TIDMSOLG

RNS Number : 4889B

SolGold PLC

08 October 2020

8 October 2020

SolGold plc

("SolGold" or the "Company")

Drilling To Commence at Varela Porphyry Copper-Gold Target,

Rio Amarillo Project, Northern Ecuador

The Board of SolGold (LSE & TSX code: SOLG) is pleased to

provide an update on the Company's regional

exploration activities from its Rio Amarillo Project in Northern

Ecuador, held by 100% owned subsidiary

Carnegie Ridge Resources S.A. The Rio Amarillo project is one of

fourteen projects held in four 100% owned unencumbered

subsidiaries. The regional exploration projects are fully funded to

mid-to-late 2021.

Highlights

Ø Drill rig preparing to mobilise to Rio Amarillo to commence an

initial 8000m Phase 1 Drilling Program. Completion of all

regulatory permitting and camp facilities now supported by

finalisation of drill rig fit-out, with mobilisation of the first

drill rig planned for late-October.

Ø Significant upgrade of Varela Target (formerly Varela and

Target#1 areas) through extensive recent field work highlighting

strong similarities between Varela and Alpala Lithocap footprints

and geochemical signatures.

Ø Varela target exhibits a well-preserved metalliferous lithocap

and hydrothermal alteration system with a full complement of

porphyry plume chemical elements, the classic signature of a large

scale strongly mineralised Porphyry Copper-Gold(-Molybdenum)

system.

Ø Drilling at Varela will test underneath outcropping porphyry

style vein stockworks which returned surface rock-saw channel

sample results of 99m @ 0.34% CuEq including 25.1m @ 0.58% CuEq

(announced 13 February 2020).

Ø The cluster of porphyry targets delineated so far at Rio

Amarillo are supported by high quality magnetic data which reveals

a highly magnetic NE/SW trending corridor, spatially coincident

with porphyry style surface mineralisation covering a vertical

extent of up to 1500m over a 12km long and 3km wide northeast

trending porphyry belt.

Ø The regional position of the Rio Amarillo Project is

geologically consistent with the district's distribution of

porphyry deposits, with the Tier 1 Alpala ( 9.9 Mt Cu, 21.7 Moz Au,

92.2 Moz Ag ) and Llurimagua ( 16.9 Mt Cu) deposits occurring some

30km and 60km away respectively.

References to figures relate to the version visible in PDF

format by clicking the link below:

http://www.rns-pdf.londonstockexchange.com/rns/4889B_1-2020-10-8.pdf

Commenting on the recent developments, Regional Exploration

Manager Mr Chris Connell, said:

"The Rio Amarillo project represents a second cluster of large

fertile porphyry systems to explore in Northern Ecuador. The Varela

lithocap area is highly visible from the air, as are a number of

large porphyry deposits along the Andean Copper Belt which have now

been developed into mines. Extensive outcropping hydrothermally

altered rock is spread across the ground surface immediately

upstream of the rock saw location, which is typical of intense acid

alteration in a highly leached lithocap environment. The Varela

metalliferous lithocap is the most classical example of a fully

preserved, whole column porphyry system that we have encountered in

our exploration activities in Ecuador to date. This latest update

is another step forward as we look to unearth the significant value

contained within SolGold's licences throughout Ecuador".

With regard to the potential at Rio Amarillo, Technical Services

Manager Mr Benn Whistler, said:

"HP Drilling is finalising a good portion of the fleet of

diamond drill rigs, for exploratory drilling at our regional

projects, at its Cuenca workshop facility in Southern Ecuador.

SolGold's 'Sleeping Giant' at Rio Amarillo including its two

high-quality large-scale porphyry targets at Varela and Palomar are

two of the Company's highest priority targets."

"In the case of Varela, we observe a beautifully preserved

porphyry column displaying a complete range of porphyry plume

chemical elements including Bismuth, Selenium, Lithium and

Tellurium at surface. Geochemical contouring reveals a Lithium halo

surrounding a tight Molybdenum high indicative of the centre of the

top of a porphyry plume. This occurs with coincident

copper-molybdenum-gold geochemical highs and the presence of B-type

porphyry veins amongst highly-altered host rocks. This provides

what we believe is a perfect example of a metalliferous lithocap

formed above a porphyry copper-gold(-molybdenum) deposit. A good

targeting tool this high up in a porphyry plume is the Molybdenum -

Manganese ratio geochemistry and using this we see that the Varela

Target holds close similarities to the footprint and geochemical

signature of the lithocap at Alpala, only 30km to the

northwest."

Nick Mather, CEO of SolGold said:

"The gross geological architecture of Ecuador endorses the

presence of very large mineralised systems where the Andean Copper

belt bends. We can see that in both southern Ecuador where the

Porvenir project is revealing a large copper porphyry in the first

drill hole. Similarly, northern Ecuador shows the same

characteristics and we're confident that the tier 1 Alpala project

at Cascabel will be followed by Rio Amarillo in this highly

prospective emerging province."

Further Information

SolGold's 100% owned Rio Amarillo Project in Northern Ecuador

lies approximately 30km Southeast of the Company's flagship Alpala

Porphyry Copper-Gold-Silver Deposit which holds a Measured plus

Indicated Resource of 2.66 Bt @ 0.53% CuEq (9.9 Mt Cu, 21.7 Moz Au,

92.2 Moz Ag)(announced 7 April 2020). The Rio Amarillo Project

comprises three concessions, Rio Amarillo 1, 2 & 3 (Figure

1).

Completion of all regulatory permitting and camp facilities

(Figure 2) are now supported by finalisation of drill rig fit-out,

with mobilisation of the first drill rig planned for late-October.

The first drill rig is preparing to mobilise to Rio Amarillo to

commence an initial 8000m Phase 1 Drilling Program at the Varela

target.

Hubbard Perforaciones (HP Drilling), the same drilling experts

that completed over 170,000m at the Alpala Deposit, are finalising

several new custom-built man-portable drilling machines, at the HP

Drilling workshop facility in Cuenca, Southern Ecuador (Figure 3).

This work will continue as SolGold and HP Drilling work together to

expand the fleet of diamond drill rigs for exploratory drilling on

SolGold's regional projects.

The conspicuous geological feature of the Rio Amarillo Project

is a cluster of preserved litho-cap zones at Palomar, Varela and

Chalanes where porphyry style veining, copper-gold-molybdenum

mineralisation and associated acid alteration were discovered

through geological mapping, geochemical sampling and satellite

imagery (Figure 4). The Varela lithocap area is highly visible from

the air, as are a number of large porphyry deposits along the

Andean Copper Belt which are now mines.

The main target areas at Varela, Florida, Palomar and Chalanes

exhibit porphyry style surface mineralisation and alteration

covering a vertical extent of up to 1500m over a 12km-long by

3km-wide northeasterly-trending, magnetically anomalous, porphyry

belt (Figure 5). The major northeast trending magnetically

anomalous belt is intersected by a secondary northwesterly-trending

feature, likely to represent the intersection of two deep-seated

crustal-scale fracture zones, later filled by intrusive bodies with

magnetic characteristics indicative of strongly differentiated and

mineralised systems. This structural regime has strong similarities

to that encountered at the Alpala Deposit, located about 30km to

the northwest.

Field work completed at the Rio Amarillo project includes

extensive rock and rock-saw channel sampling, with Terra-Spec4(TM)

(ASD) analysis of rock samples to map hydrothermal alteration over

the main litho-cap areas at Chalanes, Varela and Palomar. Rock

samples have been obtained from surface pits up to 1.3m deep.

Varela target exhibits a well-preserved metalliferous lithocap and

hydrothermal alteration system with a full complement of porphyry

plume elements, the typical signature of a large scale strongly

mineralised Porphyry Copper-Gold(-Molybdenum) system (Figure

6).

This r ecent and extensive rock and soil geochemical sampling at

Varela has significantly upgraded the quality of the Varela Target

(formerly Varela and Target#1 areas) and highlights strong

similarities between Varela and Alpala Lithocap footprints and

geochemical signatures (Figure 7).

At Varela outcropping porphyry style A, M and B type quartz vein

stockworks occur in dioritic host rocks which returned encouraging

rock-saw channel sample results of 99m @ 0.34% CuEq (0.12% Cu, 0.29

g/t Au, 38ppm Mo) including 25.1m @ 0.58% CuEq (0.12% Cu, 0.61 g/t

Au, 85ppm Mo). Mineralised quartz veins and veinlets within the

Varela lithocap area predominantly strike in a northwest

direction.

At Varela, SolGold geologists observe a well-preserved porphyry

column displaying a complete range of porphyry plume elements

including Bismuth, Selenium and Tellurium at surface (Figure 8;

Cohen, 2011 and Halley et al, 2015). Rock geochemical contouring

reveals a Lithium halo surrounding a tight Molybdenum high, which

is inferred to indicate the top of a porphyry plume. This occurs

with coincident copper-molybdenum-gold geochemical highs and the

presence of B-type porphyry veins amongst highly altered host

rocks, which SolGold geologists believe provides an excellent

example of a metalliferous lithocap formed above a porphyry

copper-gold(-molybdenum) deposit. The lithocap and associated

Molybdenum (Mo) - Manganese (Mn) ratio results at the Varela Target

holds close similarities to the footprint and geochemical signature

of the lithocap at Alpala (Figure 7).

The Varela litho-cap rocks are characterised by magnetite- and

feldspar-destructive, clay-mica rich hydrothermal alteration with

crackle and hydrothermal breccias that contain veins with mineral

assemblages typical of the upper levels of some mineralised

porphyry systems. Examples of lithocap rocks and alteration within

the Varela lithocap are shown in Figures 9-11.

The regional position of the Rio Amarillo Project is

geologically consistent with the district's distribution of

porphyry deposits, with the Tier 1 Alpala and Llurimagua deposits

occurring some 30km and 60km away respectively.

References

Cohen, J.F., 2011, Mineralogy and geochemistry of alteration at

the Ann-Mason copper deposit, Nevada: Comparison of large-scale ore

exploration techniques to mineral chemistry: M.Sc. thesis,

Corvallis, Oregon, Oregon State University, 112 p. plus

appendices.

Halley, S., Dilles, J.H, and Tosdal, R.M., 2015, Footprints:

Hydrothermal alteration and geochemical dispersion around porphyry

copper deposits, Society of Economic Geologists Newsletter v. 100,

p 1, 12-17.

https://www.mining-journal.com/copper-news/news/1378628/llurimagua-decision-possible-in-2023

Figure 1 : Location plan showing the Rio Amarillo project

location in relation to the giant Alpala ( SolGold ) and the

Llurimagua ( ENAMI - Codelco ) deposits. The Rio Amarillo project

holds similar infrastructure advantages to the Alpala Project.

Figure 2 : Camp facilities at the recently completed Rio Amarilo

Base Camp (Varela Camp), situated immediately west of the Varela

lithocap area.

Figure 3 : HP Drilling customised man-portable drill rigs being

finalised at the HP Drilling workshop facility in Cuenca, Southern

Ecuador. This work will continue as SolGold and HP Drilling work

together to expand the fleet of diamond drill rigs for exploratory

drilling at SolGold's regional projects.

Figure 4 : Location plan of mapped litho-cap areas (outlined

yellow) within the Rio Amarillo Project concessions (red), showing

the highly visible natural scarring at Varela lithocap area.

Figure 5 : Location plan showing mapped litho-cap areas

(outlined red), comprising the four target areas of outcropping

porphyry mineralisation at Palomar, Varela, Florida and Chalanes.

Rock-saw channel sample sites within the Palomar and Varela

litho-cap areas are marked as large black circles. Recent 3D

magnetic inversion models are also shown, highlighting the major

northeasterly-trending magnetic belt which is intersected by a

secondary northwesterly-trending magnetic feature, likely to

represent the intersection of deep-seated crustal-scale fracture

zones filled by intrusive bodies. This structural regime has strong

similarities to that encountered at the Alpala Project, some 30km

to the northwest.

Figure 6 : Plan view of Varela target, showing SolGold's Varela

Camp, the mapped lithocap area (yellow), and Molybdenum-Manganese

(Mo/Mn) geochemical high (magenta outline). Rock Mo/Mn results,

north and west of the current data limit are coloured-coded in the

legend (top right). Rock geochemistry samples with assay results

pending lie east and south of the current data limit. The overall

size of the Varela Mo/Mn anomaly is approximately 1200m x 800m. The

Mo/Mn anomalies are open to the east and south of the current data

limit. Drill sites for the initial four holes planned as part of

the Phase#1 5000m drilling program are shown in black.

Figure 7 : Same-scale comparison between Varela and Alpala

Lithocap footprints and geochemical signatures, showing mapped

lithocap areas (yellow), and Mo/Mn geochemical highs (magenta

outlines). The rock Mo/Mn anomalies at Varela remain open to the

south and east. Rock saw results of 99m @ 0.34% CuEq and 25m @

0.26% CuEq at Varela are planned for drill testing in the Phase 1

drill program.

Figure 8 : Element distribution in global porphyry systems

showing the porphyry plume vertical geochemical dispersion model in

porphyry Cu-Au-Mo systems (after Cohen 2011 and Halley et al.,

2015). In this model Mo/Mn and Cu/Zn increase towards the porphyry

centre. Many global porphyry systems, including Alpala, show a

telescoping of metal zoning and Cu-Mo-Au mineralisation, such that

the ore zones lie closer to the paleosurface than indicated in this

schematic section.

Figure 9 : Looking north from the southern end of the lower

Varela lithocap area, towards the Varela rock-saw outcrop location

in the deeply incised Varela Creek below. Intense acid alteration

within the highly leached lithocap is evident in the natural

scarring of this land-slip area. The photograph field of view is

approximately 250m wide.

Figure 10 : Example of gold bearing hydrothermal breccia

containing clay altered lithocap fragments. This sample returned

assay result of 1.0g/t Au.

Figure 11 : Strongly altered rocks from upper Varela lithocap,

containing B-type porphyry veins and visible trace chalcopyrite and

molybdenite mineralisation. Assay results pending.

Market Abuse Regulation (MAR) Disclosure

Certain information contained in this announcement would have

been deemed inside information for the purposes of Article 7 of the

Regulation (EU) No 596/2014 until the release of this

announcement.

Qualified Person:

Information in this report relating to the exploration results

is based on data reviewed by Mr Jason Ward ((CP) B.Sc. Geol.), the

Chief Geologist of the Company. Mr Ward is a Fellow of the

Australasian Institute of Mining and Metallurgy, holds the

designation FAusIMM (CP), and has in excess of 20 years' experience

in mineral exploration and is a Qualified Person for the purposes

of the relevant LSE and TSX Rules. Mr Ward consents to the

inclusion of the information in the form and context in which it

appears.

By order of the Board

Karl Schlobohm

Company Secretary

CONTACTS

Nicholas Mather Tel: +61 (0) 7 3303 0665

SolGold Plc (Chief Executive Officer)

nmather@solgold.com.au

Karl Schlobohm

SolGold Plc (Company Secretary) Tel: +61 (0) 7 3303 0661

kschlobohm@solgold.com.au

Ingo Hofmaier

SolGold Plc (GM - Project & Corporate Tel: +44 (0) 20 3823 2131

Finance) ihofmaier@solgold.com.au

Gordon Poole / Nick Hennis

Camarco (Financial PR / IR) Tel: +44 (0) 20 3757 4997

solgold@camarco.co.uk

Andrew Chubb Tel: +44 (0) 20 7907 8500

Hannam & Partners (Joint Broker and Financial

Advisor)

solgold@hannam.partners

Ross Allister / David McKeown Tel: +44 (0)20 7418 8900

Peel Hunt (Joint Broker and Financial

Advisor)

solgold@peelhunt.com

James Kofman / Darren Wallace Tel: +1 416 943 6411

Cormark Securities Inc. (Financial Advisor)

dwallace@cormark.com

Clayton Bush / Scott Mathieson Tel: +44 (0) 20 3100 2184

Liberum (Joint Broker and Financial Advisor)

Clayton.Bush@liberum.com

Follow us on twitter @SolGold_plc

ABOUT SOLGOLD

SolGold is a leading resources company focussed on the

discovery, definition and development of world-class copper and

gold deposits. In 2018, SolGold's management team was recognised by

the "Mines and Money" Forum as an example of excellence in the

industry and continues to strive to deliver objectives efficiently

and in the interests of shareholders. SolGold is the largest and

most active concession holder in Ecuador and is aggressively

exploring the length and breadth of this highly prospective and

gold-rich section of the Andean Copper Belt.

The Company operates with transparency and in accordance with

international best practices. SolGold is committed to delivering

value to its shareholders, while simultaneously providing economic

and social benefits to impacted communities, fostering a healthy

and safe workplace and minimizing the environmental impact.

Dedicated stakeholders

SolGold employs a staff of over 600 employees of whom 98% are

Ecuadorean. This is expected to grow as the operations expand at

Alpala, and in Ecuador generally. SolGold focusses its operations

to be safe, reliable and environmentally responsible and maintains

close relationships with its local communities. SolGold has engaged

an increasingly skilled, refined and experienced team of

geoscientists using state of the art geophysical and geochemical

modelling applied to an extensive database to enable the delivery

of ore grade intersections from nearly every drill hole at Alpala.

SolGold has over 80 geologists on the ground in Ecuador exploring

for economic copper and gold deposits.

About Cascabel and Alpala

The Alpala deposit is the main target in the Cascabel

concession, located on the northern section of the heavily endowed

Andean Copper Belt, the entirety of which is renowned as the base

for nearly half of the world's copper production. The project area

hosts mineralisation of Eocene age, the same age as numerous Tier 1

deposits along the Andean Copper Belt in Chile and Peru to the

south. The project base is located at Rocafuerte within the

Cascabel concession in northern Ecuador, an approximately

three-hour drive on sealed highway north of the capital Quito,

close to water, power supply and Pacific ports.

Having fulfilled its earn-in requirements, SolGold is a

registered shareholder with an unencumbered legal and beneficial

85% interest in ENSA (Exploraciones Novomining S.A.) which holds

100% of the Cascabel concession covering approximately 50km(2) .

The junior equity owner in ENSA is required to repay 15% of costs

since SolGold's earn in was completed, from 90% of its share of

distribution of earnings or dividends from ENSA or the Cascabel

concession. It is also required to contribute to development or be

diluted, and if its interest falls below 10%, it shall reduce to a

0.5% NSR royalty which SolGold may acquire for US$3.5million.

Advancing Alpala towards development

The resource at the Alpala deposit contains a high-grade core

which will be targeted to facilitate early cashflows and an

accelerated payback of initial capital. SolGold is currently

progressing its Pre-Feasibility Study and is fully funded through

to development decision following the Net Smelter Royalty Financing

with Franco-Nevada Corporation for US$100million. Franco-Nevada

will receive a perpetual 1% NSR interest from the Cascabel licence

area.

SolGold is currently assessing financing options available to

the Company for the development of the Alpala mine following

completion of the Definitive Feasibility Study.

SolGold's Regional Exploration Drive

SolGold is using its successful and cost-efficient blueprint

established at Alpala, and Cascabel generally, to explore for

additional world class copper and gold projects across Ecuador.

SolGold is the largest and most active concessionaire in

Ecuador.

The Company wholly owns four other subsidiaries active

throughout the country that are now focussed on thirteen high

priority gold and copper resource targets, several of which the

Company believes have the potential, subject to resource definition

and feasibility, to be developed in close succession or even on a

more accelerated basis compared to Alpala.

SolGold is listed on the London Stock Exchange and Toronto Stock

Exchange (LSE/TSX: SOLG). The Company has on issue a total of

2,072,213,495 fully-paid ordinary shares and 113,175,000 share

options.

Quality Assurance / Quality Control on Sample Collection,

Security and Assaying

SolGold operates according to its rigorous Quality Assurance and

Quality Control (QA/QC) protocol, which is consistent with industry

best practices.

Primary sample collection involves secure transport from

SolGold's concessions in Ecuador, to the ALS certified sample

preparation facility in Quito, Ecuador. Samples are then air

freighted from Quito to the ALS certified laboratory in Lima, Peru

where the assaying of drill core, channel samples, rock chips and

soil samples is undertaken. SolGold utilises ALS certified

laboratories in Canada and Australia for the analysis of

metallurgical samples.

Samples are prepared and analysed using 100g 4-Acid digest ICP

with MS finish for 48 elements on a 0.25g aliquot (ME-MS61).

Laboratory performance is routinely monitored using umpire assays,

check batches and inter-laboratory comparisons between ALS

certified laboratory in Lima and the ACME certified laboratory in

Cuenca, Ecuador.

In order to monitor the ongoing quality of its analytical

database, SolGold's QA/QC protocol encompasses standard sampling

methodologies, including the insertion of certified powder blanks,

coarse chip blanks, standards, pulp duplicates and field

duplicates. The blanks and standards are Certified Reference

Materials supplied by Ore Research and Exploration, Australia.

SolGold's QA/QC protocol also monitors the ongoing quality of

its analytical database. The Company's protocol involves

Independent data validation of the digital analytical database

including search for sample overlaps, duplicate or absent samples

as well as anomalous assay and survey results. These are routinely

performed ahead of Mineral Resource Estimates and Feasibility

Studies. No material QA/QC issues have been identified with respect

to sample collection, security and assaying.

Reviews of the sample preparation, chain of custody, data

security procedures and assaying methods used by SolGold confirm

that they are consistent with industry best practices and all

results stated in this announcement have passed SolGold's QA/QC

protocol.

The data aggregation method for calculating Copper Equivalent

(CuEq) for rock-saw channel sampling intervals are reported using

copper equivalent (CuEq) cut-off grades with up to 10m internal

dilution, excluding bridging to a single sample and with minimum

intersection length of 50m.

Copper Equivalent is currently calculated (assuming 100%

recovery of copper and gold) using a Gold Conversion Factor of

0.751 (CuEq = Cu + Au x 0.751), calculated from a current nominal

copper price of US$3.30/lb and a gold price of US$1700/oz.

See www.solgold.com.au for more information. Follow us on

twitter @SolGold plc

CAUTIONARY NOTICE

News releases, presentations and public commentary made by

SolGold plc (the "Company") and its Officers may contain certain

statements and expressions of belief, expectation or opinion which

are forward looking statements, and which relate, inter alia, to

interpretations of exploration results to date and the Company's

proposed strategy, plans and objectives or to the expectations or

intentions of the Company's Directors. Such forward-looking and

interpretative statements involve known and unknown risks,

uncertainties and other important factors beyond the control of the

Company that could cause the actual performance or achievements of

the Company to be materially different from such interpretations

and forward-looking statements.

Accordingly, the reader should not rely on any interpretations

or forward-looking statements; and save as required by the exchange

rules of the TSX and LSE or by applicable laws, the Company does

not accept any obligation to disseminate any updates or revisions

to such interpretations or forward-looking statements. The Company

may reinterpret results to date as the status of its assets and

projects changes with time expenditure, metals prices and other

affecting circumstances.

This release may contain "forward--looking information" within

the meaning of applicable Canadian securities legislation.

Forward--looking information includes, but is not limited to,

statements regarding the Company's plans for developing its

properties. Generally, forward--looking information can be

identified by the use of forward-looking terminology such as

"plans", "expects" or "does not expect", "is expected", "budget",

"scheduled", "estimates", "forecasts", "intends", "anticipates" or

"does not anticipate", or "believes", or variations of such words

and phrases or state that certain actions, events or results "may",

"could", "would", "might" or "will be taken", "occur" or "be

achieved".

Forward--looking information is subject to known and unknown

risks, uncertainties and other factors that may cause the actual

results, level of activity, performance or achievements of the

Company to be materially different from those expressed or implied

by such forward--looking information, including but not limited to:

transaction risks; general business, economic, competitive,

political and social uncertainties; future prices of mineral

prices; accidents, labour disputes and shortages and other risks of

the mining industry. Although the Company has attempted to identify

important factors that could cause actual results to differ

materially from those contained in forward-looking information,

there may be other factors that cause results not to be as

anticipated, estimated or intended. There can be no assurance that

such information will prove to be accurate, as actual results and

future events could differ materially from those anticipated in

such statements. Factors that could cause actual results to differ

materially from such forward-looking information include, but are

not limited to, risks relating to the ability of exploration

activities (including assay results) to accurately predict

mineralization; errors in management's geological modelling;

capital and operating costs varying significantly from estimates;

the preliminary nature of visual assessments; delays in obtaining

or failures to obtain required governmental, environmental or other

required approvals; uncertainties relating to the availability and

costs of financing needed in the future; changes in equity markets;

inflation; the global economic climate; fluctuations in commodity

prices; the ability of the Company to complete further exploration

activities, including drilling; delays in the development of

projects; environmental risks; community and non-governmental

actions; other risks involved in the mineral exploration and

development industry; the ability of the Company to retain its key

management employees and skilled and experienced personnel; and

those risks set out in the Company's public documents filed on

SEDAR at www.sedar.com.

Accordingly, readers should not place undue reliance on

forward--looking information. The Company does not undertake to

update any forward-looking information, except in accordance with

applicable securities laws.

The Company and its officers do not endorse, or reject or

otherwise comment on the conclusions, interpretations or views

expressed in press articles or third-party analysis, and where

possible aims to circulate all available material on its

website.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DRLFIFVEITLTIII

(END) Dow Jones Newswires

October 08, 2020 02:00 ET (06:00 GMT)

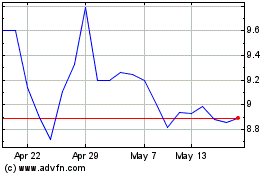

Solgold (LSE:SOLG)

Historical Stock Chart

From Oct 2024 to Nov 2024

Solgold (LSE:SOLG)

Historical Stock Chart

From Nov 2023 to Nov 2024