TIDMINHC

RNS Number : 5227I

Induction Healthcare Group PLC

05 December 2022

Induction Healthcare Group PLC

("Induction", the "Company", or the "Group")

Unaudited Interim Results

for the six months ended 30 September 2022

Induction Healthcare (AIM: INHC), a leading digital health

platform driving transformation of healthcare systems , announces

its unaudited interim results for the six months ended 30 September

2022, a period of continued revenue growth driven by the Company's

leading position providing products to support the digitization of

healthcare delivery.

Induction's products power remote consultations, capture patient

reported data and empower patients to self-manage their care

pathway. They are designed around the needs of the patient and

deliver cost and efficiency benefits to hospitals, regional care

systems and governments. Used at scale by national and regional

healthcare systems, Induction's applications are relied upon by

hundreds of thousands of clinicians and millions of patients across

almost every hospital in the British Isles.

Financial Highlights

-- Recorded Revenues up 54% to GBP7.1m (H1 2021: GBP4.6m) with

organic growth across key products

- Induction Attend Anywhere revenues GBP5.6m (H1 2021: GBP3.6m)

- Induction Zesty revenue GBP1.1m (H1 2021: GBP0.6m)

-- Adjusted EBITDA loss of GBP1.0m (H1 2021: GBP0.7m)

-- Annual Recurring Revenues ("ARR") at period end of GBP14.5m

up from GBP13.5m at the start of H1 2022

-- Cash position as at 30 September 2022 of GBP9.0m (31 March 2022: GBP7.5m)

Operational Highlights

-- Strong start to the financial year with better-than-expected

Induction Attend Anywhere renewals across NHS England

-- Value Added Reseller agreement signed with System C for Induction Zesty

-- Induction Zesty contracts with 8 further hospitals in

England, building on the previously announced contract win with 4

hospitals in South West London

-- Christopher Samler appointed as Non-Executive Chairman

James Balmain, CEO of Induction, said: " We are confident that

the business is well-positioned to deliver continued revenue growth

from its core products, Induction Attend Anywhere and Induction

Zesty. It is however apparent that the rate of growth this year

will be impacted by the delays we've seen in the implementation of

centrally funded digitisation programmes and the general political

turmoil of recent months. We don't expect to see these

opportunities drop away, rather they are now more likely to

conclude next financial year.

"Despite these headwinds, we remain confident that overall year

end revenues will show an improvement of at least 75% against our

year end 31 March 2022 recognised revenues of GBP7.9m and we expect

to grow our recurring revenues by at least 23% year on year. Both

of these key metrics, whilst encouraging, are lower than our

expectation and as a result the business is heavily focussed on

underlying profitability and cash. We have initiated programmes

internally to ensure our business is sized correctly to capture

growth and to ensure that we do not have to raise further working

capital pending reaching our objective of cash-flow breakeven by

the fourth quarter of next financial year.

"Nothing has changed in terms of the critical need to further

advance the digital transformation of the NHS, and in particular to

drive efficiencies and support the reduction of extended waiting

times. The strategic pillars for growth, as described in our

recently published Annual Report remain as relevant as before and

we remain confident about the future prospects of the Group."

Investor Presentation

The Company will be hosting a live online presentation via the

Investor Meet Company platform at 4pm (GMT) today. The presentation

is open to all existing and potential shareholders.

Investors can sign up to Investor Meet Company for free and

register for the presentation here:

https://www.investormeetcompany.com/induction-healthcare-group-plc/register-investor

.

A recording of the presentation, a PDF of the slides used, and

responses to the Q&A session will be available on the Investor

Meet Company platform and the Company's investor website

afterwards.

ENQUIRIES

Induction Via Walbrook PR Ltd: induction@walbrookpr.com

James Balmain, Chief Executive Officer

Christopher Samler, Chair

Singer Capital Markets (Nominated

Adviser and Broker) +44 (0)20 7496 3000

Philip Davies / Kailey Aliyar

Walbrook PR Ltd induction@walbrookpr.com

Paul McManus / Alice Woodings Mob: +44 (0)7980 541 893 / +44

(0)7407 804 654

About Induction - www.inductionhealthcare.com

Induction (AIM: INHC) Induction delivers a suite of software

solutions through a single integrated platform that transforms care

delivery. Our system-wide applications help healthcare providers

and administrators to deliver care at any stage remotely as well as

face-to-face - giving the communities they serve greater

flexibility, control and ease of access. Purpose-built for

integration with leading Electronic Medical Record (EMR) platforms,

our products offer immediate stand-alone value that becomes even

greater when integrated with pre-existing systems.

Used at scale by national and regional healthcare systems, as

well non-health government services, our applications are relied

upon by hundreds of thousands of clinicians and millions of

patients across almost every hospital in the British Isles.

CEO REVIEW

Overview

Over the last six months we have seen continued year-on-year

revenue growth from our Induction Zesty patient engagement platform

and maintained strong annually recurring revenue from our Induction

Attend Anywhere video consultation platform, building on a

successful renewal of key NHS England contracts at the start of the

year.

The need to continue the digital transformation of the NHS

remains as strong as ever. Despite recent political and economic

turmoil in the UK, delivering this transformation is still very

much a key focus for the Government and NHS bodies across the UK.

There is committed funding to support the roll-out of software that

will help reduce NHS waiting lists.

However, the allocation of this central capital to fund key

digital programmes has been slower than expected. Central funding

and policy guidance is now in place to drive all hospitals in

England to have suitable patient engagement platforms in place by

the end of March 2023 . This has had the net effect of deferring

some expected contract wins and their associated revenue into next

financial year.

Induction is well positioned to receive new contracts as a

result of this funding:

-- Induction Attend Anywhere is the leading hospital video

consultation platform throughout NHS England

-- Induction Zesty's selected as one of the first four patient

engagement platforms to be directly integrated into the NHS App

-- To qualify for central funding NHS Trusts have been strongly

encouraged to procure those platforms that have integrated into the

NHS App

-- Induction's unique Value Added Reseller Agreements with both

Oracle Cerner and System C for Induction Zesty allows Induction to

exclusively capture separate funding made available for upgrades to

hospital EMR systems.

H1 performance

Overall recorded revenues for the first half showed an

improvement of just over 54% to GBP7.1m (H1 2021: GBP4.6m).

We continue to work closely with NHS Wales, NHS Scotland and the

Scottish government in ensuring Induction Attend Anywhere continues

to deliver a high quality service to the millions of users it

serves. Looking ahead to the second half of this year, we remain

confident in key H2 contract renewals with these customers.

We have seen some delays in the roll-out of Induction Attend

Anywhere in relation to the Department of Work and Pensions (DWP)

contract announced in November 2021 as we seek to meet changing

platform requirements from the DWP. Completion of these platform

updates will be required before the DWP can make the platform

available to a wider range of departments, a key driver of

increased revenue.

As announced in April, the South West London ICS, comprising

four NHS Acute Trusts, signed up to deploy Induction Zesty to

support their outpatient transformation programme. Building on

this, eight further hospitals have been signed as at 30 September.

Induction Zesty revenues nearly doubled to GBP1.1m (H1 2021:

GBP0.6m) and, for the reasons described above, we believe we will

see further significant sales growth in Induction Zesty sales in

the second half and through into the next financial year, albeit at

a slower rate than originally anticipated.

Other Induction products (our clinical apps Induction Guidance

and Induction Switch) delivered revenues of GBP0.4m (H1 2021:

GBP0.3m). As we've stated in our Annual Report, given the

relatively minor contribution of these clinical apps to overall

group revenues, as well as their cost base, we are considering the

future role of clinical apps within the group.

At the period end, the Group recorded GBP14.5m of annual

recurring revenue (compared to GBP13.5m at the start of H1 2022)

with recurring revenue for the period accounting for over 90% of

total revenues.

In the first half we recorded an adjusted EBITDA loss of GBP1.0m

(H1 2021: GBP0.7m).

Cash position

The Group ended the first half with cash on hand of GBP9.0 m (

31 March 2022: GBP7.5m).

We currently expect revenue for the full year to be

approximately GBP3m lower than forecast . In addition, we expect

cost escalations of GBP0.9m relating to increased hosting costs

(AWS) and adverse foreign exchange movements versus the US Dollar

which is the payment currency of many of our IT services. To offset

this , the business is con ducting an immediate review of its

expenditure to align with the current and expected future growth of

our public sector customer base. These and other related savings

will be material and are to be initiated forthwith, although the

benefits are not expected to fully flow through until the first

half of next financial year.

The majority, by value, of our main Induction Attend Anywhere

contracts renew at the end of March . We therefore receive

significant cash inflows during April and May. A notable feature of

the recent upheaval across public sector finance is a move towards

fewer advance payments and a trend towards quarterly payments .

These two trends further underline the need to tightly manage our

expenditure, enforce our contractual payment terms more rigorously

and drive the business towards profitability. The Group considers

that it should give more prominence to adjusted operating income

(free cash flow) which will provide investors with a clearer view

of cash generation from operations.

Whilst we currently do not foresee a need for further working

capital, it is not yet possible to fully quantify the value and

timing of our major contracts or the cadence of their cash inflows.

T he Group intends to update its guidance on this metric ,

providing investors with additional clarity in due course. In the

meantime, we recognise the need to take a conservative approach to

cash and cash management.

Board Changes

During the first half we announced a number of Board changes as

part of the natural evolution of the business. In May 2022 Dr Hugo

Stephenson returned to the Non-executive Director role he

originally held on admission to AIM in May 2019, and in July 2022

we announced the appointment of Christopher Samler as Non-Executive

Chairman and the executive team are delighted to benefit from their

combined experience and support as we drive the business

forward.

Ian Johnson has been appointed to the Board as the Senior

Independent Director ('SID') replacing Leslie-Ann Reed who will be

stepping down following completion of her three-year term. Ian

brings over 30 years of Board experience working with quoted and

private companies in the Life Sciences space, having spent a career

providing strategic direction and business development expertise.

He has a proven track record of overseeing business growth and

providing commercial advice through scale-up, organic growth and

M&A activity.

More recently, Guy Mitchell has stepped down as the company CFO

and is replaced by John Mcintosh as Interim CFO. The board will

commence a process to recruit a permanent CFO.

James Balmain

Chief Executive Officer

Condensed Income Statement (Unaudited)

For the six months ended 30 September 2022

30 September 2022 30 September 2021

Unaudited Unaudited

Note GBP'000 GBP'000

------------------ ------------------

Revenue from contracts with customers 2 7,118 4,593

Cost of sales (2,414) (997)

--------------------------------------- ------------------ ------------------

Gross Profit 4,704 3,596

Sales and marketing expenses 3 (821) (514)

Development expenses 3 (4,159) (2,711)

Administrative expenses 3 (4,237) (5,959)

Operating loss (4,513) (5,588)

--------------------------------------- ------------------ ------------------

Finance Costs (4) (12)

Finance Income - -

--------------------------------------- ----- ------------------ ------------------

Loss before tax (4,517) (5,600)

--------------------------------------- ------------------ ------------------

Taxation (311) (404)

---------------------------------------

Loss for the financial period (4,828) (6,004)

--------------------------------------- ------------------ ------------------

Attributable to:

Equity holders of the parent (4,828) (6,004)

---------------------------------------

(4,828) (6,004)

--------------------------------------- ------------------ ------------------

Loss per share from operations

--------------------------------------- ------------------ ------------------

- Basic 4 (0.06) (0.08)

- Diluted 4 (0.06) (0.08)

--------------------------------------- ------------------ ------------------

Condensed Consolidated Statement of Comprehensive Income

(Unaudited)

For the six months ended 30 September 2022

30 September 30 September

2022 2021

Unaudited Unaudited

Note GBP'000 GBP'000

------------- -------------

Loss for the period (4,828) (6,004)

-------------------------------- ------------- -------------

Other comprehensive income

Items that may be reclassified

to profit or loss

Foreign currency translation

differences 457 (59)

Reclassified to profit and

loss during the period (801) 9

Other comprehensive income

for the financial period (344) 50

-------------------------------- ------------- -------------

Total comprehensive loss

for the financial period (5,172) (6,054)

-------------------------------- ------------- -------------

Attributable to:

Equity holders of the parent (5,172) (6,054)

(5,172) (6,054)

-------------------------------- ------------- -------------

Loss per share:

Basic loss per share (GBP) 4 (0.06) (0.08)

Diluted loss per share (GBP) 4 (0.06) (0.08)

Unaudited Condensed Consolidated Statement of Financial

Position

As at 30 September 2022

30 September 31 March

2022 2022

Unaudited Unaudited

Note GBP'000 GBP'000

------------- ----------

Non-current assets

Goodwill 6 19,758 19,758

Intangible Assets 6 20,213 20,962

Property, Plant and Equipment 213 244

Deferred tax assets 1,549 1,540

41,733 42,504

----------------------------------------------------- ------------- ----------

Current assets

Trade and other receivables 7 3,543 3,349

Contract Assets 2 2,090 787

Current tax receivable 1,208 1,240

Cash and cash equivalents 7 8,978 7,495

-----------------------------------------------------

15,819 12,872

----------------------------------------------------- ------------- ----------

Total assets 57,552 55,376

----------------------------------------------------- ------------- ----------

Non-current liabilities

Contract liabilities 2 (310) (326)

Deferred tax liabilities 2 (5,833) (5,851)

Other financial liabilities 2 (170) (128)

(6,313) (6,305)

----------------------------------------------------- ------------- ----------

Current liabilities

Trade and other payables 8 (4,316) (3,365)

Contract liabilities (8,944) (2,580)

Current tax payable (833) (789)

Other financial liabilities - (73)

(14,093) (6,806)

----------------------------------------------------- ------------- ----------

Total liabilities (20,406) (13,111)

-----------------------------------------------------

Net assets/(liabilities) 37,146 42,265

----------------------------------------------------- ------------- ----------

Equity attributable to equity holders of the parent

Share capital 9 471 460

Share premium 9 41,665 41,665

Translation reserve 9 457 801

Other reserves 9 1,447 1,405

Merger reserve 9 20,206 20,206

Accumulated deficit (27,100) (22,272)

-----------------------------------------------------

Total equity 37,146 42,265

----------------------------------------------------- ------------- ----------

Unaudited Condensed Consolidated Statement of Changes in

Equity

For the six months ended 30 September 2022

Share Share Translation Other Merger Accumulated Total

Capital Premium reserve reserve reserve deficit equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------- ----------------- -------------- -------------------- -------------------- -------------- ------------------- -----------

Balance at 1

April 2022 460 41,665 801 1,405 20,206 (22,272) 42,265

Total

comprehensive

loss for the

period

Loss for the

period - - - - - (4,828) (4,828)

Other

comprehensive

loss for the

period - - (344) - - - (344)

Total

comprehensive

loss for the

period - - (344) - - (4,828) (5,172)

---------------- ----------------- -------------- -------------------- -------------------- -------------- ------------------- -----------

Transactions

with owners, in

their

capacity as

owners

Issue of

ordinary

shares 11 - - (204) - - (193)

Issue of

ordinary shares

as

consideration

for a business

combination - - - - - - -

Equity-settled

share-based

payments - - - 246 - - 246

Total

contributions

by and

distributions

to owners 11 - - 42 - - 53

---------------- ----------------- -------------- -------------------- -------------------- -------------- ------------------- -----------

Balance at 30

September 2022 471 41,665 457 1,447 20,206 (27,100) 37,146

---------------- ----------------- -------------- -------------------- -------------------- -------------- ------------------- -----------

Unaudited Condensed Consolidated Statement of Changes in

Equity

For the six months ended 30 September 2022

Share Share Translation Other Merger Accumulated Total

Capital Premium reserve reserve reserve deficit equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------- ------------------ -------------- ------------------- -------------------- ------------------ ------------------- -----------

Balance at 1

April 2021 210 18,432 (9) 792 10,879 (13,838) 16,466

Total

comprehensive

loss for the

period

Loss for the

period - - - - - (6,004) (6,004)

Other

comprehensive

loss for the

period - - (50) - - - 37

Total

comprehensive

loss for the

period - - (50) - - (6,004) (6,004)

---------------- ------------------ -------------- ------------------- -------------------- ------------------ ------------------- -----------

Transactions

with owners, in

their

capacity as

owners

Issue of

ordinary

shares 179 24,821 - - - - 25,000

Issue of

ordinary

shares as

consideration

for a business

combination 71 - - - 8,928 - 9,000

Equity-settled

share-based

payments - - - 332 - - 332

Total

contributions

by and

distributions

to owners 250 28,821 - 332 8,928 - 34,332

---------------- ------------------ -------------- ------------------- -------------------- ------------------ ------------------- -----------

Balance at 30

September 2021 460 43,253 (59) 1,124 19,807 (19,842) 44,747

---------------- ------------------ -------------- ------------------- -------------------- ------------------ ------------------- -----------

Unaudited Condensed Consolidated Statement of Cash Flows

For the six months ended 30 September 2022

For the period ended For the period ended

30 September 2022 30 September 2021

GBP'000 GBP'000

------------------------------------------------------------------- --------------------- ---------------------

Cash flows from operating activities

Loss for the financial period (4,828) (6,004)

Adjustments for:

Depreciation of property, plant and equipment 39 4

Amortisation and impairment of intangible assets 2,363 1,569

Finance costs 4 12

Finance income - -

Share-based payment expense 246 332

Net foreign exchange differences - 49

Fair value adjustment of contingent consideration - -

Net loss arising on fair value adjustments of deferred income - 1,742

Taxation 311 404

2,963 4,112

--------------------- ---------------------

Decrease / (Increase) in trade and other receivables and contract

assets (1,500) 3,911

(Decrease) / Increase in trade and other payables and contract

liabilities 7,303 (1,491)

Interest received - -

Interest paid (4) (12)

Income taxes received 44 -

Income taxes paid (288) (404)

Net cash generated from / (used in) operating activities 3,690 112

-------------------------------------------------------------------- --------------------- ---------------------

Cash flows from investing activities

Payments for acquiring businesses, net of cash acquired - (13,486)

Payment of software development costs (1,615) (1,207)

Acquisitions of property, plant and equipment (5) -

Net cash from investing activities (1,620) (14,693)

-------------------------------------------------------------------- --------------------- ---------------------

Cash flow from financial activities

Repayments of loans and borrowings - -

Share issue costs - -

Share issue proceeds (194) 25,000

Net cash from financing activities (194) 25,000

-------------------------------------------------------------------- --------------------- ---------------------

Net increase in cash equivalents 1,876 10,419

Cash and cash equivalents at the beginning of the financial period 7,495 2,472

Effects of exchange rate changes on cash and cash equivalents (393) (49)

Cash and cash equivalents at the end of the financial period 8,978 12,842

==================================================================== ===================== =====================

Notes to the Unaudited Condensed Consolidated Interim Financial

Statements

1. Accounting Policies

1.1 Reporting entity

Induction Healthcare Group PLC ("Induction", the "Group" or the

"Company") is publicly listed on the AIM market of the London Stock

Exchange ("LSE"), and incorporated, domiciled and registered in the

United Kingdom. The registered number is 11852026 and the

registered address is 20 St. Dunstan's Hill, London, United

Kingdom, EC3R 8HL. Induction is a leading healthcare technology

company helping to streamline delivery of care by providing

software to healthcare professionals.

As of 30 September 2022, Induction Healthcare Group PLC

comprised of nine legal subsidiaries, that are majority owned and

controlled, and therefore fully consolidated in the Company's

consolidated financial statements. Details of the Company's

subsidiaries are included in note 5.

1.2 Basis of preparation

These interim financial statements have been prepared and

approved by the directors in accordance with International

Financial Reporting Standards ("Adopted IFRSs"). They do not

include all the information required for a complete set of IFRS

financial statements. However, selected explanatory notes are

included to explain events and transactions that are significant to

an understanding of the changes in the Group's financial position

and performance since the most recent annual consolidated financial

information included in the annual report and accounts as of and

for the year ended 31 March 2022.

The accounting policies applied are consistent with those

applied in the most recent consolidated annual report and accounts

for the year ended 31 March 2022, which are available on the

Company's website at www.inductionhealthcare.com under "Investors -

Financial reports & publications."

Subsidiaries are fully consolidated from the date of

acquisition, being the date on which the Group obtained control and

continue to be consolidated until the date when such control

ceases. The financial information of the subsidiaries is prepared

for the same reporting period as the Group, using consistent

accounting policies. All intra-group balances, transactions,

unrealised gains and losses resulting from intra-group transactions

are eliminated in full.

Changes in the Group's interest in a subsidiary that do not

result in a loss of control are accounted for as equity

transactions.

When the Group loses control over a subsidiary, the assets and

liabilities are derecognised along with any related non-controlling

interest and other components of equity. Any resulting gain or loss

is recognised in profit or loss. Any interest retained in the

former subsidiary is measured at fair value when control is

lost.

These interim condensed consolidated financial statements are

unaudited and were approved by the Board of Directors and

authorised for issue on 5 December 2022 and are available on the

Company's website at www.inductionhealthcare.com under "Investors -

Financial reports & publications".

2. Revenue

2.1 Revenue by performance obligations

Period to 30 September 2022 Period to 30 September

2021

GBP'000 GBP'000

--------------------------------------------- ---------------------------- -----------------------

Provision of software 6,296 4,382

Post-contract support and maintenance 103 76

Set-up services 30 3

Professional services 492 -

Text message revenue 197 132

----------------------------------------------

Total Revenue from contracts with customers 7,118 4,593

---------------------------------------------- ---------------------------- -----------------------

2.2 Revenue by geographical location

Period to 30 September Period to 30 September

2022 2021

GBP'000 GBP'000

--------------------------------------------- ----------------------- -----------------------

United Kingdom 7,086 4,528

Europe 7 6

United States 9 8

Rest of World 16 51

---------------------------------------------- ----------------------- -----------------------

Total Revenue from contracts with customers 7,118 4,593

---------------------------------------------- ----------------------- -----------------------

2.3 Revenue by product line

Period to 30 September Period to 30 September

2022 2021

GBP'000 GBP'000

--------------------------------------------- ----------------------- -----------------------

Induction Anywhere 5,600 3,638

Induction Zesty 1,162 617

Induction Guidance 340 322

Induction Switch 16 16

---------------------------------------------- ----------------------- -----------------------

Total Revenue from contracts with customers 7,118 4,593

---------------------------------------------- ----------------------- -----------------------

2.4 Timing of revenue recognition

Period to 30 September Period to 30 September

2022 2021

GBP'000 GBP'000

--------------------------------------------- ----------------------- -----------------------

Services transferred over time 6,628 4,451

Services transferred at a point in time 490 142

Total Revenue from contracts with customers 7,118 4,593

---------------------------------------------- ----------------------- -----------------------

2.5 Contract balances

31 March

30 September 2022 2022

GBP'000 GBP'000

---------------------- ------------------ ---------

Trade receivables 2,121 1,039

Contract assets 2,090 399

Contract liabilities (9,254) (2,657)

3. Expenses by nature

Period to 30 September Period to 30 September

2022 2021

GBP'000 GBP'000

---------------------- ----------------------

Employee benefit expense 4,810 3,444

Contractors 1,858 1,520

Fundraise and acquisition related transaction costs - 1,613

Amortisation of intangible assets 2,363 1,568

Depreciation of property, plant and equipment 39 4

Professional and legal fees 251 56

Research and development expense capitalised (1,615) (1,207)

Remeasurement of contingent consideration - -

Fair value adjustments on contract liabilities - 1,742

4. Earnings per share

Basic EPS is calculated by dividing the profit for the year

attributable to ordinary equity holders of the parent by the

weighted average number of ordinary shares outstanding during the

year.

Diluted EPS is calculated by dividing the profit attributable to

ordinary equity holders of the parent (after adjusting for interest

on the convertible preference shares) by the weighted average

number of ordinary shares outstanding during the year plus the

weighted average number of ordinary shares that would be issued on

conversion of all the dilutive potential ordinary shares into

ordinary shares.

The following table reflects the income and share data used in

the basic and diluted EPS calculations:

Loss attributable to ordinary shares (basic and diluted)

30 September 30 September

2022 2021

GBP'000 GBP'000

--------------------------------------------------------- ------------ ------------

Loss attributable to ordinary shares (basic and diluted) (4,828) (6,004)

---------------------------------------------------------- ------------ ------------

(4,828) (6,004)

------------ ------------

Weighted average number of ordinary shares (basic and

diluted)

Period to 30 September 2022 Period to 30 September 2021

----------------------------------------------------- ---------------------------- ----------------------------

Shares in issue on 1 April 92,050,727 42,050,728

Shares issued 248,089 35,714,285

Shares issued in a business combination - 14,285,714

------------------------------------------------------

Issued ordinary shares as at the end of the period 92,298,816 92,050,727

------------------------------------------------------ ---------------------------- ----------------------------

Weighted-average number of ordinary shares (basic and

diluted) 73,413,131 72,925,044

------------------------------------------------------ ---------------------------- ----------------------------

Basic loss per share (0.06) (0.08)

Diluted loss per share (0.06) (0.08)

5. Investments in subsidiaries

Company Registered number Principal Country of Ownership

activities incorporation

-------------------- ------------------ ------------------- -------------------

30 September 2022 31 March 2022

-------------------- ------------------ ------------------- ------------------- ------------------ --------------

Induction Investment Holding

Healthcare Limited 11232772 Company United Kingdom 100% 100%

Induction 11237890 Provision of United Kingdom 100% 100%

Healthcare (UK) software to

Limited healthcare

providers

Induction 625119397 Provision of Australia 100% 100%

Healthcare Pty Ltd software to

healthcare

providers

Podmedics Limited 6840040 Dormant United Kingdom 100% 100%

Horizon Strategic 6285278 Provision of United Kingdom 100% 100%

Partners Limited software to

healthcare

providers

Zesty Limited 08294659 Provision of United Kingdom 100% 100%

software to

healthcare

providers

Attend Anywhere Pty 081211707 Provision of Australia 100% 100%

Ltd software to

healthcare

providers

Attend Anywhere 11883931 Provision of United Kingdom 100% 100%

Limited software to

healthcare

providers

A.C.N. 167 231 307 Investment Holding

Pty Ltd 167231307 Company Australia 100% 100%

6. Goodwill and intangible assets

Goodwill Technology Users Tradename Development costs Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------------------- --------- ----------- -------- ---------- ------------------ --------

Cost

Balance at 31 March 2022 20,175 7,972 9,460 633 9,442 47,682

Recognised on acquisitions - - - - - -

Internally developed - - - - 1,615 1,615

Translation differences - - - - - -

At 30 September 2022 20,175 7,972 9,460 633 11,057 49,297

---------------------------- --------- ----------- -------- ---------- ------------------ --------

Amortisation

Balance at 31 March 2022 418 1,532 1,386 144 3,482 6,962

Recognised on acquisitions - - - - - -

Provided during the year - 719 645 31 968 2,363

Translation differences - - - - - -

At 30 September 2022 418 2,251 2,031 175 4,450 9,325

---------------------------- ------- ------ ------ ---- ------ -------

Net book value

At 31 March 2022 19,757 6,440 8,074 489 5,960 40,720

---------------------------- ------- ------ ------ ---- ------ -------

At 30 September 2022 19,757 5,721 7,429 458 6,607 39,972

---------------------------- ------- ------ ------ ---- ------ -------

7. Trade and other receivables

30 September 2022 31 March

2022

GBP'000 GBP'000

Receivables from third-party customers 2,880 2,900

Other receivables 210 116

Prepayments 373 251

Social security and other taxes receivable 80 82

------------------ ---------

3,543 3,349

------------------ ---------

Allowance for credit losses - -

------------------ ---------

3,543 3,349

------------------ ---------

Trade receivables are non-interest bearing and are generally on

terms of 30 days. Included within trade and other receivables is

GBPnil expected to be recovered in more than 12 months.

Cash and cash equivalents

30 September 2021 31 March

2022

GBP'000 GBP'000

Cash at banks and on hand 8,978 6,995

Short-term deposits - 500

------------------ ------------------

Cash and cash equivalents per the statement of financial position and

cash flow statement 8,978 7,495

------------------ ------------------

Cash at banks earns interest at floating rates based on daily

bank deposit rates. Short-term deposits are made on a weekly basis,

depending on the immediate cash requirements of the Group, and earn

interest at the respective short-term deposit rates.

8. Trade and other payables

30 September 31 March 2022

2022

GBP'000 GBP'000

------------- --------------

Trade payables 833 901

Accruals 1,864 1,680

Social security and other taxes 230 238

Other payables 1,389 108

Current tax payable 833 765

------------- --------------

5,149 3,692

------------- --------------

Included within trade and other payables is GBPnil expected to

be settled in more than 12 months.

All trade and other payables are non-interest bearing and are

normally settled on 30 day terms.

9. Capital and Reserves

9.1 Share Capital

2022 2021

No. of shares ('000) GBP'000 No. of shares ('000) GBP'000

--------------------- -------- --------------------- --------

In issue at 1 April 92,051 460 42,051 210

Issue of ordinary shares as consideration for a

business combination - - 14,286 71

Issue of ordinary shares 248 1 35,714 179

--------------------- -------- --------------------- --------

In issue at 30 September 92,299 461 92,051 460

--------------------- -------- --------------------- --------

9.2 Share Premium

2022 2021

GBP'000 GBP'000

(Restated)

-------- -----------

At 1 April 41,665 18,432

Issue of ordinary shares as consideration for a business combination - 23,223

At 30 September 41,665 41,665

-------- -----------

9.3 Merger Reserve

2022 2021

GBP'000 GBP'000

(Restated)

At 1 April 2022 20,206 10,879

Issue of ordinary shares as consideration for a business combination - 9,327

Transaction costs on issue of shares - -

At 30 September 2022 20,206 20,206

-------- -----------

During the completion of the annual report and accounts for 31

March 2022, amounts recognised in share premium that related to the

issuance of ordinary shares as consideration for a business

combination were reclassified to the merger reserve. Management

have therefore restated the amounts presented for the merger

reserve and for the share premium for the 6 months ended 30

September 2021 to reflect this.

10. Related Parties

Transactions with key management personnel

The compensation of key management personnel (directors) is as

follows:

30 September 2022 30 September 2021

GBP'000 GBP'000

------------------ ------------------

Short-term employee benefits 338 384

Post-employment pension and other benefits 8 6

Termination benefits - -

Share based payment transactions 123 123

Key management remuneration including social security costs 469 513

------------------ ------------------

Total compensation paid to key management personnel 469 513

------------------ ------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR DDBDDIBGDGDS

(END) Dow Jones Newswires

December 05, 2022 02:00 ET (07:00 GMT)

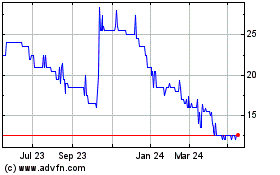

Induction Healthcare (LSE:INHC)

Historical Stock Chart

From Jun 2024 to Jul 2024

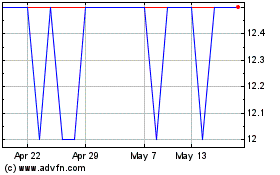

Induction Healthcare (LSE:INHC)

Historical Stock Chart

From Jul 2023 to Jul 2024