TIDMIPX

RNS Number : 2570T

Impax Asset Management Group plc

16 March 2023

16 March 2023

Impax Asset Management Group plc ("Impax" or the "Company")

Result of AGM

Impax confirms that at the Company's Annual General Meeting held

today all resolutions were duly passed. The proxy votes validly

cast for each of the resolutions are set out in the table

below.

Resolution Votes cast % Votes % Votes Total

'For' cast withheld Votes

(includes 'Against' Cast

discretionary) (excluding

Withheld)

To receive

and adopt the

Company's annual

accounts for

the financial

year ended

30 September

1 2022 94,990,874 100.0 218 0.00 48,013 95,039,105

-------------------- ---------------- ------- ----------- ------ ----------- ------------

To receive

and approve

the Directors'

Remuneration

Report (advisory

2 vote) 55,590,313 79.28 14,619,547 20.72 24,471,134 95,040,994

-------------------- ---------------- ------- ----------- ------ ----------- ------------

To re-elect

Sally Bridgeland

3 as a Director 94,580,057 99.52 453,518 0.48 7,419 95,040,994

-------------------- ---------------- ------- ----------- ------ ----------- ------------

To re-elect

Ian R Simm

4 as a Director 94,871,810 99.83 161,765 0.17 7,419 95,040,994

-------------------- ---------------- ------- ----------- ------ ----------- ------------

To re-elect

Arnaud de Servigny

5 as a Director 94,486,127 99.42 547,448 0.58 7,419 95,040,994

-------------------- ---------------- ------- ----------- ------ ----------- ------------

To elect Annette

E Wilson as

6 a Director 95,022,785 99.99 10,790 0.01 7,419 95,040,994

-------------------- ---------------- ------- ----------- ------ ----------- ------------

To re-elect

Lindsey Brace

Martinez as

7 a Director 94,740,853 99.69 291,291 0.31 8,850 95,040,994

-------------------- ---------------- ------- ----------- ------ ----------- ------------

To re-elect

William Simon

O'Regan as

8 a Director 94,799,404 99.75 234,171 0.25 7,419 95,040,994

-------------------- ---------------- ------- ----------- ------ ----------- ------------

To reappoint

KPMG LLP as

auditor of

9 the Company 92,798,010 97.70 2,181,238 2.30 68,600 95,047,848

-------------------- ---------------- ------- ----------- ------ ----------- ------------

To authorise

the Directors

to fix the

remuneration

10 of the auditor 94,416,623 99.41 556,607 0.59 65,875 95,039,105

-------------------- ---------------- ------- ----------- ------ ----------- ------------

To declare

a final dividend

of 22.9 pence

11 per share 95,040,776 100.00 218 0 0 95,040,994

-------------------- ---------------- ------- ----------- ------ ----------- ------------

To authorise

the Directors

12 to allot shares 94,364,717 99.29 675,402 0.71 875 95,040,994

-------------------- ---------------- ------- ----------- ------ ----------- ------------

To authorise

the Directors

to disapply

pre-emption

13 rights* 94,978,900 99.94 61,019 0.06 1,075 95,040,994

-------------------- ---------------- ------- ----------- ------ ----------- ------------

To authorise

the Directors

to disapply

pre-emption

rights in relation

to an acquisition

or capital

14 investment* 94,739,561 99.68 300,358 0.32 1,075 95,040,994

-------------------- ---------------- ------- ----------- ------ ----------- ------------

To authorise

the Company

to

make market

purchases of

15 its shares* 92,728,559 99.99 11,705 0.01 2,300,690 95,040,994

-------------------- ---------------- ------- ----------- ------ ----------- ------------

* Special Resolutions requiring 75% majority to pass

Impax is committed to enhancing its corporate governance

practices, and notes that while the non-binding resolution to

approve the Directors' Remuneration Report was passed, the

Directors are mindful of the votes against and withheld. Building

on feedback from shareholders we have increased our disclosures

around variable remuneration in this year's report. We intend to

develop this disclosure by publishing further details on the

Executive Directors' objectives as our approach to variable

remuneration continues to evolve.

LEI number: 213800AJDNW4S2B7E680

Enquiries:

Impax Asset Management Group plc

Ian Simm, Chief Executive

Paul French, Director of Communications +44 (0)20 3912 3000

p.french@impaxam.com +44 (0)20 3912 3032

Montfort Communications

Gay Collins

Jack Roddan +44 (0)7798 626 282

impax@montfort.london +44 (0)7825 670 695

Peel Hunt LLP, Nominated Adviser

and Joint Broker

Paul Shackleton or John Welch +44 (0)20 7418 8900

Berenberg , Joint Broker

Gillian Martin +44 (0)20 3207 7800

Notes to Editors - About Impax Asset Management

Founded in 1998, Impax is a specialist asset manager, with

GBP40.4bn / US$48.6bn as of 28 February 2023 in both listed and

private markets strategies, investing in the opportunities arising

from the transition to a more sustainable global economy.

Impax believes that capital markets will be shaped profoundly by

global sustainability challenges, including climate change,

pollution and essential investments in human capital,

infrastructure and resource efficiency. These trends will drive

growth for well-positioned companies and create risks for those

unable or unwilling to adapt.

The company seeks to invest in higher quality companies with

strong business models that demonstrate sound management of risk.

Impax offers a well-rounded suite of investment solutions spanning

multiple asset classes seeking superior risk-adjusted returns over

the medium to long term.

Impax has approximately 300 employees across its offices in the

United Kingdom, the United States, Ireland and Hong Kong, making it

one of the investment management sector's largest investment teams

dedicated to sustainable development.

For further information please visit www.impaxam.com.

Issued in the UK by Impax Asset Management Group plc, whose

shares are quoted on the Alternative Investment Market of the

London Stock Exchange. Impax Asset Management Group plc is

registered in England & Wales, number 03262305. AUM relates to

Impax Asset Management Limited, Impax Asset Management (AIFM)

Limited, Impax Asset Management Ireland Limited and Impax Asset

Management LLC. Impax Asset Management Limited and Impax Asset

Management (AIFM) Limited are authorised and regulated by the

Financial Conduct Authority and are wholly owned subsidiaries of

Impax Asset Management Group plc. Please note that the information

provided and links from it should not be relied upon for investment

purposes.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

RAGJFMJTMTABBIJ

(END) Dow Jones Newswires

March 16, 2023 09:56 ET (13:56 GMT)

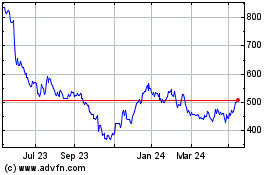

Impax Asset Management (LSE:IPX)

Historical Stock Chart

From Jul 2024 to Aug 2024

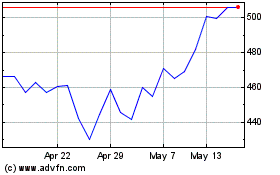

Impax Asset Management (LSE:IPX)

Historical Stock Chart

From Aug 2023 to Aug 2024