivers or expense caps. Performance information may reflect

historical or current expense waivers or reimbursements, without

which, performance would have been lower. For more information on

fee waivers and/or expense reimbursements, please see the expense

table in the prospectus.

Wellington Management Company, LLP is an independent and

unaffiliated sub-adviser to The Hartford.

The Hartford Mutual Funds are underwritten and distributed by

Hartford Investment Financial Services, LLC.

"The Hartford" is The Hartford Financial Services Group, Inc.

and its subsidiaries.

SMART529 is offered by the West Virginia College Prepaid Tuition

and Savings Program Board of Trustees and is administered by

Hartford Life Insurance Company.

“The Hartford” is a registered trademark of "Hartford" Fire

Insurance Company.

“SMART529” is a registered trademark of the West Virginia

College Prepaid Tuition and Savings Program Board of Trustees.

If you reside in or have taxable income in a state other than

West Virginia, you should consider whether your state has a

qualified tuition program that offers favorable state income tax or

other benefits exclusive to your state’s program that are not

available under the SMART529 program.

Investments in SMART529 are not guaranteed or insured by the

State of West Virginia, the Board of Trustees of the West Virginia

College Prepaid Tuition and Savings Program, the West Virginia

State Treasurer’s Office, Hartford Life Insurance Company, The

Hartford Financial Services Group, Inc., the investment

sub-advisors for the Underlying Funds or any depository institution

and are subject to investment risks, including the loss of the

principal amount invested, and may not be appropriate for all

investors.

This information is written in connection with the promotion or

marketing of the matter(s) addressed in this material. The

information cannot be used or relied upon for the purpose of

avoiding IRS penalties. These materials are not intended to provide

tax, accounting or legal advice. As with all matters of a tax or

legal nature, you should consult your own tax or legal counsel for

advice.

You should carefully consider the investment objectives,

risks, charges and expenses of SMART529 and its Underlying Funds

before investing. This and other information can be found in the

Offering Statement for SMART529 and the prospectuses or other

disclosure documents for the Underlying Funds, which can be

obtained on SMART529.com or by calling 866-574-3542. Please read

them carefully before you invest or send money. SMART529 is

distributed by Hartford Securities Distribution Company, Inc.

Member SIPC.

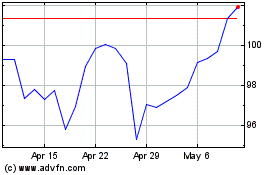

Hartford Financial Servi... (NYSE:HIG)

Historical Stock Chart

From Apr 2024 to May 2024

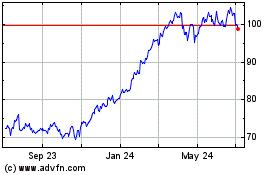

Hartford Financial Servi... (NYSE:HIG)

Historical Stock Chart

From May 2023 to May 2024