Interim Management Statement

May 16 2012 - 8:30AM

UK Regulatory

TIDMPNS

16 May 2012

Panther Securities PLC

("Panther" or "Group")

Interim management statement for the three month period ended 31 March 2012

Panther is pleased to publish its Interim Management Statement for the three

month period ended 31 March 2012. The Accounts for the financial year ended 31

December 2011 were announced on 25 April 2012 and will be posted to

shareholders shortly. These accounts included extensive information on post

balance sheet events, which for clarity we are repeating, as all material post

year end items have already been announced.

The main highlights of the period have been:

* There has been a GBP1.7 million improvement on our financial derivatives, as

they now show a decreased combined liability of GBP18.2 million as at 31

March 2012. This is compared to the combined liability of GBP19.9 million as

at 31 December 2011 as announced in April. As mentioned previously by the

Board, the valuations of financial derivatives are based on market

estimations of future interest rates, which have in recent times been very

erratic over short periods. The Board believes that these are an effective

`cash' hedge for the majority of the borrowings of the Group and unlikely

that the Group would willingly pay the estimated premium to exit these

financial instruments.

* In February 2012 the Company purchased the freeholds of a further three

Beales Department Stores, these being:-

Lowestoft, Suffolk

The freehold property, known as Beales department store, London Road North,

Lowestoft, is a modern store with 21,000 square feet of selling space on two

floors, situated on the town's main pedestrianized shopping street close to

Tesco Metro supermarket, Sports Direct and the BHS department store.

Wisbech, Cambs

The property, known as Beales department store on Little Church Street, just

off The Market Place, is a modern, two storey department store containing

26,000 square feet of selling space, which is situated in the centre of town.

Beccles, Suffolk

The department store is an older store in two separate sections adjoining but

separated by a small vehicular service road and contains approximately 17,000

square feet on mainly ground but also first floor. The property fronts through

from Smallgate to The Walk which is close to the centre of this market town and

to a Tesco superstore.

All three properties are let on similar leases to Beale PLC whereby rent is

calculated as a share of profits until May 2014, after which they will convert

to market rent subject to negotiations. The estimated turnover for these stores

to the Beale Group was approximately GBP6 million (excluding VAT). The price paid

for the freehold properties was GBP2,250,000, of which GBP300,000 is deferred,

payable in three years' time.

* Huntingdon, Cambs

In February 2012, Panther purchased a factory investment comprising 96,000

square feet (90,000 feet ground floor) of modern factory premises on 5.5 acres

on the Stukeley Meadows Industrial Estate, 1 mile north of Huntingdon town

centre. The property is let on a full repairing and insuring lease for 15 years

from February 2005 at GBP190,000 per annum exclusive with rent reviews in 2010

(still outstanding) and 2015 to 65% of open market rental value.

The property is held on a long lease for a term of 999 years from February 2005

at a fixed nominal rent and the price paid was GBP1,278,000 (including stamp

duty).

General trading update

The Group already has financing in place and has invested a substantial amount

of this during 2011 and the first quarter of 2012 but still has significant

funds for potential investments. The Group is also pleased to report that it is

experiencing a noticeable increase in enquiries for its vacant properties, some

of which we have agreed terms and instructed solicitors, which if the majority

complete will add value to the portfolio in terms of rent of circa GBP200,000

p.a.

As ever we remain upbeat about Panther's future prospects.

Other than as stated above, there has been no significant change in the Group's

financial position since 31 December 2011.

Andrew Perloff

Chairman

For further information contact:

Panther Securities PLC 01707 667 300

Andrew Perloff - Chairman

Simon Peters - Finance Director

END

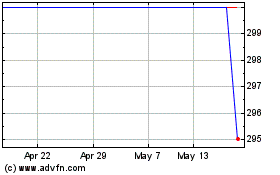

Panther Securities (LSE:PNS)

Historical Stock Chart

From Jun 2024 to Jul 2024

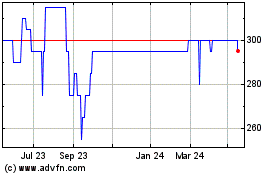

Panther Securities (LSE:PNS)

Historical Stock Chart

From Jul 2023 to Jul 2024