Final Results

June 24 2004 - 3:00AM

UK Regulatory

RNS Number:0802A

Mulberry Group PLC

24 June 2004

MULBERRY GROUP PLC

24 JUNE 2004

MULBERRY GROUP PLC ("Mulberry" or the "Group")

PRELIMINARY RESULTS FOR

THE YEAR TO 31 MARCH 2004

Mulberry Group Plc, the AIM listed designer and manufacturer of a portfolio of

accessories, ready to wear clothing and interior design products, today

announced its preliminary results for the year ended 31 March 2004.

HIGHLIGHTS

Operating profit of #0.6 million achieved (2003: loss #1.7 million).

Profit before tax for the year of #41,000 (2003: loss #2.1 million).

Significantly strengthened balance sheet with borrowings reduced by #4.3 million

to #2.2 million.

Gross margin, increased from 45% to 50%.

Overheads reduced by #2.1 million (15%).

Continued repositioning of the Mulberry brand in the UK and overseas.

GODFREY DAVIS, CHAIRMAN AND CHIEF EXECUTIVE COMMENTED:

"We have achieved a substantial business turnaround. The first financial

objective for the year was to break the loss making pattern of previous years.

We have achieved this by focusing on our core accessories business, improving

margins, reducing costs and eliminating non profitable sales. The second was to

reduce borrowings and restore the balance sheet. This has been achieved by

the Open Offer completed in September 2003 and by generating cash from

operations. As a result, the Group is profitable, adequately funded and has a

sound base from which it can build. Our strategy for the brand is to invest in

design and to focus our marketing resources to significantly raise our game."

FOR FURTHER DETAILS PLEASE CONTACT :

WMC Communications

Alex Glover or Jo Livingston 0207 7591 3999

CHAIRMAN'S STATEMENT

We have achieved a substantial business turnaround. The Group made an operating

profit of #0.5 million (2003: loss #1.7 million). The balance sheet is greatly

strengthened with net debt reduced by #4.3 million to #2.2 million. Equally

importantly, Mulberry's product range and brand image have been transformed.

This has resulted in extensive press coverage in both the leading fashion

magazines and the national newspapers. Our Piccadilly, Bayswater and Roxy bags

are 'must have' fashion accessories carried by many of the most fashionable

celebrities. This renaissance has been recognised worldwide.

The first financial objective for the year was to break the loss making pattern

of previous years. We have achieved this by focusing on our core accessories

business, improving margins, reducing costs and eliminating non profitable

sales. The second was to reduce borrowings and restore the balance sheet. This

has been achieved by the Open Offer completed in September 2003 and by

generating cash from operations. As a result, the Group is profitable,

adequately funded and has a sound base from which it can build.

Our strategy for the brand is to invest in design and to focus our marketing

resources to significantly raise our game. This has resulted in strong demand

for our new more fashionable products and excellent reviews from the UK press.

RESULTS FOR THE YEAR ENDED 31 MARCH 2004

Sales for the year reduced to #25.3 million (2003: #28.2 million). The reduction

reflects the elimination of loss making and strategically flawed sales channels,

reduced clearance sales of discontinued lines and lower sales of men's and

women's clothing. Sales of our core accessory products are growing in our UK and

European markets.

Gross margin, increased from 45% to 50%. This reflected the continuing

improvement in accessories margins and the lower level of discounting to clear

stocks, which have fallen by a further #0.9 million after last year's reduction

of #1.7 million.

Overheads reduced by #2.1 million (15%) and the Group made an operating profit

of #0.5 million (2003: loss #1.7 million).

The Group made a profit before tax for the year of #41,000 (2003: loss #2.1

million) after accounting for the costs of shop closures and the related loss on

disposal.

Gearing reduced to 23% at 31 March 2004. Net bank borrowings reduced to #1.8

million. The Group has term loan and overdraft facilities of #7.5 million with

its principal bankers HSBC Bank plc.

THE MULBERRY BRAND

Our marketing effort has focused on the UK, with advertising and PR campaigns

which succeeded in their objective of bringing our brand to the attention of a

more fashion conscious customer. Our new campaigns for Autumn/Winter 2004 and

Spring/Summer 2005 will be designed to communicate our unique brand values to

develop demand from consumers outside the UK as well as continuing to build on

the progress we have achieved in the UK.

ACCESSORIES

Accessories, which are our core business, account for over 70% of Group sales.

Spring/Summer 2004 wholesale orders for accessories from department stores and

others in the UK have increased by 14% on the prior year. In Europe, orders have

increased by 2%, after several years of decline, despite the recession in

fashion retail in those markets. New designs of handbags for women and unisex

casual work bags in the new leathers, 'Darwin' and 'Matt Glove', have become

best sellers. In the forthcoming year, we will complete the updating and renewal

of the classic 'Congo' and 'Scotchgrain' product ranges.

MEN'S AND WOMEN'S CLOTHING

We have continued to restrict the distribution of the men's and women's wear

collections, which we are repositioning to bring them into line with our

accessories range. This has resulted in lower sales. These collections are

bringing a more fashion conscious consumer into our stores and have achieved

extensive press coverage. Our strategy will continue to be to limit the

distribution of men's and women's wear and to focus on growing the sales of

accessories.

HOME COLLECTION

Our licensed home furnishings and bath towel collections continue to develop

satisfactorily.

RETAIL

Like for like sales in our full price shops were 1% lower for the year. This was

due to reduced sales in the July and January mark- down sale periods, which we

were able to limit to a shorter period at reduced discounts due to improved

stock management. As a result, margins improved.

We have continued to refit our shops with the new retail format. The most recent

is our shop in Heathrow Terminal 4.

OUTLOOK

Early indications for the Autumn/Winter 2004 wholesale season for our core

accessory business are encouraging and show growth in both the UK and export

markets. Like for like sales in our full price shops for the first 9 weeks of

the new financial year are 4% higher than last year.

We are planning to open a limited number of new shops in the UK to sell

accessories but will only consider these where the property deals are

attractive.

We have agreed to launch Mulberry in the USA this autumn with Bergdorf Goodman,

the leading New York store. Mulberry USA LLC, the joint venture formed at the

time of the original share subscription by Challice Limited, has commenced

trading and is the distributor for this market. The impact on the current year

will be small but is expected to increase thereafter.

In parallel with these developments in the USA, we are working on opportunities

in Japan and the rest of Asia.

DIVIDENDS

The Board is not recommending the payment of a dividend on the ordinary or

preference shares.

STAFF

I would like to thank all our staff who have continued to drive the brand

forward with determination and commitment and without whom, the achievements of

the last year would not have been possible.

Godfrey Davis

CHAIRMAN AND CHIEF EXECUTIVE

24 June 2004

Contacts:

WMC Communications

Alex Glover or Jo Livingstone 020 7591 3999

Teather & Greenwood Limited

Christopher Hardie 020 7426 9576

CONSOLIDATED PROFIT AND LOSS ACCOUNT

For the year ended 31 March 2004

2004 2003

Total Total

#'000 #'000

TURNOVER 25,327 28,177

Cost of sales (12,539) (15,499)

---------- ----------

GROSS PROFIT 12,788 12,678

Other operating expenses (net) (12,248) (14,340)

---------- ----------

OPERATING PROFIT/(LOSS) 540 (1,662)

Group share of profit of associated undertakings 3 1

Loss on disposal of fixed assets (166) -

Interest payable and similar charges (336) (450)

----------

----------

PROFIT/(LOSS) ON ORDINARY ACTIVITIES BEFORE TAXATION 41 (2,111)

Tax on profit/(loss) on ordinary activities (10) (91)

---------- ----------

PROFIT/(LOSS) ON ORDINARY ACTIVITIES AFTER TAXATION, BEING PROFIT FOR THE FINANCIAL 31 (2,202)

YEAR

7% preference dividend proposed on non-equity shares (196) (196)

1% preference dividend proposed on non-equity shares 4 (3)

Difference between non-equity finance costs and the related dividends (53) -

---------- ----------

RETAINED LOSS FOR THE YEAR (214) (2,401)

---------- ----------

LOSS PER ORDINARY SHARE - basic (0.49p) (6.64p)

========== ==========

CONSOLIDATED BALANCE SHEET

31 March 2004

2004 2003

#'000 #'000

FIXED ASSETS

Tangible assets 5,385 6,533

Investments 73 76

------------- ----------

5,458 6,609

------------- ----------

CURRENT ASSETS

Stocks 6,565 7,435

Debtors 3,441 4,027

Cash at bank and in hand 1,245 71

------------- ----------

11,251 11,533

CREDITORS: Amounts falling due within one year (3,912) (10,996)

------------- ----------

NET CURRENT ASSETS 7,339 537

------------- ----------

TOTAL ASSETS LESS CURRENT LIABILITIES 12,797 7,146

CREDITORS: Amounts falling due after more than one year (3,178) (373)

------------- ----------

NET ASSETS 9,619 6,773

============= ==========

CAPITAL AND RESERVES

Called-up share capital 2,838 2,457

Share premium account 11,371 8,931

Revaluation reserve 142 173

Capital redemption reserve 154 154

Preference dividend reserve 442 250

Profit and loss account (5,328) (5,192)

------------- ----------

SHAREHOLDERS' FUNDS 9,619 6,773

============= ==========

Shareholders' funds may be analysed as:

Equity interests 6,615 3,764

Non-equity interests 3,004 3,009

------------- ----------

9,619 6,773

============= ==========

CONSOLIDATED CASH FLOW STATEMENT

For the year ended 31 March 2004

2004 2003

#'000 #'000

NET CASH INFLOW FROM OPERATING ACTIVITIES 1,684 1,293

Returns on investments and servicing of finance (345) (453)

Taxation - (2)

Capital expenditure 303 (600)

------------- -----------

Cash inflow before financing 1,642 238

Financing 3,511 (328)

------------- -----------

INCREASE/(DECREASE) IN CASH IN THE YEAR 5,153 (90)

============= ===========

RECONCILIATION OF NET CASH FLOW TO MOVEMENT IN NET DEBT

2004 2003

#'000 #'000

Increase/(Decrease) in cash in the year 5,153 (90)

Cash(inflow)/outflow from(increase)/decrease in debt and lease financing (690) 318

------------- ----------

4,463 228

Inception of finance leases (130) (41)

------------- ----------

Movement in net debt 4,333 187

NET DEBT, BEGINNING OF YEAR (6,564) (6,751)

------------- ----------

NET DEBT, END OF YEAR (2,231) (6,564)

============= ==========

NOTES

1. The financial information set out above does not constitute the

Group's statutory financial statements for the years ended 31 March 2004

and 2003, but is derived from those financial statements. Statutory

accounts for the year ended 31 March 2003 have been filed with the

Registrar of Companies. The statutory accounts for the year ended 31 March

2004 will be filed at Companies House upon receiving the approval of the

Annual General Meeting. The auditors have reported on the accounts for the

year ended 31 March 2003 and their report was unqualified and did not

contain a statement under section 237 (2) or (3) of the Companies Act 1985.

2. The results for the year ended 31 March 2004 contained in this report have

been prepared using accounting policies consistent with those used in the

preparation of the Annual Report and Financial Statements for the year

ended 31 March 2003.

3. Basic earnings per ordinary share has been calculated by dividing the loss

on ordinary activities after taxation and dividends on non-equity shares

for each financial year by 43,453,282 (2003: 36,147,123) ordinary shares,

being the weighted average number of ordinary shares in issue during the

year.

4. Copies of the Annual Report and Financial Statements will be posted to

shareholders. Further copies can be obtained from Mulberry Group plc's

registered office at Kilver Court, Shepton Mallet, Bath, BA4 5NF.

Copies of this announcement are available for a period of one month from the

date hereof from the Company's registered office, Kilver Court, Shepton Mallet,

Bath, BA4 5NF and from the Company's nominated adviser, Teather & Greenwood

Limited, Beaufort House, 15 St. Botolph Street, London, EC3A 7QR.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR UOVNRSWRNUAR

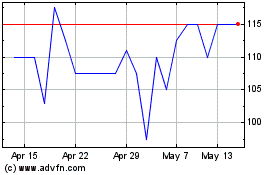

Mulberry (LSE:MUL)

Historical Stock Chart

From Jun 2024 to Jul 2024

Mulberry (LSE:MUL)

Historical Stock Chart

From Jul 2023 to Jul 2024