RNS No 1145q

INTERNET TECHNOLOGY GROUP PLC

8 September 1999

PART 2

13.Information on the ITG Group

Business description

ITG, based in Putney, London, is the parent company of two

leading UK Internet Service Providers: GX Networks and

Global Internet. The combination of the group's growing

base of leased line and web hosting customers through GX

Networks, and extensive dial-up operations through Global

Internet, makes ITG one of the largest carrier-independent

ISPs in the UK.

ITG currently serves the enterprise market in the UK and in

the Netherlands through its GX Networks subsidiary. ITG's

strategy is to provide a range of Internet and networking

services to business clients across Europe. Products and

services are built around high bandwidth, flexible Internet

connections, and value added services, as well as

commercial web hosting products ranging from aggressively

priced solutions for the SME to high-end server solutions.

By taking advantage of the company's high quality data

centres with back-up power, multiple high bandwidth network

connections and peering arrangements, ITG can serve the

most stringent demands of eBusiness.

ITG's Business Services Group provides a complete range of

ISDN Internet access and web hosting products sold through

a specialised telesales group, providing SME customers with

the appropriate product for their network needs.

ITG's UK subscription-based Global Internet service is

targeted at SME, SOHO and serious consumer Internet users,

differentiated through the addition of value added

services. ITG has also recently launched two own-brand,

subscription-free consumer Internet access services: Dial-

Start and FreeNetName. The latter offers consumers a choice

of their own personalised domain name for the email address

and website. Furthermore, through a dedicated sales team,

ITG offers outsourced dial-up access services to major

brand owners who wish to market a free Internet service.

These subscription free Internet services generate income

for ITG in the form of payments from the telephone

companies who terminate the calls.

As part of its strategy to become a pan-European Internet

services company, ITG is starting a subsidiary in France

with a data centre and offices in Paris. ITG has a publicly

stated strategy for expansion further into Europe, aiming

to provide services in the key Northern European markets

(UK, France, Netherlands and Germany) next year, when it

will offer sophisticated services, such as virtual private

networks, on its pan-European infrastructure.

ITG's strategy is underpinned by the commitment of

substantial funds and engineering resources to building a

highly resilient network and dial-up services platform. The

strategy is to use high bandwidth transmission facilities

sourced from a number of different providers to

interconnect POPs owned by ITG in the UK and Europe. ITG's

UK network currently has 35 points of presence (the UK's

largest POP network for the provision of IP services) from

which it can provide service to corporate leased-line

customers. ITG also exploits its relationship with

telecommunications carriers to provide carrier-diverse

local-call coverage across the United Kingdom to modem

banks at several dialup POPs. ITG has also invested in

substantial transatlantic bandwidth to ensure high quality

facilities to the USA, as well as a network within the

United States. ITG has connections directly into the major

US peering points. ITG has also recently invested in

substantial trans-european bandwidth between the UK, the

Netherlands, France, Germany and Sweden, giving

connectivity not only to GX Networks BV in the Netherlands,

but also to major European peering points and data centers

in Paris, Frankfurt and Stockholm. Once completed, the

network is expected to be the largest pan-European network

operated by any carrier-independent ISP.

Financial Information

For the financial year ended 31st October, 1998, for which

accounts have been audited, ITG achieved revenues of #11.0

million, losses from operation of #1.0 million, losses from

continuing operations before tax and exceptional items of

#1.2 million and net earnings of #0.1 million. Reported

net earnings per share were #0.12. Shareholders' equity as

at 31st October, 1998 was #3.4 million.

For the unaudited six month period ended 30th April, 1999,

ITG achieved revenues of #8.9 million, losses from

operations of #1.2 million, losses from continuing

operations before tax and exceptional items of #1.6 million

and net losses of #1.6 million. Reported net losses per

share were #3.55. Shareholders' equity as at 30th April,

1999 was #6.4 million.

14. Background to and reasons for the Offer

The boards of Concentric and ITG believe their businesses

are complementary and that a range of economic, strategic

and operational benefits will arise from combining them.

The telecommunications industry is driven by, among other

factors, the need for achieving scale economies due to the

capital intensive nature of the network services business.

The boards of Concentric and ITG believe that the two

companies combined are more likely to achieve sustainable

scale economies than they would as two independent

entities. The acquisition of ITG will also provide

Concentric with the ability to begin to penetrate the

European market as the ITG network is built out throughout

Europe. The boards of both Concentric and ITG believe that

the two companies will have a broader product offering as a

combined entity and therefore will be a stronger competitor

in the marketplace. Both companies predict strong revenue

growth from the SME market segment and marketing efforts

will target the SME customer base.

Concentric and ITG have been working together since

September 1998. This relationship provides the strong

foundation for moving forward as a successful combined

business. Both companies view innovative products and

quality of service as key differentiators in today's

market. ITG will lead the effort to expand Concentric in

the European region.

With 35 points of presence in the UK and over 350

metropolitan areas served in the US, Concentric will be

able to reach a significant SME customer base offering a

broad portfolio of business IP-based network services

including web hosting, e-commerce, virtual private

networks, internet access, and transit services.

Industry analysts expect the world wide market size for

both value-added IP data networking services and Internet

access to grow rapidly as businesses and consumers increase

their use of the Internet, intranets and privately managed

IP networks. Therefore, in addition to pursuing a strategy

of growth in North America, Concentric is pursuing a

strategy that positions it as a global service provider.

Following the acquisition of ITG, Concentric is expected to

have:

* approximately 960 employees and contractors

* 35 points of presence in the UK and over 350

metropolitan areas served in the United States

* over 30,000 business customers in Europe and North

America

* a broad portfolio of business IP-based network services

* operations in Europe and North America

* enhanced internet transit offerings

15. Management and employees

Concentric has given assurances to the board of ITG that it

will honour the current employment agreements in place for

key members of ITG management and intends to ensure that

they have industry competitive compensation packages.

Concentric has also given assurances to the board of ITG

that the existing rights of the employees of the ITG Group

will be fully safeguarded.

16. ITG Share Option Schemes

The Offer will extend to any ITG Shares issued or

unconditionally allotted prior to the Scheme becoming

effective as a result of the exercise of options granted

under the ITG Share Option Schemes or otherwise.

Appropriate proposals will be made to participants in the

ITG Share Option Schemes in the Scheme Document.

17. Other Arrangements between Concentric and ITG

Concentric has agreed to provide to ITG a loan facility of

up to $10 million to fund certain short term expenditure

requirements. The loan will be made available to ITG with

the benefit of security in the form of (a) a first fixed

and floating charge over the Non-ISP Interests and (b) a

second fixed and floating charge over the other assets and

undertaking of ITG, to rank after existing security granted

in favour of MCI Worldcom. In the event that for any

reason the Scheme does not become effective or the Offer

lapses for any reason, the loan is repayable after a three

month grace period for repayment. In the event of a change

of control occurring with respect to ITG, the loan becomes

repayable within 5 days of demand.

It having been a pre-condition to the announcement of the

Offer and the Warrant Proposals and to the provision of the

loan facility described above, ITG has agreed to pay to

Concentric a fee of #1 million in the event of any third

party announcing a firm intention to make a takeover offer

for, or proposal for merger with, ITG (whether or not an

announcement is subject to any pre-conditions provided that

all such pre-conditions have been accepted by, or are

acceptable to, the Panel) and the Scheme does not become

effective. ING Barings and the directors of ITG consider

the amount of this fee and the circumstances in which it

may become payable to be in the best interests of ITG

Shareholders.

18.General

The availability of the Offer and the Warrant Proposals to

persons not resident in the United Kingdom may be affected

by the laws of the relevant jurisdiction. Persons who are

not resident in the United Kingdom should inform themselves

of and observe any applicable requirements.

No application will be made for listing of the new

Concentric Shares on the London Stock Exchange or any other

recognised investment exchange other than the Nasdaq

National Market.

As at 7th September, 1999 (the latest practicable date

prior to this announcement), neither Concentric, nor any of

the directors of Concentric nor, so far as Concentric is

aware, any party acting in concert with Concentric (other

than Jan Murray, Laurence Blackall and The Monument Trust

Company Limited who are interested in 1,470,441, 3,239,362

and 14,975,605 ITG Shares, respectively, together

representing 34.1 per cent of the fully diluted issued

share capital of ITG), owned or controlled any ITG Shares

or held options to purchase ITG Shares.

The Offer and the Warrant Proposals will be subject to the

conditions and certain further terms which are set out in

Appendix I and Appendix II to this announcement and to such

other terms which will be set out in the Scheme Document,

the Form of Election, the Warrantholders' Form of Election

and as may be required to comply with the rules and

regulations of Nasdaq, the London Stock Exchange (so far as

they relate to the Alternative Investment Market) and the

provisions of the City Code.

Bear, Stearns International, which is regulated in the

United Kingdom by The Securities and Futures Authority

Limited, is acting for Concentric in connection with the

Offer and the Warrant Proposals and for no-one else and

will not be responsible to anyone other than Concentric for

providing the protections afforded to customers of Bear,

Stearns International, or for providing advice in relation

to the Offer or the Warrant Proposals.

ING Barings, which is regulated in the United Kingdom by

The Securities and Futures Authority Limited, is acting for

ITG in connection with the Offer and the Warrant Proposals

and for no-one else and will not be responsible to anyone

other than ITG for providing the protections afforded to

customers of ING Barings, or for providing advice in

relation to the Offer or the Warrant Proposals.

This announcement does not constitute an offer or

invitation to purchase any securities nor an offer of the

new Concentric Shares in the United States.

This announcement contains forward looking statements

regarding Concentric's proposed acquisition of ITG, and the

potential benefits to be realised by the combined group,

including but not limited to expansion of Internet services

into Europe, that are subject to risks and uncertainties.

Actual results may differ materially from those described

in the forward looking statements as a result of a number

of factors, including the requirement for ITG Shareholders'

approval, court and regulatory approval and the ability of

the combined group successfully to integrate and expand

their service offerings.

The directors of ITG accept responsibility for the

information contained in this announcement relating to the

ITG Group.

Jan Murray and The Monument Trust Company Limited accept

responsibility for the information contained in this

announcement relating to Red Wave.

The directors of Concentric accept responsibility for all

other information contained in this announcement.

Appendix VII contains the definitions of certain terms used

in this announcement.

Enquiries:

Hank Nothhaft/James Isaacs

+(1) 408 817 2222/+(1) 408 817 2829

Concentric Network Corporation

Laurence Blackall/Richard Brocksom

0181 957 1180

Internet Technology Group plc

Richard Strang

0171 516 6937

Bear, Stearns International

Graham Edgerton/Julian Briant

0171 767 1000

ING Barings

David Simpson

0171 253 2252

Ludgate Communications

Nicola Weiner/Archie Berens

0171 457 2020

College Hill Associates

Appendix I

Conditions and certain further terms of or relating to the

Offer and the Warrant Proposals

The Offer and the Warrant Proposals will comply with the

City Code, the applicable rules and regulations of Nasdaq

and (insofar as they relate to the Alternative Investment

Market) of the London Stock Exchange, except to the extent

of any dispensation, waiver or exemption granted by the

appropriate body or (as the case may be) the Panel.

Part A: Circumstances in which the Offer and Warrant

Proposals will not proceed or may be varied

1. If a valid prospectus, drawn up in accordance with the

Public Offers of Securities Regulations 1995, in

relation to the Red Wave Shares, the Red Wave Offer

and the Non-ISP Interests has not been prepared by Red

Wave and posted to ITG Shareholders and Warrantholders

together with the Scheme Document and filed with the

Registrar of Companies for England and Wales in

accordance with Regulation 4 of those Regulations on

or before 31st October, 1999 (or such later date as

Concentric and ITG, with the consent of Red Wave and,

if required, the Court may agree), Concentric may

decide not to proceed with the Offer and the Warrant

Proposals. In the alternative, Concentric may, in

these circumstances, elect to proceed with the Offer

on the basis that the sale of the Non-ISP Interests to

Red Wave shall not take place and the Red Wave Offer

will not be made available to ITG Shareholders and

Warrantholders (and that, accordingly, no such person

will be able to elect to have the Additional Cash

Payments due to him under the Scheme applied in

subscribing for Red Wave Shares). If Concentric so

elects, the Offer and the Warrant Proposals will

proceed on the basis that the condition set out in

paragraph (g) of Part B of this Appendix I shall not

be a condition of the Scheme.

2. Concentric will be entitled, with the consent of the

Panel, not to proceed with the Offer and the Warrant

Proposals if any event, circumstance or matter occurs

with respect to ITG or any member of the ITG Group

prior to the Posting Date which would (or would be

reasonably likely to), if it were to occur subsequent

to the Posting Date, result in any of the conditions

set out in Part B of Appendix I not being satisfied or

fulfilled or would be reasonably likely to prevent any

such condition from being satisfied or fulfilled, or

would or would be reasonably likely to give Concentric

grounds not to proceed with the Offer.

3. ITG will be entitled, with the consent of the Panel,

not to proceed with the posting of the Scheme Document

if any event, circumstance or matter occurs with

respect to Concentric or any member of the Concentric

Group prior to the Posting Date which would (or would

be reasonably likely to), if it were to occur

subsequent to the Posting Date and on the basis that

the conditions set out in Part B of Appendix I of this

announcement were to apply to Concentric on the same

terms, mutatis mutandis, as they apply to ITG, result

in any such conditions not being satisfied or

fulfilled or would be reasonably likely to prevent any

such condition from being satisfied or fulfilled.

4. If the Scheme Document has not been posted to ITG

Shareholders on or before 31st October, 1999, either

Concentric or ITG may elect not to proceed with the

Offer and the Warrant Proposals or the Scheme as the

case may be.

Part B: Conditions of the Scheme

The Scheme will be subject to the following conditions

being satisfied or, where permitted, waived on or before

31st January, 2000:

(a) (i) the approval by a majority in number

representing three fourths or more in value of

the ITG Shareholders present and voting, either

in person or by proxy, at the Court Meeting and

at any separate class meeting which may be

required by the Court or appropriate undertakings

to be bound by the Scheme being received from ITG

Shareholders and the passing of the resolutions

necessary to implement the Scheme and the Warrant

Proposals at the Extraordinary General Meetings;

(ii) the sanction (with or without modification agreed

to by Concentric and ITG) of the Scheme by the

Court and a certified copy of the interlocutor

confirming the order made at the Court Hearing

being delivered for registration to the Registrar

of Companies in Scotland;

(b) the Office of Fair Trading in the United Kingdom not

having indicated that it proposes to refer the

proposed acquisition of ITG by Concentric, or any

matter arising therefrom or related thereto, to the

Competition Commission;

(c) all filings having been made and all or any

appropriate waiting periods under the United States

Hart-Scott-Rodino Antitrust Improvements Act of 1976

and the regulations thereunder having expired, lapsed

or been terminated as appropriate in each case in

respect of the Scheme and the proposed acquisition of

any ITG Shares or control of ITG by the Offeror or any

member of the Concentric Group;

(d) (i) Faultbasic Limited and Drive Memory Limited

each having received a written indication from

the Secretary of State for Trade and Industry, in

terms reasonably satisfactory to Concentric, to

the effect that the proposed acquisition of ITG

by Concentric or any matter arising therefrom or

related thereto will not lead to the revocation

of any licences ("Licences") issued pursuant to

the Telecommunications Act 1984 which are held by

Faultbasic Limited and Drive Memory Limited

respectively; and

(ii) Faultbasic Limited and Drive Memory Limited each

having received written confirmation from the

Office of Telecommunications on behalf of the

Director General of Telecommunications (the

"Director") in terms reasonably satisfactory to

Concentric that the Director has not (x) made,

and does not intend to make, any modifications to

any of the Licences other than modifications

which are or will be made to all or substantially

all such licences issued pursuant to the

Telecommunications Act 1984; or (y) taken, and

does not intend to take, any steps pursuant to

section 16 of the Telecommunications Act 1984 to

secure compliance with any of the conditions in

any of the Licences, except for, in the case of

(x), such modifications, or, in the case of (y),

such steps as would not have a material adverse

effect on Faultbasic Limited, Drive Memory

Limited or ITG following the proposed acquisition

of ITG by Concentric;

(e) a resolution setting out the First Issue Warrant

Proposals having been validly approved at a meeting of

the holders of the First Issue Warrants duly convened

and held;

(f) a resolution setting out the Third Issue Warrant

Proposals having been validly approved at a meeting of

the holders of the Third Issue Warrants duly convened

and held;

(g) the Implementation Agreement becoming unconditional as

to completion of the sale and purchase of the Non-ISP

Interests save in respect of any condition relating to

satisfaction of the conditions of the Scheme and all

steps necessary to complete the sale and purchase of

the Non-ISP Interests having been taken save for

payment of the consideration due thereunder;

(h) the new Concentric Shares to be issued pursuant to the

Scheme and the exercise of any Warrants having been

approved for listing on the Nasdaq National Market

subject to official notice of issuance of such new

Concentric Shares;

(i) all necessary consents with regard to the proposed

acquisition of any ITG Shares or of ITG by the Offeror

being obtained from the providers of finance to any

member of the ITG Group;

(j) the entitlement of any person to receive ITG Shares

other than Warrantholders, holders of ITG Options or

pursuant to the ITG Share Option Schemes having been

settled, satisfied or discharged;

(k) not fewer than four of the senior management team of

ITG (comprising Laurence Blackall, Richard Brocksom,

Alex Bligh, Maria Cappella, Peter Venmore and Robert

Rainford) remaining in the employment of the ITG Group

and no notice having been given by such persons to the

ITG Group the result of which would be that fewer than

four members of the senior management team remain in

such employment;

(l) except as fairly disclosed in writing by ITG to

Concentric by letter dated 7th September, 1999, there

being no provision of any agreement, arrangement,

licence, permit or other instrument to which any

member of the wider ITG Group is a party or by or to

which any such member or any of its assets may be

bound, entitled or subject, which in consequence of

the Scheme or the proposed acquisition of any shares

or other securities in ITG or because of a change in

the control or management of ITG or otherwise, could

or might result in:

(i) any moneys borrowed by or any other indebtedness

(actual or contingent) of, or grant available to

any such member, being or becoming repayable or

capable of being declared repayable immediately

or earlier than their or its stated maturity date

or repayment date or the ability of any such

member to borrow moneys or incur any indebtedness

being withdrawn or inhibited or being capable of

becoming or being withdrawn or inhibited;

(ii) any such agreement, arrangement, licence, permit

or instrument or the rights, liabilities,

obligations or interests of any such member

thereunder being terminated or modified or

affected or any obligation or liability arising

or any action being taken thereunder;

(iii)any assets or interests of any such member

being or falling to be disposed of or charged or

any right arising under which any such asset or

interest could be required to be disposed of or

charged;

(iv) the creation or enforcement of any mortgage,

charge or other security interest over the whole

or any material part of the business, property or

assets of any such member;

(v) the rights, liabilities, obligations or interests

of any such member in, or the business of any

such member with, any person, firm or body (or

any arrangement or arrangements relating to any

such interest or business) being terminated,

adversely modified or affected;

(vi) the value of any such member or its financial or

trading position or prospects being prejudiced or

adversely affected; or

(vii)any such member ceasing to be able to carry

on business under any name under which it

presently does so,

and no event having occurred which, under any

provision of any agreement, arrangement, licence,

permit or other instrument to which any member of the

wider ITG Group is a party or by or to which any such

member or any of its assets may be bound, entitled or

subject, could result in any of the events or

circumstances as are referred to in sub-paragraphs (i)

to (vii) of this paragraph (l) which would be material

in the context of the wider ITG Group;

(m) no government or governmental, quasi-governmental,

supranational, statutory, regulatory, environmental or

investigative body, court, trade agency, association,

institution or any other body or person whatsoever in

any jurisdiction (each a "Third Party") having decided

to take, institute, implement or threaten any action,

proceeding, suit, investigation, enquiry or reference,

or enacted, made or proposed any statute, regulation,

decision or order, or having taken any other steps

which would or might reasonably be expected to:

(i) require, prevent or delay the divestiture, or

alter the terms envisaged for any proposed

divestiture by any member of the wider Concentric

Group or any member of the wider ITG Group of all

or any portion of their respective businesses,

assets or property or impose any limitation on

the ability of any of them to conduct their

respective businesses (or any of them) or to own

any of their respective assets or properties or

any part thereof;

(ii) require, prevent or delay the divestiture by any

member of the wider Concentric Group of any

shares or other securities in ITG;

(iii)impose any limitation on, or result in a

delay in, the ability of any member of the wider

Concentric Group directly or indirectly to

acquire or to hold or to exercise effectively any

rights of ownership in respect of shares or loans

or securities convertible into shares or any

other securities (or the equivalent) in any

member of the wider ITG Group or the wider

Concentric Group or to exercise management

control over any such member;

(iv) otherwise adversely affect the business, assets,

profits or prospects of any member of the wider

Concentric Group or of any member of the wider

ITG Group;

(v) make the Scheme, the Warrant Proposals, the

implementation of either of them or the

acquisition or proposed acquisition by Concentric

or any member of the wider Concentric Group of

any shares or other securities in, or control of

ITG void, illegal, and/or unenforceable under the

laws of any jurisdiction, or otherwise, directly

or indirectly, restrain, restrict, prohibit,

delay or otherwise materially interfere with the

same, or impose additional conditions or

obligations with respect thereto, or otherwise

challenge or interfere therewith;

(vi) require any member of the wider Concentric

Group or the wider ITG Group to offer to acquire

any shares or other securities (or the

equivalent) or interest in any member of the

wider ITG Group or the wider Concentric Group

owned by any third party;

(vii)impose any limitation on the ability of any

member of the wider ITG Group to co-ordinate its

business, or any part of it, with the businesses

of any other members; or

(viii)result in any member of the wider ITG Group

ceasing to be able to carry on business under any

name under which it presently does so,

and all applicable waiting and other time periods

during which any such Third Party could institute,

implement or threaten any action, proceeding, suit,

investigation, enquiry or reference or any other step

under the laws of any jurisdiction in respect of the

Scheme, the Offer, the Warrant Proposals or the

acquisition or proposed acquisition of any ITG Shares

having expired, lapsed or been terminated;

(n) all necessary filings or applications having been made

in connection with the Scheme, the Offer and the

Warrant Proposals and all statutory or regulatory

obligations in any jurisdiction having been complied

with in connection with the Scheme, the Offer and the

Warrant Proposals or the acquisition by any member of

the wider Concentric Group of any shares or other

securities in, or control of, ITG and all

authorisations, orders, recognitions, grants,

consents, licences, confirmations, clearances,

permissions and approvals deemed appropriate by

Concentric for or in respect of the Scheme, the Offer,

the Warrant Proposals or the proposed acquisition of

any shares or other securities in, or control of, ITG

by any member of the wider Concentric Group having

been obtained in terms and in a form satisfactory to

Concentric from all appropriate Third Parties or

persons with whom any member of the wider ITG Group

has entered into contractual arrangements and all such

authorisations, orders, recognitions, grants,

consents, licences, confirmations, clearances,

permissions and approvals together with all material

authorisations orders, recognitions, grants, licences,

confirmations, clearances, permissions and approvals

necessary or appropriate to carry on the business of

any member of the wider ITG Group remaining in full

force and effect and all filings necessary for such

purpose have been made and there being no notice or

intimation of any intention to revoke or not to renew

any of the same at the time at which the Scheme would

otherwise become effective and all necessary statutory

or regulatory obligations in any jurisdiction having

been complied with;

(o) except as publicly announced by ITG prior to 8th

September, 1999 or fairly disclosed in writing by ITG

to Concentric by letter dated 7th September, 1999 no

member of the wider ITG Group having, since 31st

October, 1998:

(i) save as between ITG and wholly-owned subsidiaries

of ITG or for ITG Shares issued pursuant to the

exercise of options granted under ITG Share

Option Schemes, Warrants or ITG Options, issued,

authorised or proposed the issue of additional

shares of any class;

(ii) save as between ITG and wholly-owned subsidiaries

of ITG or for the grant of options under ITG

Share Option Schemes, issued or agreed to issue,

authorised or proposed the issue of securities

convertible into shares of any class or rights,

warrants or options to subscribe for, or acquire,

any such shares or convertible securities;

(iii) other than to another member of ITG Group,

recommended, declared, paid or made or proposed

to recommend, declare, pay or make any bonus,

dividend or other distribution whether payable in

cash or otherwise;

(iv) save for intra-ITG Group transactions, merged or

demerged with any body corporate or acquired or

disposed of or transferred, mortgaged or charged

or created any security interest over any assets

or any right, title or interest in any asset

(including shares and trade investments) or

authorised or proposed or announced any intention

to propose any merger, demerger, acquisition or

disposal, transfer, mortgage, charge or security

interest in each case, (other than in the

ordinary course of business);

(v) save for intra-ITG Group transactions, made or

authorised or proposed or announced an intention

to propose any change in its loan capital;

(vi) issued, authorised or proposed the issue of any

debentures or (save in the ordinary course of

business or intra-ITG Group transactions)

incurred or increased any indebtedness or become

subject to any contingent liability;

(vii) purchased, redeemed or repaid or announced

any proposal to purchase, redeem or repay any of

its own shares or other securities or reduced or

save in respect to the matters mentioned in sub-

paragraph (i) above made any other change to any

part of its share capital;

(viii) implemented, or authorised, proposed or

announced its intention to implement, any

reconstruction, amalgamation, scheme, commitment

or other transaction or arrangement otherwise

than in the ordinary course of business or

entered into or changed the terms of any contract

with any director or senior executive;

(ix) entered into or materially varied or authorised,

proposed or announced its intention to enter into

or vary any contract, transaction or commitment

(whether in respect of capital expenditure or

otherwise) which is of a long term, onerous or

unusual nature or magnitude or which is or could

be materially restrictive on the businesses of

any member of the wider ITG Group or the wider

Concentric Group or which involves or could

involve an obligation of such a nature or

magnitude or which is other than in the ordinary

course of business;

(x) (other than in respect of a member which is

dormant and was solvent at the relevant time)

taken any corporate action or had any legal

proceedings started or threatened against it for

its winding-up, dissolution or reorganisation or

for the appointment of a receiver, administrative

receiver, administrator, trustee or similar

officer of all or any of its assets or revenues

or any analogous proceedings in any jurisdiction

or had any such person appointed;

(xi) entered into any contract, transaction or

arrangement which would be restrictive on the

business of any member of the wider ITG Group or

the wider Concentric Group and which would be

material in the context of the wider ITG Group

other than to a nature and extent which is normal

in the context of the business concerned;

(xii) waived or compromised any claim otherwise

than in the ordinary course of business; or

(xiii) entered into any contract, commitment,

arrangement or agreement otherwise than in the

ordinary course of business or passed any

resolution or made any offer (which remains open

for acceptance) with respect to or announced any

intention to, or to propose to, effect any of the

transactions, matters or events referred to in

this condition,

and, for the purposes of paragraphs (iii),(iv), (v)

and (vi) of this condition, the term "ITG Group" shall

mean ITG and its wholly-owned subsidiaries;

(p) since 31st October, 1998 and save as disclosed in the

accounts for the year then ended and save as publicly

announced by ITG prior to 8th September, 1999 or as

fairly disclosed in writing by ITG to Concentric by

letter dated 7th September, 1999 or which in any such

case is material in the context of the wider ITG Group

taken as a whole:

(i) no adverse change or deterioration having

occurred in the business, assets, financial or

trading position or profits or prospects of any

member of the wider ITG Group;

(ii) no litigation, arbitration proceedings,

prosecution or other legal proceedings to which

any member of the wider ITG Group is or may

become a party (whether as a plaintiff, defendant

or otherwise) and no investigation by any Third

Party against or in respect of any member of the

wider ITG Group having been instituted announced

or threatened by or against or remaining

outstanding in respect of any member of the wider

ITG Group which in any such case might reasonably

be expected to adversely affect any member of the

wider ITG Group;

(iii) no contingent or other liability having

arisen or become apparent to Concentric which

would be likely to adversely affect any member of

the wider ITG Group; and

(iv) no steps having been taken which are likely to

result in the withdrawal, cancellation,

termination or modification of any licence held

by any member of the wider ITG Group which is

necessary for the proper carrying on of its

business;

(q) save as publicly announced by ITG prior to 8th

September, 1999 or as otherwise fairly disclosed in

writing by ITG to Concentric by letter dated 7th

September, 1999, Concentric not having discovered:

(i) that any financial, business or other information

concerning the wider ITG Group as contained in

the information publicly disclosed at any time by

or on behalf of any member of the wider ITG Group

is materially misleading, contains a material

misrepresentation of fact or omits to state a

fact necessary to make that information not

misleading and which is material in the context

of the wider ITG Group;

(ii) that any member of the wider ITG Group or any

partnership, company or other entity in which any

member of the wider ITG Group has a significant

economic interest and which is not a subsidiary

undertaking of ITG is subject to any liability

(contingent or otherwise) which is not disclosed

in the annual report and accounts of ITG for the

year ended 31st October, 1998; or

(iii) any information which affects the import of

any information disclosed at any time by or on

behalf of any member of the wider ITG Group and

which is material in the context of the wider ITG

Group taken as a whole;

(r) Concentric not having discovered that:

(i) any past or present member of the wider ITG Group

has failed to comply with any and/or all

applicable legislation or regulation, of any

jurisdiction with regard to the disposal,

spillage, release, discharge, leak or emission of

any waste or hazardous substance or any substance

likely to impair the environment or harm human

health or animal health or otherwise relating to

environmental matters, or that there has

otherwise been any such disposal, spillage,

release, discharge, leak or emission (whether or

not the same constituted a non-compliance by any

person with any such legislation or regulations,

and wherever the same may have taken place) any

of which disposal, spillage, release, discharge,

leak or emission would be likely to give rise to

any liability (actual or contingent) on the part

of any member of the wider ITG Group; or

(ii) there is, or is likely to be, for that or any

other reason whatsoever, any liability (actual or

contingent) of any past or present member of the

wider ITG Group to make good, repair, reinstate

or clean up any property or any controlled waters

now or previously owned, occupied, operated or

made use of or controlled by any such past or

present member of the wider ITG group, under any

environmental legislation, regulation, notice,

circular or order of any government,

governmental, quasi-governmental, state or local

government, supranational, statutory or other

regulatory body, agency, court, association or

any other person or body in any jurisdiction.

For the purposes of these conditions the "wider ITG

Group" means ITG and its subsidiary undertakings,

associated undertakings and any other undertaking in

which ITG and/or such undertakings (aggregating their

interests) have a significant interest and the "wider

Concentric Group" means Concentric and its subsidiary

undertakings, associated undertakings and any other

undertaking in which Concentric and/or such

undertakings (aggregating their interests) have a

significant interest and for these purposes

"subsidiary undertaking", "associated undertaking" and

"undertaking" have the meanings given by the Act,

other than paragraph 20(1)(b) of Schedule 4A to that

Act which shall be excluded for this purpose, and

"significant interest" means a direct or indirect

interest in ten per cent. or more of the equity share

capital (as defined in that Act).

Concentric reserves the right to waive, in whole or in

part, all or any of the above conditions, except

conditions (a) and (h). If condition (g) is waived by

Concentric, not having been satisfied on or prior to

the business day preceding the Hearing Date, the

Scheme shall proceed as described in this announcement

but on the basis that the sale of the Non-ISP

Interests shall not take place and elections for Red

Wave Shares under the Red Wave Offer shall not be

accepted.

If Concentric is required by the Panel to make an

offer for ITG Shares under the provisions of Rule 9 of

the City Code, it may make such alterations to any of

the above conditions as are necessary to comply with

the provisions of that Rule.

Part C: Certain further terms of the Offer and the

Warrant Proposals

Fractions of new Concentric Shares will not be allotted or

issued pursuant to the Scheme to ITG Shareholders or to

holders of First Issue Warrants or of Third Issue Warrants.

Fractional entitlements to new Concentric Shares will be

aggregated and sold in the market with the net proceeds

distributed pro rata to the persons entitled thereto.

However, individual entitlements to amounts of less than #3

will not be distributed but will be retained for the

benefit of the enlarged Concentric Group.

The Scheme will not proceed if it is referred to the

Competition Commission before the date of the Court

Hearing.

The Scheme and the Warrant Proposals will be governed by

Scottish law and be subject to the non-exclusive

jurisdiction of the Scottish courts, to the conditions set

out above and in the Scheme Document, the Form of Election

and the Warrantholders' Form of Election.

The new Concentric Shares will be issued credited as fully

paid and will rank pari passu in all respects with the

existing Concentric Shares.

Upon the Scheme becoming effective, the ITG Shares will be

acquired by Concentric fully paid and free from all liens,

equities, charges, encumbrances and other interests and

together with all rights attaching thereto at or after the

Posting Date, including the right to receive and retain all

dividends and other distributions declared made or paid

after that date.

This announcement contains forward looking statements

regarding Concentric's proposed acquisition of ITG, and the

potential benefits to be realised by the combined group,

including but not limited to expansion of Internet services

into Europe, that are subject to risks and uncertainties.

Actual results may differ materially from those described

in the forward looking statements as a result of a number

of factors, including the requirement for ITG Shareholders'

approval, court and regulatory approval and the ability of

the combined group successfully to integrate and expand

their service offerings.

MORE TO FOLLOW

OFFLVFBBKKKFBKZ

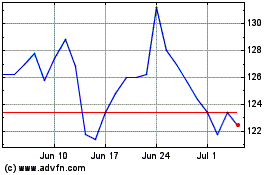

Ithaca Energy (LSE:ITH)

Historical Stock Chart

From Jul 2024 to Aug 2024

Ithaca Energy (LSE:ITH)

Historical Stock Chart

From Aug 2023 to Aug 2024