RNS Number:5402I

Vp PLC

27 November 2007

Press Release 27 November 2007

Vp plc

("Vp" or "the Group")

Interim Results

Vp plc, the equipment rental specialist, today announces its Interim Results for

the six months ended 30 September 2007.

* Profit before tax increased by 55% to #12.1m (2006: #7.8m)

* Strong revenue growth of 24% to #76.0m ( 2006: #61.3m)

* Significant margin improvement to 15.9% (2006: 12.7%)

* Interim dividend increased by 24% to 2.80 pence per share

* Capital investment almost doubled to #24m

* Two successful acquisitions during the period and four acquisitions since

period end

Jeremy Pilkington, Chairman of Vp plc, commented:

"I am delighted to be announcing what we believe to be an outstanding set of

results for the period, followed by continued positive trading through the

Autumn. We are satisfied with performance across all our businesses and are

especially pleased with Hire Station's achievement of its margin recovery a year

ahead of schedule.

Furthermore, we are confident that the strength and breadth of our business mix

will stand the Group in good stead for the rest of the year and beyond."

- Ends -

For further information please contact:

Vp plc

Jeremy Pilkington, Chairman Tel: +44 (0) 1423 533 405

jeremypilkington@vpplc.com

Neil Stothard, Group Managing Director Tel: +44 (0) 1423 533 445

neil.stothard@vpplc.com

Mike Holt, Group Finance Director Tel: +44 (0) 1423 533 445

mike.holt@vpplc.com

Abchurch

Sarah Hollins / Emma Johnson Tel: +44 (0) 20 7398 7700

sarah.hollins@abchurch-group.com www.abchurch-group.com

CHAIRMAN'S STATEMENT

I am very pleased to report a further period of excellent progress for the

Group.

In the six months ended 30 September 2007, profit before tax grew by 55% to

#12.1m on revenues ahead by 24% to #76.0m. Margins improved significantly to

15.9% (2006: 12.7%) as did return on average capital employed, rising to 19.8%

from 16.5% at 31 March 2007. Recognising the Group's continuing progress and

these outstanding results in particular, the Board is declaring an interim

dividend of 2.80 pence per share, an increase of 24% payable on 4 January 2008

to shareholders registered at 7 December 2007.

These results have been delivered primarily through strong organic growth

supported by significant capital investment in a generally supportive trading

environment, both domestically and internationally. Capital investment in the

period rose to #24m, almost double last year's level. This level of investment

has been made whilst maintaining gearing at a modest 63%, only marginally ahead

of this time last year, and importantly, whilst further improving the quality of

the return on investment. Recent acquisitions have also made a useful

contribution.

We have seen strong performances from the water, house-building, construction

and remediation sectors, but weaker trading conditions in the rail sector. The

strength of this overall result demonstrates the resilience the Group derives

from operating in a wide diversity of markets.

Business Review

Groundforce produced an outstanding result with all constituent businesses

performing well, including the recently established formwork rental business.

Groundforce finally started to derive benefit from the AMP4 programme and demand

from basement propping and large civil engineering schemes for the large bracing

systems was particularly strong. The depot in Ireland will be operational

shortly and, since the reporting date, Groundforce have acquired two Irish

businesses engaged in shoring and pipe testing rental, for an aggregate

consideration of Euro0.8m. These businesses mirror the type of activities we offer

to our UK customer base and their acquisition will significantly accelerate the

development of our activities in Ireland. During the period, Survey Technology

was successful in being named Sokkia European Dealer of the Year against strong

international competition and we are pleased that the progress this business has

achieved over the last two years has been recognised in this way.

UK Forks had an exceptional period delivering a profit performance in six months

in excess of that achieved for the whole of the previous financial year.

Residential and general construction markets each account for approximately half

of UK Forks business and demand was buoyant from both sectors. Recovery of

market share in the critical South East territory has been an important

contributing factor. UK Forks' unique product offering of a specialist

telehandler service on a national basis continues to offer economies of scale to

those customers who wish to take costs out of their supply chain. Performance

within UK Forks was also aided by strong international demand for the

telehandlers which we have been disposing of as part of our planned fleet

renewal programme. As usual, we expect a less busy second half, including as

it does the traditionally weak Christmas period, but we nevertheless anticipate

a very satisfactory result for the year as a whole.

Airpac Bukom produced a useful improvement in profitability. We have committed

significant capital investment to this business to take advantage of the

opportunities opened up to us by last year's acquisition of Bukom Oilfield

Services and the underlying strength in the international oil and gas markets.

The long manufacturers lead times associated with some of this highly

specialised equipment means that the majority of deliveries will not be received

until the second half of the year, thereby reducing their impact on this year's

result, but giving us a firm base from which to start the next financial year.

The business is heavily engaged in the well test market internationally and on

rig maintenance activities in the North Sea but there remain significant

opportunities for us in pipeline dewatering and other high pressure applications

which the new capital investment will better facilitate. The new satellites in

Western Australia, the Middle East and South America are coming on stream as

planned and will give us a much stronger network from which to service our

international customers.

Torrent Trackside, along with other suppliers to the rail sector, has

experienced difficult trading conditions and faced a number of challenges during

the period. Network Rail conducted a review of its supply chain with a view to

rationalising the number of renewal contractors from six to four and this

inevitably disrupted the work flow during and after the review process. Also,

in July 2007 the Metronet Consortium, one of two providers to London Underground

went into administration. Over the past two years Torrent has been very

successful in diversifying into the London Underground market where a very

significant investment is being made in the maintenance and upgrade of track and

platforms. The subsequent interruption to project activity had an adverse

impact on Torrent's revenues and profitability in this important market. The

work remains to be carried out but it will inevitably be some time before normal

trading patterns are resumed.

On the positive side, in October, Torrent acquired for a consideration of #1.2m

the rail portable plant assets of First Engineering, one of the successful

renewal contractors, together with their premises in Glasgow. The acquisition

includes a three year supply agreement which will enable us to work more closely

with First Engineering in the upgrading of the national rail infrastructure.

Under the circumstances, Torrent has achieved a creditable performance, whilst

carefully managing investment and maintaining its ability to take advantage of

future prospects.

TPA had a successful first half with strong demand from the summer events

market. The MD40 roadway and fence system was launched during the period and

its versatility has proven very popular with customers. TPA's German subsidiary

had a very successful period from modest beginnings and work was also carried

out in Ireland and France. We had expected significant demand from the

multi-billion pound upgrade to the National Grid transmission infrastructure

that was announced last year. Unfortunately, this programme has got off to a

slow start and it will be next year before we see workloads from this sector

improving. During the period, the barrier hire business has been reorganised to

reduce its cost base and refocus it on a broader range of activities outside of

its traditional London market. TPA's business is highly seasonal and its

outturn for the year will be very dependent upon how successful it is in

securing work over the much slower winter period.

Hire Station has had a remarkable half year, with profits ahead of the previous

year's full year figure. Margins at Hire Station continue to improve and we are

now approaching, one year ahead of plan, our goal of matching industry best

margins. MEP, acquired last year, has performed ahead of expectations and has

extended its distribution via the national tool branch network. Climate Hire,

aided by the acquisition of Cool Customers in April has proved highly

successful. The summer period did not produce the usual demand for air

conditioning equipment but the business was instead heavily engaged in

supporting the flood remediation work. We expect Climate Hire's activity to

return to a more normal trading pattern next year. In August Hire Station

acquired the Scottish operations of ET Hire, a three branch tool business in

central Scotland, significantly improving our distribution coverage in this

region. Post the period end, Hire Station acquired Able Safety, a safety

equipment, rental and training business based in West Yorkshire. This

acquisition is an excellent fit with our existing ESS Safeforce business into

which it will be integrated to consolidate our market leadership position.

Outlook

We consider these to be an outstanding set of results and we are pleased to have

seen trading remain positive into the autumn. However, the inevitable

uncertainties of the winter period lie ahead of us and we believe that the full

impact of the liquidity problems in the financial markets has yet to be felt

within the broader economy.

Overall therefore, we remain optimistic about future prospects for the Group and

confident that the outcome for the full year will demonstrate continuing

progress.

Jeremy Pilkington

Chairman

27 November 2007

Condensed Consolidated Income Statement

For the period ended 30 September 2007

Note Six months to 30 Six months to 30 Full year to

Sep 2007 Sep 2006 31 Mar 2007

(unaudited) (unaudited) (audited)

#000 #000 #000

Revenue 3 76,008 61,263 121,607

Cost of sales (50,448) (42,159) (84,897)

Gross profit 25,560 19,104 36,710

Administrative expenses (12,125) (10,333) (20,459)

Operating profit before other income 3 13,435 8,771 16,251

Other income - property profit - - 257

Operating profit 13,435 8,771 16,508

Financial income 132 58 125

Financial expenses (1,496) (1,034) (2,154)

Profit before tax 12,071 7,795 14,479

Income tax expense 4 (2,865) (2,339) (3,998)

Net profit for the period 9,206 5,456 10,481

Basic earnings per 5p ordinary share 8 21.57p 12.71 p 24.50 p

Diluted earnings per 5p ordinary share 8 20.51p 12.16 p 23.34 p

Dividend per share 9 2.80p 2.25 p 8.25p

Dividends paid and proposed (#000) 1,199 954 3,520

Condensed Consolidated Statement of Recognised Income and Expense

For the period ended 30 September 2007

Six months to Six months to Full year to

30 Sep 2007 30 Sep 2006 31 Mar 2007

(unaudited) (unaudited) (audited)

#000 #000 #000

Actuarial gains on defined benefit pension - - 411

scheme

Impact of change in tax rate on items taken (56) - -

direct to equity

Tax on items taken direct to equity - - (123)

Effective portion of changes in fair value of

cash flow hedges (160) 130 366

Foreign exchange translation difference - - (1)

Net (expense)/income recognised directly to (216) 130 653

equity

Profit for the period 9,206 5,456 10,481

Total recognised income and expense for the

period 8,990 5,586 11,134

Condensed Consolidated Balance Sheet

At 30 September 2007

Note 30 Sep 2007 31 Mar 2007 30 Sep 2006

Restated

(unaudited) (audited) (unaudited)

#000 #000 #000

Non-current assets

Property, plant and equipment 5 89,585 76,797 69,592

Intangible assets 6 37,125 35,909 34,122

Total non-current assets 126,710 112,706 103,714

Current assets

Inventories 4,938 4,814 3,372

Trade and other receivables 39,193 30,112 29,735

Cash and cash equivalents 6,746 6,662 4,979

Assets classified as held for resale - - 217

Total current assets 50,877 41,588 38,303

Total assets 177,587 154,294 142,017

Current liabilities

Interest bearing loans and borrowings (15,866) (7,535) (3,073)

Income tax payable (2,970) (1,500) (2,213)

Trade and other payables (37,884) (31,698) (23,466)

Total current liabilities (56,720) (40,733) (28,752)

Non-current liabilities

Interest bearing loans and borrowings (36,283) (35,677) (36,616)

Employee benefits (1,886) (2,048) (2,734)

Other payables (4,240) (4,240) (7,930)

Deferred tax liabilities (6,526) (6,004) (4,944)

Total non-current liabilities (48,935) (47,969) (52,224)

Total liabilities (105,655) (88,702) (80,976)

Net assets 71,932 65,592 61,041

Equity

Issued capital 2,309 2,309 2,309

Share premium 16,192 16,192 16,192

Hedging reserve 117 277 41

Retained earnings 53,287 46,787 42,472

Total equity attributable to equity 71,905 65,565 61,014

holders of parent

Minority interest 27 27 27

Total equity 7 71,932 65,592 61,041

Condensed Consolidated Statement of Cash Flows

For the period ended 30 September 2007

Note Six months to Six months to Full year to

30 Sep 2007 30 Sep 2006 31 Mar 2007

(unaudited) (unaudited) (audited)

#000 #000 #000

Cash flows from operating activities

Profit before taxation 12,071 7,795 14,479

Adjustment for:

Pension fund contributions in excess of service

cost (222) (160) (435)

Share based payment charges 498 497 1,000

Depreciation 5 8,546 6,899 14,093

Amortisation of intangibles 12 12 25

Net interest expense 1,364 976 2,029

Profit on sale of property, plant and equipment (1,731) (1,131) (3,307)

Operating cash flow before changes in working 20,538 14,888 27,884

capital and provisions

Decrease/(increase) in inventories 55 (253) (1,458)

Increase in trade and other receivables (8,761) (1,662) (1,131)

Increase in trade and other payables 5,463 1,708 4,599

Cash generated from operations 17,295 14,681 29,894

Interest paid (1,397) (522) (1,930)

Interest element of finance lease rental (77) (91) (155)

payments

Interest received 132 58 125

Income tax paid (1,051) (894) (2,890)

Net cash from operating activities 14,902 13,232 25,044

Investing activities

Proceeds from sale of property, plant and 4,583 3,267 8,966

equipment

Purchase of property, plant and equipment (25,758) (15,052) (26,746)

Acquisition of businesses and subsidiaries (net 6 (1,889) (91) (4,375)

of cash and overdrafts)

Net cash from investing activities (23,064) (11,876) (22,155)

Cash flows from financing activities

Purchase of own shares by Employee Trust (691) (3,434) (3,671)

Repayment of borrowings - - (156)

Repayment of loan notes (70) (941) (941)

New loans 4,500 3,000 7,000

New finance lease 28 - -

Payment of hire purchase and finance lease (521) (580) (1,105)

liabilities

Dividends paid 9 - - (2,932)

Net cash from financing activities 3,246 (1,955) (1,805)

Net (decrease)/increase in cash and cash

equivalents

(4,916) (599) 1,084

Cash and cash equivalents at beginning of

period

6,662 5,578 5,578

Cash and cash equivalents at end of period 1,746 4,979 6,662

Notes to the Condensed Financial Statements

1. Basis of Preparation

Vp plc (the "Company") is a company domiciled in the United Kingdom. The

Condensed Consolidated Interim Financial Statements of the Company for the half

year ended 30 September 2007 comprise the Company and its subsidiaries (together

referred to as the "Group").

This interim announcement has been prepared in accordance with the Disclosure

and Transparency Rules of the UK Financial Services Authority and the

requirements of IAS34 ("Interim Financial Reporting") as adopted by the EU. The

accounting policies applied are consistent for all periods presented and are in

line with those applied in the annual financial statements for the year ended 31

March 2007 which were prepared in accordance with International Financial

Reporting Standards ("IFRS") as adopted by the EU.

The financial statements for the year ending 31 March 2008 will be impacted by

IFRS 7 Financial Instruments: Disclosure and the Amendment to IAS 1 Presentation

of Financial Instruments - Capital Disclosures which will increase the amount of

disclosure in the full financial statements. The net income and net assets will

not be affected by these two new standards.

The interim announcement was approved by the Board of Directors on 26 November

2007.

The Condensed Consolidated Interim Financial Statements do not include all the

information required for full annual Financial Statements.

The comparative figures for the financial year ended 31 March 2007 are extracted

from the Company's statutory accounts for that financial year. Those accounts

have been reported on by the Company's auditors and delivered to the Registrar

of Companies. The report of the auditors was (i) unqualified, (ii) did not

include a reference to any matters to which the auditors drew attention by way

of emphasis without qualifying their report, and (iii) did not contain a

statement under section 237(2) or (3) of the Companies Act 1985.

The preparation of financial statements in conformity with IFRS requires

management to make judgements, estimates and assumptions that affect the

application of policies and reported amounts of assets and liabilities, income

and expenses. The estimates and associated assumptions are based on historical

experience and various other factors that are believed to be reasonable under

the circumstances; these form the basis of the judgements relating to carrying

values of assets and liabilities that are not readily apparent from other

sources. Actual results may differ from these estimates.

The estimates and underlying assumptions are reviewed on an ongoing basis.

Revisions to accounting estimates are recognised in the period in which the

estimate is revised if the revision affects only that period, or in the period

of the revision and future periods if the revision affects both current and

future periods.

The Balance Sheet comparatives disclosed for the six month period ended 30

September 2006 have been restated to reflect refinements to the completion

accounts for acquisitions in the 12 months following acquisition. The impacts

of the restatement were an increase in the deferred tax liability of #210,000, a

net decrease in current assets and liabilities of #72,000, an increase in fixed

assets of #8,000 and an increase in goodwill of #274,000.

2. Risks and Uncertainties

The risks and uncertainties for the Group have not changed from those disclosed

in the last statutory accounts. In particular the Group comprises six

businesses serving different markets and manages the risks inherent to these

activities. The key external risks include general economic conditions,

competitor actions, the effect of legislation, credit risk and business

continuity. Internal risks relate mainly to investment and controls failure

risk. The Group seeks to mitigate exposure to all forms of risk where

practicable and to transfer risk to insurers where cost effective. The

diversified nature of the Group limits the exposure to external risks within

particular markets. Exposure to credit risk in relation to customers, banks and

insurers is managed through credit control practices. Business continuity plans

exist for key operations and accounting centres. The Group is an active

acquirer and acquisitions may involve risks that might materially affect the

Group performance. These risks are mitigated by extensive due diligence and

appropriate warranties and indemnities from the vendors.

3. Summarised Segmental Analysis

Revenue Operating Profit

Sept 2007 Sept 2006

External Internal Total External Internal Total 2007 2006

Revenue Revenue Revenue Revenue Revenue Revenue

#000 #000 #000 #000 #000 #000 #000 #000

Groundforce 17,260 - 17,260 13,010 - 13,010 4,551 2,752

UK Forks 8,098 320 8,418 6,930 180 7,110 1,929 667

Airpac Bukom 6,075 - 6,075 4,998 - 4,998 1,358 1,248

Hire Station 29,340 240 29,580 22,121 150 22,271 3,449 1,353

Torrent 6,519 - 6,519 6,566 - 6,566 366 910

Trackside

TPA 8,716 - 8,716 7,638 - 7,638 1,782 1,841

76,008 560 76,568 61,263 330 61,593 13,435 8,771

4. Income Tax

The effective tax rate of 23.7% in the period to 30 September 2007 (30 September

2006: 30%) is made up of two elements. Firstly, an estimated underlying tax

rate of 27.9% for the full year to 31 March 2008 and secondly a release of #0.5m

(4.2%) from the opening deferred tax balance as a result of the change in the

future UK corporation tax rate from 30% to 28% with effect from next financial

year.

5. Property, Plant and Equipment

2007 2006

#000 #000

Carrying amount 1 April 76,797 66,041

Additions 23,530 12,803

Acquisitions 656 -

Depreciation (8,546) (6,899)

Disposals (2,852) (2,136)

Transfer to assets held for resale - (217)

Carrying amount 30 September 89,585 69,592

The value of capital commitments at 30 September 2007 was #13,186,000 (31 March

2007: #12,465,000).

6. Acquisitions

The Group acquired the following businesses in the period to 30 September 2007.

The acquisitions were made by its subsidiary Hire Station Limited.

Name of acquisition Date of Type of acquisition Principle activity

acquisition

L&P 52 Limited (Cool Customers) 17 April 2007 Share purchase (100% equity) Hire and sale of cooling

equipment

Scottish branches of ET Hire 6 August 2007 Business and assets Hire and sale of small tools

None of the acquisitions in the current period were individually material in

Group terms and hence the details are provided in aggregate below:

#000

Property, plant and equipment 656

Current assets 339

Cash 257

Tax, trade and other payables (334)

Book value and fair value of assets acquired 918

Goodwill on acquisition 1,228

Cost of acquisitions 2,146

Satisfied by

Cash consideration 2,100

Acquisition costs 46

2,146

Analysis of cash flow for acquisitions

Consideration 2,100

Acquisition costs 46

Cash included in acquisitions (257)

1,889

Certain of the fair values included above are provisional due to the timing of

acquisitions and will be finalised within 12 months of the acquisition date.

As a result of the immediate integration of the acquisitions into Hire Station's

business, including the transfer of assets between branches, it is not possible

to accurately disclose separately the trading performance of the acquisitions in

the Income Statement. For the same reason it is not possible to disclose what

the revenue or profit for the combined entity would have been had all business

combinations effected in the period occurred on 1 April 2007.

Goodwill on acquisitions relates to the relationships, skills and inherent

market knowledge of employees within the acquired businesses together with the

synergistic benefits within the enlarged businesses post acquisition,

principally through economies of scale and improved business processes and

management. These are critical to the ongoing success of any specialised

equipment rental business, together with the availability of the right

equipment.

7. Statement of Changes in Equity

Six months to Six months to Full year to

30 Sep 2007 30 Sep 2006 31 Mar 2007

#000 #000 #000

Total recognised income and expense for the 8,990 5,586 11,134

period

Impact of change in tax rate on items taken (51) - -

directly to equity

Tax movements to equity - - (22)

Share option charge in the period 498 497 1,000

Gains/(losses) on disposal of shares 160 47 (240)

Net movement in shares held by Vp Employee (691) (3,434) (3,671)

Trust at cost

Dividends to shareholders (2,566) (1,978) (2,932)

Change in equity during the period 6,340 718 5,269

Equity at the start of the period 65,592 60,323 60,323

Equity at the end of the period 71,932 61,041 65,592

Included in the above changes are a reduction of #160,000 (September 2006:

#130,000 increase, March 2007: #366,000 increase) in the Hedging Reserve. There

were no changes in Issued Share Capital or Share Premium.

8. Earnings Per Share

Earnings per share have been calculated on 42,684,615 shares (2006: 42,934,732)

being the weighted average number of shares in issue during the period. Diluted

earnings per share have been calculated on 44,886,741 shares (2006: 44,869,566)

adjusted to reflect conversion of all potentially dilutive ordinary shares.

9. Dividends

The Directors have declared an interim dividend of 2.80 pence (2006: 2.25 pence)

per share payable on 4 January 2008 to shareholders on the register at 7

December 2007. The dividend proposed at the year end was subsequently approved

at the AGM in September and therefore accrued, but was not paid in the period

(2006 paid: nil). The cost of dividends in the Statement of Changes in Equity

is after adjustments for the interim and final dividends waived by the Vp

Employee Trust in relation to the shares it holds for the Group's share option

schemes.

10. Analysis of Net Debt

As at Cash As at

1 Apr 07 Flow 30 Sep 07

#000 #000 #000

Cash in hand and at bank less overdrafts 6,662 (4,916) 1,746

Revolving credit facilities (40,500) (4,500) (45,000)

Loan notes (70) 70 -

Finance leases and hire purchases (2,642) 493 (2,149)

(36,550) (8,853) (45,403)

The movement in revolving credit facilities is a further draw down from the

existing facilities.

11. Subsequent Events

Since the half year the Group has made four acquisitions totalling #2.5m. In

October the rail portable assets of First Engineering together with their

premises in Glasgow were acquired by Torrent Trackside Limited for a

consideration of #1.2m. In November, the Company acquired two Irish businesses

engaged in shoring and pipe testing rental, for a consideration of Euro0.8m and

Hire Station Limited acquired Able Safety (Yorkshire) Limited, a safety

equipment rental and training business based in West Yorkshire for #0.75m.

Responsibility statement of the directors in respect of the half-yearly

financial report

We confirm that to the best of our knowledge:

* the condensed set of financial statements has been prepared in accordance with

IAS 34 Interim Financial Reporting as adopted by the EU

* the interim management report includes a fair review of the information

required by:

(a) DTR 4.2.7R of the Disclosure and Transparency Rules, being an indication of

important events that have occurred during the first six months of the financial

year and their impact on the condensed set of financial statements; and a

description of the principal risks and uncertainties for the remaining six

months of the year; and

(b) DTR 4.2.8R of the Disclosure and Transparency Rules, being related party

transactions that have taken place in the first six months of the current

financial year and that have materially affected the financial position or

performance of the entity during that period; and any changes in the related

party transactions described in the last annual report that could do so.

By order of the Board

27 November 2007

The Board

The Board of Directors who served during the 6 months to 30 September 2007 is

unchanged from that set out on page 16 of the Annual Report and Financial

Statements 2007.

Independent Review Report to Vp plc

We have been engaged by the Company to review the condensed set of Financial

Statements in the half-yearly financial report for the six months ended 30

September 2007 which comprises the Condensed Consolidated Income Statement,

Condensed Consolidated Balance Sheet, Condensed Consolidated Statement of Cash

Flows, Condensed Consolidated Statement of Recognised Income and Expense and the

related explanatory notes. We have read the other information contained in the

half-yearly financial report and considered whether it contains any apparent

misstatements or material inconsistencies with the information in the condensed

set of financial statements.

This report is made solely to the company in accordance with the terms of our

engagement to assist the company in meeting the requirements of the Disclosure

and Transparency Rules ("the DTR") of the UK's Financial Services Authority

("the UK FSA"). Our review has been undertaken so that we might state to the

Company those matters we are required to state to it in this report and for no

other purpose. To the fullest extent permitted by law, we do not accept or

assume responsibility to anyone other than the company for our review work, for

this report, or for the conclusions we have reached.

Directors' responsibilities

The half-yearly financial report is the responsibility of, and has been

approved by, the directors. The directors are responsible for preparing the

half-yearly financial report in accordance with the DTR of the UK FSA.

As disclosed in note 1, the annual Financial Statements of the Group are

prepared in accordance with IFRSs as adopted by the EU. The condensed set of

Financial Statements included in this half-yearly financial report has been

prepared in accordance with IAS 34 Interim Financial Reporting as adopted by the

EU.

Our responsibility

Our responsibility is to express to the Company a conclusion on the condensed

set of Financial Statements in the half-yearly financial report based on our

review.

Scope of review

We conducted our review in accordance with International Standard on Review

Engagements (UK and Ireland) 2410 Review of Interim Financial Information

Performed by the Independent Auditor of the Entity issued by the Auditing

Practices Board for use in the UK. A review of interim financial information

consists of making enquiries, primarily of persons responsible for financial and

accounting matters, and applying analytical and other review procedures. A

review is substantially less in scope than an audit conducted in accordance with

International Standards on Auditing (UK and Ireland) and consequently does not

enable us to obtain assurance that we would become aware of all significant

matters that might be identified in an audit. Accordingly, we do not express an

audit opinion.

Conclusion

Based on our review, nothing has come to our attention that causes us to

believe that the condensed set of Financial Statements in the half-yearly

financial report for the six months ended 30 September 2007 is not prepared, in

all material respects, in accordance with IAS 34 as adopted by the EU and the

DTR of the UK FSA.

KPMG Audit Plc

Chartered Accountants Leeds

27 November 2007

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR UNRKRBBRAUAA

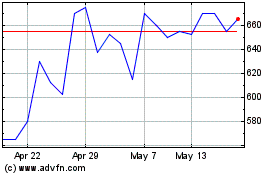

Vp (LSE:VP.)

Historical Stock Chart

From Jul 2024 to Aug 2024

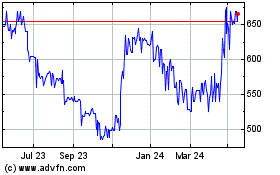

Vp (LSE:VP.)

Historical Stock Chart

From Aug 2023 to Aug 2024