Interim Management Statement

October 20 2008 - 2:00AM

UK Regulatory

RNS Number : 1592G

Senior PLC

20 October 2008

Senior plc

Interim Management Statement for the three months ended 30 September 2008

Senior plc ("Senior" or "the Group"), an international manufacturer of high technology components and systems, principally for the

aerospace, defence, road vehicle and energy markets, issues this interim management statement for the three-month period ended 30 September

2008 (the "third quarter").

Trading

Overall, trading for the three month period to 30 September has been good with the Group's adjusted profit before tax, and free cash

flow, slightly ahead of the Board's expectations.

Markets

The wide-bodied commercial aircraft market (40% of Aerospace divisional sales) has remained strong with Boeing and Airbus' combined net

order intake totalling 404 aircraft for the third quarter. This was more than twice the level of deliveries (188 aircraft) and, as a

consequence, their combined order book increased to 7,535 aircraft at the end of September 2008 (6,848 aircraft at the end of December

2007). This represents an order book of over seven and a half years at current build rates. The Boeing 787, for which there are around 900

orders and where Senior has over �400k in sales value per aircraft, recently passed its high pressure burst test, one of three key

land-based tests required ahead of its first flight. The first 787 customer delivery is now anticipated to occur towards the end of 2009.

As anticipated, Boeing's machinists went on strike at the beginning of September. They remain on strike today. The Board does not expect

there to be any adverse impact on the Group's expected performance in 2008 if a return to work is agreed before early November.

Elsewhere, the business jet market has remained very healthy, with increasing build rates and strong order intake being reported.

Volumes in the regional jet market have been steady. Senior's military and defence sales volumes have been slightly ahead of last year,

partly as a result of improved USA Government spares activity.

The global oil and gas, power generation and chemical processing markets remained very strong throughout the third quarter, with a

healthy level of emergency repair work being serviced. This, together with declining stainless steel prices, more than offset the effect of

much weaker passenger vehicle markets in North America and Europe and, as a result, the Flexonics Division reported a further strong

financial performance for the third quarter. Although the heavy truck markets remain weak, this is a relatively new market for Senior and

the Group's diesel-engine and truck exhaust products both saw increasing volumes during the quarter. Sales into the solar renewable energy

market also increased, and a number of new opportunities are being pursued.

Funding Position

As announced on 9 October, the Group has issued $120m of new loan notes through a private placement offer. The new loan notes mature

between 2015 and 2020 and carry a weighted average fixed coupon rate of 6.77% per annum. The new funds are being used to repay $75m of loan

notes (coupon of 6.52% per annum), which mature on 22 October 2008, and to reduce the level of borrowings under the Group's existing �80m

revolving credit facility. Following these transactions, the Group will have committed facilities of around �200m, with a weighted average

maturity of 6.4 years. Given the ongoing uncertainty in the financial markets, it is very pleasing to report that the new long term facility

secures the Group's funding requirements for the foreseeable future.

The Group was strongly cash generative over the quarter, although reported net debt increased to �129.6m at the end of September (30

June 2008: �121.7m) because of the strengthening of the US$. The majority of the Group's borrowings (and facilities) are denominated in US$

which strengthened from $1.99:�1 at the end of June to $1.84:�1 at the end of September.

Outlook

Boeing and Airbus, and many business jet manufacturers, have record order books and, as a result, their future output is expected to be

strong. Regional jet volumes are steady, whilst Senior's sales into the military and defence markets are improving as production rates

increase on key programmes such as the C130 military transporter. In the medium term, new programmes, such as the Boeing 787, Bombardier "C"

Series, Airbus 400M and Lockheed Martin's Joint Strike Fighter, will provide additional growth as production commences and build rates

increase.

In the Flexonics Division, Senior's main industrial markets (oil and gas, power generation and chemical processing) remain healthy with

the Group's main beneficiary, Senior Flexonics Pathway, having a strong order book for 2009. The market move to smaller more fuel-efficient

vehicles should help offset some of the ongoing weakness in the passenger vehicle market, whilst the Group's sales into the heavy truck

market are anticipated to increase next year as tighter emission requirements create greater demand for the Group's products.

The majority of Senior's end markets remain healthy, with the global financial crisis not having had a material impact on the Group.

However, the future strength of the world economy is uncertain and the Board remains vigilant and prepared to take the required action

should this prove necessary. Many of the Group's components and systems are targeted at more cost effective aircraft, developing energy

markets and fuel efficient road vehicles. This, together with the Group's strong cash generative nature and long term funding position,

leave Senior well placed to deal with future challenges. The Board remains confident in the future prospects for the Group.

Further information

Mark Rollins, Group Chief Executive, Senior plc +44 (0) 1923 714 738

Simon Nicholls, Group Finance Director, Senior plc +44 (0) 1923 714 722

Clare Strange, Finsbury Group +44 (0) 20 7251 3801

About Senior

Senior is an international manufacturing group with operations in 11 countries. It is listed on the main market of the London Stock

Exchange (symbol SNR). Senior designs, manufactures and markets high technology components and systems for the principal original equipment

producers in the worldwide aerospace, defence, road vehicle and energy markets. It employs over 5,900 people worldwide. Further information

on Senior plc, may be found at: www.seniorplc.com

Cautionary Statement

This announcement contains certain forward-looking statements. Such statements are made by the Directors in good faith based on the

information available to them at the time of the announcement and they should be treated with caution due to the inherent uncertainties

underlying any such forward-looking information.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IMSGUGWUUUPRGQM

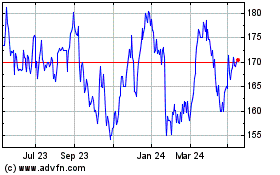

Senior (LSE:SNR)

Historical Stock Chart

From Jun 2024 to Jul 2024

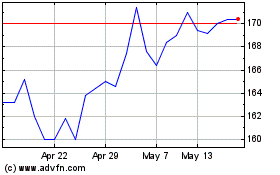

Senior (LSE:SNR)

Historical Stock Chart

From Jul 2023 to Jul 2024