Terra Catalyst Fund Net Asset Value (0333L)

July 13 2017 - 10:30AM

UK Regulatory

TIDMTCF

RNS Number : 0333L

Terra Catalyst Fund

13 July 2017

13 July 2017

TERRA CATALYST FUND

Net Asset Value of the Company

The Directors of Terra Catalyst Fund ("TCF" or the "Company")

announce that the unaudited Net Asset Value ("NAV") for the Company

as at 30 June 2017 was 57.49 pence per share. This compares with an

unaudited NAV as at 31 May 2017 of 244.05 pence per share.

The 76.4% reduction in the Company's NAV per share is primarily

due to a decision by the Directors of TCF to reduce the value of

its indirect holding in Spazio Investments NV ("Spazio"). The

Company indirectly owns 26.7% of Spazio.

Since 31 July 2014, the Company has valued its holding in Spazio

on the basis of the last audited NAV per share disclosed by Spazio.

The 'Managing Directors' Report' accompanying Spazio's audited

accounts for the years ended 31 December 2014 and 2015, disclosed

possible going concern issues. The Investment Manager has been

notified of a deterioration in Spazio's financial condition and

that it currently has insufficient liquid resources to complete and

publish its audited accounts for the year ended 31 December 2016.

As such, the NAV per Spazio share at 31 December 2016 is estimated

by the Investment Manager and is unaudited.

According to management information provided to Laxey Partners

Limited, the Company's investment manager ("Investment Manager") by

Spazio, the Investment Manager estimates the NAV of Spazio as at 31

December 2016 to be EUR5.984 per share, calculated on a going

concern basis.

Spazio's principal asset is its holding in all 563 of the units

issued by Spazio Industriale, a property fund established, managed

and regulated in Italy. Spazio Industriale is managed by a

regulated property investment manager, IDeA FIMIT. IDeA FIMIT

calculates, on a semi-annual basis for Spazio Industriale an NAV

per unit in accordance with the rules governing Italian property

funds. IDeA FIMIT values each property in the portfolio based on an

independent valuation conducted annually. Spazio Industriale's

audited NAV as of 31 December 2016 was EUR252,306.49 per unit

(totalling EUR142,048,553).

The Board has consulted with the Investment Manager, Spazio,

IDeA FIMIT and Celtic Italy (Spazio's Italian property adviser)

regarding the current market conditions for selling industrial

property in Italy, the requirement to meet debt repayments to

Spazio Industriale's banks and Spazio's financial position. As a

result, in calculating the Company's NAV per share, the Board

has:

-- reduced the implied carrying value of Spazio to EUR1.5764 per unit;

-- utilised the Investment Manager's estimate of Spazio's NAV

per share, adjusted for the TCF Directors' revaluation of the units

in Spazio Industriale; and

-- made no provision for Spazio not continuing as a going concern.

Shareholders should be aware that the lack of audited accounts

for Spazio will delay the issue of audited financial statements for

the Company for the year ended 31 March 2017, however the Directors

currently expect that the Company's audited financial statements

will be published by 30 September 2017.

This announcement contains inside information which is disclosed

in accordance with the Market Abuse Regulation.

ENQUIRIES TO:

Terra Catalyst Fund

Mike Haxby, Director

www.terracatalystfund.com

Tel: +44 (0)1624 690 900

Smith & Williamson Corporate Finance Limited

Azhic Basirov

Tel: +44 (0)20 7131 4000

This information is provided by RNS

The company news service from the London Stock Exchange

END

NAVLLFFSDIIVLID

(END) Dow Jones Newswires

July 13, 2017 10:30 ET (14:30 GMT)

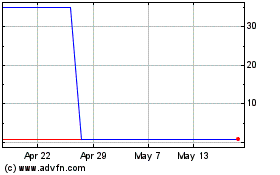

Theracryf (LSE:TCF)

Historical Stock Chart

From May 2024 to Jun 2024

Theracryf (LSE:TCF)

Historical Stock Chart

From Jun 2023 to Jun 2024