Regional REIT Limited Dividend Declaration (2586E)

February 27 2020 - 2:00AM

UK Regulatory

TIDMRGL

RNS Number : 2586E

Regional REIT Limited

27 February 2020

27 February 2020

REGIONAL REIT Limited

("Regional REIT", the "Group" or the "Company")

Q4 2019 Dividend Declaration: +2.5% FY 2019

Regional REIT (LSE: RGL), the regional real estate investment

specialist focused on building a diverse portfolio of income

producing regional UK core and core plus office and industrial

property assets, today announces its Q4 2019 dividend, making a

2.5% increase for the 2019 full year dividend distributions to

shareholders.

The Company will pay a dividend of 2.55 pence per share ("pps")

for the period 1 October 2019 to 31 December 2019. The dividend

payment will be made on 9 April 2020 to shareholders on the

register as at 6 March 2020. The ex-dividend date will be 5 March

2020. The entire dividend will be paid as a REIT property income

distribution ("PID").

This fourth quarter dividend marks the Company's successful

achievement of its annual distribution target, having paid a

dividend of 1.90pps for each of the first three quarters of

2019.

In respect of the financial year 2019, Regional REIT has

declared dividends amounting to 8.25pps. This increase of 2.5% from

the 2018 full year dividend of 8.05pps has been made in accordance

with the Company's intention to pursue a progressive dividend

policy.

Stephen Inglis, CEO of London and Scottish Property Investment

Management, the Asset Manager, commented:

"We are delighted to announce our fourth quarter 2019 dividend

of 2.55pps, which is in-line with our full year 2019 target of

8.25pps.

Our 2019 preliminary results will be announced on the 26th March

2020, and we expect both EPRA earnings per share and EPRA net asset

value per share to be in line with market expectations.

As previously announced, we are considering an equity fundraise

to take advantage of the near term pipeline of accretive growth

opportunities in the investment market, and we look forward to

updating our shareholders in due course."

- ENDS -

Enquiries:

Regional REIT Limited

Toscafund Asset Management Tel: +44 (0) 20 7845

6100

Investment Manager to the Group

Adam Dickinson, Investor Relations, Regional

REIT Limited

London & Scottish Property Investment Management Tel: +44 (0) 141

248 4155

Asset Manager to the Group

Stephen Inglis

Buchanan Communications Tel: +44 (0) 20 7466

5000

Financial PR regional@buchanan.uk.com

Charles Ryland / Victoria Hayns / Henry

Wilson

About Regional REIT

Regional REIT Limited ("Regional REIT" or the "Company") and its

subsidiaries (the "Group") is a United Kingdom ("UK") based real

estate investment trust that launched in November 2015. It is

managed by London & Scottish Property Investment Management

Limited, the Asset Manager, and Toscafund Asset Management LLP, the

Investment Manager.

Regional REIT's commercial property portfolio is comprised

wholly of income producing UK assets and comprises, predominantly,

offices and industrial units located in the regional centres

outside of the M25 motorway. The portfolio is highly diversified,

with 160 properties, 904 tenants as at 31 December 2019, with a

valuation of GBP787.9m.

Regional REIT pursues its investment objective by investing in,

actively managing and disposing of regional core and core plus

property assets. It aims to deliver an attractive total return to

its Shareholders, targeting greater than 10% per annum, with a

strong focus on income supported by additional capital growth

prospects.

The Company's shares were admitted to the Official List of the

UK's Financial Conduct Authority and to trading on the London Stock

Exchange on 6 November 2015. For more information, please visit the

Group's website at www.regionalreit.com .

Cautionary Statement

This document has been prepared solely to provide additional

information to Shareholders to assess the Group's performance in

relation to its operations and growth potential. The document

should not be relied upon by any other party or for any other

reason. Any forward looking statements made in this document are

done so by the Directors in good faith based on the information

available to them up to the time of their approval of this

document. However, such statements should be treated with caution

due to the inherent uncertainties, including both economic and

business risk factors, underlying any such forward-looking

information.

ESMA Legal Entity Identifier ("LEI"): (549300D8G4NKLRIKBX73)

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

DIVMZGZZNVZGGZM

(END) Dow Jones Newswires

February 27, 2020 02:00 ET (07:00 GMT)

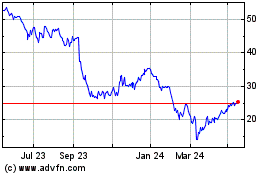

Regional Reit (LSE:RGL)

Historical Stock Chart

From Jun 2024 to Jul 2024

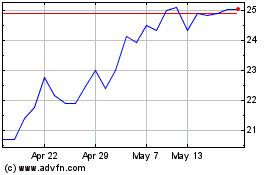

Regional Reit (LSE:RGL)

Historical Stock Chart

From Jul 2023 to Jul 2024