TIDMHUW

RNS Number : 4562N

Helios Underwriting Plc

30 September 2021

30 September 2021

Helios Underwriting plc

("Helios" or the "Company")

Interim Results for the Six Months Ended 30 June 2021

Helios Underwriting plc, the unique investment vehicle that

acquires and consolidates underwriting capacity at Lloyd's,

announces its unaudited results for the six months ended 30 June

2021, a half year in which Helios completed its successful

fundraising and continued its strategy of driving portfolio growth

and shareholder value.

Chairman's statement

Six months ended 30 June 2021

Nigel Hanbury, Chief Executive, provides the following

overview:

"Whilst these interim results have yet to reflect the

improvement in syndicate profitability following cumulative rate

increases of an average of 51% since January 2018, Helios' strategy

to generate growth and shareholder returns is firmly on track.

"We have completed or have agreed terms for the acquisition of

28 Limited Liability Vehicles with capacity of, in aggregate,

GBP33m for 2021 underwriting year for a total outlay of GBP38m. The

continued improvement in current market conditions have opened up

an exciting window of opportunity for Helios. The improvement in

underwriting conditions over 4 years will provide a platform for

better prospects for underwriting margins over the next few years,

and we are confident of a strong performance in the remainder of

the year."

SUMMARY FINANCIAL INFORMATION

6 months to 30(th) Year to 31(st)

June December

2021 2020 2020

GBP000's GBP000's GBP000's

Underwriting profits 1,102 154 639

Other income 526 850 2,887

Costs (2,108) (1,112) (3,190)

---------- ----------- ---------------

Operating (loss)/profit for the period

before impairment (480) (108) 336

---------- ----------- ---------------

(Loss)/profit after tax (2,319) (96) 301

Earnings per share (3.88p) (0.55p) 1.59p

Net Tangible Asset Value per Share GBP1.46 GBP1.90 ( GBP1.51

restated)

-- Operating loss is GBP480,000 (30 June 2020 - a loss of GBP108,000)

-- The underwriting profits have recovered following the losses

arising from the Covid-19 coronavirus pandemic in 2020

-- The cumulative premium rate increase achieved by underwriters

since 1(st) January 2018 is 51%, which together with greater

discipline encouraged by the Franchise Board at Lloyd's, has

improved the prospects for profitable underwriting

-- The Net Tangible Asset Value per share is GBP1.46 per share

(31(st) December 2020 - GBP1.51 per share)

-- Net Tangible Asset Value per share has been impacted by the

increase in the rate of corporation tax to 25%.

The underwriting profits have recovered following the losses

arising from the Covid-19 coronavirus pandemic in 2020. Both the

2019 and 2020 underwriting years have contributed to the result as

confidence in the reserves required for the Covid-19 losses have

improved and as the profits from the balance of the portfolio start

to be recognised. The contribution from the 2021 underwriting year

is an initial loss following the winter storms in the USA and as

Helios has increased its retained capacity to 54% of the portfolio,

this small loss has had a greater impact on the overall result.

The positive momentum in both insurance and reinsurance pricing

for many years has continued into 2021. The improvement in

underwriting conditions over 4 years will provide a platform for

better prospects for underwriting margins over the next few years.

. Cumulative rate increases since 1(st) January 2018 are 51%. We

have been advised of further pre-emptions of approximately GBP6.0m

of capacity (2020 - GBP9.5m) from our supported syndicates to take

advantage of improved market conditions.

Acquisition of LLV's

Following the capital raise in April 2021, we have been active

in agreeing terms for the acquisition of Limited Liability Vehicles

(LLV's). We have completed 8 acquisitions to date and have agreed

terms with a further 20 LLV's where completion is subject, inter

alia, to regulatory approval. The aggregate of the capacity,

consideration and total outlay for the LLV's agreed and completed

transactions to date are as follows:

GBPm

Consideration 24.6

Vendor Underwriting Capital

replaced 13.7

Total Outlay 38.3

-----

Humphrey Valuation 26.2

Consideration as a Discount

to Valuation 6.2%

These acquisitions have increased the capacity retained by

Helios for the 2021 underwriting year to 64% of the portfolio, an

increase of 20% so far in 2021.

Capacity by Year

of Account

GBPm 2021 2020 2019

Capacity as 1st Jan 2021 110.3 80.0 70.3

Capacity Acquired 33.0* 34.2* 34.8*

------ ------ ------

Total Current Capacity

by year of account 143.3 114.2 105.1

------ ------ ------

Capacity reinsured 51.5 49.1 39.0

Helios Retained Capacity 91.7 65.0 66.2

Helios Retained Capacity

- % 64% 57% 63%

*Acquired post 30 June 2021

Helios has received preliminary indications of pre-emptions for

2022 year of account from the syndicates supported, which are

subject to approval by Lloyd's, which together with the capacity

acquired will increase the capacity portfolio for 2022 year of

account to GBP151m - an increase of 37%.

The value of the capacity portfolio, using the 2020 weighted

average prices, including the value of the capacity acquired and

the value of the expected pre-emptions for 2022 (using the 2020

weighted average capacity prices) has increased to GBP46m - an

increase of 50%

Capacity

GBPm 2021 Capacity Value

2021 YOA as at 1st January

2021 110.3 30.8

Expected Pre-emptions 6.3 1.2

Capacity Acquired / agreed

terms 33.0 13.5

Expected Pre-emptions 1.8 0.6

Total 151.4 46.1

============== =========

Our strategy of building a portfolio of syndicate capacity

continues to rely on the flow of LLVs for sale at reasonable

prices. The discounts achieved to the Humphrey Valuations have

decreased as both Vendor expectations of future value have

increased and as other purchasers have realised the value of the

potential future profitability of these capacity portfolios.

The exposure on the 2021 open underwriting year as at 1st

January 2021 has been reduced by 46% through quota share

reinsurance. The quota share reinsurers fund their share of the

capital requirements and pay Helios a fee and a profit commission.

The reinsurance costs have increased as GBP7.6m of additional

underwriting capital has been sourced through a reinsurance

contract at a cost of GBP0.8m. In addition the stop loss for the

Helios retained capacity continues to be bought which has a 10%

indemnity to protect the Group from a loss excess of 5% loss for

the 2021 underwriting year.

The Net Tangible Asset Value per share is GBP1.46p per share

(Dec 2020 - GBP1.51p per share). The tax charge includes an

increased provision for deferred tax of GBP1.8m (3p per share) on

the value of the capacity portfolio following the increase in the

corporation tax to 25%. The total deferred tax provision on the

capacity value has increased to GBP7.0m representing 10p per share

of net asset value. It is expected that there will continue to be

demand for the top syndicates that make up a significant proportion

of the Helios Capacity Fund at the Lloyds Capacity Auctions that

take place later this year.

Helios Underwriting plc

Nigel Hanbury - Chief Executive +44 (0)7787 530 404 / nigel.hanbury@huwplc.com

Arthur Manners - Chief Financial Officer +44 (0)7754 965 917

Shore Capital

Robert Finlay +44 (0)20 7601 6100

David Coaten

Willis Re Securities (Financial Adviser)

Alastair Rodger +44 (0)20 3124 6033

Buchanan

Helen Tarbet / Henry Wilson / George Beale +44 (0)7872 604 453

+44 (0)20 7466 5111

About Helios

Helios provides a limited liability direct investment into the

Lloyd's insurance market and is quoted on the London Stock

Exchange's AIM market (ticker: HUW). Helios trades within the

Lloyd's insurance market writing approximately GBP110m of capacity

for the 2021 account. The portfolio provides a good spread of

business being concentrated in property insurance and reinsurance.

For further information please visit www.huwplc.com .

Financial results summary

Six months ended 30 June 2021

6 months to 6 months to 30 Year to 31 December

30 June 2021 June 2020 2020

Underwriting profits 1,102 154 639

Other Income -

Fees from reinsurers 474 400 334

Corporate reinsurance recoveries 14 202 (282)

Goodwill on bargain purchase - 172 1,260

Investment income 38 76 1,575

Total Other Income 526 850 2,887

Costs

Pre - acquisition - (9) (92)

Stop loss costs (968) (181) (1,097)

Operating costs (1,140) (922) (2,001)

Total Costs (2,108) (1,112) (3,190)

Operating profit before

impairments of goodwill

and capacity (480) (108) 336

Impairment charge for - - -

capacity

Tax (1,839) 12 (35)

Profit for the period/year (2,319) (96) 301

============== =============== ====================

Period to 30(th) June 2021

Helios retained

capacity at Helios

30 June 2021 Portfolio mid Profits

Underwriting Year GBPm point forecasts GBP'000

2019 31.3 0.01% 1,062

2020 30.8 0.98% 984

2021 58.7 - (944)

------------------ --------------- ---------------- --------

1,102

------------------ --------------- ---------------- --------

Period to 30(th) June 2020

Helios retained

capacity at Helios

30 June 2020 Portfolio mid Profits

Underwriting Year GBPm point forecasts GBP'000

------------------ --------------- ---------------- --------

2018 27.6 (3.10%) 439

2019 23.3 (1.60%) 101

2020 21.1 - (386)

------------------ --------------- ---------------- --------

154

------------------ --------------- ---------------- --------

Year to 31 December 2020

Helios retained

capacity at

31 December Helios

2020 Portfolio mid Profits

Underwriting Year GBPm point forecasts GBP'000

------------------ --------------- ---------------- --------

2018 36.1 (0.30)% 1,691

2019 31.3 (2.20)% 338

2020 30.8 - (1,391)

------------------ --------------- ---------------- --------

639

------------------ --------------- ---------------- --------

Summary Balance Sheet

The summary Group balance sheet excludes items relating to

syndicate participations. See Note 15 for further information.

6 Months to June 2021 6 Months to June 2020 Year to 31 December 2020

GBP'000 GBP'000 GBP'000

------------------ --------------------- ----------------------- ------------------------

Intangible assets 31,601 21,655 31,601

Funds at Lloyd's 18,543 8,989 19,713

Other cash 52,272 1,156 4,961

Other assets 12,385 8,179 12,731

------------------ --------------------- ----------------------- ------------------------

Total assets 114,801 39,979 69,006

------------------ --------------------- ----------------------- ------------------------

Deferred tax 8,546 3,686 6,492

Borrowings - 2,000 4,000

Other liabilities 3,409 1,118 2,222

------------------ --------------------- ----------------------- ------------------------

Total liabilities 11,955 6,804 12,714

------------------ --------------------- ----------------------- ------------------------

Syndicate equity (3,573) (5,123) (5,743)

------------------ --------------------- ----------------------- ------------------------

Total equity 99,273 28,052 50,549

------------------ --------------------- ----------------------- ------------------------

Summary Group Cash Flow

The summary group cash flow sheet excludes items relating to

syndicate participations. See Note 15 for further information.

6 months to 6 months to 30 Year to 31 December

30 June 2021 June 2020 2020

GBP'000 GBP'000 GBP'000

Opening Balance (free cash) 4,961 3,028 3,028

Income

Acquired on acquisition - 280 632

Distribution of profits (net

of tax retentions) 365 54 120

Transfers from Funds at Lloyds' 224 4,252 4,901

Investment income 5 28 248

Other income - - 1,649

Issue of new ordinary shares 53,231 - 11,283

Borrowings - 2,000 2,000

Expenditure

Operating costs (inc Hampden

/ Nomina fees) (933) (406) (2,810)

Reinsurance Cost (1,025) (353) -

Acquisition of LLV's - (4,875) (6,075)

Transfers to Funds at Lloyds' (8) (750) (9,733)

Tax (548) (102) (282)

Dividends paid - - -

Revolving credit facility

repayment (4,000) (2,000) -

Share buy backs - - -

Closing balance 52,272 1,156 4,961

-------------- --------------- --------------------

Net Tangible Asset per share

6 months 6 months Year to 31

to 30 June to 30 June December

2021 2020 2020

GBP'000 GBP'000 GBP'000

(restated)

Net tangible assets 67,642 6,397 18,948

Group letters of

credit - - -

Value of capacity

(WAV) 30,826 26,827 30,826

------------ ------------ -----------

98,468 33,224 49,774

------------ ------------ -----------

Shares in issue

- on the market 67,254 17,478 33,012

Shares in issue

- total of on the

market and JSOP

shares 67,754 17,978 33,512

Net tangible asset

value per share

GBP - on the market 1.46 1.90 1.51

Net tangible asset

value per share

GBP - on the market

and JSOP shares 1.45 1.85 1.49

Interim condensed consolidated statement of comprehensive

income

Six months ended 30 June 2021

6 months

ended 6 months 12 months

30 June ended 30 ended

2021 June 2020 31 December

Unaudited Unaudited 2020 Audited

Note GBP'000 GBP'000 GBP'000

------------------------------------------------------- ----- ---------- ---------- -------------

Gross premium written 4 53,351 36,950 68,263

Reinsurance premium ceded (17,107) (11,575) (17,660)

------------------------------------------------------- ----- ---------- ---------- -------------

Net premium written 4 36,244 25,375 50,603

------------------------------------------------------- ----- ---------- ---------- -------------

Change in unearned gross premium provision 5 (15,678) (7,700) (2,481)

Change in unearned reinsurance premium provision 5 6,141 3,837 647

------------------------------------------------------- ----- ---------- ---------- -------------

5 (9,537) (3,863) (1,834)

------------------------------------------------------- ----- ---------- ---------- -------------

Net earned premium 3,4 26,707 21,512 48,769

Net investment income 6 185 1,174 2,006

Other underwriting income 476 400 420

Gain on bargain purchase 12 - 172 1,260

Other income 30 - 1,399

------------------------------------------------------- ----- ---------- ---------- -------------

Revenue 27,398 23,258 53,845

------------------------------------------------------- ----- ---------- ---------- -------------

Gross claims paid (19,108) (16,380) (38,496)

Reinsurers' share of gross claims paid 4,946 3,784 9,967

------------------------------------------------------- ----- ---------- ---------- -------------

Claims paid, net of reinsurance (14,162) (12,596) (28,529)

------------------------------------------------------- ----- ---------- ---------- -------------

Change in provision for gross claims 5 (2,118) (5,927) (8,255)

Reinsurers' share of change in provision for gross

claims 5 (156) 2,162 2,704

------------------------------------------------------- ----- ---------- ---------- -------------

Net change in provision for claims 5 (2,274) (3,765) (5,551)

------------------------------------------------------- ----- ---------- ---------- -------------

Net insurance claims and loss adjustment expenses 4 (16,436) (16,361) (34,080)

------------------------------------------------------- ----- ---------- ---------- -------------

Expenses incurred in insurance activities (10,665) (6,166) (17,916)

Other operating expenses (777) (839) (1,522)

------------------------------------------------------- ----- ---------- ---------- -------------

Operating expenses (11,442) (7,005) (19,438)

------------------------------------------------------- ----- ---------- ---------- -------------

Operating (loss)/profit before impairments of goodwill

and capacity 4 (480) (108) 336

Impairment of goodwill - - -

Impairment of syndicate capacity - - -

------------------------------------------------------- ----- ---------- ---------- -------------

(Loss)/profit before tax (480) (108) 336

Income tax charge 7 (112) 12 (35)

Income and deferred tax charge as a result of change

in tax rates 7 (1,727) - -

(Loss)/Profit for the period (2,319) (96) 301

------------------------------------------------------- ----- ---------- ---------- -------------

Other comprehensive income

Foreign currency translation differences - - -

Revaluation of syndicate capacity - - 5,604

Deferred tax relating to change in tax rates on

revaluation of capacity (340) - (1,622)

------------------------------------------------------- ----- ---------- ---------- -------------

Other comprehensive (loss)/income for the period,

net of tax (340) - 3,982

------------------------------------------------------- ----- ---------- ---------- -------------

Total other comprehensive (loss)/income for the

period (2,659) (96) 4,283

------------------------------------------------------- ----- ---------- ---------- -------------

(Loss)/profit for the period attributable to owners

of the Parent (2,659) (96) 301

------------------------------------------------------- ----- ---------- ---------- -------------

Total comprehensive (loss)/income for the period

attributable to owners of the Parent (2,659) (96) 4,283

------------------------------------------------------- ----- ---------- ---------- -------------

(Loss)earnings per share attributable to owners

of the Parent

Basic 8 -3.88p -0.55p 1.59p

Diluted 8 -3.82p -0.52p 1.55p

------------------------------------------------------- ----- ---------- ---------- -------------

The profit attributable to owners of the Parent and earnings per

share set out above are in respect of continuing operations.

The notes are an integral part of these Financial

Statements.

Interim condensed consolidated statement of financial

position

Six months ended 30 June 2021

6 months

ended 6 months 12 months

30 June ended 30 ended

2021 June 2020 31 December

Unaudited Unaudited 2020 Audited

Note GBP'000 GBP'000 GBP'000

------------------------------------------------------- ----- ---------- ---------- -------------

Assets

Intangible assets 31,601 21,655 31,601

Financial assets at fair value through profit or

loss 83,047 64,143 85,277

Reinsurance assets:

- reinsurers' share of claims outstanding 5 32,800 28,141 30,781

- reinsurers' share of unearned premium 5 10,694 9,195 6,028

Other receivables, including insurance and reinsurance

receivables 66,227 52,799 58,348

Deferred acquisition costs 8,119 6,853 7,726

Prepayments and accrued income 1,633 882 1,176

Cash and cash equivalents 62,143 8,501 8,495

------------------------------------------------------- ----- ---------- ---------- -------------

Total assets 296,264 192,169 229,432

------------------------------------------------------- ----- ---------- ---------- -------------

Liabilities

Insurance liabilities:

- claims outstanding 5 115,559 99,758 113,371

- unearned premium 5 42,974 35,961 32,356

Deferred income tax liabilities 8,546 3,686 6,507

Borrowings - 2,000 4,000

Other payables, including insurance and reinsurance

payables 25,640 20,841 19,356

Accruals and deferred income 4,272 1,871 3,293

------------------------------------------------------- ----- ---------- ---------- -------------

Total liabilities 196,991 164,117 178,883

------------------------------------------------------- ----- ---------- ---------- -------------

Equity

Equity attributable to owners of the Parent:

Share capital 11 6,817 1,839 3,393

Share premium 11 85,502 18,938 35,525

Revaluation reserve 3,642 - 3,982

Other reserves - treasury shares 11 (50) (50) (50)

Retained earnings 3,362 7,325 7,699

------------------------------------------------------- ----- ---------- ---------- -------------

Total equity 99,273 28,052 50,549

------------------------------------------------------- ----- ---------- ---------- -------------

Total liabilities and equity 296,264 192,169 229,432

------------------------------------------------------- ----- ---------- ---------- -------------

The Financial Statements were approved and authorised for issue

by the Board of Directors on 29 September 2021, and were signed on

its behalf by:

Nigel Hanbury

Chief Executive

The notes are an integral part of these Financial

Statements.

Interim condensed consolidated statement of changes in

equity

Six months ended 30 June 2021

Attributable to owners

of the Parent

-------------------------------------------------------

Note Share Share Revaluation Other Retained

capital premium reserve reserves earnings Total

Consolidated GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------------------------- ----- -------- --------- ----------- ---------- --------- --------

At 1 January 2021 3,393 35,525 3,982 (50) 7,699 50,549

Total comprehensive income for - -

the year: - - - -

Loss for the year - - - - (2,319) (2,319)

Other comprehensive income, net

of tax - - (340) - - (340)

-------------------------------- ----- -------- --------- ----------- ---------- --------- --------

Total comprehensive income for

the year - - (340) - (2,319) (2,659)

-------------------------------- ----- -------- --------- ----------- ---------- --------- --------

Transactions with owners: - - - - - -

Dividends paid 9 - - - - (2,018) (2,018)

Company buy back of shares 11 - - - - - -

Share issue 3,424 49,977 - - - 53,401

-------------------------------- ----- -------- --------- ----------- ---------- --------- --------

Total transactions with owners 3,424 49,977 - - (2,018) 51,383

At 30 June 2021 6,817 85,502 3,642 (50) 3,362 99,273

-------------------------------- ----- -------- --------- ----------- ---------- --------- --------

At 1 January 2020 1,839 18,938 - (50) 7,421 28,148

Total comprehensive income for - -

the year: - - - -

Loss for the year - - - - (96) (96)

Other comprehensive income, net - -

of tax - - - -

-------------------------------- ----- -------- --------- ----------- ---------- --------- --------

Total comprehensive income for

the year - - - - (96) (96)

-------------------------------- ----- -------- --------- ----------- ---------- --------- --------

Transactions with owners: - - - - - -

Dividends paid - - - - - -

Share issue - - - - - -

-------------------------------- ----- -------- --------- ----------- ---------- --------- --------

Total transactions with owners - - - - - -

-------------------------------- ----- -------- --------- ----------- ---------- --------- --------

At 30 June 2020 1,839 18,938 - (50) 7,325 28,052

-------------------------------- ----- -------- --------- ----------- ---------- --------- --------

At 1 January 2020 1,839 18,938 - (50) 7,421 28,148

Total comprehensive income for

the year:

Profit for the year - - - - 301 301

Other comprehensive income, net

of tax - - 3,982 - - 3,982

-------------------------------- ----- -------- --------- ----------- ---------- --------- --------

Total comprehensive income for

the year - - 3,982 - 301 4,283

-------------------------------- ----- -------- --------- ----------- ---------- --------- --------

Transactions with owners:

Dividends paid - - - - - -

Company buy back of shares 11 - - - - (23) (23)

Share issue 11 1,554 16,587 - - - 18,141

-------------------------------- ----- -------- --------- ----------- ---------- --------- --------

Total transactions with owners 1,554 16,587 - - (23) 18,118

-------------------------------- ----- -------- --------- ----------- ---------- --------- --------

At 31 December 2020 3,393 35,525 3,982 (50) 7,699 50,549

-------------------------------- ----- -------- --------- ----------- ---------- --------- --------

Interim condensed consolidated statement of cash flows

Six months ended 30 June 2021

Note 6 months 6 months 12 months

ended ended ended

30 June 30 June 31 December

2021 2020 Unaudited 2020

Unaudited GBP'000 Audited

GBP'000 GBP'000

-------------------------------------------------------------- ----- ---------- --------------- ------------

Cash flows from operating activities

(Loss)/Profit before taxp (480) (108) 336

Adjustments for:

- Other comprehensive income, gross of tax - - -

- Interest received (2) (45) (156)

- Investment income 6 (183) (1,136) (1,318)

- Recognition of negative goodwill - (172) -

- Goodwill on bargain purchase - - (1,260)

- (Profit)/loss on sale of intangible assets - - (1,775)

Changes in working capital:

* change in fair value of financial assets held at fair

value through profit or loss (140) (79) (297)

* decrease/(increase) in financial assets at fair value

through profit or loss 2,230 4,171 (7,768)

- (increase)/decrease in other receivables (8,729) (3,863) 4,491

- decrease/(increase) in other payables 5,245 (1,193) (4,706)

- net decrease/(increase) in technical provisions 6,121 5,059 (650)

-------------------------------------------------------------- ----- ---------- --------------- ------------

Cash generated/(utilised) from operations 4,062 2,634 (13,103)

-------------------------------------------------------------- ----- ---------- --------------- ------------

Income tax paid - (312)

-------------------------------------------------------------- ----- ---------- --------------- ------------

Net cash inflow from operating activities 4,062 2,634 (13,415)

-------------------------------------------------------------- ----- ---------- --------------- ------------

Cash flows from investing activities

Interest received 2 45 156

Investment income 183 1,136 1,318

Purchase of intangible assets - - (186)

Proceeds from disposal of intangible assets - - 1,779

Acquisition of subsidiaries, net of cash acquired - (1,218) (364)

-------------------------------------------------------------- ----- ---------- --------------- ------------

Net cash inflow/(outflow) from investing activities 185 (37) 2,703

-------------------------------------------------------------- ----- ---------- --------------- ------------

Cash flows from financing activities

-------------------------------------------------------------- ----- ---------- --------------- ------------

Net proceeds from issue of ordinary share capital 53,401 - 11,193

Buy back of ordinary share capital - (133) -

Payment for company buy back of shares - - (23)

Proceeds from borrowings - - 2,000

Repayment of borrowings (4,000) - -

Dividends paid to owners of the Parent - - -

-------------------------------------------------------------- ----- ---------- --------------- ------------

Net cash inflow/(outflow) from financing activities 49,401 (133) 13,170

-------------------------------------------------------------- ----- ---------- --------------- ------------

Net increase in cash and cash equivalents 53,648 2,464 2,458

Cash and cash equivalents at beginning of period 8,495 6,037 6,037

-------------------------------------------------------------- ----- ---------- --------------- ------------

Cash and cash equivalents at end of period 62,143 8,501 8,495

-------------------------------------------------------------- ----- ---------- --------------- ------------

Cash held within the syndicates' accounts is GBP9,871,000 (2020:

GBP7,345,000) of the total cash and cash equivalents held at the

end of the period GBP62,143,000 (2020: GBP8,501,000). The cash held

within the syndicates' accounts is not available to the Group to

meet its day-to-day working capital requirements.

Cash and cash equivalents comprise cash at bank and in hand.

The notes are an integral part of these Financial

Statements.

Notes to the financial statements

Six months ended 30 June 2021

1. General information

The Company is a public limited company quoted on AIM. The

Company was incorporated in England, is domiciled in the UK and its

registered office is 40 Gracechurch Street, London EC3V 0BT. The

Company participates in insurance business as an underwriting

member at Lloyd's through its subsidiary undertakings.

2. Accounting policies

Basis of preparation

The Condensed Consolidated Interim Financial Statements have

been prepared using accounting policies consistent with

International Financial Reporting Standards (IFRSs) and in

accordance with UK adopted International Accounting Standard (IAS)

34 Interim Financial Reporting, in accordance with the requirements

of the Companies Act 2006.

The Condensed Consolidated Interim Financial Statements are

prepared for the six months ended 30 June 2021.

The Condensed Consolidated Interim Financial Statements for the

six months ended 30 June 2021 and 2020 are unaudited, but have been

subject to review by the Group's auditors. The Condensed

Consolidated Interim Financial Statements have been prepared in

accordance with the accounting policies adopted for the year ended

31 December 2020, and the adoption of new and amended standards as

set out further below.

The Condensed Consolidated Interim incorporate the Financial

Statements of Helios Underwriting plc, the Parent Company, and its

directly and indirectly held subsidiaries (see note 10).

The underwriting data on which these Condensed Consolidated

Interim Financial Statements are based upon has been supplied by

the managing agents of those syndicates which the Group supports.

The data supplied is the 100% figures for each syndicate. The Group

has applied its share of the syndicate participations to the gross

figures to derive its share of the syndicates transactions, assets

and liabilities.

Significant accounting policies

The Condensed Consolidated Interim Financial Statements have

been prepared under the historical cost convention as modified by

the revaluation of the financial assets at fair value through the

profit and loss. The same accounting policies, presentation and

methods of computation are followed in these Condensed Consolidated

Interim Financial Statements as were applied in the preparation of

the Group Financial Statements for the year ended 31 December

2020.

International Financial Reporting Standards

Adoption of new and revised standards

In the current year, the Group has applied new IFRSs and

amendments to IFRSs issued by the IASB that are mandatory for an

accounting period that begins on or after 1 January 2020.

IFRS 16 Amendments, Leases COVID 19 Related Rent Concessions.

Lessees are provided with an exemption from assessing whether a

COVID-19-related rent concession is a lease modification. The Group

has not applied this exemption and the amendment has not had an

impact on the Consolidated Financial Statements.

IFRS 3 Amendments, Business Combinations. The amendment is aimed

at resolving the difficulties that arise when an entity determines

whether it has acquired a business or a group of assets. The

amendments provide further clarity on what constitutes an acquired

business, and this clarification has not impacted the Group's

recognition of acquired business in the year and has not had an

impact on the Consolidated Financial Statements

IFRS 9, IAS 39 and IFRS 7 Amendments, Interest Rate Benchmark

Reform. The amendments deal specifically with interest rate hedge

accounting and is the first phase of change relating to interest

rate benchmark reform and the replacement of LIBOR. The Group has

not been impacted by these amendments for hedge accounting.

IAS 1 and IAS 8 Amendments, Definition of Material. The

amendments clarify the definition of 'material' and align the

definition used in the Conceptual Framework and the standards

themselves. Information is material if omitting, misstating or

obscuring it could reasonably be expected to influence decisions

that the primary users of general purpose financial statements make

on the basis of those financial statements, which provide financial

information about a specific reporting entity. The Financial

Statements have been prepared in accordance with this

clarification.

New standards, amendments and interpretations not yet

adopted

A number of new standards and amendments adopted by the UK, as

well as standards and interpretations issued by the IASB but not

yet adopted by the UK, have not been applied in preparing the

Consolidated Financial Statements.

The Group does not plan to adopt these standards early; instead

it will apply them from their effective dates as determined by

their dates of UK endorsement. The Group continues to review the

upcoming standards to determine their impact.

IFRS 9, Financial Instruments (IASB effective date 1 January

2018) has not been applied under IFRS 4 Amendment option to defer

until IFRS 17 comes into effect on 1 January 2023.

IFRS 17, Insurance Contracts. (IASB effective date 1 January

2023).

IFRS 9, IAS 39 and IFRS 7 Amendments, Interest Rate Benchmark

Reform Phase 2. (IASB effective date 1 January 2021).

Amendments to IFRS 3 Business Combinations, IAS 16 Property,

Plant and Equipment, IAS 37 Provisions, Contingent Liabilities and

Contingent Assets. (IASB effective date 1 January 2022).

IAS 1 Presentation of Financial Statements Amendments,

Classification of Liabilities as Current or Non-current. (IASB

effective date 1 January 2023).

IAS 8 Accounting Policies Amendments, Changes in Accounting

Estimates and Errors. (IASB effective date 1 January 2023).

IFRS 9, Financial instruments (IASB effective date 1 January

2018) has not been applied under IFRS 4 Amendment option. IFRS 9

provides a reform of financial instruments accounting to supersede

IAS 39 Financial Instruments: Recognition and Measurement. Applying

IFRS 9 Financial Instruments with IFRS 4 Insurance Contracts

contained an optional temporary exemption from applying IFRS 9 for

entities whose predominant activity is issuing contracts within the

scope of IFRS 4. The Group meets the eligibility criteria and has

taken advantage of this temporary exemption not to apply this

standard until the effective date of IFRS 17.

3. Segmental information

Nigel Hanbury is the Group's chief operating decision-maker. He

has determined its operating segments based on the way the Group is

managed, for the purpose of allocating resources and assessing

performance.

The Group has three segments that represent the primary way in

which the Group is managed, as follows:

-- syndicate participation;

-- investment management; and

-- other corporate activities.

Other

Syndicate Investment corporate

participation management activities Total

6 months ended 30 June 2021 Unaudited GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------------ -------------- ----------- ----------- --------

Net earned premium 27,658 - (951) 26,707

Net investment income 157 28 - 185

Other income - - 506 506

Net insurance claims and loss adjustment

expenses (16,436) - - (16,436)

Expenses incurred in insurance activities (9,068) - (1,597) (10,665)

Other operating expenses - - (777) (777)

Loss before tax 2,311 28 (2,819) (480)

------------------------------------------ -------------- ----------- ----------- --------

Other

Syndicate Investment corporate

participation management activities Total

6 months ended 30 December 2020 Audited GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------------ -------------- ----------- ----------- --------

Net earned premium 48,769 - - 48,769

Net investment income 2,126 (120) - 2,006

Other income 101 - 1,718 1,819

Net insurance claims and loss adjustment

expenses (33,990) - (90) (34,080)

Expenses incurred in insurance activities (17,572) - (343) (17,916)

Other operating expenses 203 - (1,725) (1,522)

Goodwill on bargain purchase - - 1,260 1,260

Impairment of syndicate capacity - - - -

------------------------------------------ -------------- ----------- ----------- --------

Profit before tax (363) (120) 820 336

------------------------------------------ -------------- ----------- ----------- --------

The Group does not have any geographical segments as it

considers all of its activities to arise from trading within the

UK.

No major customers exceed 10% of revenue.

Net earned premium within 2021 other corporate activities

totalling GBP951,000 (2020: GBP90,000 Net insurance claims and loss

adjustment expenses - 2018, 2019 and 2020 years of account)

represents the 2019, 2020 and 2021 years of account net Group quota

share reinsurance premium payable to Hampden Insurance Guernsey PCC

Limited - Cell 6. This net quota share reinsurance premium payable

is included within "reinsurance premium ceded" in the Consolidated

Statement of Comprehensive Income of the period.

4. Operating profit before impairments of goodwill and

capacity

Underwriting year of account*

-------------------------------------------

2019 and Pre- Corporate Other

6 months ended 30 prior 2020 2021 Sub-total acquisition reinsurance corporate Total

June 2021 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------------- -------- --------- --------- ----------- ------------ ------------ ---------- --------

Gross premium written 285 5,823 47,243 53,351 - - - 53,351

Reinsurance ceded (430) (1,168) (13,590) (15,188) - (951) (968) (17,107)

----------------------- -------- --------- --------- ----------- ------------ ------------ ---------- --------

Net premium written (145) 4,655 33,653 38,163 - (951) (968) 36,244

----------------------- -------- --------- --------- ----------- ------------ ------------ ---------- --------

Net earned premium 1,218 18,769 8,639 28,626 - (951) (968) 26,707

Other income 84 41 54 179 - 474 38 691

Net insurance claims

and loss adjustment

expenses 901 (11,323) (6,028) (16,450) - - 14 (16,436)

Operating expenses (725) (5,225) (4,353) (10,302) - - (1,139) (11,442)

----------------------- -------- --------- --------- ----------- ------------ ------------ ---------- --------

Operating profit

before impairments

of goodwill and

capacity 1,478 2,262 (1,687) 2,053 - (477) (2,056) (480)

----------------------- -------- --------- --------- ----------- ------------ ------------ ---------- --------

Quota share adjustment (416) (1,278) 743 (951) - (951) - -

----------------------- -------- --------- --------- ----------- ------------ ------------ ---------- --------

Operating profit

before impairments

of goodwill and

capacity

after quota share

adjustment 1,062 984 (944) 1,102 - 474 (2,056) (480)

----------------------- -------- --------- --------- ----------- ------------ ------------ ---------- --------

Underwriting year of account*

---------------------------------------------

2018 and Pre- Corporate Other

6 months ended 30 prior 2019 2020 Sub-total acquisition reinsurance corporate Total

June 2020 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------------- ---------- --------- --------- ----------- ------------ ------------ ---------- --------

Gross premium written 115 4,439 32,491 37,045 (95) - - 36,950

Reinsurance ceded (131) (1,089) (9,578) (10,798) 24 (621) (181) (11,575)

--------------------- ---------- --------- --------- ----------- ------------ ------------ ---------- --------

Net premium written (16) 3,350 22,913 26,247 (70) (621) (181) 25,375

--------------------- ---------- --------- --------- ----------- ------------ ------------ ---------- --------

Net earned premium 1,519 15,105 5,756 22,380 (66) (621) (181) 21,512

Other income 702 301 102 1,105 (7) 400 248 1,746

Net insurance claims

and loss adjustment

expenses (401) (10,523) (5,686) (16,610) 48 - 202 (16,361)

Operating expenses (581) (4,092) (1,427) (6,100) 18 - (922) (7,005)

--------------------- ---------- --------- --------- ----------- ------------ ------------ ---------- --------

Operating profit

before impairments

of goodwill and

capacity 1,239 791 (1,255) 775 (9) (221) (653) (108)

--------------------- ---------- --------- --------- ----------- ------------ ------------ ---------- --------

Quota share

adjustment (800) (690) 869 (621) - 621 - -

--------------------- ---------- --------- --------- ----------- ------------ ------------ ---------- --------

Operating profit

before impairments

of goodwill and

capacity

after quota share

adjustment 439 101 (386) 154 (9) 400 (653) (108)

--------------------- ---------- --------- --------- ----------- ------------ ------------ ---------- --------

Underwriting year of account*

---------------------------------------------

2018 Pre- Corporate Other

12 months ended 31 and prior 2019 2020 Sub-total acquisition reinsurance corporate Total

December 2020 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------------- ---------- --------- --------- ----------- ------------ ------------ ---------- --------

Gross premium written 348 6,105 69,693 76,146 (7,883) - - 68,263

Reinsurance ceded 202 (1,410) (16,817) (18,025) 1,462 - (1,097) (17,660)

--------------------- ---------- --------- --------- ----------- ------------ ------------ ---------- --------

Net premium written 550 4,695 52,876 58,121 (6,421) - (1,097) 50,6303

--------------------- ---------- --------- --------- ----------- ------------ ------------ ---------- --------

Net earned premium 3,116 24,807 27,759 55,682 (5,816) - (1,097) 48,769

Other income 1,242 585 604 2,431 (515) 334 2,835 5,085

Net insurance claims

and loss adjustment

expenses 579 (17,074) (21,386) (37,881) 4,174 (90) (283) (34,080)

Operating expenses (1,473) (7,373) (10,657) (19,503) 2,065 - (2,000) (19,438)

--------------------- ---------- --------- --------- ----------- ------------ ------------ ---------- --------

Operating profit

before impairments

of goodwill and

capacity 3,464 945 (3,680) 729 (92) 244 (545) 336

--------------------- ---------- --------- --------- ----------- ------------ ------------ ---------- --------

Quota share

adjustment (1,773) (606) 2,289 (90) - 90 - -

--------------------- ---------- --------- --------- ----------- ------------ ------------ ---------- --------

Operating profit

before impairments

of goodwill and

capacity

after quota share

adjustment 1,691 339 (1,391) 639 (92) 334 (545) 336

--------------------- ---------- --------- --------- ----------- ------------ ------------ ---------- --------

Pre-acquisition relates to the element of results from the new

acquisitions before they were acquired by the Group.

* The underwriting year of account results represent the Group's

share of the syndicates' results by underwriting year of account

before corporate member level reinsurance and members' agents

charges.

5. Insurance liabilities and reinsurance balances

Movement in claims outstanding

Gross Reinsurance Net

GBP'000 GBP'000 GBP'000

------------------------------------------------- -------- ----------- --------

At 1 January 2021 113,371 30,781 82,590

Increase in reserves arising from acquisition of

subsidiary undertakings - - -

Movement of reserves 2,118 (156) 2,274

Other movements 70 2,175 (2,105)

------------------------------------------------- -------- ----------- --------

At 30 June 2021 115,559 32,800 82,759

------------------------------------------------- -------- ----------- --------

Movement in unearned premium

Gross Reinsurance Net

GBP'000 GBP'000 GBP'000

------------------------------------------------- -------- ----------- --------

At 1 January 2021 32,356 6,028 26,328

Increase in reserves arising from acquisition of

subsidiary undertakings - - (1)

Movement of reserves 15,678 6,141 9,537

Other movements (5,060) (1,475) (3,584)

------------------------------------------------- -------- ----------- --------

At 30 June 2021 42,974 10,694 32,280

------------------------------------------------- -------- ----------- --------

Included within other movements are the 2018 and prior years'

claims reserves reinsured into the 2019 year of account on which

the Group does not participate and currency exchange

differences.

Movement in claims outstanding

Gross Reinsurance Net

GBP'000 GBP'000 GBP'000

------------------------------------------------- -------- ----------- --------

At 1 January 2020 95,616 25,760 69,856

Increase in reserves arising from acquisition of

subsidiary undertakings 2,036 505 1,531

Movement of reserves 5,927 2,162 3,765

Other movements (3,821) (286) (3,535)

------------------------------------------------- -------- ----------- --------

At 30 June 2020 99,758 28,141 71,617

------------------------------------------------- -------- ----------- --------

Movement in unearned premium

Gross Reinsurance Net

GBP'000 GBP'000 GBP'000

------------------------------------------------- -------- ----------- --------

At 1 January 2020 26,522 5,023 21,499

Increase in reserves arising from acquisition of

subsidiary undertakings 530 92 438

Movement of reserves 7,700 3,837 3,863

Other movements 1,209 243 966

------------------------------------------------- -------- ----------- --------

At 30 June 2020 35,961 9,195 26,766

------------------------------------------------- -------- ----------- --------

Included within other movements are the 2017 and prior years'

claims reserves reinsured into the 2018 year of account on which

the Group does not participate and currency exchange

differences.

Movement in claims outstanding

Gross Reinsurance Net

GBP'000 GBP'000 GBP'000

------------------------------------------------- -------- ----------- --------

At 1 January 2020 95,616 25,760 69,856

Increase in reserves arising from acquisition of

subsidiary undertakings 17,737 3,592 14,145

Movement of reserves 8,255 2,704 5,551

Other movements (8,237) (1,275) (6,962)

------------------------------------------------- -------- ----------- --------

At 31 December 2020 113,371 30,781 82,590

------------------------------------------------- -------- ----------- --------

Movement in unearned premium

Gross Reinsurance Net

GBP'000 GBP'000 GBP'000

------------------------------------------------- -------- ----------- --------

At 1 January 2020 26,522 5,023 21,499

Increase in reserves arising from acquisition of

subsidiary undertakings 4,679 613 4,066

Movement of reserves 2,481 647 1,834

Other movements (1,326) (255) (1,071)

------------------------------------------------- -------- ----------- --------

At 31 December 2020 32,356 6,028 26,328

------------------------------------------------- -------- ----------- --------

Included within other movements are the 2018 and prior years'

claims reserves reinsured into the 2019 year of account on which

the Group does not participate and currency exchange

differences.

6. Net investment income

6 months 6 months 12 months

ended ended ended 31

30 June 30 June December

2021 Unaudited 2020 Unaudited 2020 Audited

GBP'000 GBP'000 GBP'000

------------------------------------------------------ --------------- ---------------- -------------

Investment income 183 1,136 1,318

Realised (losses)/gains on financial assets at fair

value through profit or loss - 126 288

Unrealised (losses)/gains on financial assets at fair

value through profit or loss - (133) 297

Investment management expenses - - (53)

Bank interest 2 45 156

------------------------------------------------------ --------------- ---------------- -------------

Net investment income 185 1,174 2,006

------------------------------------------------------ --------------- ---------------- -------------

7. Income tax charge

Analysis of tax charge/(credit) in the period

6 months 6 months 12 months

ended ended ended 31

30 June 30 June December

2021 Unaudited 2020 Unaudited 2020 Audited

GBP'000 GBP'000 GBP'000

------------------ --------------- ---------------- -------------

Income tax credit 1,839 (12) 35

------------------ --------------- ---------------- -------------

The income tax expense is recognised based on management's best

estimate of the weighted average annual income tax rate expected

for the full financial year. The estimated average annual tax rate

used is 19.00% (2019: 19.00%). Included above is GBP1,727,000 which

relates to the increase in deferred tax rates from 1 April

2023.

8. Earnings per share

Basic earnings per share is calculated by dividing the profit

attributable to ordinary shareholders after tax by the weighted

average number of ordinary shares outstanding during the

period.

Diluted earnings per share is calculated by dividing the net

profit attributable to ordinary equity holders of the Company by

the weighted average number of ordinary shares outstanding during

the period, plus the weighted average number of ordinary shares

that would be issued on the conversion of all the dilutive

potential ordinary shares into ordinary shares.

Earnings per share has been calculated in accordance with IAS 33

"Earnings per share".

The earnings per share and weighted average number of shares

used in the calculation are set out below:

6 months 6 months 12 months

ended 30 ended 30 ended 31

June 2021 June 2020 December

Unaudited Unaudited 2020 Audited

----------------------------------------------------- ----------- ----------- -------------

(Loss)/profit for the year after tax attributable

to ordinary equity holders of the parent (2,319,000) (96,000) 301,000

----------------------------------------------------- ----------- ----------- -------------

Basic - weighted average number of ordinary shares* 59,704,671 17,978,841 18,921,902

----------------------------------------------------- ----------- ----------- -------------

Adjustments for calculating the diluted earnings per

share: Treasury shares (JSOP scheme) 500,000 500,000 500,000

----------------------------------------------------- ----------- ----------- -------------

Diluted - weighted average number of shares* 60,204,671 17,478,841 19,412,902

----------------------------------------------------- ----------- ----------- -------------

Basic (loss)/earnings per share (3.88) (0.55p) 1.59p

----------------------------------------------------- ----------- ----------- -------------

Diluted (loss)/earnings per share (3.82) (0.52p) 1.55p

----------------------------------------------------- ----------- ----------- -------------

* Used as the denominator in calculating the basic earnings per

share, and diluted earnings per share, respectively.

9. Dividends paid or proposed

It was proposed and agreed at the AGM on 29 June 2021 that a

dividend of 3p will be payable in 2021 (2020: nil).

10. Investments in subsidiaries

30 June 30 June 31 December

2020 2019 2019

GBP'000 GBP'000 GBP'000

------------------------------------------------------------------------------- -------- -------- -----------

Total 45,335 25,905 32,901

------------------------------------------------------------------------------- -------- -------- -----------

30 June 30 June 31 December

Company or Direct/indirect 2021 2020 2020

partnership interest ownership ownership ownership Principal activity

--------------------- ---------------- ---------- ----------- ------------ ---------------------------------

Hampden Corporate

Member Lloyd's of London corporate

Limited Direct - 100% 100% vehicle

Nameco (No. 917) Lloyd's of London corporate

Limited Direct 100% 100% 100% vehicle

Nameco (No. 229) Lloyd's of London corporate

Limited Direct - 100% 100% vehicle

Nameco (No. 518) Lloyd's of London corporate

Limited Direct - 100% 100% vehicle

Nameco (No. 804) Lloyd's of London corporate

Limited Direct - 100% - vehicle

Halperin Underwriting Lloyd's of London corporate

Limited Direct - 100% 100% vehicle

Lloyd's of London corporate

Bernul Limited Direct - 100% 100% vehicle

Nameco (No. 311) Lloyd's of London corporate

Limited Direct - 100% 100% vehicle

Nameco (No. 402) Lloyd's of London corporate

Limited Direct - 100% 100% vehicle

Updown Underwriting Lloyd's of London corporate

Limited Direct - 100% 100% vehicle

Nameco (No. 507) Lloyd's of London corporate

Limited Direct - 100% 100% vehicle

Nameco (No. 76) Lloyd's of London corporate

Limited Direct - 100% 100% vehicle

Kempton Underwriting Lloyd's of London corporate

Limited Direct - 100% - vehicle

Devon Underwriting Lloyd's of London corporate

Limited Direct 100% 100% 100% vehicle

Nameco (No. 346) Lloyd's of London corporate

Limited Direct 100% 100% 100% vehicle

Lloyd's of London corporate

Pooks Limited Direct 100% 100% 100% vehicle

Charmac Underwriting Lloyd's of London corporate

Limited Direct 100% 100% 100% vehicle

RBC CEES Trustee Joint Share Ownership

Limited Direct 100% 100% 100% Plan

Nottus (No 51) Lloyd's of London corporate

Limited Direct 100% 100% 100% vehicle

Chapman Underwriting Lloyd's of London corporate

Limited Direct 100% 100% 100% vehicle

Helios UTG Partner

Limited Direct 100% 100% 100% Corporate partner

Lloyd's of London corporate

Nomina No 035 LLP Indirect - 100% - vehicle

Lloyd's of London corporate

Nomina No 342 LLP Indirect - 100% - vehicle

Lloyd's of London corporate

Nomina No 372 LLP Indirect - 100% - vehicle

Lloyd's of London corporate

Salviscount LLP Indirect 100% 100% 100% vehicle

Lloyd's of London corporate

Inversanda LLP Indirect 100% 100% 100% vehicle

Fyshe Underwriting Lloyd's of London

LLP Indirect 100% 100% 100% corporate vehicle

Lloyd's of London corporate

Nomina No 505 LLP Indirect 100% 100% 100% vehicle

Lloyd's of London corporate

Nomina No 321 LLP Direct 100% 100% 100% vehicle

Llewellyn House

Underwriting Lloyd's of London corporate

Limited Direct 100% 100% 100% vehicle

Lloyd's of London corporate

Advantage DCP Limited Direct 100% 100% 100% vehicle

Romsey Underwriting Lloyd's of London corporate

Limited Direct 100% 100% 100% vehicle

Nameco (No 409) Lloyd's of London corporate

Limited Direct 100% 100% 100% vehicle

Nameco (No 1113 Lloyd's of London corporate

Limited Direct 100% 100% 100% vehicle

Lloyd's of London corporate

Catbang 926 Limited Direct 100% 100% 100% vehicle

Whittle Martin Lloyd's of London corporate

Underwriting Direct 100% 100% 100% vehicle

Nameco (No 408) Lloyd's of London corporate

Limited Direct 100% 100% 100% vehicle

Lloyd's of London corporate

Nomina No 084 LLP Indirect 100% - 100% vehicle

Nameco (No 510) Lloyd's of London corporate

Limited Direct 100% - 100% vehicle

Nameco (No 544) Lloyd's of London corporate

Limited Direct 100% - 100% vehicle

Lloyd's of London corporate

N J Hanbury Limited Direct 100% - 100% vehicle

Helios UTG Partner Limited, a subsidiary of the Company, owns

100% of Nomina No 035 LLP, Nomina No 342 LLP, Nomina No 372 LLP,

Salviscount LLP, Inversanda LLP, Fyshe Underwriting LLP, Nomina No

505 LLP and Nomina No 321 LLP. The cost of acquisition of these

LLPs is accounted for in Helios UTG Partner Limited, their

immediate Parent Company.

RBC CEES Trustee Limited is a newly incorporated entity in year

2017 to satisfy the requirements of the Joint Share Ownership

Plan.

11. Share capital and share premium

Partly

Ordinary share paid ordinary Share

Number of capital share capital premium Total

shares (i) GBP'000 GBP'000 GBP'000 GBP'000

----------------------------------------------------- ----------- -------------- -------------- -------- --------

Ordinary shares of 10p each and share premium at 31

December 2020 33,931,345 3,343 50 35,525 38,918

----------------------------------------------------- ----------- -------------- -------------- -------- --------

Ordinary shares of 10p each and share premium at 30

June 2021 68,173,232 6,817 50 85,502 92,369

----------------------------------------------------- ----------- -------------- -------------- -------- --------

(i) Number of shares

30 June 2021 31 December 2020

------------------------------------------------------------------- ------------ ----------------

Allotted, called up and fully paid ordinary shares:

On the market 67,254,063 33,012,176

Company buy back of ordinary shares held in treasury 419,169 419,169

------------------------------------------------------------------- ------------ ----------------

67,673,232 33,431,345

------------------------------------------------------------------- ------------ ----------------

Uncalled and partly paid ordinary share under the JSOP scheme (ii) 500,000 500,000

------------------------------------------------------------------- ------------ ----------------

68,173,232 33,931,345

------------------------------------------------------------------- ------------ ----------------

(ii) The partly paid ordinary shares are not entitled to

dividend distribution rights during the year.

12. Related party transactions

A number of subsidiary companies have entered into quota share

reinsurance contracts for the 2019, 2020 and 2021 years of account

with protected cell companies of Hampden Insurance PCC (Guernsey)

Limited. The quota share percentages for the above years was 70% on

the 2019 and 2020 years of account, and an average of 46% on the

2021 year of account.

Nigel Hanbury, a Director of Helios Underwriting plc and its

subsidiary companies, is also a director and majority shareholder

in Hampden Insurance Guernsey PCC Limited. Hampden Capital plc, a

substantial shareholder in Helios Underwriting plc, is also a

substantial shareholder in Hampden Insurance Guernsey PCC Limited -

Cell 6. Under quota share agreements between Cell 6 and certain

Helios subsidiaries, the Group accrued a net reinsurance premium

recovery of GBP4,232,000 (2020: GBP4,741,000) during the

period.

In addition, HIPCC provide stop loss, portfolio stop loss and

HASP reinforce policies for the company.

HIPCC Limited acts as an intermediary for the reinsurance

products purchased by Helios. An arrangement has been put in place

so that 51% of the profits generated by HIPCC (being Nigel

Hanbury's share) in respect of the business relating to Helios will

be repaid to Helios for the business transacted for the 2021 and

subsequent underwriting years.

13. Ultimate controlling party

The Directors consider that the Group has no ultimate

controlling party.

14. Syndicate participations

The syndicates and members' agent pooling arrangements ("MAPA")

in which the Company's subsidiaries participate as corporate

members of Lloyd's are as follows:

Allocated capacity per year

of account

-----------------------------------------------

Syndicate

or MAPA 2021 2020 2019 2018

number Managing or members' agent GBP GBP GBP GBP

--------- ------------------------------------ ----------- ---------- ---------- ----------

33 Hiscox Syndicates Limited 8,701,668 8,697,873 7,325,844 8,354,200

218 ERS Syndicate Management Limited 6,478,828 5,900,943 5,901,060 5,896,524

308 Tokio Marine Kiln Syndicates Limited - - - -

318 Beaufort Underwriting Agency Limited 742,948 150,000 836,250 866,250

386 QBE Underwriting Limited 1,434,079 1,365,177 1,365,180 1,360,797

510 Tokio Marine Kiln Syndicates Limited 16,780,613 13,642,803 12,379,884 12,364,816

557 Tokio Marine Kiln Syndicates Limited 3,177,784 2,969,384 2,122,922 2,136,776

609 Atrium Underwriters Limited 6,779,365 6,205,260 5,501,013 5,490,164

623 Beazley Furlonge Limited 12,982,891 10,685,023 9,456,718 9,041,504

727 S A Meacock & Company Limited 1,048,498 2,048,498 2,181,026 2,181,026

958 Canopius Managing Agents Limited - - - -

1176 Chaucer Syndicates Limited 2,563,237 2,563,238 2,593,236 2,592,140

1200 Argo Managing Agency Limited - - 57,397 58,111

1729 Asta Managing Agency Limited - 4,096 90,318 360,221

Charles Taylor Managing Agency

1884 Limited - - - -

1910 Asta Managing Agency Limited - - - -

1969 Apollo Syndicate Management Limited 400,001 - - 131,082

1991 Covery's Managing Agency Limited - - - -

2010 Cathedral Underwriting Limited 8,095,459 2,635,873 2,589,260 2,586,521

2014 Pembroke Managing Agency Limited - - 184,534 644,994

2121 Argenta Syndicate Management Limited 4,723,104 1,503,868 1,003,093 1,003,093

2525 Asta Managing Agency Limited 689,091 637,609 512,869 475,051

2689 Asta Managing Agency Limited - 2,377 145,853 586,706

2791 Managing Agency Partners Limited 5,845,085 6,695,085 6,892,527 6,877,501

2988 Brit Syndicates Limited - - 23,461 247,848

4242 Asta Managing Agency Limited 8,013,778 15,894 321,154 385,199

4444 Canopius Managing Agents Limited - - - 1,205,277

5623 Beazley Furlonge Limited 4,688,357 2,839,943 - -

Amtrust Syndicate Limited Syndicates

5820 Limited - - - -

5886 Asta Managing Agency Limited 11,047,742 6,173,502 554,077 467,960

6103 Managing Agency Partners Limited 2,290,041 1,734,879 1,663,522 1,808,645

6104 Hiscox Syndicates Limited 1,427,825 1,427,825 1,522,434 1,647,436

6107 Beazley Furlonge Limited 1,287,436 1,287,435 1,482,427 1,169,554

6111 Catlin Underwriting Agencies Limited - - - 249,065

6117 Argo Managing Agency Limited 1,064,471 803,055 3,573,409 4,100,230

6123 Asta Managing Agency Limited - - 6,406 12,369

--------- ------------------------------------ ----------- ---------- ---------- ----------

Total 110,262,301 79,989,640 70,285,874 74,301,060

--------- ------------------------------------ ----------- ---------- ---------- ----------

15. Group-owned net assets

The Group statement of financial position includes the following

assets and liabilities held by the syndicates on which the Group

participates. These assets are subject to trust deeds for the

benefit of the relevant syndicates' insurance creditors. The table

below shows the split of the statement of financial position

between Group and syndicate assets and liabilities:

30 June 2021 30 June 2020 31 December 2020

------------------------- ----------------------------- ----------------------------- -----------------------------

Group Syndicate Total Group Syndicate Total Group Syndicate Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------- -------- --------- -------- -------- --------- -------- -------- --------- --------

Assets

Intangible assets 31,601 - 31,601 21,655 - 21,655 31,601 - 31,601

Financial assets at fair

value through profit or

loss 18,543 64,504 83,047 8,989 55,154 64,143 19,713 65,564 85,277

Reinsurance assets: - - - - - - - - -

- reinsurers' share of

claims outstanding 61 32,739 32,800 61 28,080 28,141 61 30,720 30,781

- reinsurers' share of

unearned premium - 10,694 10,694 - 9,195 9,195 - 6,028 6,028

Other receivables,

including

insurance and

reinsurance

receivables 11,496 54,731 66,227 7,837 44,962 52,799 12,008 46,340 58,348

Deferred acquisition

costs - 8,119 8,119 - 6,853 6,853 - 7,726 7,726

Prepayments and accrued

income 828 805 1,633 281 601 882 662 514 1,176

Cash and cash equivalents 52,272 9,871 62,143 1,156 7,345 8,501 4,961 3,534 8,495

------------------------- -------- --------- -------- -------- --------- -------- -------- --------- --------

Total assets 114,801 181,463 296,264 39,979 152,190 192,169 69,006 160,426 229,432

------------------------- -------- --------- -------- -------- --------- -------- -------- --------- --------

Liabilities

Insurance liabilities:

- claims outstanding - 115,559 115,559 - 99,758 99,758 - 113,371 113,371

- unearned premium - 42,974 42,974 - 35,961 35,961 - 32,356 32,356

Deferred income tax

liabilities 8,546 - 8,546 3,686 - 3,686 6,492 15 6,507

Borrowings - - - 2,000 - 2,000 4,000 - 4,000

Other payables, including

insurance and

reinsurance

payables 89 25,551 25,640 10 20,831 20,841 364 18,992 19,356

Accruals and deferred

income 3,320 952 4,272 1,108 763 1,871 1,858 1,435 3,293

------------------------- -------- --------- -------- -------- --------- -------- -------- --------- --------

Total liabilities 11,955 185,036 196,991 6,804 157,313 164,117 12,714 166,169 178,883

------------------------- -------- --------- -------- -------- --------- -------- -------- --------- --------

Equity attributable to

owners of the Parent

Share capital 6,817 - 6,817 1,839 - 1,839 3,393 - 3,393

Share premium 85,502 - 85,502 18,938 - 18,938 35,525 - 35,525

Revaluation reserve 3,642 - 3,642 - - - 3,982 - 3,982

Other reserves (50) - (50) (50) - (50) (50) - (50)

Retained earnings 6,935 (3,573) 3,362 12,448 (5,123) 7,325 13,442 (5,743) 7,699

------------------------- -------- --------- -------- -------- --------- -------- -------- --------- --------

Total equity 102,846 (3,573) 99,273 33,175 (5,123) 28,052 56,292 (5,743) 50,549

------------------------- -------- --------- -------- -------- --------- -------- -------- --------- --------

Total liabilities and

equity 114,801 181,463 296,264 39,979 152,190 192,169 69,006 160,426 229,432

------------------------- -------- --------- -------- -------- --------- -------- -------- --------- --------

16. Event after the financial reporting period

On 16th August 2021, the company issued and allotted 600,000 new

ordinary shares of GBP0.10 each in the Company ("Ordinary Shares").

The new Ordinary Shares have been issued at a subscription price of

155.0p per Ordinary Share, being the closing price of an Ordinary

Share on 13th August 2021, pursuant to The Helios Underwriting plc

Employees' Joint Share Ownership Plan (the "Plan").

The new Ordinary Shares have been issued into the respective

joint beneficial ownership of (i) each of the participating

executive Directors listed below and (ii) the trustee of the Trust

upon and subject to the terms of joint ownership agreements

("JOAs") respectively entered into between the Director, the

Company and the Trustee. The nominal value of the new Ordinary

Shares has been paid by the Trust out of funds advanced to it by

the Company (with the participating executives contributing to

those funds) with the additional consideration of 145p per Ordinary

Share left outstanding until such time as new Ordinary Shares are

sold. The Company has waived its lien on the Shares such that there

are no restrictions on their transfer.

The terms of the JOAs provide, inter alia, that if jointly owned

shares become vested and are sold, the proceeds of sale will be

divided between the joint owners so that the participating Director

receives an amount equal to the amount initially provided by the

participating Director plus any growth in the market value of the

jointly owned Ordinary Shares above a target share price of 174.8p

(so that the participating Director will only ever receive value if

the share sale price exceeds this).

The vesting of the award will be subject to performance

conditions relating to growth in Net Tangible Asset Value per share

measured over the three calendar years from the Net Tangible Asset

per share disclosed as at 31 December 2021 of 151p.

Note:

The Plan was established and approved by resolution of the

Remuneration Committee of the Company on 13 December 2017 and

provides for the acquisition by employees, including executive

directors, of beneficial interests as joint owners (with the Trust)

of Ordinary Shares in the Company upon the terms of a JOA. The

terms of the JOA provide that if the jointly owned shares become

vested and are sold, the proceeds of sale will be divided between

the joint owners on the terms set out above.

The beneficial interests of the executives as follows:

Director Interests Interests Other interests Total Shareholding

in jointly in jointly in Ordinary

owned Ordinary owned Ordinary Shares

Shares issued Shares

under JSOP issued

awarded 14th under JSOP

December 2017 awarded

16th August

2021

Arthur Manners 200,000 277,500 709,868 1,187,368

---------------- ---------------- ---------------- -------------------

Nigel Hanbury 300,000 322,500 8,927,294 9,549,794

---------------- ---------------- ---------------- -------------------

Acquisitions of LLV's since the period end

Since the Financial reporting period, the company has acquired

the following entities either directly, or indirectly:

Helios Acquisitions

2021 Purchase Humphrey Discount

Capacity price Valuation to Humphreys

North Breache Underwriting

Limited 3,934,673 3,856,593 4,170,520 7.53%

Nameco (No 1095) Limited 2,914,405 2,919,483 3,057,575 4.52%

Nomina No 533 LLP 682,419 280,000 295,420 5.22%

Nameco (No 1011) Limited 949,407 891,000 973,324 8.46%

Hillnameco Limited 1,005,873 335,000 371,977 9.94%

Nameco (No 2012) Limited 618,385 360,000 388,993 7.45%

G.T.C. Underwriting Limited 820,013 700,000 752,748 7.01%

Nameco (No 1111) Limited 556,362 225,000 241,851 6.97%

Total Acquisitions Completed 8 11,481,537 9,567,076 10,252,408 6.68%

Acquisitions With Terms

Agreed 20 21,475,110 15,002,500 15,943,058 5.90%

The Interim Report will be made available in electronic format

on the Company's website, www.huwplc.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR DKLFLFKLEBBV

(END) Dow Jones Newswires

September 30, 2021 02:00 ET (06:00 GMT)

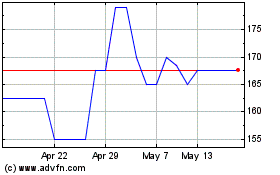

Helios Underwriting (LSE:HUW)

Historical Stock Chart

From May 2024 to Jun 2024

Helios Underwriting (LSE:HUW)

Historical Stock Chart

From Jun 2023 to Jun 2024