TIDMSOLG

RNS Number : 7984W

SolGold PLC

28 April 2021

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED HEREIN IS NOT

FOR RELEASE, PUBLICATION OR DISTRIBUTION, DIRECTLY OR INDIRECTLY,

IN WHOLE OR IN PART, IN OR INTO THE UNITED STATES, AUSTRALIA, NEW

ZEALAND, HONG KONG, JAPAN, SOUTH AFRICA OR ANY OTHER JURISDICTION,

WHERE SUCH PUBLICATION, RELEASE OR DISTRIBUTION WOULD BE

UNLAWFUL.

THIS ANNOUNCEMENT DOES NOT CONSTITUTE AN OFFER TO BUY, ACQUIRE

OR SUBSCRIBE FOR (OR THE SOLICITATION OF AN OFFER TO BUY, ACQUIRE

OR SUBSCRIBE FOR) ORDINARY SHARES TO ANY PERSON WITH A REGISTERED

ADDRESS IN, LOCATED IN, OR WHO IS A RESIDENT OF, THE UNITED STATES,

AUSTRALIA, NEW ZEALAND, HONG KONG, JAPAN, SOUTH AFRICA OR IN ANY

OTHER JURISDICTION, WHERE SUCH OFFER, SOLICITATION OR SALE WOULD BE

UNLAWFUL OR CONTRAVENE ANY REGISTRATION OR QUALIFICATION

REQUIREMENTS UNDER THE SECURITIES LAWS OF ANY SUCH

JURISDICTION.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF THE MARKET ABUSE REGULATION (EU) NO. 596/2014, INCLUDING AS IT

FORMS PART OF DOMESTIC LAW IN THE UNITED KINGDOM BY VIRTUE OF THE

EUROPEAN UNION (WITHDRAWAL) ACT 2018.

THIS ANNOUNCEMENT IS FOR INFORMATION PURPOSES ONLY AND IS NOT AN

OFFER OF SECURITIES IN ANY JURISDICTION.

TERMS USED IN THIS ANNOUNCEMENT HAVE THE SAME MEANING GIVEN TO

THEM AS DEFINED IN THE PLACING ANNOUNCEMENT.

For immediate release

28 April 2021

SolGold plc

("SolGold" or the "Company")

Results of Placing

SolGold plc (LSE & TSX: SOLG) , the copper exploration and

development company focussed in Ecuador, is pleased to announce the

successful completion of the Placings and Retail Offer announced

yesterday (the "Placing Announcement").

A total of 208,202,938 new Ordinary Shares in the capital of the

Company have been placed with new and existing investors at a

Placing Price of 25.5 pence per new Ordinary Share. The Placing and

Retail Offer have raised gross proceeds of approximately US$73.8

million for the Company (GBP53.1 million) (before expenses).

Pursuant to the Placing, a total of 206,466,501 Placing Shares

have been placed at the Placing Price, raising gross proceeds of

approximately US$73.2 million (GBP52.6 million).

In addition, retail investors have subscribed in the Retail

Offer for 1,736,437 Retail Offer Shares at the Placing Price

raising gross proceeds of approximately US$0.6 million (GBP0.4

million).

The Placing Price represents a discount of approximately 11.1

per cent. to the closing mid-market price per share of 28.7 pence

on 27 April 2021.

The 208,202,938 new Ordinary Shares to be issued in aggregate

pursuant to the Placing and the Retail Offer (the "New Ordinary

Shares") represent 9.99 per cent. of the issued ordinary share

capital of the Company prior to Admission (as defined below).

The net proceeds of the Placing and Retail Offer are intended to

fund (i) a minimum of 40,000 meters of diamond core drilling, (ii)

related technical services and staff expenses and (iii) CSR

initiatives work related to the Company's Regional Portfolio.

Excess cash will be used for the DFS and related workstreams

related to the Alpala Project and be available for general

corporate purposes and working capital.

PDMR participation in the Placing

Certain directors of the Company have agreed to participate via

the Placing for the number of Placing Shares at the Placing Price

as set out below:

Director Number of Placing

Shares

Liam Twigger 392,156

------------------

Nicholas Mather 392,156

------------------

Kevin O'Kane 392,156

------------------

James Clare 143,137

------------------

Keith Marshall 98,039

------------------

Brian Moller 78,431

------------------

Maria Amparo Alban 28,176

------------------

Elodie Grant Goodey 19,607

------------------

Peel Hunt LLP ("Peel Hunt"), H&P Advisory Ltd ("H&P")

and Cantor Fitzgerald Canada Corporation ("Cantor") acted as joint

bookrunners (the "Joint Bookrunners") to the Company in connection

with the Placing.

Keith Marshall, Interim CEO of SolGold, commented:

"We are delighted to announce the successful completion of a two

and a half times oversubscribed Placing. We have added some very

strong names to our shareholder register and I would like to thank

existing and new investors for their support and backing of our

strategy and future investment in Ecuador. This Placing underscores

the quality of our mineral assets in Ecuador and the strong market

sentiment for the development of copper mines in a tight

market."

Details of the Placing

The Placing Shares and Retail Shares, when credited, will rank

pari passu in all respects with the Company's existing Ordinary

Shares at that time.

The Company has applied to the London Stock Exchange ("LSE") for

Admission, and to the TSX to list, 208,202,938 New Ordinary Shares.

Subject to, inter alia, the Placing Agreement not having been

terminated in accordance with its terms as well as admission to the

LSE, it is expected that admission and dealing on LSE of the

208,202,938 New Ordinary Shares will occur at 8:00 am on or around

30 April 2021 that the New Ordinary Shares will be listed and

posted for trading on TSX on or around 30 April 2021. The Company

is relying on an exemption set forth in Section 602.1 of the TSX

Company Manual, which exemption provides that the TSX will not

apply certain of its standards (including the private placement

standards set out in Section 607 of the Manual) to "Eligible

Interlisted Issuers" (as such term is defined in the Manual).

Total Voting Rights

In accordance with the provision of the Disclosure Guidance and

Transparency Rules of the FCA ("DTRs"), the Company confirms that,

following Admission, its issued share capital will comprise

2,292,316,432 Ordinary Shares, each of which carries the right to

vote, with zero Ordinary Shares held in treasury. This figure may

be used by Shareholders as the denominator for the calculations by

which they will determine if they are required to notify their

interest in, or a change to their interest in, the Company under

the DTRs.

http://www.rns-pdf.londonstockexchange.com/rns/7984W_1-2021-4-28.pdf

For further information, please contact:

SolGold plc +44 (0) 20 3823 2130

Keith Marshall (Interim CEO)

Ingo Hofmaier (Executive General Manager,

Corporate Finance)

Website: www.solgold.com .au

Peel Hunt LLP - Joint Bookrunner

Investment Banking - Ross Allister / Alexander

Allen

ECM/Syndicate - Al Rae / Sohail Akbar +44 (0) 20 7418 8900

H&P Advisory Ltd - Joint Bookrunner

Andrew Chubb / Ernest Bell +44 (0) 20 7907 8500

Cantor Fitzgerald Canada Corporation - Joint

Bookrunner

Graham Moylan / Craig Warren / James Mazur +1 (0) 416 350 1203

ABOUT THE COMPANY

SolGold is a leading exploration company focussed on the

discovery, definition and development of world-class copper and

gold deposits. SolGold, with 76 concessions covering approximately

3,100km(2), is the largest and most active concession holder in

Ecuador (based on exploration expenditure reported by SNP Global)

and is aggressively exploring this highly prospective,

underexplored and copper-gold-rich section of the Andean Copper

Belt which is currently responsible for c40% of global mined copper

production (according to Wood Mackenzie). Ecuador is one of the

most important new mining jurisdictions and is endorsed by major

mining companies. The Company further believes that the newly

elected president will offer continued support for responsible

mining activities and a focus on foreign direct investments.

The Company's current activities are focussed on progressing a

PFS study at its Alpala project and regional exploration as the

Company continues to pursue its strategy as an integrated explorer

and developer, based on preservation of value for all shareholders.

The Company maintains its plan of applying its blueprint of

systematic evaluation and exploration across its regional

exploration portfolio of 75 concessions, having created the

successful blueprint at the company's Tier 1 Alpala project.

The Alpala deposit comprises 2,663 Mt at 0.53% CuEq in the

Measured plus Indicated categories and contained metal content of

9.9 Mt copper, 21.7 Moz gold and 92.2 Moz silver. The Company is of

the view that the Alpala resource is one of the most significant

copper-gold porphyry discoveries of the last decade. The Company

further believes that it has the potential to become a key source

of future copper supply amid an expected growing medium-term market

deficit, reflecting limited new project development, a declining

base production and growing demand supported by the shift towards

electrification and decarbonisation.

The Company is making good progress studying potential Alpala

mine plans while addressing a number of mine development and

metallurgical enhancements as well as potential upsides. The

Company is optimistic that the revised mine plan currently being

studied as part of the PFS process could deliver similar metal

production while mining significantly less material with

anticipated benefits of the revised approach being studied

including lower potential execution risks, lower potential

pre-production capital and the potential for significantly reduced

time to first production all of which is expected to enhance

project economics.

A significant part of SolGold's success to date in driving

shareholder value growth has been through its successful

exploration programmes across Ecuador's highly prospective and

under-explored section of the Andean Copper Belt. Whilst this has

resulted in the discovery and development of the world class Alpala

project, the board of directors believe that the best way to

continue to drive shareholder value at present is through further

exploration success at priority projects. The goal of the Company

is to drive value for stakeholders through this exploration

programme by the assessment and study of exciting prospective

targets already identified within the Regional Portfolio and to

seek to discover another highly prospective mineral system such as

that at the Company's flagship Alpala project.

IMPORTANT NOTICES

THIS ANNOUNCEMENT IS NOT FOR PUBLIC RELEASE, PUBLICATION OR

DISTRIBUTION, DIRECTLY OR INDIRECTLY, IN WHOLE OR IN PART, IN OR

INTO THE UNITED STATES, AUSTRALIA, NEW ZEALAND, JAPAN, SOUTH

AFRICA, HONG KONG OR ANY OTHER JURISDICTION, WHERE SUCH

PUBLICATION, RELEASE OR DISTRIBUTION WOULD BE UNLAWFUL. FURTHER,

THIS ANNOUNCEMENT IS FOR INFORMATION PURPOSES ONLY AND IS NOT AN

OFFER OF SECURITIES IN ANY JURISDICTION. NO PUBLIC OFFERING OF THE

PLACING SHARES IS BEING MADE IN ANY SUCH JURISDICTION. ANY FAILURE

TO COMPLY WITH THESE RESTRICTIONS MAY CONSTITUTE A VIOLATION OF THE

SECURITIES LAWS OF SUCH JURISDICTIONS.

THIS ANNOUNCEMENT HAS NOT BEEN APPROVED BY THE LONDON STOCK

EXCHANGE OR THE FCA, NOR IS IT INTED THAT IT WILL BE SO

APPROVED.

THIS ANNOUNCEMENT DOES NOT ITSELF CONSTITUTE AN OFFER FOR SALE

OR SUBSCRIPTION OF ANY SECURITIES IN SOLGOLD PLC IN ANY

JURISDICTION.

The distribution of this Announcement in certain jurisdictions

may be restricted by law. No action has been taken by the Company,

any of the Joint Bookrunners or any of their respective affiliates,

agents, directors, officers, partners, advisers and/or employees

that would permit an offer of the securities referred to herein or

possession or distribution of this Announcement or any other

offering or publicity material relating to such securities in any

jurisdiction where action for that purpose is required. Persons

receiving this Announcement or into whose possession this

Announcement comes are required by the Company and the Joint

Bookrunners to inform themselves about and to observe any such

restrictions contained in this Announcement. Persons (including,

without limitation, nominees and trustees) who have a contractual

or other legal obligation to forward a copy of this Announcement

should seek appropriate advice before taking any action. Persons

distributing any part of this Announcement must satisfy themselves

that it is lawful to do so.

No prospectus will be made available in connection with the

matters contained in this Announcement and no such prospectus is

required (in accordance with the UK Prospectus Regulation or EU

Prospectus Regulation) to be published. Persons needing advice

should consult an independent financial adviser.

This announcement or any part of it does not constitute or form

part of any offer to issue or sell, or the solicitation of an offer

to acquire, purchase or subscribe for, any securities in the United

States, Australia, New Zealand, the Republic of South Africa,

Japan, Hong Kong or any other jurisdiction in which the same would

be unlawful. No public offering of the securities referred to

herein is being made in any such jurisdiction.

This communication is not a public offer of securities for sale

in the United States. The securities referred to herein have not

been and will not be registered under the US Securities Act 1933,

as amended (the "Securities Act") or under the securities laws of

any state or other jurisdiction of the United States, and may not

be offered or sold directly or indirectly in or into the United

States except pursuant to an exemption from, or in a transaction

not subject to, the registration requirements of the Securities Act

and in compliance with the securities laws of any state or any

other jurisdiction of the United States. The securities referred to

herein may not be offered and sold within the United States except

pursuant to an exemption from, or in a transaction not subject to,

the registration requirements of the Securities Act.

Persons (including, without limitation, nominees and trustees)

who have a contractual right or other legal obligations to forward

a copy of this Announcement should seek appropriate advice before

taking any action.

This Announcement may contain and the Company may make verbal

statements containing "forward-looking statements" with respect to

certain of the Company's plans and its current goals and

expectations relating to its future financial condition,

performance, strategic initiatives, objectives and results Without

limitation, forward-looking statements sometimes use words such as

"aim", "anticipate", "target", "expect", "estimate", "intend",

"plan", "goal", "believe", "seek", "may", "could", "outlook",

"project" or other words or terms of similar meaning (or the

negative thereof) . By their nature, all forward-looking statements

involve risk and uncertainty because they relate to future events

and circumstances which are beyond the control of the Company,

including (without limitation and amongst other things),

commercial, operational, domestic and global economic business

conditions, the macroeconomic and other impacts of COVID-19,

market-related risks such as fluctuations in interest rates and

exchange rates, the policies and actions of governmental and

regulatory authorities, the effect of competition, inflation,

deflation, the timing effect and other uncertainties of future

acquisitions or combinations within relevant industries, the effect

of tax and other legislation and other regulations in the

jurisdictions in which the Company and its respective affiliates

operate, the effect of volatility in the equity, capital and credit

markets on the Company's profitability and ability to access

capital and credit, a decline in the Company's credit ratings; the

effect of operational risks; and the loss of key personnel, that

could cause actual results, financial condition, performance or

achievements to differ materially from those expressed or implied

by these forward--looking statements. As a result, the actual

future financial condition, performance and results of the Company

may differ materially from the plans, goals and expectations set

forth in any forward-looking statements. Due to such uncertainties

and risks, readers are cautioned not to place undue reliance on

such forward-looking statements. In light of these risks,

uncertainties and assumptions, the events described in the

forward-looking statements in this Announcement may not occur. Any

forward-looking statements made in this Announcement by or on

behalf of the Company speak only as of the date they are made.

Except as required by applicable law or regulation, the Company,

its directors and each of the Joint Bookrunners each expressly

disclaim any obligation or undertaking to update or revise, or

publish any updates or revisions to any forward-looking statements

contained in this Announcement, whether as a result of new

information, future events or otherwise to reflect any changes in

the Company's expectations with regard thereto or any changes in

events, conditions or circumstances on which any such statement is

based.

Peel Hunt is regulated by the FCA in the United Kingdom and is

acting exclusively for the Company and no one else in connection

with the Placing, and Peel Hunt will not be responsible to anyone

(including any Placees) other than the Company for providing the

protections afforded to its clients or for providing advice in

relation to the Placing or any other matters referred to in this

Announcement.

H&P is regulated by the FCA in the United Kingdom and is

acting exclusively for the Company and no one else in connection

with the Placing, and H&P will not be responsible to anyone

(including any Placees) other than the Company for providing the

protections afforded to its clients or for providing advice in

relation to the Placing or any other matters referred to in this

Announcement.

Cantor which is regulated by the Investment Industry Regulatory

Organization of Canada is acting exclusively for the Company and no

one else in connection with any investment in the Placing Shares,

and will not regard any other person as their client in relation to

any investment in the Placing Shares and will not be responsible to

anyone other than the Company for providing the protections

afforded to their respective clients nor for giving advice in

relation to any investment in the Placing Shares or any transaction

or arrangement referred to in this Announcement.

This Announcement does not constitute a recommendation.

Recipients of this Announcement should conduct their own

investigation, evaluation and analysis of the business, data and

other information described in this Announcement. The price of

shares and any income expected from them may go down as well as up

and investors may not get back the full amount invested upon

disposal of the shares. Past performance is no guide to future

performance. The contents of this Announcement are not to be

construed as legal, business, financial or tax advice. Each

investor or prospective investor should consult his, her or its own

legal adviser, business adviser, financial adviser or tax adviser

for legal, financial, business or tax advice.

This Announcement has been prepared for the purposes of

complying with applicable law and regulation in the United Kingdom

and the information disclosed may not be the same as that which

would have been disclosed if this Announcement had been prepared in

accordance with the laws and regulations of any jurisdiction

outside the United Kingdom.

This Announcement is being issued by and is the sole

responsibility of the Company. No representation or warranty,

express or implied, is or will be made as to, or in relation to,

and no responsibility or liability is or will be accepted by the

Joint Bookrunners (apart from the responsibilities or liabilities

that may be imposed by the Financial Services and Markets Act 2000,

as amended (" FSMA ") or the regulatory regime established

thereunder) or by any of their respective affiliates or any of

their respective directors, officers, partners, employees, advisers

and/ or agents as to, or in relation to, the accuracy or

completeness of this Announcement or any other written or oral

information made available to or publicly available to any

interested party or its advisers, and any liability therefore is

expressly disclaimed.

No statement in this Announcement is intended to be a profit

forecast or estimate for any period, and no statement in this

Announcement should be interpreted to mean that earnings, earnings

per share or income, cash flow from operations or free cash flow

for the Company (as appropriate), for the current or future

financial years would necessarily match or exceed the historical

published earnings, earnings per share or income, cash flow from

operations or free cash flow for the Company.

Any indication in this Announcement of the price at which

ordinary shares of the Company have been bought or sold in the past

cannot be relied upon as a guide to future performance. The price

of shares and any income expected from them may go down as well as

up and investors may not get back the full amount invested upon

disposal of any Placing Shares or other securities of the Company.

Past performance is no guide to future performance, and persons

needing advice should consult an independent financial adviser.

The New Ordinary Shares will not be admitted to trading on any

stock exchange other than the London Stock Exchange and the Toronto

Stock Exchange.

Neither the content of the Company's website (or any other

website) nor the content of any website accessible from hyperlinks

on the Company's website (or any other website) is incorporated

into, or forms part of, this Announcement.

The GBP/US$ exchange used herein is GBP1.00:US$1.3899.

Qualified Persons Statement

The scientific or technical information contained in this press

release has been approved by Jason Ward (the Company's Head of

Exploration), a qualified person under National Instrument 43-101 -

Standards of Disclosure for Mineral Projects.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ROIEAELPAALFEEA

(END) Dow Jones Newswires

April 28, 2021 02:00 ET (06:00 GMT)

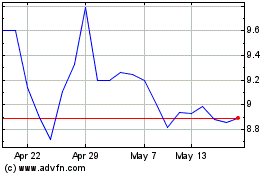

Solgold (LSE:SOLG)

Historical Stock Chart

From Oct 2024 to Nov 2024

Solgold (LSE:SOLG)

Historical Stock Chart

From Nov 2023 to Nov 2024