RNS Number:9314X

Vp PLC

07 June 2007

Press Release 7 June 2007

Vp plc

("Vp" or "the Group")

Final Results

Vp plc, the equipment rental specialist, today announces its Final Results for

the year ended 31 March 2007.

Highlights

* Record results

* Operating profit up by 44% to #16.5 million (2006: #11.5 million)

* Profit before tax up 36% to #14.5 million (2006: #10.7 million)

* Revenue up 22% to #121.6 million (2006: #99.4 million)

* Earnings per share increased by 40% to 24.5 pence (2006: 17.5 pence)

* Total dividend increased by 25% to 8.25 pence (2006: 6.60 pence)

based on recommended final dividend of 6.00 pence per share

Jeremy Pilkington, Chairman, commented:

"The record result we are reporting reflects the underlying strength of the

markets served by the Group and the success of our strategy in translating

opportunities into profitable growth.

The outlook remains positive and we are confident that the Group can deliver

sustainable growth over the medium term."

- Ends -

Enquiries:

Vp plc

Jeremy Pilkington, Chairman Tel: +44 (0) 1423 533 405

jeremypilkington@vpplc.com

Neil Stothard, Group Managing Director Tel: +44 (0) 1423 533 445

neil.stothard@vpplc.com

Mike Holt, Group Finance Director Tel: +44 (0) 1423 533 445

mike.holt@vpplc.com www.vpplc.com

Media enquiries:

Abchurch Communications

Sarah Hollins/ Helen Waggott/ Emma Johnson Tel: +44 (0) 20 7398 7784

emma.johnson@abchurch-group.com www.abchurch-group.com

CHAIRMAN'S STATEMENT

Results

I am very pleased to report record results for the Group for the year ended 31

March 2007.

Operating profits rose 44% to #16.5 million (2006: #11.5 million) on revenues

ahead by 22% at #121.6 million. Profit before tax increased by 36% to #14.5

million and earnings per share increased 40% to 24.50 pence per share. In

recognition of this excellent performance the Board is recommending a final

dividend of 6.00 pence per share, making a total for the year of 8.25 pence per

share, an increase of 25%. Subject to shareholder approval at the Annual

General Meeting on 11 September 2007, the dividend will be paid on 1 October

2007 to shareholders registered as at 7 September 2007.

The Group continues to enjoy a period of sustained growth in all of its

principal markets and we are committing significant capital investment to take

the fullest advantage of the opportunities this presents. In parallel, we are

strengthening our human resources and infrastructure systems to ensure that our

capabilities in these performance critical areas remain aligned with our growth

aspirations.

It remains our strategy to seek market leadership for each of our businesses and

to be irresistibly the provider and employer of choice. We regard these

qualitative objectives as being highly interdependent with the Group's financial

aspirations.

The Group retains significant financial capacity to pursue growth opportunities

as they are identified.

Groundforce

Groundforce performed strongly during the year with significant progress being

achieved in all of its businesses. Operating profits rose by 21% to #6.4

million on turnover up 19% to #28.1 million. The AMP4 water industry capital

investment programme is now gathering pace and is providing useful incremental

revenue streams in many parts of the country.

In the course of the new financial year Groundforce will be opening a depot in

the Republic of Ireland. Groundforce has traded in Ireland for a number of

years but with a local operational base it will be in a much stronger position

to offer the full range of its services to an already established customer base.

Hire Station

Hire Station delivered an outstanding result with profits more than doubling to

#3.1 million on revenues ahead by 7% at #44.9 million. This profit growth is

largely organic, reflecting continuing improvements in operational efficiency

and revenue quality, together with a strong contribution from the ESS Safeforce

activity.

Hire Station has continued to make selective acquisitions. MEP, the specialist

pipework fittings company, acquired in November 2006, has progressed well and

made a contribution ahead of expectations in its first period. A single branch

acquisition in Colchester was completed at the end of the period and has been

successfully integrated into our Southern region. Post the year end, in April

2007, our acquisition of Cool Customers adds a substantial revenue stream and

the experience of a successful internet based business model to the recently

established Climate Hire business.

Hire Station has delivered its three year profit recovery plan and I am

confident of significant upside as margins improve and the business pursues

further revenue growth.

Airpac Bukom

Airpac Bukom's results reflect strong underlying organic growth and the first

full year contribution from the acquisition of Bukom in March 2006. Profits

increased by 90%, to #2.4 million on revenues which doubled to #10.0 million.

Market conditions in the oil and gas exploration business remain very positive

and we have committed significant capital investment to meet demand. To better

support the broader global reach of the enlarged business, we are establishing

additional distribution centres in Western Australia, South America and the

Middle East. We expect these locations to be fully operational in the second

half of 2007.

UK Forks

UK Forks profits, as previously indicated, were not sustainable at the excellent

levels of the previous year. Profits reduced to #1.4 million on revenues of

#13.9 million. It is positive to note that trading stabilised in the second

half of the year and that revenue levels have improved significantly as we have

entered the new financial year.

TPA

TPA reported its first full year contribution of #1.0 million on turnover of

#11.4 million. TPA derives a significant proportion of its revenue and profits

from the seasonal summer events market which weights its contribution heavily

towards the first half. Winter period losses were more severe than anticipated

and were exacerbated by the underperformance of the barrier hire activity.

Management are focussed on addressing these issues to stabilise first half

profits in the forthcoming financial year.

Torrent Trackside

Torrent Trackside had a very good year with profits increasing 13% to #2.0

million on revenues ahead by 8% at #13.1 million. The rail infrastructure

industry remains an attractive but challenging market and we remain confident

that Torrent's reputation and expertise will sustain its position as a leading

supplier to this market.

Outlook

The record result we are reporting reflects the underlying strength of the

markets served by the Group and the success of our strategy in translating

opportunities into profitable growth.

The outlook remains positive and we are confident that the Group can deliver

sustainable growth over the medium term.

Jeremy Pilkington

Chairman

7 June 2007

BUSINESS REVIEW

Overview

The year ended 31 March 2007 demonstrates excellent progress in the development

of the Vp business, and the delivery of substantial earnings growth.

Operating profits increased 44% on the corresponding period to #16.5 million, on

revenues 22% ahead of last year at #121.6 million. Whilst prior year

acquisitions have assisted this growth, 30% of the increase in profit is

organic.

To support new business opportunities we made organic capital investment of over

#30 million during the year. In addition, we have completed three business

acquisitions with a combined value of #4.6 million. We have seen only a

marginal increase in gearing as a result of these investments due to the

excellent cash generation from the Group and there remains a comfortable level

of financial headroom to pursue further expansion.

The markets the Group operates within have remained stable and supportive, with

oil and gas and latterly water being particularly buoyant.

Groundforce

Excavation support systems and specialist products for the water, civil

engineering and construction industries.

Revenue #28.1 million (2006: #23.5 million)

Operating Profit #6.4 million (2006: #5.3 million)

Investment in Rental Fleet #5.4 million (2006: #2.2 million)

All constituent Groundforce businesses enjoyed growth in the year with combined

revenues up #4.6 million to #28.1 million, delivering a very good result,

improving profit by 21% to #6.4 million.

Revenues were underpinned by the ongoing activity in housing and construction,

but were buoyed by the release of AMP4 contracts in the second half.

Involvement in projects, such as the tunnel under the River Shannon in Limerick

and the Bristol Broadmeads redevelopment, has widened the scope of our

activities in the large civil engineering project arena. The 250 tonne strut

product launched during 2006 was utilised in these projects. Groundforce now

holds a class leading position in what is a technically challenging area and we

expect further opportunities to arise in the coming year. In March 2007, we

acquired Evershore, a small, Leeds based, shoring rental company which has been

fully integrated into the division. The formwork activity, Easiform, completed

its first full year of operation in line with expectations, and we are pleased

with the progress of this business.

Piletec Dudley Vale also benefited from the upturn from AMP4 and delivered

revenues above expectation. Our technical leadership in this field paid

dividends, with the business being involved in many large contracts that have

provided a consistent income stream. We will continue to build the Piletec

business capabilities with ongoing investment in high performance equipment.

The reorganisation of Survey in the previous year proved effective, with the

streamlined business delivering a good performance. Further investment in

high-tech survey fleet was completed as a result of important customer gains.

We believe that all elements of Groundforce are capable of acquisitive growth

should the right opportunity arise. However, each element has the ability to

grow organically and with new products, services and geographic expansion

underway, we expect a year of further progression and development.

Hire Station

Tools and specialist products for industry, construction and home owners.

Turnover #44.9 million (2006: #41.9 million)

Operating Profit #3.1 million (2006: #1.4 million)

Investment in Rental Fleet #8.4 million (2006: #7.3 million)

After a strong profit turnaround in the prior year, Hire Station, made further

excellent progress. Full year operating profits of #3.1 million were 118% up on

prior year on revenues, up 7% at #44.9 million. The majority of the revenue

growth was delivered organically, although there was a valuable five month

contribution from MEP, following its acquisition in November.

Midway Plant and Tool hire, based in Colchester was purchased in March 2007

strengthening our distribution capability in Essex. After the year end, in

April, the business purchased Cool Customers, based in Derbyshire, specialising

in the hire and sale of air conditioning units, chillers and cooling equipment -

this business has been successfully integrated into our Climate Hire operation,

which was launched in the final quarter of the current financial year.

The tools business has made further solid progress during the year, delivering

good profit growth. Strong capital investment in our core stock items has helped

drive revenues forward with stock availability being a key differentiator. We

were pleased to achieve the environmental and quality accreditations (ISO 9001

and ISO 14001), recognising the high levels of systems and controls that we

operate within the business.

We have invested once again in additional resource at our national hire desk in

Manchester, as a result of an increase in customers expressing a preference to

transact business through this centre.

Revenues for the seasonal products were mixed; a very warm summer and excellent

stock availability meant we significantly increased our cooling income, although

the relatively mild winter impacted heating equipment hire. Two new greenfield

sites have opened since the year end in Hull and Exeter, areas that we

identified as important to our national distribution network.

The specialist lifting business, Lifting Point, performed well and we have now

introduced satellite-stocking operations in all tool branches. This expansion

has delivered a 20% improvement in turnover in this product area, and more is

expected in the coming year.

The specialist safety rental business, ESS Safeforce had an excellent year in a

broadly supportive market, with strong performances from the hire, sales and

confined space training activities. During the year we opened a further centre

at Andover for confined space training. We also enjoyed solid revenues from the

oil and petro-chemical market supplying safety equipment and labour in support

of customers carrying out maintenance during temporary shutdowns. This is an

area we expect to grow further in 2007.

In November 2006, we acquired Mechanical and Electrical Pressfittings Limited

(MEP), a business based near Glasgow which specialises in the hire and sale of

electrofusion and pressfitting tools to the mechanical, electrical and plumbing

sectors. Trading in the five months subsequent to the acquisition was ahead of

expectation. In the month following the acquisition, we relocated into a new

8,500 sq ft building nearby to accommodate growth plans and the central hire

desk facility of the business. The first MEP distribution satellite has been

established at Heathrow. Since the year end we have established a trading

location in Dublin in response to local demand.

The Climate Hire business was established in the final quarter of the year and

will specialise in four key product areas: Warm Air (heaters), Dry Air

(dehumidifiers, airmovers), Cool Air (chillers, aircon units) and Clean Air

(ozone units, air purifiers). As with Lifting Point, ESS Safeforce and MEP,

Climate Hire is an additional specialist business which will complement the

general tool hire offer. The acquisition post year-end of Cool Customers is an

important development for the business.

Airpac Bukom Oilfield Services

Equipment and service providers to the international oil and gas exploration and

development markets.

Revenue #10.0 million (2006: #5.0 million)

Operating Profit #2.4 million (2006: #1.2 million)

Investment in Rental Fleet #2.5 million (2006: #0.8 million)

During the year our oilfield services division successfully integrated the

business of Bukom Oilfield Services, which was acquired in March 2006. The

combined business continued to enjoy the benefit of healthy demand across its

primary markets and in this challenging year produced a very satisfactory

result. The business delivered a 90% increase in profits to #2.4 million

generated from revenues which doubled at #10.0 million.

Oil company expenditure held at a healthy level, driven by the continued

strength of the oil price and global oil and gas demand. The demand for oilfield

support services has in turn remained high, with the expanded business in a

position to take advantage of these opportunities.

The early months of the year saw a smooth integration of the Bukom business in

terms of fleet, personnel, bases and systems across our facilities in the UK and

Singapore. The management team of the combined business has been further

strengthened, with a number of key appointments made to support the future

growth of the business.

The focus of the Bukom offering was historically in support of international

well testing operations, and this has become the primary market for the enlarged

business. As anticipated, our position in the Asia Pacific region has

strengthened and we now have improved access to markets in Africa, North and

South America and the Middle East. The addition of new products such as sand

filters, heat exchangers and coflexip hoses to the fleet has broadened our

service offering to our clients.

We saw high demand for the provision of our specialist compressors to large

contractors conducting maintenance and modification work on the offshore

platform infrastructure, primarily in the North Sea. Our high pressure fleet was

involved on a number of important pipeline related works during the year.

Taking account of the combined resources of the enlarged business, we have

embarked upon a significant capital investment programme which will achieve

marked growth in the fleet over the coming year. At the same time several key

customer support initiatives involve developing our present network of

facilities and our plans in this regard are well progressed. We anticipate

opening further hub locations for the business in support of the Australian,

Middle East and South American markets by the end of summer 2007.

The market fundamentals and outlook remain positive. The strength of our

expanded organisation, enhanced product offering, broader geographic exposure

and our fleet and network expansion initiatives place us in a good position to

develop the business further during the coming year.

UK Forks

Rough terrain material handling equipment for industry, residential and general

construction.

Revenue #13.9 million (2006: #14.3 million)

Operating Profit #1.4 million (2006: #2.1 million)

Investment in Rental Fleet #3.4 million (2006: #3.1 million)

UK Forks had a challenging year, with activity levels subdued in the first nine

months, but picking up strongly in the final quarter. Revenues of #13.9 million

produced operating profits of #1.4 million, #0.7 million lower than the prior

year.

The ongoing consolidation in the housebuilding sector created some volatility.

Whilst volumes in the South East were disappointing for most of the year, this

performance reversed in the final quarter. Further progress was also made with

a number of national accounts, particularly in general construction, a growth

sector targeted by the business.

Fleet size remained broadly static at over 1,200 machines. However, investment

of #3.4 million enabled product mix improvement, reflecting increased demand for

telehandlers at both ends of the size spectrum. In construction, tighter access

within sites created demand for smaller machines up to 6 metres and the larger

rotational telehandlers up to 25 metres. In housebuild, the continued

popularity of flats and apartments (representing nearly 50% of housebuilding

starts in the UK in 2006) meant that standard products up to 17 metres were in

demand.

The year finished strongly in the final quarter, and with activity levels at the

start of the new financial year maintaining that momentum, prospects for the

business going forward are much improved.

TPA

Portable roadway systems, bridging, fencing and barriers primarily to the UK

market, but also in the Republic of Ireland and mainland Europe.

Revenue #11.4 million (2006: #2.5 million)

Operating Profit #1.0 million (2006: #(0.3) million)

Investment in Rental Fleet #4.7 million (2006: #1.1 million)

TPA completed its first full year as part of the Vp Group, delivering operating

profit of #1.0 million on revenues of #11.4 million. The summer period proved

buoyant with strong demand from both the events and transmission markets. The

demand during the winter period reduced, an historic trend, with a general lack

of activity in the transmission market, and a challenging trading environment

for the barriers business.

In further developing the business, a satellite facility in Scotland was opened

in the year, enabling a more efficient service to the local market. In addition

we established TPA in Germany with the formation of a German subsidiary which

will act as a platform for further expansion into mainland Europe. Both

ventures performed well in the first year of operation. We also relocated the

barriers business to improved premises in Croydon during the year. Investment

in the fleet has continued strongly to ensure that TPA maintains its quality and

market leading offer to the marketplace. A new lightweight roll-out roadway,

MD40 has been developed and will be launched in the new financial year.

The markets within which TPA operates remain broadly supportive. In particular,

the announcement by the National Grid in October 2006 of a major five year

programme of investment to upgrade and develop the electricity transmissions

network across England and Wales is likely to act as a valuable longer term

market driver, albeit that regulated spend of this type can be unpredictable in

terms of timing. The outdoor events market in the UK remains stable and we

expect it to deliver further potential opportunities.

Torrent Trackside

Infrastructure equipment and services for the railway renewals and maintenance

industry.

Revenue #13.1 million (2006: #12.1 million)

Operating Profit #2.0 million (2006: #1.7 million)

Investment in Rental Fleet #3.2 million (2006: #2.4 million)

The year was one of further development in the railway renewals and maintenance

market. Torrent performed well in this changing market, growing revenues by 8%

to #13.1 million and delivering operating profit of #2.0 million, a 13.0%

increase on the prior year.

We have accelerated our plant replacement programme to ensure that the quality

of our equipment is the benchmark for the industry and to also reinforce our

reputation for introducing innovative products that further improve operational

safety and production. These initiatives continue to strengthen our status in

this safety critical environment and Torrent continues to be regarded as a key

supplier in this specialist market.

Our ongoing systems development programme provides Torrent with an advantage in

the supply of quality operational data to our major customers, helping them to

reduce costs and improve production in a manner which is safe.

Overall, the business remains well positioned to participate in Network Rail's

ongoing rail expenditure programme and to further support the London Underground

as it works towards the 2012 Olympics.

Prospects

We remain ambitious to further enhance the quality track record established over

recent years and have the resource and management capability to deliver on that

ambition. In order to maintain profitable growth, we recognise that investment

in people and infrastructure is essential. We have successfully developed a

breadth of business activities which we believe provides a resilient and strong

platform for future growth.

Neil Stothard

Group Managing Director

7 June 2007

Financial Highlights

Consolidated Income Statement

For the year ended 31 March 2007

Note 2007 2006

#000 #000

Revenue 1 121,607 99,396

Cost of sales (84,897) (72,092)

Gross profit 36,710 27,304

Administrative expenses (20,459) (15,842)

Operating profit before other income 16,251 11,462

Other income - property profit 257 -

Operating profit 1 16,508 11,462

Financial income 125 188

Financial expense (2,154) (978)

Profit before taxation 14,479 10,672

Taxation 5 (3,998) (3,070)

Net profit for the year 10,481 7,602

Pence Pence

Basic earnings per 5p ordinary share 2 24.50 17.49

Diluted earnings per 5p ordinary share 2 23.34 16.83

Dividend per 5p ordinary share paid and proposed 6 8.25 6.60

Consolidated Statement of Recognised Income and Expense

For the year ended 31 March 2007

Note 2007 2006

#000 #000

Actuarial gains on defined benefit pension schemes 411 231

Tax on items taken directly to equity (123) (67)

Effective portion of changes in fair value of cash flow

hedges 366 (89)

Foreign exchange translation difference (1) -

Net income recognised direct to equity 653 75

Profit for the year 10,481 7,602

Total recognised income and expense for the year 3 11,134 7,677

Consolidated Balance Sheet

As at 31 March 2007

Note 2007 2006

(Restated)

#000 #000

ASSETS

Non-current assets

Property, plant and equipment 76,797 66,041

Intangible assets 35,909 34,133

Total non-current assets 112,706 100,174

Current assets

Inventories 4,814 3,119

Income tax receivable - 34

Trade and other receivables 30,112 28,185

Cash and cash equivalents 4 6,662 5,578

Total current assets 41,588 36,916

Total assets 154,294 137,090

LIABILITIES

Current liabilities

Interest bearing loans and borrowings 4 (7,535) (2,148)

Income tax payable (1,500) (1,183)

Trade and other payables (31,698) (21,744)

Total current liabilities (40,733) (25,075)

Non-current liabilities

Interest bearing loans and borrowings 4 (35,677) (36,062)

Employee benefits (2,048) (2,894)

Other payables (4,240) (7,930)

Deferred tax liabilities (6,004) (4,806)

Total non-current liabilities (47,969) (51,692)

Total liabilities (88,702) (76,767)

Net assets 65,592 60,323

EQUITY

Issued share capital 2,309 2,309

Share premium account 16,192 16,192

Hedging reserve 277 (89)

Retained earnings 46,787 41,884

Total equity attributable to equity holders of the parent 65,565 60,296

Minority interests 27 27

Total equity 3 65,592 60,323

The restatement of the prior year relates solely to refinements to the

accounting for acquisitions.

Consolidated Cash Flow Statement

For the year ended 31 March 2007

2007 2006

#000 #000

Cash flow from operating activities

Profit before taxation 14,479 10,672

Pension fund contributions in excess of service cost (435) (791)

Share based payment charge 1,000 292

Depreciation 14,093 12,224

Intangible amortisation 25 4

Financial expense 2,154 978

Financial income (125) (188)

Profit on sale of property, plant and equipment (3,307) (2,275)

Operating cashflow before changes in working capital 27,884 20,916

Increase in inventories (1,458) (559)

Increase in trade and other receivables (1,131) (579)

Increase in trade and other payables 4,599 2,832

Cash generated from operations 29,894 22,610

Interest paid (1,930) (710)

Interest element of finance lease rental payments (155) (111)

Interest received 125 188

Income tax paid (2,890) (3,120)

Net cash flow from operating activities 25,044 18,857

Cash flow from investing activities

Disposal of property, plant and equipment 8,966 6,181

Purchase of property, plant and equipment (26,746) (15,506)

Acquisition of businesses (4,375) (28,964)

Net cash flow from investing activities (22,155) (38,289)

Cash flow from financing activities

Purchase of own shares by Employee Trust (3,671) (1,073)

Repayment of borrowings (156) (8,000)

Repayment of loan notes (941) (125)

Proceeds from new loans 7,000 33,500

Capital element of hire purchase/finance lease agreements (1,105) (2,475)

Dividends paid (2,932) (2,572)

Net cash flow from financing activities (1,805) 19,255

Increase/(decrease) in cash and cash equivalents 1,084 (177)

Cash and cash equivalents at the beginning of the year 5,578 5,755

Cash and cash equivalents at the end of the year 6,662 5,578

NOTES

The final results have been prepared on the basis of the accounting policies

which are to be set out in Vp plc's annual report and accounts for the year

ended 31 March 2007.

EU Law (IAS Regulation EC1606/2002) requires that the consolidated accounts of

the group for the year ended 31 March 2007 be prepared in accordance with

International Financial Reporting Standards ("IFRSs") as adopted for use in the

EU ('adopted IFRSs').

The financial information set out above does not constitute the Company's

statutory accounts for the years ended 31 March 2007 or 2006. The statutory

accounts for 2006 have been delivered to the Registrar of Companies and those

for 2007 will be delivered following the Company's Annual General Meeting. The

auditors have reported on these accounts; their reports were unqualified and did

not contain a statement under section 237 (2) or (3) of the Companies Act 1985.

The financial statements were approved by the board of directors on 6 June 2007.

1. Business Segments

Revenue Depreciation Operating profit/

and (loss)

amortisation

2007 2006 2007 2006 2007 2006

#000 #000 #000 #000 #000 #000

Groundforce 28,119 23,542 2,510 2,313 6,384 5,258

UK Forks 13,933 14,307 2,347 2,416 1,407 2,071

Airpac Bukom 10,033 4,997 1,324 757 2,360 1,242

Hire Station 44,931 41,937 4,584 4,531 3,121 1,433

Torrent Trackside 13,149 12,134 1,686 1,485 1,954 1,733

TPA 11,442 2,479 1,272 428 1,025 (275)

Group - - 395 298 257 -

Total 121,607 99,396 14,118 12,228 16,508 11,462

Group costs have been allocated across the trading divisions and included above

with the exception of the #257,000 property profit which is shown at Group

level.

2. Earnings Per Share

Basic earnings per share is based on the profit after taxation of #10,481,000

(2006: #7,602,000) and the weighted average number of 5p ordinary shares in

issue during the year of 42,780,000 (2006: 43,460,000).

2007 Weighted 2006 Weighted

Average Shares Earnings per Earnings Average Shares Earnings per

Earnings #000 Number 000's share pence #000 Number 000's share pence

Basic earnings 10,481 42,780 24.50 7,602 43,460 17.49

Share options - 2,133 - - 1,697 -

Diluted earnings 10,481 44,913 23.34 7,602 45,157 16.83

3. Consolidated Statement of Changes in Equity

2007 2006

#000 #000

Total recognised income and expense for the year 11,134 7,677

Dividends paid (2,932) (2,572)

Net movement in shares held by Vp Employee Trust at cost (3,671) (1,073)

Share option charge in the year 1,000 292

(Losses)/gains on disposal of shares (240) 80

Tax movements on equity (22) 489

Change in Equity 5,269 4,893

Equity at start of year 60,323 55,430

Equity at end of year 65,592 60,323

4. Analysis of Debt

At At

31 March 1 April

2007 2006

#000 #000

Cash and cash equivalents (6,662) (5,578)

Current debt 7,535 2,148

Non current debt 35,677 36,062

Net debt 36,550 32,632

Year end gearing (calculated as net debt expressed as a percentage of

shareholders' funds) stands at 56% (2006: 54%).

5. Taxation

The charge for taxation for the year represents an effective tax rate of 27.6%

(2006: 28.8%). The effective tax rate excluding adjustments in respect of prior

years is 29.4% (2006: 29.6%).

6. Dividend

The Board has proposed a final dividend of 6.00 pence per share to be paid on 1

October 2007 to shareholders on the register at 7 September 2006. This,

together with the interim dividend of 2.25 pence per share paid on 11 January

2007 makes a total dividend for the year of 8.25 pence per share.

7. Annual Report and Accounts

The Annual Report and Accounts for the year ended 31 March 2007 will be posted

to shareholders on or about 27 July 2007.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR EAPKKEDXXEFE

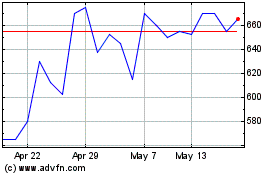

Vp (LSE:VP.)

Historical Stock Chart

From Jul 2024 to Aug 2024

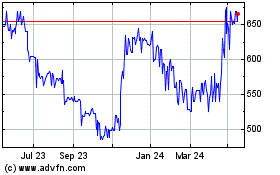

Vp (LSE:VP.)

Historical Stock Chart

From Aug 2023 to Aug 2024