Westmount Energy Limited Investment in Eco (Atlantic) Oil & Gas Ltd (3292W)

February 08 2017 - 4:17AM

UK Regulatory

TIDMWTE

RNS Number : 3292W

Westmount Energy Limited

08 February 2017

8 February 2017

Westmount Energy Limited

("Westmount" or the "Company")

Investment in Eco (Atlantic) Oil & Gas Ltd

The Board of Westmount is pleased to announce that it has

subscribed for 3,125,000 ordinary shares of no par value in Eco

(Atlantic) Oil & Gas Ltd ("EOG") at a price of 16 pence per

ordinary share (the "Subscription"). The Subscription will be

funded by the Company's existing resources and a loan of GBP250,000

from Mr Gerard Walsh, Chairman of Westmount (the "Loan").

EOG is a Canadian oil and gas exploration company that currently

holds interests in the 1,800 km(2) Orinduik offshore block in

Guyana and four offshore petroleum licenses, covering more than

32,000 km(2) in the Walvis and Lüderitz Basins in Namibia. EOG is

currently traded on TSX Venture Exchange and has today successfully

completed a GBP5.09 million placing in connection with its

admission to AIM. It is expected that Westmount will hold

approximately 2.6% of EOG's issued share capital following

admission of the Subscription shares.

For the 12 months ended 31 March 2016, EOG made a net loss of

CAD$5,107,496 and had gross assets of CAD$7,312,774. EOG provides

further disclosures on its business and financial position through

its website at www.ecooilandgas.com. Following completion,

Westmount's shareholding in EOG will represent approximately 63 per

cent. of Westmount's gross assets as at 7 February 2017.

Loan Agreement & Related Party Transaction

To part finance the investment, the Company has entered into a

loan agreement with Gerard Walsh, director of the Company, for the

sum of GBP250,000. The Loan is unsecured and does not attract

interest. The Loan is repayable by the Company within 60 days upon

receipt of written notice from Mr Walsh.

The Loan is considered a related party transaction under the AIM

Rules for Companies. The Board of Westmount, excluding Mr Walsh,

having consulted with Cenkos Securities plc as the Company's

Nominated Adviser, considers the terms of this transaction to be

fair and reasonable in so far as the Company's shareholders are

concerned.

Gerard Walsh, Chairman of Westmount, commented:

"The motive for the investment in EOG is to offer Westmount

shareholders a low entry cost for exposure to the Orinduik block in

the Guyana basin. The Orinduik block is operated by Tullow Oil Plc

and is adjacent to the Stabroek Block operated by Exxon Mobil that

contains the world-class Liza discovery, which is estimated by

Exxon to have recoverable resources of approximately 1.4 billion

boe, together with the recently announced Payara discovery. The

Guyana basin is attracting significant industry interest and

expects to see considerable exploration activity over the coming

years. The EOG management team has strong expertise in global oil

and gas exploration and operation of resource assets. EOG will be

the only junior exploration and production company listed on AIM to

operate in the Guyana basin. I am pleased to offer my continued

support to the Company by providing additional cash resources to

fund this investment."

For further information, please contact:

Westmount Energy Limited www.westmountenergy.com

David King, Director Tel: +44 (0)1534

823028

Cenkos Securities plc Nomad and Tel: +44 (0)20

Broker 7397 8900

Nicholas Wells / Elizabeth Bowman

(Corporate Finance)

This announcement contains inside information.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCUWAKRBOAURRR

(END) Dow Jones Newswires

February 08, 2017 04:17 ET (09:17 GMT)

Westmount Energy (LSE:WTE)

Historical Stock Chart

From Apr 2024 to May 2024

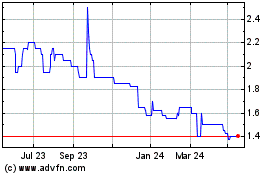

Westmount Energy (LSE:WTE)

Historical Stock Chart

From May 2023 to May 2024