Trading Update

February 09 2006 - 2:22AM

UK Regulatory

RNS Number:1550Y

Matrix Communications Group PLC

09 February 2006

Matrix Communications Group Plc

Trading Update

As outlined on 2 February 2006 Matrix Communications Group Plc ('Matrix' or 'the

Group') is implementing its strategy as it matures from being a product-based

distribution and reseller business, to becoming a focused solutions and services

provider in the converged telecoms and IT services sector. This process started

with the acquisition of Network Partners, a telecommunication service provider,

in November 2004, which provided the platform for the Group's entry into the

managed services sector.

As part of this strategic development the Group has completed a review of its

revenue recognition policies and made appropriate changes to reflect more

accurately Matrix's new business model as a supplier of managed data solutions

to its customers. As a result, the Group's accounting policy for the recognition

of revenue and costs for managed service contracts (including where the

maintenance is fully provided by a third party supplier) will be recognised over

the lifetime of the contract. Hitherto such contracts where the maintenance was

fully provided by a third party supplier had been recognised on contract

approval. The change to the accounting policy has no cash impact.

The Directors believe that the new accounting policy is more appropriate as it

better reflects risk and reward over the life of such contracts in the context

of the transition of Matrix to a supplier of managed data solutions to its

customers and ultimately will deliver greater financial stability and better

shareholder value.

Matrix will announce its Preliminary Results for the year ended 31 October 2005

on Tuesday 14 February.

The Board estimates that the deferment of revenue recognition in accordance with

its accounting policies together with certain additional cost accruals will

reduce pre-tax profits, before amortisation of goodwill and exceptional costs

(for restructuring during the financial year and the impairment of goodwill

arising on the disposal of Equip announced on 2 February 2006) in the year ended

31 October 2005 by around #1.0 million relative to the current market consensus

forecasts.

In the current year to October 2006, Matrix estimates that profits will be

reduced by a similar amount as a result of the accounting policy change and

additional operating costs.

Matrix will give a further detailed update on its strategy, its performance in

the year ended 31 October 2005 (including the change in accounting policy) in

its Preliminary Results.

9 February 2006

Enquiries

Matrix Communications 01342 871 888

Ian Smith, Chief Executive Officer

Tony Weaver, Chief Operating Officer

College Hill 020 7457 2020

Adrian Duffield / Corinna Dorward

This information is provided by RNS

The company news service from the London Stock Exchange

END

TSTIIFFDFIIAIIR

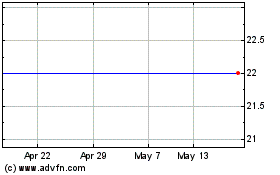

Mgc Pharmaceuticals (LSE:MXC)

Historical Stock Chart

From Sep 2024 to Oct 2024

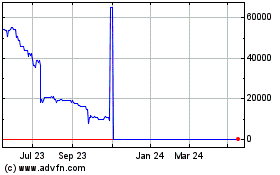

Mgc Pharmaceuticals (LSE:MXC)

Historical Stock Chart

From Oct 2023 to Oct 2024