TIDMPOW

RNS Number : 3025D

Power Metal Resources PLC

18 October 2022

18 October 2022

Power Metal Resources plc

("Power Metal" or the "Company")

Quarterly Business Update

Power Metal Resources PLC (LON:POW) the London listed

exploration company seeking large-scale metal discoveries across

its global project portfolio announces the quarterly business

update for shareholders.

Paul Johnson, Chief Executive Officer of Power Metal Resources

plc, commented:

"The Power Metal business is positioned exactly where we want it

to be, which is in readiness for a resurgent commodity and junior

exploration climate. However, we are not merely waiting for more

upbeat conditions to return.

Instead, we are building towards the goal of making major

mineral discoveries alongside corporate value generation which

includes spin-outs and other crystallisation events, that of

themselves may build the value of the Company substantially.

We are actively drilling high priority exploration targets at

Molopo Farms in Botswana where we are targeting a major mineral

discovery or discoveries, with the first hole well underway and

progressing well. We also await impending drill programme assay

results from our Tati gold project in Botswana and sampling assay

results from our uranium work programmes at certain of our

Athabasca Basin focussed projects in Canada.

I appreciate investors are keen for further exploration updates

and we look forward to releasing additional information, which we

will do at the earliest opportunity.

Our work continues and as I have said before and will say again,

my thanks to our amazing team within the business and externally to

our corporate advisers and in-country operational teams for their

unstinting support."

HIGHLIGHTS SINCE OUR LAST QUARTERLY REPORT OF 27 JULY 2022:

-- Diamond drill programme commenced at the Molopo Farms Complex

project ("Molopo Farms") located in Botswana. The 2,600m programme

is underway with the latest update from site prior to preparation

of this report confirming progress of the first hole, DDH1-6B, to a

depth of 450m and drilling is continuing.

-- Geophysical work completed led to the identification of three

Power Metal designated high-priority (A+) geophysical conductors at

Molopo Farms, all of which will be drilled during the ongoing

campaign.

-- Ground exploration including field mapping and sampling

successfully completed across three of our Athabasca Basin focused

uranium properties located in Saskatchewan, Canada. Assay results

are awaited. Additionally, we announced the considerable expansion

of our uranium portfolio to a total of 12 properties, as well as

the conditional disposal of the Reitenbach property.

-- Reverse circulation (RC) drilling completed successfully at

our Tati Gold project located in Botswana, where we are targeting

high-grade near surface gold, with 490m drilled in 9 holes, all of

which intersected targeted quartz reef structures.

-- Listing of First Class Metals PLC, in which Power Metal has a

27.91% interest and that holding is currently valued at

c.GBP2.6m.

-- Golden Metal Resources PLC ("GMT") advanced to readiness for

listing in London, ground exploration successfully completed at two

of GMT's 4 Nevada projects and multiple initiatives underway with

various third parties.

-- First Development Resources PLC ("FDR") has completed a large

proportion of pre-IPO listing workstreams, advanced technical work

across its portfolio and completed a detailed field trip including

field-based Heritage Survey work at the Wallal Project in Western

Australia.

-- New Ballarat Gold Corporation PLC ("NBGC") has advanced its

Victoria Goldfields interests with two former high-grade producing

gold mines now included in the portfolio and where drilling is

planned for later in the year.

-- Various exploration and corporate initiatives underway to

seek advancement of wider portfolio interests including Silver

Peak, Authier North, Haneti and Wilan projects.

-- New non-executive director, Owain Morton, appointed 10

October 2022, bringing geological and mine engineering expertise to

the Power Metal board.

-- GBP1.08m financing undertaken in early September with current

cash and listed investments of GBP4.4m as at the date of this

report.

GUIDANCE FOR READERS

The tables below include the latest position of each project and

our near-term plans, with projects grouped in the categories of

Priority Exploration, Project Disposal or IPO Process Underway, and

Projects with Next Steps Under Consideration. Below the project

tables additional information is provided covering New

Opportunities and updates regarding

Management/Financial/Compliance.

For additional information please review Power Metal's corporate

website and presentation which are regularly updated and are

available through the following links:

Website: www.powermetalresources.com

Corporate Presentation:

https://www.powermetalresources.com/presentation/

PRIORITY EXPLORATION PROJECTS

Project Latest Position & Forward Plans

Athabasca Uranium

Saskatchewan, Canada Power Metal currently holds 12 properties

(Uranium) covering 829.58km(2) within and surrounding

POW 100% the prolific Athabasca Basin, including

a number of new property acquisitions and

additional staked ground, secured in the

last quarter.

Detailed data compilation has been completed

and external datarooms opened for third

parties in respect of the Athabasca properties.

The conditional disposal of one property,

Reitenbach, was announced in August 2022,

and work is in process to complete that

transaction through a listing on the London

capital markets for the proposed holding

vehicle, Teathers Financial PLC, to be renamed

Uranium Energy Exploration PLC.

A detailed update was announced in September

2022 covering a recently completed exploration

programme covering Tait Hill, Thibault Lake

and Clearwater and the launch of hyperspectral

remote sensing review work at Cook Lake

and E-12 properties. The update also included

the expansion of the Tait Hill property

and the staking of a new property Badger

Lake, which followed on from the newly staked

strategic Durrant Lake property, announced

earlier in September.

Assay results from samples collected during

recent ground exploration are awaited and

extensive exploration work will continue

across the Company's Athabasca portfolio,

where we believe we will see a direct line

between investment and a material increase

in the valuation of properties.

---------------------------------------------------------------------------------------

Molopo Farms Complex Power Metal secured a conditional agreement

Project to acquire an additional 58.7% of shares

Botswana in project partner Kalahari Key Mineral

(Nickel - Copper Exploration Pty Limited ("KKME") as announced

- Platinum Group on 18 May 2022:

Element) https://www.londonstockexchange.com/news-article/POW/kalahari-key-botswana-acquisition

POW: Effective Economic /15458701

Interest is currently This acquisition, conditional on receipt

52.6% increasing of in country regulatory approval, will

to 87.71% subject see Power Metal holding 87.71% of KKME which

to completion of will hold 100% of the Molopo Farms Complex

the KKME shares Project ("Molopo Farms"). At Molopo Farms,

acquisition & restructuring Power Metal is targeting large-scale nickel-copper-PGE

announced 18.5.22. mineralisation.

KKME and Power Metal, working with advisers

in Botswana, have prepared and submitted

relevant documentation to the local authorities

with regard to the approvals required to

complete the aforementioned transaction.

In early August 2022, Power Metal announced

the commencement of two moving loop electromagnetic

("MLEM") surveys over two target areas related

to the previous 2020/2021 drill programme

drillholes K1-6 and K1-14.

Later in August, the Company announced that

the geophysical survey work had identified

a large shallow dipping geophysical conductor,

which drillhole K1-6 had intersected at

its edge at a similar stratigraphic level

to nickel-sulphide mineralisation identified

from core review and assays from drillhole

K1-6.

Following receipt of the survey results,

accelerated plans were announced for follow

up diamond drilling, the first drill programme

operated and managed by Power Metal. The

drill rig was mobilised 8 September 2022,

with drilling commencing on 21 September

at the first drillhole DDH1-6B targeting

the core of the T1-6 conductor.

The latest update from site prior to preparation

of this report saw the DDH1-6B drill progress

at a depth of 450m. Drilling is continuing

and this hole currently has an expected

total depth of 600m.

The Company's Exploration Manager, Oliver

Friesen, together with Roger Key (original

founder of KKME), have attended site to

meet with the local operational team and

review operations, and further members of

the Power Metal team are expected to attend

site during the coming weeks.

Overall, the drill programme will include

5 or 6 holes for a total of 2,600m of diamond

drilling, and will include two drillholes

into target T1-6, located approximately

530m and 830m south of original hole K1-6,

both designed to intersect the core of the

geophysical conductor target.

Follow up geophysical work, including further

analysis of historical airborne electromagnetic

survey data enabled the estimation of the

T1-6 conductor dimensions to have a strike

length of 2,600m and a down dip extent of

1,000m.

Further MLEM surveys were completed over

targets T1-14, T2-3 and T1-3.

Target T2-3 was shown to host a large geophysical

conductor open in all directions which was

coincident with a magnetic body identified

by a historical airborne magnetic survey.

These historical results showed that the

magnetic body coincident with the newly

identified geophysical conductor was shown

to extend for approximately 12km in an east-west

direction.

Targets T1-6 and T2-3 have been designated

high-priority A+ status, along with T1-3

where a further large geophysical conductor

has been identified. All three high-priority

Company designated A+ targets are expected

to be drilled as part of the ongoing drill

programme.

A further Company designated priority B

target has been established at T1-14 and

five further airborne EM targets (T1-2,

1-4, 1-5, 1-10 & 1-11) have been upgraded

and are now designated as priority airborne

conductors where follow up work is being

considered.

Power Metal raised GBP1.08m in September

2022 to provide additional capital in support

of the Molopo Farms Complex drill programme

and a potential expansion of operations,

as required.

---------------------------------------------------------------------------------------

Tati Project

Botswana In August 2022 Power Metal announced the

(Gold - Nickel) commencement of RC drilling at the Tati

POW: 100% Gold Project, designed to test the along

strike and down dip extension of quartz

reefs associated with the historical Cherished

Hope gold mine.

In early September the Company announced

the completion of 490m of RC drilling over

9 holes and the successful intersection

of quartz reef in all holes drilled, with

multiple holes intersecting multiple sub-parallel

quartz reef structures.

Samples from the drilling have been sent

for assay testing and the results are awaited.

Assay results from sampling of the fines

dumps (waste material from the Cherished

Hope mine) were also announced in early

September confirming levels of residual

gold at a grade that supports potential

processing.

Work is being undertaken to secure local

approvals for processing and with potential

processing partners, enabling potential

revenue generation which can be reinvested

into more extensive exploration at the Tati

Project.

A project site visit has taken place at

the Tati Project, led by the Company's Exploration

Manager Oliver Friesen. A further update

from this site visit and the findings is

expected.

---------------------------------------------------------------------------------------

PROJECT DISPOSALS OR IPO PROCESSES UNDERWAY

Note: other project packages within the Power Metal portfolio

are also in earlier stages of disposal and/or spin-out preparations

in addition to those listed below.

Project Latest Position

Kanye Resources On 8 July 2022 Power Metal announced the

Conditional Disposal conditional disposal of its Kanye Resources

to Kavango Resources interest to its joint-venture partner Kavango

Resources plc (LON:KAV)("Kavango").

The disposal is subject to the publication

of a prospectus by Kavango including provision

for the transaction.

Full terms and disposal consideration payable

to Power Metal may be viewed in the announcement

linked below:

https://www.londonstockexchange.com/news-article/POW/conditional-disposal-of-kanye-resource

s-interests/15532470

On completion of the transaction Power Metal

will receive consideration including shares

& warrants in Kavango and a net smelter

royalty. The shares element comprises 60m

Kavango shares valued at GBP1.14m as at

the date of this report.

Kavango has announced multiple operational

updates recently including the commencement

of drilling at Prospecting Licence PL 082

in the Kalahari Copper Belt in Botswana

(not part of the Kanye Resources joint venture),

targeting a large-scale copper-silver discovery

or discoveries. Drilling under the joint

venture completed earlier in the year has

identified the potential for an iron oxide

copper gold ore ("IOCG") system at the Ditau

project, also in Botswana.

--------------------------------------------------------------------------------------------

First Class Metals FCM secured a listing on the London Stock

PLC (FCM) Exchange in late July 2022 with Power Metal

Schreiber-Hemlo, holding a current interest of 27.91%, worth

Ontario, Canada circa GBP2.6m as at the date of this report.

(Gold - Base Metals) Since listing FCM have announced a massive

POW 27.91% sulphide discovery, high-grade nickel assays

and a new acquisition with an associated

GBP1.08m financing.

Going forward FCM will now be recognised

in the listed investments held by Power

Metal and covered within the Management

- Financial - Compliance section below.

--------------------------------------------------------------------------------------------

Golden Metal Resources GMT produced an operational update in August

PLC (GMT) 2022, confirming the completion of an Induced

Nevada, USA Polarisation ("IP") survey at the Pilot

Gold - Base Metals Mountain Project and completion of a high-resolution

POW 83.13% soil geochemical survey at the Garfield

Project .

Both surveys are expected to deliver an

enhanced understanding of the additional

prospectivity across the two projects and

notably, to highlight new target areas for

future exploration.

Pre-IPO work for GMT is essentially complete,

with some ongoing work to keep the listing

documentation up to date and in a state

of preparedness for listing. GMT is seeking

to list at the earliest opportunity.

GMT continues to work on the development

of relationships in the USA, and elsewhere,

which may potentially lead to grants, direct

project investment, corporate investment

and liaison from potential downstream users

of tungsten, being the primary commodity

from the flagship Pilot Mountain Project.

Since commencement of listing preparations,

in our view, the inherent value of GMT's

interests led by the flagship Pilot Mountain

Project, has increased. Tungsten is a critical

mineral per the United States Geological

Survey, and currently there is increasing

interest in homeland security in the USA

for critical minerals. Global tensions have

further increased the urgency for that critical

mineral security and Pilot Mountain, which

hosts one of the largest known undeveloped

tungsten deposits located within the USA,

could play an important part.

The IPO listing, which could be triggered

at any time going forward, will enable GMT

to move forward at pace with advanced exploration

including planned drilling at Pilot Mountain.

--------------------------------------------------------------------------------------------

First Development FDR published a full company update in late

Resources Ltd (FDR) July 2022 providing the latest corporate

Western Australia and geological developments across its Western

/Northern Territory Australia and Northern Territory interests.

(Gold - Copper - The highlights of which included:

Rare Earth Elements * The appointment of DDH1 Drilling Limited to undertake

- Uranium - Lithium) the Phase I diamond core drilling programme at the

POW: 62.12% Wallal Project in the Paterson to target the eastern

magnetic bullseye anomaly identified during the

in-depth desktop review. The Heritage Clearance

Survey required to facilitate the drilling works was

undertaken in September 2022.

* The finalisation of the desktop review of Braeside

West and Ripon Hills projects in the Eastern Pilbara.

The review identified multiple mineral targets in

both the project areas which are similar to the gold

and base-metal mineral deposits and occurrences

located within the Rumble Resources Ltd, Braeside

Project situated to the east.

* Reconnaissance at the Selta Project in the Northern

Territory confirmed the presence of pegmatites.

Litho-geochemical analysis of samples recovered

suggests the area is dominated by a zoned pegmatite

system originating from nearby granites and supports

the lithium and rare-earth element prospectivity of

the region.

A follow up field visit was conducted in

August/September 2022, which included all

projects held by FDR.

Extensive exploration targets have been

identified across all FDR properties with

further work ongoing to refine post listing

exploration plans across the entire portfolio.

Pre-IPO work streams continue, with a significant

proportion of work now undertaken.

--------------------------------------------------------------------------------------------

New Ballarat Gold Through its Australian operating subsidiary,

Corporation PLC Red Rock Australasia Pty Ltd, NBGC has a

(NBCG) substantial licence footprint within the

Victoria, Australia Victoria Goldfields, Australia, which is

(Gold) comprised of 15 granted exploration licences

POW: 49.9% 50.1% covering 1,835km(2) and 5 licence applications

JV Partner Red Rock covering 493km(2) .

Resources PLC LON:RRR) The portfolio of interests includes the

substantial licence footprint above, and

within it, two former high-grade working

mines (Ajax and Berringa) where our technical

team believe a considerable, and potentially

high-grade, gold endowment remains.

In August we published the exploration target

for Berringa, with a median target range

of 246,812 ounces of gold and an upper target

of 853,037 ounces. This followed on from

the announcement of the conditional acquisition

of Berringa in July 2022, when we published

a risk weighted exploration target of 697,000

ounces of gold.

The completion of the Berringa acquisition

was announced in September 2022, and we

are now working with the local team to finalise

drill plans across both properties with

a view to drilling commencing in 2022. It

is noted the licence containing Berringa

is subject to renewal in November 2022.

In parallel, steps are being taken to move

the IPO preparatory process forward. With

the newly generated dual model of near-term

production potential from former high-grade

producing gold mines and a large blue-sky

exploration footprint, together with appropriate

ownership structures and management team,

we believe NBGC will represent a compelling

investment opportunity.

--------------------------------------------------------------------------------------------

PROJECTS WITH NEXT STEPS UNDER CONSIDERATION

Project Latest Position & Key Forward Events

Alamo Gold Project

Arizona, USA Following the receipt and review of various

(Gold) technical reports for the Alamo Gold Project

POW: Earn-in to in Arizona the Company has decided not to

75% continue with the project in its current

form.

Recent significant positive developments

across the Power Metal business compel us

to focus our time and resources on only

the most prospective and potentially value

generative opportunities.

There are alternative options at the project

and we have confirmed to our partners in-country

that we would be willing to look at alternative

approaches.

-----------------------------------------------------

Authier North

Quebec, Canada In July 2022 Power Metal decided to proceed

(Lithium) into year 2 of the earn-in to a 100% interest

POW earn-in to 100% in Authier North following completion and

review of a Property Evaluation Report by

Canada-based lithium geologist.

Ground exploration plans have been finalised

however the Company has concentrated recently

on the advancement of the Molopo Farms Complex

project in Botswana, the Tati Gold project

in Botswana and the commercial & exploration

based advancement of the Company's Athabasca

uranium interests.

It is expected that the ground exploration

programme will be undertaken in Spring 2023

and in the interim, the Company is considering

the commercial options for the project.

-----------------------------------------------------

Wilan Project The Wilan Project (previous name Gawler

South Australia Project) is held within Power Metal Resources

(Gold, Copper) Australia Pty Limited ("Power Australia"),

POW: 100% Power Metal's wholly owned operating subsidiary

company. The Wilan Project was originally

comprised of two licence applications (submitted

October 2021 and covering 1,994km(2) ).

One licence application (ELA2021/00163),

covering 999km(2) , was formally granted

in August 2022 under the new licence reference

EL6819. Internal technical work by Power

Metal confirmed a potential Iron-Oxide-Copper-Gold

("IOCG") target within the EL6819 licence

footprint which is under further investigation.

In addition, Power Australia has been advised

that the Department of Energy and Mining

("DEM") proposed granting of licence application

ELA2021/00162 (995km(2) ) for a period of

6 years. The initial expenditure commitment

for the licence is AUD$100,000 in total

over 2 years, and Power Metal has paid AUD$23,465

in respect of first year rent and administration

fees to the DEM. The Company now awaits

final regulatory sign-off and release of

granted licence documentation.

Internal technical review by Power Metal

has established potential diamond and uranium

exploration targets within the licence footprint

for ELA2021/00162. These targets are the

subject of ongoing review.

-----------------------------------------------------

Haneti Project

Tanzania Power Metal is currently in discussions

(Polymetallic) with joint venture partner Katoro Gold (LON:KAT)

POW: 35% (65% JV to determine the future of the Haneti Project.

Partner Katoro Gold

plc LON:KAT) The Company remains of the view that Haneti

offers considerable potential, with a commitment

to proactive and methodical exploration.

The exploration programme to be undertaken

needs to recognise the scale of the geological

footprint and associated challenges of identifying

economic deposits under cover, something

Power Metal is increasingly focused on.

-----------------------------------------------------

Silver Peak Project

British Columbia, A planned site visit and evaluation was

Canada undertaken in August 2022. Follow on work

(Silver) is appropriate though as of yet unplanned;

POW: 30% the findings from the visit have confirmed

the significant high grade silver potential

of the project.

Following the Silver Peak site visit the

Company is now in active discussions with

our project partners to create a valuable

commercial outcome, with the goal to finalise

this outcome at the earliest opportunity.

-----------------------------------------------------

NEW OPPORTUNITIES

Project Latest Position

Power Metal Resources The primary acquisition focus for the foreseeable

plc future is on further uranium projects as

has been demonstrated with the recent expansion

of the Company's existing Athabasca Basin

focused uranium portfolio.

Outside uranium, Power Metal will only engage

with exceptional acquisitions which complement

the existing portfolio.

Should the Company's drill programme at

Molopo Farms in Botswana prove successful

and recognising the significance of that

project, there will be an immediate cessation

in the review of any new opportunities.

This would allow the Company to devote more

managerial & technical time as well as financial

resources to that project.

--------------------------------------------------

Power Capital Investments Power Capital Investments ("Power Capital")

Limited has to date reviewed a number of opportunities

Global Resource for the investment in and advancement of

Project Incubator new project opportunities.

(Multi-Commodity) The aim is for Power Capital to be a leading

POW: 100% new project finder, attracting external

capital for its own operations and run by

its own dedicated team under the umbrella

of Power Metal.

--------------------------------------------------

MANAGEMENT - FINANCIAL - COMPLIANCE

Project Latest Position

Board The Board currently comprises:

Scott Richardson Brown - Interim Non-executive

Chairman

Paul Johnson - Chief Executive Officer

Ed Shaw - Non-executive Director

Owain Morton - Non-executive Director

Owain Morton joined the board of Power Metal

on 10 October 2022, bringing geological

and mine engineering expertise onto the

Board.

Power Metal is seeking to add further board

members and has been liaising with various

candidates in this regard. The Company also

remains active reviewing new board members

for spin-out and associated vehicles.

------------------------------------------------------------------------

Management and Power Metal has built a strong operational

Team team which along with the board now comprises

eleven team members based out of our UK

office.

We work extensively overseas and have developed

equally strong operational partnerships

in countries around the world, forming an

efficient and cost effective hub-and-spoke

operational model.

Power Metal is actively seeking to bring

new team members in to support the growth

in business and we continue to invite talented

individuals from all backgrounds who feel

they can contribute to our work to reach

out and contact us through the following

link:

https://www.powermetalresources.com/join-us/

T he Company has received many emails from

potential new team members and retains details

of all to enable a rapid acceleration of

operations where and when required.

Where possible the Company has sought to

incentivise all team members and external

advisers & consultants with exposure to

equity upside. This was further advanced

earlier this month with the creation of

a pool of 25m warrants for external advisers

and consultants ("Adviser Warrants"). The

Adviser Warrants carry an exercise price

of 3.25p, a life to expiry of 3 years and

a condition that the volume weighted average

share price ("VWAP") of the Company must

exceed 5.0p for ten consecutive days prior

to exercise. Adviser Warrants may be accelerated

or cancelled by the Company should the VWAP

exceed 10.0p for five consecutive days.

------------------------------------------------------------------------

Financial Position Cash and Listed Investments

Current cash and listed investments as at

the date of this report amount to GBP4.4m.

Pre-IPO Vehicles

Power Metal has holdings in three current

vehicles undertaking a planned IPO including:

* Golden Metal Resources (Nevada, USA)

* First Development Resources (WA and NT, Australia)

* Uranium Energy Corporation (Saskatchewan, Canada)

Based on the most recent financings undertaken

for each of the above vehicles the total

value Power Metal's holdings in the above

vehicles amounts to GBP6.25m.

In addition, Power Metal is seeking with

JV partners (Red Rock Resources PLC) to

undertake a listing of NBGC, the valuation

of which is not confirmed at the current

time.

The listing of further project packages

may be undertaken which will be incorporated

into the above list as appropriate.

Project Investments & Intercompany Loans

As at 30 September 2022 Power Metal's remaining

assets comprising project investments and

intercompany loans, amounted to GBP4.5m.

Future Financing Sources

The Company has multiple sources of potential

additional financing:

* As an AIM listed vehicle traditional equity financing

can be undertaken to raise additional sums where

considered necessary as demonstrated in September

2022 with the GBP1.08m financing undertaken.

* Through the exercise of financing and transactional

warrants or the exercise of director, team member or

adviser options. A full breakdown of all warrants and

options outstanding is available on the Company's

website through the following link:

https://www.powermetalresources.com/warrants-options-outstanding/

* In addition to the above, the Company will benefit

from the planned listings of the pre-IPO vehicles as

outlined above which will if successful and in line

with expected valuations on listing, add considerably

to overall Power Metal asset value. This was recently

demonstrated with the IPO of FCM which now carries a

value of GBP2.6m for Power Metal's holding.

* It is anticipated that further value generative

events may occur including additional spin-outs into

new listed vehicles and outright disposal of certain

business interests. One item currently in process is

the disposal of the Kanye Resources interest

highlighted above, from which consideration payable

to Power Metal includes 60m Kavango shares currently

valued at GBP1.14m.

------------------------------------------------------------------------

Audit and Compliance The Company's year end is 30 September 2022

and it is expected that the audited financial

accounts for the full year will be published

in February 2023.

Power Metal is now well advanced with preparation

of a new environmental, social and governance

("ESG") initiative which will be launched

by the end of December 2022.

The Company is also updating its Financial

Position and Prospects Procedures ("FPPP")

which is an underlying governance document.

This work will be completed by the end of

December 2022 and this will be included

in the updated year end Corporate Governance

Statement, covered in the audited financial

accounts and on the Company's website in

Q1 2023.

The above ESG and FPPP initiatives are being

managed by Jamie Tosh, Power Metal's Commercial

Operations Manager, and who holds a Diploma

in Corporate Governance from the UK Corporate

Governance Institute.

------------------------------------------------------------------------

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with

the Company's obligations under Article 17 of MAR.

For further information please visit

https://www.powermetalresources.com/ or contact:

Power Metal Resources plc

Paul Johnson (Chief Executive Officer) +44 (0) 7766 465 617

SP Angel Corporate Finance (Nomad and Joint Broker)

Ewan Leggat/Charlie Bouverat +44 (0) 20 3470 0470

SI Capital Limited (Joint Broker)

Nick Emerson +44 (0) 1483 413 500

First Equity Limited (Joint Broker)

David Cockbill/Jason Robertson +44 (0) 20 7330 1883

NOTES TO EDITORS

Power Metal Resources plc - Background

Power Metal Resources plc (LON:POW) is an AIM listed metals

exploration company which finances and manages global resource

projects and is seeking large scale metal discoveries.

The Company has a principal focus on opportunities offering

district scale potential across a global portfolio including

precious, base and strategic metal exploration in North America,

Africa and Australia.

Project interests range from early-stage greenfield exploration

to later-stage prospects currently subject to drill programmes.

Power Metal will develop projects internally or through

strategic joint ventures until a project becomes ready for disposal

through outright sale or separate listing on a recognised stock

exchange thereby crystallising the value generated from our

internal exploration and development work.

Value generated through disposals will be deployed internally to

drive the Company's growth or may be returned to shareholders

through share buy backs, dividends or in-specie distributions of

assets.

Exploration Work Overview

Power Metal has multiple internal exploration programmes

completed or underway, with results awaited. The status for each of

the Company's priority exploration projects is outlined in the

table below.

Project Location Current Work Completed or Results Awaited

POW Underway

%

Athabasca Canada 100% Ground exploration Assay results from

Uranium programme complete samples collected

at 3 properties. Preliminary during fieldwork.

planning for work

in Spring/Summer 2023

is ongoing.

--------- --------- ------------------------------ ----------------------

Molopo Botswana c.53%(#) T1-6 conductor target Drill programme

Farms drilling underway updates and findings

and MLEM surveys over from further MLEM

T1-6, T1-14, T1-3 survey work.

and T2-3 completed.

Further MLEM surveys

planned over additional

AEM targets identified.

--------- --------- ------------------------------ ----------------------

Tati Botswana 100% RC drilling and sampling Review of mine dumps

Project of mine dumps complete. sampling and assay

results from RC

drill programme.

--------- --------- ------------------------------ ----------------------

(#) subject to completion of acquisition announced 18.5.22

interest will increase to 87.71%

Exploration work programmes may also be underway within Power

Metal investee companies and planned IPO vehicles where Power Metal

has a material interest, the findings from which will be released

on their respective websites, with simultaneous updates through

Power Metal regulatory announcements where required. These

interests are summarised in the table below:

Company Status/Operations Link

First Class Investment - www.firstclassmetalsplc.com

Metals PLC POW 27.91%

Exploration

in the Schreiber-Hemlo

region of Ontario,

Canada

------------------------ ------------------------------------------------------------------

First Development Planned IPO www.firstdevelopmentresources.com

Resources - POW 62.12%

PLC Exploration

in Western Australia

and the Northern

Territory of

Australia

------------------------ ------------------------------------------------------------------

Golden Planned IPO www.goldenmetalresources.com

Metal Resources - POW 83.13%

PLC Exploration

and development

in Nevada, USA

------------------------ ------------------------------------------------------------------

Kavango Investment - www.kavangoresources.com

Resources POW 14.03% (subject

PLC to completion

of Kanye Resources

disposal announced

8.7.22)

Exploration

in Botswana

------------------------ ------------------------------------------------------------------

New Ballarat Planned IPO A new website is currently in development

Gold PLC - POW 49.9% which will be found at www.newballaratgoldcorp.com

Exploration .

in the Victoria In the interim further information

Goldfields of in respect of NBGC can be found at:

Australia https://www.powermetalresources.com/project/victoria-goldfields/

.

------------------------ ------------------------------------------------------------------

Uranium Planned IPO www.uraniumenergyexploration.com

Energy Exploration - POW on listing

PLC estimated 40-55%

Uranium exploration

in the Athabasca

region of Canada

------------------------ ------------------------------------------------------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDDZMMGFRRGZZM

(END) Dow Jones Newswires

October 18, 2022 09:50 ET (13:50 GMT)

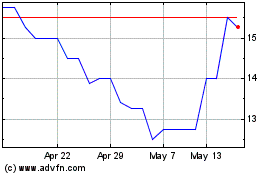

Power Metal Resources (LSE:POW)

Historical Stock Chart

From May 2024 to Jun 2024

Power Metal Resources (LSE:POW)

Historical Stock Chart

From Jun 2023 to Jun 2024