TIDMLDSG

RNS Number : 5550Y

Leeds Group PLC

17 January 2022

Issued on behalf of Leeds Group plc

Embargoed: 7.00am

Date: 17 January 2022

Leeds Group plc

("Leeds Group" or the "the Group")

Unaudited Interim Results for the six months ended 30 November

2021

The unaudited interim results of Leeds Group plc ("Leeds Group"

or "the Group") for the six months ended 30 November 2021 are

presented as follows:

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014 (MAR) and has been arranged

for release by Jan G Holmstrom, Chairman. The Directors of the

Company accept responsibility for the content of this

announcement.

Enquiries:

Leeds Group plc Cairn Financial Advisers LLP

Dawn Henderson - 01937 547877 Liam Murray/Sandy Jamieson - 020 7213 0880

Chairman's Statement

The activities of the Group are that of a wholesaler and

retailer of fabrics and haberdashery and are conducted by its

German trading subsidiary Hemmers/Itex Textil Import Export GmbH

("Hemmers") and Stoff-Ideen-KMR GmbH ("KMR"), a subsidiary of

Hemmers also based in Germany.

As already communicated in our AGM statement of 23 November

2021, the ongoing Covid-19 pandemic continues to impact on the

Group's trading activities. It had been expected that the early

months of this financial year would be difficult but that there

would then be a gradual return to more normal trading levels.

However, the prolonged nature of the pandemic, exacerbated by the

emergence of the Omicron variant in late November 2021, has

impacted consumer confidence and caused many our customers to

become overstocked and reduce demand while they correct that

position. Although there have been no further country-wide

lockdowns in Germany, the German government and other European

governments have introduced restrictions to curb the spread of the

new Omicron variant which directly impact retail operations. Sales

at Hemmers and KMR have consequently reduced by 19% and 33%

respectively compared with the previous year which is consistent

with reductions being reported by competitors in our sector.

The Group turnover in the first six months of the financial year

was GBP15,592,000 (2020: GBP19,956,000): Hemmer's turnover

decreased to GBP12,668,000 (2020: GBP15,598,000) and KMR turnover

decreased to GBP2,924,000 (2020: GBP4,358,000).

Hemmers and KMR management teams are monitoring and managing the

Covid-19 market situation to ensure the cost base and inventories

are aligned over time with the reduced turnover, however, t he

Group made a loss before tax of GBP487,000 (2020: profit of

GBP735,000. Hemmers reported a loss of GBP192,000 (2020: profit of

GBP729,000) and KMR a loss of GBP242,000 (2020: profit of

GBP145,000). Management will take further action in the second half

of the year to reduce costs further and will also apply for further

government financial support.

Group net bank debt, as analysed in note 4, was GBP5,877,000 as

at 30 November 2021 (30 November 2020: GBP4,034,000; 31 May 2021:

GBP3,952,000). Group debt increased in the first half of the year

due to the reduced level of trading and seasonal increased stock

levels.

The short-term business outlook remains difficult to predict

because of the prolonged nature of the pandemic with new variants

continuing to emerge. In the medium term we assume that increased

immunity amongst the population will enable a return to more normal

trading levels and profitability.

Jan G Holmstrom

Chairman

17 January 2022

Unaudited Consolidated Statement of Comprehensive Income

for the six months ended 30 November 2021

6 months 6 months Year to

to to 31 May

30 November 30 November 2021

2021 2020 GBP000

GBP000 GBP000

---------------------------------------- -------------- -------------- --------------------

Continuing operations

Revenue 15,592 19,956 33,013

Cost of sales (12,514) (15,371) (26,700)

Gross profit 3,078 4,585 6,313

Distribution costs (1,250) (1,442) (2,647)

Administrative costs (2,188) (2,293) (4,912)

Other income - - 966

(Loss)/profit from operations (360) 850 (280)

Finance expense (127) (115) (228)

(Loss)/profit before tax (487) 735 (508)

Taxation - - 42

(Loss)/profit for the period/year

attributable to the equity holders

of the Parent Company (487) 735 (466)

Other comprehensive loss for the

period/year (101) (63) (556)

Total comprehensive (loss)/profit

for the period/year attributable

to the equity holders of the Company (588) 672 (1,022)

======================================== ============== ============== ====================

(Loss)/earnings per share for profit attributable to the equity

holders of the Company

6 months 6 months Year to

to to 31 May

30 November 30 November 2021

2021 2020

------------------------------------------ -------------- -------------- ----------

Basic and diluted total (loss)/earnings

per share (pence) (1.8)p 2.6p (1.7)p

========================================== ============== ============== ==========

Unaudited Consolidated Statement of Financial Position

at 30 November 2021

As at As at As at

30 November 30 November 31 May

2021 2020 2021

GBP000 GBP000 GBP000

----------------------------------- -------------- -------------- ---------

Assets

Non-current assets

Property, plant and equipment 7,631 8,104 7,750

Right-of-use assets 2,175 1,962 2,453

Intangible assets 57 66 58

Total non-current assets 9,863 10,132 10,261

----------------------------------- -------------- -------------- ---------

Current assets

Inventories 12,446 10,851 10,287

Trade and other receivables 3,755 3,862 2,867

Corporation tax recoverable 61 77 136

Cash on demand and on short term

deposit 216 905 670

Total current assets 16,478 15,695 13,960

----------------------------------- -------------- -------------- ---------

Total assets 26,341 25,827 24,221

=================================== ============== ============== =========

Liabilities

Non-current liabilities

Loans and borrowings (987) (1,751) (1,498)

Lease liabilities (1,006) (1,075) (1,856)

Total non-current liabilities (1,993) (2,826) (3,354)

----------------------------------- -------------- -------------- ---------

Current liabilities

Trade and other payables (3,649) (2,532) (2,265)

Loans and borrowings (5,102) (3,188) (2,926)

Lease liabilities (1,524) (893) (1,015)

Derivative financial liability - (33) -

Provisions (100) (100) (100)

Total current liabilities (10,375) (6,746) (6,306)

----------------------------------- -------------- -------------- ---------

Total liabilities (12,368) (9,572) (9,660)

=================================== ============== ============== =========

TOTAL NET ASSETS 13,973 16,255 14,561

=================================== ============== ============== =========

Capital and reserves attributable

to

equity holders of the company

------------------------------------ -------- -------- --------

Share capital 3,279 3,792 3,279

Capital redemption reserve 1,113 600 1,113

Treasury share reserve - (807) -

Foreign exchange reserve 2,084 2,678 2,185

Retained earnings 7,497 9,992 7,984

TOTAL EQUITY 13,973 16,255 14,561

==================================== ======== ======== ========

Unaudited Consolidated Cash Flow Statement

for the six months ended 30 November 2021

6 months 6 months Year to

to to 31 May

30 November 30 November 2021

2021 2020 GBP000

GBP000 GBP000

---------------------------------------------- -------------- -------------- ---------

Cash flows from operating activities

(Loss)/profit for the period/year (487) 735 (466)

Adjustments for:

Government assistance credit - - (966)

Depreciation of property, plant and

equipment 334 381 624

Depreciation of right-of-use assets 461 447 1,062

Impairment of right-of-use assets - - 333

Amortisation of intangible assets - - 6

Finance expense - interest on bank

loans 89 80 154

Finance expense - interest lease

liabilities 38 35 74

Movement in derivative financial - 33 -

assets

Gain on sale of fixed assets - (30) (14)

Taxation credit - - (42)

Cash flows generated from operating

activities before changes in working

capital and provisions 435 1,681 765

Increase in inventories (2,254) (713) (571)

(Increase)/decrease in trade and

other receivables (677) (416) 718

Increase/(decrease) in trade and

other payables 1,386 (323) (599)

Cash (used in)/generated from operating

activities (1,110) 229 313

Taxation received 73 134 110

Net cash flows (used in)/generated

from operating activities (1,037) 363 423

============================================== ============== ============== ===========

Investing activities

Purchase of property, plant and equipment (283) (347) (562)

Proceeds from sale of fixed assets - 38 21

Net cash used in investing activities (283) (309) (541)

============================================== ============== ============== ===========

Financing activities

Bank borrowings drawn 2,272 339 787

Bank borrowings repaid (564) - (771)

Repayment of principal on lease liabilities (519) (475) (985)

Repayment of interest on lease liabilities (38) (35) (74)

Bank interest paid (89) (80) (154)

Government assistance received - - 705

Net cash generated from/(used in)

financing activities 1,062 (251) (492)

============================================== ============== ============== ===========

Net decrease in cash and cash equivalents (258) (197) (610)

Translation loss on cash and cash

equivalents (2) (2) (22)

Cash and cash equivalents at beginning

of period/year 472 1,104 1,104

Cash and cash equivalents at end

of period/year 212 905 472

============================================== ============== ============== ===========

Cash on demand or on short term deposit 216 905 670

Bank overdrafts (4) - (198)

============================================== ============== ============== ===========

Cash and cash equivalents at end

of period/year 212 905 472

============================================== ============== ============== ===========

Unaudited Consolidated Statement of Changes in Equity

for the six months ended 30 November 2021

Share Capital Treasury Foreign Retained Total

capital redemption share exchange earnings equity

reserve reserve reserve

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

---------------------- ---------- ------------- ---------- ----------- ----------- ---------

At 1 June 2021 3,279 1,113 - 2,185 7,984 14,561

Loss for the period - - - - (487) (487)

Other comprehensive

loss - - - (101) - (101)

At 30 November 2021 3,279 1,113 - 2,084 7,497 13,973

====================== ========== ============= ========== =========== =========== =========

Share Capital Treasury Foreign Retained Total

capital redemption share exchange earnings equity

reserve reserve reserve

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

------------------------ ---------- ------------- ---------- ----------- ----------- ---------

At 1 June 2020 3,792 600 (807) 2,741 9,257 15,583

Profit for the period - - - - 735 735

Other comprehensive

loss - - - (63) - (63)

At 30 November 2020 3,792 600 (807) 2,678 9,992 16,255

======================== ========== ============= ========== =========== =========== =========

Share Capital Treasury Foreign Retained Total

capital redemption share exchange earnings equity

reserve reserve reserve

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

--------------------------- ---------- ------------- ---------- ----------- ----------- ---------

At 1 June 2020 3,792 600 (807) 2,741 9,257 15,583

Cancellation of treasury

shares (513) 513 807 - (807) -

Loss for the year - - - - (466) (466)

Other comprehensive

income - - - (556) - (556)

At 31 May 2021 3,279 1,113 - 2,185 7,984 14,561

=========================== ========== ============= ========== =========== =========== =========

The following describes the nature and purpose of each reserve

within equity:

Reserve Description and purpose

-------------------------- -----------------------------------------------------

Capital redemption Amounts transferred from share capital on redemption

reserve of issued shares

Treasury share reserve Cost of own shares held in treasury

Foreign exchange reserve Gains/(losses) arising on retranslation of

the net assets of overseas operations into

sterling

Retained earnings Cumulative net gains/(losses) recognised in

the consolidated statement of comprehensive

income after deducting the cost of cancelled

treasury shares

Notes to the Interim Results

for the six months ended 30 November 2021

1. General information

Leeds Group plc is an AIM listed public company, limited by

shares and incorporated in England and Wales under the Companies

Act and its number is 00067863. The address of the registered

office is Craven House, 14-18 York Road, Leeds, Wetherby, LS22

6SL.

The interim results for the six months ended 30 November 2021

and 30 November 2020 are unaudited. The interim financial

statements have been prepared using accounting policies consistent

with International Accounting Standards in conformity with the

Companies Act 2006. The Group has chosen not to comply with IAS 34

'Interim Financial Statement' in these interim financial

statements.

The financial information for the year ended 31 May 2021 does

not constitute the full statutory accounts for that period. The

Annual Report and Financial Statements for the year ended 31 May

2021 have been filed with the Registrar of Companies. The

Independent Auditor's Report on the Annual Report and Financial

Statements for the year ended 31 May 2021 was unqualified, did not

draw attention to any matters by way of emphasis, and did not

contain a statement under 498(2) or 498(3) of the Companies Act

2006.

2. Accounting policies

Basis of preparation

This announcement has been prepared using accounting policies

consistent with International Financial Reporting Standards (IFRS)

and in conformity with the Companies Act 2006.

Going Concern

When considering its opinion about the application of the going

concern basis of preparation of the interim results, the Directors

have given due consideration to the historic performance of the

Group, the robustness of forecasts prepared for the period to 31

May 2023, the ongoing impact of the Covid-19 pandemic on the

business, its suppliers and its customers, the financing facilities

available to the Group and the circumstances in which these could

be limited or withdrawn.

Forecasts have been prepared for the period to 31 May 2024 which

indicates a return to profit over the period. These forecasts are

based on the current Covid-19 conditions and assume that there will

be no protracted periods of country-wide lockdowns. Both Hemmers

and KMR are located in Germany and have been affected by

restrictions imposed by the German and other European governments.

Management continues to work hard to manage the effects of the

ongoing pandemic on both businesses. In the medium term we assume

that increased immunity amongst the population will enable a return

to more normal trading levels and profitability.

Bank debt has increased as expected in the first half of the

year. Both businesses are trading within their banking facilities.

The Directors have prepared sensitivities on these forecasts and

will continually review the current situation with regard to the

Covid-19 pandemic, but the Directors are of the currently available

facilities will be sufficient for all the various scenarios.

Considering the trading results in the first half of the current

financial year, the likely ongoing impact of the Covid-19 pandemic

and the headroom available on the working capital facilities, the

Directors are of the opinion that it is appropriate to apply the

going concern basis of preparation to the financial statements.

2. (Loss)/earnings per share

Ordinary shares of 12 pence each used in the calculation of

earnings per share:

6 months 6 months Year to

to to 31 May

30 November 30 November 2021

2021 2020

------------------------------ -------------- -------------- ------------

Number of shares (basic and

diluted) 27,320,843 27,320,843 27,320,843

============================== ============== ============== ============

3. Segmental information

Group external revenue 6 months 6 months Year to

to to 31 May

30 November 30 November 2021

2021 2020 GBP000

GBP000 GBP000

------------------------- -------------- -------------- ----------

Continuing operations

Hemmers 12,668 15,598 27,669

KMR 2,924 4,358 5,344

Group external revenue 15,592 19,956 33,013

========================= ============== ============== ==========

Group (loss)/profit before tax 6 months 6 months Year to

to to 31 May

30 November 30 November 2021

2021 2020 GBP000

GBP000 GBP000

--------------------------------- -------------- -------------- ---------

Continuing operations

Hemmers (192) 621 (21)

KMR (242) 145 (311)

Holding company (53) (31) (176)

Group (loss)/profit before tax (487) 735 (508)

================================= ============== ============== =========

Group net assets As at As at As at

30 November 30 November 31 May

2021 2020 2021

GBP000 GBP000 GBP000

------------------------ -------------- -------------- ----------

Continuing operations

Hemmers 9,931 11,779 10,214

KMR 1,292 1,541 1,545

Holding company 2,750 2,935 2,802

Group net assets 13,973 16,255 14,561

======================== ============== ============== ==========

4. Analysis of net bank debt

As at As at As at

30 November 30 November 31 May

2021 2020 2021

GBP000 GBP000 GBP000

-------------------------------------- -------------- -------------- ---------

Cash on demand and on short

term deposit 216 905 670

Bank overdrafts (4) - (198)

Current loans and borrowings (5,102) (3,188) (2,926)

Non - current loans and borrowings (987) (1,751) (1,498)

Net bank debt at end of period/year (5,877) (4,034) (3,952)

====================================== ============== ============== =========

Current loans and borrowings

At 30 November 2021 current loans and borrowings of GBP5,102,000

(2020: GBP3,188,000) comprise short term loans of GBP4,804,000 and

instalments due on long term loans detailed below of GBP298,000.

The interest rate on the short-term loans ranges from 1.5% to 3%

(2020: 1.25% to 3%) and these loans are secured on working capital

of Hemmers and KMR. The short-term loans are drawn down by Hemmers

against short-term borrowing facilities of up to a maximum of

GBP9.8m (EUR11.5m) and by KMR against short-term borrowing

facilities of GBP0.9m (EUR1m).

Non-current loans and borrowings

A non-current loan was drawn down in 2007 from Kreissparkasse to

finance the freehold extension of the warehouse in Nordhorn. This

has been repaid early during the first half of the year and

refinanced by short term debt at lower interest rates. In 2016 and

2017 further loans were drawn down to finance developments at

Nordhorn.

The Group's loans and borrowings are within the accounts of

Hemmers. They are denominated in Euros, and their principal terms

are as follows:

Fixed Repayment Final As at As at As at

interest profile repayment 30 November 30 November 31 May

rate date 2020 2020 2021

GBP000 GBP000 GBP000

Equal

Loan monthly September

1 4.07% instalments 2027 - 400 353

Equal

Loan quarterly September

2 1.65% instalments 2025 710 995 835

Equal

Loan quarterly March

3 1.05% instalments 2026 277 356 310

Non-current loans 987 1,751 1,498

==================================== ============ ================ ================ ===========

5 . Forward-Looking Statements

Certain statements made in this announcement are forward-looking

statements. These forward-looking statements are not historical

facts but rather are based on the Company's current expectations,

estimates, and projections about its industry; its beliefs; and

assumptions. Words such as 'anticipates,' 'expects,' 'intends,'

'plans,' 'believes,' 'seeks,' 'estimates,' and similar expressions

are intended to identify forward-looking statements. These

statements are not a guarantee of future performance and are

subject to known and unknown risks, uncertainties, and other

factors, some of which are beyond the Company's control, are

difficult to predict, and could cause actual results to differ

materially from those expressed or forecasted in the

forward-looking statements. The Company cautions security holders

and prospective security holders not to place undue reliance on

these forward-looking statements, which reflect the view of the

Company only as of the date of this announcement. The

forward-looking statements made in this announcement relate only to

events as of the date on which the statements are made. The Company

will not undertake any obligation to release publicly any revisions

or updates to these

forward-looking statements to reflect events, circumstances, or

unanticipated events occurring after the date of this announcement

except as required by law or by any appropriate regulatory

authority.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR UVSWRUVUAAAR

(END) Dow Jones Newswires

January 17, 2022 02:00 ET (07:00 GMT)

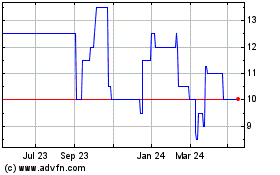

Leeds (LSE:LDSG)

Historical Stock Chart

From Dec 2024 to Jan 2025

Leeds (LSE:LDSG)

Historical Stock Chart

From Jan 2024 to Jan 2025