TIDMLWDB

RNS Number : 9870G

Law Debenture Corp PLC

30 July 2021

The Law Debenture Corporation p.l.c. today published its results

for the half-year ended 30 June 2021

Group Highlights:

-- 2021 dividend to be increased from 2020 level of 27.5 pence per share

-- Dividend yield of 3.7% as quarterly dividend increased by 5.8%

-- Investment Portfolio delivered strong positive returns outperforming the benchmark

-- Independent Professional Services business (IPS) has entered

its fourth consecutive year of both revenue and earnings per share

growth.

-- 4 million new ordinary shares issued to existing and new

investors, worth c. GBP29.2 million, exceeding GBP20 million target

to refinance the acquisition of new Company Secretarial business.

We continue to issue shares when the opportunity arises to generate

value for the Trust

-- Increase in the valuation of the IPS business by 10.1% year to date to GBP149.7m.

Investment Portfolio Highlights:

-- NAV total return (with debt at par) for the six months grew

16.7% compared to 11.1% for the benchmark, FTSE Actuaries All-Share

Total Return Index

-- Material outperformance of the benchmark over one, three, five and ten years

-- Net investors in the period, investing GBP36.4m (2020:

GBP33m) to take advantage of attractive valuation opportunities

-- On-going charges remain low at 0.50%(1) compared to the industry average of 1.02%(2)

YTD 1 year 3 years 5 years 10 years

NAV total return debt at par(3) 16.7% 41.7% 27.5% 75.6% 167.5%

NAV total return debt at fair

value(3) 19.4% 46.0% 26.5% 77.1% 158.8%

Share price total return(4) 10.9% 50.0% 42.6% 85.5% 184.0%

FTSE Actuaries All-Share Index(4) 11.1% 21.5% 6.3% 36.9% 85.5%

IPS Highlights:

-- Wholly-owned independent provider of professional services,

continues to provide a diversified and repeatable revenue stream

for the dividend

-- IPS enters its fourth consecutive year of growth with

revenues increased by 18.2%(5) , Profit before tax of 6.1% and

earnings per share by 5.0%(6)

-- Acquired Company Secretarial business expected to strengthen

capabilities and offer growth opportunities

Longer Term Track Record:

-- 132 years of value creation for shareholders

-- 116% increase in the dividend over the last 10 years

-- 42 years of increasing or maintaining dividends to shareholders

-- IPS revenues funded 36%(7) of dividends for the Trust over the preceding 10 years

Robert Hingley, Chairman, commented:

"Against a challenging economic backdrop, I am pleased to report

that your company has continued to outperform its benchmark on a

one, three, five and ten year basis. In addition, our IPS business

experienced further strong financial performance. The business

provides your company with a diverse steady income stream and its

financial performance is not directly correlated with markets.

The board is committed to targeting both capital appreciation

and steadily increasing the income for our shareholders. Subject to

market conditions, our current intention is to increase the total

2021 dividend compared to the total 2020 dividend of 27.5 pence per

ordinary share. We are confident that, in the long term, the

combination of a robust equity portfolio and continued growth in

our IPS business will deliver strong NAV total returns and

attractive dividend growth."

Denis Jackson, Chief Executive Officer, commented:

"We are pleased to report another period of strong financial

performance - further outperformance by our Investment Portfolio

while our IPS business has performed strongly, with revenue up

18.2% and profit before tax up 6.1%.

I am extremely grateful to my excellent colleagues who have been

as diligent and hard working as ever during the first half of the

year. We have invested significantly in our people, bolstering our

team and widening our existing expertise, and have continued to

provide a high quality client service from our new offices in

London and Salford. We look forward to capturing the opportunities

ahead."

The Law Debenture Corporation +44 (0)20 7606 5451

Denis Jackson, Chief Executive Officer denis.jackson@lawdeb.com

Trish Houston, Chief Operating Officer trish.houston@lawdeb.com

Tulchan Communications (Financial +44 (0) 777 193 7173

PR) l awdebenture@tulchangroup.com

Simon Pilkington

Deborah Roney

Company History:

From its origins in 1889, Law Debenture has diversified to

become a group with a unique range of activities in the financial

and professional services sectors. The group has two distinct areas

of business.

Investment Portfolio:

Our portfolio of investments is managed by James Henderson and

Laura Foll of Janus Henderson Investors.

Our objective is to achieve long term capital growth in real

terms and steadily increasing income. The aim is to achieve a

higher rate of total return than the FTSE Actuaries All-Share Index

Total Return through investing in a diversified portfolio of

stocks.

Independent Professional Services:

We are a leading provider of independent professional services,

built on three excellent foundations: our Pensions, Corporate Trust

and Corporate Services businesses. We operate globally, with

offices in the UK, New York, Ireland, Hong Kong, Delaware and the

Channel Islands.

Companies, agencies, organisations and individuals throughout

the world rely upon Law Debenture to carry out our duties with the

independence and professionalism upon which our reputation is

built.

(1) Calculated based on data held by Law Debenture for the six

months ended 30 June 2021.

2 Source: Association of Investment Companies (AIC) industry

average (excluding 3i) as at 31 December 2020.

3 NAV is calculated in accordance with the AIC methodology,

based on performance data held by Law Debenture including the fair

value of the IPS business and long-term borrowings.

4 Source: Bloomberg.

5 Calculated on revenue net of cost of sales

6 Calculated as at 30 June 2021.

7 Calculated for the 10 years ended 31 December 2020.

The Law Debenture Corporation p.l.c. and its subsidiaries

Half yearly report for the six months to 30 June 2021

(unaudited)

Financial summary 30 June 30 June 31 December

2021 2020 2020

GBP000 GBP000 GBP000

--------------------------- ------- --------- -----------

Net assets(1) 936,448 642,705 787,219

Pence Pence Pence

Net Asset Value (NAV) per

share at fair value(1,2*) 766.89 543.93 666.15

Revenue return per share

- Investment portfolio 8.48 6.33 12.12

- Independent professional

services 4.39 4.18 9.35

- Group charges -- 0.09

Group revenue return per

share 12.87 10.51 21.56

Capital return/(loss) per

share 79.92 (131.86) (19.06)

Dividends per share(3) 6.875 13.0 27.50

Share price 750.00 517.00 690.00

--------------------------- ------- --------- -----------

%% %

Ongoing charges(4*) 0.50 0.48 0.55

Gearing(*) 11 19 9

(Discount)/Premium(*) (2.2) (5.0) 3.6

* Items marked "*" are considered to be alternative performance

measures. For a description of these measures, see page 128 of the

annual report and financial statements for the year ended 31

December 2020.

(1) Please see below for calculation of NAV.

(2) NAV is calculated in accordance with the AIC methodology,

based on performance data held by Law Debenture including fair

value of IPS business and long-term borrowings. NAV is shown with

debt measured at par and with debt measured at fair value.

(3) The second interim dividend is not due to be announced until

September 2021 and has not been factored in the calculation

presented. The Board have already indicated their intention to pay

three interim dividends of 6.875p with respect to 2021,

representing a quarter of the total 2020 dividend declared of

27.5p. The final dividend will be declared in February 2022.

(4) Ongoing charges are based on the costs of the investment

trust and include the Janus Henderson Investors management fee of

0.30% of NAV of the investment portfolio. There is no performance

related element to the fee.

Half yearly management report

Introduction

At the start of Law Debenture's reporting year, the UK entered a

third lockdown. This continued the Covid-19 related disruptions to

the economy to which we had become all too accustomed in 2020.

Despite these challenges, Law Debenture delivered on both of its

objectives: producing long-term capital growth and steadily

increasing income for our shareholders.

Our Investment Managers have continued their successful

long-term record of material outperformance against our benchmark,

the FTSE Actuaries All Share Index, over one, three, five and ten

years, and drivers of their performance are covered in detail in

their report. Our IPS business entered its fourth year of growth,

with net revenue up 18.2% and profit before tax up 6.1%, all while

retaining its reputation for quality and outstanding client

outcomes.

Dividend

We are pleased to continue building on our 42-year track record

of maintaining or increasing dividends, and I am extremely proud

that we have been able to do so against a backdrop of repeated

lockdowns and ensuing economic difficulty. Although the UK dividend

outlook is looking increasingly bright, predominantly thanks to the

impact of the successful vaccine rollout, some uncertainties in

global markets do remain - Law Debenture's unique structure and

diversified pool of businesses will be as important as ever.

We recently declared a first interim dividend of 6.875 pence per

ordinary share, representing an increase of 5.8% over the prior

year's first interim dividend. This once again highlights the

benefits of IPS' stable and consistent income stream, as well as

the level of our substantial revenue reserves - a crucial feature

of investment trusts that enabled us to continue delivering for our

shareholders throughout the Covid-19 crisis.

This dividend was paid on 7 July 2021 to shareholders on the

register at close of business on 4 June 2021. Based on the current

share price, the dividend yield per Law Debenture share is 3.7%.

Since the publication of our Annual Report at the end of February

2021, we have issued 4 million new ordinary shares to existing and

new investors, worth GBP29.2 million. This exceeds the GBP20

million target to refinance the acquisition of our new company

secretarial business.

It is the Board's current intention to recommend that the total

dividend in relation to 2021 is an increase on the total 2020

dividend of 27.5p. Our shareholders will be asked to vote on the

final dividend at our AGM in April 2022.

IPS performance

The IPS businesses continue to perform well. We are pleased to

be reporting strong revenue growth and growth of PBT and EPS in

line with our objective of mid to high single digit growth.

Pensions

Following a very strong first half of 2020, I am delighted to

report that our Pensions business maintained its positive momentum

with revenue growth of 10.7% in the first six months of 2021. There

is no doubt that driven by the regulator, and much like listed

company governance, professionalism of Pensions Governance in the

UK continues to increase. Over the past thirty years, the UK listed

company governance journey has seen the publication of The Cadbury

Report in 1992; The Greenbury Report in 1995; The Hempel Report in

1995; The Combined Code in 2000; The Higgs Review in 2003; The

Walker Review in 2009; The Stewardship code in 2010; and the

revised Corporate Governance Code. Whilst the Pensions journey may

not quite match that volume of governance changes, echoes from it

will be heard; regulatory burdens will increase and the demand for

high-quality expertise to help navigate through these changes will

grow.

Our non-executive Director Trustee offering was established over

fifty years ago and is one of the largest independent providers of

Pension Trustees in the UK. It is essential that we continue to

invest in our expertise in order to stay ahead of the regulatory

changes, exceed the expectations of our clients and maintain our

leading position in this growing, competitive market. During the

first half of the year we secured additional, and highly sought

after, legal and restructuring knowledge to both broaden and deepen

the skill set our Trustee team offers. During the first half of the

year, we welcomed Paul Torsney to the business with a remit to

establish a Pensions Trustee offering in Ireland, as that market

accelerates its governance enhancements.

It is clear from the meetings that I have attended this year

that our Pensions clients place a very high value on the wealth of

knowledge and experience that a Law Debenture Trustee brings to

discussions. The combined experience of the team, across a large

client footprint, takes years to replicate and is a material

competitive advantage. As the economic impact of the pandemic was

felt, new business enquiries were understandably quiet during the

first half of 2020. However, the additions to our business

development team made during this time, have produced a strong

current pipeline of new opportunities.

Our Pension Executive offering, Pegasus, continues to

demonstrate good growth. We have welcomed Sankar Mahalingham as

Director of Pegasus. Year on year revenue growth for the first six

months was again in excess of 40%. Particularly pleasing is our

ability to win new appointments across the broadest range of our

product suite from scheme secretarial, at its simplest, through to

fully outsourced pensions management and professional sole trustee

solutions, at its most complex. The pandemic has increased the

focus of Chief Financial Officers on their cost base and the

willingness of these potential buyers to outsource critical but

non-core activities continues to grow.

Similar to our Trustee offering, we have invested in the

expertise required to support our Pension Executive business. In

particular, we have added further specialists with experience in

GMP equalisation, Buy-out and Buy-in skills to our employee roster

as demand for experienced help in these areas of specialism

continues to increase.

The Pension business is now four years into a growth journey

which so far has yielded compound annual growth of 10.1%. Momentum

and operating margins are strong. Our reputation for excellence in

execution has been further enhanced as the stresses placed on the

pensions eco system, by the pandemic, have needed to be

systematically addressed. Our success is hard earned, and we are

proud of our progress. We will continue to invest in the people and

infrastructure required to be a market leader in this growth

business.

Corporate Trust

Given the 19.5% growth recorded in our Corporate Trust business

in 2020, comparisons were always going to be tough, and our broadly

flat year on year revenues are reflective of that. Last year's

excellent performance was underpinned by robust activity in both

the capital markets and post issuance work. The impact of 21%

growth in debt issuance revenues in European Capital Markets* and a

pick up in the counter cyclical post issue work that we undertake

to act as a bridge between economically stressed issuers and their

bondholders served us well in 2020. Market conditions in the first

half of 2021 have been more subdued. Overall debt issuance revenues

in Europe (our main market) were flat in the first half of the

year*. Despite the tougher operating environment, we have

maintained market share. New appointments have included trustee

appointments of public deals for Natwest, Hammerson, Gamenet,

Santander and Telegram group.

A bi-product of the unprecedented financial support offered to

corporates around the world by central governments has been a

material reduction in the number of bankruptcies recorded during

the period. By way of example, UK Insolvency Service data shows

that UK bankruptcies have approximately halved since the onset of

the pandemic and are currently running at levels not seen since the

economic boom of the late 1980's. This data helps us to understand

why following a sharp pick up in post issuance work in the first

half of 2020 as the initial impact of the pandemic was felt, our

post issuance revenues have not continued to grow as we have

experienced in prior economic downturn and recovery cycles. We do

not wish ill on any company, but we would not be surprised to see

bankruptcies return to more normal or even elevated levels as many

of the emergency funding mechanisms provided by central governments

are gradually withdrawn. This in turn would support demand for our

expertise as issuers work their way through from covenant waivers

to default and beyond.

That said, we are not passive, and we continue to invest in the

skills necessary to grow this business. During the first half of

the year we have hired an incremental business development

headcount into our team to support Corporate Trust. This resource

is being applied across our full Corporate Trust offering and

Escrow appointments have shown strong growth in terms of number,

size of underlying transaction, and breadth of underlying

purpose.

Flat year on year revenues in any business never feel good.

Given the challenging market conditions detailed above and the

substantial growth recorded last year, we consider the results to

be satisfactory. Remember too, that approximately two thirds of the

annual revenues in our book of business is contractually secured

and that over the past three this business has produced compound

annual growth in revenues of 10.9%.

Our operating margins remain strong and we continue to enhance

our reputation for speed, innovation and deep domain expertise. We

were incorporated in 1889 to act as a bond trustee and remain

confident in our ability to produce excellent outcomes for both our

clients and our shareholders over time.

*Source: Dealogic

DIVISION Revenue(1) Revenue(1) Growth

30 June 30 June 2020/2021

2021 2020

GBP000 GBP000 %

------------------- --- ---------- ---------- ----------

Pensions 6,462 5,839 10.7%

Corporate Trust 4,937 4,878 1.2%

Corporate Services 8,069 5,753 40.3%

Total 19,468 16,470 18.2%

------------------------ ---------- ---------- ----------

(1) Revenue shown is net of cost of sales.

Corporate Services

Overall, our revenues across these businesses were up by 40.3%

year on year with a material amount of this driven by acquisition

as further detailed below.

Structured Finance Services

A very small business at present for us but one that we hope to

grow materially over time. The acquired company secretarial

business enhances our capabilities and growth opportunities in a

sector that we know well, having served clients for over twenty

years. We will look to provide an extended product suite to a

significantly expanded book of clients as we get to know and

understand them .

Experience tells us that the provision of company secretarial

services can be right at the start of corporate journey. If that

journey is more of a Special Purpose Vehicle than an operating

company, it may offer opportunities for outsourced accounting and

transaction management services, both of which we provide. This is

particularly the case in the fast growing continuum of the Private

Equity/Hedge Fund/Boutique Asset Manager industries. Structurally

long on capital and constrained on headcount, such organisations

are frequent adopters of third party services to outsource elements

of their underlying asset servicing and this has yielded a number

of such appointments in the first half of the year. We will look to

accelerate our sales pipeline as we further embed our recent

acquisition.

Service of Process

As we mentioned in our latest annual report, this is our

operating business with the least recurring amount of contractual

revenues. Whilst it seems like a long time ago now, 2020 had

actually started very brightly for this business until the pandemic

took hold. Consequently, revenues for the first two and half months

of 2021 were materially down from the equivalent period in 2020.

Happily, as global economic activity started to benefit from the

easing of Covid-19 restrictions, we ended the reporting period with

our noses in front compared to last year.

Further progress will to some degree be driven by the strength,

or otherwise, of global economic activity but again we continue to

invest in building a strong growth platform. Ten days ago we rolled

out a new technology platform to support this business that will

help to scale its operations whilst enhancing control. Whilst we

will not be abandoning our traditional distribution channels, the

truly global footprint of the product lends itself well to digital

distribution channels. Additional focus from the business

development team will ensure that we build and maintain a very high

profile with our extensive referral partner network as we hopefully

emerge from lockdown in the second half of the year.

Safecall

At the year-end we announced that after twenty-two years Graham

Long, the Co-founder and CEO of Safecall would be stepping down

from his executive responsibilities in 2021 to become the

non-executive Chairman of Safecall. We are delighted to announce

that Joanna Lewis will be joining us in August to lead this

business through the next chapters in its story.

Despite the difficult economic conditions in Europe particularly

during the first quarter, the business recorded growth for the six

months to June 2021. We added 70 new clients to the platform

including high profile organisations such as ITV, The AA and Great

Ormond Street Hospital, which underscore the breadth of appeal of

our proposition.

As well as new leadership, we continue to invest in our

operating capability. Elevated levels of cases to be handled, from

an ever-expanding client base, means that we have added additional

call handlers and operations management to the team to allow us to

maintain our differentiated high quality offering.

Corporate Secretarial Services Acquisition

The headline here for the first half of 2021 was the acquisition

of the corporate secretarial business from Konexo UK, a division of

Eversheds Sutherland (International) LLP (Eversheds), a global top

10 law practice. We completed the acquisition at 5pm on Friday 29th

January. At 9am on Monday 1st February we started our journey with

the same staff, servicing the same clients, on the same commercial

terms. It was critical to both us and Eversheds that the highest

levels of client service were maintained during the transition.

Many of the clients in the newly acquired business still remain key

clients of Eversheds' broader law firm offerings.

Five months into the acquisition, we have demonstrated that we

can continue to service existing clients well. Moreover, we have

demonstrated our ability to win business with notable new

relationships including Rio Tinto and Monzo Bank.

Corporate Centre

We are now working out of our new offices at 100 Bishopsgate,

London. This new location has been well received by both our people

and clients. We continue to invest more widely in our Corporate

Centre to support the ongoing growth of our business. We have made

investments into new Finance and HR systems and strategic hires in

Business Development, HR, Finance and IT.

The acquisition also gave us a regional footprint in the North

West and on June 23rd we opened our new office at 2 New Bailey,

Manchester. We are in the process of establishing a group shared

service centre in the office to support all of our businesses; many

of our shared group functions have already transitioned from London

to Manchester. We have also taken on our first Pensions staff in

Manchester, allowing us to accelerate delivery of a regional

offering to a considerable local client base.

We recently welcomed all of our colleagues to our new offices in

both London and Manchester when government restrictions were lifted

on July 19th.

We continuously strive to ensure our expenditure and investment

serves to bring value to our shareholders. We have recently

completed a competitive audit tender process and we are delighted

to announce our intention to appoint Deloitte LLP as our new

external auditors, subject to the completion of the engagement

process. Throughout the tender process, Deloitte demonstrated the

value they would bring to the Group as our external auditors and

will be responsible for undertaking the 2021 Group audit.

Environmental, Social and Governance (ESG)

We continue to give consideration to ESG factors across both the

investment portfolio and the IPS business. We will be enhancing our

reporting on ESG in the 2021 Annual Report.

Outlook

As we enter the second half of the year, with the UK economy on

the path to recovery, we remain confident in our ability to deliver

for our shareholders. The attractiveness of Law Debenture's unique

offering is stronger than ever and is built to weather difficult

periods.

As an important source of income for many of our shareholders,

we understand the importance they place on us to deliver regular

and reliable income. We remain focussed on continuing our unbroken

42-year track record of maintaining or raising the dividend. Our

confidence is underpinned by the diversified and repeatable nature

of the revenues of our IPS business. The cash flows from IPS allow

James and Laura increased flexibility in portfolio construction to

outperform the benchmark over time.

We remain on track with our IPS business, which continues to

follow a trajectory of sustainable growth. At Law Debenture we take

a long-term view - we build to last. As part of our growth

strategy, we are investing in growing our high-quality workforce to

support our ambitious plans, enabling us to win new business while

retaining our exceptional level of client service that is critical

to superior performance. We would like to thank our staff for their

continued hard work and focus on delivering skillfully for our

clients. As previously stated, we are always alert to opportunities

presented by acquisitions, where we believe they could accelerate

the growth in returns for our shareholders.

In today's ever-changing market landscape characterised by

emerging public health risks, geopolitical threats and inflation,

there is no shortage of difficulties for investors. We are

especially pleased with James and Laura's performance.

The Board has great confidence in your Company's future and

appreciates the enduring trust you place in us with your

capital.

Denis Jackson

Chief Executive

29 July 2021

Investment manager's report

Overview

The vaccination rollout which has allowed the economy to slowly

reopen has been a positive background for equities. The results

from companies have, in aggregate, been at the top end of investor

expectations. The forward guidance by companies has been supportive

of further upgrades in earnings projections. The relationship

between earnings upgrades and share price performance is strong. It

has been a more powerful factor in investors' minds than the

growing concerns around the pick-up in inflation and any consequent

future increases in interest rates. Therefore, in spite of concerns

around the economy it has been a good period for growth in assets

and earnings.

During the first half of the year we have been net buyers of

equities as we respond to the opportunities that have arisen. The

weighting in the banking sector, for instance, has been increased

as they are benefitting from the increased economic activity with

their provisions for bad debts proving overly cautious.

The valuation of the UK market is low in an international

context as the UK market has been out of favour with international

investors for a number of years as a result of concerns over

politics and Brexit. These concerns have receded and sterling has

stabilised, which has led to a return of investor interest. This

has not just been confined to portfolio managers but also to

corporates, where takeover activity has increased. Agreed bids for

the insurer RSA (in November 2020) and St Modwen, the property

company, have been two notable examples having a positive impact on

Law Debenture's portfolio.

Portfolio performance and activity

The first six months of 2021 were a good period for the Trust on

an absolute basis and relative to the FTSE All-Share benchmark. The

Trust's NAV (keeping debt at par) grew 16.7% in the period. This

compares with the FTSE All-Share benchmark which rose 11.1%. We go

into more details of the stock-specific drivers of performance in

the attribution section below, but broadly the Trust benefitted

from its exposure to the domestic and global economic recovery. The

industrials sector, which as at the end of the period was 23.8% of

the portfolio, was a key contributor to the outperformance. For

many of the industrial companies in the portfolio, the sales

recovery that has begun in the first half of this year has come at

a time when meaningful costs have been taken out following the

pandemic. This has led to a faster than expected earnings recovery,

a trend which we expect to continue into the second half of the

year.

During the first half of the year we were net investors,

investing GBP36.4m (net). The majority of this investment

(GBP29.7m) went into the UK, as this is where we continue to

identify the most attractive valuation opportunities. As a result

the UK remains the majority of the investment portfolio (82% as at

the end of June 2021). North America was the second largest area

for net investment (GBP6.0m), consisting predominantly of a new

position in Merck and an addition to the existing position in

Schlumberger.

New positions established in the six months included Vertu

Motors, iEnergizer, Plant Health Care, Sanofi, Glencore, Convatec

and VH Global Sustainable Energy Opportunities. There is

deliberately no common end market exposure across these holdings.

They range from small domestic companies such as Vertu Motors (a UK

motor retailer) to global pharmaceutical companies such as Sanofi.

Were there to be a common theme it is that they are market leaders

in the areas they operate in, with highly experienced management

teams that are focused on growth.

The largest sale during the period was St Modwen Properties,

which was sold in June following an increased takeover offer from

private equity. This was a trend seen elsewhere in the first half

of the year with bids received (that were rejected by the boards)

for aerospace components supplier, Senior and speciality chemicals

company, Elementis.

Other full sales during the period included British American

Tobacco, following which the portfolio has no tobacco exposure. The

regulatory outlook for traditional tobacco products and next

generation products remains unclear. Therefore despite the high

dividend yields available in the sector, in our view there are

better opportunities elsewhere. The income provided by Law

Debenture's IPS business means that the investment portfolio has

flexibility to avoid investing in high dividend yield sectors that

are not viewed as attractive total return opportunities, while

continuing to provide an attractive dividend yield to

shareholders.

Portfolio attribution

In a reversal of performance in the first half of 2020 the

industrials sector was the largest positive contributor to

performance, and three of the top five best performers seen below

are in this sector. While the overall driver of industrial

performance was the economic recovery, there were distinct end

markets behind each of the holdings. Royal Mail benefitted from

heightened ecommerce demand at a time when traditional retailers

were often closed, Senior will benefit as the civil aerospace

market recovers and Kier is benefitting from strong levels of UK

infrastructure spend (such as HS2).

Applied Materials, which designs and manufactures equipment for

the semiconductor industry, is seeing good demand as semiconductors

are increasingly used in end markets outside of technology (such as

cars and white goods). BT was a new position added in November

2020. It is our view that the fibre to the home rollout that is

currently underway will provide a visible path to earnings growth

over the next decade. Following the final regulatory outcome

announced in the first half of this year, this improved growth

profile is now beginning to be reflected in the valuation.

Top five contributors

The following five stocks produced the largest absolute

contribution to performance in the first half of 2021:

Share price Contribution

total return (GBPm)

Stock (%)

Royal Mail 71.0 7.3

-------------- -------------

Senior 69.7 5.3

-------------- -------------

Applied Materials 65.0 4.3

-------------- -------------

BT Group 46.7 4.1

-------------- -------------

Kier 96.7 3.8

-------------- -------------

Source: Bloomberg calendar year share price total return as at

30 June 2021.

Top five detractors

The following five stocks produced the largest negative impact

on portfolio valuation in the first half of 2021:

Share price Contribution

total return (GBPm)

Stock (%)

SIMEC Atlantis Energy -77.4 -2.9

-------------- -------------

Ceres Power -19.9 -2.8

-------------- -------------

Provident Financial -24.4 -1.7

-------------- -------------

AFC Energy -20.0 -1.5

-------------- -------------

Hiscox -16.3 -1.5

-------------- -------------

Source: Bloomberg calendar year share price total return as at

30 June 2021.

Three of the five largest detractors from performance this year

are in the alternative energy sector (SIMEC Atlantis Energy, Ceres

Power, AFC Energy). This sector was among the key drivers of

outperformance in 2020, and we had taken significant profits in the

area, for example reducing the Ceres Power and ITM Power positions.

It remains our view that some of the companies held could be future

leaders in large end markets such as fuel cells, but the route to

full commercialisation is unlikely to be smooth. The first half of

this year saw little material news, but there was a period of share

price consolidation following good performance last year.

Provident Financial fell as a result of customer complaints in

its home collected credit business, a division which they are

currently in the process of exiting (the costs of this exit remain

uncertain). The key driver of long-term shareholder value is their

credit card business which has grown significantly over the last

decade. Hiscox is an insurer primarily for small and medium sized

businesses that incurred large events and business interruption

insurance claims last year following the pandemic. As the pandemic

progressed (for example with further 'lockdowns' in late 2020 and

early 2021) further claims levels remained unclear and this has

remained an overhang on the shares. On a longer-term basis we

continue to view Hiscox as a good quality underwriter and the

shares trade on a lower valuation than they have historically,

therefore we supported Hiscox in a placing last year and have

continued to hold the shares.

Income

It was encouraging to see a rise in investment income during the

period, which rose to GBP11.8m from GBP9.1m in 2020. Among the key

drivers of this growth was the financial sector, particularly the

banks which totalled approximately 5% of investment income in the

period (having paid nothing in the first half of 2020 as returns to

shareholders were suspended by the regulator). The comparable

investment income figure in 2019 was GBP15.1m. Therefore income

levels have recovered from the depressed levels of 2020, but have

not yet fully recovered to pre-pandemic levels. We expect further

income growth from here, driven by a combination of earnings

recovery and dividend pay-out ratios rising. For example,

continuing to use the banks as an example, while dividends have

resumed they are currently based on low pay-out ratios and excess

capital positions remain material. Therefore there is further scope

for significant dividend growth as company boards gain confidence

in the sustainability of the economic recovery.

Outlook

The approach used for running the portfolio is to focus on

companies and how they are developing, while being mindful of their

valuation. There is, however, a need to remain aware of the

macroeconomic outlook. In the short-term, economic growth should

continue to positively surprise as activities open up. The

bottlenecks in supply will be overcome by increased capital spend,

which will in time further aid growth.

An important question is how long and persistent the pick-up in

inflation will be, and how high interest rates will need to go in

response. In the medium term there will be large costs for the

economy in the move towards decarbonisation that could create long

term inflationary pressures. It is necessary in this environment

not only to be invested in companies that have pricing power

because of the relative uniqueness of their offering, but also to

be invested in companies leading the transformation of the

economy.

The portfolio is a diverse list of holdings in businesses that

are equipped to deal and respond to rapid changes in their

operating environments. Part of the evidence for this is how well

they have coped with the events of the last eighteen months.

James Henderson and Laura Foll

Investment Managers

29 July 2021

Sector distribution of portfolio by value

30 June 2021 31 December 2020

% %

Oil and gas 10.0 11.6

------------- -----------------

Basic materials 11.0 9.3

------------- -----------------

Industrials 23.8 22.0

------------- -----------------

Consumer goods 5.9 6.2

------------- -----------------

Health care 6.5 5.2

------------- -----------------

Consumer services 7.3 8.9

------------- -----------------

Telecommunications 3.1 1.9

------------- -----------------

Utilities 3.8 4.8

------------- -----------------

Financials 26.8 28.5

------------- -----------------

Technology 1.8 1.6

------------- -----------------

Geographical distribution of portfolio by value

30 June 2021 31 December 2020

% %

United Kingdom 82.0 82.1

------------- -----------------

North America 6.7 5.4

------------- -----------------

Europe 9.5 10.1

------------- -----------------

Japan 1.1 1.1

------------- -----------------

Other Pacific 0.7 0.9

------------- -----------------

Other 0.0 0.4

------------- -----------------

Fifteen largest holdings: investment rationale

at 30 June 2021

Approx. Valuation Appreciation/ Valuation

% of Market 2020 Purchases Sales (Depreciation) 2021

Rank Company portfolio Cap. GBP000 GBP000 GBP000 GBP000 GBP000

----- -------------------- ---------- -------- ---------- ------------ --------- ---------------- ----------

1 GlaxoSmithKline 2.52 GBP72bn 22,479 - - 1,296 23,775

2 Rio Tinto 2.37 GBP76bn 20,513 - - 1,796 22,309

3 Barclays 1.96 GBP29bn 7,261 8,766 - 2,454 18,481

4 HSBC 1.92 GBP85bn 11,881 5,297 - 917 18,095

5 BP 1.91 GBP63bn 14,524 - - 3,431 17,955

Royal Dutch

6 Shell 1.86 GBP60bn 15,743 - - 1,744 17,487

7 Royal Mail 1.80 GBP6bn 10,466 - (745) 7,265 16,986

8 Accsys Technologies 1.72 GBP339m 11,131 1,372 - 3,802 16,305

Lloyds Banking

9 Group 1.48 GBP33bn 7,652 3,572 - 2,783 14,007

10 Ceres Power 1.47 GBP2bn 24,198 - (7,512) (2,800) 13,886

11 Aviva 1.45 GBP16bn 11,008 - - 2,732 13,740

Morgan Advanced

12 Materials 1.44 GBP1bn 11,974 - - 1,616 13,590

Herald Investment

13 Trust 1.38 GBP2bn 17,506 - (4,034) (392) 13,080

14 National Grid 1.37 GBP33bn 12,189 - - 787 12,976

15 Anglo American 1.37 GBP41bn 10,910 - - 2,016 12,926

Calculation of net asset value (NAV) per share

Valuation of our IPS business

Accounting standards require us to consolidate the income, costs

and taxation of our IPS business into the Group income statement

below. The assets and liabilities of the business are also

consolidated into the Group column of the statement of financial

position below. A segmental analysis is provided below, which shows

a detailed breakdown of the split between the investment portfolio,

IPS business and Group charges.

Consolidating the value of the IPS business in this way failed

to recognise the value created for shareholders by the IPS

business. To address this, from December 2015, the NAV we have

published for the Group has included a fair value for the

standalone IPS business.

The current fair value of the IPS business is calculated based

upon historical earnings before interest, taxation, depreciation

and amortisation (EBITDA) for the second half of 2020, and the

EBITDA for the half year to June 2021, with an appropriate multiple

applied.

The calculation of the IPS valuation and methodology used to

derive it are included in the previous annual report at note 14. In

determining a calculated basis for the fair valuation of the IPS

business, the Directors have taken external professional advice.

The multiple applied in valuing IPS is from comparable companies

sourced from market data, with appropriate adjustments to reflect

the difference between the comparable companies and IPS in respect

of size, liquidity, margin and growth. A range of multiples is then

provided by the professional valuation firm, from which the Board

selects an appropriate multiple to apply. The multiple selected for

the current year is 10.1x, which represents a discount of 27% on

the mean multiple across the comparable companies to reflect the

relative size of the IPS business and the fact that it is

unlisted.

The comparable companies used, and their recent performance, is

presented in the table below:

Revenue EBITDA

LTM EV /EBITDA CAGR margin

Company 30 June 2021 2016-2020 LTM

Law Debenture IPS 10.1x 7% 44%

--------------- ----------- --------

Intertrust N.V. 10.3x 11% 32%

--------------- ----------- --------

SEI Investments Company 13.9x 2% 29%

--------------- ----------- --------

JTC PLC 19.8x 23% 27%

--------------- ----------- --------

SS&C Technologies Holdings,

Inc. 13.0x 30% 41%

--------------- ----------- --------

EQT Holdings Limited 13.8x 3% 39%

--------------- ----------- --------

Perpetual Limited 12.3x -1% 33%

--------------- ----------- --------

Source: Capital IQ.

It is hoped that our initiatives to inject growth into the IPS

business will result in a corresponding increase in valuation over

time. As stated above, management is aiming to achieve mid to high

single digit growth in 2021. The valuation of the IPS business has

increased by GBP59.2m/65.5% since the first valuation of the

business as at 31 December 2015.

Valuation guidelines require the fair value of the IPS business

be established on a stand-alone basis. The valuation does not

therefore reflect the value of Group tax relief from the investment

portfolio to the IPS business.

In order to assist investors, the Company restated its

historical NAV in 2015 to include the fair value of the IPS

business for the last ten years. This information is provided in

the annual report within the 10 year record.

Long-term borrowing

The methodology of fair valuing all long-term borrowings is to

benchmark the Group debt against A rated UK corporate bond

yields.

Calculation of NAV per share

The table below shows how the NAV at fair value is calculated.

The value of assets already included within the NAV per the Group

statement of financial position that relates to IPS is removed

(GBP20.9m) and substituted with the calculation of the fair value

and surplus net assets of the business (GBP128.8m). The fair value

of the business has increased by 10.1% as a result of an increased

multiple and EBITDA. An adjustment of GBP41.6m is then made to show

the Group's debt at fair value, rather than the book cost that is

included in the NAV per the Group statement of financial position.

This calculation shows NAV fair value for the Group as at 30 June

2021 of GBP936.4m or 766.89 pence per share:

30 June 2021 31 December 2020

Pence per Pence per

GBP000 share GBP000 share

------------------------------------ ----------- ---------- --------- ----------

Net asset value (NAV) per Group

statement of financial position 849,239 695.47 726,994 615.19

------------------------------------ ----------- ---------- --------- ----------

Fair valuation of IPS: EBITDA at

a multiple of 10.1x (2020: 8.7x) 138,017 113.03 125,349 106.07

Surplus net assets 11,696 9.58 10,605 8.97

Fair value of IPS business 149,713 122.61 135,954 115.05

Removal of assets already included

in NAV per financial statements (20,938) (17.15) (23,547) (19.93)

Fair value uplift for IPS business 128,775 105.46 112,407 95.12

Debt fair value adjustment (41,566) (34.04) (52,182) (44.16)

NAV at fair value 936,448 766.89 787,219 666.15

Group income statement

for the six months ended 30 June 2021 (unaudited)

30 June 2021 30 June 2020

Revenue Capital Total Revenue Capital Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

-------------------------------- --------- --------- --------- ---------- ----------- -----------

UK dividends 10,050 - 10,050 6,654 - 6,654

UK special dividends - - - 458 - 458

Overseas dividends 1,789 - 1,789 1,986 - 1,986

Overseas special dividends - - - - - -

-------------------------------- --------- --------- --------- ---------- ----------- -----------

Total dividend income 11,839 - 11,839 9,098 - 9,098

Interest income - - - 88 - 88

Independent professional

services fees 23,047 - 23,047 18,633 - 18,633

Other income 302 - 302 16 - 16

-------------------------------- --------- --------- --------- ---------- ----------- -----------

Total income 35,188 - 35,188 27,835 - 27,835

-------------------------------- --------- --------- --------- ---------- ----------- -----------

Net gain/(loss) on investments

held at fair value through

profit or loss - 99,170 99,170 - (152,698) (152,698)

-------------------------------- --------- --------- --------- ---------- ----------- -----------

Total income and capital

gains/(losses) 35,188 99,170 134,358 27,835 (152,698) (124,863)

-------------------------------- --------- --------- --------- ---------- ----------- -----------

Cost of sales (3,579) - (3,579) (2,163) - (2,163)

Administrative expenses (14,826) (1,105) (15,931) (11,943) (1,145) (13,088)

--------------------------------

Operating profit/(loss) 16,783 98,065 114,848 13,729 (153,843) (140,114)

Finance costs

Interest payable (660) (1,979) (2,639) (660) (1,979) (2,639)

Profit/(loss) before

taxation 16,123 96,086 112,209 13,069 (155,822) (142,753)

Taxation (650) - (650) (650) - (650)

Profit/(loss) for the

period 15,473 96,086 111,559 12,419 (155,822) (143,403)

-------------------------------- --------- --------- --------- ---------- ----------- -----------

Return per ordinary share

(pence) 12.87 79.92 92.79 10.51 (131.86) (121.35)

Diluted return per ordinary

share (pence) 12.87 79.92 92.79 10.51 (131.86) (121.35)

-------------------------------- --------- --------- --------- ---------- ----------- -----------

Statement of comprehensive income

for the six months ended 30 June 2021 (unaudited)

30 June 2021 30 June 2020

Revenue Capital Total Revenue Capital Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

-------------------------------- ------- ------- ------- ------- ---------- ----------

Profit/(loss) for the

period 15,473 96,086 111,559 12,419 (155,822) (143,403)

-------------------------------- ------- ------- ------- ------- ---------- ----------

Foreign exchange on translation

of foreign operations - (20) (20) - 489 489

Total comprehensive income

for the period 15,473 96,066 111,539 12,419 (155,333) (142,914)

-------------------------------- ------- ------- ------- ------- ---------- ----------

Group statement of financial position

Unaudited Unaudited Audited

30 June 2021 30 June 2020 31 December 2020

Non-current assets GBP000 GBP000 GBP000

--------------------------------- -------------- -------------- ------------------

Goodwill 20,122 1,966 1,914

Property, plant and equipment 2,202 78 1,088

Right-of-use asset 5,591 5,632 5,413

Other intangible assets 620 73 619

Investments held at fair

value through profit or

loss 945,471 701,014 812,297

Retirement benefit asset - 3,180 -

Deferred tax assets 771 - 771

Total non-current assets 974,777 711,943 822,102

--------------------------------- -------------- -------------- ------------------

Current assets

Trade and other receivables 12,979 9,208 16,129

Other accrued income and

prepaid expenses 9,759 5,822 6,529

Cash and cash equivalents 9,885 25,504 41,762

--------------------------------- -------------- -------------- ------------------

Total current assets 32,623 40,534 64,420

--------------------------------- -------------- -------------- ------------------

Total assets 1,007,400 752,477 886,522

--------------------------------- -------------- -------------- ------------------

Current liabilities

Trade and other payables 25,490 13,376 27,405

Lease liability 250 240 -

Corporation tax payable 763 814 238

Deferred tax liability - 150 -

Other taxation including

social security 670 714 860

Deferred income 5,305 5,417 4,367

Total current liabilities 32,478 20,711 32,870

--------------------------------- -------------- -------------- ------------------

Non-current liabilities

and deferred income

--------------------------------- -------------- -------------- ------------------

Long-term borrowings 114,214 114,179 114,201

Deferred income 3,234 2,451 4,011

Lease liability 5,881 5,803 5,606

Retirement benefit liability 2,354 - 2,840

Provision for onerous contracts - 127 -

--------------------------------- -------------- -------------- ------------------

Total non-current liabilities 125,683 122,560 126,658

--------------------------------- -------------- -------------- ------------------

Total net assets 849,239 609,206 726,994

--------------------------------- -------------- -------------- ------------------

Equity

Called up share capital 6,123 5,922 5,923

Share premium 38,346 9,171 9,277

Own shares (2,003) (1,533) (1,461)

Capital redemption 8 8 8

Translation reserve 1,982 2,386 2,002

Capital reserves 770,677 541,297 674,591

Retained earnings 34,106 51,955 36,654

Total equity 849,239 609,206 726,994

--------------------------------- -------------- -------------- ------------------

Net Asset Value (pence)

per share 695.47 515.58 615.19

--------------------------------- -------------- -------------- ------------------

Group statement of cash flows

Unaudited Unaudited Audited

30 June 2021 30 June 2020 31 December 2020

GBP000 GBP000 GBP000

---------------------------------------- -------------- -------------- ------------------

Operating activities

Operating profit/(loss) before

interest payable and taxation 114,848 (140,114) 9,406

(Gains)/losses on investments (98,066) 153,843 18,570

Foreign exchange (gains)/losses - (26) 19

Depreciation of property, plant

and equipment 181 21 37

Depreciation of right-of-use

assets 354 572 1,179

Interest on lease liability 257 35 49

Amortisation of intangible assets - 37 59

Loss on sale of fixed assets - - (15)

(Increase)/decrease) in receivables (80) (811) (9,007)

(Decrease)/increase in payables (1,931) 163 14,926

Transfer from capital reserves (800) (798) (1,341)

Normal pension contributions

in excess of cost (486) (480) (960)

---------------------------------------- -------------- -------------- ------------------

Cash generated from operating

activities 14,277 12,442 32,922

---------------------------------------- -------------- -------------- ------------------

Taxation (125) (479) (1,103)

Operating cash flow 14,152 11,963 31,819

---------------------------------------- -------------- -------------- ------------------

Investing activities

Acquisition of property, plant

and equipment (1,295) (31) (1,079)

Expenditure on intangible assets (1) (6) (574)

Purchase of investments (112,370) (89,827) (173,831)

Sale of investments 77,980 58,089 166,908

Acquisition of subsidiary undertakings (18,208) - -

Cash flow from investing activities (53,894) (31,775) (8,576)

---------------------------------------- -------------- -------------- ------------------

Financing activities

Interest paid (2,639) (2,639) (5,278)

Dividends paid (18,021) (22,976) (46,071)

Payment of lease liability (212) (613) (1,163)

Proceeds of increase in share

capital 29,269 25 132

Purchase of own shares (542) (201) (129)

Net cash flow from financing

activities 7,855 (26,404) (52,509)

---------------------------------------- -------------- -------------- ------------------

Net decrease in cash and cash

equivalents (31,887) (46,216) (29,266)

---------------------------------------- -------------- -------------- ------------------

Cash and cash equivalents at

beginning of period 41,762 71,236 71,236

Foreign exchange gains/(losses)

on cash and cash equivalents 10 484 (208)

Cash and cash equivalents at

end of period 9,885 25,504 41,762

---------------------------------------- -------------- -------------- ------------------

Group statement of changes in equity

Share Share Own Capital Translation Capital Retained

capital premium shares redemption reserve reserves earnings Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

--------------------- --------- --------- -------- ------------ ------------ ---------- ---------- ---------

Balance at

1 January 2021 5,923 9,277 (1,461) 8 2,002 674,591 36,654 726,994

--------------------- --------- --------- -------- ------------ ------------ ---------- ---------- ---------

Net gain for

the period - - - - - 96,086 15,473 111,559

Foreign exchange - - - - (20) - - (20)

--------------------- --------- --------- -------- ------------ ------------ ---------- ---------- ---------

Total comprehensive

income for

the period - - - - (20) 96,086 15,473 111,539

Issue of shares 200 29,069 - - - - - 29,269

Movement in

own shares - - (542) - - - - (542)

Dividend relating

to 2020 - - - - - - (9,614) (9,614)

Dividend relating

to 2021 - - - - - - (8,407) (8,407)

Total equity

at 30 June

2021 6,123 38,346 (2,003) 8 1,982 770,677 34,106 849,239

--------------------- --------- --------- -------- ------------ ------------ ---------- ---------- ---------

Group segmental analysis

Independent Professional

Investment Portfolio Services Group charges Total

----------------------------------- --------------------------------- --------------------------- ------------------------------------

30 30 30 30 30

June 30 31 June June 31 June June 31 30 30 31

2021 June 2020 Dec 2020 2021 2020 Dec 2020 2021 2020 Dec 2020 June 2021 June 2020 Dec 2020

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

---------------- ---------- ----------- ---------- --------- ---------- ---------- ------- ------- --------- ----------- ----------- ----------

Revenue

Segment income 11,839 9,098 17,937 23,047 18,633 38,898 - - - 34,886 27,731 56,835

Other income 299 12 213 3 4 6 - - - 302 16 219

Cost of sales - - - (3,579) (2,163) (4,405) - - - (3,579) (2,163) (4,405)

Administration

costs (1,289) (1,034) (2,570) (13,537) (10,909) (22,301) - - (8) (14,826) (11,943) (24,879)

Release of

onerous

contracts - - - - - - - - 118 - - 118

----------------

10,849 8,076 15,580 5,934 5,565 12,198 - - 110 16,783 13,641 27,888

Interest

payable

(net) (660) (600) (1,260) - 28 29 - - - (660) (572) (1,231)

---------------- ---------- ----------- ---------- --------- ---------- ---------- ------- ------- --------- ----------- ----------- ----------

Return,

including

profit on

ordinary

activities

before

taxation 10,189 7,476 14,320 5,934 5,593 12,227 - - 110 16,123 13,069 26,657

Taxation - - - (650) (650) (1,178) - - - (650) (650) (1,178)

---------------- ---------- ----------- ---------- --------- ---------- ---------- ------- ------- --------- ----------- ----------- ----------

Return,

including

profit

attributable

to

shareholders 10,189 7,476 14,320 5,284 4,943 11,049 - - 110 15,473 12,419 25,479

---------------- ---------- ----------- ---------- --------- ---------- ---------- ------- ------- --------- ----------- ----------- ----------

Return per

ordinary

share (pence) 8.48 6.33 12.12 4.39 4.18 9.35 - - 0.09 12.87 10.51 21.56

---------------- ---------- ----------- ---------- --------- ---------- ---------- ------- ------- --------- ----------- ----------- ----------

Assets 952,257 714,209 850,255 55,122 38,218 36,246 21 50 21 1,007,400 752,477 886,522

Liabilities (123,977) (128,105) (146,992) (34,184) (15,039) (12,536) - (127) - (158,161) (143,271) (159,528)

---------------- ---------- ----------- ---------- --------- ---------- ---------- ------- ------- --------- ----------- ----------- ----------

Total net

assets 828,280 586,104 703,263 20,938 23,179 23,710 21 (77) 21 849,239 609,206 726,994

---------------- ---------- ----------- ---------- --------- ---------- ---------- ------- ------- --------- ----------- ----------- ----------

The capital element of the income statement is wholly

attributable to the investment portfolio.

Principal risks and uncertainties

The principal risks of the Company relate to the investment

activities and include market price risk, foreign currency risk,

liquidity risk, interest rate risk, credit risk, country/region

risk and regulatory risk. These are explained in the notes to the

annual accounts for the year ended 31 December 2020. In the view of

the Board these risks are as applicable to the remaining six months

of the financial year as they were to the period under review.

Since the year end the Board has continued to consider the risks

faced by the Corporation arising from the Covid-19 pandemic on both

the investment portfolio and the ability of the IPS business to

operate. More information on the impact is given above in the half

yearly management report and the Investment Manager's report.

The principal risks of the IPS business arise during the course

of defaults, potential defaults and restructurings where we have

been appointed to provide services. To mitigate these risks we work

closely with our legal advisers and, where appropriate, financial

advisers, both in the set up phase to ensure that we have as many

protections as practicable, and at all other stages whether or not

there is a danger of default.

Related party transactions

There have been no related party transactions during the period

which have materially affected the financial position or

performance of the Group. During the period transactions between

the Corporation and its subsidiaries have been eliminated on

consolidation. Details of related party transactions are given in

the notes to the annual accounts for the year ended 31 December

2020.

Directors' responsibility statement

We confirm that to the best of our knowledge:

-- the condensed set of financial statements have been prepared

in accordance with IAS 34 Interim Financial Reporting as adopted by

the EU and gives a true and fair view of the assets, liabilities,

financial position and profit of the Group as required by DTR

4.2.4R;

-- the half yearly report includes a fair review of the information required by:

(a) DTR 4.2.7R of the Disclosure Guidance and Transparency

Rules, being an indication of important events that have occurred

during the first six months of the current financial year and their

impact on the condensed set of financial statements; and a

description of the principal risks and uncertainties for the

remaining six months of the year; and

(b) DTR 4.2.8R of the Disclosure Guidance and Transparency

Rules, being related party transactions that have taken place in

the first six months of the current financial year and that have

materially affected the financial position or performance of the

entity during that period.

On behalf of the Board

Robert Hingley

Chairman

29 July 2021

Basis of preparation

The results for the period have been prepared in accordance with

International Financial Reporting Standards (IAS 34 - Interim

financial reporting).

The financial resources available are expected to meet the needs

of the Group for the foreseeable future. The financial statements

have therefore been prepared on a going concern basis.

The Group's accounting policies during the period are the same

as in its 2020 annual financial statements, except for those that

relate to new standards effective for the first time for periods

beginning on (or after) 1 January 2021, and will be adopted in the

2021 annual financial statements.

Notes

1. Presentation of financial information

The financial information presented herein does not amount to

full statutory accounts within the meaning of section 435 of the

Companies Act 2006 and has neither been audited nor reviewed

pursuant to guidance issued by the Auditing Practices Board. The

annual report and financial statements for 2020 have been filed

with the Registrar of Companies. The independent auditor's report

on the annual report and financial statements for 2020 was

unqualified, did not include a reference to any matters to which

the auditor drew attention by way of emphasis without qualifying

the report, and did not contain a statement under section 498(2) or

(3) of the Companies Act 2006.

2. Calculations of NAV and earnings per share

The calculations of NAV and earnings per share are based on:

NAV: shares at end of the period 122,109,313 (30 June 2020:

118,159,734; 31 December 2020: 118,173,664) being the total number

of shares in issue less shares acquired by the ESOT in the open

market.

Income: average shares during the period 120,226,033 (30 June

2020: 118,169,964; 31 December 2020: 118,171,875) being the

weighted average number of shares in issue after adjusting for

shares held by the ESOT.

3. Listed investments

Listed investments are all traded on active markets and as

defined by IFRS 7 are Level 1 financial instruments. As such they

are valued at unadjusted quoted bid prices. Unlisted investments

are Level 3 financial instruments. They are valued by the Directors

using unobservable inputs including the underlying net assets of

the instruments.

4. Portfolio investments

A full list of investments is included on the website each

month.

5. Half yearly report 2021

The half yearly report 2021 will be available on the website in

early August via the following link:

https://www.lawdebenture.com/investment-trust/shareholder-information/annual-reports-and-half-yearly-reports

Registered office:

8th Floor, 100 Bishopsgate, London, EC2N 4AG Telephone: 020 7606

5451

(Registered in England - No. 00030397)

LEI number - 2138006E39QX7XV6PP21

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FLFLDDEIAFIL

(END) Dow Jones Newswires

July 30, 2021 02:00 ET (06:00 GMT)

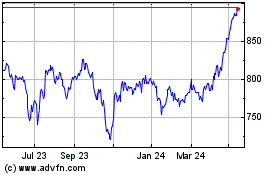

Law Debenture (LSE:LWDB)

Historical Stock Chart

From Jun 2024 to Jul 2024

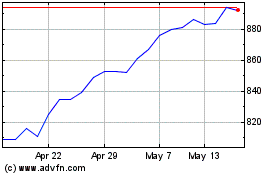

Law Debenture (LSE:LWDB)

Historical Stock Chart

From Jul 2023 to Jul 2024