United Utilities Grp United Utilities Business Plan 2015-20

December 02 2013 - 7:05AM

UK Regulatory

TIDMUU.

United Utilities Group PLC

2 December 2013

UNITED UTILITIES BUSINESS PLAN 2015-20

United Utilities Water PLC has today submitted to Ofwat its business plan

covering the 2015-20 period.

Balanced plan

Our business plan for the next five-year period means that customers would

benefit from below inflation average household bills for the decade to 2020. We

have sought the views of over 27,000 customers, as well as consulting with our

regulators, to deliver a plan which we believe strikes the right balance for

all our stakeholders. This includes a substantial capital investment programme

to meet our environmental obligations and which will provide a significant

contribution to the North West economy. Our plan reflects the views of

customers on service and affordability, it delivers a paced environmental

programme and it provides an appropriate return for investors.

Customer bills

Extensive stakeholder engagement has highlighted that the principal concern for

customers is affordability. Customers are generally satisfied with the current

high levels of water and wastewater services being provided and are only

prepared to pay for specific targeted areas of improvement, with 86% of

household customers supportive of bill rises no higher than inflation. This has

been a key driver in the formulation of our plan and we are proposing an

average real terms bill decrease of 1.7% for household customers across the

five-year period (excluding the impact of the previously announced special

customer discount of cGBP20 million to be applied to 2014/15 bills).

For non-household customers, we are proposing an average real terms bill

decrease of 0.5% in 2015/16 with a total real terms increase of 2.5% by 2019/

20. We have tested this proposal with non-household customers and 76% are

supportive and we will work hard to help them reduce their overall spend.

Total expenditure

Our plan includes total expenditure of GBP6.6 billion (2012/13 prices). This

comprises capital investment (capex), including infrastructure renewals

expenditure, of GBP3.8 billion and operating expenditure (opex) of GBP2.8 billion.

This mix of opex and capex has been derived from the optimal cost assessment

over the life of our assets. We have reflected this mix in setting the

wholesale business `pay as you go'1 ratio of 50%, which would result in real

growth in the regulatory capital value of around GBP800 million over the 2015-20

period.

Operating expenditure

Our plan includes initiatives designed to save around GBP66 million per annum of

opex by 2019/20, relative to 2012/13. This will largely offset the unavoidable

cost increases in areas such as rates and power, alongside the addition of

private pumping stations and enhancement programme costs.

Capital expenditure

Our proposed GBP3.8 billion capital investment programme (net of grants and

contributions) comprises GBP1.3 billion for the water service, GBP2.4 billion for

the wastewater service and GBP0.1 billion for the retail service. Investment to

meet tighter regulatory quality standards, enhance service to customers and

maintain the supply/demand balance is forecast at around GBP1.5 billion, with the

remainder relating to maintenance. We have kept capex constrained at GBP3.8

billion by meeting new environmental obligations via a phased approach,

supported by the Environment Agency and the Drinking Water Inspectorate.

Company specific adjustments

Reflecting the impact of the extreme levels of deprivation in the North West on

our costs, we are seeking an adjustment to the household retail average cost to

serve of around GBP25 million per annum. We have provided robust evidence to

Ofwat in support of this approach.

We have worked hard with the Environment Agency to constrain and balance our

expenditure programme. Nonetheless, similar to previous regulatory periods, our

wastewater spend includes a significant environmental programme. In view of our

regional differences, we believe it is necessary to assess this programme

outside of Ofwat's totex modelling methodology.

Return on capital

In deriving the weighted average cost of capital (WACC) in our business plan,

we have carefully considered both financeability and customer affordability. In

light of this, we have adopted a real, vanilla WACC2 of 4.1% for our wholesale

business. When adding in our proposed non-household retail margin of 4%, this

translates to an overall appointed business WACC of 4.3%.

Next steps

Ofwat is expected to publish draft determinations by August 2014, with final

determinations due by December 2014.

United Utilities' contacts

For further information on the day, please contact:

Gaynor Kenyon - Corporate Affairs Director +44 (0) 7753 622282

Darren Jameson - Head of Investor Relations +44 (0) 7733 127707

Peter Hewer / Michelle Clarke - Tulchan +44 (0) 20 7353 4200

Communications

This announcement and a summary of the business plan will be available on the

day at: http://corporate.unitedutilities.com/investors.aspx

1 `Pay as you go' ratio is the proportion of wholesale total expenditure

recovered directly through wholesale revenues

2 Vanilla WACC is derived from pre-tax debt and post-tax equity

END

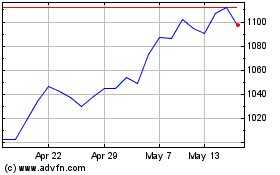

United Utilities (LSE:UU.)

Historical Stock Chart

From Jun 2024 to Jul 2024

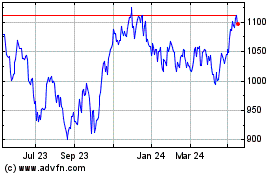

United Utilities (LSE:UU.)

Historical Stock Chart

From Jul 2023 to Jul 2024