Interim Results

December 12 2002 - 2:01AM

UK Regulatory

RNS Number:9995E

Mulberry Group PLC

12 December 2002

MULBERRY GROUP PLC

12 DECEMBER 2002 - EMBARGOED FOR 7AM

MULBERRY GROUP PLC ("Mulberry" or the "Company")

INTERIM RESULTS FOR THE SIX MONTHS TO 30 SEPTEMBER 2002

CHAIRMAN AND CHIEF EXECUTIVE'S REVIEW

This is my first report to shareholders as Chairman and CEO following the

departure of Roger Saul to become President and a non-executive director.

The Board has addressed the issues that face the Group. In the last two weeks, a

programme of cost reduction has been completed totalling #0.8 million, which

will benefit next year. Our priority is to bring increased financial discipline

to bear throughout the company in order to bring us back to profitability as

soon as possible and to consolidate the base for the next phase of development.

The recruitment of a new chief executive which was announced previously has been

deferred.

RESULTS FOR THE SIX MONTHS TO 30 SEPTEMBER 2002

Trading conditions continued to be demanding in the six months to 30 September

2002 and despite some significant achievements, the financial performance of the

Group has been held back by a range of factors.

Sales increased during the period by 10% to #13.3 million (2001: #12.1 million).

Sales through the off price business increased by #0.6 million mainly due to the

outlet in Bicester village, which opened in August 2001. The balance of the

increase was higher wholesale sales of accessories.

Despite this increase in sales, the Group made a loss of #1.05 million before

tax (2001: #0.96 million). Gross profit reduced by #0.7 million with the gross

margin falling from 54.2% to 44.1%. This reflected the higher proportion of

sales made through the off price business and discounting to reduce stocks,

which have been reduced by #1.2 million compared to the prior year.

The result for the period includes the trading loss of the Tokyo store, which

closed on 20 June 2002, of #0.2 million (2001: #0.2 million). The closure cost

was provided for in the previous year.

THE MULBERRY BRAND

Our marketing and public relations activities have achieved exceptional coverage

in the media and I believe the Mulberry brand has been significantly

strengthened throughout the period.

The new store in Copenhagen, which opened in April 2002, has shown strong sales

growth and the next new style shop in Europe opens in The Hague on 12 December.

The first of the new franchised stores in Russia has opened in St Petersburg.

The next opening is planned for Moscow in the first half of 2003.

ACCESSORIES

Accessories are our core business and account for 70% of group sales. Autumn/

Winter 2002 sales of accessories to department stores and independent retailers

in the UK have increased by 12% and they are reporting strong sales growth of

the Mulberry products. The recession in fashion retail in Northern Europe and

Scandinavia, which has been widely reported, has resulted in a sales reduction

of 13% in our export business in the region.

MEN'S AND WOMEN'S CLOTHING

The menswear business has made steady progress in the first six months of the

year. The womenswear business has retrenched in a period of transition and has

suffered from late deliveries. Spring/Summer 2003 is the final collection under

the old design regime. The Autumn/Winter 2003 collection, the first range

designed by Nicholas Knightly, the new design director, will arrive in the

showrooms in January.

HOME COLLECTION

Our licence relationship with Kravet Lee Jofa, who produce and sell our Home

furnishings collection, continues to develop satisfactorily.

Two new licence agreements have been signed; the Mulberry bath towel collection

with Christy UK Limited and the Mulberry bed linen collection with Peter Reed

Limited. The first sales are expected in Spring 2003.

RETAIL

Retail trading in London where most of the Group's own shops are based remains

tough and continues to be affected by the lack of tourists. It is not possible

to produce reliable like for like sales statistics for the period because of the

extended closure of our Bond Street flagship store for 16 weeks last year.

OUTLOOK

Sales in our full price shops for the 8 weeks to 7 December 2002 are 2% higher

than last year. The outlook for the second half of the year will become clearer

when we see the results of the key Christmas trading period. Early indications

for the Spring/Summer 2003 season are satisfactory for accessories but

disappointing for clothing, particularly womenswear, where sales of the final

collections developed by the old design regime will be below expectations. In

addition, the costs of the recent shareholder dispute and extraordinary general

meeting requisition together with the subsequent management changes and

recruitment costs are estimated to be #0.9 million. These factors will adversely

affect the financial results for the full year.

BORROWINGS

Net debt of #7.9m is in line with the normal seasonal pattern. The higher levels

of debt compared to the previous year are due to the completion of the

refurbishment of the Bond Street shop in the second half of the last financial

year.

DIVIDENDS

In view of the current losses and in the absence of distributable reserves, the

Board is not recommending the payment of a dividend on the ordinary or

preference shares.

EXTRAORDINARY GENERAL MEETING

As you all know, the events of late November when our largest external

shareholder Challice Limited requisitioned an EGM to remove Roger Saul as a

director of the company, was resolved when Roger agreed to resign as Chairman

and CEO. He remains a non-executive director and I am delighted we will still

have the advice and support of the company's founder available to us.

STAFF

I would like to say a particularly heartfelt thank you to all our staff who have

had to cope with exceptional circumstances this year whilst at the same time

driving the brand forward with optimism and commitment.

GODFREY DAVIS

CHAIRMAN AND CHIEF EXECUTIVE

12 December 2002

ENQUIRIES:

For further information, please contact Alex Glover WMC Communications

Telephone: 020 7591 3999

CONSOLIDATED PROFIT & LOSS ACCOUNT

for the six months to 30 September 2002

Unaudited Unaudited Audited

6 months to 6 months to 12 months to

30 September 30 September 31 March

2002 2001 2002

#'000 #'000 #'000

TURNOVER 13,263 12,060 27,817

Cost of sales (7,409) (5,521) (13,873)

GROSS PROFIT 5,854 6,539 13,944

Other operating expenses (6,676) (7,159) (14,757)

(net)

OPERATING LOSS (822) (620) (813)

Loss on disposal of fixed - (200) (593)

assets

Group share of profit of - - 1

associated company

Interest payable and (229) (139) (343)

similar charges

Loss on ordinary (1,051) (959) (1,748)

activities before

taxation

Tax on loss on ordinary - - (6)

activities (note 2)

LOSS FOR THE PERIOD (1,051) (959) (1,754)

Preference dividends (99) (99) (199)

ACCUMULATED LOSS (1,150) (1,058) (1,953)

Loss per share (3.18) (2.93) (5.40)

Dividend per ordinary Nil pence Nil pence Nil pence

share

CONSOLIDATED BALANCE SHEET

at 30 September 2002

Unaudited Unaudited Audited

30 September 2002 30 September 31 March 2002

2001

#'000 #'000 #'000

FIXED ASSETS 6,900 6,636 7,027

CURRENT ASSETS

Stocks 8,472 9,652 9,096

Debtors 5,707 5,155 3,938

Cash 1 13 151

14,180 14,820 13,185

CREDITORS: Amounts (12,658) (9,526) (8,623)

falling due within one year

NET CURRENT ASSETS 1,522 5,294 4,562

TOTAL ASSETS LESS 8,422 11,930 11,589

CURRENT LIABILITIES

CREDITORS: Amounts (538) (2,071) (2,654)

falling due after

one year

NET ASSETS 7,884 9,859 8,935

CAPITAL AND RESERVES

Called up share 2,457 2,457 2,457

capital

Reserves 5,427 7,402 6,478

7,884 9,859 8,935

CONSOLIDATED CASH FLOW

for the six months to 30 September 2002

Unaudited Unaudited Audited

6 months to 6 months to 12 months to

30 September 30 September 31 March

2002 2001 2002

#'000 #'000 #'000

Operating loss (822) (620) (813)

Depreciation 430 566 818

Decrease /(increase) in 624 (2,274) (1,718)

stocks

Increase in debtors (1,769) (1,232) (14)

Increase /(decrease) in 826 157 (521)

creditors

NET CASH FLOW FROM (711) (3,403) (2,248)

OPERATIONS

Interest (229) (139) (320)

Taxation - - (6)

Capital expenditure (180) (1,278) (2,146)

Preference dividends paid - (156) (259)

NET CASH FLOW BEFORE (1,120) (4,976) (4,979)

FINANCING

Financing (138) 952 829

DECREASE IN CASH IN THE (1,258) (4,024) (4,150)

PERIOD

RECONCILIATION OF NET

CASHFLOW TO MOVEMENT IN NET DEBT

Decrease in cash in the (1,258) (4,024) (4,150)

year

Cash outflow/(inflow)

from decrease/(increase)

in debt and lease finance 138 (952) (829)

(1,120) (4,976) (4,979)

Inception of finance (41) (75) (997)

leases

Movement in net debt (1,161) (5,051) (5,976)

NET DEBT, BEGINNING OF (6,751) (775) (775)

PERIOD

NET DEBT, END OF PERIOD (7,912) (5,826) (6,751)

NOTES

1. ACCOUNTING POLICIES

The interim results contained in this report, which have not been reviewed or

audited, have been prepared using accounting policies consistent with those used

in the preparation of the annual report and accounts for the year ended 31 March

2002.

2. TAXATION

The corporation tax charge for the period is based on the effective rate which

it is estimated will apply for the full year.

3. COMPARATIVE FIGURES

The comparative figures for the year ended 31 March 2002, which do not

constitute statutory accounts, are abridged from the company's statutory

accounts which have been filed with the Registrar of Companies. The report of

the auditors, Arthur Andersen, on these accounts was unqualified and did not

contain a statement under section 237(2) or (3) of the Companies Act 1985.

4. APPROVAL AND DISTRIBUTION

This report was approved by the Board of Directors on 11 December 2002 and is

being sent to all shareholders. Additional copies are available from the

Company Secretary at the Registered Office Kilver Court, Shepton Mallet, Bath,

BA4 5NF.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR FFFFUFSESESE

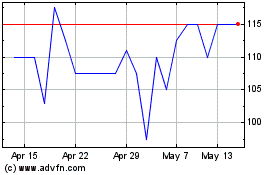

Mulberry (LSE:MUL)

Historical Stock Chart

From Jun 2024 to Jul 2024

Mulberry (LSE:MUL)

Historical Stock Chart

From Jul 2023 to Jul 2024