TIDMSND

RNS Number : 3410Z

Sondrel (Holdings) plc

15 May 2023

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the UK Market Abuse Regulation

15 May 2023

Sondrel (Holdings) plc

("Sondrel", the "Company" and together with its subsidiaries the

"Group")

Key Milestone Update and Notice of Results

Update on material contract with Tier 1 automotive customer

Sondrel (AIM: SND), the fabless semiconductor business providing

turnkey services in the design and delivery of 'application

specific integrated circuits' ("ASICs") and 'system on chips'

("SoCs") for leading global technology brands, provides a further

update on its Tier 1 automotive customer contract and notice of its

final results for the year ended 31 December 2022 ("FY22").

Further to the announcement on 15 February 2023, significant

progress and investment has continued in respect of the material

turnkey ASIC engagement for a Tier 1 OEM Automotive customer and

remains on schedule for the release to silicon manufacture later

this year. Following mutual agreement of the reorganisation of

certain project workstreams in order to prioritise and enable

enhanced performance in the design, along with ensuring the optimal

time to tapeout (and ultimately production), in line with industry

practice, key milestones have been redefined and the payment

receipt connected to the second project milestone, previously

anticipated to occur in Q1 2023, is now expected to occur in the

next few months.

As stated at the time of the Company's IPO, Sondrel expects

typical production volumes for each contract to deliver revenue of

GBP10m to GBP100m per annum and the contract with the Tier 1 OEM

Automotive customer could deliver production revenue at the upper

end of this range.

The Group also continues to deliver other live ASIC projects in

line with its expectations, as demonstrated by the January 2023

design tapeout for a leading provider of Edge AI Hardware

Accelerator solutions and the March 2023 tapeout of an ASIC design

for a leading provider of home network devices, both of which were

fully funded by the customer.

Based on production volumes and lifetime currently projected by

the customers, revenues for Sondrel associated with the production

and supply of these two projects would be worth in excess of US$20

million to the Company over three years and US$25 million over five

years, respectively.

Notice of Results

The Company will announce its full year results for the year

ended 31 December 2022 ("FY22") on Wednesday, 24 May 2023 when, as

announced by the Company on 15 February 2023, the Company expects

to report FY22 revenues of GBP17.5 million, reflecting 116% year on

year growth (FY21: GBP8.5 million). In addition, the Company

announces that, excluding both the non-cash impact of a GBP1.1m

write off of a capitalised asset and now confirmed treatment of

FY22 amortisation charges, the Company expects to report Adjusted

EBITDA* in line with market expectations** (FY22 Adjusted EBITDA

loss of GBP1.1m including the effects of these two accounting

provisions).

There will be an in-person presentation for analysts at 9:30

a.m. (BST) on the day of the announcement, hosted by Graham Curren

(CEO) and Joe Lopez (CFO), at Buchanan's offices at 107, Cheapside,

London EC2V 6DN.

Please contact Buchanan for further details.

*Adjusted EBITDA is defined as earnings before interest, tax,

depreciation, amortisation and IPO costs.

**Current market expectations of FY22 Adjusted EBITDA as at the

date of this announcement of GBP1.0 million.

Graham Curren, Chief Executive Officer of Sondrel,

commented:

"We continue to work closely with our Tier 1 automotive customer

as we progress towards the next project milestone. This project,

together with the other tapeouts we have announced in recent

months, provides the Group with significant momentum and

considerable traction in building a solid base of production

revenues in the years ahead."

"Our focus on end markets that are aligned with strong and

enduring global technology megatrends means that we have a good

pipeline of design opportunities for 2023 and I look forward to

updating the market on these as the year progresses."

Sondrel (Holdings) plc Via Buchanan

Graham Curren, CEO Tel: +44 (0) 20 7466

5000

Joe Lopez, CFO

Cenkos Securities plc Tel: +44 (0)20 7397

8900

Ben Jeynes / Katy Birkin / George Lawson

- Corporate Finance

Alex Pollen / Michael Johnson - Sales

Buchanan Communications Tel: +44 (0) 20 7466

5000

Chris Lane sondrel@buchanan.uk.com

Stephanie Whitmore

Jack Devoy

Abby Gilchrist

About Sondrel

Sondrel is a UK-based fabless semiconductor company specialising

in high end, complex digital Application Specific Integrated

Circuits (ASICs) and System on Chips (SOCs). It provides a full

turnkey service in the design, prototyping, testing, packaging and

production of ASICs and SoCs.

The Company is one of only a few companies capable of designing

and supplying the higher-spec chips built on the most advanced

semiconductor technologies, selling into a range of hyper growth

end markets such as high-performance computing, automotive,

artificial intelligence, VR/AR, video analytics, image processing,

mobile networking and data centres. Sondrel designs have enabled

products by leading technology brands including Apple (iPhone),

Sony (PlayStation), Meta's (Oculus), Samsung, Google and Sony

smartphones, JVC (prosumer camcorders), Tesla and Mercedes-Benz

cars.

Sondrel is well-established, with a 20-year track record of

successful delivery, supported by long standing ecosystem

partnerships including Arm, TSMC and Samsung. Headquartered in the

UK, Sondrel has a global presence with offices in UK, USA, China,

India and Morocco.

For more information please visit: www.ir.sondrel.com .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCAIMBTMTBBTRJ

(END) Dow Jones Newswires

May 15, 2023 02:00 ET (06:00 GMT)

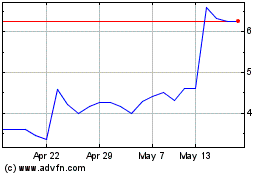

Sondrel (holdings) (LSE:SND)

Historical Stock Chart

From Jun 2024 to Jul 2024

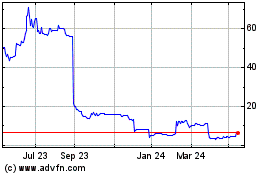

Sondrel (holdings) (LSE:SND)

Historical Stock Chart

From Jul 2023 to Jul 2024