Acquisitions

July 14 2011 - 11:57AM

UK Regulatory

TIDMPNS

14 July 2011

Panther Securities PLC

("Panther" or the "Company")

Acquisitions

Panther is pleased to announce that on 13 July 2011 the Company entered into

contracts to purchase five freehold department stores which are owned and were

formerly occupied by the Anglia Regional Co-operative Society Limited ("ARCS")

trading as Westgate Stores. The majority of the trade and assets of Westgate

Stores were recently acquired by Beale PLC, a Fully Listed department store

group in which Panther holds just under 20 per cent. of the issued ordinary

share capital. The Company paid approximately GBP7.1 million (in aggregate) for

these five properties.

The stores in question are:

80 Newgate Street, Bishop Auckland, County Durham comprising approximately

50,000 sq ft over three floors just off the prime shopping position in the town

centre.

49 Low Street, Keighley, West Yorkshire comprising approximately 35,000 sq ft

on three floors. It adjoins a Marks &Spencer store and the main shopping centre

in the town.

53-57 High Street, St Neots, Cambs comprising approximately 30,000 sq ft on two

floors together with an 80 space car park to the rear, adjoining a Marks &

Spencer store.

Market Place/Bridge Street, Spalding, Lincolnshire comprising approximately

23,000 sq ft on two floors in the main trading position of the town.

8 Market Place, Diss, Norfolk comprising approximately 8,000 sq ft in the prime

shopping of the town centre.

These department stores previously generated approximately GBP14 million per

annum, excluding VAT, under the ARCS ownership. The acquisition agreements

relating to these stores allow for a two year rent free period commencing on 22

May 2011 for the stores other than 80 Newgate Street, Bishop Auckland which has

a one year rent free period. The total rent that will be receivable by Panther

(the majority of which will be received in 22 months' time) will be GBP675,000

per annum.

The rent passing under the leases is a minimum figure, subject to an additional

five per cent. Turnover rent on turnover in excess of targets which the board

believes should be achieved. The leases are all on full repairing and insuring

terms for 15 years with rent reviews.

In addition, the Company exchanged auction contracts last week to purchase the

long leasehold property known as Templegate House, 115-123 High Street,

Orpington for GBP1,250,000. This modern building contains five shops and 17,000

sq ft of office space over the three floors above. The property is almost fully

let and produces rent of GBP276,000 per annum. The price reflects the fact that

two of the larger tenants' leases expire towards the end of this year. The

property is held under a ground lease at a peppercorn rent, with approximately

94 years unexpired, and was purchased from an LPA Receiver.

In addition, this week Panther exchanged contracts to purchase 79/97 Commercial

Street, Batley, a freehold property which is well positioned in the town. The

property currently produces GBP143,000 per annum, excluding the potential income

from two vacant shops. The tenants include Boots, the Card Factory, Coral

Estates, TUI UK and Kirkwood Hospice. The price paid was GBP1,326,000.

All the purchase prices quoted are, of course, exclusive of the monstrously

excessive four per cent. stamp duty on larger purchases.

The Directors are extremely pleased with the range and spread of these

properties which, in due course, will increase Panther's rental income by over

GBP1.1 million per annum, for an aggregate purchase price of GBP10.1 million,

including stamp duty.

The Directors hope to be able to purchase other long term investment

opportunities immediately following the completion of the Company's new loan

facility, which was set out in the announcement of the Company's final results

on 20 April 2011. The current purchases set out above are being funded out of

existing cash resources and short term loan facilities available to the Group.

For further information contact:

Panther Securities PLC 01707 667 300

Andrew Perloff - Chairman

Simon Peters - Finance Director

City Profile 020 7448 3244

Simon Courtenay

Sheena Khan

END

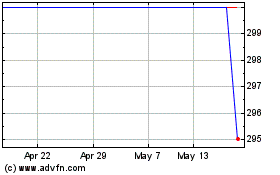

Panther Securities (LSE:PNS)

Historical Stock Chart

From Jun 2024 to Jul 2024

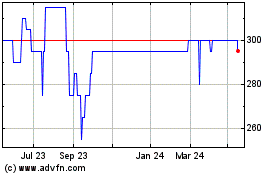

Panther Securities (LSE:PNS)

Historical Stock Chart

From Jul 2023 to Jul 2024